Notifying the bank about erroneous receipt of funds

A company that has received an erroneous payment must send a written notification to the bank within 10 days of receiving the bank account statement showing the excess funds. The form of such a written message to the bank is not established by law, therefore banks establish such forms with their own internal documents. If the bank does not have an approved form, the organization draws up a message in free form.

Bank, depending on the terms of the bank account agreement:

- if it is possible to write off erroneously credited amounts from the company’s bank account without acceptance, writes off the erroneously credited funds without a separate order from the organization;

- If there is no such possibility under the agreement between the bank and the organization, the erroneously transferred funds are written off only upon receipt of the corresponding order.

Exceptions

As a rule, a VAT refund is possible until the verification is completed. This right is available to taxpayers whose total VAT amount is more than 7 million rubles, and three years or more have passed since the organization was created. This right also applies to other taxpayers:

- provided a bank guarantee;

- citizens of a territory that is ahead of other regions in socio-economic development;

- residents of Vladivostok;

- persons who provided guarantors.

To receive a refund by application, along with a report to the Federal Tax Service, you need to send a surety agreement or a bank guarantee within up to 5 days.

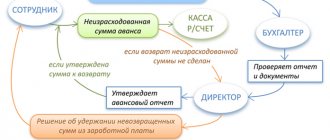

Accounting and tax accounting of cash return transactions

In accounting, when returning funds, a posting is used that mirrors the one with which the funds were accepted for accounting:

- Dt 51 K 62 - cash receipt;

- Dt 62 Kt 51 - refund.

In tax accounting:

- simplified tax system: crediting funds is reflected in taxable income on the date of receipt of funds to the current account; upon return, taxable income is reversed by the date of return;

- BASIC: crediting and returning funds transferred by mistake is not reflected.

Refund of erroneously transferred amount

Contents The company's bank account received funds from a completely unrelated company.

While correspondence was being conducted about the return of the erroneously transferred amount, the quarter came to an end. In this regard, the accountant has a dilemma: should VAT be charged on this amount or not?

LLC on OSNO received money from the organization in the 3rd quarter, but as it turned out, it was transferred incorrectly.

Do I need to take into account the amount of VAT on these funds in the declaration for the 3rd quarter if the money was returned only in October as it was transferred by mistake? If so, should we make an advance invoice?— Button @ A reader of our forum fears that the tax office may file a claim if VAT is not calculated on the amount received into the account, since although the receipt was erroneous, the company has already spent this money for your needs.

Meanwhile, the discussion participants note that an erroneously received amount is not a reason for charging VAT and advise the accountant to stock up on documents proving that it was indeed a mistake. Let us add that the Ministry of Finance also agrees that the Tax Code does not provide for an increase in the tax base by amounts not related to payment for goods (work, services) sold.

In letter No. 03-07-11/329 dated 08/02/10, officials explained that funds mistakenly received into the organization’s current account are not included in the VAT tax base. The issue of charging VAT on a non-existent advance is discussed in the forum topic “Accounting for VAT on an erroneously received payment.” The first thing a buyer should do if they sent money by mistake is to contact the seller by phone, mail or email.

It is necessary to briefly outline the situation in a letter and ask for a refund of the entire amount. In this case, do not forget to attach:

- original details of the incorrect payment;

- personal bank details of the buyer – personal account number, bank card number. It is to them that the erroneously transferred funds will be returned. The payment instructions from the seller will sound exactly like this.

Not only the payer himself, but also the bank can inform about the receipt of an erroneous amount in the account. Bank employees provide an individual or legal entity with relevant information using:

- SMS notifications;

- letters;

- account statements.

If funds transferred to your bank account were received by mistake, you should:

- send a written notification to the bank about the problem;

- make a refund.

At the same time, it is also important to correctly indicate the appropriate purpose of payment when returning funds to the buyer.

Bank employees will deal with this issue. Also see

“Filling out a payment order in 2021: sample”

. If there is an agreement between organizations, the return of the erroneously transferred amount occurs upon termination of this document.

Other

nds_pri_vozvrate_avansa_pokupatelyu.jpg

Related publications

The changes that have occurred with the increase in the VAT rate since the beginning of 2021 have raised many questions regarding settlements between counterparties working with this tax. Let's figure out how to correctly document transactions related to the return of the transferred advance payment to the buyer.

VAT upon return of advance payment to the buyer

The main criterion for the transition period is the rule: regardless of the size of the tax rate accrued on the advance payment (in 2018 - 18%, in 2021 - 20%) for shipments made in 2021, VAT is taken into account in the shipping invoice at the rate of 20%. There are no other innovations regarding VAT on prepayments.

The algorithm of operations remains the same: upon receipt of the advance, the supplier charges VAT and pays it, and no later than after 5 days, registers a “preliminary (advance) invoice” in the sales book and issues it to the buyer. The advance is recorded in the reporting quarter when it was received, and is reflected in the VAT return on page 070 of section 3.

When shipping goods and materials as an advance payment, the seller has the right to reimburse the amount of tax from the budget. But if the contract is terminated or its provisions are revised, and only part of the goods is shipped or the delivery is canceled completely, then the seller is obliged to return the previously received advance payment (or the unused balance). Its return is also associated with a VAT adjustment, since the seller has the right to claim a deduction from the amount of the unused advance payment if the basis for non-fulfillment of obligations was the termination of the contract or a change in its terms. In this case, the supplier issues an adjustment invoice, recording the refund.

The supplier can deduct VAT when returning the advance payment to the buyer on the date of return of the advance payment. VAT is calculated as the amount of the advance received multiplied by the rate that was applied when receiving the advance payment. The fact of a payment return must be reflected in accounting and confirmed by a payment document. You can claim the right to a deduction within one year from the date of return of payment for a failed (or partially failed) transaction. VAT on the return of the advance payment to the buyer in the declaration is reflected on page 120 of section 3.

What are the dangers of erroneous VAT in a payment invoice for those who use the special regime?

The article from the magazine “MAIN BOOK” is current as of July 8, 2011 N.A.

Land law is associated with disputes between owners of property boundaries. Housing construction and land privatization.

Martynyuk, tax expert

You can find the texts of the court decisions mentioned in the article: It happens that a VAT evader receives money from a buyer, but this tax is highlighted in the payment slip by mistake.

At the same time, the buyer did not change the amount due from him, but simply determined the VAT by calculation and indicated its amount in the “Purpose of payment” field, or simply wrote: “Including VAT 18%.” Is this situation familiar to you? Then our article is for you. “Our company works on the simplified tax system. When transferring the advance, the customer mistakenly highlighted VAT in the payment order.

Somehow the tax office found out about this and made a decision that we must pay VAT to the budget.

In addition, our current account was blocked! At the same time, there was no inspection - at least we were not given an inspection report.”

Elena Vladimirova, chief accountant, Moscow You are not required to pay such VAT, since an invoice with the allocated VAT amount was not issued to the buyer; . However, you should not calm down and expect that you will easily explain everything to the tax authorities when they come to you with an on-site audit.

The thing is that the inspectorate will most likely see the VAT payment much earlier. And it’s good if the inspector starts by asking you for clarification. But, as practice shows, he can act differently, causing you a lot of trouble.

So, what could a buyer’s mistake result in and what needs to be done to prevent negative consequences? The inspectorate may discover that VAT is included in the payment order much earlier than it comes to you for an on-site inspection.

Tax authorities will see this during a desk audit of your declarations for the period in which the payment was made with the erroneously allocated VAT.

The fact is that, when checking your declarations, the inspectorate may request statements from the taxpayer’s bank accounts from the bank. The statement for each payment indicates, among other things, its purpose, the wording of which the bank transfers from the corresponding field of the payment order.

When analyzing statements, tax authorities specifically pay attention to payments including VAT.

After all, apart from an on-site inspection, this is the only way to identify cases of VAT filing by those who are not payers of this tax. Of course, the inspection can detect the VAT allocated in the payment invoice during an on-site or desk inspection carried out at the buyer’s place. However, in this case, the buyer will not have your invoice (since you did not issue it), and the inspector will have no reason to suspect you of filing VAT.

Having discovered a payment with VAT, the inspectors will decide that you issued an invoice to the buyer with the allocated tax, which means you had to pay its amount to the budget. In addition, tax authorities believe that if a VAT evader has issued an invoice with VAT, then he is obliged to file a return for this tax; ; , . True, the courts refuse to fine even those special regime officers who actually issued tax invoices for failure to submit a declaration; , .

Refund of advance payment to buyer in 2021: VAT

So, when returning an advance payment received in 2021, VAT in the supplier’s accounting is accepted for reimbursement on the date of return of the advance in its amount multiplied by 18/118.

When shipping goods and materials as an advance payment, VAT is deducted on the date of shipment, and the rate of tax accepted for deduction is equal to the rate at which the advance payment was paid.

The same rules apply if a partial refund of the advance payment is issued to the buyer. VAT is accepted for deduction on the date of shipment, the unused part of the advance payment is transferred to the buyer, the tax on it is reimbursed at the rate applied on the date of receipt of the advance payment. In the purchase book, code “22” is used to encrypt VAT when returning the advance payment to the buyer.

Refund to bank account

If there is no card , the consumer has the right to receive money to his current bank account. To do this, he indicates the details in the application:

- Owner's full name;

- TIN and BIC of the bank;

- Bank correspondent account number;

- Name of the office that services the account;

- Client's bank account number.

The refund mechanism is the same: the seller instructs the acquirer to transfer money to the buyer’s bank, which, in turn, credits it to the client’s account. Without a card, you can cash out at a bank branch.

Refund to the buyer: VAT on advance payment

The acquirer has the right to recover previously refunded tax from the prepayment, but it is important to remember that he is not obliged to deduct “advance VAT. Thus, the restoration of VAT when returning the advance payment to the buyer is relevant for him, unless the tax deduction has already been accepted.

Let us remind you that you can accept a deduction only if the following conditions are met:

the agreement between the parties provides for an advance;

the buyer has the following documents:

— invoice for advance payment;

— payment order confirming the transfer of the advance payment.

The buyer must declare the deduction in the quarter when all the specified conditions are met; it cannot be transferred to future reporting periods.

Payment by card - cash refund: is it legal?

Directive of the Bank of Russia No. 3073-U dated October 07, 2013 determines that legal entities and individual entrepreneurs do not have the right to return cash for goods paid for by bank card . According to the Federal Tax Service, such transactions are monitored and regarded as illegal cash withdrawals, terrorist financing, or violation of cash discipline.

The vast majority of stores are guided only by the instructions of the Central Bank and the Tax Service. At the same time, the law does not oblige the buyer to be a client of the bank. In this case, the seller’s refusal to refund on the basis of his lack of a card/valid account is a clear violation of consumer rights.

Therefore, the Central Bank clarified its requirements. Cash received from other customers cannot be given to the consumer as a refund for goods paid for by card . But you can transfer money from your current bank account to the cashier, and then pay with it.

All these operations - moving funds from the bank to the cash desk, returns - are documented for the Federal Tax Service. In the application, the consumer specifically indicates that he requires cash due to the lack of a bank card and account.

Postings when returning the advance payment to the buyer - VAT

Let's consider the reflection of transactions for the return of advance payments in accounting:

On December 10, 2018, Lama LLC, in accordance with the concluded agreement, received an advance from Rhythm LLC for the supply of furniture in the amount of 118,000 (including VAT 18,000). We will consider fulfilling obligations in several options:

The transaction was terminated by agreement of both parties on December 20, 2018, as a result of which the following entries were made in the parties’ accounting records:

Should I pay VAT when returning money to the buyer?

vozvrat.jpg

Transactions with non-cash money transfers are carried out through payment orders. The form of the document and the procedure for filling it out are regulated by the regulatory documents of the Bank of Russia (Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012). When generating a payment order, the correct details of the parties to the transaction, the amount of the transfer, VAT must be highlighted, and the essence of the transaction must be indicated. How the purpose of payment is formed when returning funds to the buyer, we will consider further.

On the deduction of advance VAT when returning the advance payment to the buyer (Zaitseva S.

A payment order, in the “Purpose of payment” field, the basis for the transfer will be indicated “Return of advance payment under supply agreement N.”, and can serve as such a document-based basis for deducting “advance” VAT from the amount that falls on the withdrawn advance payment. If in the “payment” for a refund to the buyer the details of letters demanding the return of previously transferred money and a reference to the reasons for withdrawing the advance (part of the advance) are indicated, claims from controllers will generally be minimized. The capital's tax authorities, explaining a similar issue, indicated: in the event of a change in the terms of the supply contract or its termination, as well as the return of advance amounts against the upcoming supply of goods, the amounts of VAT calculated by the supplier of such goods and paid by him to the budget from the specified advance amounts are subject to full deduction in the amount after the corresponding adjustment transactions are reflected in the accounting in connection with the return of the advance, but no later than one year from the date of its return (Letter dated March 14, 2007 N 19-11/022386).

Clause 4 art. 172 of the Tax Code of the Russian Federation specifies: deductions of tax amounts specified in paragraph 5 of Art. 171 of the Tax Code of the Russian Federation, are carried out in full after the corresponding adjustment operations are reflected in the accounting in connection with the return of goods or refusal of goods (work, services), but no later than one year from the date of return or refusal.

But the wording (you will agree) is such that there is no doubt: clause 4 of Art. 172 is directly related only to paragraph. 1 clause 5 art. 171. Then it is not clear whether the annual limitation on the deduction of “advance” VAT applies to the cases provided for in paragraph.

2 clause 5 art. 171. If yes, then from what moment should the time be counted?

The agreement to terminate the contract, drawn up on 9.2013 (later than the deadline for submitting “clarifications” with the declared deductions - June 2013), did not save the situation: the company’s arguments that the right to deduct amounts of “advance” VAT arose only from the moment of termination of the contract (from the date of drawing up the agreement), were not accepted by the cassation authority. The court issued a verdict: by claiming deductions in June 2013, the company missed the deadline established by law for claiming these deductions.

Incorrectly received funds are not included in the VAT base

The company's bank account received funds from a completely unrelated company. While correspondence was being conducted about the return of the erroneously transferred amount, the quarter came to an end.

In this regard, the accountant has a dilemma: should VAT be charged on this amount or not? OSNO LLC received money from the organization in the 3rd quarter, but as it turned out, it was transferred incorrectly. Do I need to take into account the amount of VAT on these funds in the declaration for the 3rd quarter if the money was returned only in October as it was transferred by mistake? If yes, should I issue an advance invoice?

— Button @ A reader of our forum fears that the tax office may file a claim if VAT is not calculated on the amount received into the account, since although the receipt was erroneous, the company has already spent this money on its own needs. Meanwhile, the discussion participants note that an erroneously received amount is not a reason for charging VAT and advise the accountant to stock up on documents proving that it was indeed a mistake.

Let us add that the Ministry of Finance also agrees that the Tax Code does not provide for an increase in the tax base by amounts not related to payment for goods (work, services) sold. In the letter, officials explained that funds mistakenly transferred to the organization's current account are not included in the VAT tax base.

Discussion of the issue of charging VAT on a non-existent advance takes place in the forum topic “”.

Protect yourself from tax audits.

from a former employee of the Department of Economic Crimes, and now a well-known tax consultant. Now for only 2750 rubles. You will learn to withstand the pressure of tax authorities, behave competently during interrogations and seizures, and protect yourself from criminals and subsidiaries. Lots of practical advice and a minimum of theory.

Training is completely remote, we issue a certificate. Hurry up to buy (). "". Categories: Subscribe to the “Morning Accountant”. Everything for an accountant. It's time to start a blog on Klerk.ru A blog is your new tool to talk about yourself.

Publish any content about your company.

Deduction of VAT from the seller when returning advances and goods

CORRECT OPTION OF CALCULATIONS At the time of provision of services: DEBIT 62 CREDIT 90-1 – 107,600 rubles. — revenue from the provision of services is reflected; DEBIT 90-3 CREDIT 68 – 16,414 rub. — VAT is charged on the sale of services; DEBIT 68 CREDIT 62 “Advance received” – 16,414 rubles. — previously accrued VAT was accepted for deduction in the part of the realized CREDIT 62 – 107,600 rubles. - offset of advance payment. At the time of transfer of the unused advance: DEBIT 62 “Advance received” CREDIT 51 – 10,400 rubles. — return of the advance payment to the buyer; DEBIT 68 CREDIT 62 “Advance received” – 1586 rubles. — accepted for deduction of VAT on the returned part of the advance. Please note that in practice a situation may arise when the seller returns the unused advance payment to the buyer for the upcoming delivery of goods, performance of work or provision of services. In this case, the return of the advance payment is not related to the termination of the contract.

As a rule, the amount of tax previously accrued upon receipt of this amount has already been taken for deduction. With a literal interpretation of the provisions of the Tax Code, in the case of a refund of an advance payment not related to a change or termination of a contract, a deduction of previously accrued tax is not provided. Therefore, there is a high probability of tax disputes related to the legality of deducting VAT previously accrued on payment amounts for upcoming deliveries of goods (performance of work, provision of services). In this case, we recommend that you reverse this tax amount in your accounting and submit an updated VAT return to the tax authorities.

In one of their latest letters, tax authorities explained the procedure for applying VAT deductions in the event that the receipt and return of advance payments are carried out in the same tax period upon termination of the contract. The organization must reflect in the VAT return the amount of tax on the prepayment received and in the same tax period, if there are documents confirming the return of the amounts of this prepayment, and subject to a change or termination of the contract, it has the right to deduct the corresponding amount of tax 5. Upon receipt of the prepayment, the seller ( the contractor) is obliged to charge VAT, including if the advance payment was received in non-monetary means (for example, by a third party’s bill of exchange). In paragraph 5 of Article 172 of the Tax Code, the condition for deducting VAT in the event of a change in conditions or termination of a previously concluded agreement with the buyer (customer) is the return of the corresponding amounts of advance payments. However, it is not indicated that such a return must necessarily be made in cash. In this regard, we can conclude that when an advance payment previously received by the seller is returned by a third party bill of exchange, the corresponding amount of VAT is subject to deduction, regardless of whether this third party bill of exchange was received as an advance from the buyer (customer) or otherwise. This conclusion is also confirmed by a number of court decisions (post. FAS MO dated June 20, 2005 in case No. KA-A40/5402-05, FAS PO dated March 28, 2005 in case No. A12-20637/04-C36, dated April 26, 2007 in case N A55-11874/06, dated January 15, 2009 in case N A65-9611/2008).

Do I have to pay taxes for an erroneous payment?

“Hello, dear editors! We recently discovered an erroneous payment on our current account. It turns out that it came to us from a buyer two months ago. The counterparty paid twice for the same one-time order. It is surprising, of course, that he did not immediately rush to look for his money.

And we, apparently, simply did not pay attention to him, so we did nothing.

We cannot offset the money against subsequent purchases, since we currently have no business with this buyer. So I’m trying to figure out taxes. Should this payment be included in the tax base for value added tax or not?

Will it somehow affect the income tax base? After all, controllers may consider that during these two months we used other people’s funds free of charge. Of course, we will return the money transferred in excess to the buyer, but tell me how to do it correctly.” Nadezhda Krinitsyna, accountant Opinion of colleagues Regarding VAT in case of an erroneous payment, I can advise the following.

Nadezhda needs to charge value added tax on the advance payment. Then resubmit the declaration that applies to the period for calculating VAT on the advance payment. Keep in mind that you will need to calculate penalties.

And only when you return the money, will you be able to accept the previously accrued VAT on the advance for deduction. Alina Bolshak, accountant at Valisk OJSC Colleagues’ opinion When unidentified money arrives in your current account, it must be “posted” to account 76 until the circumstances are clarified.

If after some time the owner has not been found, you need to draw up an accounting certificate and assign the amount to account 91.1 “Non-operating income.” Yulia Fedyaeva, chief accountant of Linko LLC Colleagues’ opinion Since Nadezhda did not return the payment, it became an advance payment with everyone the ensuing consequences. That is, with payment of VAT and penalties. It is unlikely that you will be able to get out of the situation any other way.

Even if you ask for a letter from that company retroactively stating that the money was transferred erroneously, the inspector will still have a question about why Nadezhda didn’t return it right away. Ksenia Sokhina, accountant at Chernoe Zveno LLC Colleagues’ opinion We once had such a situation - to a bank account an erroneous payment was received from an individual. We wanted to know the coordinates where we could return the money, but the payer’s address was not indicated on the receipt form.

I hope there will soon be fewer such erroneous payments. I heard that the bank now requires, in addition to the recipient’s receipt, to fill out another receipt with your full name. and passport data. The second document remains with them to identify the payer. Lyubov Nogotkova, individual entrepreneur Opinion of colleagues I think that only VAT will be charged on an erroneous payment.

You do not need to pay other taxes, such as Unified Social Tax.

Because income is proceeds from the sale of goods, works or services (Article 249 of the Tax Code). And if there is no longer any business relationship with the company that sent you the erroneous payment, then this money is not considered income. Evgeniy Danilov, accountant What do the tax authorities say? Yes, the situation is interesting.

VAT when returning goods from the buyer

The seller issues an adjustment invoice, guided by legislative acts, registers the transaction in the purchase book and makes corrections in accounting documents. An invoice is issued within five days from the date of registration of the return. Watch a video about adjustments from organizations on the simplified tax system. The majority of simplified companies operate without VAT due to the specifics of the special tax regimes applied.

The buyer can return the money or replace it with a similar product without defects. If the conditions regarding the range of goods were violated. Return of goods from the buyer with VAT to the supplier without VAT 506 of the Civil Code of the Russian Federation). Unless otherwise provided by the rules of the Civil Code of the Russian Federation on the supply contract, the provisions provided for in paragraph 1 of Chapter 30 “Purchase and sale of the Civil Code of the Russian Federation” apply to the contract for the supply of goods (clause

The basis of the “tax-free shopping” system (hereinafter referred to as TFS) is the procedure established in the European Union: if a person permanently resides outside the borders of the European Union, then when leaving it, you can receive a refund of the VAT paid when purchasing goods. The VAT refund mechanism is quite simple. When making a purchase of goods in a TFS store, they issue a special check, on which a customs stamp is placed when leaving the country, then you can receive money using this check. 2 However, keep some details in mind.

The amount is deductible by the seller within a year after shipment. By law, any transaction must be reflected in accounting journals (purchase book, sales book). When shipping, an entry is made in the accounting journals, and returns are also recorded in the journal.

The 1C program, when generating the tax that is payable to the budget, will itself make the necessary deductions. The main thing is to make all entries into the program in a timely manner.

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens.

As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs.

Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist. The convenience is that consultation with a lawyer is free and online. Where and how to get free legal advice?

is provided throughout the Russian Federation.

Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support. Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation.

Legal advice is provided free of charge online around the clock, regardless of weekends and holidays.

The response time from specialists on the website is up to 15 minutes.

There is no need to register on the Internet portal and you can send a personal appeal anonymously.

Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties.

Legal advice can be obtained in the following ways:

- use the online chat service; draw up a contact form for the feedback service; call the hotline.

Online legal consultation can also be carried out via email. The advantages of the services of our law firm are due to the professional attitude of our specialists to their work, the receipt of regular training courses, as well as participation in official forums. This ensures that individuals and businesses can receive advice that complies with current legal provisions.

Certificates are provided to citizens in the following areas: Resolving conflicts within the framework of family law. Termination of marital relations and their registration with the preparation of a marriage contract, assignment of alimony, distribution of child custody, as well as division of real estate.

Housing disputes. Most often, such conflicts are associated with defending interests within the framework of equity participation agreements, private construction and commissioning of houses. Renting housing, selling objects, buying an apartment on credit. This category of issues may include receiving a tax deduction and other housing benefits.

We recommend reading: How to calculate salary if you quit in January

Providing consultations on the Labor Code. A legal consultant will help you regain your job after illegal dismissal and protect you in case of refusal of employment. Resolving conflicts under employment contracts, as well as guaranteeing additional benefits to workers.

Refunds in case of non-delivery of goods, including VAT or not

In particular, it is customary to confirm any requirements with references to relevant regulations, contractual obligations, etc. The structure of the application must be strictly observed so that the supplier can understand without much difficulty what is required of him and for what reason. The text of the letter must contain: In general, the supplier must receive such requirements that cannot be interpreted in any way other than what is indicated in the letter. 3 Art. 168 NK).

There is discord between the non-payer and the non-payer. Thus, when goods are returned by a buyer who has not paid VAT, two options for VAT document flow are possible: - if only part of the goods is returned, the seller issues an adjustment invoice; - in the case of returning a full shipment of goods, an adjustment invoice is not issued, and in the purchase book the seller registers the original invoice that was issued when the goods were shipped to the buyer. If the product is not returned on the day of purchase, then the money is returned from the general cash register. Date of publication of the article: 12/08/2015 Plus, the parties to the purchase and sale agreement, due to the freedom of contract, are free to agree on the return of the goods for other reasons, for example due to the lack of demand for the product, etc. Thus, the seller has every right to deduction of “output VAT if the buyer returns goods previously purchased from him.

The only thing left to do, as they say, is to follow the procedure for applying this deduction. In particular, it is customary to confirm any requirements with references to relevant regulations, contractual obligations, etc. The structure of the application must be strictly observed so that the supplier can understand without much difficulty what is required of him and for what reason. In the case of making an advance payment for the ordered goods, the customer’s goal is precisely to return the funds. Should I pay VAT when returning money to the buyer?

Refund to e-wallet

In many online stores, you can pay for your purchase with money from an electronic wallet ( Yandex.Money, WebMoney, PayPal ) or cell phone balance. The refund procedure in such cases depends entirely on the seller’s internal rules.

For example, OZON transfers money not to a wallet, but to the buyer’s Personal Account in the system. From there they can be withdrawn to a bank card. Other stores make a direct transfer from their wallet to the customer's wallet.