In accordance with paragraph 1 of Art. 8 of Federal Law No. 14-FZ of 02/08/1998 “On Limited Liability Companies”, company participants have the right to receive, in the event of liquidation of the company, part of the property remaining after settlements with creditors, or its value.

As stated in Letter of the Ministry of Finance of Russia dated March 27, 2015 N 03-03-10/16935, taxation of distributed property of a liquidated limited liability company or joint stock company is carried out taking into account the following.

- Firstly , pp. 1 item 2 art. 43 of the Code establishes that dividends are not recognized as payments during the liquidation of an organization to a shareholder (participant) of this organization in cash or in kind, not exceeding the contribution of this shareholder (participant) to the authorized (share) capital of the organization. Moreover, since the distribution of the organization’s property during its liquidation between shareholders (participants) is made after satisfying the claims of all creditors, that is, payment of all obligations, including obligations for taxes and fees, such payments are actually aimed at distributing the net profit of this organization and satisfy the definition of dividends, established by paragraph 1 of this article, according to which a dividend is any income received by a shareholder (participant) from an organization when distributing profits remaining after taxation (including in the form of interest on preferred shares) on shares owned by the shareholder (participant) ( shares) in proportion to the shares of shareholders (participants) in the authorized (joint) capital of this organization. Do you need qualified assistance regarding the taxation of distributed property? Contact the Raut legal agency. Initial consultation with an opinion from a professional lawyer - FREE!

- Secondly (applies to joint stock companies, not LLCs), if payments are made on shares that are subject to mandatory redemption in accordance with Art. 75 of Federal Law N 208-FZ, such payments, in our opinion, are taxed in accordance with Art. 214.1 of the Code as income from transactions with securities (income from the sale by a shareholder of his shares to the company). At the same time, when determining the tax base for personal income tax in relation to the corresponding income, expenses for the acquisition of these shares, including contributions to the authorized capital, may be taken into account.

- Thirdly , accrued but unpaid dividends paid from the property of a liquidated company are subject to taxation as income in the form of dividends. At the same time, the tax base for income received by a taxpayer from a liquidated company in kind, in the case of their taxation, is determined in accordance with the specifics established by Art. 211 of the Code.

Thus, the receipt by a shareholder (participant) - an individual of payments in cash or in kind in an amount not exceeding the contribution of this shareholder (participant) to the authorized (share) capital of the organization is not recognized as income and is not subject to taxation on personal income tax, if such payments are not made on shares subject to mandatory redemption, and also do not constitute payment of accrued but unpaid dividends from the property of the liquidated company.

Taxable period

The procedure for determining the tax period for which taxes (contributions) of a liquidated organization need to be calculated is presented in the table.

Situation: within what time frame must a liquidated organization pay taxes?

Upon liquidation, the following tax payment procedure applies.

During the period from the moment the decision on liquidation is made until the interim balance sheet is approved, pay taxes within the time limits established by tax legislation. This also applies to the payment of taxes (fines, penalties) accrued based on the results of an on-site tax audit in connection with liquidation (letter of the Ministry of Finance of Russia dated April 11, 2000 No. 04-01-10).

During the period from the approval of the interim balance sheet to the approval of the liquidation balance sheet, repay the debt to the budget in the order of priority established by civil legislation (clauses 5, 6 of Article 63 of the Civil Code of the Russian Federation). During this stage of liquidation, debts incurred and presented by creditors (including the tax inspectorate) before the approval of the interim balance sheet are repaid.

After approval of the liquidation balance sheet, the remaining property is distributed among the founders (participants, shareholders) of the organization (Clause 8, Article 63 of the Civil Code of the Russian Federation). If during this period the organization has an obligation to pay taxes (penalties, fines), the organization must fulfill it before the end of the liquidation period. This also applies to tax charges that arose if the organization carried out taxable transactions in the period from the approval of the interim balance sheet to the approval of the liquidation balance sheet. This rule is explained by the fact that the liquidated organization ceases to be a tax payer only after all settlements with the budget have been made (subclause 4, clause 3, article 44 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 17, 2006 No. 03-02-07/1/ 57). For newly arising obligations, the tax inspectorate must send a tax payment request to the organization (Article 69 of the Tax Code of the Russian Federation). If this is not done, it is impossible to refuse to liquidate the organization due to failure to complete all payments to the budget (clause 1 of Article 23 of the Law of August 8, 2001 No. 129-FZ, resolution of the Federal Antimonopoly Service of the East Siberian District of April 17, 2006 No. А19-13065/04-27-39-Ф02-1583/06-С2).

In an indisputable manner (by collection orders), the tax inspectorate cannot write off the amount of taxes, penalties and fines from the account of the liquidated organization. In arbitration practice, there are court decisions that recognize that such actions violate the rights of both the organization itself and its creditors (see, for example, resolution of the Federal Antimonopoly Service of the Ural District dated October 16, 2012 No. F09-9497/12).

Declaration of income received by a participant after the liquidation of the company

The rules for taxation of income received by a shareholder (participant, shareholder) of an organization in the event of its liquidation are ambiguous due to the constant changes made to the Tax Code of the Russian Federation. Let's try to understand the indisputable and controversial points.

Tax base (what is considered income): When receiving funds (property) by a shareholder (participant, shareholder) of an organization in the event of its liquidation, the actual value of the share is recognized as income (clause 10, clause 1, article 208, clause 1, article 209) Tax Code RF).

For example, a citizen was a participant in two LLCs - “A” and “B”. Both organizations were liquidated. In “A” he made an initial contribution to the management company in the amount of 15,000 rubles. During liquidation, the actual value of the share was calculated and he received a payment in the amount of 150,000 rubles. In this case, the income (tax base) for further calculation of personal income tax will be 150,000 rubles. In “B” he made an initial contribution to the management company in the amount of 15,000 rubles. And he received money after calculating the actual value of the share - 1,500 rubles. Accordingly, the income (tax base) for calculating personal income tax will be 1,500 rubles.

Tax base (what is considered an expense, what deduction to use):

A) exercise the right to a property deduction provided for in subclause 2 of clause 2 of Article 220 of the Tax Code of the Russian Federation - to reduce income by the amount of actually incurred and documented expenses associated with the payment of the authorized capital. Such expenses include amounts paid as payment to the Criminal Code. And in cases where such payments were made at the expense of loan funds, then the amount of interest paid under the loan agreement (see Letter of the Ministry of Finance of Russia dated November 10, 2015 N 03-04-07/64620). For “A” tax base = 135000 (150000-15000); for “B” tax base = 0 (1500-15000).

Please note that only payment (in cash or property) of the authorized capital is considered an expense. If the value of your share has increased by increasing the authorized capital at the expense of net profit, then the “increase due to net profit” will not be included in the expense.

B) in the event that you do not have documents confirming the costs of acquiring a share, you have the right to take advantage of a property deduction in an amount not exceeding 250,000 rubles, in accordance with paragraph. 2 subparagraph 1 paragraph 2 art. 220 Tax Code of the Russian Federation. For “A” tax base = 0 (150000-250000); for “B” tax base = 0 (1500-250000).

Holding period: There is no minimum holding period for income received as a result of the liquidation of an organization, therefore, regardless of the holding period, income will have to be declared.

We submit the declaration ourselves, because in any case, it becomes necessary to use one of the deductions, and only the tax authority has the right to provide them on the basis of the 3-NDFL declaration. Explanations on this issue are contained in Letter of the Ministry of Finance of Russia dated May 27, 2016 N 03-04-06/30627.

Liquidation of an enterprise: how to minimize tax risks

In economic activity, there are situations when the founders decide to liquidate the enterprise. The reasons can be very different - from liquidating a non-core business to minimizing tax risks. In order to liquidate without problems, the company needs to pay off its debts to employees, suppliers, and most importantly, the budget. Moreover, tax payments (mainly for VAT and income tax) can be minimized if various options for calculating the tax base for them are analyzed in advance.

Value added tax

In accordance with Articles 39 and 146 of the Tax Code of the Russian Federation, the transfer of property to a participant during the liquidation of a company within the value of his contribution is not recognized as a sale, and therefore is not subject to VAT. However, such a transfer entails the need to restore the VAT previously accepted for deduction when acquiring the relevant property (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation), which is subject to inclusion in income tax expenses. On the value of the property of a liquidated company exceeding the value of the participant’s contribution, VAT is subject to payment in the general manner.

Example 1

The contribution of a participant when creating a company was 1 million rubles, and upon its liquidation, he was transferred to a fixed asset, the residual value of which is 1.5 million rubles. When transferring property to a participant, a company in liquidation is obliged to:— restore VAT on the value of property up to the participant’s contribution from 1 million rubles. At a rate of 18%, VAT is subject to restoration and payment in the amount of 180 thousand rubles. The amount of restored VAT will reduce the tax base for income tax in the amount of 43.2 thousand rubles. (180 thousand, rub. x 24%);

— accrue and pay VAT to the budget on the value of property exceeding the participant’s contribution, that is, from 500 thousand rubles. At a rate of 18%, VAT is subject to accrual and payment in the amount of 90 thousand rubles.

Thus, the company will pay VAT to the budget in the amount of 270 thousand rubles. (180 thousand + 90 thousand), while saving 43.2 thousand rubles on income tax.

The example clearly shows that the amount of savings on income tax is not comparable with the amount of VAT to be restored and paid to the budget (savings, by definition, cannot exceed 24% of the amount of the restored VAT).

Moreover, there will be no savings at all if the liquidated enterprise is unprofitable, since in this case additional expenses do not reduce taxable profit, but only increase losses. This situation can be avoided if, during the liquidation of an enterprise, property is distributed among the participants, transactions for the sale of which are not subject to VAT (for example, securities, shares in the authorized capital of organizations, cash, etc.). Accordingly, even before making a decision to liquidate the company, it is necessary to change the structure of its assets. This can be done in various ways; we will consider two of them in more detail.

Method one

An enterprise that is subject to liquidation invests property (for example, fixed assets) into the authorized capital of the newly created subsidiary, and only after that a decision on liquidation is made. The liquidated enterprise distributes among the participants not fixed assets, but shares in the authorized capital or shares (see Fig. 1). It will be obliged to restore VAT on the entire residual value of the property transferred to the authorized capital (subclause 1, clause 3, article 170 of the Tax Code of the Russian Federation). At the same time, the restored VAT can be deducted by a subsidiary that receives property as part of its authorized capital. The transfer of property (shares in the authorized capital, shares) by a liquidated enterprise to a participant is not subject to VAT (subclause 12, clause 2, article 149 of the Tax Code of the Russian Federation).

Example 2

The contribution of a participant when creating a company was 1 million rubles, and the value of the property (for example, the residual value of fixed assets) to be transferred to the participant was 1.5 million rubles. Wherein— a liquidated enterprise, when transferring property to the authorized capital of a subsidiary, restores and pays VAT to the budget in the amount of 0.27 million rubles.

— the subsidiary claims VAT in the amount of 0.27 million rubles for deduction from the budget.

- a liquidated enterprise does not pay VAT when transferring property to a participant, since property is transferred that is not subject to VAT (shares in the authorized capital, shares), including in the case when the value of such property exceeds the contribution of a participant in the liquidated company. Thus, the total VAT obligations of all liquidation participants (liquidated enterprise, its participant, subsidiary) are equal to zero.

If a participant in a liquidated enterprise is a VAT payer (an organization or an individual entrepreneur), then to minimize the tax upon liquidation, it is advisable to use the second method.

Method two

Before a decision on liquidation is made, the enterprise subject to liquidation sells property (for example, fixed assets) to its participant. In this case, the liquidated enterprise will charge and pay VAT on the sale of property. At the same time, its participant will present the corresponding amount of VAT for deduction from the budget.

In the future (after the decision on liquidation is made), the proceeds from the sale of property will be distributed (see Fig. 2). As a result, the total VAT liability of the founder and the liquidated enterprise will be equal to zero.

This method is advisable to use in a situation where a participant in a liquidated enterprise is a VAT payer and wants to own its property directly, and not through a subsidiary company. In addition, this option is simpler from an organizational point of view compared to the creation of subsidiaries.

At the same time, it also has disadvantages. First of all, it should be noted the differences in the procedure for calculating the tax base. If, according to the first method, when making a contribution to the authorized capital and subsequent liquidation of the enterprise, VAT is restored based on the residual value of the property distributed (invested in the authorized capital), then according to the second method, the tax base is determined based on the price of the contract. Considering that the sale is carried out between interdependent persons, the tax authorities can control the price of the transaction according to the rules of Art. 40 Tax Code of the Russian Federation.

Income tax

If, when distributing the property of a liquidated enterprise, obligations to pay VAT arise for the liquidated company, then for the payment of income tax - for the participant. In this case, income in the form of property received within the limits of the participant’s contribution is not taken into account when distributing the property of a liquidated enterprise between its participants and when determining the tax base for income tax (subclause 4, clause 1, article 251 of the Tax Code of the Russian Federation).

The value of the property in excess of the participant’s contribution falls under the definition of dividends contained in Art. 43

Personal opinion

Vladimir Altergot, Director of Legal Affairs, OJSC “Domestic Medicines” (Moscow)

In my opinion, the direct transfer of property to a participant upon liquidation of a company is generally difficult to consider as a way to minimize taxes (since this is a common result of liquidation). In addition, not many companies being liquidated have an authorized capital of 1 million rubles. (as indicated in example 1) with distributed property of 1.5 million rubles. Much more often, situations arise when the company’s property (the liquidation of which generally makes sense) is worth several million, and deposits amount to 50-100 thousand rubles. As for the preliminary sale of property to the founder with subsequent payment of funds to him, such a scheme should be approached very carefully. Firstly, as the author of the article correctly points out, this is a transaction between interdependent parties, and tax authorities have the right to check the compliance of the sales price with the market price. Thus, a company participant will be forced to “exclude” from circulation for quite a long time an amount of funds approximately equal to the market price of the acquired property. The duration is determined by the participant’s desire to protect himself from suspicions of the tax authorities that the transaction is a sham. Secondly, trying to “escape” VAT, the company will have to pay income tax when selling property, if it itself is not unprofitable. In addition, the scheme does not work if the participant of the organization is a VAT non-payer (for example, an individual), since in this case he will not be able to reimburse the VAT paid. A more promising scheme from a tax point of view is the transfer of property to the authorized capital of a subsidiary. However, then the question arises: why bother with liquidation at all, if as a result, instead of a share in one company, the participant receives a share in another. At the same time, we do not consider the openly criminal goal of obtaining a “clean” organization without debts, but with property. In this case, we must not forget about the possibility of collecting debts from a subsidiary (subclause 16, clause 1, article 31 of the Tax Code of the Russian Federation), and also that the transaction can be declared invalid if it contradicts the fundamentals of law and order and morality (Article 169 of the Civil Code RF). When deciding to liquidate a company, it should be remembered that in accordance with Art. 87 of the Tax Code of the Russian Federation, the tax authority has the right (and in practice this is done obligatory) to conduct an on-site tax audit of a liquidated company, including in relation to already audited periods. Therefore, when liquidating, a company attracts increased attention from tax authorities, which cannot be avoided. Thus, transactions whose purpose is to evade taxes can most likely be identified and challenged by tax authorities.

Tax Code of the Russian Federation1. The conclusion about the need to consider such an excess as a dividend also indirectly follows from the wording of subclause. 1 item 2 art. 43 of the Tax Code of the Russian Federation: “Payments upon liquidation of an organization to a shareholder (participant) of this organization in cash or in kind, not exceeding the contribution of this shareholder (participant) to the authorized (share) capital of the organization.” It can be assumed that, according to the definition of paragraph 1 of Art. 43 of the Tax Code of the Russian Federation, any payments to a shareholder (participant) during the liquidation of an enterprise fall under the definition of dividends, and only by virtue of the direct indication of sub. 1 clause 2 of the Tax Code of the Russian Federation, amounts within the limits of the contribution of this participant are not considered a dividend. However, there is no such indication regarding the amount of excess.

Moreover, dividends are subject to taxation at a special rate. So, according to paragraph 3 of Art. 284 of the Tax Code of the Russian Federation, a 9% rate is applied to the tax base for income in the form of dividends if we are talking about income received from Russian companies by Russian enterprises and individuals - tax residents of the Russian Federation. If a foreign company receives dividends from a Russian enterprise, then the rates may vary depending on a number of factors, namely:

- a foreign company operates through a permanent representative office or receives so-called “passive” income from sources in the Russian Federation;

- Is the foreign company a resident of a country with which Russia has a valid agreement (treaty, convention) for the avoidance of double taxation (hereinafter referred to as the Agreement), which provides for a non-discrimination clause?

The results of combinations of these factors are presented in the table on p. 64./

Personal opinion

Zhanna Malkova, chief accountant of Caiman LLC (Kaliningrad) In my opinion, the excess of payments received by a participant during liquidation over his contribution to the authorized capital, in accordance with the provisions of clause 1 of Art. 43 of the Tax Code of the Russian Federation, can be considered as dividends. With this approach, tax must be withheld by the tax agent (the liquidated company) at a rate of 9%. However, it should be noted that the participant will probably have to prove the legality of this position in an arbitration court. The ambiguity of the situation is due to the fact that payments to participants (income in the form of payments exceeding the initial contribution) are not named in the Tax Code of the Russian Federation as dividends. In addition, the provision on taxation of income in the form of property of a liquidated company during its distribution did not find a place in Art. 275 of the Tax Code of the Russian Federation “Features of determining the tax base for income received from equity participation in other organizations” This provision is included in Art. 277 of the Tax Code of the Russian Federation “Features of determining the tax base for income received upon transfer of property to the authorized capital.” In particular, in paragraph 4 of Art. 277 of the Tax Code of the Russian Federation states that during the liquidation of an enterprise and the distribution of its property, the income of taxpayers - participants in the liquidated company is determined based on the market price of such property (property rights) at the time of its receipt, minus the cost of shares actually paid by the relevant participants of this companyThe fact that the amount subject to income tax is determined as the difference between the value of the property received and the down payment is confirmed by sub. 4 paragraphs 1 art. 251 of the NKRF, according to which “income in the form of property, property rights that are received within the limits of the contribution (contribution) by a participant in a business company or partnership (his legal successor or heir) is not subject to taxation upon exit (disposal) from the business company or partnership or upon distribution of property of a liquidated business company or a partnership between its participants.” From the above it follows that payments received during the liquidation of an organization in excess of contributions to the authorized capital are not considered by Chapter 25 of the Tax Code of the Russian Federation as dividends, but are subject to inclusion in the non-operating income of participants in accordance with Art. 250 of the Tax Code of the Russian Federation when calculating the tax base, taxed at a rate of 24% in accordance with clause 1 of Art. 284 of the Tax Code of the Russian Federation, the considered point of view is based on the provisions of Chapter 25 of the Tax Code of the Russian Federation and is valid only in the case when the recipient of the income is a legal entity. If property is distributed between participants - individuals, then their income is subject to taxation in accordance with Chapter 23 of the Tax Code of the Russian Federation “Income Tax on Individuals”. This chapter does not contain any separate provisions regarding income in the form of distributed property received by participants upon liquidation of the company, nor the definition of dividends. When distributing property between legal entities and individuals, participants in a limited liability company, the value of the property exceeding their initial contribution, for the former, can be recognized as non-operating income (tax rate - 24%), for the latter - dividends (tax rate - 9%)

From the table on p.

64 shows the following feature of the taxation of dividends distributed in favor of foreign companies. As a general rule, dividends distributed in favor of a foreign company in the absence of its permanent establishment in the Russian Federation and the Double Taxation Agreement are taxed at a rate of 15%. Meanwhile, property distributed in favor of such a foreign company upon liquidation is also considered a dividend, but is taxed at a rate of 20%.

This approach of the legislator allows optimizing the tax rate on dividends if, before making a decision on liquidation, the founders of the company decide to pay dividends and pay them. Tax will be paid at a rate of 15%. When it comes to distributing the property of the liquidated enterprise between the participants, the tax base (as the excess of the value of the distributed property over the participant’s contribution) will not arise. In addition, it should be taken into account that the Double Taxation Agreement may establish other (more preferential) rates.

If the property of a Russian enterprise being liquidated is subject to distribution in favor of a Russian company, then at first glance it may seem that taxing income as a dividend at a reduced rate of 9% is always beneficial for a participant in the liquidating enterprise.

Table: Income tax rates on dividends distributed by a Russian company in favor of a foreign one

| Availability of agreement | Income tax rates | |

| A permanent representative office of a foreign company in Russia has not been created | A permanent representative office of a foreign company in Russia has been established | |

| Absent | 15% - according to the general rule (according to subparagraph 1, paragraph 1, article 309 of the NKRF, paragraph 1, article 310 of the NKRF, subparagraph 2, paragraph 284 of the Tax Code of the Russian Federation); 20% - on dividends distributed upon liquidation of organizations (according to subparagraph 2, paragraph 1, article 309 of the Tax Code of the Russian Federation, paragraph 1, article 310 of the Tax Code of the Russian Federation, subparagraph 1, paragraph 2, article 284 of the Tax Code of the Russian Federation) | 15% - according to clause. 2 p. 3 art. 284 Tax Code of the Russian Federation |

| Present | At the rates established by the Tax Code of the Russian Federation, but not more than the rates established by the Agreement (usually from 5 to 15%) | 9% |

| The provisions of the relevant Double Taxation Agreement on non-discrimination, as well as sub. 1 clause 3 art. 284 Tax Code of the Russian Federation. The same approach is expressed in clause 6.2.4 of the Methodological recommendations to tax authorities on the application of certain provisions of Chapter 25 of the Tax Code of the Russian Federation concerning the specifics of taxation of profits (income) of foreign organizations, approved. by order of the Ministry of Taxes and Taxes of Russia dated March 28, 2003 No. BG-3-23/150. | ||

However, it should be noted that the tax base for profits taxed at different rates is determined by the taxpayer separately (clause 2 of Article 274 of the Tax Code of the Russian Federation). Therefore, if a participant - an unprofitable Russian company - receives dividends, then he does not have the right to reduce income in the form of dividends for expenses for ordinary activities, but is obliged to pay income tax.

In such a situation, it is advisable in advance (before making a decision to liquidate the enterprise) to consider the possibility of changing the classification of income and bringing it under the type of income taxed at a rate of 24%. As a result, the obligation to pay income tax may not arise: income will be reduced by expenses. This is possible if the corresponding income is transferred, for example, free of charge.

Moreover, it is also beneficial to transfer property free of charge (and not as dividends) when the participant - a Russian company - owns a share in the authorized (share) capital (fund) of the liquidated enterprise in the amount of more than 51%. In this case, you can use the benefit provided for in subsection. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, and do not take this property into account when calculating income tax.

Speaking about the possible benefits of a gratuitous transfer of property from the point of view of income tax, you should also remember the value added tax, since such a transfer is subject to VAT. Therefore, gratuitous transfer should be used, perhaps, only in relation to funds not subject to VAT. s

Personal opinion

Elena Denisova, financial director of Chateau le Grand Vostock (Chateau le Grand Vostok) (Krasnodar) When deciding whether running a business is inappropriate, its owners often consider two options - liquidation of the company or its sale. Selling a company makes sense if among its assets there are significant intangible assets (licenses, certificates, permits, etc.) that have a certain market value and are inextricably linked with the legal name of the company. In this case, the new owner continues to submit tax and accounting reports, ensuring the legal continuity of the company. However, the previous owner still does not withdraw the assets/liabilities.The most common method of withdrawing assets is the sale by the liquidated company of its accounts payable and receivable, when a bill of exchange with a long maturity is accepted as payment. Legally deferred debts and receivables are a way to smoothly complete operations. In general, during liquidation, the most important thing is to notify the owners in advance about liquidation plans. Then the accounting and legal department will undoubtedly find the correct, optimal and legal ways to complete the company’s activities, which will guarantee the absence of claims from the tax authorities,

In conclusion, it should be noted that there is no single recipe for optimal liquidation of an enterprise.

This is due to the fact that when making a decision, it is necessary to take into account a number of factors, such as the size and structure of the assets of the liquidated enterprise, the profitability or unprofitability of the founder, whether the liquidated enterprise itself is a VAT payer, etc. Opinions of experts

Alexander Bashkov, Deputy General Director for Economics and Finance of Russian Electronics OJSC

When liquidating a company, it is necessary to take into account many factors: from the organizational and legal form of the liquidated company, the composition of participants, the structure of assets, the taxation regime for each of the participants in the liquidation process, the method of acquiring the right to a share in the liquidated organization, to how judicial practice develops on each of the problematic issues. links in the chain of the taxation process during the liquidation of an enterprise.

To avoid increased attention from tax authorities to a company during liquidation and to minimize tax risks, one should prepare for the liquidation process, including changing the structure of the assets of the liquidated enterprise, over a long period, taking into account the doctrine of good faith of the taxpayer. It is necessary to formulate the business purpose of each transaction made during the liquidation process, develop and document the economic justification for each procedure. In addition, it should be remembered that tax minimization cannot be the only goal of the actions taken.

It should be noted that even a conscientious taxpayer during the liquidation of a company is not immune from errors in the application of complex and contradictory tax legislation. For example, non-operating income of a taxpayer is recognized as income in the form of amounts of accounts payable (liabilities to creditors) written off due to the expiration of the statute of limitations. At the same time, the tax authorities are making both legitimate demands for the inclusion of these incomes in non-operating income, and demands for including in non-operating income amounts of accounts payable with an unexpired statute of limitations, with which taxpayers do not agree, and their point of view is confirmed in court (resolution FAS Moscow District dated December 13, 2005 No. KA-A40/12166-05-P). In addition, claims from tax officials arise when submitting (failure to submit) tax reports after submitting the liquidation balance sheet due to the unsettled nature of this issue in the legislation. And finally, you can always expect tax authorities to demand that the transfer of property be recognized as a sale in full in relation to a participant who is not a founder, and that a tax rate of 24% be applied to income upon receipt of property.

Irina Kushnaryova, tax analyst at IFD Kapital (Moscow)

One of the gaps in the Tax Code of the Russian Federation is the lack of information in it about reporting during the liquidation or reorganization of an enterprise. Therefore, in this case, the company faces the problem of when and for what period to submit declarations. The matter is complicated by the fact that the tax authorities still do not have a consensus on this issue.

When a company is liquidated, the last tax period for it will be the time from the beginning of the year until the day the liquidation process is completed and the entry is deleted from the Unified State Register of Legal Entities (Article 55 of the Tax Code of the Russian Federation). For those taxes for which the tax period is a month or a quarter, the last tax period is determined in agreement with the tax office.

According to the norms of the Tax Code of the Russian Federation, tax returns must be submitted after the end of the tax period. However, the liquidated company will then no longer exist, and there will be no one to prepare the papers. When should declarations be submitted in this case?

There are two opinions on this matter.

1. The latest declarations must be submitted at the time the notice of liquidation is submitted.

According to employees of the Federal Tax Service of Russia, declarations should be submitted along with a notice of liquidation. Moreover, declarations are filled out for the entire tax period, regardless of when it ends. If the company then has any additional income or expenses, it will have to submit an “adjusted declaration”.

Please note that the on-site tax audit will only cover the period before the notification is submitted. Most likely, they will not check the activities of the organization while the liquidation procedure is ongoing. And even if an inspection is carried out after liquidation, there will be no one to collect fines and arrears from.

2. The last report must be made on the date of drawing up the liquidation balance sheet. Many local inspectors believe that the latest tax returns are submitted as of the date of the final liquidation balance sheet. Until this moment, declarations must be submitted in the usual manner, because the company continues to exist until the entry is deleted from the Unified State Register of Legal Entities, and it may still have obligations to pay taxes.

1 A dividend is any income received by a shareholder (participant) from an organization when distributing the profit remaining after taxation on shares (shares) owned by the shareholder (participant) in proportion to the shares of shareholders (participants) in the authorized (share) capital of this organization.

Magazine "Financial Director" No. 9 (September) 2006

According to VAT

On the basis of subparagraph 5 of paragraph 3 of Article 39 and subparagraph 1 of paragraph 2 of Article 146 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the transfer of property within the limits of the initial contribution to a participant in a business company or partnership (his legal successor or heir) is not recognized as an object of taxation with value added tax. exit (disposal) from a business company or partnership, as well as when distributing the property of a liquidated business company or partnership between its participants.

According to subparagraph 2 of paragraph 3 of Article 170 of the Code, the amounts of value added tax accepted for deduction by the taxpayer on goods (work, services), property rights in the manner prescribed by the Code are subject to restoration by the taxpayer in cases of further use of such goods (work, services), property rights rights to carry out transactions for which tax is not charged, with the exception of a number of transactions named in the specified subparagraph 2 of paragraph 3 of Article 170 of the Code, to which the transfer of property within the limits of the down payment to a participant in a business company upon leaving this company does not apply. Taking into account the above, when transferring property to a company participant, the amounts of value added tax previously accepted for deduction on property are subject to restoration in the amount proportional to the value of the property corresponding to the initial contribution of the company participant (Letter of the Ministry of Finance of Russia dated July 7, 2015 N 03-07-11 /39115)

Accounting info

The procedure for submitting declarations. One of the gaps in the Tax Code of the Russian Federation is the lack of information about reporting during the liquidation or reorganization of a company. Therefore, in this case, the accountant faces the problem of when and for what period to submit declarations. The matter is complicated by the fact that officials will not come to a consensus on this issue. The procedure for submitting tax reports during the reorganization and liquidation of an enterprise is demonstrated in the diagram (it does not specify which declaration is meant: the rules are the same for all taxes).The procedure for submitting tax reports upon liquidation and reorganization of a company.

In case of forced liquidation, if the company has not submitted reports for 12 months and has not carried out any transactions on any bank account during this period, then the tax authorities independently exclude the organization from the Unified State Register of Legal Entities. On the one hand, this is very convenient: you don’t have to submit reports or deal with the tedious procedure of voluntary liquidation. On the other hand, there is a possibility that tax authorities will apply penalties for unsubmitted reports.

In addition, the inspectorate’s decision to exclude a company from the register must be published. Within three months from the date of publication, the owners of the organization, creditors or other interested parties can submit an application to the tax authorities. In this case, no decision will be made to exclude the company from the register. But it will be possible to apply other liquidation procedures, such as bankruptcy. Accordingly, the owners of the organization will have to decide what to do next with this company and what to do with the reporting. After all, the number of reporting periods for which reports will not be submitted will increase. The amount of the fine will also increase. Therefore, before leaving a company, you need to think through all further risks and possible penalties.

The voluntary liquidation method will require more labor from the company than in the case of forced liquidation. But there is confidence to avoid fines and close the company legally.

When a company is liquidated, the last tax period for it will be the period from the beginning of the year until the day the liquidation process is completed and the entry is deleted from the Unified State Register of Legal Entities (Article 55 of the Tax Code of the Russian Federation). For those taxes for which the tax period is a month or a quarter, the last tax period is determined in agreement with the tax office.

According to the norms of the Code, tax returns must be submitted after the end of the tax period. However, the liquidated organization will then no longer exist, and there will be no one to hand over the papers. When should declarations be submitted in this case?

There are two opinions on this matter. The first is that the last declarations must be submitted at the moment when the notice of liquidation is submitted. Moreover, declarations are filled out for the entire tax period, regardless of when it ends. And the second opinion is that the last report should be made on the date of drawing up the liquidation balance sheet.

In general, you should proceed as follows. If liquidation is expected in the current tax period and no settlements affecting taxes are expected, it is better to file the returns along with the notice. And all possible changes in calculated taxes for this period will be reflected in the “clarifications”.

If you draw up the liquidation balance sheet in the next period, then submit the declarations for the current year at the end of the period in the general manner. Then, when submitting the liquidation balance sheet, you will have to submit returns for the tax period.

Inspections by tax authorities. One of the stages of liquidation of an organization is an on-site tax audit, which is carried out on the basis of a decision of the head of the tax authorities or his deputy, which indicates the reason for the control measure (liquidation of the taxpayer). According to Art. 89 of the Tax Code of the Russian Federation, tax inspectors do not have the right to conduct two on-site inspections on the same taxes within one calendar year, however, this restriction does not apply to inspections of organizations that are ceasing their activities. An on-site inspection cannot last more than two months, but most often tax inspectors inspecting a liquidated organization do not meet such deadlines.

Based on acts of reconciliation with tax authorities and acts of documentary verification of settlements, the amount of the organization's debt is determined. The liquidation commission is obliged to submit to the tax authority declarations for each of the taxes payable to the budget until the liquidation of the organization. In case of failure to fulfill the obligation to pay taxes within the time limits established by the legislation on taxes and fees, in accordance with Art. 75 of the Tax Code of the Russian Federation, the taxpayer is obliged to pay penalties in the amount of arrears.

If an organization sells any assets, it becomes obligated to pay taxes (income tax, VAT). If before the sale of assets the organization had no debt to the budget and had already begun to settle accounts with its counterparties, then after the sale of assets the obligation to pay taxes reappears. Clause 1 of Art. 49 of the Tax Code of the Russian Federation establishes that the obligation to pay taxes and fees (fines, penalties) of a liquidated organization is fulfilled by the liquidation commission at the expense of the organization’s funds, including those received from the sale of its property. If the funds of a liquidated organization, including those received from the sale of its property, are not enough to fulfill the obligation to pay taxes and fees, penalties and fines due, then the remaining debt must be repaid by the founders (participants) of the said organization within the limits and procedure established by the legislation of the Russian Federation. Federation (clause 2 of article 49 of the Tax Code of the Russian Federation). At the same time, the order of fulfillment of obligations to pay taxes and fees during the liquidation of an organization is determined by the civil legislation of the Russian Federation (clause 3 of Article 49 of the Tax Code of the Russian Federation).

If a liquidated organization has amounts of taxes or fees and (or) penalties and fines overpaid by this organization, then these amounts are subject to offset against the debt of the liquidated organization for taxes, fees (penalties, fines) by the tax authority in the manner established by Chapter. 12 of the Tax Code of the Russian Federation, no later than one month from the date of filing the application of the taxpayer-organization (clause 4 of Article 49 of the Tax Code of the Russian Federation). The amount of overpaid taxes and fees (penalties, fines) subject to offset is distributed among budgets and (or) extra-budgetary funds in proportion to the total amount of debt on taxes and fees (penalties, fines) to the relevant budgets and (or) extra-budgetary funds. If the liquidated organization does not have a debt to fulfill the obligation to pay taxes and fees, as well as to pay penalties and fines, the amount of taxes and fees (penalties, fines) excessively paid by this organization is subject to return to this organization no later than one month from the date of filing the application of the taxpayer-organization .

If the liquidated organization has amounts of excessively collected taxes or fees, as well as penalties and fines, then these amounts are subject to return to the taxpayer-organization in the manner established by Chapter. 12 of the Tax Code of the Russian Federation, no later than one month from the date of filing the application of the taxpayer-organization.

Personal income tax. As a result of the organization's activities, the size of its authorized capital may increase or decrease. Thus, if, as a result of an increase in the authorized capital of the organization, a participant during liquidation receives, according to his share of property, more than he contributed during the formation of the organization, then the difference between the property received upon exit and the initial contribution will be considered subject to personal income tax. Payments in cash or in kind during the liquidation of an organization to its participant, not exceeding the contribution of this participant to the authorized (share) capital of the organization, are not recognized as its income (Article 43 of the Tax Code of the Russian Federation).

In accordance with clause 5 of clause 1 of Art. 208 of the Tax Code of the Russian Federation, income subject to personal income tax from sources in the Russian Federation includes, among other things, income from the sale in the Russian Federation of shares in the authorized (share) capital of organizations. In the event of liquidation of the company, the paid shares of the individual participant are his income. The tax agent is the liquidated organization represented by its executive body. By virtue of Art. 226 of the Tax Code of the Russian Federation, an organization is obliged to calculate, withhold from the taxpayer and pay the amount of personal income tax.

A tax agent who is unable to withhold the calculated amount of tax from the taxpayer is obliged, within one month from the moment the relevant circumstances arise, to notify in writing the tax authority at the place of his registration about the impossibility of withholding personal income tax and the amount of the taxpayer’s debt. Individuals, from whose income upon receipt personal income tax was not withheld by tax agents, calculate and pay personal income tax based on the amounts of such income independently by submitting a tax return to the tax authority at the place of residence (clause 4, clause 1, article 228 of the Tax Code of the Russian Federation). The indicated income in accordance with clause 1 of Art. 224 of the Tax Code of the Russian Federation are taxed at a tax rate of 13%.

When distributing the profit remaining after taxation of an organization, any income received by its participant in proportion to the participant’s shares in the authorized (share) capital of this organization is recognized as a dividend on the basis of clause 1 of Art. 43 Tax Code of the Russian Federation. Dividends also include any income received from sources outside the Russian Federation that are classified as dividends in accordance with the laws of foreign countries.

Since January 1, 2005 the tax rate in respect of income from equity participation in the activities of an organization received by individuals who are tax residents of the Russian Federation in the form of dividends is set at 9% (clause 4 of Article 224 of the Tax Code of the Russian Federation). The Russian organization that is the source of the taxpayer's income received in the form of dividends is recognized as a tax agent, and in this case the amount of tax is determined separately for each taxpayer in relation to each payment of the specified income at a rate of 9%.

Income tax. In order to calculate income tax, you must be guided by Chapter 25 of the Tax Code of the Russian Federation. According to paragraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, non-operating expenses that reduce the tax base for income tax include expenses for the liquidation of fixed assets being decommissioned, including the amount of depreciation underaccrued in accordance with the established useful life, as well as expenses for the liquidation of unfinished construction projects and other property, the installation of which has not been completed (costs of dismantling, disassembly, removal of disassembled property), protection of subsoil and other similar work. In this case, it is necessary to take into account the requirement of Article 252 of the Tax Code of the Russian Federation: expenses must be economically justified and documented.

Based on clause 13 of Article 250 of the Tax Code of the Russian Federation, non-operating income should include income in the form of the cost of materials received or other property during dismantling or disassembly during the liquidation of fixed assets being decommissioned. The exception is the income specified in clause 18 of Article 251 of the Tax Code of the Russian Federation, namely income in the form of the cost of materials and other property that is received during dismantling, disassembly during the liquidation of decommissioned facilities, destroyed in accordance with Article 5 of the Convention on the Prohibition of Mining , production, stockpiling and use of chemical weapons and their destruction and Part 5 of the Verification Annex to the Convention on the Prohibition of the Development, Production, Stockpiling and Use of Chemical Weapons and on Their Destruction. These incomes are not taken into account for tax purposes.

The date of recognition of income in the form of the cost of received material assets is determined depending on the method of determining income and expenses.

Under the accrual method, such income is recognized on the date of drawing up the act of liquidation of depreciable property, drawn up in accordance with the accounting requirements (clause 8, clause 4, article 271 of the Tax Code of the Russian Federation).

Under the cash method, such income is recognized at the time of capitalization of property (clause 2 of Article 273 of the Tax Code of the Russian Federation).

There are some peculiarities in the taxation of income tax in the case where the founder of the company is a foreign organization that does not operate through a permanent representative office in the Russian Federation and receives income from sources in the Russian Federation. Income received as a result of the distribution in favor of foreign organizations of profits or property of organizations, other persons or their associations, including during their liquidation (taking into account the provisions of paragraphs 1 and 2 of Article 43 of the Tax Code of the Russian Federation, establishing the concept of dividends and interest) , according to Art. 309 of the Tax Code of the Russian Federation, relate to the income of a foreign organization from sources in the Russian Federation and are subject to tax withheld at the source of payment of income.

VAT. In order to calculate value added tax, you must be guided by Chapter 21 of the Tax Code of the Russian Federation. The main question that arises when disposing of under-depreciated fixed assets is: is it necessary to restore VAT on the residual value of retired fixed assets?

The position of the tax authorities is as follows: the amount of tax paid when acquiring fixed assets and accepting them for accounting, by which the VAT payable to the budget was reduced, must be restored in the part of the VAT that falls on the residual value of the object, not written off for production and distribution costs through depreciation.

However, the Tax Code of the Russian Federation does not provide that upon disposal of fixed assets before their full depreciation, the taxpayer is obliged to return to the budget the value added tax attributable to the residual value of fixed assets. Thus, the disposal of fixed assets before their full depreciation does not entail the taxpayer’s obligation to return to the budget the value added tax attributable to the residual value of the retired fixed assets.

When calculating value added tax, it is also necessary to take into account that, according to paragraph 2 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, the transfer of goods on the territory of the Russian Federation (performance of work, provision of services) for one’s own needs, expenses for which are not deductible (including including through depreciation deductions) when calculating corporate income tax, is recognized as subject to VAT.

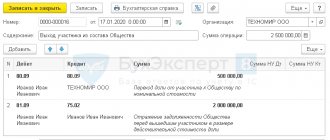

Example: An organization is liquidating equipment due to its complete moral and physical wear and tear. The initial cost of the equipment is 30,000 rubles, the amount of accrued depreciation is 26,000 rubles. The costs of liquidation (dismantling) of equipment amounted to: wages and unified social tax of workers involved in dismantling the equipment - 1000 rubles, general production costs - 500 rubles. The cost of parts and assemblies received from liquidation is 2,000 rubles. In accounting, the write-off of a fixed asset item is reflected in the following entries: Debit 01 “Disposal of fixed assets” Credit 01 – 30,000 rubles. – the initial cost of the equipment being written off is reflected; Debit 02 Credit 01 “Disposal of fixed assets” – 26,000 rubles. – the amount of accrued depreciation is written off; Debit 91-2 Credit 01 “Disposal of fixed assets” – 4,000 rubles. – the residual value of the equipment is written off; Debit 91-2 Credit 69, 70 – 1000 rubles. – the costs of wages and unified social tax for workers involved in dismantling equipment associated with the liquidation (write-off) of fixed assets were written off; Debit 91-2 Credit 25 – 500 rubles. – general production expenses associated with the liquidation of equipment are written off; Debit 10 Credit 91-1 – 2000 rubles. – material assets remaining from the write-off of fixed assets were capitalized (at market value). Debit 99 Credit 91-9 – RUB 3,500. – for the amount of loss from the liquidation of equipment. For tax accounting purposes: the amount of other expenses will be: 4000 + 1000 + 500 = 5500 rubles; the amount of other income is 2000 rubles.

Paragraph 1 of Article 49 of the Tax Code of the Russian Federation establishes that the obligation to pay taxes and fees (fines, fines) of a liquidated organization is fulfilled by the liquidation commission at the expense of the organization’s funds, including those received from the sale of its property.

If the funds of a liquidated organization, including those received from the sale of its property, are not enough to fulfill the obligation to pay taxes and fees, penalties and fines due, the remaining debt must be repaid by the founders (participants) of the above organization within the limits and procedure established by the legislation of the Russian Federation (Clause 2 of Article 49 of the Tax Code of the Russian Federation).

At the same time, the order of fulfillment of obligations to pay taxes and fees during the liquidation of an organization among settlements with other creditors of such an organization is determined by the civil legislation of the Russian Federation (clause 3 of Article 49 of the Tax Code of the Russian Federation).

The procedure for repaying the tax debt of a liquidated organization is established by clause 4 of Article 49 of the Tax Code of the Russian Federation.

According to paragraph 1, paragraph 4, article 49 of the Tax Code of the Russian Federation, if a liquidated organization has amounts of taxes and fees and (or) penalties, fines overpaid by this organization, then the above amounts are subject to offset against the debt of the liquidated organization for taxes, fees (penalties, fines) by the tax authority in the manner established by Chapter 12 of the Tax Code of the Russian Federation, no later than one month from the date of filing the application of the taxpayer-organization.

From the provisions of paragraphs 2 and 3 of paragraph 4 of Article 49 of the Tax Code of the Russian Federation, it follows that the amount of overpaid tax is distributed among budgets and extra-budgetary funds in proportion to the total amounts of debt for other taxes of the liquidated organization to the corresponding budgets and extra-budgetary funds. If the liquidated organization does not have a debt to fulfill its obligation to pay taxes and fees, as well as to pay penalties and fines, the amount of taxes and fees (penalties, fines) excessively paid by this organization is subject to return to this organization no later than one month from the date of filing the taxpayer’s application - organizations.

Clause 5 of Article 78 of the Tax Code of the Russian Federation provides that tax authorities have the right to independently offset the amounts of overpaid tax if there is arrears on other taxes.

Comments:

- In contact with

Download SocComments v1.3

| Next > |

Main points of civil law relations

In accordance with Art. Art. 57, 58 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”, a company can be liquidated voluntarily in the manner established by the Civil Code of the Russian Federation, taking into account the requirements of this Federal Law and the company’s charter. Liquidation of a company entails its termination without the transfer of rights and obligations by way of succession to other persons.

The property of the liquidated company remaining after completion of settlements with creditors is distributed by the liquidation commission among the company's participants in the following order:

- first of all, payment to the company participants of the distributed but unpaid part of the profit is carried out;

- secondly, the property of the liquidated company is distributed among the company's participants in proportion to their shares in the authorized capital of the company.