We all receive income from different types of sources. In the Russian Federation, as in the vast majority of countries, funds received are subject to tax. To correctly determine whether income is taxed and in what amount, there is a so-called income code in the 3rd personal income tax return. This reporting form is the main declaration for reflecting income received and the amount of tax paid.

Selecting a reward code

Employers pay bonuses to employees based on their own local regulations. The reason for payments can be different (for exceeding specified volumes, improving the quantity and quality of products, etc.), the frequency of accrual also varies - one-time incentive, monthly payments, annual bonus. The personal income tax code for different types of premiums may differ.

A complete breakdown of all income codes is given in the Appendix to the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/ [email protected] (the last changes were made to the reference book on October 24, 2017). For bonuses, income codes (codes 2002 and 2003) were introduced by order of the Federal Tax Service dated November 22, 2016 No. ММВ-7-11 / [email protected] They are also valid for certificates for 2021.

The bonus code in 2-NDFL depends on the source and reason for payment of bonuses. The tax agent himself chooses the desired value based on the actual circumstances of the accrual. For one-time bonuses, the income code may also vary.

Remuneration for the performance of labor duties is indicated in 2-NDFL by code 2000. But for bonuses, code 2000 is not suitable, because it is intended for wages and amounts of monetary allowance or maintenance during the performance of labor/official duties. Awards should be reflected in the certificate under codes 2002 and 2003.

Filling out the form

The declaration form is approved by Pr. Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/03/2018, which also reflects the requirements for its completion. The new form is used from 01/01/2019.

Information on how to fill out the Z-NDFL for the past year is provided on the official website of the Federal Tax Service. On the online resource you can find examples of filing a declaration, taking into account various nuances, as well as sample statements.

Providing reporting requires compliance with a number of rules:

- Filling out for the past 3 years is allowed.

- It is possible to submit it in an electronic version, through a special program “Declaration 2018” or in your own hand, but without blots, corrections and in blue (black) ink.

- A separate declaration form is filled out for each year.

- Registration without indicating the date, signature, TIN is unacceptable, the document will be returned as invalid.

- Each form must be completed in duplicate.

- When printing, double-sided design is not allowed.

We recommend additional reading: Calculation of personal income tax from sick leave for pregnancy and childbirth

If the taxpayer reports for several employers, then sections with OKTMO and salary data are prepared separately for each option.

- The order and numbering must be observed in the arrangement of sheets.

- The basic blocks of the document are required to be completed (title part, sections 1 and 2, official profit).

Brief instructions on the required information on the form:

- Selecting filling criteria - a check mark is placed on filling out the 3-NDFL form with the choice of the territorial tax authority.

- Filling out information about the applicant - strictly in accordance with the passport data.

- Indication of sources of profit (the default tax rate is 13%, for each type of income you must select the appropriate percentage).

- Registration of the required deduction (property, for children, social, for an individual investment account, return under a mortgage loan agreement).

First, appendices to the declaration from 1 to 8 are drawn up, and based on this information, sections 2 and 1 are required to be completed. That is, the data in the appendices must correspond to the types of income and expenses indicated in the relevant sections.

In what cases is the code 2002 entered?

For bonuses, code 2002 is used for remunerations accrued for production results or other indicators provided for by the laws of the Russian Federation and/or paid to employees in accordance with labor and collective agreements. Typically, these payments are included in labor costs.

Example 1

The company accrues additional remuneration to each sales department employee who completes the volume of transactions specified in the Bonus Regulations during the month. The bonus amount is 10,000 rubles for each employee who has concluded contracts with customers in a month worth more than 150,000 rubles. For such a monthly premium, the income code in the 2-NDFL certificate is 2002.

Example 2

Based on the results of the calendar year, all employees of the enterprise are paid bonuses if the total volume of production increased by more than 5%. What bonus code should I use at the end of the year? The payment is directly related to production activities, therefore, when the annual bonus is calculated, the income code must be selected - 2002.

Codes of income that are subject to personal income tax when the limit is exceeded

Income code 2720 - cash gifts to the employee. If the amount exceeds 4,000 rubles, then tax is charged on the excess. In the certificate, the amount of the gift is shown with income code 2720 and at the same time with deduction code 501 .

Income code 2760 - financial assistance to an employee or former employee who retired due to disability or age. If the amount of assistance exceeds 4,000 rubles, then a tax is levied on the excess. In the certificate, the amount of financial assistance is shown with the income code 2760 and at the same time the deduction code 503 .

Income code 2762 is a one-time payment in connection with the birth or adoption of a child. If the amount exceeds 50,000 for each child, but for both parents, then tax is charged on the excess amount. In the certificate, this amount is shown with income code 2762 and deduction code 504 .

When does code 2003 apply?

The withholding agent provides premium code 2003 only in certain cases. Such operations include:

- payment of bonuses from the company’s net profit;

- payment of bonuses to employees from special-purpose funds or from targeted revenues.

Example 3

In a company engaged in the construction of residential buildings, for Builder’s Day they decided to give out 3,000 rubles from the company’s profits. bonuses for all employees. The holiday bonus income code that the accountant will indicate in the 2-NDFL certificates is 2003, since the payment is not directly related to labor results, and its source is the company’s net profit.

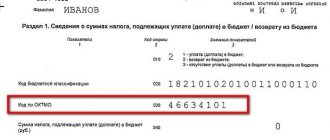

Budget classification code 3-NDFL

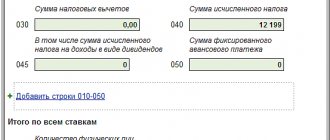

In field “020” of Section 1 “Information on the amounts of tax subject to payment (surcharge) to the budget/refund from the budget”, mark the budget classification code (BCC) of tax revenues, which is used to group items of the state budget. Find out the appropriate BCC for your case on the website of the Federal Tax Service.

In addition, you can use a service that will help you determine not only the BCC, but also the numbers of your inspection of the Federal Tax Service and the All-Russian Classifier of Municipal Territories (OKTMO).

Explanations from the Federal Tax Service

When choosing a bonus code in the 2-NDFL certificate for 2021, you can be guided by the Federal Tax Service letter No. SA-4-11 / [email protected] dated 08/07/2017. It explains what types of rewards can be attributed to a particular code.

For a bonus in 2-NDFL, income code 2002 is selected in the case when the reward is accrued:

- based on the results of work activity for a certain period of time (month, year, quarter);

- for particularly important assignments or assignments;

- in connection with the conferment of an honorary title;

- in connection with receiving awards for production achievements.

The certificate contains personal income tax code 2003 if the premium:

- issued for the anniversary;

- accrued for the holiday;

- designed for additional stimulation;

- refers to other payments not related to the performance of labor or official duties.

Sometimes it is not possible to unambiguously attribute income to one or another indicator. In difficult cases of choosing an income code for a bonus in 2020, the tax agent is recommended to submit a detailed request to the Federal Tax Service of Russia.

Example 4

The employee was awarded a bonus for length of service. The company was faced with a question: which award code should be specified: 2000 or 2002? The additional payment does not directly depend on the employee’s production results, and at the same time is associated with a long period of his working activity. In letter No. SA-4-11/ [email protected] the Federal Tax Service explained that the long service bonus should be included in income with the coding 2000.

Thus, for different types of bonuses, the personal income tax code may differ. Moreover, the indicator does not depend on the frequency of payment. The tax agent independently determines which code to assign the accrued remuneration to, guided by the current income coding directory and its own Regulations on Bonuses (or other local document), which makes it possible to determine the source and procedure for assigning incentive amounts. For bonuses, personal income tax codes in 2020 are 2002 or 2003, depending on the reason for payment.

How to specify several types at once

Conventionally, the application sheets of the form are divided into 3 parts, implying the ability to mark various profit options. But their number may be greater. For example, when reporting on several grounds: salary, sale of an apartment, receipt of a gift and rental of land.

When filling out the declaration, the tax rate of the profit option matters. When considering rewards that are subject to different rates, calculations should be made on different pages rather than on the same page.

Legislative regulation

The declaration is submitted to the tax authorities electronically, in person or by mail before April 30 of the following year (except for cases of filing a tax deduction).

Legislative regulation of issues related to form 3-NDFL is carried out:

- Chapter 23 of the Tax Code of the Russian Federation.

- By Order of the Federal Tax Service of Russia No. ED-7-11/ dated August 28, 2020 (comes into force on January 1, 2021).

IMPORTANT!

The form consists of many sheets, but the taxpayer is required to fill out a title page indicating the document type code in the 3-NDFL declaration and pages reflecting the individual situation.

ConsultantPlus experts discussed how to fill out the 3-NDFL declaration to receive a property deduction for the costs of purchasing an apartment and for interest on a mortgage loan. Use these instructions for free.

Let's look at an example when it is necessary to indicate code 2013 in the 2-NDFL certificate

Kolos LLC terminated the employment contract with employee Zheleznyak I.P. in December 2021. For the period worked, he had 28 days of unused basic leave for 2021, and for 2016-2017 the unused leave amounted to 36 days. The collective agreement states that the employee is entitled to additional 3 days of vacation per year.

Zheleznyak did not use his additional vacation for 3 years, so they accumulated in the amount of 9 days. Ultimately, Kolos LLC must pay compensation to Zheleznyak for 73 days of unused vacation. And the amount of compensation is 136,800.00 rubles.

It is this amount that must be reflected in the 2013 income code of the 2-NDFL certificate.

Checking reports

Before submitting the statements, it is imperative to check them to ensure that all amounts are reflected correctly. If errors are found, then corrections must be submitted. For example, in 2021, when an employee is dismissed, the amount of compensation for unused vacation is not reflected. And this is already considered an error and it is necessary to redo the 2-NDFL certificate and send the adjustment to the tax office.

If reporting with errors is sent to the tax office and the taxpayer does not submit an adjustment on time, then penalties in the amount of 500 rubles will be applied to him. What amounts of the fine are provided for incorrect submission of reports can be found in paragraph 1 of Article 126 of the Tax Code of the Russian Federation. If the company independently identified the error and promptly sent the adjustment to the tax office, then in such a situation there is no penalty. The adjustment is filled out according to the general rules.