When to cook

When declaring a liquidation procedure, an organization must compile a LP. First of all, an intermediate LB is formed, with the help of which the actual values are determined for the following key indicators:

- mutual settlements with counterparties;

- assets;

- liabilities;

- property value and so on.

Interim reporting is prepared after the publication of the notice of liquidation, 2 months after the release of the official Bulletin notifying creditors of the procedure being carried out. The PLB can be compiled repeatedly - based on indicators as of the reporting date or another date, so a copy of it does not have to be provided to the territorial tax office.

The final LB sums up the financial and economic activities of the organization. OLB is an accounting register that is compiled after the completion of all mutual settlements with counterparties (creditors, employees, government agencies) and reflects the economic condition of the institution at the time of its closure. The final liquidation balance is zero, as it is compiled at the stage of completion of the liquidation process. This document must be submitted to the Federal Tax Service once, on the date preceding the exclusion of the organization from the Unified State Register of Legal Entities. To reflect the opening balances in the OBL, the opening balances of interim reporting are used.

The formal type of reporting during liquidation is not fixed by any legal act, therefore both the final and interim LB are compiled according to Form No. 1 “Balance Sheet”.

The answer to the question, what is the liquidation balance code: 90 or 94, is as follows:

- 90 — LB code (final);

- 94 - PLB code.

Drafting rules for state employees

Budgetary institutions form a liquidation (separation) balance sheet in the form OKUD 0503830 (approved by Order of the Ministry of Finance of the Russian Federation No. 33n dated March 25, 2011). Let's look at the question of how to draw up final reporting upon the liquidation of a budget organization. When carrying out such a procedure, immediately before the formation of the OLB, all funds, assets, liabilities and liabilities of the accounting system are subject to mandatory inventory (Article 11 402-FZ). During the inventory count, the actual value for each item is determined. The results entered into the protocol are compared with current data from primary accounting documents. The results of the inventory carried out before liquidation are carried out in the OLS (clause 82 of the GHS “Conceptual Framework”). All final financial statements must be generated according to information from accounting registers (clause 7 of the Federal Standard, approved by Order of the Ministry of Finance No. 260n dated December 31, 2016). It is compiled in terms of codes for the type of financial security - KFO. All data at the beginning of the reporting period must strictly correspond to the final balance sheet information for the previous accounting year. The final information in the LB is indicated without taking into account final transactions and turnover. The separating BB is compiled according to clauses 14-21 of Instruction No. 33n. The composition of the financial statements of a liquidated budgetary institution will be as follows (clause 77 of Instruction 33n):

- separation (liquidation) BB - according to form 0503830;

- certificate of consolidated settlements - f. 0503725;

- certificate of conclusion by the institution of accounting accounts for the reporting financial year - f. 0503710;

- report on the institution's implementation of its financial and economic activity plan - f. 0503737;

- report on the obligations of the institution - f. 0503738;

- report on the financial results of the institution - f. 0503721;

- explanatory note - f. 0503760.

In addition to the tax inspectorate, the OBL must be provided to the founder, whose subordinate institution is the liquidated budget organization.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Procedure for approving the SRS

Members of the liquidation commission must draw up the SRS, but due to the fact that the document contains accounting data, the final reporting of the organization is prepared by the chief accountant.

In the header of the document, it is necessary to indicate the LP, the period and date of preparation, as well as all information about the closing legal entity: full name, location, INN/KPP, legal form and type of activity. In the tabular part, indicators of current and non-current assets and liabilities are entered by accounting period. At the end of the OBL, the signature of the chairman of the commission with a transcript is placed.

As soon as the final LP is ready, it must be approved by the persons who initiated the liquidation. At the general meeting of participants, a decision is signed to approve the liquidation balance sheet.

Then a protocol on approval of the liquidation balance sheet is formed and endorsed, the preparation of which is marked on the OLB form.

At the end, the final statements are signed by the liquidator and the founders of the organization, an application in form P16001 is filled out, and all the necessary documents are completed and submitted to the Federal Tax Service for consideration and making a further decision on the liquidation of the institution.

What it is

The liquidation balance sheet is a balance sheet that is compiled during the liquidation of an LLC in order to determine the actual property state of affairs of the liquidated enterprise.

The liquidation balance is intermediate

and final.

The interim liquidation balance sheet is drawn up after 2 months from the date of publication in the State Registration Bulletin

notices of liquidation (unless the liquidation commission has established a longer period for filing claims by creditors).

Due to its specific nature, preliminary preparation of data and the preparation of the interim balance sheet usually fall on the shoulders of accounting workers. Although formally, by law, this procedure must be carried out by the liquidation commission.

The procedure for drawing up an interim liquidation balance sheet

In addition to financial indicators, the interim liquidation balance sheet must contain:

Information on the composition of the organization’s property

The interim liquidation balance sheet must include (if available) data on property:

- List of machinery, equipment and other fixed assets indicating:

- object inventory number;

- name of the object and its location;

- brands;

- year of commissioning;

- actual wear and tear;

- their residual value.

- List of buildings and structures indicating:

- object inventory number;

- name of the object and its location;

- year of commissioning;

- actual wear and tear;

- their residual value.

- List of unfinished capital construction projects and uninstalled equipment, indicating:

- name of the object and its location;

- year of construction start;

- volume actually completed;

- their book value.

- List of long-term financial investments indicating:

- names of long-term financial investments;

- their value according to the balance sheet asset.

- List of intangible assets indicating:

- names of intangible assets;

- their value according to the balance sheet asset.

- List of inventories, expenses, cash and other financial assets, expenses, cash and other financial assets indicating:

- industrial stocks;

- animals for growing and fattening;

- work in progress;

- deferred expenses;

- finished products;

- goods;

- VAT on purchased assets;

- other inventories and costs;

- Money;

- calculations;

- other assets (including indication of shipped goods).

- Settlements with debtors:

- for goods, works and services;

- on bills received;

- with subsidiaries;

- with a budget;

- with staff;

- for other transactions;

- with other debtors.

- Advances issued by suppliers and contractors.

- Short-term financial investments.

- Cash:

- cash register;

- current accounts;

- foreign currency accounts.

This is interesting: Sample act of mutual settlements between individuals

List of claims presented by creditors and the results of their consideration

When filling out the list of claims presented by creditors, indicate:

- name of the creditor (in order of priority);

- amount of debt;

- satisfaction decision.

The results must be reflected in a separate column

consideration of creditors' claims by the liquidation commission.

Note

, the above information can be included directly in the balance sheet itself, or can be issued in

the form of an appendix

() drawn up in any form (act, protocol, etc.).

When compiling an interim liquidation balance sheet, data from the last balance sheet prepared before the decision on liquidation was made is usually used.

The interim liquidation balance sheet can be drawn up more than once.

What are the intervals for accounting?

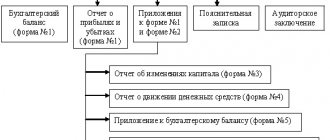

First of all, it is necessary to mention those documents that make up the financial statements of absolutely any period.

Usually this is: a balance sheet and a statement of financial results of the enterprise. The balance sheet is a statement of the assets and liabilities of a business. In this case, assets are understood as all the property of the enterprise: from real estate and products to the most ordinary ballpoint pen, and liabilities are capital and reserves, as well as liabilities (all funds that the enterprise received for development and stable operation and is now obliged to return within the established time frame) . This could be shareholders’ money, loans from credit institutions, and other funds.

The financial results report contains the most complete and reliable data on all purchases, sales, expenses for raw materials and equipment, taxes paid and tax benefits, in short, about the smallest penny that has ever been received or given by any employee of the enterprise as part of the work process .

As mentioned above, financial statements represent a very powerful layer of information about the activities of an enterprise. An intelligent manager who regularly studies financial documentation for reporting periods and compares information will be able to foresee ways of business development, assess the profitability or, conversely, unprofitability of certain areas of production, detect increased losses where this should not be, and a thousand other little things.

That is, accounting reporting is one of the effective tools for making far-sighted management decisions. In addition, reports must be submitted to the tax service to assess the activities of the enterprise and monitor the correct payment of all taxes due.

The report, which, as we remember, includes a balance sheet and information about profits and losses (as well as, if necessary, an auditor’s report, appendices to the balance sheet and other necessary financial statements), is submitted to the tax service before March thirty-first of the current year. That is, the financial report for 2021 must be submitted by March 31, 2021.

The reporting period for financial statements can also be a month, a quarter or a half year. Reporting for these periods is called intra-annual or interim.

Until recently, enterprises were required, in addition to annual financial statements, to also submit interim ones, but this requirement is no longer in effect (according to letter of the Russian Ministry of Finance dated October 23, 2012 No. 03-11-09/80).

However, some organizations, such as insurance companies, are still required to file interim (quarterly) reports with the tax authorities. Those for whom interim reporting is not mandatory are still not recommended to neglect it, because it is known: the more often the results are summed up, the more accurately the records are kept. In addition, by comparing the final figures, it is easier to identify an error or deficiency.

| Type | date | Required electronic reporting |

| 4-FSS for the past year | Annual report - paper version - until January 20, electronic - until January 25 | Over 25 workers |

| 4-FSS for the current year 2021 | Quarterly - April 20, July 20 and October 20 (for paper format), for electronic - April 27, July 27 and October 27 | More than 25 |

| RSV-1 for the past year | Year – February 15 (for paper version), for electronic – February 22 | More than 25 workers |

| RSV-1 for 2021 | Every 3 months – May 16, August 15, November 15 (paper format), Electronic – May 20, August 22, November 21 | From 25 employees |

| Type | date | Required electronic reporting |

| VAT declaration | Quarterly – January 25, April 25, July 25, October 25 | Any number of workers |

| Average number for 2021 | Once a year - January 20 | Over 100 employees |

| For transport and land taxes | Once a year – February 1 | From 100 employees |

| Declaration on the use of the simplified tax system | Once a year. For enterprises – March 31, for businessmen – May 3 | More than 100 people |

| According to UTII | Every quarter – January 20, April 20, July 20, October 20 | Over 100 |

| Personal income tax | Every quarter – May 3, August 1, October 31 | More than 25 employees |

| Type | Deadlines |

| UTII | Quarterly until the 20th |

| Under the simplified tax system for the tax service, in extra-budgetary funds, in statistics | No need to submit until April 30th, no need either |

Reporting period

For the preparation of financial statements, the reporting date is considered to be the period between January 1 and the date on which the report is prepared. The main reporting period is a year, the intermediate one is a quarter.

There is such a thing as “accounting reporting period code” - a two-digit number that is given a separate place in the report.

| 1st-12th | Reporting period code, which is equal to a month |

| 20 | Quarterly code |

| 21-22 | Code from 1st to 4th quarters |

| 31 | For half a year |

| 33 | In 9 months |

| 34 | Annual code |

| 90 | Reorganized enterprise |

| 94 | Reformed |

Coding is necessary for quick reference in reporting information.

Annual reports

Compiled at the end of the reporting year. How to properly prepare annual reports? First, the accountant must check whether the transactions carried out in the organization are correctly reflected.

Annual reports are submitted 3 months from the beginning of the new year. If the last reporting date falls on a weekend, it is postponed until the next working day.

Compilation requirements:

- information must be neutral, that is, exclude the satisfaction of requests of one category over others;

- it is necessary to indicate the indicators of all divisions of the organization;

- facts and performance results for the year must be reliable;

- sequencing.

The annual declaration is submitted by all individuals and legal entities. It is not provided if the taxpayer received the following income:

- from agents who have already withheld tax at the time of payment;

- from one tax agent;

- in case of sale or exchange of property when the tax has already been paid;

- in case of receiving an inheritance;

- if the amount of taxes for the year does not exceed 120 times the minimum wage.

Entrepreneurs submit an annual declaration, even if there was no activity for a certain period.

https://www.youtube.com/watch?v=

Individuals submit a report before May 1 of the year following the reporting year, entrepreneurs - before February 9.

Registration procedure:

- Carrying out an inventory approved by the commission.

- Reconciliation of mutual settlements with creditors, budget, and other enterprises.

- Registration of postings.

- Closing those accounts that play a minor role in collecting data for the report.

- Entering information into the declaration.

- Reporting.

Since the reporting is annual, the listed items should be as close as possible to the reporting date. If the organization has recently opened, then reporting is completed from the moment of registration.

Order of the Federal Tax Service of Russia dated October 29, 2014 N ММВ-7-3/

Income tax

Order of the Federal Tax Service of Russia dated November 26, 2014 N ММВ-7-3/

during reorganization (liquidation) of an organization

Calculation of advance payments for property tax

Order of the Federal Tax Service of Russia dated November 24, 2011 N ММВ-7-11/895

Property tax declaration

Order of the Federal Tax Service of Russia dated November 24, 2011 N ММВ-7-11/895

Order of the Federal Tax Service of Russia dated February 20, 2012 N ММВ-7-11/

Declaration of tax paid when applying the simplified tax system

Order of the Federal Tax Service of Russia dated July 4, 2014 N ММВ-7-3/

(upon termination of activity as an individual entrepreneur)

Order of the Federal Tax Service of Russia dated July 4, 2014 N ММВ-7-3/

Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/

Unified calculation of insurance premiums

Order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/

Tax returns must indicate the tax period code.

Digital designations of periods depend on the type of declaration. We’ll figure out what codes to use when reporting taxes in this article.

- month;

- quarter;

- half year;

- 9 months;

- year.

For consolidated groups of taxpayers, their own codes have been approved: from 13 to 16 (where code 14 corresponds to a half-year, and 16 to a year).

The coding of monthly reporting of consolidated groups begins with code 57 and ends with code 68.

When liquidating a company, you need to enter code 50.

51 - I quarter during reorganization;

47 - half a year during reorganization;

48 - 9 months during reorganization.

There are other codes corresponding to certain reporting periods.

Thus, when preparing reports for several months, digital designations are used in the number range from 35 to 46.

The form of submission depends on the number of employees - if there are many of them, then only the electronic version of reporting is used. New forms: 3-NDFL Provides for new tax rates on dividends In form 2-NDFL There have also been changes Starting in April, employers are required to submit a simplified report for each employee to the Pension Fund, indicating personal data, identification code and insurance code Another quarterly reporting has been introduced 6-NDFL If the report is not submitted on time A fine of one thousand rubles is provided for each overdue month If the report contains incorrect data Fine 500 rubles In 2021, the chief accountant has the right not to sign the report.

Order of the Ministry of Finance of the Russian Federation N 124n) Total current assets Value added tax on acquired assets Financial investments (except for cash equivalents) Filing reports in 2018 to the tax office - what are the deadlines and reporting periods? Advice: if annual financial statements are prepared by small enterprises, then, in accordance with the regulations of Federal legislation, they are allowed to submit simplified forms of the above reports to Rosstat and the Federal Tax Service.

- when submitting reports in paper form directly to the Federal Tax Service, the last day of submission of reports is considered to be the actual submission to the authorized inspector employee,

- when sending a paper version of financial statements by mail, the delivery date will be the day when the statements are submitted to the post office,

- the electronic version of the financial statements should be considered submitted from the date indicated in the automatically generated receipt for acceptance of the financial statements in electronic form.

- 21 - first quarter;

- 31 - 6 months (six months);

- 33 - 9 months;

- 34 - year;

- 50 is the last reporting period in the financial statements and tax reports during the reorganization (liquidation) of the institution.

After drawing up the interim liquidation balance sheet

After the interim liquidation balance sheet has been drawn up, it must be approved by the persons who made the decision on liquidation. To do this, they need to draw up a protocol (decision) on approval or put the appropriate marks directly on the balance sheet.

As soon as the interim balance is approved, the tax office must provide:

- notarized notification in form P15001;

- interim liquidation balance sheet.

In addition, many Federal Tax Service may additionally require:

- protocol (decision) on approval of the interim liquidation balance sheet;

- documents confirming publication in the Vestnik

.

Liquidation process

To understand more about what this balance is, you should understand the step-by-step instructions according to which the operation of the enterprise is completed:

- Decision to terminate activities. Accepted either by the company owners or government agencies.

- Submitting information about the decision to the tax office. They will have to change the data in the Unified State Register of Legal Entities.

- The liquidation committee approves the intention to close the business.

- Notifying clients about the end of activities.

- Inventory of all property.

- Closing all debts and notifying creditors.

- Preparation of the liquidation balance sheet of the first type - interim. The deadline for submission is 60 days after notification of completion of work (clause 4). This time is extended by a special commission if necessary.

- Payments to all legal entities and individuals.

- Approval of the final, last liquidation balance sheet.

- Distribution of property between owners.

- Registration of the end date of the company's work.

As you can see from this list, there are two points about the liquidation document. During calculations they should not turn out to be the same. The features of each are discussed later in the article.

A few words about the essence of financial statements

As any manager of an organization knows, financial statements are documentation that represents a complete and reliable picture of the economic, business and property status of the enterprise. The reports reflect:

- products manufactured at the enterprise, or work performed, or services provided - depending on the activities of the enterprise;

- income received from the sale of property;

- income received as a result of repayment of loans or interest on deposits;

- funds received from the shareholders of the enterprise;

- expenses for the purchase of raw materials and equipment necessary for production;

- loan repayment expenses;

- taxes paid and tax benefits received.

- and another hundred or so different items for which the company received any amounts during the reporting period or parted with some amounts.

Back to contents

Interim liquidation balance sheet

The deadlines for its preparation are clearly defined by law, and this should happen after the claims are presented to the creditors.

In the 2021 interim liquidation balance sheet form, you usually need to fill out the following information:

- About the property that was described in the company during the inventory. Based on its materials, confirmation of this information will be counted in the balance sheet.

- About the funds, their inventory results, names, locations, etc.

- About buildings owned by the company, including those under construction.

- About intangible assets.

- About financial investments, for example, advances, balances, savings, and current and foreign currency accounts, etc. are also taken into account.

- Requirements for creditors and the results of their consideration by the commission. In most cases, they are reflected in the application, which is then attached to the text of the balance sheet.

- Requirements, the adoption of which by the court came into force, regardless of the liquidation commission.

- The table usually contains only generalized values.

Based on the information above, we can conclude that the liquidation document cannot have a negative value in this case.

Its approval occurs by the party that made the decision to close the business, that is, either its owner or an authorized body. The balance is finally formed only when the following conditions are not met:

- The court has a claim from a creditor against the company being closed, the case is in progress and no decision has either been made or it has not entered into force.

- The company conducting the liquidation process is undergoing a tax audit, and there is no confirmation of its completion.

There is no direct prohibition for these situations; however, the law states that under such conditions it is impossible to submit balance sheet information to the tax office.

There can be several intermediate balances. This depends primarily on:

- The duration of the business closure process.

- Resolving issues with creditors and disputing parties due to the division of property.

stroki_ofr.jpg

Indicators with a negative value are indicated in parentheses.

Report on the intended use of funds (OKUD 0710003)

The form is filled out by NPOs and firms that received targeted funds. Other companies do not need to submit these reports. The lines contained in this form do not need a detailed description, so we will provide a brief breakdown of the indicators in Table 3.

Final liquidation balance

The legislation states that the form for its preparation will be approved by the standard, but so far this has not happened. For this reason, there is no special procedure or standards for generating a report. However, on what date the interim liquidation balance sheet is drawn up is a frequently asked question and very important to avoid errors. It will be the day preceding the date when an entry about the end of the company’s activities is made in the Unified State Register of Legal Entities.

This is interesting: Passport for written control sample

All data is filled out in the same form as the interim liquidation document. In fact, it is not clearly established, so the recommendations of the Ministry of Finance and an accounting type template are usually used. Based on them, a form has been compiled that can be downloaded from the link, and you can see a sample of the interim balance sheet for the liquidation of LLC 2021 here. This link has an example of filling out a zero balance form.

Along with it, the following are submitted to the Federal Tax Service:

- A document approving the summing up.

- Payment document for payment of the duty.

- Resolutions confirming the absence of claims due to debts.

- An application filled out using the form, which can be downloaded here. Notarized.

Zero liquidation balance

The issue of its preparation arises for most companies and is one of the main problems, because there is simply no single method by which the final indicators for this balance sheet are compiled.

Difficulties also arise here:

- Lack of clear indication of when exactly a balance sheet needs to be drawn up before dividing property. After all, it is only stated that this should happen after all debts are repaid, but there is no specific moment.

- Lack of understanding of the powers of the commission, especially the part that concerns the division of property. It is not said whether she can do this herself, or whether this is exclusively done by business owners.

Since there is no clear answer in the legislation, both scenarios are recognized as correct and are chosen under the influence of an analysis of the advantages and disadvantages for each company independently.

In the first case, the following are usually considered disadvantages:

- Accounts receivable in assets. Collecting it is not the fastest thing, and for this reason, drawing up an interim liquidation document will take a long time, because this can only be done after the debt has been paid off.

- There is no clear scheme for resolving disputes arising from the division of property. Usually, in this case, the item is put up for auction, but this will not be possible if, by decision of the commission, something has already been transferred to one of the parties to the dispute. Then the liquidation balance sheet is closed only after the conflict is resolved.

In the second case, another problem may arise - the presence in the company of assets that are subject to:

- Property tax.

- Transport tax.

Here, a company that is being liquidated retains the obligation to pay these taxes until it is distributed or sold to someone. Tax debt will not allow you to accept the balance.

The liquidation balance sheet has two types - interim and final, and you need to be especially careful with the first type, because on their basis a complete picture will be drawn up and they contain much more information than the latter. Therefore, it is important not to make interim balances zero, but with the final balance such a situation can happen. It won’t be difficult for a professional to complete them; the main thing, as always, is to be very careful when filling them out.

Liquidation balance sheet: step-by-step closure of a business

To determine the actual financial condition of a closing organization, legislators provided for interim and final liquidation balance sheets. In this case, the reason for closing the business does not matter; this document will have to be drawn up in any case, since without it the Federal Tax Service will not register the termination of the legal entity’s activities in the Unified State Register of Legal Entities.

The procedure for liquidating a company is strictly regulated by law. In particular, according to the provisions of Article 61 of the Civil Code of the Russian Federation, the liquidation of a legal entity entails its termination without the transfer of rights and obligations by way of succession to other persons. This means that the concept of “liquidation” is final and irrevocable, so the last report should ideally be zero. After all, it is necessary to sell all assets or transfer them to interested parties during the organization’s activities. Therefore, with figures there is usually an interim liquidation balance sheet, a sample of which can be filled out at the end of this article. It is noteworthy that the form of this report is not directly regulated by any regulatory documents, so it can be filled out either in any form or using the forms of a regular balance sheet given in the appendix to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. This is exactly what the Federal Tax Service of Russia recommends in its information “On the provision of documents upon liquidation of a legal entity.” However, before drawing up a report, it is necessary to perform a number of actions provided for by the Civil Code and Federal Law No. 402-FZ on accounting, without which the document will not be accepted.

Reasons for closing a company

An exhaustive list of grounds for closing an existing enterprise is given in Article 61 of the Civil Code of the Russian Federation. There are only three global cases:

- On a voluntary basis, by decision of the founders or an authorized body, including the expiration of the period for which the legal entity was originally created, as well as the achievement of the purpose of its creation.

- By court decision (the grounds are listed in the article. This may be the implementation of prohibited activities, lack of a license, gross violation of the law or the Charter of the organization itself).

- As a result of financial insolvency.

The last case is the most severe and is separately regulated by the provisions of Article 65 of the Civil Code of the Russian Federation. In this case, the analysis of the liquidity of the balance sheet is especially important, because it primarily concerns the creditors of the bankrupt organization. True, in this situation external management is introduced, and all procedures with summing up the results fall on the shoulders of the arbitration manager. This is a separate topic, so we will consider, first of all, these actions by the organization itself and evaluate how the liquidation of an LLC with a zero balance occurs, i.e. when there are enough assets to satisfy the claims of all creditors.

This is interesting: Timing of working hours for office cleaners sample

The main purpose

Each fixed report has its own individual method; keeping it all in your head at the same time is almost impossible unless you have been working in this field for twenty years, and remembering all the meanings is just as difficult, which is why a large number of specialists are confused about this concept, for example, “ Is the twenty-first moment quarterly or monthly?”

Everything depends directly on the declaration; codes can have different meanings, which sometimes confuses an accountant.

There are ciphers that are created to identify types of declarations; the codification features have a large number of features. In order to designate a certain period of time or a specified period, a form has been drawn up that defines fiscal reporting. The cipher represents a two-digit number, for example, periods twenty-two, fifty, thirty-one, and so on.

Each type of tax reporting provides for an individual codification procedure. Therefore, each company uses its own version of calculation for the correct final work. Ciphers for reports are determined by the main types; they are intended for full-fledged work in order to eliminate time wasted on unnecessary things.

Step-by-step liquidation of an organization

The stages that each legal entity must go through during the closure procedure are defined in Articles 61&ndash. Briefly, these steps look like this:

- Step 1. The management body or sole owner makes decisions to close the organization.

- Step 2. A notification of the decision (form P15001) is sent to the territorial body of the Federal Tax Service so that the necessary changes are made to the Unified State Register of Legal Entities.

- Step 3. The liquidation commission is assembled and approved.

- Step 4. Public information about the termination of the legal entity’s activities is published in the media and on the Internet.

- Step 5. An inventory of the obligations and all assets of the organization is carried out.

- Step 6. An interim balance sheet is drawn up upon liquidation of the LLC.

- Step 7. Measures are taken to collect receivables.

- Step 8: Creditors are properly informed of the closure of the organization.

- Step 9. Compile an interim liquidation balance sheet, a sample of which can be found below.

- Step 10. Final settlement with creditors.

- Step 11. The property of a legal entity remaining after satisfying the creditors' claims is distributed among its founders (participants).

- Step 12. The final liquidation balance sheet is compiled (form 0710099), we will look at a sample filling (2017) below.

- Step 13. State registration of the results of closure of a legal entity. Exclusion from the Unified State Register of Legal Entities.

From this instruction it is clear that during the process of closing an organization, several interim balance sheets can be drawn up and only one final balance sheet. It is important that the first interim results can be summed up only after an inventory, as provided for in Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n “On approval of the Regulations on accounting and financial reporting in the Russian Federation.” All reports must be different.

Tax period code in financial statements

First of all, it should be noted that the reporting periods in tax and accounting documentation may not coincide and most often do not coincide. At the same time, both tax reporting and accounting have certain codes that undergo changes annually. Therefore, before filling out the necessary forms, it is better to double-check the available data on the codes in order to be absolutely sure that the documents are filled out correctly.

So for 2012 (accounting statements for which had to be submitted by March 30, 2013) the following codings were established:

- for the quarterly report – 21;

- for the half-year report – 31;

- for a report for nine months – 33;

- for the annual report – 34;

- for liquidation annual reporting in the event of dissolution (liquidation) of an enterprise - 90;

- for liquidation interim reporting in the event of dissolution (liquidation) of an enterprise - 94.

When filling out financial statements for 2013, the codes will need to be clarified.

Back to contents

What data should the interim liquidation balance sheet contain (filling sample)

The organization has the right to draw up a report in any form. However, there is data that must be included in it. The procedure for summing up interim results is regulated by Article 63 of the Civil Code of the Russian Federation. It states that organizations must disclose information about:

- your property and assets (based on inventory results);

- requirements presented by creditors and the results of their consideration;

- requirements certified by court decisions that have entered into force.

Federal Law No. 129-FZ dated 08.08.2001 “On state registration of legal entities and individual entrepreneurs” does not oblige the owners of the organization to submit the interim liquidation balance sheet to the tax authority. By law, only the final document should go there. However, it is better to familiarize the tax authorities with the interim results. This will allow them to quickly verify the accuracy of the information provided and complete the business closure procedure. The decision to approve the interim liquidation balance sheet is made by the founders (participants) of the organization or the authorized body that made the decision to terminate the activity. Sometimes approval is required from the authorized government agency.

In its appearance, content and procedure for filling out the liquidation balance sheet does not differ from the usual annual balance sheet. The only difference is that the results must be summed up not on December 31 of the reporting year, but on the date of compilation.

Assets

Passive

As can be seen from this example, the chairman of the liquidation commission signs the document. The reporting year of an organization that ceases its activities is incomplete. It begins, as always, on January 1 of the current calendar year, and ends on the date that precedes the date of entry into the Unified State Register of Legal Entities on the liquidation of the legal entity. It is on this date that the last financial statements - the liquidation balance sheet - should be compiled. The sample for filling out this document is practically no different from the one given above. It is imperative to indicate that this is a final report. It should not contain obligations to creditors, and if the liquidation commission was able to distribute among the founders or sell the property of a legal entity, an example of a zero balance will be presented to the attention of the regulatory authorities. This means that his assets and liabilities will contain zeros.

Finally, it should be noted that Federal Law N 402-FZ determines that the composition of the final financial statements, as well as the procedure for its preparation, must establish federal standards. However, such standards have not yet been approved, and the exact procedure for presenting the final balance sheet has not been established. This remains at the discretion of authorized persons of the organization and territorial regulatory authorities who enter information into the Unified State Register of Legal Entities.

Submission of interim accounting reports

According to paragraph 5 of Art. 13 402-FZ, accounting records that are compiled for an interval of less than one calendar year are considered intermediate. These can be monthly or quarterly registers.

Interim reports are submitted only when the organization is obliged to submit them in accordance with the current legislation of the Russian Federation, by-laws and regulations, as well as constituent documents or decisions of managers and owners (clause 4 of Article 13 402-FZ). In such cases, the OP dates must be fixed in the accounting policies of the institution.

The deadline for submitting intermediate forms is not established by current legislation. The deadlines and time intervals for which you need to report are determined by internal and external users of accounting.

DIRECTORY OF CODES DETERMINING THE TAX (REPORTING) PERIOD

| Code | Tax (reporting) period |

| Section 1. Codes for documents prepared for the tax period - month | |

| 01 | January |

| 02 | February |

| 03 | March |

| 04 | April |

| 05 | May |

| 06 | June |

| 07 | July |

| 08 | August |

| 09 | September |

| 10 | October |

| 11 | november |

| 12 | December |

| Section 2. Codes for documents compiled for the tax period - quarter | |

| 21 | 1st quarter |

| 22 | 2nd quarter |

| 23 | 3rd quarter |

| 24 | 4th quarter |

| Section 3. Code for documents compiled only for the tax period - calendar year | |

| 34 | year |

| Section 4. Codes for documents compiled on an accrual basis from the beginning of the year: | |

| 4.1. |