Policyholders regularly submit reports to the Social Insurance Fund. If the company employs 25 or more people, the policyholder submits reports electronically. You can submit reports through your operator - most often this operation does not require much labor, just generate a report and click the “send” button. There is another way to send reports to the Fund - through a special gateway. In addition, policyholders participating in the Direct Payments pilot project send registers and certificates of incapacity for work to the Social Insurance Fund.

Basic principle of data transfer

According to Order No. 19, the payer can provide information electronically to the Social Insurance Fund in two main ways:

- Through the Internet. To do this, you need to prepare a report, certify it with a qualified electronic signature of the CEP, go to the website, and then send the finished document to the reporting gateway to the FSS. This is the simplest option, which does not require you to personally go to the organization’s office.

- Transferring data using media - flash drives, floppy disks, disks, etc. In this case, you also need to prepare an electronic file, certify it with the help of CEP and take it to the social insurance fund yourself.

The first option takes much less time and causes a minimum of difficulties, however, there are also a certain number of difficulties. The FSS reception gateway is used by hundreds of users every day, and heavy loads lead to an inevitable slowdown in its operation. Sudden technical problems may prevent the timely sending of data, so it is better not to leave this procedure until the last minute.

In addition, reporting is not checked instantly - it takes up to 24 hours. If any errors are found during the check, the calculation will be considered incomplete and will have to be redone, and this will also take time. If you leave reporting until the last minute, the task may remain undone, which will lead to negative consequences for the organization.

Reporting to the FSS can be submitted via the Internet (through the FSS reception gateway located at the address). In this case, the payer of contributions needs to go to the Fund’s website, attach a calculation file and send it to the gateway. All these actions are quite simple and intuitive.

Gateway purpose

Officially registered citizens have the right, in the event of loss of ability to work, to receive payments from extra-budgetary state funds.

The Social Insurance Fund finances workers who have received the right to financial support. The transferred contributions from all legal entities go to this structure and are accumulated there for subsequent payments. Submitting electronic reporting on the FSS portal using a special gateway allows for more efficient processing of large volumes of information. The labor-intensive work of receiving documents by FSS specialists is simplified, since the procedures performed are automated.

This reporting allows you to optimize the work of accountants and inspectors, therefore this form of submission is approved by law.

The fundamental document for the preparation of reports is the Federal Law of July 27, 2009 No. 212, called “On Insurance Premiums”.

You can learn about the options and procedure for submitting reports to the fund from the following video:

Possible errors when sending data

The main groups of errors are errors with the preparation of an electronic file and its certification with an electronic signature and errors with making calculations. In the first case, the organization will be refused to accept the report, and it will have to be redone, eliminating the shortcomings. This takes time and then the report will have to be resubmitted. If the FSS gateway for submitting reports fails at this very moment, there is a high risk of delaying the submission and receiving penalties.

The order details errors that must be avoided when filling out an electronic document:

- The document bears the signature of an unauthorized person.

- The certificate has expired. It expires after a year and must be reapplied.

- The report file is in the wrong format. This question needs to be clarified in advance.

If the organization makes errors in the calculations, the report will be considered submitted on time, but after a certain time the payer will receive a receipt indicating the inaccuracies. The FSS gateway for sending registers, checking and monitoring allows you to send reports in advance in order to promptly eliminate possible errors and avoid them in the future. After the correction, it is necessary to send a second electronic report to the FSS, but the date of acceptance remains the date of sending the first version.

Taking into account possible technical problems and problems with obtaining an electronic signature, it is recommended to take care in advance of preparing the document in electronic form and sending it. Renewing an electronic signature and solving other problems takes a lot of time, so it is better to prevent fines and other sanctions from regulatory authorities in advance. The ability to submit a report electronically has significantly speeded up and simplified the process of interaction with the social insurance fund.

Important aspects

Officially employed citizens of the Russian Federation are provided with appropriate payments in case of loss of ability to work from various state extra-budgetary funds.

This regulatory document includes the following main sections:

| General provisions |

| Payment of insurance premiums |

| How to ensure the fulfillment of obligations to pay insurance premiums |

| What rights and responsibilities do insurance premium payers have directly? |

| How is control over the payment of insurance contributions to the Social Insurance Fund and other funds carried out? |

| Responsibility for violation of laws related to insurance deductions and reporting |

| How to appeal acts drawn up by control authorities |

| The reporting procedure is reflected, as well as other important points. |

It is important to remember that violation of established deadlines for reporting is subject to quite serious liability.

It is expressed in fines. Moreover, they are imposed on both individuals and enterprises.

In 2021, the FSS gateway for reporting on the main type of activity should work normally

The FSS has implemented the ability to confirm the main type of economic activity through the Fund’s gateway. This was reported on the official website of the department.

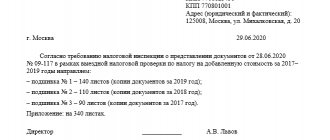

FSS experts remind that in order to confirm the main type of economic activity for compulsory social insurance against accidents at work and occupational diseases, each employer must submit the following documents no later than April 15, 2020:

- application for confirmation of the main type of economic activity;

- certificate confirming the main type of economic activity;

- a copy of the explanatory note to the balance sheet for the previous year (except for policyholders - small businesses).

These documents are submitted to the territorial body of the Social Insurance Fund at the place of registration on paper or in the form of an electronic document.

The FSS also notes that now electronic documents can be sent in three different ways:

- using the Public Services Portal;

- using the policyholder's Personal Account;

- through the FSS Gateway.

The agency clarifies that employers can submit the necessary documents to confirm the main type of economic activity after submitting the balance sheet for 2021 to the Federal Tax Service, but no later than April 15, 2020.

Read also

29.02.2020

Creating a new document

To add a document you need:

- Go to the main page of the service, select the “FSS” and then “FSS Benefits” .

- On the page that opens, select “Create document” :

- In the shape of "Creating a new document" you need to select the type of benefit:

- Specify the type of certificate of incapacity for work "Paper". To create an electronic sick leave certificate, we recommend that you refer to the separate instructions.

- Select employee:

- The employee is on the list. You should select it and click “Create document” . You can use the search bar. The search is carried out by last name or SNILS of the employee. After entering the data in the line, click “Find” .

- The employee is not on the list. You need to use the “Add a new employee” . After entering your last name, first name and SNILS, you need to click “Add employee” . The newly created employee will appear in the list. You should select it and click “Create document” . When you create a new employee, he will be displayed in the “Contour. PF report” (the services have the same list of employees). It will be available for reporting to the Pension Fund.

- Enter data into the table. The information consists of several sections, the number of which depends on the type of benefit.

General information

The FSS sending gateway is a point for receiving reports, which was developed by the fund as a service for transmitting data for policyholders. The service is provided free of charge, but to use the service you will need an electronic digital signature.

Previously, FSS reports were submitted exclusively in paper form. At the moment, this opportunity is retained only for organizations and enterprises whose number of employees has not exceeded 25 people over the past year.

Regions in which the pilot part of the project is being implemented

The implementation of the program for the full use of electronic document management between employers and the Social Insurance Fund is carried out on the basis of Decree of the Government of the Russian Federation No. 294 of April 21, 2011.

Based on the provisions of this Resolution, the following regions are identified in which this project has been implemented since July 1, 2021 (today there are 39 of them):

- federal city of Sevastopol;

- the republics of Adygea, Altai, Buryatia, Kabardino-Balkaria, Kalmykia, Karachay-Cherkessia, Karelia, Crimea, Mordovia, North Ossetia-Alania, Tatarstan, Tyva;

- Altai, Primorsky, Khabarovsk territories;

- regions Amur, Astrakhan, Belgorod, Bryansk, Vologda, Jewish Autonomous, Kaliningrad, Kaluga, Kostroma, Kurgan, Kursk, Lipetsk, Magadan, Nizhny Novgorod, Novgorod, Novosibirsk, Omsk, Oryol, Rostov, Samara, Tambov, Tomsk, Ulyanovsk.

From January 1, 2021, this system, if successfully tested at the level of pilot regions, should be introduced throughout the Russian Federation.

Regulatory framework governing reporting

Payment of insurance premiums is regulated by Chapter 34 of the Tax Code of the Russian Federation, which includes the following information:

- Who is the payer of insurance premiums?

- What is subject to insurance premiums?

- What is the basis for calculating insurance premiums?

- What amounts are not subject to insurance premiums?

- What is the reporting period?

- Determining the date of payments and other remuneration

- Insurance premium rates

- Reduced insurance premium rates

- Additional insurance premium rates for certain categories of payers

- The procedure for calculating and paying insurance premiums

Electronic document flow is regulated by:

Who may need sick leave verification

We can talk about checking:

- A regular paper sick leave certificate. The check here will be carried out, first of all, for the authenticity of the document. The main stakeholders in this are the employer and the employee for whom the sick leave is issued.

- Innovative electronic sick leave. Since July 2021, electronic sick leave began to operate at the federal level (before that in several regions). Unlike paper ones, which are handed out to patients, they are stored on the FSS servers. If necessary, they can be accessed by:

- FSS;

- medical organization that issued the document;

- employer;

- employee-patient.

Each of them can request access to sick leave for different purposes.

Read more information about electronic sick leave. Let's take a closer look at how to check sick leave in the two indicated varieties when using the FSS website and other available resources. Let us agree that such a check is required to be carried out by the employer, a representative of the medical institution and the patient himself.

The second stage is filling out the payslip according to Form 4 of the FSS of the Russian Federation on the Portal of the FSS of the Russian Federation.

If in order to obtain a payroll file according to Form 4 of the Federal Tax Service of the Russian Federation . xml

established

by the Technology

, you use third-party software (for example, accounting systems, Parus, etc., or provided by your special operator), proceed to the third stage.

Connect to the Portal of the FSS of the Russian Federation https://fz122.fss.ru, log in with your username

and

password

.

We recommend reading the Frequently asked questions

.

After that, click the Form-4

to add a payslip according to Form 4 of the Federal Tax Service of the Russian Federation.

Check and, if necessary, fill in the fields Registration data of the policyholder

, click the

Save

.

It is recommended that before continuing to fill out the payslip, read the section Filling out F4 (help)

.

After that, click the Add report

Select the required sections with the corresponding codes, click the Create

Fill out the required fields of the payroll according to Form 4 of the Federal Tax Service of the Russian Federation, then click the Upload to XML

and save the file in

.xml

on your local computer, such as your desktop or My Documents folder.

The file name looks like Reg.number_year_quarter. xml

(quarter in format

3

– for the 1st quarter,

6

– for the 2nd quarter,

9

– for the 3rd quarter,

0

– for the 4th quarter)