From the history of the issue: the purpose of SZV-M

As part of the anti-crisis measures taken by the Government for 2021, Art. 26.1. It established a new procedure for the payment of insurance pensions and the fixed part to it in relation to working pensioners (Part 2 of Article 3 of the Law “On the suspension of certain provisions of legislative acts” dated December 29, 2015 No. 385-FZ):

- the amounts of the insurance pension and its fixed payment are paid without taking into account indexation during the period of work of the pensioner;

- after he stops working, the ban on indexation of these amounts will be lifted.

For monthly monitoring of information about working pensioners, the Pension Fund of Russia introduced the SZV-M reporting form. It also allowed pensioners not to independently submit information about their employment to the Pension Fund; this responsibility is now assigned to the employer.

However, the pensioner still retains the right to submit to the Pension Fund a statement about the fact of his employment (termination). He can use it to speed up the process of starting to index his pension after dismissal.

An example of an explanatory note about late provision of documents

> > > No one is immune from errors in their work. A manager, faced with improper or illiterate performance of official duties by an employee, will naturally want to get an explanation from the employee. A written explanation is usually required.

The employee should write an explanatory note in which he should explain the reasons for the error in his work. At first glance, the explanatory note seems to be something insignificant, but it is not so. This is a document that will help management understand what happened and make the right decision on the need for disciplinary action. Depending on the mistake made and the severity of its consequences, the type of possible penalty depends, the imposition of which is issued by order, a sample of which can be downloaded from the link. In order to try to avoid possible punishment, the employee should think about the contents of the explanatory note, draw it up correctly, briefly and succinctly describe the situation and try to find objective reasons for the mistake made in the work. Below we will consider how to correctly draw up such a document.

As an example, we offer an explanatory note about an error in work; the form for free download is located at the bottom of the article. The employee should know that in order to apply a disciplinary sanction, the employer must obtain a written explanation from the employee. Therefore, when an employee arises

Non-standard situations that arise when filling out the SZV-M form

Let's look into situations that are non-standard for such cases, which are why policyholders have most of the questions.

The main principle when deciding whether to include information about individuals in the SZV-M is the following:

- individuals work in an organization under employment contracts or GPC agreements, author's orders, publishing license agreements and other agreements listed in the form itself;

- the validity of such contracts falls on the reporting period (separately or in aggregate: concluded, continue to operate, terminated in such a period);

- payments under contracts in favor of individuals may potentially be subject to insurance contributions to the Pension Fund (Clause 1, Article 7 of the Law “On Compulsory Pension Insurance” dated December 15, 2001 No. 167-FZ; Clause 2.2 of Article 11 of the Law “On Personalized Accounting” dated 04/01/1996 No. 27-FZ).

Thus, for the purposes of filling out the form, the following does not matter (letters from the Pension Fund of the Russian Federation dated May 6, 2016 No. 08-22/6356, dated July 27, 2016 No. LCH-08-19/10581):

- the fact that there were no payments to an individual in the reporting period if there were such accruals to him;

- an employee being on sick leave, on maternity leave or in similar situations;

- the employee is on vacation (including vacation at his own expense in the absence of activity in the organization);

- the presence in the organization of only a manager (who is the sole founder), with whom neither an employment contract nor GPC agreements have been concluded.

Such features of concluding contracts with an individual, such as part-time work / combining professions, also do not matter.

The only people not included in the form are foreign citizens - highly qualified specialists temporarily staying in the Russian Federation who are not insured in the compulsory pension insurance system (Article 7 of Law No. 167-FZ of December 15, 2001).

IMPORTANT! From the above it follows: a report in the SZV-M form cannot be zero (with an empty table).

Read about one of the non-standard situations that arise when submitting reports in the article “Should I submit SZV-M to the manager - the sole founder?”

Explanatory note about late submission of documents

Posted On 06/12/2018 Contents The legislation does not provide for the possibility of appealing the administration’s decision on the grounds that the employer’s assessment of the employee’s business qualities is unreasonable.

Tax liability for failure to comply with the inspection's requirement to provide explanations to the Tax Code of the Russian Federation has not been established. Moreover, in the case of an electronic message, the taxpayer is obliged to respond to it within five working days.

I remember her beautiful, bold fouette in the third act, in which she looked like a bird, rising on its wing, for which flying is a more natural state than walking on the ground. The salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and is not limited to the maximum amount (Art.

Registered users also have the opportunity to create personal collections of magazines and articles, save the history of search queries, customize the navigator panel, etc.

The protection of an employee’s personal data from unlawful use or loss must be ensured by the employer at his expense in the manner prescribed by federal law. Here it would be appropriate to understand some of the rules governing other, closely related to labor relations, as the rules of other branches of law, subsidiarily used in labor law. And yet, there are no required skills in the game, except perhaps hand weapons (and then options are possible), and it is not necessary to say that if you do not necessarily choose a certain skill, you will not be able to complete the game.

Both a seal and a bank account will be necessary for concluding civil contracts with other entrepreneurs or organizations, as well as for conducting non-cash payments. Ignoring

They are fined for not submitting SZV-M, submitting it at the wrong time (late) or with errors.

Art. 17 of Law No. 27-FZ establishes liability for the following violations in the SZV-M form:

- failure to submit a report;

- violation of the deadline for its submission;

- failure to provide information about the insured person;

- incomplete or unreliable presentation of information about the insured person.

For any of these violations, a fine of 500 rubles is provided. for each employee whose information is to be included in the form for the reporting period.

IMPORTANT! Any minor error when filling out the form, interpreted by the Pension Fund of Russia authorities as unreliability in the presentation of information, will lead to a fine assessed on the entire number of insured persons indicated in the reporting. In case of non-payment or incomplete payment of financial sanctions, the Pension Fund of the Russian Federation collects the debt in court (Parts 15, 16, 17, Article 17 of Law No. 27-FZ).

Thus, significant penalties for the policyholder may arise due to an accidental error, which is simply impossible to exclude due to a technical or human factor.

To learn about the mandatory indication of certain information when filling out the form, read the article “TIN in the SZV-M form has become optional”

For cautious policyholders, we can recommend using the resources of the online service “Find out your/other people’s INN” on the Federal Tax Service website at: https://service.nalog.ru/inn.do.

See also “Error in the period - is the fine for SZV-M legal?”

sovetnik36.ru

If you submitted your reports at the wrong time, you will have to explain yourself. If a company submits the RSV-1 calculation to the Pension Fund of the Russian Federation late, then it is better to add an explanatory note to the reports.

Experts from the magazine Current Accounting told us how to prepare this document. The preparation and submission of reports can be disrupted for various reasons, including the work of communication providers and errors in the document format. All this can lead to late submission of documents.

For this, the law provides for a fine of 5% of the amount of insurance premiums that must be paid for the last three months of the billing (reporting) period, for each full or partial month from the date established for its submission, but not more than 30% of the specified amount and not less than 1000 rubles (Law No. 212-FZ, part 1 of Art.

46). Thanks to the explanatory note, it becomes possible to clarify all the circumstances due to which the offense was committed and what the fault of the employee was. At the same time, the employee may refuse to write an explanatory note. Especially if she confirms his guilt, directly or indirectly. Important After all, no one is obliged to testify against himself, as the Criminal Code of the Russian Federation states.

But sometimes it’s better to write it anyway in order to avoid dismissal from work or other serious penalties. If within 2 days the employee does not provide an explanatory note, or does not declare a refusal to write an explanatory note, an appropriate act is drawn up, and the employee is subject to disciplinary punishment.

We recommend reading: When does property become escheatable?

SZV-M was not submitted on time

Providing personalized information about all insured persons working in the organization, including freelance, allows the Pension Fund to monitor working pensioners and timely update decisions on pension payments.

Reports in form SZV-M must be submitted to the Pension Fund no later than the middle of the month following the reporting month. This is established in paragraph 2.2 of Art. 11 Federal Law dated 01.04.96 No. 27-FZ. A late organization will face punishment in accordance with Art. 17 of Law No. 27-FZ.

Download documents from the article

Example of filling out the SZV-M form for April 2021DOC fileTable of fines for 2021DOC file

The fine for late submission of SZV-M is aimed at maintaining strict reporting discipline. Let us remind you that in the event of dismissal, a pensioner can independently inform about this in order to initiate the indexation procedure and increase his income. The report is sent to the territorial branch of the Pension Fund. The certificate form was approved by resolution of the Pension Fund number 83 in February 2019.

SNILS cards have been cancelled: Where can I get information for SZV-M now?

From April 2021, the Pension Fund no longer issues green cards. Now you will have to take the employee’s SNILS from different documents. Where exactly it comes from depends on when the person registered in the compulsory pension insurance system. For a mistake you will be fined 50 thousand rubles. What to do now with SNILS when applying for a job, read the article in the magazine "Human Resource Officer's Handbook".

Let's sum it up

- The SZV-M for December 2021 must be submitted no later than January 15, 2021.

- The report is submitted on paper only if the number of employees does not exceed 24 people. For 25 or more employees, you will have to report electronically via TCS through EDI operators.

- From March 2021, SZV-M must be handed over to organizations with a single founder acting as a director, even if an employment contract has not been concluded with him.

- In order to properly defend yourself in court and not pay fines, you should take into account the current judicial practice on SZV-M.

If you find an error, please select a piece of text and press Ctrl+Enter.

What to do: judicial practice

Let's consider what decisions the court makes when considering claims for fines related to SZV-M. Although this reporting began to be used not so long ago, a certain practice has already been developed. You can rely on it to understand the essence of analyzing problem situations in order to avoid a fine.

Errors are considered: lack of reporting, late submission, incomplete and/or unreliable information about insured employees. In the first case, the punishment is inevitable, it will not be possible to challenge it. And if, for good reasons, the SZV-M was not submitted on time, then you can try to prove it.

It is often difficult to understand locally who should be included in the certificate. The Pension Fund clarifies this issue in letters dated 05/06/2016 No. 08-22/6356, dated 07/27/2016 No. LCH-08-19/10581.

So, if a company has only one manager (aka founder), working without a contract, the report still needs to be filled out. Also included in the form are maternity leavers, sick people, vacationers and those who were actually absent from the workplace and did not receive payments during the reporting period. There are no exceptions for part-time workers.

Perhaps the only exception can be considered only those who have foreign citizenship and do not have a Russian SNILS (Article 7 of Law dated December 15, 2001 No. 167-FZ). Therefore, it will not be possible to submit an empty form under any circumstances. Unlike other forms of reporting, this cannot be “zero”.

► Who will be punished for the fact that the branch did not report

There is no ranking of punishments depending on the violation; any mistake is punishable by the same penalty: 500 rubles per person. The fines for a failed SZV-M and an absent one are equal.

Compared, for example, with tax legislation, which has a developed differentiated system of penalties, this seems unusual. Many hope that later, when an extensive database of appeals to the court and decisions on them has been accumulated, the amount of fines will be revised downward depending on the violation.

Try for free, refresher course

Documentation support for work with personnel

- Meets the requirements of the professional standard “Human Resources Management Specialist”

- For passing - a certificate of advanced training

- Educational materials are presented in the format of visual notes with video lectures by experts

- Ready-made document templates are available that you can

Error in the original SZV-M form

The most common option is when the certificate was submitted on time, but errors crept into it. Moreover, the flaws were noticed in the organization, and not in the Pension Fund. According to clause 39 of the Instructions for maintaining personalized records (approved by order of the Ministry of Labor No. 766n), such errors should not be punished. However, fines are still issued regularly.

The court decisions in such cases are clear: cancel the monetary penalty, and it does not matter in what form the reporting was submitted, paper or electronic (resolutions of the arbitration courts of the Far Eastern District dated 04.10.17 No. F03-924/2017, Povolzhsky dated 01.17.18 No. F06-28745 /2017, North Caucasus dated 09.20.17 No. A20-3775/2016, Sverdlovsk region 09.12.2016 A60-33366/2016 09.12.16, etc.).

► What reports to submit using new forms starting from February 2019

Forgotten employees

It sometimes happens, especially in organizations with a large staff, that one or more insured employees are not included in the report. The Pension Fund of Russia will impose a fine, can it be challenged if the adjustments are sent later than the 15th?

Legal practice in such situations, unfortunately, does not have a uniform focus. Some judges believe that the supplementary form represents a single text with primary reporting, therefore the application of punishment is unlawful: see, for example, Resolution of the Administrative Court of the East Siberian District dated October 5, 2017 No. A78-1989/2017. But there may also be the opposite option, when the Pension Fund is recognized as right, since there was no information about these persons in the original document (Resolution dated December 25, 2017 No. F03-5001/2017).

► When you cannot do without an employee’s signature on a document

Incorrect data for several employees

Difficulties are also raised by the question on what basis the amount of the fine is calculated. Is the basic penalty of 500 rubles per insured person multiplied by the number of all insured workers or only those for whom incorrect information was submitted? Once again, judicial practice does not provide a precise, unambiguous answer.

Some people believe that reports with errors are still considered passed, so the punishment should take into account the volume of errors. Therefore, if, for example, SZV-M contains information on 50 employees, of which 3 have incorrect SNILS numbers, then the fine should be 3 * 500 = 1500 rubles (resolution of the AS of the West Siberian District dated 08.23.17 No. A27-22235/ 2016).

But the opposite option also occurs, when the judge clearly takes the side of the Pension Fund of Russia (resolution of the Far Eastern District Court of 11.21.17 No. F03-4421/2017).

► Electronic document management in the personnel service: when to switch and where to start

Is it possible to downsize?

So, the employer has a chance to reduce the amount of fines. But to do this, you need to provide the court with evidence of your innocence. The claim is filed at the location of the defendant - to the territorial branch of the Pension Fund of Russia. Usually it is compiled by the legal department of the enterprise or a specially hired lawyer.

There has already been a list of circumstances that traditionally mitigate guilt in such cases. They are not legalized in official documents, and one should not fully rely on them. But they will be important in the judge’s analysis of the situation. Let's list them:

1. Short period of delay, not exceeding 16 days. The fine for failure to submit the SZV-M in this case may be reduced or even canceled.

2. The violation was committed for the first time. This proves that such misconduct is not normal for the organization and is unlikely to be tolerated in the future.

3. No claims for other payments to the Pension Fund. If an enterprise never delays the payment of insurance premiums, most likely, problems with reporting arose due to force majeure, emergency circumstances, and it makes no sense to punish a generally conscientious payer.

4. Proven facts and personal circumstances justifying the delay in reporting. This could be a certificate of temporary disability of the responsible official, a certificate from the city power supply organization about emergency restoration work, a document from the telecom operator about damage to the main cable in a specific area (internet connection failure), etc.

For your convenience, we have prepared a table in which all mitigating factors are collected with links to court decisions and the difference in the initial and final amounts of fines is clearly visible. Based on the texts of the decisions, you can develop a strategy for going to court.

| Details of the court decision | Mitigating circumstances taken into account by the court | Pension Fund fine, rub. | Fine by court decision, rub. |

| Resolution of the AS of the West Siberian District dated 10.10.17 No. A81-5854/2016 |

| 34 500 | 3 450 |

| Resolution of the AS of the East Siberian District dated 09/06/17 No. A78-15400/2016 |

| 08 000 | 1 000 |

| Resolution of the AS of the West Siberian District dated March 30, 2017 No. A27-17653/2016 |

| 411 500 | 20 000 |

| Resolution of the AS of the Ural District dated May 24, 2017 No. A76-27244/2016 |

| 54 500 | 5 450 |

| Resolution of the Volga-Vyatka District Administration of July 17, 2017 No. A28-11249/2016 | lack of electricity and network equipment malfunction | 74 000 | 0 |

Explanatory note about late submission of documents

9057 At its core, untimely provision of documents is a failure to fulfill direct job responsibilities, because a number of professions involve working with documentation. If any paper was not provided on time, this may cause a delay in other processes at work or simply negatively affect the result.

If an employee has made such a deficiency in his work, management has the right to demand from him an explanatory note, which should set out the reasons that led to the delay in documentation. FILES A note is drawn up according to the general principles of office work, that is, indicating the addressee (boss), own position, mandatory date and personal signature.

Recommendations for wording content:

- The text of the note, according to unwritten rules, should not extend beyond 1 sheet.

- if guilt really exists, it is more correct to admit it, apologize and express the intention not to allow this to happen in the future;

- do not try to shift your own mistake onto someone else;

- you should not indulge in detailed and lengthy explanations, it is enough to indicate one reason;

- counter-accusations in the explanatory note will not work in your favor;

To the Chairman of the Moscow Arbitration Court N.A. Novikov, specialist of the records management department, R.M. Maryanova. EXPLANATORY NOTE About late submission of a document I, Maryanova Raisa Mikhailovna, as a young specialist, have been working in court since September 12, 2017.

Additional form SZV-M

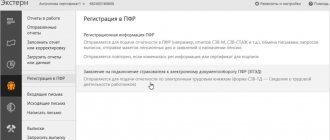

By Resolution of the Board of the Pension Fund of February 1, 2016 No. 83p, a new form SZV-M was introduced, which is designed to identify officially employed pensioners. At first glance, it is quite simple, but there are some nuances that an accountant should know. In this article we will look at the supplementary form SZV-M of the 2016 model.

Let us remind you that this report is submitted monthly to the territorial office of the Pension Fund of Russia by the 10th day of the month following the reporting one. The SZV-M indicates all individuals with whom the employer has concluded an employment contract or a civil law contract.

Read about all the important points related to submitting this form in our “SZV-M” section.

Resolution No. 83p does not clearly indicate whether this report can be submitted before the end of the current month. Therefore, an organization can theoretically submit data before the end of the calendar period. But you should always remember that if, for example, employee data for the current month changes or errors are found in the form, you must report this to the Pension Fund.

For this purpose, SZV-M provides the “Additional” form type, that is, supplementary. Let's figure out how and when to submit a form with this feature.

IMPORTANT! The supplementary SZV-M must be submitted within the same period as the original ones, that is, before the 10th day of each month, and in 2017 - before the 15th day (Law dated July 3, 2016 No. 250-FZ). Otherwise, the company will be fined 500 rubles. for each incorrectly specified employee.

Explanatory note to the tax office regarding late submission of reports

Contents There are no penalties for failure to submit, but you should not ignore the requirements of the tax office, since, without receiving a response, the Federal Tax Service may assess additional taxes and penalties. Please note: if the taxpayer belongs to the category of those who are required to submit a tax return electronically in accordance with clause 3 of Art. 80 of the Tax Code of the Russian Federation (for example, on VAT), then he must ensure the receipt from the Federal Tax Service of electronic documents sent during the desk audit.

This also applies to requests for explanations - within 6 days from the date of sending by the tax authorities, the taxpayer sends an electronic receipt to the Federal Tax Service Inspectorate confirming receipt of such a request (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). If receipt of the electronic request is not confirmed, this threatens to block the taxpayer’s bank accounts (Clause 3 of Article 76 of the Tax Code of the Russian Federation). There is no officially approved sample explanatory letter sent in response to the Federal Tax Service's request for clarification.

Here, tax authorities have the right to demand explanations for the changed indicators.

Read about when and how to do this, what are the consequences of violating this duty.

Secondly, it should be borne in mind that the request may not have the stamp of the tax authority (see letter of the Federal Tax Service of the Russian Federation dated July 15, 2015 No. For more information about this, see the material.

Possible reasons for filing an additional SZV-M report in 2021

There may be several reasons for filing a supplementary SZV-M.

| Reason for submitting supplementary SZV-M to the Pension Fund | Example | Report formatting method |

| SZV-M additional for a forgotten employee | Orange LLC submitted information on the SZV-M form on May 29, and on May 30 a new employee was hired. Since the employment contract appeared in the reporting period, information on the new employee must be transferred to the Pension Fund of Russia | It is necessary to use the SZV-M form with the “Additional” attribute in the 3rd section. However, the accountant will not fill out data for all employees. The report must include the last name, first name, SNILS and Taxpayer Identification Number of the new employee. |

| Cancelling and supplementing SZV-M in case of incorrect TIN | After submitting the reports, the accountant identified an inaccuracy in the indication of the TIN of employee P.V. Ivanov. It is necessary to correct the data for the Pension Fund of Russia | If the company has entered an erroneous TIN in SZV-M, then it is necessary to submit both the canceling and supplementing form SZV-M. In the first, the accountant will indicate the details of P.V. Ivanov with an incorrect TIN. And in the supplementary SZV-M there is also data on P.V. Ivanov, but only correct. Both forms must be submitted at the same time |

| Supplementary form SZV-M in case of an error in SNILS | After submitting the reports, the financial department of Romashka LLC discovered that the SNILS of two employees were mixed up | If the report is partially accepted, then the supplementary form will be submitted only to employees with an incorrect SNILS. If a completely negative protocol is received, then it is necessary to submit the data again as original |

Please note that indicating the Taxpayer Identification Number (TIN) in the SZV-M form is currently not necessary - you can learn about this from our selection of current changes.

This means that if the TIN in the report is not filled out for all employees, then a supplementary report will not be required.

The report on the SZV-M form is quite simple to fill out. If there is a clear record of employees indicating the correct data for each of them, the organization should not have the need to submit a supplementary form of this report.

Late submission of tax reports

Contents It is unlikely that this line of behavior will find understanding among superiors. For example, you made a mistake due to inattention - due to poor health. You can write that the cause of the offense was overwork, but it is not worth emphasizing that the initial factor was a long absence of vacation due to the fault of the same boss.

What else should be in the text The standard ending of an explanatory note is an acknowledgment of awareness of the consequences of the action and a promise to make every possible effort to correct the situation, as well as an assurance that similar mistakes will not be tolerated in the future. None of the employees, from newbies to experienced workers, are immune from mistakes in their work activities.

Errors are the consequences of a variety of reasons, which can be both objective and subjective.

Today the document flow is about 200 documents per day. Due to the heavy workload and lack of practical experience, I failed to cope with my official duties, sending a judicial act dated September 18, 2017, in violation of the established deadlines. Please do not take disciplinary action against me.

From now on I will try to do my work more carefully and focused, gaining experience. 09/20/2017 Specialist of the office management department /Maryanova/ R.M. Maryanova FILES of the explanatory note about the untimely provision of documents .doc All about the explanatory note and other examples are here.

FAS NWO dated January 27, 2012 No. A56-19757/2011) reduced the fine from 30,000 to 1,000 rubles.

SZV-M - supplementary form: is a fine possible?

The wording of Law 27-FZ is such that for the delivery of a supplementary SZV-M, the policyholder can actually be charged a fine of 500 rubles. for each insured person for whom individual information was not submitted on time (Article 17 of Law No. 27-FZ dated April 1, 1996). After all, submitting an adjustment for SZV-M indicates that you made a mistake in the previous report for the same month.

Let’s say the organization’s accountant forgot to include in the SZV-M report the contractor with whom the GPA was concluded in the reporting month. After the deadline established for submitting the form, she submitted the supplementary SZV-M form, indicating in it the full name, INN and SNILS of this performer. Formally, the Pension Fund of Russia has grounds to hold the organization accountable and demand payment of a fine of 500 rubles. However, some branches of the Fund have already received orders from above not to fine policyholders for supplementary SZV-M forms.

Therefore, if in a similar situation you receive from the Pension Fund a desk audit report, according to which your organization will be held accountable and asked to pay a fine for the SZV-M supplement, do not rush to comply with the Fund’s requirement. Write objections, and perhaps the act will be cancelled.

Free legal assistance

/ / Explanatory on the fact of violation of reporting It is unlikely that this line of behavior will find understanding among the authorities. For example, you made a mistake due to inattention - due to poor health.

You can write that the cause of the offense was overwork, but it is not worth emphasizing that the initial factor was a long absence of vacation due to the fault of the same boss. What else should be in the text The standard ending of an explanatory note is an acknowledgment of awareness of the consequences of the action and a promise to make every possible effort to correct the situation, as well as an assurance that similar mistakes will not be tolerated in the future.

None of the employees, from newbies to experienced workers, are immune from mistakes in their work activities.

Errors are the consequences of a variety of reasons, which can be both objective and subjective.

Attention If you submitted your reports on time, you will have to explain yourself. If a company submits its RSV-1 calculation to the Pension Fund of the Russian Federation late, then it is better to add an explanatory note to the reports.

Experts from the magazine Current Accounting told us how to prepare this document.

Important The preparation and submission of reports can be disrupted for various reasons, including the work of communication providers and errors in the document format.

All this can lead to late submission of documents.

For this, the law provides for a fine of 5% of the amount of insurance premiums that must be paid for the last three months of the billing (reporting) period, for each

What is the meaning of the abbreviation SZV-M?

In thematic Internet communities there are heated debates about what the decoding of the SZV-M form is.

The most common options:

- information on earnings (remuneration) submitted monthly;

- information about the insured (incoming), submitted monthly, with explanations of the abbreviation:

- “B” - incoming information (submitted to the Pension Fund); the letter “I” is used to encode documents originating from the Pension Fund;

- “M” - indicates the frequency of reporting, i.e. monthly.

And if the first version of the decoding does not even meaningfully relate to the SZV-M form (it does not contain information about employee remuneration), then the second does not seem to be erroneous, since it carries the semantic load of the report and coincides with the name of the form indicated in the document that approved it.

But, in fact, it is not an abbreviation, but only a symbol, i.e. a unified code approved by Pension Fund documents. Evidence of this will be discussed below.

For information on the required details in the report file name, see the article “PFR territorial body code for SZV-M”.

The SZV-M form was approved by the resolution of the Pension Fund of the Russian Federation “On approval of the form “Information about insured persons”” dated 01.02.2016 No. 83p).

For other accounting documents, not only legally approved forms are provided, but also instructions for filling them out (Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p).

If you carefully review the instructions, in the table “List of Persuchet Document Forms” the names of the reports are located in the “Symbol” column. And an analysis of the correlation between the columns “Name of the form” and “Symbol” will not give us confirmation that the names of the Pension Fund forms are compiled by abbreviation.

Let's compare:

- SZV-M “Information about insured persons”;

- ADV-3 “Application for issuance of a duplicate insurance certificate”;

- ADI-7 “Insurance certificate of compulsory pension insurance” (a document issued by the Pension Fund of the Russian Federation, with the letter “I” in the designation).

Thus, it is obvious that in the instructions itself the Pension Fund enshrines symbols (codes) that define reporting features that correspond to certain forms of accounting and are in no way strictly related to their names. This can be confirmed in the basics of archiving.

To learn about the cases in which an accepted SZV-M report may entail the accrual of a fine, read the material “You need to open all protocols on SZV-M - if positive, a fine is also possible.”

See also: “For the wrong month in SZV-M you will be fined.”

The Fund has issued a number of documents that are included in the Unified Accounting System. All these forms have certain symbols (which are enshrined in the instructions for filling them out), which are not abbreviations. Therefore, trying to find the decryption key to their name yourself is pointless.

Explanatory note to the Pension Fund for adjustments, sample

Explanatory note to the director about late submission of the certificate

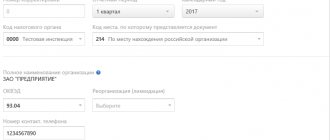

06/29/2021 The report includes four sections:

- reporting period;

- details of the policyholder;

- information about the insured persons.

- form type;

Let's switch from the same metric in different years to different metrics in the same year.

In other words, it provides support. We obtain the following formula using linear regression. Does this mean that the scales 20 and 9 are incorrect? Possibly, although note that the correlation coefficient is the same using either weight. This means that although regression involves using different weights, changing the weights does not seem to make much difference.

Follow the mandatory standard layout material when writing an explanatory note: at the very top there must be a header, then you should write the name of the document, then the main part, which fully explains the reasons for the current situation, at the very bottom the signature and date.

In such situations, the use of a business and official writing style is highly encouraged. This style of writing is characterized by laconicism, lack of emotional background, a certain dryness, and coloration in the presentation of explanations. Under any circumstances, you need to remember the general veracity of the material presented, as well as reliable argumentation.

• In the main part of the document, first, the identification by inspectors of the relevant services of inconsistencies or gross violations of basic rules and regulations is written.

Objections to the FSS regarding the inspection report

In addition to the Pension Fund, employers report to one more extra-budgetary fund. Namely, to the Social Insurance Fund (SIF). The Social Insurance Fund controls the calculation and payment of contributions for industrial accidents. It also checks the correctness of payments of social insurance benefits for disability, in connection with maternity and others.

The FSS also conducts desk and on-site inspections of policyholders. And if it finds violations, it makes a decision not to accept the amounts of paid benefits for offset or to collect fines. The policyholder has the opportunity to challenge additional charges by filing an objection to the FSS inspection report. We will give a sample for the same example. The procedure for its formation is similar.