Fixed assets in the enterprise balance sheet (line 1150): definition, classification

Fixed assets of an enterprise are understood as assets (property) that were acquired for the purpose of long-term use in the course of business activities. That is, the object must have a long useful life.*

Take our proprietary course on choosing stocks on the stock market → training course

*Useful life is the period of time during which the operation of any property brings commercial benefits to the owner (provides income). For fixed assets, the useful life can be calculated not by time intervals, but by the volume of products (goods) in kind that the company plans to produce as a result of the operation of the fixed asset.

In order for any company property to be classified as fixed assets, it is necessary to check whether the following conditions are met in relation to this object:

- The property under study can be useful commercially (it will definitely generate income for the owner company).

- When purchasing an object, the company does not think about reselling it to third parties in the near future.

- The useful life of the property is at least 1 year (or it is planned to be used for at least one operating cycle lasting more than 1 year).

- The property was acquired by the organization for the purpose of:

- transfer to third parties for temporary use (possession) for a fee;

- meeting the management needs of the company;

- operation during the performance of work or provision of services;

- application in the production process.

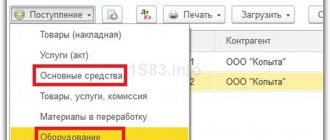

Thus, a company accountant has the right to classify the following types of property and capital investments into the category of fixed assets:

- buildings, structures;

- capital investments in fixed assets leased;

- vehicles;

- power and working machines;

- various types of equipment;

- regulating and measuring devices, instruments;

- tool;

- Computer Engineering;

- household and industrial equipment, various types of accessories;

- breeding, productive, draft animals;

- land;

- capital investments in radical improvement of land (reclamation, irrigation, drainage);

- environmental management facilities (natural resources, subsoil, reservoirs);

- on-farm roads;

- perennial plantings;

- properties that are similar in nature.

The concept of fixed assets

Definition

A fixed asset is a special asset that is used in the economy repeatedly in production in its natural form without changes. The turnover of such asset funds transfers its value partially to the created product.

In accounting and basic statistics of an enterprise, fixed assets consist of valuable objects that have a long service life, more than a year. Key asset prices appear to be fixed and revised from time to time. This value depends on changes in the price of the manufactured product.

The conditional systematization of key funds divides them into two types:

- Fixed production assets (FPF). Contain work resources, their parts are able to create a complete picture of value, by transferring their own price, according to shares and participation in the cyclical production process.

- Fixed non-production assets (NFF). Which are represented by material benefits of long-term use, but they do not play a major role in the production process, and their subventions or financing come from the general budget.

In addition, there are intensive and inert shares of key production assets. The intensive share contains a complex of funds that directly operate in the object of work. Through the influence of the unused share of assets in production, the requirement for the standard functioning of production is formed.

Comment

The division of fixed assets into active and passive parts is conditional.

Actual expenses for the purchase, manufacture, construction of fixed assets

In order to form the initial cost of a fixed asset, at which it will subsequently be accepted for accounting, it is necessary to sum up the expenses actually incurred by the company for the purchase (construction, production) of a fixed asset item. Such costs may include:

- non-refundable tax amounts;

- state fees for the right to purchase fixed assets;

- the cost of the purchased fixed asset (specified in the purchase and sale agreement);

- the amount of payment for setting up the property, bringing it into a condition suitable for use;

- the amount of payment for the service of delivering a fixed asset to the place of its use;

- duties and fees collected by customs;

- amounts of payment to construction contractor companies under the contract for the construction of an environmental facility;

- remuneration for the services of intermediaries in transactions related to the acquisition of an asset;

- fees for specialist consultations, legal advice, information support, etc.;

- other expenses, if they are directly related to the acquisition (independent production) of an OS item.

Valuation of fixed assets in accounting

In Russian economic accounting, accounting and statistical practice, in general, a number of key types of points of primary funds are used, from among them it is possible to note the assessment relative to the initial price, according to the initial price, taking into account the wear and tear of valuable units, according to the corrective price, taking into account the wear of units, and according to book value.

Definition

The initial price of the product appears as a fund at prices that take into account the fixed assets at the time they are placed on the main balance sheet. Using this book value, you can express the actual expenses for a future enterprise, the valuation of which is carried out at prices that are in effect at the time of acquisition of these objects before they are placed on the starting balance sheet.

After the process of accepting key money for use is completed, this price can be reflected in the balance sheet asset according to the “Key Resources” account, remaining constant until the revaluation stage.

The variable initial price contains a value measured in the value of the main balance sheet item of key money through the presence of depreciation accounting during the period of its establishment. This price is determined according to the starting price of fixed assets minus the amount of depreciation that has been accumulated in accordance with accounting information and is calculated using the formula

OPst = PPst – Wear

Depreciation is possible of two types: material (depending on technological capital), moral (reduction in production costs, reduction in the narrow consumer price of functioning assets after the introduction of the newest, most productive money work).

The full price for the restoration of some elements can be established by measuring costs, according to the reproduction of the latest components of key money. This price provides for the presence of a revaluation of key, estimated prices for the implementation of money, based on the current circumstances of reproduction (conditional costs of construction and prefabricated work, wholesale costs, etc.).

The residual revalued value can be established as a result of revaluation of the absolute revalued price of key money and the currency score of their depreciation in accordance with accounting data:

OVst = PVst – Wear

Analysis, according to the balance sheet price, determines the price of money during the period of its registration, according to the accounting balance. The balance price contains a hybrid valuation of key money, since the share of inventory items is in equilibrium, according to the corrective price during the period of final revaluation. Items and objects included in further stages are consistent with the original price.

How are fixed assets valued in the balance sheet of an enterprise when they are registered?

Important! All fixed assets must be taken into account based on their original cost.

Depending on what kind of fixed asset we are talking about and how it was acquired, the initial cost may mean different amounts:

| Type of fixed assets | Determining the initial cost of the OS |

| Property acquired by an enterprise for a fee specified in the purchase and sale agreement | The amount of actual expenses incurred for the purchase, manufacture, construction of an asset minus the amount of VAT and other tax payments (in addition to situations specifically regulated by the laws of the Russian Federation) |

| Objects received by the company free of charge under a gift agreement | Current market value at the time of inclusion in investments in non-current assets when accepting fixed assets for accounting |

| Fixed assets contributed to the company's property as a contribution to the authorized (share) capital | Monetary value determined at the meeting of founders (participants), unless otherwise provided by law |

| Objects received under contracts that specify a non-monetary method of payment for their receipt | The cost of an asset, determined by reference to the price that would normally be paid by a company under similar circumstances. |

The concept of fixed assets

Definition 1

Fixed assets are assets used in the economy a large number of times in production in an unchanged natural (material) form. These funds gradually transfer their own value to the product or service being created.

In practice, in accounting and statistics, fixed assets include objects with a service life of more than a year. The cost of fixed assets is an established and periodically revised value depending on changes in prices for products (products) of capital-forming industries.

The classification of fixed assets divides them into 2 types:

- Fixed production assets (FPF), including means of labor that are fully involved in the repeating production process by transferring their value in parts to finished products as they wear out.

- Fixed non-productive assets, which are material goods of long-term use. They do not take part in the production process, but are considered objects of public or personal consumption (residential building, school, hospital, club, cinema, public transport, etc.) This group of fixed assets is financed from the budget.

Can not understand anything?

Try asking your teachers for help

There is also an active and passive part of fixed assets. The active part includes a set of funds that directly affect objects of labor. Through the action of the passive part of fixed assets, conditions for the normal functioning of the production process are created.

Note 1

The classification of fixed assets into active and passive parts is conditional.

What information on fixed assets must be disclosed in the financial statements?

The minimum set of information about the fixed assets of an enterprise that must be disclosed in the financial statements includes the following points:

- initial cost, the amount of accumulated depreciation for the main groups of fixed assets (as of the beginning and end of the period);

- a list of real estate that is already in use and in relation to which the state is in charge. registration;

- movement of fixed assets during the reporting period by main groups (acceptance to the enterprise, retirement, etc.);

- methods for calculating depreciation for each group of fixed assets;

- rules for assessing the cost of fixed assets that were received by an enterprise under an agreement that does not provide for payment in money;

- property that is taken into account as profitable investments in the MC;

- a list of objects that are provided for use for a fee or, conversely, are issued under a lease agreement;

- cases of adjustment of the initial cost of fixed assets due to revaluation, partial liquidation, reconstruction, additional equipment, completion;

- about the property of fixed assets, the value of which is not subject to repayment through depreciation;

- the procedure for determining the useful life of property objects.

Conditions for classifying objects as fixed assets

The regulation of accounting for key money is carried out in accordance with the Regulations “On Accounting for Assets”, according to which objects are recognized as main ones and are required to meet many conditions:

- The use of items must be realized in production activities or in the administrative affairs of the company, including the rental of assets (the cost of items that are purchased for the purpose of leasing assets, and is not displayed in the line “key assets in balance”).

- The company is obliged to use the item for 12 months.

- The initial cost of the item must be no less than 100 thousand rubles.

- When acquired by an enterprise, an item of key money is not required to be transferred or sold within the shortest possible period.

- In the future, such items are ready to bring the company a stable income throughout the reporting year.

What is reflected in line 1150 “Fixed assets”

It is obvious that the line of the Balance Sheet, which is called “Fixed Assets,” should reflect the fixed assets of the enterprise as of the reporting date. However, not everything is so simple - accountants should be aware of three nuances associated with filling out line 1150:

- The mentioned line does not account for all fixed assets of the company without exception. Only those objects that are reflected in account 01 “Fixed Assets” are taken into account. The situation is relevant when registering objects whose sole purpose is to hand them over for temporary use (possession) by the owner of the enterprise for a certain fee to third parties. Such operating systems will be reflected on line 1160, and not on line 1150.

- Like other indicators, fixed assets should be displayed on the balance sheet in a net valuation (i.e., at residual value).

- It is also possible to display in line 1150 information about the debit balance of account 08 for subaccounts 01-04 in terms of fixed assets, as well as the debit balance of account 07. The accounting department of an enterprise has the right to independently make such a decision on the inclusion of this information; the law does not prohibit this. However, if the data values are insignificant, it is recommended to reflect them on line 1190.

Sale and disposal of property

Disposal value is the amount a company expects to receive for a tangible asset when it is disposed of at the end of its useful life, less the cost of disposal. This indicator is reviewed at least once a year.

Depreciation cost is determined as the difference between the actual value and the liquidation indicator of a tangible asset.

Property may be deregistered as a result of its loss, or if a competent decision is made to cease its use without receiving financial profit.

Losses and gains arising from the sale or disposal of assets are calculated as the difference between the estimated proceeds and the carrying amount of the item and are recognized as a gain or expense in the statement of losses and gains.

How to calculate the value of line 1150 “Fixed assets” (balance sheet formula)

When filling out line 1150, the value of the indicator can be calculated using the formula below based on the Balance Sheet database:

Important! The cost of fixed assets must be reduced only by depreciation related to fixed assets (which are recorded on account 01). Often, missing this point leads to errors in calculations. As mentioned earlier, line 1150 does not take into account fixed assets that are intended for rental and are subject to accounting under account 1160 “Income-generating investments in tangible assets.” But depreciation on such fixed assets is also accrued on account 02. Therefore, it is important to remember that depreciation related to fixed assets of account 03 is not taken into account when calculating the value on line 1150, because such fixed assets are not included in this line.

Why is account 02 needed?

Fixed assets (PE) are assets that a company uses to produce products or provide services for more than a year.

Depreciation is regularly charged on fixed assets - their cost, as they wear out, is transferred in parts to the cost of goods, work, and services. Most fixed assets are very expensive, so a one-time write-off of the cost as an expense will result in the cost of production being greatly inflated. Account 02 according to the chart of accounts is called “Depreciation of fixed assets”. On it, accountants keep records of accrued depreciation, its increase and decrease, write-off, and through it they register the disposal of fixed assets.

Depreciation and wear should not be confused. Depreciation is accounted for in off-balance sheet account 010, and is accrued at the end of the year for housing stock, housing and communal services, or fixed assets of non-profit organizations.

Explanations for account 02 are given in the chart of accounts approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n.

How are fixed assets depreciated on the company's balance sheet?

An item of fixed assets is depreciated from the 1st day of the month following the month in which the property was accepted for accounting. Depreciation is accrued until the property is written off or until its cost is fully repaid (depreciation stops on the 1st of the month following the month in which one of the above 2 events occurred).

Important! The depreciation method chosen by the company for a group of fixed assets characterized by homogeneity must be applied throughout the entire useful life of the property included in this group.

In total, there are 4 methods of calculating depreciation available when paying off the cost of fixed assets:

Whatever depreciation method is chosen by the enterprise, depreciation charges are accrued in the amount of 1/12 of the annual amount during the reporting year. Depreciation is carried out in compliance with the following rules:

| Controversial issue regarding depreciation of fixed assets | Solution |

| Suspension of depreciation charges for fixed assets | Depreciation continues throughout its useful life. Exception: – OS recovery time is more than 1 year, – conservation of the object for more than 3 months by order of the authorities. |

| Dependence of depreciation charges on fixed assets on the results of the company’s work in the reporting period | Depreciation is reflected in the accounting of the period to which it relates and does not depend on the results of the enterprise for the reporting year. |

| Displaying summary information about asset depreciation | Generalized data on deductions accumulated over the period of use of the operating system are reflected in account 02. |

| Reflection of fixed assets depreciation amounts in correspondence with various accounting accounts | Accrued depreciation payments are indicated according to Kt. 02 in correspondence with production (sales) expense accounts. |

| Depreciation of retired and damaged fixed assets | Written off in CT account. 01 subaccount “Disposal of fixed assets”. Likewise for: – completely worn out OS, – lost OS, – realized objects, – decommissioned OS, – donated free of charge, – partially liquidated. |

Reflection of fixed assets in financial statements.

[p.126] Develop a program for obtaining evidence of the accuracy of the reflection of information about fixed assets in the financial statements. [p.114]

Accounting accounts are divided into accounts that are used independently (containing basic indicators that, as a rule, retain the initial or restorative assessment of the object of observation reflected in the account, and are used independently), and regulating ones (these accounts take into account clarifying indicators that cannot be used independently without accounts, the assessment of the indicator on which is regulated) -Fig. 12.6. Thus, in the independently used account 01 Fixed assets are accounted for at book value (newly acquired - at historical value, and those that have been revalued - at replacement value). In each reporting period, when depreciation of fixed assets is calculated, the main indicator in the account used independently does not change, and the amount of the distributed cost (accumulated depreciation) increases in the regulating account 02 Depreciation of fixed assets. In financial statements starting from 1996, two indicators (main and regulatory) are reflected as one item, i.e. the calculated indicator is included in the balance sheet asset currency [p.309]

The methodology for conducting accounting transactions assumes, in accordance with the cost principle, the reflection of the main ones. funds and intangible assets at non-decreasing historical (and for fixed assets that have undergone revaluation - at replacement) cost. At the same time, non-current assets (tangible and intangible) transfer their value to the manufactured product (expenses of the reporting period) during their useful life or according to special rules for the distribution of value selected for a specific object of accounting observation. There is a need for separate accounting of indicators for non-decreasing cost and accumulated indicators of distributed cost. [p.287]

When reflecting data in the financial statements, it should be borne in mind that if, in accordance with regulatory documents on accounting, an indicator must be subtracted from the corresponding indicators (data) when calculating the relevant data (interim, final, etc.) or has a negative value, then in the accounting reporting, this indicator is shown in parentheses (uncovered loss, cost of goods sold, products, works, services, loss on sales, interest payable, operating expenses, use of funds (reserves), reduction of capital, direction of funds, disposal of fixed assets and etc.). [p.341]

The results of the revaluation carried out by the organization in accordance with the established procedure before the beginning of the reporting year as of the first day of the reporting year of fixed assets are subject to reflection in accounting in the month of January and are taken into account in the financial statements when generating data at the beginning of the reporting year. [p.342]

Subsequent valuation of fixed assets reflected in the financial statements [p.223]

The use of unified forms of financial statements and uniform rules for classifying accounting objects is intended to ensure unambiguous interpretation of the information reflected in the financial statements. The auditor must ensure that the audited organization complies with the established rules for the classification and disclosure of reporting information. For example, under the item Fixed assets, the residual value of precisely those accounting objects that co- [p.248]

Based on the above, we see that IFRS, just like Russian standards, allow for the revaluation of fixed assets, and their book value is equal to the difference between the original or revalued cost and depreciation. It should also be noted that there are similarities in the calculation of initial cost, revaluation rules, and methods for calculating depreciation of fixed assets in domestic standards and in IFRS. At the same time, it should be noted that due to the influence of the traditional approach and tax restrictions, not all possibilities established by domestic accounting standards are used in practice to reflect fixed assets in reporting. For example, just like IFRS, Russian standards allow four methods for calculating depreciation of fixed assets, which are identical to those set out in IFRS 16. However, for tax purposes, with any method of calculating depreciation other than the traditional linear one in our country, the amount of taxable profit must be adjusted. This leads to the fact that the enterprise does not use methods other than linear, possibly sacrificing the reliability of information about fixed assets. [p.242]

Due to the fact that currently the procedure for revaluation of fixed assets is not established by resolutions of the Government of the Russian Federation, and tax legislation does not contain a clear procedure for forming the value of fixed assets that would be accepted for taxation, the Ministry of the Russian Federation for Taxes and Duties, in agreement with the Ministry of Finance The Russian Federation brings to the attention that the revaluation of fixed assets carried out by organizations in accordance with the above-mentioned Accounting Regulations and reflected in the financial statements is taken into account when calculating property tax, as well as Income Tax (in particular, when calculating depreciation charges). [p.65]

In connection with the upcoming revaluation of fixed assets in accordance with Decree of the Government of the Russian Federation No. 1233 of November 25, 1993, the Ministry of Culture of the Russian Federation brings to the attention of theatrical and entertainment enterprises the procedure for reflecting the results of the revaluation in their accounting and reporting, taking into account the specifics of accounting for capital investments reflected in letter of the Ministry of Culture of the Russian Federation No. 01-146/16-21 dated May 20, 1993 “On the procedure for accounting for capital investments in theaters and concert organizations.” [p.111]

The costs of major repairs of leased fixed assets, taken into account by the lessee, must be reflected in the accounting statements of the lessor. To do this, the tenant issues a notice for the actual amount of capital repair costs and sends it to the landlord. Having received the notice, the lessor debits account No. 03.2 Major repairs and credits account No. 88.4 Fixed Asset Repair Fund, while repaying these costs from the source of financing. [p.77]

In accordance with the Instructions of the Ministry of Finance of the USSR and the State Statistics Committee of the USSR “On the procedure for reflecting in accounting and reporting business transactions related to the rental of property” No. 218 dated April 11, 1990, “the lessee takes into account the value of the leased property on off-balance sheet account 001 “Leased fixed assets” facilities". At the time of acceptance of leased fixed assets, a posting is made according to Dt 001, the data of which is reflected in the appendix to the balance sheet (Form No. 5 - annual) on line 910. [p.29]

Let us briefly dwell on the analytical properties of the balance sheet and show how its data is used to study the financial position of an enterprise. Currently, the balance sheet of an industrial enterprise is built in such a way as to facilitate its analysis in every possible way, i.e., to create its maximum analyticity. The balance sheet is built on the principle of contrasting asset items (economic funds) with corresponding liability items (sources of economic funds). Thus, fixed assets in the first section are opposed in the liability side by the authorized capital as their source, and diverted funds are opposed by profit. The enterprise's funds, reflected in the first and second sections of the asset, are opposed to their sources in the liability - own and borrowed. The comparison and interrelation of these items underlies the analysis of financial condition. In this case, a very important indicator is calculated - the availability of own and equivalent funds that the enterprise has at the balance sheet date. To do this, from the total of section I of the liability (all own sources), subtract the total of section I of the asset (fixed and diverted funds), as a result, the amount of own working capital is obtained. By comparing it with the indicator of the standard of these funds, which is indicated in the balance sheet as a reference, the degree of provision of the enterprise with its own working capital is determined. It is important to compare the actual value of individual types of inventories (Section II of the asset) with their standards. It is necessary to find out the trend towards reducing the existing gap between reporting and standard indicators, since they are given as of the end and beginning of the year. [p.208]

The correctness of the reflection in the financial statements of the residual value of fixed assets, the completeness and correctness of the disclosure of information in the statements [p.185]

The main element of the balance sheet is the accounting item, which corresponds to a specific type of property, liabilities, and source of formation of property. Balance sheet items are combined into groups - balance sheet sections. The combination of balance sheet items into groups (sections) is carried out based on their economic content. To reflect the state of funds in the balance sheet, two columns are provided for digital indicators at the beginning of the reporting year and the end of the reporting period. [p.110]

Therefore, any errors (distortions) made in previous tax (reporting) periods when calculating the property tax of organizations, as well as when maintaining accounting records of fixed assets and forming the residual value of property as of the 1st day of each month, applied in accordance with Article 375 of the Tax Code RF in order to calculate the tax base for this tax, they must be reflected in the financial statements of the credit organization in the manner prescribed by the Directives of the Central Bank of the Russian Federation dated December 17, 2004 No. 1530-U On the procedure for preparing annual financial statements by credit organizations. [p.68]

In PBU 10/99 Expenses of the organization and PBU 9/99 Income of the organization, which entered into force on January 1, 2000, the concepts of income and expenses were first defined for accounting purposes. In this case, expenses are understood as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property) 1. Expenses include such items , as costs for the production of sold products (works, services), for wages of management personnel, depreciation charges, as well as losses (losses from natural disasters, sales of fixed assets, changes in exchange rates, etc.). Drawing up Form No. 2 Profit and loss statement for external users of financial statements involves a detailed and symmetrical reflection of information about the organization’s income and expenses. [p.45]

Of particular importance to all users of reporting data is the explanation of the balance sheet and income statement. They reflect important information (at the beginning and end of the reporting period) about intangible assets by their individual types, on fixed assets (by main items), leased fixed assets, on types of financial investments, on accounts receivable and payable, on authorized, reserve and additional capital, on the number of shares of the joint-stock company (fully paid, unpaid, partially paid for the nominal value of shares owned by the joint-stock company, its subsidiaries and affiliates) on the composition of reserves for future expenses and estimated reserves on the volume of products sold, goods, works, services by type of activity and geographical sales markets on the composition of production and distribution costs, on other non-operating income and expenses on any issued and received obligations and payments. [p.73]

The first aspect of activity is reflected in the balance sheet; the active side of the balance sheet gives an idea of the enterprise’s property, the passive side gives an idea of the structure of the sources of its funds. The second aspect is presented in the income statement - all income and expenses (costs) of the enterprise for the reporting period in certain groupings are presented in this form. By looking at the form in dynamics, you can understand how efficiently a given company operates on average. The third aspect is reflected in the capital flow statement, which shows the movement of all components of equity capital, authorized and additional capital, reserve fund, other funds, profit, etc. The fourth aspect is determined by the fact that profit and cash are not the same thing. For the rhythm of settlements with creditors, it is not profit that is important, but the availability of funds in the required amounts and at the right time. A certain characteristic of this aspect of the company’s financial and economic activities is provided by the cash flow statement. The last form is the most difficult to compile and interpret, however, along with the balance sheet and profit and loss account, it forms the minimum set of reporting forms recommended for publication by international accounting standards. All other forms of reporting are generated by the company at its discretion, are considered as annexes to the main reporting and are compiled in any form - in the form of tables, explanatory notes, analytical sections of the annual report or explanations to the main reporting forms. [p.340]

For the purpose of comparability, the assessment of property and sources of funds for reflection in accounting and financial statements must be carried out uniformly in all organizations, which is achieved by complying with the established provisions and rules of assessment. For example, the current regulatory documents establish that in the balance sheet fixed assets are shown at their residual value, and in accounting they are reflected at their original cost, industrial inventories are valued at the actual cost of their acquisition and procurement, etc. [p.104]

Current balances are compiled periodically throughout the existence of the organization. They are divided into initial (incoming), intermediate and final (outgoing). The opening balance is formed at the beginning, and the final balance at the end of the reporting year. It follows that the final balance sheet of the reporting year is the opening balance sheet of the next year, i.e. these balances are essentially final. Interim balances are prepared for the period between the beginning and end of the year. Interim balance sheets differ from final balance sheets, firstly, in that they are accompanied by fewer reporting forms disclosing certain balance sheet items. Secondly, interim balance sheets are compiled, as a rule, only on the basis of current accounting data, whereas before drawing up the final balance sheet, a complete inventory of all balance sheet items (fixed assets, inventory, cash and settlements) must be carried out, reflecting its results, making the closing balances more realistic. [p.25]

We can highlight several large reporting elements, the most significant from the standpoint of their influence on the assessment of the current financial condition of the enterprise in conditions of inflation, fixed assets, inventories, and calculations. The latest regulations in the field of accounting offer fundamentally new methods for assessing and reporting these accounting objects in conditions of changing prices. Knowledge of these methods is necessary for both external and internal analysts. [p.497]

Accounting Regulations Accounting for fixed assets PBU 6/01 pp. 46—54 Regulations on accounting and financial reporting in the Russian Federation Order of the Ministry of Finance of the Russian Federation On the reflection in accounting of transactions under a leasing agreement dated February 17, 1997 No. 15 Instructions for the use of the chart of accounts for accounting of financial and economic activities of organizations Guidelines for accounting of the main funds (order of the Ministry of Finance of Russia dated July 20, 1998 No. ЗЗн) [p.550]

In Chile, companies operating in conditions of significant inflation are required to submit financial statements restated using a general price index. In a number of other countries, only individual balance sheet items are selectively adjusted, providing information about fixed assets, long-term capital and financial investments. In countries where inflation rates are insignificant, companies are given the opportunity to independently make decisions about the advisability of reflecting the consequences of inflation in accounting and reporting. [p.517]

Federal Law No. 129 FZ dated November 21, 1996 Civil Code of the Russian Federation Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n) Chart of accounts for financial accounting economic activity, approved by the USSR Ministry of Finance dated November 1, 1991, No. 56 (with amendments and additions as of December 24, 1998) Accounting Regulations Accounting for fixed assets (PBU 6/97), approved by order of the Ministry of Finance dated September 3, 1997, No. 65n Order of the Ministry of Finance of Russia dated February 17, 1997 No. 15 On the reflection in accounting of transactions under a leasing agreement Regulations on the composition of costs for the production and sale of products (works, services), included in the cost of products (works, services), and on the procedure for forming financial results taken into account when taxing profits, approved by Decree of the Government of the Russian Federation dated August 5, 1992 No. 552, taking into account changes and additions Letter of the Ministry of Finance of Russia dated November 12, 1996 No. 96 On the procedure for reflecting certain tax-related transactions in accounting on value added and excise taxes Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a On approval of unified forms of primary accounting documentation for accounting for labor and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction Regulations on accounting accounting Accounting policy of the organization (PBU 1/98), approved by order of the Ministry of Finance of Russia dated December 9, 1998 No. 60n Guidelines for accounting [p.33]

The explanatory note must contain information about the data, the requirement for disclosure of which is defined in paragraph 27 of the Accounting Regulations Accounting statements of the organization PBU 4/99, as well as other accounting provisions (on changes in the organization’s accounting policies, on inventories, fixed assets, income and expenses of the organization, events after the reporting date and conditional facts of economic life, information on affiliates, information on operating and geographic segments, etc.) and not reflected in the financial reporting forms. [p.380]

In addition, practice shows that orders on accounting policies often provide accounting methods for all possible elements, regardless of whether there was experience in using one or another method in the accounting of the previous reporting period or not. At the same time, it is possible to correctly select accounting methods only based on those aspects of reflecting the organization’s economic activities that it had at the end of the previous reporting period. For example, if there is a wide range of possible methods for calculating depreciation for fixed assets and intangible assets, you can choose one only based on an analysis of data on similar existing equipment and intangible assets. [p.83]

Other than land, property, plant and equipment are expected to lose their economic value over time, both as measured by financial statement analysis and as measured by GAAP and the Internal Revenue Service. Initially, fixed assets are valued at cost, limited by a reasonable market price at the time of purchase. Subsequently, they are depreciated annually, i.e. partially expensed and measured at successively lower amounts (referred to as book value) on the balance sheet. Finally, it is considered that fixed assets either have no value or retain a residual (liquidation) value below which the valuation cannot fall. This reflects the fact that fixed assets eventually wear out and must be replaced. However, there are different methods of recording depreciation, and the same company may use different methods for financial reporting and tax purposes. [p.159]

Legal regulation for the development and approval of an organization's accounting policy for costs and calculation of product costs is based on the following regulatory documents Federal Law on Accounting dated November 21, 1996 No. 129-FZ Civil Code of the Russian Federation Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34-n) Accounting Regulations Accounting for fixed assets PBU 6/97 (approved by order of the Ministry of Finance of the Russian Federation dated September 3, 1997 No. 65-n Accounting Regulations Accounting policy of the organization ( approved by order of the Ministry of Finance of the Russian Federation dated July 28, 1994 No. 100 Chart of accounts for accounting financial and economic activities Regulations on the composition of costs for the production and sale of products (works, services) included in the cost of products (works, services), and on the procedure for the formation of financial results taken into account when taxing profits (approved by Decree of the Government of the Russian Federation dated August 5, 1992, No. 552, taking into account changes and additions) letter from the Ministry of Finance of the Russian Federation On the procedure for reflecting in accounting certain transactions related to value added tax and excise taxes dated November 12, 1996 No. 96 Basic provisions for planning, accounting and calculating the cost of products at industrial enterprises approved by the State Planning Committee of the USSR, the Ministry of Finance of the USSR, the State Committee for Prices of the USSR, the Central Statistical Office of the USSR on July 20, 1970) Methodological recommendations for planning, accounting and calculating the cost of products (works, services) in agriculture (approved by the Ministry of Agriculture of the Russian Federation on March 11, 1993 No. 2-11/473) Standard methodological recommendations for planning and accounting for the cost of construction work (approved [p.210]

Basic accounting entries for fixed assets

The following accounting entries are most often found in financial statements when it comes to fixed assets:

| Operation | DEBIT | CREDIT |

| The initial cost has been formed, the OS has been put into operation | 01 | 08 |

| The residual value was written off upon disposal of fixed assets | 91 | 01 |

| Depreciation accrued | 20, 23, 25, 26, 29 (depending on production) | 02 |

| Accumulated depreciation was written off due to disposal of property | 02 | 01 |

| Depreciation was accrued due to the revaluation of fixed assets | 83 | 02 |

| Depreciation has been accrued on an object transferred to third parties under a temporary use agreement | 91 | 02 |

Capital investments in tangible assets: efficiency

Fixed assets for a company are such only after they are put into operation. Until this time, all costs associated with their purchase, installation, and construction are taken into account as capital investments.

Capital investments – financing of tangible or non-current assets, or costs of reproduction and creation of fixed assets.

Capital investments are a large part of the main investments required by an enterprise to carry out commercial activities. If an organization neglects financing of fixed assets, then, regardless of the increase in profit in the current period, in the long term, this can serve as the main reason for the loss of income and a decrease in the level of competitiveness.

Capital investments are long-term investments going towards the development of your company. They provide current profit and can provide income in the future, but at the same time they do not participate in the economic activities of the organization: they are not depreciated or consumed.

Capitalization of a fixed asset (example, calculation, postings)

The hypothetical enterprise Rabotyaga LLC buys new equipment for production to replace completely worn-out equipment. Its price is 310,000 rubles, including the company’s expenses for delivering the fixed asset to the workshop and for bringing it into working condition by a specialist. VAT on the cost of equipment is 42,155 rubles. When new equipment is put into operation, the accountant will make the following entries:

| Operation | Amount (rubles) | DEBIT | CREDIT |

| The costs of purchasing equipment are taken into account (the price includes delivery and setup services) | 267 845 | 08 | 60 |

| Input VAT reflected | 42 155 | 19 | 60 |

| The initial cost of the equipment was formed, the facility was put into operation | 267 845 | 01 | 08 |

| Submitted for deduction of input VAT | 42 155 | 68 | 19 |

Answers to frequently asked questions about fixed assets in the balance sheet of an enterprise

Question: Can the initial cost of a fixed asset at which the object was accepted for accounting be changed?

Answer: Changing the initial cost of a fixed asset previously accepted for accounting is generally unacceptable. However, the law makes an exception for cases of revaluation of fixed assets, their partial liquidation, modernization, reconstruction, additional equipment and completion. When one of the listed moments occurs, recalculation of the initial cost is allowed.

Question: Are all fixed assets subject to depreciation?

Answer: No, depreciation is not charged on those fixed assets that do not lose their consumer properties (plots of land, reservoirs and other natural objects, museum exhibits, etc.).

Tasks and methods of auditing asset accounting

In order to avoid possible fines for violating the requirements of regulations in force in Russia, enterprises conduct an audit of fixed asset accounting. This event involves monitoring the following facts:

- The fixed assets listed on the balance are available, and their condition corresponds to that indicated.

- Documentary support for operations with fixed assets (receipt, disposal, revaluation, etc.) is carried out correctly.

- Depreciation is carried out properly.

- All taxes have been assessed and paid.

- Objects are classified as OS justifiably.

If a shortage is identified, the auditor reflects it in the reconciliation sheet. The result in the form of an act serves as a guide for eliminating violations. If they are discovered by government audits, penalties will inevitably be imposed, possibly very severely.