Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

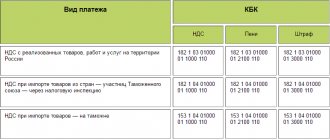

KBK is a numeric code, one of the payment order details for encrypting budget payments, in particular for VAT. Codes change frequently; if you specify the wrong BCC, the operation will not be performed correctly. To ensure that the payment does not end up among the unknown, use the current BCC for VAT in 2021, which are listed below.

How VAT is paid: general approach

The VAT amount calculated based on the results of each quarter of 2021 must be paid evenly over the next 3 months. Payment deadlines are no later than the 25th of each of these months.

EXAMPLE

VAT payable to the budget for the first quarter of 2021 must be transferred in equal installments no later than April 25, May 25 and June 25, 2021.

If the 25th falls on a weekend or a non-working holiday, then pay VAT no later than the first working day that follows this non-working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). Thus, you must pay VAT for the first quarter of 2021 within the following deadlines:

- April 25, 2021 inclusive;

- May 25, 2021 inclusive;

- June 25, 2021 inclusive.

Deadline for submitting VAT returns and deadlines for paying VAT for the 3rd quarter of 2021.

- About company

- Accounting calendar, deadlines for submitting reports Accounting calendar for deadlines for submitting all reports for individual entrepreneurs, LLCs, non-profit organizations, etc., urgent consultation with an accountant of the company Kind Help

- Articles

- Accounting services

- Commercial organizations

- Basic tax system

- Simplified taxation system for commerce

- UTII – unified tax on imputed income for certain types of activities

- Accounting restoration

- Online cash registers (cash discipline)

- Accounting services for non-profit organizations

- Accounting for non-commercial organizations

- NPO on the simplified tax system

- Managing NPOs on UTII

- Individual entrepreneur

- IP on OSNO

- Individual entrepreneur on the simplified tax system (Simplified taxation system for individual entrepreneurs)

- UTII for individual entrepreneurs

- Individual entrepreneur taxes, regardless of taxation regime

- Zero reporting for individual entrepreneurs

- Online cash registers

- Individuals

- Property tax for individuals

- Preparation of 3 personal income taxes

- Reimbursement of personal income tax from the budget

- Transport tax for individuals

- Land tax for individuals

- Declaration of property and accounts abroad

- Foreign economic activity

- Federal Law on Currency Regulation and Currency Control

- Preparation of foreign trade activities

- Consultations on foreign trade activities

- Preparation of documents for foreign economic activity

- Return, VAT refund

- Avoidance of double taxation of foreign trade activities

- Features of taxation with EAEU countries

- Additional services

- Accounting consulting

- Accounting calendar, reporting deadlines

- Legal services

- Legal services for LLC

- Registration, liquidation, re-registration of a commercial organization

- Extract from the Unified State Register of Legal Entities

- Preparation of the contract

- Legal services for commercial organizations

- Representation of interests in court

- Opening a foreign currency account

- Bankruptcy of legal entities

- Obtaining licenses

- Trademark registration

- Non-profit organizations

- Registration of non-profit organizations (NPOs)

- Liquidation of NPOs

- Re-registration of a non-profit organization

- Preparation of an agreement for an NPO

- Legal services for NPOs

- Representing the interests of NPOs in court

- Receive a grant, prepare documents for a grant

- Extract from the Unified State Register of Legal Entities

- Obtaining licenses

- Trademark registration

- Legal services for individual entrepreneurs

- Individual entrepreneur registration

- Registration of an individual entrepreneur as an employer

- Liquidation of individual entrepreneurs

- Re-registration of individual entrepreneurs

- Preparation of the contract

- Legal services for individual entrepreneurs

- Representing the interests of individual entrepreneurs in court

- Bankruptcy of individual entrepreneurs

- Obtaining taxi permits

- Obtaining licenses

- Legal services for individuals

- Representation of interests in court

- Legal protection of consumer rights

- Labor law

- Family law

- Housing law

- Bankruptcy of individuals

- FOREIGN ECONOMIC ACTIVITIES

Important details in payments

Please fill out payment orders for tax transfers in accordance with Bank of Russia Regulation No. 383-P dated June 19, 2012 and Appendices No. 1 and 2 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013.

Please note that some errors in the VAT payment order are fatal. This means that the transferred VAT on payments with such errors will not be considered paid, and the obligation of the taxpayer or agent to pay the tax will remain unfulfilled.

Such shortcomings include errors:

- in the Federal Treasury account number;

- in the name of the recipient's bank.

It also makes sense to pay attention to other details of the payment order so that the VAT payment transferred in 2021 is considered credited to the treasury.

Below is a table that explains the individual VAT payment details.

| Field | Content | Filling |

| 101 | Payer status | 01 (if the taxpayer is an organization); 09 (if the taxpayer is an individual entrepreneur); 02 (for tax agent) |

| 104 | KBK | 18210301000011000110 (tax, except for imports from the EAEU); 18210301000012100110 (penalties); 18210301000013000110 (fine). |

| 105 | OKTMO | OKTMO at the location of the organization (place of residence of the individual entrepreneur) |

| 106 | Basis of payment | TP – payments of the current year; ZD – voluntary repayment of debt for expired tax periods in the absence of a requirement for payment; TR – repayment of debt at the request of the tax authority; and etc. |

| 107 | Tax period indicator | КВ.XX.YYYY, where XX is the quarter number (for example, for the 1st quarter, code 01), YYYY is the year for which payment is made (for example, 2018) |

| 108 | Number of the payment basis document | When paying current payments on the basis of a tax return or when voluntarily repaying a debt in the absence of a requirement from the Federal Tax Service (payment basis “TP” or “ZD”), indicate “0” |

| 109 | Date of payment basis document | 0 if field 108 contains “0” |

| 24 | Purpose of payment | For example, “Value added tax on goods (work, services) sold on the territory of the Russian Federation (3rd payment for the first quarter of 2018)” |

The deadline for paying 1/3 of the VAT amount for the third quarter of 2021 is approaching

VAT taxpayers, as well as tax agents, must pay 1/3 of the tax amount for the third quarter of 2021 by November 27 (Monday) inclusive (clause 1 of Article 174 of the Tax Code). The tax amount is determined as 1/3 of the VAT amount calculated for the previous tax period. Our accountant's calendar reminds us of this, which we recommend bookmarking so as not to miss other deadlines for paying taxes and fees, as well as submitting tax returns and calculations. The tax is paid to the budget at the place of registration of the taxpayer with the tax authorities (clause 2 of Article 174 of the Tax Code of the Russian Federation). Tax agents (organizations and individual entrepreneurs) pay tax at their location (clause 3 of article 174 of the Tax Code of the Russian Federation). Let us remind you that the following transactions are subject to VAT taxation:

- sale of goods (work, services) on the territory of Russia, as well as transfer of property rights, including gratuitous transfer of goods, gratuitous performance of work, provision of services;

- transfer of goods on the territory of the Russian Federation (performance of work, provision of services) for one’s own needs;

- carrying out construction and installation work for own consumption;

- import of goods into the customs territory of the Russian Federation (clause 1 of Article 146 of the Tax Code of the Russian Federation).

Information sources

The taxpayer takes information for the report from the following documents:

- Books of purchases and sales . This is the main source of information on the basis of which the declaration is formed.

- Separate invoices . Data from them is used by businessmen who are not VAT payers, but are required to fill out a declaration if they have issued an invoice with the allocated tax amount.

- Logs of received and issued invoices . Data from these registers are used by taxpayers working in the interests of other persons (agents, commission agents).

- Other accounting and tax registers are used if necessary.

Deadlines for submitting reports to the Federal Tax Service and paying taxes for the 3rd quarter (9 months) of 2021

Deadlines for submitting a VAT return and deadlines for paying VAT for the 3rd quarter of 2017. The VAT return must be submitted no later than October 25, 2021. VAT payment deadline for the 3rd quarter of 2021: October 25, 2021, November 27, 2021, December 25, 2021 (1/3 of the tax amount accrued for the 3rd quarter).

Deadlines for submitting reports and paying income tax for the 3rd quarter of 2021. The income tax return for the 3rd quarter of 2021 is submitted no later than October 30, 2021. The deadline for paying income tax for the 3rd quarter of 2021 is no later than October 30, 2021.

Deadlines for submitting the calculation of insurance premiums for the 3rd quarter of 2021. The calculation of insurance premiums for the 3rd quarter of 2021 is submitted to the Federal Tax Service no later than October 30, 2021.

Deadlines for submitting reports and paying taxes when applying the simplified tax system for the 3rd quarter of 2021. Organizations and individual entrepreneurs using the simplified tax system must pay an advance tax payment no later than October 25, 2017. Submission of quarterly tax reports under the simplified tax system is not provided.

Deadlines for submitting reports and paying taxes when applying UTII for the 3rd quarter of 2021. The UTII declaration for the 3rd quarter of 2021 must be sent no later than October 20, 2021. The UTII tax for the 3rd quarter of 2021 must be paid no later than October 25, 2021.

Deadlines for submitting 6-NDFL reports for the 3rd quarter of 2021. The calculation in form 6-NDFL for the 3rd quarter of 2021 must be sent no later than October 31, 2021.

Deadlines for submitting reports and paying property taxes for the 3rd quarter of 2017. The property tax return for the 3rd quarter of 2017 is submitted no later than October 30, 2021. Payers of property tax are companies with property on their balance sheet; the tax payment deadline is no later than October 30, 2017.

Deadlines for submitting a single simplified declaration for the 3rd quarter of 2021. The unified simplified tax return for the 3rd quarter of 2021 is submitted no later than October 20, 2021. This declaration is submitted only if at the same time: - there was no movement of funds in current accounts and at the cash desk; - there were no objects of taxation for the taxes for which they are recognized as payers.

Send reports to the Federal Tax Service via the Internet

Results

Taxpayers should fill out payment orders for VAT very carefully, since if an error is made in some details, the transferred funds will not reach the addressee and will “get stuck” in some treasury account. In the meantime, the taxpayer realizes that he made a mistake and begins to look for his lost payment, the tax office will charge him a fine and penalties for late paid tax.

That is why you should carefully check not only the correct spelling of all the required details, but also their relevance at the moment.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for submitting reports to funds and paying insurance premiums for the 3rd quarter (9 months) of 2017

Individual entrepreneurs who have employees, as well as all organizations must pay insurance premiums monthly and submit reports to regulatory authorities quarterly (monthly). If insurance premiums and wages were not calculated in the reporting quarter, then you will need to submit a zero declaration.

Deadline for submitting reports to the Social Insurance Fund for the 3rd quarter of 2021. From 2021, contributions for occupational diseases and injuries remain under the jurisdiction of the Social Insurance Fund. From the 1st quarter of 2021, reporting to the Social Insurance Fund will be submitted in an abbreviated form. In paper form, due no later than October 20, 2021. In electronic form, due no later than October 25, 2021.

Send reports to the Social Insurance Fund via the Internet

Deadline for submitting reports to the Pension Fund for the 3rd quarter of 2021. The Pension Fund must submit information about the insured persons (form SZV-M) and information about the insurance period.

Monthly reporting SZV-M: Reporting in the SZV-M form must be submitted before the 15th day of the beginning of the month following the reporting one. Deadlines for the 3rd quarter of 2021: For July 2021 - no later than August 15, 2021 For August 2021 - no later than September 15, 2021 For September 2021 - no later than October 16, 2017

Send reports to the Pension Fund via the Internet

Deadlines for payment of insurance premiums to funds Individual entrepreneurs (employers) and organizations must pay insurance premiums monthly by the 15th day of the month following the month in which contributions are calculated. If the 15th is a non-working day, then the deadline is considered to be the next working day. Deadlines for payment of contributions to the funds for the 3rd quarter of 2021 are until July 17 (for June), until August 15 (for July), until September 15 (for August), until October 16 (for September).

Are you having difficulties preparing reports? Or do you need help submitting reports online? Call us at 8 (499) 499-15-85, or fill out an application and our accountants will prepare and submit reports for you!