On January 1, 2019, the federal accounting standard for public sector organizations “Accounting policies, estimates and errors” came into force (approved by order of the Ministry of Finance of Russia dated December 30, 2017 No. 274n). The standard introduced a new procedure for reflecting corrections of errors of previous years in accounting and reporting. In this article, 1C experts talk about the regulatory framework for correcting errors of past years and the methodology for correcting such errors, implemented in the 1C: Public Institution Accounting 8 program.

Correcting past mistakes: part 2 , part 3

What is a material accounting error?

The main regulatory act regulating the procedure for correcting errors in accounting is PBU 22/2010 “Correcting errors in accounting and reporting” (approved by Order of the Ministry of Finance dated October 28, 2010 No. 63n).

According to PBU, an error cannot be an inaccuracy in accounting or reporting that arises due to the appearance of information after the fact of economic activity has been entered into accounting. PBU 22/2010 divides accounting errors into significant and insignificant. A significant error is one that, by itself or in combination with other errors for the reporting period, can affect the economic decisions of users made on the basis of accounting records for this reporting period.

The legislation does not establish a fixed amount of a significant error - the taxpayer must identify it independently in absolute or percentage terms. The level of materiality above which an error is considered significant must be indicated in the accounting policy.

Officials in some regulations recommend setting the level of materiality equal to 5% of the indicator of a reporting item or the total amount of an asset or liability (clause 1 of Order of the Ministry of Finance dated May 11, 2010 No. 41n, clause 88 of Order of the Ministry of Finance dated December 28, 2001 No. 119n). We propose to establish simultaneously both an absolute and a relative indicator for determining a significant error. The firm can set the absolute indicator at any size.

Example of an accounting policy statement:

An error is considered significant if the amount of distortions exceeds ... thousand rubles. or the magnitude of the error is 5% of the total amount of the asset (liability), the value of the financial reporting indicator.

Read about what you need to be guided by when drawing up your accounting policies in the material “PBU 1/2008 “Accounting Policies of an Organization” (nuances).”

If an individual error is not significant, according to the established criterion, but there are many similar errors in the reporting period - for example, an accountant incorrectly takes into account personal protective equipment - then these errors must be considered in their entirety, since in total they can be considered significant.

For significant errors in accounting, separate correction rules have been established.

"1C: Public Institution Accounting 8", ed. 1.0

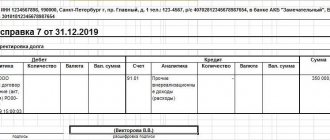

The following procedure for correcting errors from previous years has been implemented using standard documents:

Step 1: create a document with records of correcting the error of previous years as an error of the current year.

Step 2: Click on the “ Correction of Past Errors”

" in the top command bar of the document.

Step 3: in the “Correcting errors of previous years” method selection form that opens, select the error correction method:

- Not a mistake.

- Last year's mistake.

- Error earlier last year.

- Error: specify postings manually...

Then click " OK"

».

After posting the document, the program generates transactions using special error correction accounts according to the selected period.

Correcting errors in accounting documentation

The algorithm for correcting inaccuracies in accounting depends on where the error was made - in the primary records and registers or in the reporting itself, the timing of the error detection and whether it is significant.

There are the following correction methods in the primary and registers:

- Proofreading - used in paper documents; incorrect information is crossed out so that the original information can be read, and the correct entry is made next to it. The correction must be certified by the full name and signature of the responsible person, the date and seal of the company (Clause 7, Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

ATTENTION! There are a number of documents in which corrections are unacceptable. These include cash and bank documents.

- “Red reversal” - used in case of incorrect posting of accounts. When entering by hand, the erroneous entry is repeated in red ink, and the amounts highlighted in red must be subtracted when calculating the totals. As a result, the incorrect entry is canceled, and instead a new entry must be made with the correct accounts and amount. If accounting is kept in a standard computer program, then it is usually enough to make a posting with the same correspondence, but indicate the amount with a minus sign. The entry in the registers will be subtracted and offset the incorrect entry. Next you need to make the right one.

- Additional entry - used if the original correspondence of accounts was correct, but with the wrong amount, or if the transaction was not recorded on time. The company makes an additional entry for the missing amount, and if the original amount was overestimated, it makes an entry for the required difference using a red reversal. The accountant is also required to draw up a certificate explaining the reason for the correction.

For information on how to draw up such a certificate, read the article “Accounting certificate of error correction - sample.”

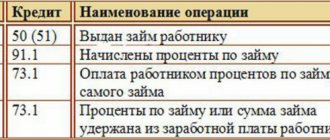

Reflection in accounting

The entries used are also determined depending on the time the error was discovered and its significance. For example, the following postings can be used:

- DT 44 CT 60 (reversal of debt to suppliers).

- DT 90-2 CT 44 (reversal of expenses in standard areas of activity).

- DT 44 CT 60 (fixation of debt to the supplier).

- DT 20 CT 68 (additional tax assessment).

Corrections are being made using expense and income accounts. If the specialist did not indicate income or overstated expenses, the following entries apply:

- DT 62, 76. CT 84 (detection of unfixed income or inflated expenses).

If an inaccuracy resulted in the specialist not recording expenses or overestimating profits, the following entry will be required:

- DT 84 CT 60, 76 (detection of unfixed expenses or inflated income).

Correction of inaccuracies must be carried out in accordance with the new rules.

Ways to correct errors in accounting for 2020

The order of corrections depends on the significance of the error and the period of detection:

- Errors from 2021 that were identified before the end of 2021 will be corrected in the month in which they were identified.

- An insignificant error made in 2021, but identified in 2020, after approval of the statements for 2021, is corrected by entries in the relevant accounting accounts in the month of 2021 in which the error was identified; profit or loss resulting from correction of an error is attributed to account 91.

- The 2021 error, which was discovered in 2021, but before the date of signing the accounting statements for 2021, is corrected by making an entry in the accounting transactions for December 2021. Significant accounting errors that were discovered after the signing of the financial statements for 2021, but before the date of their submission to the government agency or owners (shareholders), are similarly corrected.

- If the error for 2021 is significant, and the reporting for 2021 has already been signed and provided to the owners (shareholders) and government agencies, but has not been approved, we correct it with accounts that will be dated December 2021. At the same time, in the new version of the accounting statements, it is necessary to indicate that these statements replace the originally provided ones and indicate the reasons for the replacement.

ATTENTION! New reporting must be submitted to all recipients to whom the previous uncorrected reporting was submitted.

- A significant error for 2021 was identified after the accounting statements for 2021 were approved - we are correcting them with entries in the accounting accounts already in 2021. Account 84 will be used in the postings.

Example:

The accountant of Perspektiva LLC discovered in May 2021 that he had not reflected rent in the amount of 100,000 rubles in the transactions for 2021. This is a significant error in accordance with the accounting policy of Perspektiva LLC, and it was identified after the approval of the financial statements for 2021. The accountant will make the following entries:

Dt 84 Kt 76 in the amount of 100,000 rubles. — erroneously not reflected expenses for 2021 were identified.

In addition, Perspektiva LLC must submit an income tax update for 2021.

Also, when correcting a significant error discovered after the approval of the annual statements, it is necessary to perform a retrospective recalculation of the financial statements - this is a procedure for bringing the reporting indicators into the appropriate form as if the error had not been made. For example, if, after a retrospective recalculation of data, the profit indicator for 2021 decreased from 200,000 rubles. up to 100,000 rubles, then in the 2021 reports in the comparative data columns for 2021, it is no longer necessary to indicate 200,000 rubles. (according to the approved report), and 100,000 rubles. (by correction). Companies that use simplified accounting methods are not allowed to do this procedure.

For information about what kind of reporting companies submit using a simplified method of accounting, read the material “Simplified accounting financial statements - KND 0710096”.

Information about identified significant errors from previous years that were corrected in the reporting period must be indicated in the explanatory note to the annual accounting reports. The legal entity must indicate the nature of the error, the amount of adjustment for each reporting item and the adjustment to the opening balance. If the organization provides information on earnings per 1 share, then the explanatory note also indicates the amount of adjustment based on data on basic and diluted earnings per 1 share.

What other information needs to be indicated in the explanatory note is described in the article “We are preparing an explanatory note for the balance sheet (sample)” .

In accordance with the letter of the Ministry of Finance dated January 22, 2016 No. 07-01-09/2235, the organization has the right to independently develop an algorithm for correcting errors in accounting and reporting based on current legislation. We recommend that you consolidate the chosen procedure in the accounting policy.

How do they affect current reporting?

If incorrect maintenance of the accounting register is long-term and continues in the current period, then the degree of materiality will change. For example, in November equipment was accepted for accounting, and the depreciation group was incorrectly determined. As a result, depreciation was calculated incorrectly starting in December last year. Since the incorrect amount of depreciation was accrued only for one month of the previous period, this is an insignificant error of the previous reporting year that was discovered after the reporting date. If an accountant discovers an inaccuracy at the beginning of the year, then it is enough to make a corrective operation by issuing an accounting certificate dated January 1 of the current year. If depreciation has been calculated incorrectly all year, the error will be material and will significantly impact the financial result.

ConsultantPlus experts looked at how to take into account the correction of an error that led to excessive payment of wages. Use these instructions for free.

to read.

Dividends of participants, bank decisions on issuing loans and other important aspects of the economic life of the enterprise depend on the financial result. In this regard, significant errors of previous years in the financial statements that change the indicators of retained profit or loss are subject to correction with the subsequent provision of a corrected copy of the statements to interested parties.

Correcting errors in tax accounting

If the provisions of PBU 22/2010 are relevant for legal entities, since the self-employed population is not required to keep accounting records, then the procedure for correcting errors in tax accounting applies to both entrepreneurs and organizations.

According to Art. 314 of the Tax Code of the Russian Federation, errors in tax registers must be corrected using a corrective method: there must be a signature of the person who corrected the register, the date and justification for the correction.

The procedure for correcting errors in tax accounting is described in detail in Art. 54 Tax Code of the Russian Federation.

If an error in calculating the tax base for previous years was discovered in the current reporting period, then it is necessary to recalculate the tax base and the amount of tax for the period the error was committed.

If it is impossible to determine the period of the error, then the recalculation is made in the reporting period in which the error was found.

Errors in tax accounting, as a result of which the tax base was underestimated, and therefore the tax was underpaid to the budget, must not only be corrected, but also an update provided to the Federal Tax Service for the period the error was committed (Article 81 of the Tax Code of the Russian Federation). However, if an error is discovered during a tax audit, then there is no need to submit an amendment. In this case, the amount of arrears or overpayments will be recorded in the audit materials, and the tax authorities will enter this data into the company’s personal account card. If the company submits a clarification to the tax authority, the data on the card will be doubled.

If at the end of the year there is a dispute with the Federal Tax Service and there is a high probability of additional taxes (penalties), then an estimated liability must be recognized in the accounting reports. Read more about this in the material “Tax dispute = estimated liability”.

In the case where a company overpaid tax due to its own error, it may submit an amendment or not correct the error (for example, the amount of overpayment is insignificant). Another option that a company can use is to reduce the tax base in the period the error is discovered by the amount of overstatement of the tax base in the previous period. This can be done when calculating transport tax, mineral extraction tax, simplified tax system and income tax.

ATTENTION! This method cannot be used when identifying errors in VAT calculations, since inflated VAT can only be corrected by submitting an amendment for the period the error was committed.

If a company operated at a loss and identified an error in the previous period that would increase the loss, then these expenses cannot be included in the tax calculation for the current period. The company should submit an update with new amounts of expenses and losses (letter of the Ministry of Finance dated April 23, 2010 No. 03-02-07/1-188).

ConsultantPlus experts explained in detail what to do if errors are identified in primary documents. Get trial access to the K+ system and go to the Tax Guide for free.

Neutral errors

Errors that are “paper” in nature and do not lead to either underpayment or overpayment are considered neutral. These include errors when assigning income or expenses to one group or another, incorrect determination of the date of expenses within the reporting period, as well as errors associated with filling out declarations and other reporting forms.

If, as part of a desk audit, the tax authorities discover such errors in the declaration, then they may demand to provide not only explanations, but also clarification (Clause 3 of Article of the Tax Code of the Russian Federation, Resolution of the Arbitration Court of the Moscow District dated 04/05/2019 No. F05-3906/2019 in the case No. A40-134022/2018).

If such a request is not received, then the error may not be corrected, and nothing will threaten her. In this case, correcting an error is the taxpayer’s right, not an obligation, and there is no responsibility for incorrectly filling out declarations and tax registers in the Tax Code of the Russian Federation (resolution of the Arbitration Court of the East Siberian District dated July 15, 2019 No. F02-3237/2019 in case No. A58 -5375/2018).

Fines for accounting errors

Errors in accounting and reporting can result in a fine for the company. Moreover, from April 10, 2016, the amount of fines for incorrect record keeping increased - with the entry into force of Law No. 77-FZ dated March 30, 2016.

Art. 15.11 of the Code of Administrative Offenses in the new edition contains the following list of violations and penalties for them:

| New edition of Art. 15.11 Code of Administrative Offenses | Old version (valid for violations committed before 04/10/2016) |

| Distortions in accounting that led to an understatement of taxes and fees by 10% or more | Distortions in accounting that led to an understatement of taxes and fees by 10% or more |

| Distortions of any accounting item by 10% or more | Distortions of any accounting item by 10% or more |

| Fixation of an imaginary, feigned accounting object or an unaccomplished event | — |

| Maintaining accounting accounts outside of registers | — |

| Preparation of accounting reports not based on information from accounting registers | — |

| Lack of primary records, accounting registers or auditor's report | — |

| Fine for a violation detected for the first time: from 5,000 to 10,000 rubles. | Fine for a violation detected for the first time: from 2,000 to 3,000 rubles. |

| Fine for repeated violation: from 10,000 to 20,000 rubles. or disqualification of the responsible official for up to 2 years | — |

| Can be fined within 2 years from the date of violation | Can be fined within 1 year from the date of violation |

Thus, officials have expanded the list of violations in accounting and reporting for which they will henceforth be fined, and have increased the sanctions, as well as the period during which the company can be punished.

basic information

When determining income tax, distortions are possible with the following results:

- Reducing the amount of expenses . It is usually discovered when expenses are incorrectly included in expenses, which are not taken into account when determining income tax.

- Increase in expenses. Adjustments must be reflected as direct or indirect costs.

- Unaccounted revenue. In this case, it is not only the income tax return that needs to be corrected. Adjustments must be made to the value added declaration. The need for two declarations is due to the fact that the amount of revenue under these documents must be the same.

If errors were discovered that caused distortions in several taxes, you need to make adjustments to these documents:

- VAT declaration.

- Income tax return.

- Calculation of property tax.

Such a list of adjustments is relevant, for example, if there is no display of the disposal of a fixed asset.

Results

Errors in accounting and tax accounting are a headache for an accountant, since this means recalculating accounting items and amounts of taxes paid.

And if the error is discovered by the tax authorities during an audit, the company will also pay a fine, and the official will be disqualified (if violations were detected more than once). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Additional Information

The updated declaration is provided in the form that is relevant during the period for which the adjustments are made (based on clause 5 of Article 81 of the Tax Code of the Russian Federation). An update can be submitted after the deadline for filing a regular declaration has expired (clause 1 of Article 81 of the Tax Code of the Russian Federation). However, if the deadline for filing a declaration and paying the tax has expired, you must pay the arrears and penalties before sending the clarification. So, if distortions are detected, you need to act according to this scheme:

- Performing a recalculation of the base and tax in the period in which the distortions occurred.

- Payment of arrears and penalties.

- Submission of clarification.

IMPORTANT! Payment of arrears and penalties will avoid a fine. The latter is appointed on the basis of Article 122 of the Tax Code of the Russian Federation.

Features of the design of the title page of the clarification

The updated declaration is drawn up in a special way. On its title page there should be an encoding of the type of paper or an adjustment number to the reporting form, which is relevant for declarations of the new format. For example, this is a company profit declaration approved by Order of the Ministry of Finance No. 54n dated May 5, 2008. A similar document is relevant when submitting an update on income tax for 2008. If this form is used, in the “Adjustment number” field you need to enter the number of repeated declarations sent for a certain period. This field is located at the top of the sheet.