One of the ways to prepare a 3-NDFL tax return is to fill it out in a program prepared by the Federal Tax Service.

You can download it directly from the tax service website, install it on your computer and fill out the necessary fields and tabs. Below is detailed step-by-step instructions that will allow you to prepare reports for individuals and individual entrepreneurs using the program for 2021.

For 2021: Filling out 3-NDFL in the Declaration 2021 program.

New declaration form in 2018

At the end of 2017, individuals must submit a 3-NDFL declaration to the Federal Tax Service, for which a new form has been in effect since this period.

Form 3-NDFL was adopted by Federal Tax Service order No. MMV-7-11/671 dated December 24, 2014, and certain changes were approved by order No. MMV-7-11/822 dated October 25, 2021. The new type of form came into force on February 18, 2021. Before this date, the Federal Tax Service accepted reports for 2017 using the old form. The new form applies not only to the declaration on paper, but also to its electronic form.

Filling out personal data

Go to the “Declarant Information” tab.

Filling it out should not be difficult. You just need to consistently indicate your passport details. The only difficulty arises if it is not possible to view the TIN. The Federal Tax Service website and the service specially created for such cases, service.nalog.ru, will come to the rescue.

How it works:

- We fill in the full name and passport data on the service;

- Enter the code from the picture;

- Click “Send request”;

- We get our TIN number (it will appear on the same page at the top) and enter it into the Declaration 2021 program.

The inspection staff can call you at the phone number you specified at the bottom of the page to clarify any unclear points.

Changes in form 3-NDFL in 2018

The order of the Federal Tax Service made the following adjustments to the current declaration form:

- The barcodes on the pages have changed.

- On the title page of 3-NDFL you no longer need to enter data on the individual’s residential address; it is enough to indicate the taxpayer’s contact phone number.

- When filling out sheet D1 in form 3-NDFL, which is filled out when applying for property tax benefits, you do not need to indicate the location of the property; it is enough to enter the cadastral number of the property.

- When filling out sheet E1 of the 3-NDFL report, you do not need to enter information about the number of months during which the individual’s cumulative income from the beginning of the year was less than 350,000 rubles. In connection with the emergence of a new social deduction, a new column has appeared on this sheet in which the amount of expenses for conducting an independent assessment of the qualifications of a given individual should be indicated.

- Since a new investment deduction has been introduced, sheets Z and I must additionally reflect the definition of income from transactions with securities and derivative funds or income from the definition of income from participation in investment partnerships.

- The 3-NDFL report includes a new appendix in which it is necessary to reflect the definition of income from the sale of real estate. It is intended for filling out information about transactions after January 1, 2016, taking into account that the income from the sale of real estate must be at least 70% of the cadastral value of the property.

Who submits this report?

When receiving income on which it is necessary to calculate and pay personal income tax, or to receive a refund of part of the tax previously paid to the budget, a declaration to the Federal Tax Service is required. As required by the Tax Code of the Russian Federation, at the end of the year the report is submitted to:

- Individual entrepreneurs (IP) on the general taxation system.

- Lawyers and notaries who have established private offices.

- Heads of farms (peasants).

- Tax residents of the Russian Federation who received income in other countries in the reporting year (these are persons who actually resided in Russia for at least 183 days a year, but received funds from foreign sources outside its borders).

- Citizens who received income from renting out their property or from fulfilling GPC agreements (provided that the customer did not fulfill the duty of a tax agent). In addition, a tax return for personal income tax (form 3-NDFL) is submitted upon sale of property. Although it is mandatory to declare receipt of income in this case, tax will have to be paid provided that the taxpayer owned it for less than the established minimum period (three years). As for real estate, you must pay income tax when selling an apartment (house):

- owned for less than 5 years, if acquired after 01/01/2016;

- owned for less than 3 years, if the property was purchased before 01/01/2016 or received by inheritance, as a gift, under a lifelong maintenance agreement with a dependent, as a result of privatization.

Citizens who win the lottery or sports betting also pay tax on the amount of their winnings, but in relation to them the tax agents are the organizers of these promotions and drawings, who paid them the amount of the winnings. If the gift is received in kind, the winner must pay tax on it themselves. In this case, he should fill out and submit the report.

Deadlines for submitting the 3-NDFL declaration for property deduction for 2021

As usual, individuals must submit a declaration to the Federal Tax Service by April 30 of the year following the reporting year.

However, if 3-NDFL is submitted to the tax office in order to issue a property tax deduction when purchasing an apartment, for example, then it can be sent to the regulatory authority at any time convenient for the individual - without observing the general deadlines.

It should be borne in mind that a declaration for the year can only be submitted after the tax period has ended. That is, for 2021 you can submit the 3-NDFL report in 2021.

Attention! In this case, you can simultaneously submit a report for 2 years at once or for 3 years at once. Submission of declarations for longer periods according to the Tax Code of the Russian Federation is not allowed. This is due to the existence of a restriction in the form of three years preceding the reporting period.

Online report preparation

To fill out 3-NDFL online, you must have a registered personal account as an individual taxpayer. The login and password for this service are obtained from the Federal Tax Service after specifying all personal data during registration.

Many operators of accounting services offer users convenient programs with instructions on how to fill out an income tax return online for subsequent sending via the Internet or for printing on paper. This method is preferable for those taxpayers who are not involved in accounting and do not have experience filling out reports, although specific knowledge is not required to correctly enter data into this form.

What documents are needed to receive a deduction?

To apply for a tax benefit in the form of a property deduction, you need to send the following package of documents to the Federal Tax Service along with the 3-NDFL declaration:

- Application for a property deduction

- Application for a refund of overpaid tax due to the use of a property deduction using the bank details of an individual.

- Bank details of an individual.

- Personal identification document and its copy.

- TIN of an individual.

- Certificate 2-NDFL, which is issued by the employer to the individual. If a person has several places of work, then certificates from all these organizations or individual entrepreneurs are attached.

- The purchase and sale agreement for the property and its copy.

- Documents confirming payment of the cost of the property.

- When purchasing real estate in a share with another owner, you must also attach an act of acceptance and transfer of the object.

- An extract from Rosreestr, which confirms the individual’s ownership of this object. It is necessary to take into account that this document has a validity period of 1 month.

- If real estate is purchased with a mortgage, you must also include a loan agreement with the bank and a copy of it.

- When applying for a property deduction for interest on a mortgage agreement, you must also attach to the declaration a bank certificate indicating the amount of interest on the mortgage. Sometimes the Federal Tax Service may also require you to provide documents confirming payment.

- Marriage certificate, when purchased as joint property.

Amount of property deduction

The Tax Code of the Russian Federation establishes the maximum amount of tax deduction that can be provided to an individual.

The benefit can be issued in the amount of:

- 2.0 million rubles - when the acquisition and construction of new housing takes place. But within the limits of actual acquisition costs. Since 2014, returns can be issued for several real estate objects, the main condition is that their total amount does not exceed the established limit. In this case, an individual can recover a maximum of 260.0 thousand rubles of personal income tax paid by him.

- 3.0 million rubles - when a mortgage is used to purchase an object, which involves repayment of interest. The limitation applies to interest paid after 2014. Before this period, it was possible to repay the entire amount of interest in full. The maximum an individual can receive is 390.0 thousand rubles.

You might be interested in:

Deflator coefficients: tables of values for 2021

How to fill out the 3-NDFL declaration for property deduction for 2021

Download the new 3-NDFL declaration form for 2021 when filing a declaration for 2017 in PDF format.

Download the new 3-NDFL declaration form in Excel format.

Title page

At the top of the sheet, the TIN code of the citizen who makes up the document and the serial number of the sheet are indicated.

Next, enter the correction number if this report is submitted to correct errors in the previous one. If the report is primary, then “0” is entered. Next, you need to indicate the period for which the document was compiled - “34” indicates the year, and the 4-digit year number.

The last step is to write down the Federal Tax Service code where the document will be sent.

The next step is to provide information about the applicant.

One by one, in the appropriate columns you need to indicate:

- country code - for Russia 643;

- Payer code - possible codes are indicated in Appendix 1 of the instructions; to receive a deduction for an ordinary citizen, 760 is usually entered here.

- Full name

- Date and place of birth.

Next, you need to write down the code of the identity document (for a Russian passport - 21) and information about it.

In the status column you need to enter:

- “1” – if the applicant is a resident of Russia;

- “2” – if a non-resident (stays in Russia less than 183 days a year).

Next, enter your contact phone number. After this, you need to indicate how many pages the document occupies (this is best entered after filling out all the necessary sheets), and how many pages the power of attorney occupies (if submitted by an authorized person).

Next, fill out the left side of the sheet. Here it is indicated who submits the form to the tax office “1” - the taxpayer personally and “2” - his representative. In the first case, you only need to put a date and sign. In the second, indicate information about the representative and the document giving him authority.

Section 1

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

The following are entered:

- Line 010 - code “2”, indicating tax refund;

- Line 020 - KBK code by which the tax was transferred (personal income tax code);

- line 030 - OKTMO code in which the tax was paid;

- “0” is entered in line 040, and in line 0505 - the amount of tax that is requested for refund.

The sheet must be signed and dated at the bottom.

Attention! If several sources of income are indicated, they must be reflected on separate sheets.

The second sheet will also need to be signed.

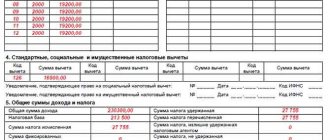

Section 2

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

The following are entered:

- Line 001 - tax rate, usually 13%;

- Line 002 - for income from employment, enter “3”;

- Line 010 - total income for the year;

- Line 020 - income for some reason not taxed;

- Line 030 - difference between 010 and 020;

- Line 040 - the amount of requested deductions. Usually equal to the amount of income for the year;

- Line 050 - expenses accepted to reduce income. Usually there is “0”;

- Line 051 - income from participation in foreign companies.

- Line 060 - calculated using the formula 030+051-040-050

- Line 070 - the amount of tax to be paid, put “0”

- Line 080-120 indicates the amounts of taxes withheld in various cases.

- Line 130 - the amount of tax to be paid, put “0”

- Line 140 is calculated using the formula 080+090+091+100+110+120-070

The sheet must be signed and dated at the bottom.

Sheet A

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

Next, enter information about income, calculated and withheld tax.

First, the tax rate is indicated - usually 13%. Next is the income code. All possible codes are written in Appendix 4 of the instructions, usually code 06 is entered here - income under an employment agreement.

Next, you need to provide information about the employer—TIN, KPP, OKTMO codes, and its name. Then the total amount of income subject to tax, calculated and withheld tax is indicated.

The sheet contains several blocks of this kind if income was received from different organizations or at different rates. If there is not enough space, you can add the required number of sheets A.

The sheet must be signed and dated at the bottom.

Sheet D1

At the top of the sheet is written the TIN code and the serial number of the page. The applicant's last name and initials are indicated below.

Further on this sheet, full information about the purchased or constructed object is indicated.

The object code is indicated in accordance with Appendix 5 of the instructions. For an apartment “2” is written here, for a house – “1”, etc.

Next, the type of property is recorded, it can be

- “1” – individual;

- “2” fractional;

- “3” joint;

- “4” – the deduction is requested for the child.

You might be interested in:

How to find out your SNILS number by passport, online, by TIN number

The taxpayer's attribute is usually indicated as “1” – owner. All codes are listed in Appendix 6 of the instructions.

Next, you need to indicate whether the applicant is a pensioner “1” - yes, “2” - no.

The following specifies what is used as an identifier:

- “1” – cadastral number;

- “2” – conditional number;

- “3” inventory;

- “4” – no number.

The number itself is entered in the next column.

Then you need to write down the address where the property is located (if you indicate the cadastral number of the property, you do not need to enter information about the address).

Next, you need to enter the date of the transfer act, registration of ownership of the home or plot, etc.

Then the share is indicated if the object is in shared ownership.

Next, you need to enter the year from which the deduction begins.

Below in the columns the cost of the object, the amount of interest paid, the amount of deductions for the acquisition of real estate and interest provided in previous years are recorded.

Then you need to write down the size of the tax base for the period, the amount of confirmed expenses and interest (they together should not exceed the base). Next, the deduction amount is recorded, which is carried forward to subsequent years.

The sheet must be signed and dated at the bottom.

Information about the declarant

In this section of the program, the taxpayer’s personal information is filled in. All of them must match the ID presented. As a rule, this is a passport of a citizen of the Russian Federation.

First you need to select the country code of residence from the list.

After this, the ID code is also selected from the list.

The remaining data is filled in manually. At the end of the section, you must indicate your current contact phone number.

A correctly completed section should look like this.

How to fill out the 3-NDFL declaration in the “Declaration” program

You can use the Declaration program to fill it out. .

Step 1. Specify the conditions

We fill out the conditions in accordance with the print screen of the screen, select:

- Declaration type – 3-NDFL;

- The inspection number must be selected from the drop-down list - click on the button on the right.

- If we submit the form for the first time in a year, then enter 0; when submitting an adjustment, indicate its number.

- OKTMO code in accordance with your tax office.

- In the taxpayer identification field, indicate “other individual”.

- The sources of income received are indicated, as well as who will submit the declaration.

Step 2. Provide information about the declarant

Nothing complicated - we fill out all the fields in accordance with the applicant’s identity documents.

Step 3. Enter information about income received

For each source of income, we enter amounts by month.

Also, for each organization, their details are entered.

Step 4. Specify information about deductions

It is enough to indicate the cadastral number of the object.

We fill out in accordance with the registration documents for the property.

General terms

The first tab in the program is “Set conditions”. Almost all values here are by default; you don’t need to touch them.

It remains to fill out two lines in the “General Information” section.

Procedure:

- We go to the special service of the Federal Tax Service www.nalog.ru

- Click on the “Address” line and in a new window indicate your registration address, since it will be used to determine the tax department to which you need to submit documents.

- Selects “OK”, and the service gives us the necessary data.

- We put them into the program.

- The first page is ready. If you do not plan to contact the tax office in person, but want to transfer documents through an intermediary, you need to indicate his details in the “Accuracy Confirmed” line.

Features of deduction registration

What if the property is distributed in shares?

If an apartment or other housing was purchased as shared ownership, then each of the owners has the right to receive a deduction. However, there are some peculiarities when providing deductions to co-owners.

Two simple owners

Currently, each co-owner is provided with a deduction as a percentage of the total cost of housing, but not more than 2 million rubles per person. For example, two people bought an apartment for 5 million rubles, each person’s share is 50%. In monetary terms, each person's share is 2.5 million rubles, but each person will be given a deduction of only 2 million rubles.

It should be noted that until 2014, the maximum deduction of 2 million rubles was divided among all owners as a percentage.

At the same time, it is impossible to redistribute the deduction shares between the owners (if they are not spouses). This means that one of the owners does not have the right to assign one hundred percent of the share to another, so that the amount of the deduction will be larger.

Attention! The unused deduction amount can be transferred to the next property. But this rule is available only to those who used the deduction for the first time since 2014.

Mortgage interest

The interest is distributed among the owners in the same way as the deduction itself. Only the maximum amount is 3 million rubles per person.

Shares in spouses' housing

If spouses own the property, then the rule for redistributing the deduction applies to them. This is due to the fact that in this case the Family Code takes precedence, which establishes common ownership of housing acquired during marriage. Thus, one spouse can waive his deduction in favor of the other.

Child's share

If a share in the housing belongs to a child who has not yet reached the age of majority, then the parent has the right to annex his share and thereby receive a larger deduction. At the same time, the maximum benefit amount is still limited to 2 million rubles.

If a parent has already applied to the Federal Tax Service for a deduction for his share, he has the right to subsequently apply to the tax office again and “use” the child’s share.

Attention! A child, if a parent uses his share to receive a tax benefit, does not lose the right to his own benefit in the future.

Where to submit reports

The Tax Code states that organizations must send reports to the tax service at their location, and entrepreneurs - at their place of residence.

In addition, companies are allowed to open branches and representative offices both in their locality and outside it. In such a situation, the main organization, as well as branches opened by it, must submit a report at their locations.

Attention! If any employee carries out activities both in the main organization and in one of its branches, then personal income tax must be withheld and transferred for each place of work. Consequently, this employee will also be included in the reports several times at each place.

The Tax Code determines that some enterprises may have the status of large taxpayers. In this situation, they are allowed to independently choose which inspectorate they will report to and make tax payments.

Deadlines for payment of deductions

After purchasing a home, there are two options to receive previously paid tax as a deduction:

- Provide the company with a notification of the provision of benefits;

- Receive through the Federal Tax Service the entire amount of tax that was transferred for the year the apartment was purchased.

In each of these situations, it is necessary to prepare a full package of required documents and contact the Federal Tax Service with them. There, the submitted papers are reviewed within 3 months. After this, you can take the following actions: receive a notification of the deduction, or submit an application to the Federal Tax Service with details for a refund of previously paid tax.

In the first case, the payroll accountant will not withhold personal income tax from the employee. This will continue either until the end of the year or month, when the total income exceeds the benefit amount. Thus, the money will be returned every month in equal installments.

In the second case, you can refund previously paid tax through the Federal Tax Service. To do this, after checking the documents, you must submit an application with bank details. Most often, such a form is drawn up immediately and submitted along with the rest. After the verification, the requested amount is credited to the bank account within one month.

Reporting Methods

There are several ways to submit a completed report to the Federal Tax Service:

- In paper form in the hands of the tax inspector - this is allowed only to those companies that have a small number of employees (up to 10 people).

- In paper form via postal service - the completed document can be sent to the Federal Tax Service by registered mail with a separately described attachment.

- In electronic form to the tax inspector - the report is filled out in a special program, after which the media with the file is handed over to the inspector. This method can be used if the number of employed workers does not exceed 3,000 people.

- Using electronic document management - for this you need to select a telecom operator and sign an agreement with it, as well as issue a digital signature.

You might be interested in:

Information on the average number of employees: sample filling, form