21.12.2020

A. Gordon

- Deadline for objections to the desk tax audit report

- Deadline for filing objections to the on-site tax audit report

As of 12/18/2020

Moscow Tax lawyer Gordon A.E.

The tax audit report is drawn up by the tax authority based on the results of the tax audit (Article 100 of the Tax Code of the Russian Federation). An objection to the tax audit report is filed by the taxpayer if the taxpayer does not agree with the results of the audit in whole or in part. It is the right of the taxpayer to submit an objection to the act (Article 21 of the Tax Code of the Russian Federation). The Tax Code of the Russian Federation provides for two types of tax audits - desk and field (Article 87 of the Tax Code of the Russian Federation). For field tax audits, drawing up a tax audit report is a mandatory procedure; for desk audits, a tax audit report is drawn up only if violations are detected.

Having received the report, the taxpayer may not agree with the results of the on-site tax audit.

Important!

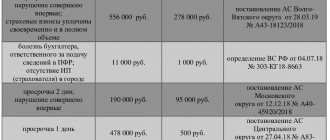

Failure to comply with the pre-trial procedure for appealing acts of visiting tax authorities is grounds for leaving the taxpayer’s application in court without consideration (decision of the Khabarovsk Territory AS dated February 15, 2016 No. A73-17478/2015, determination of the Arbitration Court of the Samara Region dated June 17, 2015 No. A55- 11027/2015).

Thus, before legal battles, the taxpayer must go through a pre-trial appeal procedure.

WHEN CAN A TAX AUDIT COME TO YOU?

Results

If you have been audited by tax officials and you do not agree with the data set out in the audit report, submit your objections to the inspectors. Present your arguments in writing in free form. You can take a sample from this article.

Please attach copies of documents supporting your position to your objections. This will help avoid tax penalties based on the results of control measures.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Objections to the on-site tax audit report: deadlines and procedure

If the taxpayer does not agree with the conclusions set out in the on-site tax audit report, then at the first stage he needs to draw up written objections to the specified act (clause 6 of Article 100 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated August 7, 2015 No. ED-4- 2/13890).

Important!

A tax audit act is not a non-normative act of the tax authority, on the basis of which the taxpayer has an obligation to pay taxes and cannot be an independent basis for applying to the court with a demand for inclusion in the register of debts for the payment of taxes, penalties, fines (determination of the AS of the Altai Republic from 02/19/2016 No. A02-1081/2015).

REASONS FOR APPOINTING ON-SITE TAX INSPECTIONS

When to use the right

Your right to submit objections should be exercised, for example, if the taxpayer categorically disagrees with the conclusions made by the tax authorities and intends to defend his position before the head of the tax authority, in a higher authority or court. Practice shows that it makes no sense to focus only on formal violations during a desk audit (for example, violation of the inspection deadline). And there is no point in filing objections based only on formal violations. Moreover, this is inappropriate, since tax authorities will have the opportunity to correct minor shortcomings in a timely manner. Accordingly, the taxpayer will lose additional “trump cards”, because formal shortcomings can be pointed out in court. Thus, one should object only to those conclusions that are formulated in the descriptive and summary parts of the desk audit report. The taxpayer must understand that only a violation of the deadline for drawing up the act or the three-month deadline for conducting a desk audit will not prevent the IFTS from making a decision.

EXAMPLE No. 1

The taxpayer received an on-site tax audit report on May 30, 2016. The deadline for filing objections to the received report is no later than June 30, 2021.

The taxpayer has the right to attach to written objections or, within the agreed period, submit to the tax authority documents (their certified copies) confirming the validity of his objections (clause 6 of Article 100 of the Tax Code of the Russian Federation).

Written objections and supporting documents are sent to the tax office that conducted the audit (clause 6 of Article 100 of the Tax Code of the Russian Federation).

Objections can be served in person or sent by mail. Then the period (month) will be counted from the seventh day from the moment of sending the registered letter (clause 5 of Article 100 of the Tax Code of the Russian Federation).

SERVICES IN THE ARBITRATION COURT

Deadlines for preparing a controversial document

The time frame for preparing the report depends on the type of inspection and varies as follows:

- ten days after completion (we are always talking about working days, unless otherwise indicated) - in case of office;

- within two months from the date of drawing up the certificate of conduct - in the case of an on-site event;

- within three months from the date of drawing up the certificate of conduct - for an on-site, relatively consolidated group of taxpayers (Chapter 3.1 of the Tax Code).

The NP act is handed over to the person who was inspected (or his representative against signature) within five days from its date. This document can be transmitted in another way, which indicates the date of its receipt.

Evasion from receiving the document is recorded in it, after which it is sent by registered mail to the location of the organization (separate unit) or the place of residence of the individual. In this case, the date of delivery is considered to be the sixth day after sending the registered letter.

If a consolidated group of taxpayers was audited, the report (within ten days from its date) is handed over to the responsible member of the specified group.

For a foreign organization that does not have a separate branch on the territory of the Russian Federation (minus an international organization, a diplomatic mission, a foreign organization that is registered for taxation under clause 4.6 of Article 83 of the Tax Code), the NP act is sent by mail (registered mail) to the address from the single state register of taxpayers. In this case, the 20th day after sending the registered letter will be the date of delivery of the document.

Filing an objection to an on-site tax audit report

There is no legally established form for filing objections to a tax audit report, and there are no clear requirements for the content of objections. However, a certain procedure that has developed in practice should be observed.

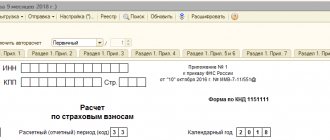

The written objections contain the general part:

- taxpayer details (TIN, KPP, registration address, etc.);

- date and place of submission of objections;

- start and end dates of the audit;

- period of inspection;

- the name of the taxes in respect of which the tax audit was carried out.

This is followed by the content:

- specific points of the audit report with which the taxpayer does not agree;

- legislative justification for objections (links to the norms of the Tax Code of the Russian Federation, letters from the Ministry of Finance of the Russian Federation posted on the official website of the Federal Tax Service of the Russian Federation);

- established arbitration practice on this issue.

Important!

The last point of the content of the objections is very important, since the tax service, when considering objections to tax audit acts and complaints against decisions, is recommended to take into account the established arbitration practice in the region on this topic (letter of the Federal Tax Service of the Russian Federation dated May 11, 2007 No. ШС-6-14 / [email protected] ).

How they are drawn up and what is noted in objections

The document is drawn up in writing, in compliance with the following structure (of three parts):

- Introductory - informs about the inspection itself, its grounds, the actual time of the inspection, the composition of the inspectors, the number and date of the document being disputed.

- Descriptive - here the person being checked has the right to present all his arguments and arguments (both indisputable and doubtful) in detail and consistently, with maximum justification.

- Resolution (final) - where both the total additional charge of payments, with which the person being inspected does not agree (broken down by periods and amounts), and the amount of tax that is refused to be reimbursed can be indicated.

Time limits for consideration of objections to the on-site tax audit report

Written objections to the tax audit report must be considered by the head (deputy head) of the tax authority that conducted the tax audit, and a decision on them must be made within 10 days from the date of expiration of the deadline for submitting objections (and not from the day the taxpayer actually submits objections to the act checks).

This period may be extended, but not more than by one month (Clause 1, Article 101 of the Tax Code of the Russian Federation).

The tax authority is obliged to notify the taxpayer of the date, place and time of consideration of the audit materials.

Based on the results of consideration of the submitted objections, the head (deputy head) of the tax authority makes a decision:

- on bringing to responsibility for committing a tax offense. When checking a consolidated group of taxpayers, the said decision may contain an instruction to hold one or more members of this group liable;

- on refusal to bring to justice for committing a tax offense (clause 7 of Article 101 of the Tax Code of the Russian Federation).

Who is objecting to what?

Among the rights of tax authorities (under Article 31 of the Tax Code of the Russian Federation) is the conduct of tax audits (TA) - a set of procedures that monitor the accuracy of calculations, as well as the completeness and timeliness of payment of mandatory payments. Control can be desk-based or on-site. In the first case, employees of the Federal Tax Service analyze the information provided by the person being checked, plus the data they have, in their office offices. In the second case, the specified analysis is carried out where the person being tested is located. They can check:

- taxpayers;

- payers of fees and insurance premiums;

- tax agents.

The results of the inspection (the presence of violations or their absence) are reflected in the act, its form is determined by Appendix No. 23 to the order of the Federal Tax Service of Russia dated 05/08/2015 N ММВ-7-2 / [email protected] Violations identified by the inspection most often become the reason for documented objections . Moreover, they can be submitted both regarding the entire list of identified violations, and part of it.

Under what conditions is it possible to challenge a tax act?

To appeal a tax audit report, certain grounds are required. If you file a complaint without such grounds, it will be rejected, in most cases - without even consideration. Therefore, it is very important to know under what conditions it is possible to file a complaint. Here are the most common grounds for challenge:

- tax inspectors committed certain violations during the audit - quite often you can encounter situations where inspectors violate the law during business inspections. Violations can be either very serious or minor, however, even the most insignificant violation (for example, they forgot to indicate the date of the inspection, did not put a signature or seal, etc.), if it is recorded on time and correctly, makes it possible to challenge the final inspection report or parts of it. Therefore, it is very important that during the inspection there is a lawyer present who can monitor compliance with the law by inspectors;

- the deadlines for conducting audits have been violated - both desk and field tax audits have legally limited periods of implementation. However, in practice, deadlines are often violated, which makes it possible to challenge the tax audit report. It does not matter of fundamental importance whose fault the delay occurred: if the deadlines are violated, you can file a complaint, because the law has already been violated;

- unlawful or groundless application of sanctions - almost any inspection, especially an on-site inspection, ends with the imposition of penalties or additional tax payments. However, there are not always sufficient reasons for this. If you find out that additional tax assessments, fines or other restrictive actions on the part of the Federal Tax Service (for example, blocking of accounts) were applied without proper grounds, this may serve as grounds for challenging such a tax audit act. But in order to discover the groundlessness of the sanctions, one cannot do without consulting a professional tax lawyer ;

- other violations that could in one way or another affect the result of the audit - this includes more rare situations, for example, when third-party organizations are involved in the audit that do not have the appropriate certification, if documents and equipment were seized that are not related to the current audit, if they were used information that does not correspond to reality, etc. All this information, with proper preparation, can be used as arguments to challenge the results of a tax audit.

This is important to know: Deadline for appealing a disciplinary sanction of the Ministry of Internal Affairs

When preparing to challenge, pay enough attention to preparing the justification, because often it is the insufficient motivational part that serves as the reason for refusing to satisfy the complaint. support of tax audits is also very important - this increases the likelihood that all violations will be recorded.

Non-standard situations

When appealing an inspection decision, a company does not always get the result it was striving for, especially in cases where the dispute has reached the court. There are often situations when fiscal services, as an interim measure, petition the court to prohibit the use of property and monetary assets of an enterprise until a court decision is made. In other words, all the company’s accounts are frozen until the court’s decision on the company’s claim to appeal the tax audit acts comes into force.

Our company's lawyers have positive experience in these types of cases. But, it is easier to prevent any trouble than to correct its consequences later. Practical experience shows that a company, when appealing a tax audit decision, without involving specialists, may miss important nuances and make mistakes when forming an evidence base, which will be difficult to correct in the future.

Grounds for disagreement with the act

Well-written objections and well-founded arguments contribute to making a decision to cancel or reduce sanctions. A taxpayer can express disagreement with the act or part of it in relation to:

- Inconsistencies between the actual data of the enterprise and those specified in the act from the point of view of the provisions of tax legislation. In a number of cases, the facts of economic activity are misinterpreted by the inspection inspector.

- Inspection procedures. Violations of procedural order occur, but are extremely rare. Violation of the procedure does not affect the decision making. Cancellation of the decision is carried out in court.

- Data inconsistencies. The materials of the act sometimes contain incomplete information.

- Arithmetic of inspectors' calculations. Errors may occur when calculating penalties, fines and when determining the amount of arrears taking into account overpayments.

The taxpayer is not required to support the arguments put forward with documents. In the form of evidence, documents restored or received from counterparties may be attached confirming the information specified in the objections.

Mistakes when drawing up an objection

In the process of presenting arguments about disagreement with the inspection report, it is necessary to avoid drafting errors:

- Lack of data in the document allowing consideration of the taxpayer’s position. The grounds for objections must be reasoned.

- Deviation from the rules of writing a business letter. Emotional attacks and arguments that have no reference to legislative acts or evidence are unacceptable in the appeal.

- Violation of established deadlines for submission. If objections are filed after the allotted period, the act is considered without taking into account the protesting data.

An enterprise that fails to submit claims within the deadline established by law must contact the Federal Tax Service with a request to postpone the deadline based on compelling evidence. The intention to protest the result must be notified in advance. The appeal is made before the deadline for filing objections.

How we can help your business

We can help any company even before the tax authorities begin an audit. Our company offers comprehensive assistance and support for your business with:

- checking the reliability of your counterparties;

- legal support of all ongoing and already concluded transactions;

- consulting all employees of the organization before the start of the fiscal audit;

- support of on-site tax audit;

- support of desk tax audit;

- appealing the results of an inspection already carried out if they do not suit the enterprise.

In each specific case, we develop a separate strategy to help the business, depending on the current situation at the time of contacting us and the client’s wishes.