As a general rule, a document such as an invoice is the basis for the buyer to accept the VAT amounts presented by the seller for deduction. This procedure is regulated by Chapter 21 of the Tax Code of the Russian Federation. In this consultation we talk about when an advance invoice is issued in 2021.

Also see:

- VAT rates in 2021: table

- VAT on advances may be canceled

- New invoice form in 2021

Advance and tax accrual

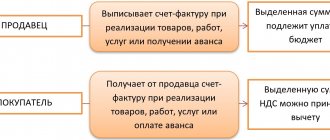

According to the law, if the seller has received an advance from the buyer, he must remember to charge VAT on it.

So, on the basis of paragraph 2 of Art. 153 of the Tax Code of the Russian Federation, when determining the tax base for VAT, revenue from sales (sales) is determined based on all income of the payer associated with settlements for payment for goods (work, services) received by him in cash or in kind.

Moreover, as a general rule, the law considers the earliest of the following dates to be the moment of determining the tax base (clause 1 of Article 167 of the Tax Code of the Russian Federation):

- day of shipment or transfer of goods/works/services;

- the day of payment or partial payment for upcoming deliveries of goods/performance of work/provision of services.

Simply put, having received an advance payment for the supply of goods, performance of work or provision of services, the seller must charge VAT for payment to the budget. The calculated rate will be 20/120 or 10/110 (clause 4 of article 164 of the Tax Code of the Russian Federation).

The choice of tax rate (0%, 10% or 20%) depends on the rate at which the law (Article 164 of the Tax Code of the Russian Federation) applies to the sale of specific goods, performance of work or provision of services for which the seller (supplier) received an advance .

What is it needed for?

A document on the basis of which the buyer of goods will be able to withhold VAT. When a retailer receives advance payment for its own goods, what should it do with it? She must issue an invoice to the consumer company. It makes no sense whether the seller shipped the goods or not. This will be considered an advance invoice.

If for any reason the seller returns the advance payment or after shipment there is a balance of the advance payment, then in both cases the buyer does not need to issue an invoice.

The peculiarities of filling out the document are associated with the fact that it will need to reflect the circumstance of receiving an advance payment. For this purpose, on the basis of which the advance was paid are recorded in the invoice

Read more about why an advance invoice is needed here.

Deadline for issuing an advance invoice

But when is the invoice issued for the advance payment due? According to the law, when selling goods, performing work or providing services, an invoice is issued no later than 5 calendar days , counting the day of shipment of goods (performance of work, provision of services).

Accordingly, an “advance” invoice must also be issued within 5 calendar days from the date of receipt of the advance payment. This is stated in paragraph 3 of Art. 168 Tax Code of the Russian Federation.

When the last day of the period for issuing an advance invoice falls on a weekend or a non-working holiday, it must be issued no later than 1 working day following such a day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

Example:

Issue an advance invoice no later than five calendar days from the date of receipt of the advance payment (clause 3 of Article 168 of the Tax Code of the Russian Federation). For example, the advance payment was received on January 29, 2021. You can issue an invoice on any of the following days: January 29, January 30, January 31, February 1 or 2, 2021.

Registration in the purchase book and sales book

When transferring an advance payment, entries in the sales book from the supplier and in the purchase book from the buyer are made in the period when the “advance” invoice is issued.

When shipping goods on account of prepayment, an entry in the supplier's purchase book is made during the shipment period. An entry in the buyer's sales book is also made in the period of shipment, and not in the period of transfer of the advance payment.

A prepayment invoice is recorded in the purchase ledger and in the sales ledger in the same way as a “regular” invoice. But there are features that need to be taken into account when filling out individual fields (see Table 2 and Table 3; for examples of filling, see the article “How to correctly fill out a purchase book and a sales book in case of prepayment, as well as when issuing an adjustment invoice” ).

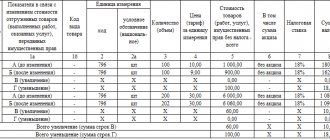

table 2

Rules for filling out individual fields of the purchase book when registering an “advance” invoice

| Number | Name | Content |

| What entries does the buyer make when transferring the advance payment? | ||

| column 2 | Operation type code | 02 |

| What entries does the seller make when shipping goods and deducting previously accrued VAT? | ||

| column 2 | Operation type code | 22 |

| column 9 | Seller's name | data from line 2 of the “advance” invoice |

Table 3

Rules for filling out individual fields of the sales book when registering an “advance” invoice

| Number | Name | Content |

| What notes does the seller make when receiving an advance? | ||

| column 2 | Operation type code | 02 |

| What entries does the buyer make when shipping the goods and restoring the previously accepted deduction? | ||

| column 2 | Operation type code | 21 |

| column 7 | Buyer's name | data from line 6 of the “advance” invoice |

| column 8 | Buyer's INN/KPP | data from line 6b of the “advance” invoice |

Maintain purchase books and sales books for free in an accounting web service

When it is not necessary to issue an invoice for an advance payment

An invoice for an advance payment for a transaction is not issued if the advance is received against future supplies of goods (performance of work, provision of services) that satisfy one of the following conditions (paragraph 3 of clause 17 of the Rules, approved by Decree of the Government of the Russian Federation dated December 26. 2011 No. 1137):

- have a production and manufacturing cycle duration of more than six months;

- are taxed at a VAT rate of 0%;

- are not subject to taxation (exempt from VAT).

According to the Russian Ministry of Finance, it is also not necessary to issue an invoice for prepayment if the shipment occurred within 5 calendar days from the date of receipt of the advance payment for this shipment (letter dated November 10, 2016 No. 03-07-14/65759).

Thus, the deadlines for issuing advance invoices have not changed recently.

Read also

15.05.2019

Rules for filling out the document: step-by-step instructions

First, let's fill in the rows , they are located in front of the tabular part:

- Line No. 1 – serial number (taken from the list of documents), date.

- Line 2, 2a, 2b – location and details of the seller.

- Line 4 – write the location of the final recipient, if the final addressee is also a consumer of the product, then put a dash.

- Line 5 – here we write the number and date of the document. When issuing an invoice based on several payments at once, all payments without exception are indicated. If the advance payment for the goods was not made in cash, only then a dash is added in column 5. Thus, an invoice can be issued only upon receipt of payment.

- Line 6, 6a, 6b – location and details of the buyer.

- Line 7 is the code of the monetary unit, if it is the ruble, then 643.

- Line 8 – suppliers under a government contract show the code of such an agreement.

Now let's start filling out the tabular part of the form. In this part of the form, only sections 1, 7, 8 and 9 are filled out, and dashes are added in the others.

- Column 1 must indicate:

- Product Name;

presentation of work performed, services provided, property rights.

- Columns 2, 3, 4 (unit of measurement, number, price per piece of measurement) do not need to be filled out. In addition, the data in columns 10 and 11 (country of origin of the goods, customs declaration number) is not indicated. They need to have dashes. When calculating VAT specifically on the prepayment amount, the estimated tax amount is used.

- Section 7 – the estimated tax rate is indicated . It is possible to make a note in the act, say, accepted from such and such.

Will it be possible to write the phrase “Advance payment” instead of the product name? In another column, it is possible to write the phrase “Advance payment under the agreement...” without providing the name of the goods (works, services). Such wording in an “advance” invoice is quite possible. In such a case, in column 1 we advise you to write the phrase “Advance payment for... (name of product required) under the contract...”.

If the seller clearly understands for which goods (works, services) payment was received from the consumer, it is possible to indicate their direct names in column 1 of the invoice. In this case, it is necessary to make an integral note that the amount of tax is calculated directly from the amount of the purchased prepayment.

The completed form must be signed by the head of the company and its chief accountant , or in the absence of the latter, the responsible person.

You will find a detailed procedure for filling out the ASF here.

Filling out and submitting the form by the supplier

The tax code does not provide for exceptions for the presentation of the form. However, there is a Russian government decree that indicates cases where an invoice may not be issued. Let's list them:

- an advance is issued for the supply of products that will be produced in 6 months or later;

- the payment was made for a transaction for which the VAT rate is 0 or is not paid;

- the company does not pay VAT under Article 145 of the Tax Code of the Russian Federation.

The period within which the document must be issued

The selling company is obliged to draw up and send an invoice to the buyer no later than 5 days from the date of receipt of funds or payment in kind.

Why is it important to follow the design?

The document to which this article is devoted is necessary for the buyer to claim VAT deduction. If critical errors are made in it, the tax service will not recognize the deduction. This means that the company will have to pay additional taxes, and in the worst case, also pay a fine. Therefore, when receiving an invoice, it is important to carefully check its basic details.

To be fair, we note that not every mistake will result in a denial of the deduction. There are a number of transaction parameters that must be identified by the invoice, namely:

- buyer and seller;

- object of the contract;

- cost of goods (services) or advance payment amount;

- VAT rate and amount.

If the specified parameters are determined from the invoice, then a deduction can be claimed on it, despite other errors. Having received a refusal from the Federal Tax Service, the taxpayer can safely go to court. However, if the supplier made an error when generating the invoice, for example, in the cost of the goods or the amount of tax, then the buyer may not count on VAT preferences.

So, an invoice is very important for calculating VAT from the supplier and deducting its incoming part from the buyer. It is necessary to monitor the current form of the document, because it changes periodically. And it is extremely important to follow the procedure and deadlines for its preparation, as well as to avoid critical errors that will lead to non-recognition of the deduction from the buyer.

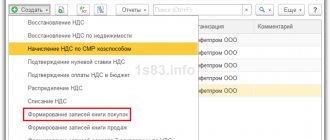

Automatically

In a situation where there are a lot of incoming invoices, registering them manually becomes inconvenient and time-consuming. In this case, it is better to set automatic registration. Instructions:

- To do this, you need to go to the “banks and cash desks” subsection, where you can find “advance accounts”. After selecting this item, a window will appear in which you should select the period for which documents will be generated.

- Then you need to click the “fill in” button and select all unregistered accounts. At the same time, the list can be easily adjusted and, if necessary, delete unnecessary ones or add new documents.

- When all the necessary advance invoices from the supplier have been selected, all that remains is to click on the “execute” button, after which they will be processed - this way all the rules for offsetting the ASF will be observed.

The list of all completed documents can be opened at any time by clicking on the link: “open list of accounts for advance payment”.

Legislation on ASF

The main legislative document is the Tax Code of Russia (namely its 169th article), which contains all the instructions and rules on the timing and procedure for drawing up, processing and submitting such an invoice.

In addition, many specific points relating specifically to the ASF are contained in the law “On Accounting” . Also, in case of any contradictions (for example, when filling out certain columns or indicating any information), you can refer to the messages of the Ministry of Finance related to to the real topic. They explain most controversial issues, including advance payments (read more about what an invoice number is and what is the procedure for continuous and separate numbering with a fraction and prefix A, here).

How to issue an advance invoice to a buyer

The tabular part of the document is filled in with the name of the goods or description of the work (services) for which the advance payment has been charged. It is important to consider that all names must match those specified in the supply contract or for the provision of the relevant services . It is not prohibited to include generic names, such as “industrial products” or “welding services.”

A sample of a completed invoice is provided below.

Header of an invoice filled out in accordance with all the rules: this document can be safely accepted for accounting

The document must indicate the tax rate (Article 164 of the Tax Code of the Russian Federation), the amount of VAT presented and the amount of the advance payment.

The management of the company, as well as the chief accountant, are responsible for signing. It is allowed to delegate these responsibilities to other officials if there is a corresponding order from management on the transfer of powers.

The content of the invoice contains a link to the supply agreement, the tax rate, the amount of VAT and the amount of the advance received

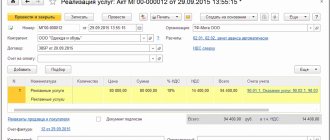

In manual mode

There are two main ways to register ASF in the 1C program. The first one is the manual method. It is suitable when you have to register a small number of accounts. Instructions:

- In order to draw up a document in this way, you need to select the button in the documents for advance payment section: create based on. From the options that appear, select “invoice issued”.

- Once this item is selected, a separate account window will appear.

- After this, you only need to check that all the data is filled out correctly and click on the “conduct” icon, after which the document will be completed.

Issue date

The document can be issued by one of the following dates:

- the day of direct provision of the service;

- sale or shipment of goods, as well as transfer of various property rights;

- or the day of accrual of advance payment (in full or in parts) for the upcoming receipt of services or goods.

If the ASF is issued for continuously supplied services, then in this case the invoice date may be the last day of the entire billing period for which payment was calculated.

When registering an account, be sure to take into account all the requirements described above (specified in the tax code). After all, even small inaccuracies or incorrectly specified data can constitute a violation and lead to serious problems for the company.

Particular attention should be paid to the timing of filling out the invoice, its serial number, indicating in it the full data of the payer, the seller and their details, as well as the exact data of the document confirming the payment.

Correctly filling out an invoice is not such a difficult task, and if problems do arise, it is enough to seek advice from a specialist.

Which transactions correspond to the issued document?

When an advance payment is received, a transaction is generated that records the funds received in the account of the service provider (seller). Then, after the advance invoice is prepared by the seller and received by the buyer, the completed invoices are posted when they are registered.

This can be done either on an individual account basis or in a generally automated manner (as explained earlier).

The seller's wiring will be something like this:

- debit 51 Credit 62ав – advance money received from the buyer;

- debit 62av. Credit 68 – the accrual of added tax, which is allocated from the advance payment, is noted;

- debit 62 Credit 90.1 – income from the sale of inventory and materials is noted in the advance account;

- debit 90.3 Credit 68 – VAT is charged on the sales transaction;

- debit 68 Credit 62av. – advance VAT is accepted for deduction;

- debit 62av. Credit 62 rub. – prepaid money is counted.

And in accounting:

- Deb. 60 av. Credit. 51 – receiving an advance.

- Deb. 68 Cred. 60 Av – tax on prepayment is deductible.

- Deb. 19 Cred. 60 rubles – tax is allocated according to the goods and materials received.

- Deb. 68 Cred. 19 – income tax is accepted as a deduction.

- Deb. 60 av Cred. 68 – advance VAT restored.

- Deb. 60 RUR Credit. 60 Av – advance payment is counted.

As can be seen from the content of this article, the use of electronic programs for registering various accounts (including advance accounts) is preferable. It allows you to store all the necessary information in one place, and due to the interconnectedness of documents, the possibility of making errors in them is minimal.

In addition, mass automatic filling of documents allows you to significantly save working time.

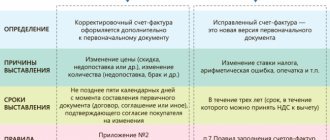

If the displayed document needs to be changed

In practice, it often happens that changes have to be made to documents. For example, there was a shortage of goods or its price changed. This is also required when an error is found in the invoice.

To change the information in the issued document, corrected and adjustment invoices are drawn up. The first is simply a new version of the document that contains the correct information. The corrected invoice is issued within three years from the period of issue of the original document. This is due to the right of the buyer to claim input tax deduction within a specified period. The corrected document exists independently and completely replaces the one in which the incorrect data was indicated. It is issued in cases where it is necessary to correct an error that did not lead to a change in the amount. For example, the supplier incorrectly indicated the buyer's name or tax rate. If incorrect information in the invoice does not make deduction impossible, then a corrected document does not need to be drawn up.

In what cases is a correction invoice issued? When the transaction amount is adjusted, for example, due to a change in the cost of the product. In this case, an agreement must be concluded between the parties to change the amount (annex to the agreement, act, decision). The adjustment document is drawn up for the amount of changes and is an addition to the original one.

It happens that the supplier sold several batches of goods to one buyer and issued a separate invoice for each. However, it happened that the amount in all deliveries needed to be changed. How many invoices are issued for adjustments? In this situation, there is no need to draw up several documents - the seller can draw up one for all changes addressed to this buyer.

Accounting and numbering

An advance invoice is a regular invoice, but with certain conditions (prepayment). Accordingly, the question of its numbering arises very often. The law (Government Decree No. 1137) states that the chronological order is the same for all invoices. This means that the advance invoice is numbered in the general order.

Some accountants keep separate records, which is not entirely true. Although there is no liability for this, for consolidation during checks, the correct sequence makes things easier. For convenience, you can put notes in the form of letter values (101/AB).

Video: how to issue and process advance invoices

Filling out an advance invoice is not difficult. In order for the written document to be accepted for credit, you must be careful and avoid common mistakes. Records should be kept in a log book, as required by law, failure to comply with which may result in fines.

- Author: Sergey Saltykov

My name is Sergey. I have completed higher education in management. I am 24 years old, I started writing articles while still a student. Freelancing for more than three years. I am ready to carry out orders on various topics, as I love to develop. Rate this article:

- 5

- 4

- 3

- 2

- 1

(1 vote, average: 5 out of 5)

Share with your friends!

Typical problems during registration

First of all, it is worth noting errors that do not affect the validity of the document and cannot be grounds for refusing to deduct VAT. Errors that do not interfere with the identification of VAT payers:

- addresses of the seller or buyer;

- tax rates;

- VAT amounts;

- name and price of goods and services.

If there is no information, instead of a dash, you can leave the field blank. O and other similar ones are also allowed.

What errors prevent VAT refunds?

Among the shortcomings in the design there are those that interfere with receiving a VAT refund. List of the most common critical errors:

- incorrect filling of the TIN and KPP;

- incorrect or unspecified document number;

- lack of information about the country of origin for foreign products.

Many accountants required to issue invoices are accustomed to giving priority to the actual address of the buyer. In fact, the main thing for identifying a counterparty is the legal address.