Refunds of personal income tax from the state budget are made in the following cases: in case of overpayment and collection by the Federal Tax Service of the Russian Federation of the excess (excess) amount of tax, as well as in the provision of a deduction. Next we will talk about the situation when an excess amount of tax has been paid (or collected) and must be returned to the payer (individual). In this situation, according to Art. 79 of the Tax Code of the Russian Federation, the return procedure provides for:

- Submitting an application using a standard form on behalf of an individual to the Federal Tax Service of the Russian Federation (individually, through TKS or through a personal account).

Important! You can submit an application within 3 years after the day on which the applicant learned that he was charged (or paid) an excess amount of tax.

- Consideration of the application, documenting the decision on it and sending a written response to the applicant within up to 10 working days. days

- If the decision of the Federal Tax Service is positive, the excess tax amount will be refunded in Russian. rubles (with interest) for a month. The countdown starts from the day the application is received.

In a similar way, not only excess amounts of taxes are refunded, but also fees, penalties, fines, as well as generally obligatory insurance contributions. All that is required from the individual payer is to write the application correctly, submit it to the Federal Tax Service of the Russian Federation and wait for a response.

Standard application form for personal income tax refund

It should be noted that when returning excess amounts paid by an individual or withheld by the Federal Tax Service, as well as for the purpose of refunding amounts, the same standard application form is used. It was introduced by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8/ [email protected] dated 02/14/2017 (as amended on 11/30/2018) and is presented in Appendix No. 8 to it. This form is called, literally: “Application for the return of the amount of overpaid (collected, subject to reimbursement) tax (fee, insurance premiums, penalties, fines).”

In connection with the adoption of a new order of the Federal Tax Service of the Russian Federation of 2017, the previously existing Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8 / [email protected] dated 03.03.2015 has lost force and is no longer applied today. Accordingly, the previous application form, which was introduced by order dated March 3, 2015, is no longer used in 2021.

The current application form (see link to Appendix No. 8 to Order No. ММВ-7-8 / [email protected] dated 02/14/2017) can be downloaded directly from the original source in PDF format. As noted in Appendix No. 8, the presented form (according to KND 1150058) is available for filling out in Adobe Reader. The form currently used includes 3 pages, each of which must be filled out.

| Model application form for tax refund in 2021 | ||

| Excel | Word | |

| Personal income tax refund application form (PDF). | Personal income tax refund application form (Excel). | Personal income tax refund application form (Word). |

The order of the Federal Tax Service of the Russian Federation of 2021 does not contain the procedure and rules for filling out the application form. However, at the bottom of the form there are some footnotes with tips on how to correctly fill out a particular line.

What should an entrepreneur do?

Having discovered an error, the entrepreneur must send a letter to the tax office asking for a refund of the overpaid tax. Remember that the statute of limitations for returns is three years. It is on this site that the forms that are current at the moment are always available.

- be very careful when filling out fields with digital codes;

- do not ignore the “application number” field - it should contain the serial number of the given year;

- correctly indicate the article of the Tax Code of the Russian Federation on the basis of which you are requesting a refund (if you have any difficulties, seek advice);

- take the time to check for accuracy using the notes at the end of the third sheet.

If the tax authorities recognize the grounds indicated by you, then the refund/credit occurs within a month.

A sample of filling out an application for a refund of overpaid tax in Excel format can be found on the Internet, but it is best to follow the recommendations of the official website of the Federal Tax Service. As always, your appeal can be submitted in writing (in person or by mail) or electronically.

Step-by-step filling out a standard personal income tax refund application form

The applicant will need to fill out, in fact, only 2 pages of the form, since the 3rd page is intended only for those individuals who still do not have a TIN. Visually, the filling process will look like this:

- The application must be assigned a unique serial number for the current year. And regardless of the type of application. If, for example, earlier in the same year an application for a standard deduction with one number was submitted, then the subsequent application will have, accordingly, the next serial number.

- Next, the applicant (individual) writes down: the Federal Tax Service code (where the application is sent), his own FI, as well as his status - code “1”, which means “taxpayer”.

- Then you need to indicate the basis for the refund of the tax amount - one of the following articles of the Tax Code of the Russian Federation: 78, 79, 176, 203 or 333.40. When choosing the right article, you should take into account their content and scope.

Art. 78: offset and return of excess amounts paid for taxes (fees, contributions, penalties, fines). Art. 79: return of excessively collected similar amounts. Art. 176: tax refund. Art. 203: refund of excise tax. Art. 333.40: refund (offset) of state duty.

- The applicant, using the appropriate code, must indicate how much he is asking to return. For example: “1” – overpaid, “1” – tax. All code options with decryptions are written next to the lines. All he has to do is select the required option from them.

- The amount to be refunded is written in numbers in Russian. rub.

- The tax (settlement) period code is indicated taking into account the decoding and explanations presented at the bottom of the form in a footnote. If the refund is made for a month, then they write “ms”, for a quarter – “qv”, for a half-year – “pl”, and for a year – “gd”. After this, the required number of the month (from 1 to 12), quarter (1, 2, 3 or 4), half-year (1 or 2). Finally, the current year is written down.

For example: “MS.09.2021”, which means: refund for September 2021.

- OKTMO is recorded according to the code according to OK 033-2013, and KBC according to the purpose of the application (i.e. for the return of personal income tax or other purposes).

- If 2 pages are completed, then, therefore, the applicant still indicates that he compiled it on three pages with attachments (or without).

- In the section where it is necessary to confirm the accuracy of the submitted data, the applicant must o (payer) or “2” (if the application is submitted by his authorized representative). Along the way, they are given a contact phone number and the corresponding date is entered in numbers, for example: “09/10/2021”.

- If the interests of the applicant are represented by his authorized representative, then the name and details of the document that will confirm his authority should be immediately written down.

- On the second page of the form you need to write down the necessary bank information (name of the credit institution, identification code, type and account number). The recipient is an individual, so you should write code “2” in the appropriate line.

Those individuals who need to fill out the third page of the form write down their full name, identification document code with its details (series, number, by whom and when issued). The application must be signed personally by the applicant.

The section intended for the Federal Tax Service and located on page 1 does not need to be filled out by the applicant. It is filled out by the responsible tax officer when registering the received application.

Instructions for filling

Let's consider a step-by-step algorithm for filling out an application for offset of tax overpayment. The following information must be reflected in the unified form:

- First, fill out the TIN and KPP;

- Next, you need to give a serial number to the document (accounting is carried out from the beginning of the current year);

- code of the territorial Federal Tax Service to which the application will be submitted;

- the full name of the budget organization is given;

- the regulating article of the Tax Code of the Russian Federation is noted - article 78;

- the basis for the offset is an overpayment of tax, an excess of the amount collected, or a tax subject to reimbursement;

- the amount of excessively transferred funds in figures;

- The period in which the overpayment of taxes occurred is entered (the instructions on the form indicate the rules for filling out this cell): year (YY), six months (PL), quarter (Q), month (MS);

- BC and OKTMO codes for overpayment are specified (can be found on the official website of the Federal Tax Service);

- the code of the territorial inspection of the Federal Tax Service, in which this payment was credited, is indicated;

- a figure is set corresponding to the further action: either repayment of the arrears (1), or offset as future payments (2);

- BC and OKTMO codes, as well as the period in which the excess tax payment must be offset;

- the exact number of sheets of the unified form and the entire package of documents provided is indicated;

- information about the applicant himself, his full name. and telephone number, status in the organization and availability of a power of attorney.

Example 1. Sample of filling out a standard tax refund application form

The proposed option for filling out the form is in Excel format. The statement uses the following conditional data.

The applicant (Saveliy Vsevolodovich Bortsov), a citizen of the Russian Federation, applies to his Federal Tax Service in order to return the excess amount of tax paid by him in the previous year 2021. The basis for the return is Art. 78 of the Tax Code of the Russian Federation, the amount to be returned is 15,000 Russian rubles. rub. Tax (calculation) period: “GD.00.2018”. The applicant submits the application independently, without an authorized representative.

The form also indicates: INN, OKTMO code 45358000 (Ostankino municipal district), corresponding to the KBK tax refund. Bank details: Sberbank PJSC (its identification code), account type “2” (current), bank no. accounts. Since the applicant S.V. Bortsov has a TIN, on page 3 he writes only his full name.

It should be noted that in this example, the option of filling out the text part of the application (i.e. digital, text, numerical indicators) is proposed. Whereas in the final version of the application, in addition to this, it is also required to put dashes in empty spaces.

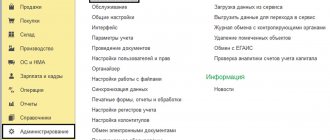

How to fill out forms using the KND form 1150058 without any problems

There are several ways to ensure that organizations that fill out the KND form can complete all actions correctly and competently. To do this, you can easily, in excel format and fill it out according to the recommendations:

But you definitely need to know the personal data of your organization or individual entrepreneur. Namely, TIN and checkpoint. Also, it is necessary to clarify the code of the tax office department where the KND form will be submitted. In addition, there is a requirement to prescribe an article of the Tax Code of the Russian Federation, on the basis of which the program operates.

Thus, we can conclude that examples in xls format for legal entities and individuals are easy to fill out, providing the opportunity not only to credit overpaid funds, but also to return the required amount using the KND form.

Common mistakes when drawing up an application for a personal income tax refund

Error 1. The application form for the return of excess amounts is not divided page by page, and its pages are not submitted separately. Therefore, if the applicant fills out only the first two pages, he still needs to submit all three sheets together to the Federal Tax Service. On page 3, he simply writes down his initials without filling it in, and then attaches it to the first two.

Error 2. An authorized representative of an individual representing his interests may be a third party. But this person has the right to perform the necessary actions and sign documents on behalf of the applicant only if two conditions are met.

First: he must always have with him the appropriate power of attorney, executed in accordance with the established procedure and certified by a notary. Second: information about its availability and about the authorized representative must be specified in the application (page 1).

Reasons for overpayment and methods of return

Both the procedure itself and the form of application depend on the reasons why the entrepreneur “overpaid” the tax. Here are the typical reasons:

- an elementary mistake by the contractor (accounting), who wrote (calculated) the wrong amount on the payment slip;

- the error was identified as a result of reconciliation;

- The tax service has collected an amount, the amount of which the entrepreneur does not agree with.

Money “disputed” from the tax authorities can be returned to your current account or offset against future payments. Naturally, the tax authorities “like” the second option more. Therefore, if the amount is not so large, then it is better to go this route.

If the fiscal authorities themselves discover an overpaid amount, they inform the business entity about this within ten days. But the return still does not occur automatically.

Answers to frequently asked questions

Question No. 1: How can a payer find out that the Federal Tax Service of the Russian Federation has collected an excess amount of tax from him?

According to paragraph 4 of Art. 79 of the Tax Code of the Russian Federation, having discovered the fact of collection of an excess amount, is obliged to independently notify the individual about this within 10 working days. after this fact has been established. Especially for this purpose, Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8/ [email protected] dated 02/14/2017 (as amended on 11/30/2018) approved a standard message form (according to KND 1165069). It is presented in Appendix No. 2 to this Order and looks as follows.

Question No. 2: Where and how can I clarify the code of my Federal Tax Service?

This can be done through the service “Determining the details of the Federal Tax Service” (see link to the request form https://service.nalog.ru/addrno.do).

To do this, just fill out and send the electronic request form offered on the website of the Federal Tax Service of the Russian Federation. So, for example, you can indicate the address and use it to find out the code of the Federal Tax Service and the municipality. Information is provided automatically upon request.

Main points

The changes that affected such a receipt are designed to carry out reforms in the field of insurance, that is, the transfer of rights for the specified contributions to the Federal Tax Service. The new KND form was adopted by a Letter from the Federal Tax Service dated February 14, 2017. And he completely canceled all the points and parameters of the previously valid form and its completion.

There are several main ways that provide a number of opportunities to manage the overpayment that has arisen:

- use as an advance for future contributions;

- applied as payment of debt on other obligations. This may include paying fines;

- Also, these funds are returned to the taxpayer’s account.

These points are spelled out in the Tax Code, Article 78. Thus, they are valid throughout Russia.

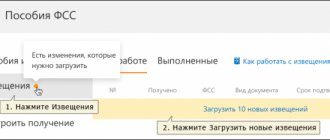

How to submit an application to the Federal Tax Service

The completed application can be submitted to the Federal Tax Service in the following ways:

- In person or through a legal representative. In the latter case, a power of attorney will be required.

- Through the taxpayer’s personal account via the Internet. But at the same time, you must have a registered personal account on the website nalog.ru, as well as a digital electronic signature.

- Send a valuable letter with a list of attachments by mail.