When submitting to the Pension Fund the following personalized accounting forms: ADV-1, ADV-2, ADV-3, as well as forms containing information about payments and contributions accrued to extra-budgetary funds: SZV-1, SZV-3, SZV-4- 1, SZV-4-2, the insurer, that is, the employer, is obliged to provide them along with the accompanying inventory in the ADV-6-1 form.

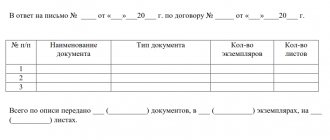

Form ADV-6-1 is a list of documents that is compiled when the employer transfers a set of documents to the Pension Fund of the Russian Federation, containing information about its employees. ADV-6-1 has been changed in 2021.

Form ADV-6-1 consists of three sections:

- The first section contains information about the employer;

- In the second, it is necessary to reflect the name of the transferred forms and their number;

- The third section is completed if the above SZV forms are submitted to the Pension Fund. Here you fill in information about the amount of contributions, the amount of payments and the period for which they were accrued.

What does the document look like?

The new form of the accompanying inventory was approved separately by Resolution of the Board of the Pension Fund of the Russian Federation No. 485p dated September 27, 2019. Until February 2020, another form ADV-6-1 was in force, but now it is not used.

The updated form of the document is called “Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation” and is one of the reporting forms regarding the provision of information about personalized registration of insured citizens to the Pension Fund of the Russian Federation.

Sample filling

The entire form is placed on one A4 sheet. It can be filled out either by hand or using a personal computer.

For ease of filling out, the form is divided into thematic blocks:

| Block one |

|

| Block two | The information in it is filled out if additional forms are available:

|

| Block three | The required data is marked with a cross:

|

Next, reporting periods are marked with a cross. This can be either a year or a quarter. Below is the total income for the period noted above. This amount is necessary for calculations when calculating pensions.

After this, the package of documents is stitched and numbered. A complete list of insured workers for whom information was provided is attached to it. The list of employees does not have clear regulations for registration, so it is compiled in a form convenient for the employer.

Sample of filling out form ADV-6-1:

When to fill it out

The accompanying register is filled out when sending information to the Pension Fund using standardized forms:

- Questionnaire ADV-1 (sample of completion and current form in special material) - created when sending individual information of an employee to create an insurance certificate (SNILS or ADI-REG) for the first time.

- ADV-2 - if an employee has changed individual data and a replacement (update) of SNILS is necessary.

- ADV-3 - sending information to create a duplicate of SNILS if the employee has lost or misplaced it.

- SZV-K - when generating information about an employee’s length of service before 2002, it is compiled at the individual request of the Pension Fund of the Russian Federation.

- Other documents provided by the policyholder to the Pension Fund of the Russian Federation upon individual requests.

Form ADV-6-1. List of documents submitted by the policyholder to the Pension Fund of Russia

An inventory in form ADV-6-1 is submitted by the policyholder to the territorial body of the Pension Fund of the Russian Federation as part of a bundle of incoming documents submitted starting from 2002, as well as as part of a bundle of corrective individual information for periods before 2002.

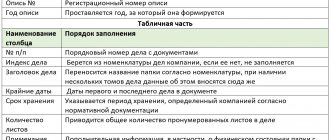

1. Codes for OKUD and OKPO are temporarily not indicated.

2. Details of the policyholder submitting the documents:

Pension Fund registration number: required. The number under which the policyholder is registered as a payer of contributions to the Pension Fund is indicated, indicating the region and district codes according to the classification adopted by the Pension Fund.

Format: XXX-XXX-XXXXXX. Example: 048-011-002356. (Leading zeros must be indicated!)

Taxpayer Identification Number: required. The taxpayer identification number is indicated.

Checkpoint: required to be filled out. The reason code for registration is indicated.

Name (short): required. The short name of the organization is indicated.

3. Notes: to be filled in by a Pension Fund employee when receiving a stack of documents.

4. Number of documents in a pack: required to be filled out. The number of documents in a bundle of the corresponding type is indicated.

5. The number of insured persons presented in the pack: must be filled out only on the Inventory accompanying the pack of SZV-4-2 forms.

6. Number of the bundle of documents assigned by the policyholder: the serial number of the bundle of documents assigned by the policyholder is indicated.

7. Registration number of the bundle in the territorial office of the Pension Fund of Russia: filled in by a Pension Fund employee when receiving a bundle of documents. The incoming number is indicated, under which a stack of documents was registered at the territorial office of the Pension Fund of Russia.

For forms SZV-4-1 or SZV-4-2

8. Billing period: must be filled in when submitting information for the billing period after 01/01/2002. The year for which information is provided is indicated. Not to be filled in when submitting corrective information for periods before 01/01/2002.

9. Category code of the insured person: must be filled in in accordance with the Classifier of parameters used in the forms of individual (personalized) accounting documents in the state pension insurance system.

10. Additional tariff code: filled in in accordance with the parameter classifier of the same name only for persons whose earnings are subject to contributions to the Pension Fund at an additional tariff (for example, for flight crew members of civil aviation aircraft).

11. Type of information: the “X” symbol indicates one of the following values:

“initial” – information submitted by the policyholder for the first time about the insured persons for a given billing period. If the submitted original individual information was returned to the policyholder due to errors contained in it, the original information is also provided in its place;

“Pension Appointment” – a form submitted for an insured person retiring. To be completed when preparing a form at the request of an insured person retiring.

12. Type of adjustment: filled in if information needs to be corrected. The “X” symbol indicates one of the following values:

“corrective” – information submitted for the purpose of changing previously submitted information about insured persons for a given reporting period. If the initial information does not correspond to reality, then the correcting individual information is indicated in full for the entire reporting period, and not just the corrected information.

The value can be specified together with the “appointment of pension” value of the “Information type” attribute.

It is unacceptable to specify this value together with the “initial” value of the “Information type” attribute;

“cancelling” - information submitted for the purpose of completely canceling previously submitted information about insured persons for the specified reporting period.

The value can be specified together with the “appointment of pension” value of the “Information type” attribute.

It is unacceptable to specify this value together with the “initial” value of the “Information type” attribute.

13. Territorial conditions: filled out in accordance with the parameter classifier of the same name only if the package contains SZV-4-2 documents. For other types of documents, filling out is unacceptable.

To be completed if the organization has workplaces that are located in an area included in the list of regions of the Far North, areas equated to regions of the Far North, exclusion zones, resettlement zones, residential zones with the right to resettle, residential zones with preferential socio-economic status.

The value of the regional coefficient established centrally for the wages of workers in non-production industries in the regions of the Far North and areas equated to the regions of the Far North is not indicated.

14. Information on the amounts of accrued insurance premiums (total for a pack of documents):

insurance part of labor pension

funded part of labor pension

at an additional rate

Details must be filled in if the package of documents contains forms SZV-4-1 or SZV-4-2.

Details are filled out in accordance with the rules for filling out forms SZV-4-1 and SZV-4-2. The total values in rubles for the entire pack are indicated.

For forms SZV-1 or SZV-3

(must be completed when submitting information on forms SZV-1 or SZV-3 for periods before 01/01/2002)

15. Reporting period: the year for which information is being submitted is indicated. Cannot be filled in if the value of the “Billing period” attribute has already been specified.

16. Information on earnings (remuneration) and income for the reporting period, taken into account when assigning a pension (total for a stack of documents):

Total accrued

including temporary disability benefits and scholarships

The details are filled out in accordance with the rules for filling out forms SZV-1 and SZV-3. The total values in rubles and kopecks for the entire pack are indicated.

17. Details: Performer, Signature, Explanation of signature must be filled out.

18. Details: Name of the manager’s position, Signature, Explanation of signature must be filled out.

19. Date: must be filled in (DD name of the month YYYY).

20. M.P.: stamping is mandatory. (An insured who is not a legal entity may not affix the stamp).

Structure of the accompanying inventory

The standardized register consists of four conditional blocks:

- The first block contains information about the policyholder. Here you must indicate the registration number of the institution issued by the Pension Fund, then enter the TIN, KPP and indicate the name. When changing the name or in other exceptional cases, we indicate additional information in the “Note” field.

- The second block is a tabular part, which presents the reporting forms named above. Here the policyholder indicates the number of documents sent to the Pension Fund.

- The third block is filled out during electronic document management with the OPFR. The block contains the package number assigned by the policyholder’s electronic system upon dispatch, and after receipt, the OPS system assigns a special number to this package.

- The fourth block is information about the contractor and the head of the insured organization, their signatures.

Step-by-step instructions for filling out and sample

If a representative of the enterprise’s personnel service is filling out the document, then he must understand the rules of this process.

To correctly form the ADV-1 form, the following steps are performed:

- personal information about the new employee is entered, for which his full name, date of birth and gender are indicated;

- information for filling out the form is taken exclusively from official documentation received from a specialist, so the data must match the information from the passport;

- the place of birth given in the passport is indicated, and not only the city is entered, but also the region, district and country;

- the citizenship of the new hired specialist is selected;

- the place of registration and the address of the citizen’s actual place of residence is indicated;

- indicate contact information represented by telephone number and email address;

- passport details are entered, and it is allowed to use other identification documents;

- a correctly formed application form of the insured person is signed by the direct employee, if there are no serious reasons for the director of the enterprise to carry out this process;

- at the end the date of compilation is indicated, after which the documentation is transferred to the representatives of the Pension Fund, and an accompanying inventory is attached to it.

Any hired specialist can understand the rules for creating the ADV-1 form. If false or incorrect information is entered, this will lead to negative consequences. Funds transferred in the form of insurance premiums for an employee will not accumulate in his individual account. Therefore, you will have to check and draw up a new questionnaire.