Introduction

Today, on the Internet and even in specialized magazines, you can easily find information on how to prepare a VAT Declaration in the 1C: Accounting 8, edition 3.0 program. Also, many resources have published articles about the organization of VAT accounting in this program and about the existing VAT accounting checks in the program and ways to find errors.

Therefore, in this article we will not once again describe in detail the principles of organizing VAT accounting in 1C: Accounting 8; we will only recall the main points:

- For VAT accounting, the program uses internal tables, which in 1C terms are called “Accumulation Registers”. These tables contain much more information than in the postings on account 19, which allows you to reflect in the program

- When posting documents, the program first performs movements in the registers, and based on the registers it generates postings for accounts 19 and 68.02;

- VAT reporting is generated ONLY according to register data. Therefore, if the user enters any manual entries into VAT accounts without reflecting them in the registers, these adjustments will not be reflected in the reporting.

- To check the correctness of VAT accounting (including the correspondence of data in registers and transactions), there are built-in reports - Express check of accounting, VAT accounting analysis.

However, the average accountant user is much more accustomed to working with “standard” accounting reports - Balance Sheet, Account Analysis. Therefore, it is natural that the accountant wants to compare the data in these reports with the data in the Declaration - in other words, check the VAT Declaration for turnover. And if the organization has simple VAT accounting - there is no separate accounting, no import/export, then the task of reconciling the Declaration with accounting is quite simple. But if some more complex situations arise in VAT accounting, users already have problems comparing data in accounting and data in the Declaration.

This article is intended to help accountants perform a “self-check” of filling out the VAT Return in the program. Thanks to this article, users will be able to:

- independently check the correctness of filling out the VAT Declaration and compliance of the data in it with accounting data;

- identify places where the data in the program registers diverges from the data in accounting.

Why the Federal Tax Service will require clarification

The remaining indicators are verified after the calculation has been accepted. However, if some control ratios are not met, the tax authority will send the payer a request for explanations. Once you receive such a request, you must send an acceptance receipt within six business days, and within the next five business days, explain the discrepancies or make corrections to the calculation.

Clarifications or corrections will be required in the following cases:

- The amounts of insurance premiums for all types of insurance specified in section 1 are not equal to the amount of contributions for all applicable tariffs specified in appendix 1 of section 1 (see table, block 3).

- The amount of payments and other remuneration in subsection 1.1 of appendix 1 of section 1 is not equal to the amount of payments on lines 210 of all subsections 3.2.1 (see table, block 4).

- The base, which does not exceed the limit (lines 050–051 of subsection 1.1 of Appendix 1), differs from the base on which contributions to the compulsory pension insurance are calculated and which is obtained by summing all lines 220 of subsection 3.2.1 (see table, block 4).

- The values of line 060 in all columns are not equal to the sum of the values of lines 061 and 062.

- Payments, base and contributions in column 2 “Total” (for the last three months) are not equal to the sum of columns 3, 4, 5 (1st month + 2nd month + 3rd month; see table, block 5) .

The Federal Tax Service will also ensure that for each individual the limit is not exceeded, that is, that the amount on line 220 on an accrual basis from the beginning of the year is no more than 876,000 rubles. In the form itself, amounts from the beginning of the year are not reflected, therefore, starting from the first half of the year, to calculate the maximum value, the Federal Tax Service will use the indicator for the previous reporting period from its base.

Starting from the first half of the year, the Federal Tax Service will compare other indicators on an accrual basis. Thus, in all subsections of Appendix 1 and in Annexes 2 and 8–10, the value of column 1 “Total from the beginning of the billing period” should be equal to the sum of the indicator of column 1 for the previous period (stored in the Federal Tax Service database) and the value of column 2 “Total” (for last three months of the reporting period).

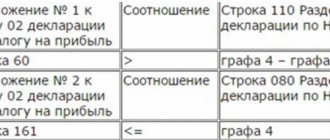

Table. Control ratios in the calculation of insurance premiums (letter of the Federal Tax Service dated March 13, 2017 No. BS-4-11/ [email protected] )

Share

Issue No. 33, June 2021 Registration of trade transactions according to the new procedure

Online trading: cash registers and checks according to new rules Alexander Lavrov

At a low start: sixth set of “Direct Payments” Yulia Skorb

Electronic VAT explanations: What? Where? When? Alexey Krainev

Actions upon receiving a request from the tax authorities Ekaterina Kostakova How to avoid a fine for not using an online cash register Alexander Lavrov Complex cases of recognition of fixed assets Alexander Lavrov Automatic completion of payments in Externa Eldar Safarov Control ratios in the new calculation of contributions Elena Kulakova

Each taxpayer has the right to return part of the money that was used to pay VAT. This is stated in Article 171 of the Tax Code of the Russian Federation. Goods and property rights are subject to VAT deductions when imported into the country for processing outside the customs territory or for domestic consumption. This also includes goods that pass through the territory of the Russian Federation without customs clearance.

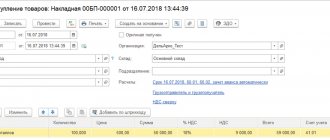

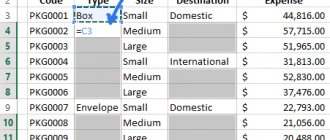

Initial data

So, for example, let’s take an organization that is engaged in wholesale trade. The organization purchases goods both on the domestic market and through import. Goods can be sold at rates of 18% and 0%. At the same time, the organization maintains separate VAT accounting.

In the first quarter of 2021, the following transactions were recorded:

- Advances were issued to suppliers, invoices for advances were generated;

- Received advances from customers, generated invoices for advances;

- Goods were purchased for activities subject to 18% VAT;

- Goods were purchased for activities subject to 0% VAT;

- Imported goods were purchased, customs VAT was registered;

- Input VAT has been registered for the services of third-party organizations, which should be distributed to operations at 18% and 0%;

- A fixed asset was purchased at a VAT rate of 18%, the tax amount must be distributed among operations at different VAT rates;

- Goods were sold at a VAT rate of 18%;

- Goods were sold for activities subject to 0% VAT;

- Some of the goods on which VAT at a rate of 18% was previously accepted for deduction were sold at a rate of 0% - the restoration of VAT accepted for deduction is reflected;

- The shipment without transfer of ownership and then the sale of the shipped goods are reflected;

- Confirmed 0% rate for sales;

- Regular VAT operations were completed - sales and purchase book entries were generated, VAT was distributed for transactions at 18% and 0%, purchase book entries were prepared for the 0% rate.

An example of filling out line 070 in the VAT return in section No. 3

Limited Liability Company "OknaPlast" is engaged in wholesale supplies of plastic windows according to customer orders. Contracts are concluded with the buyer only upon provision of an advance payment in the amount of 10% to 30% of the contractual delivery amount.

In the second quarter of 2021, OknaPlast LLC:

- We sold goods in the amount of 29,688,800 rubles. (including VAT = RUB 4,528,800);

- An advance payment was received in the amount of RUB 14,903,400. (VAT = 14,903,400 rubles × 18 / 118 = 2,273,400 rubles);

- Purchases from a supplier of plastic and other components in the amount of RUB 10,055,960, including VAT = RUB 1,533,960.

Therefore, in the second quarter:

- accrued VAT amounted to RUB 6,802,200. (RUB 4,528,800 + RUB 2,273,400);

- VAT deductible: RUB 1,533,960;

- VAT payable: RUB 6,802,200. – 1,533,960 rub. = 5,268,240 rub.

1.Verified data

After completing all regulatory VAT operations, the VAT Declaration is completed with us as follows:

Lines 010-100:

Lines 120-210:

Let's start checking the Declaration.

2.Check Section 4

To begin with, since we had sales at a 0% rate, let’s check the completion of Section 4 of the Declaration:

To do this, you need to compare the data in Section 4 with the turnover on account 19 according to the VAT accounting method “Blocked until confirmed 0%” in correspondence with account 68.02. To do this, we will generate an “Account Analysis” report for account 19, setting it to select by accounting method:

The credit turnover on account 68.02 in this report shows us the total amount of tax that “fell” on confirmed sales at a rate of 0%. This amount must coincide with line 120 of Section 4 of the VAT Declaration .

3.Check Section 3

Next, we check Section 3 of the Declaration. The main report that we will use when checking Section 3 of the Declaration is Analysis of Account 68.02. For the 1st quarter of 2021, the report looks like this:

- Line 010

This line shows the amounts from the sale of goods, works, services at a rate of 18% and the amount of tax calculated from such transactions. Therefore, the amount of tax on this line must correspond to the amount of credit turnover on account 68.02 in correspondence with accounts 90.03 and 76.OT (shipments without transfer of ownership):

- Line 70

Line 070 indicates the amount of VAT on advances received from customers in the reporting period. Therefore, to check this amount it is necessary to look at the credit turnover on account 68.02 in correspondence with account 76.AB :

- Line 080

The line should reflect the VAT amounts subject to recovery for various transactions. This line includes the amount of VAT on advances to suppliers credited in the reporting period, as well as the amount of VAT recovered when changing the purpose of use of valuables.

VAT on advances to suppliers is accounted for in account 76.VA, so we check the amount of credited VAT against the credit turnover of account 68.02 in correspondence with account 76.VA. The amounts of restored VAT are reflected in accounting as credit turnover on account 68.02 in correspondence with subaccounts of account 19 :

- Line 090

This line is a clarification to line 080 - the amounts of VAT on advances to suppliers credited in the reporting period are shown separately here:

- Line 120

How to check line 120 of the VAT return if the organization maintains separate accounting for VAT? The line must reflect the amount of tax on purchased goods, works, services, which is subject to deduction in the reporting period. Therefore, to check the value of this line, it is necessary to subtract the turnover on the debit of account 68.02 in correspondence with accounts 19.01, 19.02, 19.03, 19.04, 19.07 the turnover on account 19 using the VAT accounting method “Blocked until confirmation of 0%” in correspondence with account 68.02 (amount , specified in line 120 of Section 4 of the Declaration).

- Line 130

The line indicates the amount of VAT on advances issued to suppliers in the reporting period. We check the amounts of accrued VAT using the debit turnover of account 68.02 in correspondence with account 76.VA :

- Line 150

Line 150 indicates the amount of VAT paid at customs when importing goods. The value in this line must match the debit turnover on account 68.02 in correspondence with account 19.05 :

- Line 160

The line is filled in with the amounts of VAT that our organization paid when importing goods from the countries of the Customs Union. This line is checked against the debit turnover of account 68.02 in correspondence with account 19.10 :

- Line 170

And finally, line 170 is filled in with VAT amounts on buyer advances received during the reporting period. This value is reflected in accounting as a debit turnover on account 68.02 in correspondence with account 76.AB :

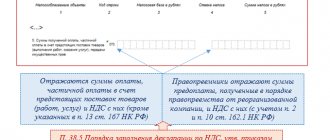

Procedure for tax refund on advances

The supply agreement may provide for partial or full prepayment for products, work or services. The use of such calculation options allows companies, using clause 12 of Art. 171 of the Tax Code of the Russian Federation, accept for offset the VAT included in the amount of the advance payment. It is first necessary to secure this provision in the company’s accounting policies.

In addition, to implement the above opportunity, the following documents are required:

Original payment document.

A contract that necessarily contains a condition for partial or full advance payment.

Having fulfilled all the requirements, the buyer can take credit for the tax paid along with the advance payment, but only at the end of the accounting period. This is due to the fact that over time the goods may be fully supplied, so the refund must be made after the time allowed for the formation of the tax base.

For all prepayments made at the end of the tax period, the amount of VAT is determined by multiplying it by the appropriate tax rate. After which, an account is generated for the received value: Dt 68 “VAT” Kt 76 “Advances issued”.

The turnovers received from all transactions are added up, and the result is entered into the declaration on line 130 “The amount of tax presented to the taxpayer-buyer when transferring the amount of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, subject to deduction from buyer."

This is interesting: License for repair of medical equipment

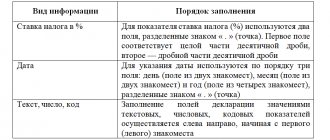

How to enter data into it is stated in clause 38.9 of the Procedure for filling out a tax return for value added tax, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] (hereinafter referred to as the Procedure for filling out).

4.Results of the inspection

If we put together all the checks for Section 3 and reflect them in the “Account Analysis” report for account 68.02, we will get this “coloring”:

Based on the results of the audit, we see that all the amounts reflected in the accounting “found” their place in the VAT Declaration. And each line from the Declaration, in turn, can be deciphered by us from the position of reflecting the data in accounting. Thus, we are convinced that all operations in the program are reflected correctly, without errors, the data in the registers and transactions match and, therefore, our VAT reporting is correct and reliable.

Why the Federal Tax Service may reject the calculation

First of all, make sure that the total amount of calculated contributions to compulsory pension insurance (CPI) as a whole for the payer for each month from a base not exceeding the limit (line 061 of subsection 1.1 of Appendix 1) is equal to the amount of calculated contributions to compulsory pension insurance for the corresponding month from base not exceeding the maximum value for all individuals (lines 240 of subsection 3.2.1; see table, block 1).

If an enterprise pays contributions to compulsory pension insurance at additional tariffs, then one more equality must be satisfied (see table, block 2). The total amount of calculated additional tariff contributions for the payer as a whole for each month (lines 050 under subsections 1.3.1 and 1.3.2) must be identical to the amount of additional tariff contributions for each month for all individuals (lines 290 of subsection 3.2.2).

If the equalities are not met, then the Federal Tax Service no later than the next day after receiving the calculation (or within 10 days if the calculation was submitted on paper) sends a notification to the payer that the calculation has not been submitted.

It will also be considered that the calculation has not been submitted if, when reconciling the personalized information (lines 070–100 of subsection 3.1) with the base of the “Centralized Taxpayer Accounting” subsystem, a discrepancy between the SNILS and the full name of the individual is revealed. To avoid such errors, enter the data in section 3 directly from the insurance certificate (or a scanned copy of it). Better yet, check the full name and SNILS of individuals with the Pension Fund of the Russian Federation in advance. Failure to comply with other control ratios, which are specified in the letter of the Federal Tax Service dated March 13, 2017 No. BS-4-11 / [email protected] , cannot serve as a reason for refusal to accept the calculation.