Accounting and tax legislation does not require an account, so the document does not have a unified form. Each organization determines the procedure for issuing it and its details. At the same time, invoices are widely used in business transactions; often the contract includes a condition for payment for goods or services on the basis of this document. an invoice itself can be a contract when it represents an offer and contains all the essential terms of the transaction. In this case, its payment-acceptance is equivalent to the conclusion of an agreement in simple written form. An invoice for payment, the form of which is issued as an offer, can be issued to an unlimited number of persons.

Purpose and content of the document

An invoice is a document containing payment details and is the basis for payment of a certain amount for goods or services provided by the seller. An individual entrepreneur can make a request for the transfer of funds to his account to persons with whom he has concluded purchase and sale agreements, provision of services, as well as to those persons with whom such agreements have not been concluded.

Required elements of the invoice for payment:

- Seller details (name of individual entrepreneur or legal entity, company address, INN and KPP)

- Buyer's details (name of LLC or individual entrepreneur, address, tax identification number and checkpoint)

- List of goods and services for payment, their quantity and cost

- Total amount due

- Payment details (seller's bank account number)

- Invoice date

Do I need a stamp on the invoice?

Since 2015, it is not necessary for LLCs and JSCs to have a seal. Whether to use it or not is determined by the business entity independently. If the organization has a seal, then the obligation to certify invoices for payment may be provided for in the contract.

According to the Accounting Law 402-FZ, a seal imprint is not a mandatory requisite of the primary accounting document. The Tax Code also does not provide for the obligation to certify it with a seal. Therefore, it is permissible to issue an invoice for payment without printing.

When is it necessary to exhibit

This is a document that serves as proof of a transaction for accounting, a company or another organization.

An invoice must be issued in the following cases:

- If the company operates in the market and is exempt from value added tax under Article 145 of the Tax Code of the Russian Federation

- The counterparties did not have time to conclude an agreement, and the delivery of goods must be carried out in a short time. The supplier can generate an invoice for payment, and a little later the parties will seal their relationship with an agreement.

- Clause 1 of Article 169 of the Tax Code of the Russian Federation - the trading process is documented in a personal name and using the special tax system

- Article 168 of the Tax Code of the Russian Federation - the enterprise received a partial prepayment

- The buyer requires a one-time delivery, and it simply does not make sense to draw up a long-term contract.

An invoice can serve as an offer if it reflects all the terms of cooperation. The paid invoice will become legal confirmation of the transaction between the counterparties. And in this case there will be no need to conclude an agreement.

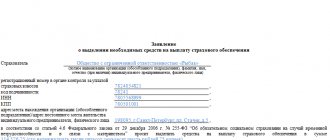

Invoice for VAT payers

Legal entities and other VAT payers use an invoice : a responsible financial document that is issued not in advance, but upon completion of work, services provided or goods shipped. It is no longer needed to speed up payment, but to confirm that excise duties and VAT have been paid in full, so that VAT can be withheld from the payer (buyer). This document has a prescribed form; it may also contain information about the origin of the goods, and if it is imported, then the number of the customs declaration for it.

The invoice is issued in two copies.

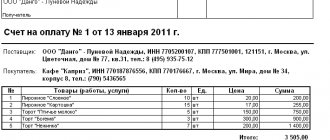

How to fill it out correctly: examples

The table provides examples of correctly filling out all the details:

| Requisites | Filling example |

| Invoice number and issue date | Invoice for payment No. 1204 dated October 25, 2018. |

| Seller's name and details | IP Aleksandrov Dmitry Aleksandrovich, TIN 65663666377, 390939, Moscow region, Moscow, st. Lenina, house 13, office 5, tel. +7 (900) 111-11-11 |

| Recipient's name and details | Vasilevs LLC, TIN 658564743579957, checkpoint 5244771559, 390939, Moscow region, Moscow, st. Lenina, house 14 |

| Products or services | Legal consultation |

| Quantity | 1 |

| Total amount in words | Total items 1, amounting to one thousand five hundred rubles 00 kopecks |

| Bank details | Recipient bank: Sberbank of Russia OJSC Moscow, BIC 6785463, account No. 748632148, account No. 57845216931 |

| Signature | The individual entrepreneur signs the invoice personally |

If, instead of an individual entrepreneur, his authorized representative signs the account, then the details of the power of attorney are indicated next to him, which confirms his powers, as well as the position of the individual, full name and decoding.

We issue invoices in English

We are talking about invoices used when working with foreign counterparties. Invoices must contain information:

- outgoing and incoming document number;

- data of counterparties, their contacts;

- date of discharge;

- taxation system in the companies participating in the transaction;

- date of dispatch of the goods, its receipt;

- information allowing the parties to the contract to track the status of the order;

- total transaction amount;

- payment terms;

- other necessary information - for example, return conditions, a description of penalties for violation of the contract, etc.

You need to take into account everything, even the smallest details, since the legislation under which foreign partners work differs from the Russian one.

Design rules

There are no strict rules for opening an account, but according to established standards, the information in it is arranged in a certain order:

- In the header - personal data of the seller and buyer

- Bank details

- Next, indicate the document number and the date of its preparation.

- Then they repeat the data of the seller and buyer again

- List of goods or services provided

- If the product is sold with VAT, this must be indicated

- Finally, the seller’s signature and details are added.

What is the difference between invoices for payment from LLC and individual entrepreneur

The sample received from the “private owner” has one signature. The LLC will issue a paper containing two “autographs” - the chief accountant and the director. Besides:

- Individual entrepreneurs indicate only full name, companies - the name recorded in the charter;

- The individual entrepreneur form contains only the TIN, the organization - TIN and KPP.

Read also: Explanatory note to the balance sheet

There are no other fundamental differences.

Differences when issuing with VAT and without VAT

VAT payers show the tax amount separately.

If the supplier is exempt from the contribution due to the use of a special tax regime (simplified system, single tax, patent), then the VAT amount is not included when writing the document. However, the corresponding mark is still affixed. And the reason must be given. For example, under the simplified tax system it is written:

- for individual entrepreneurs - paragraph 2 of Article 346.11 of the Tax Code of Russia;

- organizations - paragraph 3 of this regulatory act.

Note: if a buyer operating under a preferential tax regime is issued an invoice with VAT, then the entire amount must be paid, but then o.

How to issue a VAT invoice?

Value added tax is often indicated on the invoice.

Its allocation is not a mandatory requirement, but this step will help to avoid errors in further calculations of the total cost.

The filling out form is the same as for payment without VAT. The only difference is that at the end of the form you must indicate the amount of VAT, which will affect the final amount of payment for the products.

To avoid any missteps, an invoice is issued. This is a document that is filled out according to a template, and on the basis of which the recipient of the goods draws conclusions about the refund or deduction of VAT.

Example of an invoice with VAT:

It is worth considering that VAT can be reflected in two ways:

- Include tax in the final price. For example, if the cost of an operation including VAT is 30,000 rubles, we designate it as follows: Transaction amount = 30,000 rubles, including 18% VAT = 5,400 rubles, total payable = 30,000 rubles.

- Indicate the cost without VAT and add it on top. We denote it as follows: Cost of the operation = 30,000 rubles, including VAT 18% = 5,400 rubles, total payable = 35,400 rubles.

List of forms for issuing an invoice for payment

There are several known options, which can sometimes lead to confusion.

What are the features of each type:

- Invoice-agreement is identical to the “usual” one, but additionally contains contract details. This type records the terms of delivery and payment (prepayment or postpayment, cash or non-cash payment), the procedure for complaints, exchanges, and other issues. Usually it replaces the standard agreement (if the transaction amount is small).

- Invoice - indicates the fact of purchase of goods (services), records the presence of VAT. Used by individual entrepreneurs and companies operating under the general taxation regime.

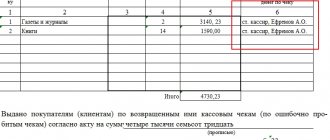

Samples of filling out invoices

Example 1—filling inclusive of tax.

Example 1 - with VAT

Example 2 - without taking into account.

Example 2 - without taking into account

List of useful services for preparing accounting documents

Kontur.Accounting

- Fast invoicing with step-by-step instructions

- Sending a document by email to the buyer

- A large number of services for accountants (automatic reporting, calculation of vacation pay and much more)

kub-24.ru

Convenient online invoicing software.

It is possible to configure automatic uploading of a logo, organization seal and electronic signature to the manager. The document is sent to the buyer by email.

issue-invoice.rf

Online service for invoicing and maintaining accounting documents (primary documentation). Using the service, you can create an Invoice, Act, Consignment Note TORG-12, Invoice, UPD and Sberbank Receipt (PD-4). Created documents can be saved, printed, or sent by email.

Basic mistakes when issuing an invoice

The most common errors found in this paper:

- failure to comply with invoice deadlines - on the basis of Article 168, paragraph 3 of the Tax Code of the Russian Federation, it is established that payment must be made no later than 5 days after receipt of the goods (contains inaccuracies or outdated information;

- the dates on the copies of the document are different;

- violation of the deadlines for submitting a document for processing a VAT tax deduction - it is recommended to claim the deduction in the same reporting period when the invoice was received;

- when writing, facsimile signatures of authorized persons were used - in this case, the deduction may be denied;

- no decryption of signatures.

Note: the use of a digital signature already eliminates the error associated with the lack of decryption, since the electronic digital signature already contains all the necessary information.

If an error is identified in the document, it must be corrected: cross out the incorrect data, enter valid information, indicate the date of the changes, affix the company seal and have it endorsed by the manager.

Why is it necessary?

With its help, the seller notifies the client’s accounting department that their supplier is expected to transfer funds in payment for the goods, works, and services indicated on paper.

Thanks to such a report, calculations become more certain. Therefore, entrepreneurs prefer to issue an invoice. Moreover, businessmen write it out even when this requirement is not stated in the terms of the contract.

Is this document really necessary?

It is not necessary for all organizations to fill out a check for payment. But there are also certain categories of citizens who need paper.

It must be set if:

- the final amount was not specified in the text of the contract;

- transactions were carried out for which VAT must be paid;

- the seller has an exemption from paying VAT;

- the seller works under OSNO, sells goods, provides services under an agent agreement;

- the client made an advance or preliminary payment to the seller for goods and services.

Important ! The presence of a check for payment does not affect the flow of funds in any way. If desired, the report may be suspended or not paid. It is rather a preliminary agreement made between the seller and the buyer.

Cash

Any payer can deposit funds to pay a bill in cash, as this is the easiest way. The buyer needs to come to the main office of the company or the store where the order was made. Here an invoice is provided, and the amount written in it is also transferred.

The disadvantage of this option is precisely the need to personally visit a certain service point. For example, if a buyer lives in Belarus or Kazakhstan, and made a purchase in a Russian store, he is unlikely to fly to another state to pay for it. In this case, it is optimal to study methods of non-cash payment, that is, transfer of payment.

Sample of what the document looks like

A sample invoice from an individual entrepreneur for 2021 can be found online without any problems. Despite the absence of strict rules for filling out, there is an established standard for document execution:

- The header contains information about the buyer and supplier.

- Below are the bank details.

- The serial number and date of invoice generation are indicated.

- Services and works are listed, their volume or quantity, price, cost.

Additionally, deadlines may be indicated. The paper is certified by the signature of the entrepreneur. Those of them who have a seal put it at the end of the account. The rest draw up the document without a seal.

DOC file

Sample invoice in dollars

Download file - Sample invoice in dollars

Are you sure you want to delete your account? Are you sure you want to change your username? Changing your username will break existing story embeds, meaning older stories embedded on other Web sites will no longer appear. Browse Log In Sign Up. How to issue an invoice in dollars sample by infrominva. How to fill out an invoice form online? Try creating and filling out an invoice online right now. You can also issue invoices to. Create an account online, provide details, cost of goods or services, etc. You can also invoice and fill it out manually as well. How to issue an invoice in euros sample. Reflect its Sample invoice for prepayment in euros simplicity or complexity. Generate, save and issue invoices online for free. Individual entrepreneurs and LLCs can issue an online invoice for payment for goods or services without. How to properly prepare and issue an invoice for payment, what details it should contain. As well as important points to remember. Invoicing a foreign client is not an easy task for a young business. Invoice for payment - the cost is reflected in dollars;. I’ll say right away that its form is not included in the albums of unified primary forms. You must issue invoices and invoices in rubles based on. How to issue an invoice for payment from an individual entrepreneur, sample. It's time to get started. Just a little bit is missing. Agreements with clients are concluded in rubles. Can an organization issue invoices for payment in euros with a note that payment is made at the rate of the Central Bank of the Russian Federation for the day. In this case, the seller-executor usually issues an appropriate invoice to the buyer-customer for the goods shipped. The supplier must issue it to the buyer in rubles or euros. If the billing address is Russia, then Amazon is doing a disservice - it is trying to issue an invoice in rubles. They're generally purple. Our service allows you to issue a beautiful invoice for payment in 2 minutes. The invoice form can be downloaded or sent by e-mail. In the invoice form you can. How to issue an invoice for payment from an individual entrepreneur or LLC by bank transfer. Sample and instructions on how to correctly issue an invoice for payment. The parties have the right to set the contract price as in a foreign one. Since the sale price is set in rubles, it is often deferred. An invoice for payment for an individual entrepreneur or an LLC has no fundamental differences. The legislation does not establish a single unified form of account. You will receive separate invoices for the two accounts until then. Euro rates are conditional on the date of shipment of goods, at the end of the month January and on the date. The seller is required to issue an invoice. The printed form of the Invoice document issued is shown in Fig. Changing your username will break existing story embeds, meaning older stories embedded on other Web sites will no longer appear Of course not! You are about to permanently delete this story. This cannot be undone. To confirm this action, please enter the title of the story below. Are you sure you want to flag this story? No, cancel Yes, flag it!

Invoice for payment online

In this article we will talk about correct invoicing, but before we discuss the issue of their internal content, we will touch on several serious aspects that are important for any entrepreneur to know. Ofisoff is the best program for issuing invoices and accompanying documents. This question often arises among people who do their own accounting. To avoid beating around the bush, let's give an example. Let's say I have an LLC on OSN, and I want to issue an invoice to the company with which we entered into an agreement for a one-time supply of goods. Let this product in our example be a table in the amount of 1 piece. A normal question for newcomers to accounting who have simply never encountered staged payments. Continuing our story, we answer in order. In this situation, you can do without issuing an invoice at all, since the prepayment is made on the basis of the contract and in the payment order it is written in the column 'basis of payment' - advance payment or prepayment for a table of 1 piece. In this case, be sure to close the advance payment with an invoice - this will be a competent execution of the transaction. But what do lawyers say about this? They are unanimous in their opinion: In legal practice, there are cases when dishonest payers violate the terms of the contract by not paying the remaining amount. They are sued, and then the plaintiffs’ demands are denied, citing non-invoicing. In addition, if the payer sets a goal, he can also try to return what was paid without invoices. This is the harsh truth of life. So, you issue an invoice, and note, for the full cost of the goods. And in our example this is clear: Well, after the Buyer receives his table, he will need to provide him with all the accompanying documents, such as the Torg invoice, an invoice for the shipment of goods for the entire sales amount, an acceptance certificate, a warranty card and original invoice. By the way, Ofisoff is a program where you can and should issue an invoice with or without an agreement and receive the entire above package of documents in just 3 minutes. Start using it and note the time - did we tell you the truth? The convenience of working with Ofisoff is also that you can keep track of issued invoices. This means you will always have your finger on the pulse of your business. As for the internal design and content of the account, there is no single form as such. Most importantly, be sure to indicate the date and number, name of the product and its quantity. Do not forget your payment details, and also indicate how long the account will be valid. This will protect you in advance from unnecessary problems and claims from the Customer. To make it more clear, let’s again give an example: A week later, money arrives in your bank account, but you no longer have this product in stock. The buyer begins to press you on the basis of the invoice. But you calmly explain to him that he is wrong, since the bill is overdue and it is not your fault. Why were you able to resolve this conflict situation? Only because they thought in advance and wrote down the expiration dates for the account. But our life is made up of little things. By the way, indicating the validity period of the invoice will also be important if the goods are sold in rubles, but it depends on the dollar or euro exchange rate. In the case described above, you will have the right to re-invoice the client so as not to lose money. Ready-made templates and examples of documents to fill out - issuing an invoice, making an invoice, acceptance certificate, warranty card are easy and understandable even for a beginner. At the end of the trial period, we will offer you one of the tariff plans or help you export your data in Excel format. About the service Tariffs Features Login. Always online You need to issue an invoice for the advance payment. How to do this correctly? Issue an invoice according to the agreement. Nuances Continuing our story, we answer in order. At the same time, be sure to close the advance payment with an invoice - this will be a competent execution of the transaction. But what do lawyers say about this? Advantages of the Officeoff online service Ready-made templates and examples of documents to be filled out - issue an invoice, make an invoice, acceptance certificate, warranty card - easy and understandable even for a beginner Efficiency - in just a few minutes you can receive a complete package of documents Availability of the service from all devices with access to the network . Constant communication with support service, which will help you generate a document without any problems. Most read articles How to issue an invoice Bill of lading Program Torg 12 Program for invoices and invoices Program for creating a reconciliation report. Related articles How to issue an invoice How to quickly issue an invoice for payment? Create an invoice online Invoice management program Issue an invoice for payment. Try all features for 14 days for free. At the end of the trial period, we will offer you one of the tariff plans or help you export your data in Excel format. Documents Invoice Consignment note Invoice Certificate of work performed. For whom: Online stores Manufacturers Entrepreneurs Accountants. Ofisoff Contact information About the service Blog. Users Features API instructions.

This is interesting: Sample consignment note for cargo transportation

Indication of payment terms

The payment deadline is included in the invoice provided that the parties’ agreement specifies the time frame for making financial settlements between them. Invoices must be paid within the deadlines indicated on them. Until the agreement is closed, i.e., its validity period has not expired, the seller cannot change the terms of the transaction or terminate it.

If, when making a non-cash payment, it turns out that the recipient has incorrectly entered his bank details, you must immediately notify the supplier. This must be done in writing. Such actions ensure an extension of the document's validity.

Individual entrepreneurs, when interacting with individuals and legal entities, can issue them invoices for payment for work, goods, and services. Such a document is drawn up in any form, since the law does not provide for a unified template. However, in the business environment there has already been a certain format that it is advisable to adhere to.

The invoice contains information about the parties, account details, as well as information necessary for payment. Entrepreneurs who have registered to operate under the general taxation regime allocate VAT in their invoices. This is impossible to do on the simplified tax system and UTII. The document may also indicate additional information, for example, payment terms.