If, when accepting imported goods, the consignee finds discrepancies in the quantity or quality of the goods, a discrepancy report is drawn up in the TORG-3 .

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

The document is used as a legal basis for making claims against the supplier, so fill it out correctly. Download the current 2021 sample of filling out TORG-3 - it contains all the necessary columns and fields.

General rules for drawing up the TORG-3 form

The act is drawn up in the presence of a special commission. The commission must include representatives of the supplier and the company receiving the goods, as well as a representative of an independent organization or expert.

Form TORG-3 is drawn up for each consignment received under one transport document. The act is drawn up in 5 copies, one for each interested party:

- for the accounting department of the recipient of the products;

- representative of the supplier company;

- a representative of a disinterested organization that took part in drawing up the act;

- for the transport company that delivered the goods;

- a copy for filing a claim.

The report is drawn up only for those product items for which discrepancies were identified. The remaining items do not need to be listed, but at the end of the document it should be noted that there are no inconsistencies for other items. The document must be issued on the day the goods arrive at the warehouse. A sample of filling out the TORG-3 form in 2021 will be given below.

At what stage is the act filled out?

The procedure for delivering goods is quite simple:

- the shipper loads the goods,

- the forwarder delivers it to its destination, where it is unloaded at the buyer’s warehouse.

At the same time, during loading, the goods are weighed, checked and all parameters are entered into the necessary documents, the same happens upon receipt.

Just at the moment of unloading, it may become clear that the indicators included in the shipping documents do not agree with those received upon delivery. You need to draw up a report about this right there, on the spot, before the driver transporting the cargo has gone home.

Who should sign the act in form TORG-3:

- the head of the recipient of the goods;

- chairman and members of a specially created commission;

- expert or representative of a disinterested organization.

The act will have legal force only if independent participants take part in the product acceptance process. These may be representatives of the Chamber of Commerce and Industry, an expert or other organization. The supplier's representative may not be present, but the management of the supplier company must give their consent to the drawing up of the act without his presence.

Section 2. Retail sales and inventories of goods by type

In section 1, line “01”, columns 3 and 4 show retail trade turnover, respectively, for the reporting period and the corresponding period of the previous year. Retail trade turnover represents revenue from the sale of goods to the public for personal consumption or use in the household in cash or paid by credit cards, bank checks, transfers from depositor accounts, on behalf of an individual without opening an account, through payment cards ( electronic money).

The cost of goods sold to the population on credit, the cost of medicines dispensed by pharmacies to certain categories of citizens free of charge or on preferential prescriptions, the cost of coal, bottled gas, wood fuel and other goods sold to certain categories of the population at a discount are included in retail trade turnover in the amount full cost.

The cost of goods sold through the retail trade network to legal entities (including social organizations, special consumers) and individual entrepreneurs is not included in retail trade turnover. The turnover of public catering is not included in the turnover of retail trade.

One of the main features of a transaction classified as retail trade is the presence of a cash receipt (invoice) or other document replacing the receipt.

Retail trade turnover is given in retail prices - actual selling prices, including trade margins, value added tax and similar mandatory payments.

Lines 01 - 82 are given with one decimal place after the decimal point. Data on line 01 must be greater than or equal to data on line 02 in columns 3 - 4. Data on line 01 must be greater than or equal to data on line 03 in columns 3 - 4. Data on line 01 must be greater than or equal to the data in line 04 in columns 3 - 4.

Difference between lines 01 and 02 according to gr. 3 and 4 should be equal to the sum of lines 39, 40, 41, 42, 45, 48, 49, 50, 51, 52, 53, 54, 55, 56, 57, 58, 59, 60, 61, 62, 63, 64, 65, 66, 67, 68, 69, 70, 71, 72, 75, 76, 77, 78, 82 of section 2 in columns 4 and 5. Data on line 02 in columns 3 and 4 must be equal to the sum of lines 06 , 11, 13, 17, 22, 23, 24, 25, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38 section 2 under columns 4 and 5.

Line 03 provides data on the retail turnover of goods sold via the Internet information and communication network (hereinafter referred to as the Internet). Online commerce is a form of electronic commerce in which the buyer becomes familiar with the product and the terms of sale, as well as informs the seller of the intention to buy the product via the Internet.

Online store is a part of a trading enterprise/trade organization or a trade organization intended to provide the buyer via the Internet with information necessary when making a purchase, including the range of goods, prices, seller, methods and conditions of payment and delivery, for receipt from buyers via Internet messages about the intention to purchase goods, as well as to ensure the possibility of delivery of goods by the seller or his contractor to the address specified by the buyer or to the pick-up point.

Line 04 provides data on the retail turnover of goods sold by mail. Mail order is the retail trade of any type of goods carried out through mail orders. The goods are sent to the buyer, who selects them from advertisements, catalogues, samples or other types of advertising.

Line “05”, columns 3 and 4 show inventories of goods purchased externally and intended for sale to the public. Inventories are assessed at average selling prices for similar goods in effect in the reporting period and the corresponding period of the previous year, including trade margins, value added tax and similar mandatory payments.

That is, inventories of goods for resale, recorded on the organization’s balance sheet at the purchase price, when reflected on line 05, must be revalued at the average selling prices for similar goods in effect in the reporting period and the corresponding period of the previous year. Data on inventories of goods are provided for all places where goods are stored (in warehouses, refrigerated warehouses, in stores), including rented ones. Goods accepted from the population on commission are not included in the volume of inventory.

Organizations (commission agents, attorneys, agents) carrying out trading activities in the interests of another person under commission agreements, commissions or agency agreements do not fill out line 05. The inventories of goods in the specified line are reflected by the owners of these goods - organizations that are principals, principals, and principals.

Data on line 05 in columns 3 and 4 must be equal to the sum of lines 06, 11, 13, 17, 22, 23, 24, 25, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 45, 48, 49, 50, 51, 52, 53, 54, 55, 56, 57, 58, 59, 60, 61, 62, 63, 64, 65, 66, 67, 68, 69, 70, 71, 72, 75, 76, 77, 78, 82 of section 2 under columns 6 and 7.

In section 2, lines 06 - 82, columns 4 and 5, a breakdown of the data in line 01 of section 1 on retail sales by product groups (goods) in value terms is provided; in columns 6 and 7 - decoding of the data on line 05 of section 1 on inventories by product groups (goods) in value terms, filled out in accordance with the explanations given on line 05 of section 1.

Line 06 reflects data on retail sales and inventories of fresh, chilled, frozen or canned animal meat, poultry, meat products and canned food, meat of animals and birds that are hunted (game meat), offal from animal meat, poultry, game.

The data on line 06 in all columns must be greater than or equal to the sum of the data on lines 07, 08, 09, 10.

Line 07 reflects data on retail sales and inventories of beef, pork, veal, lamb, goat meat, horse meat, rabbit meat and other types of animal meat. Data on sales and inventories of animal meat by-products are not reflected on line 07, but are shown only on line 06.

Line 08 reflects data on retail sales and stocks of meat from chickens, chickens, guinea fowl, geese, ducks, turkeys and other poultry. Data on sales and inventories of poultry by-products are not reflected on line 08, but are shown only on line 06.

Line 09 reflects data on retail sales and inventories of meat and poultry products, which include boiled, semi-smoked, hard smoked and other sausages, frankfurters and sausages, smoked meats, meat snacks, semi-finished products (meat cutlets, meat and vegetable cutlets and with other fillings, dumplings , pancakes and pies with meat, meatballs, minced meat and more), quick-frozen semi-finished products (with and without garnish), culinary products made from meat, including our own production, meat bouillon cubes.

Line 11 reflects data on retail sales and stocks of fish, live, chilled, frozen, salted, spiced, pickled, smoked, dried, dried, balyk products, caviar (weight and canned), crustaceans, mollusks and other seafood, canned fish in oil, tomato sauce, natural canned fish, canned fish and vegetables, preserved fish from herring, sprat, mackerel and other types of fish and seafood.

The data on line 11 in all columns must be greater than or equal to the data on line 12.

Line 13 reflects data on retail sales and inventories of animal and vegetable oils, margarine products, mayonnaise, and mayonnaise sauces.

The data on line 13 in all columns must be greater than or equal to the sum of the data on lines 14, 15, 16.

Line 14 reflects data on retail sales and inventories of butter (salted, unsalted, Vologda, amateur, peasant, dietary), ghee, butter with fillers (cheese, chocolate).

Line 15 reflects data on retail sales and stocks of refined and unrefined vegetable oils: sunflower, peanut, mustard, soybean, corn, sesame, flaxseed, olive, rapeseed, salad and others.

Line 16 reflects data on retail sales and inventories of margarine products (dairy, cream, dairy-free margarine, confectionery and cooking fat).

Line 17 reflects data on retail sales and stocks of drinking milk, milk drinks without fillers and with fillers, fermented milk products and drinks (yogurt, fermented baked milk, kefir, curdled milk, kumiss), cream, sour cream, cottage cheese, curd cheese, curd mass, curd semi-finished products (dumplings, cheesecakes), cheeses, canned milk, freeze-dried canned milk powder, condensed and concentrated milk.

The data on line 17 in all columns must be greater than or equal to the sum of the data on lines 18, 19, 20, 21.

Line 18 reflects data on retail sales and stocks of whole draft, pasteurized, sterilized drinking milk.

Line 19 reflects data on retail sales and inventories of pasteurized, sterilized milk drinks (reconstituted milk), made from whole cow's milk powder, without fillers.

Line 23. Sugar

Line 23 reflects data on retail sales and inventories of sugar, powdered sugar, xylitol, sorbitol, and other sweeteners.

Line 24 reflects data on retail sales and inventories of flour and sugar confectionery products.

Line 25 reflects data on retail sales and stocks of tea, coffee, cocoa, as well as herbal teas, children's teas, coffee drinks, capsules for coffee machines, chicory (with and without additives), tea and coffee gift sets (with cups, spoons, sweets and others).

The data on line 25 in all columns must be greater than or equal to the data on line 26.

Line 28. Flour

Line 28 reflects data on retail sales and stocks of flour, flour product concentrates for making cakes, pastries, muffins, cookies, buns, pies, dumplings and other flour dishes, as well as baby flour nutritional formulas.

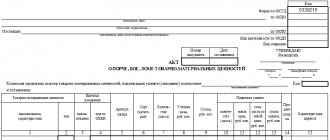

Document structure

- Front page. Information about the delivery participants and the method of delivery of the goods is displayed here.

- A table indicating the discrepancy between the quality and quantity of goods and materials actually supplied and the data specified in the accompanying documentation.

- Conclusion of the commission.

A separate act must be drawn up for each batch of goods. The finished sample of TORG-3 can be used as a basis when drawing up a similar document for your organization.

Common mistakes when filling out the TORG-3 form

- Using the TORG-2 form instead of TORG-3. Some entrepreneurs confuse these documents and file discrepancies using a form intended for internal circulation. Also, instead of TORG-3, sometimes a 3-TORG PM act is drawn up, intended for small enterprises.

- Execution of the act by a commission with an incomplete composition. In the future, this may become a reason for the supplier to refuse to compensate for the damage.

- Incorrect or incomplete description of identified product defects.

Procedure for document execution

Filling out TORG-3:

- On the title page, in the corresponding lines, indicate information about the organization that received the goods: name, structural unit, OKPO and OKDP code.

- Next, write down the number of the act and the date of its preparation.

- Below you should display information about the place of receipt of goods and materials, the consignor, accompanying documents, etc.

- After this, you must indicate the details of accompanying and other documents: agreement for the supply of goods, waybill, quality certificate, etc.

- Below indicate the delivery method, the date of dispatch of the goods, the name of the warehouse from which the goods and materials were sent, and other information.

- At the top of the document, under the heading “I approve”, the head of the organization signs.

The next part of the TORG-3 form is in the form of a table in which you must indicate:

- name of the product for which discrepancies were found and its code;

- unit of measurement;

- data from accompanying documentation;

- factual data;

- number of defective, missing goods;

- identified shortages and surpluses;

- passport ID.

Below the table, space is provided for the commission’s conclusion on the reasons for the detected inconsistencies. The prepared act is signed by all members of the commission.

TORG-3 can be further.

Where is it used?

TORG-3 is necessary to compensate for damage caused to the buyer due to short delivery of goods or delivery of goods of inadequate quality. The procedure for compensation depends on the terms of the contract and the circumstances of the incident. Based on the report, a claim is subsequently drawn up. It can be sent to the seller or the forwarder, depending on who is to blame for the incident.

The submission of the act is accompanied by a letter of claim, to which additional documents are attached:

- papers of the seller or supplier, which indicate the quantity of goods, their completeness and other data;

- packaging labels attached to areas where defects were found;

- fillings;

- power of attorney of an authorized person;

- acts of sampling and analysis results;

- transport documents;

- other documents relevant to the case.