The very concept of working time implies the period during which the employee fulfills his labor obligations in accordance with the contract concluded with him and the principles of internal regulations. This definition also includes other time periods called working time in the Labor Code.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

general information

Information on working hours is contained in Article 91 of the Labor Code of the Russian Federation. This period refers to the period of time when a person performs labor functions. By law, the standard duration of this time is 40 hours per week. In practice, such working hours are rarely used.

Firstly, in many enterprises the production process cannot be stopped, so the work schedule there is shifting. Secondly, some categories of employees cannot work for such an amount of time, since by law they are entitled to a reduction in labor standards. These are minors, people with disabilities, etc.

However, the rules for calculating working hours stipulate that a 40-hour working week should be taken as a basis.

Why is specific labor intensity calculated?

Specific labor intensity is a value showing how much time is spent on producing one unit of product (good, service). Let's look at how this coefficient is calculated. It is in inverse proportion to labor productivity and is calculated by dividing the number of workers by the amount of work in monetary terms.

Example: 5 workers produced 100 units of product in 1 shift at 80 rubles per unit. We already know that the labor intensity coefficient will be equal to 0.005. What will be the specific labor intensity? 5 / 8,000 = 0.000625.

Calculation for a month

Determining labor standards allows employers to correctly set work schedules, keep records of hours worked, pay wages and distribute vacations. Knowing how to correctly calculate the standard working time, you can easily determine how many hours an employee must work. One calendar month is often taken as the billing period.

Working hours are calculated as follows:

- First you need to find out how many working days there are in the selected accounting period, and how many weekends, holidays, etc.

- Next, the number of working hours per day is calculated. At the same time, do not forget that the normal length of a working week is 40 hours. This means you calculate the number of hours per working day. Example: 40/5=8.

- The number of days in a month when a subordinate works must be multiplied by 8 hours.

An example of such a calculation could be as follows:

- Let's say there are 21 working days in June.

- The authorized employee must determine the standards by which the personnel will work.

- For this, the time standard will be calculated using the following formula: 21*8=168 hours. This is exactly how much each subordinate must work on average.

To correctly calculate working hours, you need to check the production calendar. It contains all the information about the number of work shifts for each calendar month.

RV standards

The following time standards are distinguished:

- Work week. It may consist of five days (Saturday and Sunday are days off), or six, but its duration should normally be 40 hours, or with a shortened time period - 24, 35 or 36.

- Change. The concept of a work shift includes the time after which workers engaged in the same labor process replace each other. It happens during the day and at night. When working in shifts, sometimes such a nuance arises as the inability to reduce the duration of the shift when it is provided for (for example, on a holiday). Then this time is considered overtime and is paid in accordance with overtime standards or compensated by providing time off. Payment for the night shift (from 22.00 to 06.00) occurs at an increased rate, which is approved by the employer.

- Working day. The time during the day during which work is performed. Normally equal to 8 hours.

- Accounting period. Time worked for a calendar period (for example, a quarter or a month, but not more than a year). This period allows you to compare the hours with the standards established by law. This is a unique form of control over the RV norm.

- Occupancy limit. Employment limit established by law. An example would be a part-time job. The number of hours worked in this case cannot exceed half of the daily wage rate per month. With a 40-hour work week in October 2021, part-time work should not take more than 84 hours.

RV accounting is selected in accordance with the specifics of the enterprise.

Quarterly calculation

It is also important to know how to calculate the standard working hours for a quarter, that is, for three months. The standard working day is 8 hours. All calculations are carried out very simply. First you need to determine what the labor norm is in each month.

Calculation example:

- Let's assume that there are 168 work hours in July. It remains to calculate the amount of time only for the next 2 months.

- There are also 168 working hours in August, and 160 in September.

- This means that the norm for the quarter is as follows: 168+160+168=496 hours.

If necessary, a similar calculation can be carried out for each quarter. Most often, company management uses the definition of the norm on a quarterly basis.

What is “labor intensity”

The term “labor intensity” usually refers to the ratio of resources and time spent on their production. Typically measured in man-hours. Sometimes the word “production” is used as a synonym for the concept. Calculating this coefficient allows you to achieve the following goals:

- Calculate how much labor and time is needed to create a unit of finished product.

- Identify in which areas resources are being used productively and in which areas need optimization.

- Identify weak links in the technological process.

- Determine whether there are reserves for improving productivity.

The term “labor intensity” usually refers to the ratio of resources and time spent on their production.

Calculation for a year

Labor rationing is an important procedure that allows you to determine the number of hours that employees are required to work. When making calculations, the calendar year is often used as the accounting period. Hours are calculated in two ways. You can use the method that is used to calculate the quarter. You just need to determine the amount of the working period for all 12 months.

Another procedure for determining the norm was established by order of the Ministry of Health and Social Development of the Russian Federation No. 588n. The calculation is carried out using the formula: 40/5*number of working days per year. After this, from the resulting number you should subtract the number of hours that the employees did not work. We are talking about reductions before the holidays.

When determining the norm for 2021 according to the billing period, the following nuances should be taken into account:

- Sunday must be counted as a day off. And it doesn’t matter how many days of rest a subordinate actually has per week - 2 or 1. For some categories of subordinates, it is possible to transfer the day of rest to another date.

- Don't forget about official holidays, which are not used in calculations.

- When a holiday falls on a day of rest, the day off is postponed. These rules do not need to be used only when calculating labor standards for January.

- The length of the working day before a holiday is always reduced by 1 hour.

When making calculations, you must follow these rules, otherwise the final number of hours will be incorrect.

How to count

So, let’s figure out how to calculate man-hours, the formula:

Hh = K × T,

Where:

- K is the number of company employees;

- T is the labor time in the billing period, calculated in hours, for each employee.

This formula is convenient to use for a company with a standard eight-hour working day. But such a calculation has a number of disadvantages. For example, if an employee gets sick, goes on another vacation, or takes days without pay. Such periods cannot be included in the calculation. Therefore, the formula can only be used in relation to mercenaries who have fully worked for the pay month.

Consider the following periods in your calculations:

- Actual working hours.

- Hours of work spent on business trips.

- Overtime, overtime, night and holiday work hours.

- Part-time work (in the same organization).

Exclude the following periods from the calculation:

- Days of illness of an employee on a certificate of incapacity for work.

- Downtime, no matter the reason.

- All types of leaves (labor, educational, additional, unpaid).

- Reduced working hours, which are established for certain categories of workers (more details “Shortened working hours: 4 examples of calculations”).

- Breaks to feed the baby.

- Periods of advanced training.

- Participation in strikes.

- Off-the-job training.

- Other reasons why the employee was absent and did not perform his direct duties.

Types of charts

The length of the working day most often depends on production needs. Therefore, it is rare that employers can provide their staff with a standard 5-day period. The most commonly used modes are:

- 24 hour shift with several days off.

- Work shift with 10 or 12 hours of work. Then the staff has more days off than planned.

- Shift is 12 hours, with alternating day and night shifts.

Note: these are not all the regimes that able-bodied citizens have to face. But, based on the specifics of some professions, a regular 8-hour shift may be disadvantageous for both management and the subordinates themselves.

https://www.youtube.com/watch?v=YtMOJEFrytA

Types of labor intensity

Above are the two most common types of output in practice: production and specific. However, economists identify several more types of labor intensity:

- Technological labor intensity implies an assessment of the time costs of all workers.

- Maintenance - on the contrary, shows how much time was spent on auxiliary workers.

- Production - is the sum of the values of technological labor intensity and maintenance, that is, the time costs of main and auxiliary workers.

- Management - records the time spent by process managers.

- Construction of an object is a special case of labor intensity; it shows how many man-hours will be spent on the entire process of constructing the object.

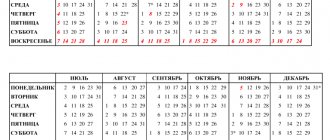

Production calendar

In order for managers to correctly calculate labor standards, there is a special document. This is the so-called production calendar, which takes into account all working days, as well as rest days, including holidays. This document is not a normative act and therefore has no legal force.

However, it is very useful for accountants or HR employees whose responsibilities include keeping time records and calculating earnings. The production calendar can be found online and used at your discretion. Also, the law does not prohibit organizations from independently developing such documents. To do this, you can take a regular calendar and indicate working days and weekends in it in accordance with established rules.

What affects labor intensity?

So, we looked at how to calculate labor costs. The man-hour formula presupposes access to primary documentation, namely a time sheet recording hours worked and acts recording the number of products produced.

The value of this indicator is influenced by a very significant number of factors. To competently analyze the data obtained, you need to know and take into account all influencing factors.

Each individual production has its own list, but the most common are:

- Professionalism of the staff.

- Streamlined technological process, comfortable working conditions.

- Timely supply of raw materials.

- No problems with infrastructure and communications (no power outages, access roads are cleared, etc.).

- Motivation of workers, mood in the team and decent wages.

Working hours standards

The work schedule (five or six days) affects the established work norm.

With a five day week

With five working days, the quarterly norms and number of days are as follows:

| 2020 | Amount of days | Length of labor time (hours) | ||||

| Calendar | Workers | Weekends and holidays | 40 hours/week | 36 hours/week | 24 hours/week | |

| I quarter | 90 | 57 | 33 | 454 | 408.4 | 271.6 |

| II quarter | 91 | 59 | 32 | 469 | 421.8 | 280.2 |

| III quarter | 92 | 66 | 26 | 528 | 475.2 | 316.8 |

| IV quarter | 92 | 65 | 27 | 519 | 467 | 311 |

| YEAR | 365 | 247 | 118 | 1970 | 1772,4 | 1179,6 |

In 2021, during the five-day period, there are the following long periods of rest:

- from 12/30/2018 to 01/08/2019 inclusive (New Year holidays);

- from 08.03 to 10.03 (International Women's Day);

- from 01.05 to 05.05 (Spring and Labor Holiday);

- from 09.05 to 12.05 (Victory Day)

- from 02.11 to 04.11 (National Unity Day).

With a six day week

With six working days, the quarterly norms and number of days are as follows:

| 2020 | Amount of days | Length of labor time (hours) | ||||

| Calendar | Workers | Weekends and holidays | 40 hours/week | 36 hours/week | 24 hours/week | |

| I quarter | 90 | 68 | 22 | 454 | 408,4 | 271,6 |

| II quarter | 91 | 74 | 17 | 469 | 421,8 | 280,2 |

| III quarter | 92 | 79 | 13 | 528 | 475,2 | 316,8 |

| IV quarter | 92 | 78 | 14 | 519 | 467 | 311 |

| YEAR | 365 | 299 | 66 | 1970 | 1772,4 | 1179,6 |

How to calculate labor costs

Labor costs are the entire amount of money payable to employees for the reporting period. The formula for labor costs is quite simple. It is necessary to multiply the average annual number of employees by the average salary per employee.

For example, let’s calculate monthly labor costs for an enterprise with 15 employees and an average salary of 27 thousand rubles. 15 x 27,000 = 405 thousand rubles. If you need to get the value for the year, then the monthly costs need to be multiplied by 12: 405,000 x 12 = 4,860,000 rubles.