Maternity leave allows a woman to prepare physically and mentally for childbirth, and after it not to leave the newborn without maternal care.

Since maternity leave is one of the social insurance cases, it is regulated by law.

The term and features of its registration, the amount of payments - all this is regulated by law.

sick leave for BiR 2021 - link.

When is sick leave issued for pregnancy?

Maternity leave (Maternity Sick Leave) is issued to every pregnant woman at 30 weeks for a singleton pregnancy, and at 28 weeks for a multiple pregnancy. A woman has the right to refuse to receive it and continue to work. In this case, a certificate of incapacity for work is issued after the pregnant woman applies for it at a medical institution.

Sick leave under BiR is also issued to a woman who has adopted a child under 3 months of age.

Sick leave for pregnancy and childbirth in 2021 is needed to:

- issue the woman with maternity leave (B&P) for the period specified by the gynecologist on the certificate of incapacity for work;

- accrue and pay B&R benefits in the amount of 100% of average earnings based on the duration of maternity leave.

Sick leave for pregnancy and childbirth in 2021 is issued on a standard form, approved. By Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n.

In 2021, electronic sick leave acts on a par with the usual paper ballots. All clinics that have an electronic signature can issue them.

To work with electronic forms, the employer will need a personal account on the FSS website. Read here whether an employer has the right to refuse to accept electronic sick leave.

In general, sick leave according to BiR is issued for 140 calendar days: 70 days before the expected date of birth and 70 days after. In case of complicated childbirth, it is issued for 156 days, in case of pregnancy with two or more children - for 194 days. You can find out more about the duration of leave under the BiR in this article.

What does correct document formatting look like?

The following information is filled in on the certificate of incapacity for work:

- Date of issue of the sheet.

- Disability code. In this case it is 05.

- Possible due date.

- A check mark when registering in early pregnancy.

- Period of incapacity.

- Position and initials with the surname of the attending physician who issued the certificate of incapacity for work.

- Patient's name.

- The organization is the employer.

- The end date of maternity leave that requires returning to work. In normal cases, by this time parental leave for up to 1.5 years is issued.

When is additional sick leave due to pregnancy issued?

Sick leave for pregnancy and childbirth in 2021 is issued for the estimated period of incapacity, depending on the course of pregnancy and the complexity of childbirth.

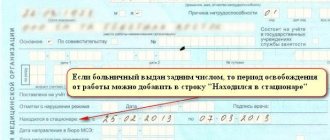

But a situation is possible when a medical institution issues a woman additional sick leave under the BiR. If a woman initially received a certificate of incapacity for work for 140 days, and then complications emerged, the gynecologist (or maternity hospital) increases the period of incapacity for work and issues additional sick leave for pregnancy and childbirth.

Where should I take it after receiving it?

Having taken a ballot on the BiR, working women and employees write an application for maternity leave, and non-working women write an application for child benefits. There is no special form for the application; you must indicate the number of the disability bulletin in the text and put your signature on the application.

The authorities to which applications are addressed are selected depending on the status of the pregnant woman:

- administration of an enterprise or public service institution . Receives requests from employees of his company working under the main contract and from part-time workers. Or from law enforcement officials. The request is addressed to the director of the company or the head of the department of the Ministry of Internal Affairs, the Ministry of Emergency Situations;

- social insurance fund . Receives applications from all citizens who make contributions independently or through an organization for at least 1 year: licensed lawyers, notaries, individual entrepreneurs and peasant farms. The application is written to the head of the fund;

- rector's office of the educational institution . Requests from female students are addressed to the manager of the institution;

- security department Unemployed people come here with written confirmation of their status from a certificate from the employment center. Women dismissed due to the liquidation of an enterprise provide sick leave and a copy of their work record book.

The application, ballot, and other documents are delivered in person or by mail: regular, electronic through the State Services website. You can issue a notarized power of attorney to represent the interests of a pregnant woman.

After considering the application, the manager issues an order to the organization regarding the time and timing of the maternity leave requested by the employee or employee and the payment of benefits.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Filling out sick leave by an employer in 2020

If the sick leave for pregnancy and childbirth contains code “052” in the “Cause of disability” line, fill out the “To be completed by the employer” section according to the same rules as the sick leave for temporary disability.

When filling out a sick leave certificate for pregnancy and childbirth B&R:

- do not fill in the line “TIN of the disabled person (if any)”;

- fill out the line “Insurance experience” even in cases where the length of service does not affect the amount of maternity benefits;

- in the boxes “at the expense of the Social Insurance Fund of the Russian Federation” indicate the entire amount of the calculated maternity benefit;

- Do not fill out the “at the expense of the employer” cells.

Errors

Doctor

Did the doctor have the right to make a mistake when filling out the document? What mistakes will the FSS turn a blind eye to? If there is a minor error, the doctor crosses it out and records the correct information on the back of the sheet with the expression “believe the corrected one . The information is confirmed by the seal and signature of the institution to exclude various abuses.

REFERENCE! According to Guidelines No. 81, approved. According to the Decree of the FSS of the Russian Federation, dated 04/07/2008, the number of errors and omissions made should not be more than two.

In case of a serious mistake made by a medical professional, not a new sheet is issued, but a duplicate document . Then the old sheet is destroyed, and the filling is carried out again with a tick in the “duplicate” line. The duplicate is dated not by the date of the old sheet, but by the date of issue of the duplicate.

The FSS may turn a blind eye to the insertion of unnecessary characters, such as quotation marks, commas, or extra space between initials . To transfer data about the doctor's name to the second, but not the 3rd line. Information in print and its design also have a free form.

Only 3 important points regarding the information in the seal impression must be observed:

- the name of the institution must match the name in the constituent document of the organization;

- the requirements of by-laws must be observed when using the image of the State Emblem of Russia in it;

- must contain the target expression “for certificates of incapacity for work/for sick leave certificates.”

The FSS can also turn a blind eye to the shortcomings:

- filling in capitals, not printed characters;

- continuation of characters to the cell border, but no further;

- writing “attending physician”, “treating doctor”, “doctor” instead of obstetrician-gynecologist;

- extra spaces.

IMPORTANT! The most important requirement of the FSS is the readability of the document . This symptom prevails over technical shortcomings. The seal must be clearly visible and readable.

The printed sign should not fall on the area with filled data , but may go beyond the boundaries of the area allocated for it.

If additional sheets are issued as a continuation of the primary document, and 1 of them is damaged, then the corresponding page must be copied indicating the latest number. Alternatively, a certificate confirming this fact is issued. It records the old number of the damaged sheet.

Accountant

The chief accountant practically does not fill out the sick leave sheet; his task is to write his last name with initials and certify the information provided with a signature . Moreover, it is the chief accountant who assures, and not his deputy, for example.

When he accepts a document with serious errors, the employer sometimes does not receive compensation from the Social Insurance Fund . Therefore, such employees carefully check the information and often return the sheet for corrections.

Terms of payment of maternity benefits

The procedure for paying maternity benefits depends on whether the region in which the employer is registered is included in the FSS “Direct Payments” pilot project or not. You can learn more about the essence of the pilot project and the list of regions included in it from the article “FSS Pilot Project 2021: List of Regions.”

- Payment of sick leave through the Social Insurance Fund in a region where the pilot project has not been introduced.

The employee brings her sick leave to the employer and writes a free-form application for the appointment and payment of benefits for her under the BiR. More details on the form of this document can be found in the article “Sample application for maternity leave during pregnancy.”

The employer is obliged to calculate the benefit within 10 days (from the date of receipt of the documents) and pay it on the next day of payment.

- Payment of sick leave through the Social Insurance Fund: pilot project.

The employer, having received documents from the employee, is obliged to transfer the documents to the Social Insurance Fund within 5 days. Social insurance will make a decision on payment of benefits within 10 days and will independently transfer it to the maternity leaver’s account.

What will the FSS not pay attention to?

The ballot should ideally be transferred to the FSS in an error-free and accurate condition , but this is not always possible due to human factor and negligence.

There are some nuances that are not serious violations, and the Social Insurance Fund will not consider the sick leave to be spoiled.

In labor practice, such minor errors include:

- technical inaccuracies (incomplete name of organization, doctor’s position);

- dots or spaces in the initials of officials, doctors;

- filling out the form in words;

- a small amount of letters/numbers extending beyond the square margins of the form;

- employer errors properly corrected;

- incorrect name of the organization, which is written correctly and completely on the reverse side;

- A slightly crumpled and folded sick leave sheet.

Procedure for paying maternity benefits if the employee continues to work

The employee has the right to either take maternity leave and receive benefits at the expense of the Social Insurance Fund of the Russian Federation, or continue to work and receive wages. If a woman continues to work after receiving sick leave for pregnancy and childbirth, then there are no grounds for paying benefits for this period (Information letter of the Federal Social Insurance Fund of the Russian Federation dated October 8, 2004 No. 02-10/11-6671). Pay the employee benefits only for the period of maternity leave specified in the application, within the period of release from work according to the sick leave.

For the benefit, the calculation period is 2 years preceding the year of the start of leave according to the BiR, and not the year indicated in the column “From what date” of the table “Exemption from work” of the sick leave (Article 255 of the Labor Code of the Russian Federation, Part 1 of Article 14 of Law No. 255-FZ “On compulsory social insurance...”).

For example, the sick leave list indicates a period of release from work from December 15, 2020 for 140 calendar days. The employee wrote an application for leave under the BiR from 01/09/2020. In this case, the calculation period is 2018-2020, and the amount of maternity benefits must be calculated based on the actual duration of the vacation - 126 calendar days.

What is the procedure for issuing?

The procedure for issuing this official paper is considered and explained by the following legislative documents:

- Order of the Ministry of Health and Social Development of the Russian Federation 624n “On approval of the Procedure for issuing certificates of incapacity for work”, Chapter VIII - Articles 46-55; Chapter IX – Art. 56-67.

- Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n “On approval of the form of a certificate of incapacity for work.”

- Letter of the Social Insurance Fund dated September 30, 2011 No. 14-03-11/15-11575 “On the inadmissibility of policyholders making independent decisions on the issue of the correct execution of certificates of incapacity for work by medical organizations.”

How to calculate additional maternity benefits

If an employee after giving birth brought a sick leave sheet in which the code “020” is indicated in the “additional code” cells, at her request the organization must provide additional maternity leave. For example, in connection with complicated childbirth, additional leave is provided for 16 calendar days (Article 255 of the Labor Code of the Russian Federation).

Leave for accounting and additional leave are associated with one insured event (clause 2, part 2, article 1.3 of Law No. 255-FZ). Therefore, to calculate the amount of benefits for additional days of vacation, you need to use the average earnings of the employee, on the basis of which the benefits for the period of the main maternity leave are calculated (Part 1, Article 14 of Law No. 255-FZ).

Example 2

Employee Artemenko Yu. V. was granted maternity leave from November 12, 2020 to March 29, 2020 for 140 calendar days. The BIR allowance is calculated based on the SDZ in the amount of 980 rubles, determined for the billing period 2017-2018.

After giving birth, Artemenko submitted a continuation of the certificate of incapacity for work and an application for 16 days of additional leave in connection with complicated childbirth.

Calculation of B&R benefits for the period of additional leave:

- SDZ - the same one that was used to calculate benefits for the period of the main leave under the BiR - 980 rubles;

- the amount of benefit for additional days is 15,680 rubles. (980 RUR x 16 days).

Entering codes and other data by the employer

In the part of the sick leave provided for filling out by the employer, the following is prescribed:

- Organization name (in the top field).

- A note about the main job or part-time job.

- In the “registration number” field – the number for the policyholder in connection with registration with the Social Insurance Fund.

- In the “subordination code” field there is a five-digit code that indicates registration affiliation with the territorial branch of the FSS.

- INN, SNILS (indicated on the basis of documents of the pregnant employee).

- The clause on the conditions for calculating payment provides for a code with a two-digit number. This mark is set to increase payments under the BiR (for example, code 43 makes it possible to receive benefits in connection with radiation exposure).

- Information about the insurance experience (the number of full years and months of work), and if there is no experience, “0” is entered in the fields.

- The amount of average earnings in rubles and kopecks (indicated in the Social Insurance Fund field).

- Total amount excluding personal income tax.

At the bottom of the relevant part of the certificate of incapacity for work, the names of the director and accountant of the enterprise, their initials and signatures are indicated.

Reference! If the policyholder is an individual, his surname and initials are indicated. If there is no position of chief accountant, the data of the head of the organization and his signature are duplicated in the corresponding field.