March 21, 2021 Benefits

Every woman who has a social package has the right to paid maternity leave - a vacation period that is allocated for pregnancy and childbirth.

The amount of benefits paid during these periods depends on the woman’s salary accruals during her working life.

How is the minimum amount of state compensation for the period of pregnancy and birth of a child calculated and how much is it?

Maternity leave in 2021: new law, payments for men and women.

Maximum amount of payments for the first child.

Providing maternity leave in 2021, example of calculation using an online calculator. Maternity leave, receiving payments and benefits during maternity leave are topics that are always of interest to expectant mothers. Despite the fact that the general principles of legislation on this issue have been in force for many years, new nuances arise every year that need to be taken into account both by a pregnant woman and by employees of the accounting department and departments of the Social Insurance Fund.

FOR YOUR INFORMATION

The main questions that are asked on this topic are what maternity leave consists of, how it is formalized, its length, who is entitled to receive benefits and in what amounts, and so on.

How much is charged if a woman does not work?

Unemployed women have fewer rights regarding child benefits. This also applies to maternity payments. Let's consider several situations when an unemployed pregnant woman is entitled to benefits under the BiR:

- during pregnancy, the employee was dismissed during the liquidation of the organization, stopped working as an individual entrepreneur, or completed private practice within the last year. The payment amount is 655.49 rubles;

- the woman is undergoing full-time training in organizations of higher, additional professional or vocational education. The amount of the benefit is determined by the amount of the scholarship received.

If at the time of maternity leave a woman was registered with the Employment Center, then on the basis of a certificate of incapacity for work at 30 weeks of pregnancy, they stop paying her unemployment benefits. This is recorded in paragraph 4 of Article 35 of the Law of April 19, 1991 No. 1032-1 “On Employment in the Russian Federation.” During the BiR period, a woman loses her unemployed status.

To avoid such a situation of being unemployed before planning a pregnancy, it is better to get any job, even a low-paying one. Then the maternity payment will be calculated according to the minimum wage and will amount to 51,919 rubles in 2021.

Maternity leave in 2021: new law

ATTENTION

In 2021, no significant changes were made to the texts of the legislation on maternity leave. However, current circumstances must be taken into account when calculating benefits.

When calculating maternity benefits, variable indicators such as:

- Minimum wage, i.e. legally established minimum wages that every employer is required to pay;

- salary limits taken into account for calculating benefits;

- a list of years for which earnings are taken into account.

The listed data changes annually and even more often.

- So in 2021, the minimum wage changed twice - as of January 1 and July 1, 7600 and 7800 rubles, respectively. In 2018, it is planned to increase the minimum wage to 9,489 rubles. Starting from 2021, it is envisaged that the minimum amount will come into line with the subsistence level, and this equality will be maintained in the future.

- Similarly, the maximum (limit amount of remuneration) that is taken into account when determining maternity benefits has increased. If in 2021 it was 718 thousand rubles, then in 2021 it was 755 thousand rubles. In plans for 2021, this amount will increase to 991 thousand rubles.

- In 2021, to calculate the salary fund, salaries for 2021 and 2021 are taken into account, i.e. two full calendar years preceding pregnancy.

If a woman works several jobs

Law No. 255-FZ considers several situations when a woman, at the time of going on BIR leave, works part-time in several organizations. There are several options when in the previous 2 years she:

- worked in the same organizations. Then the benefit is assigned to all employers. For example, Vaskova O. G. in 2021, 2021 worked at Igra OJSC and part-time at Nika LLC and Kontur LLC. The salary was: 30,000 rubles, 15,000 rubles and 23,000 rubles. In 2021, she continues to work in the same places, and in June she is going on vacation for the BiR. The benefit is calculated by each employer:

OJSC IGRA: 30,000×24/730×140 = 138,082.19 rubles.

Nika LLC: 15000×24/730×140 = 69041.10 rubles.

Kontur LLC: 23000×24/730×140 = 105863.01 rubles.

Total Vaskova O.G. will receive: 138082.19+69041.10+105863.01 = 312986.30 rubles;

- was employed by other employers. Then the benefit is calculated and paid at the last place of work of the employee’s choice. Let's take example data for 2017-2018, but in 2018 Vasyutkina changed her main place of work to OJSC Fix with a salary of 40,000 rubles, and part-time to LLC Klim with a salary of 11,000 rubles. Income at Fix OJSC is higher, so it is more profitable for a woman to submit income certificates there for 2016-2017, while Igra OJSC, Nika LLC and Kontur LLC need certificates of non-accrual of benefits in those places. Benefit calculation:

(40000+30000+15000+23000)×24/730×140 = 497095.89 rubles, which is more than the maximum amount - 302054.79 rubles.

The benefit will be paid in the amount of the upper limit - 302,054.79 rubles;

- was employed by both current and other employers. Then the benefit can be paid for all places of work, or for one of the last places of the employee’s choice. Here the woman compares which calculation has the larger amount. When benefits are calculated for all places of work, the upper limit is set for each place of work, and not as a cumulative amount, as in the second case. The example shows that it is more profitable for Vasyutkina to book a vacation with all employers.

When choosing one of the employers as the only source of payment, the woman must provide him with certificates of income from other places and that benefits were not assigned or paid to her.

For example, Tomakhina I.K. in 2021 has had her main place of work at Phoenix LLC since 2010, and from 2021 to the current moment she has been working part-time at Pristan LLC and Kremen LLC. Each employer will pay her benefits, based on the rule that total income for 2017-2018 should not exceed the maximum amount of insurance contributions. In this case, income from other places of work is not taken into account.

Maternity leave in 2021. At what stage of pregnancy does maternity leave begin?

The period of pregnancy from which a pregnant woman can go on maternity leave is calculated by a gynecologist. He also writes out sick leave as the main document giving grounds for starting vacation.

This event occurs:

- for most expectant mothers upon reaching 30 weeks from conception;

- for mothers with multiple pregnancies (twins, triplets, etc.) at 28 weeks;

- in accordance with the list of benefits for victims of Chernobyl, leave is provided for 27 weeks.

ATTENTION

The exception is early birth, which occurs between 22 and 30 weeks, i.e. before the official date of maternity leave. In this case, sick leave is provided from the day of birth for the entire vacation period.

Duration of maternity leave in 2021

The total duration of maternity leave for pregnancy and childbirth consists of two parts (before and after childbirth), which are added up and determined as the total number of days.

The duration may vary due to living conditions or the complexity of childbirth, so these nuances must be taken into account.

Duration of OBiR

| Payment terms | Total | Before giving birth | After childbirth |

| For most | 140 | 70 | 70 |

| In case of complicated labor | 156 | 70 | 86 |

| When more than one child is born | 194 | 84 | 110 |

| If a multiple pregnancy is detected during childbirth | 194 | 70 | 124 |

| For women living in the zone of eviction due to the Chernobyl disaster | 160 | 90 | 70 |

| For women living in the area of eviction due to the Chernobyl disaster with complicated childbirth | 176 | 90 | 86 |

| For women living in the zone of eviction due to the Chernobyl disaster upon the birth of twins | 200 | 90 | 110 |

All listed periods of maternity leave are indicated on the sick leave certificate. A pregnant woman can voluntarily shorten her vacation, i.e. leave later than indicated in the documents, but due to this, the vacation dates do not move forward. In addition, social benefits are not paid for those days for which wages are accrued.

Maternity leave in 2021: new law. Step-by-step registration instructions

Registration of maternity leave is a two-way process in which the pregnant employee and administration employees (HR managers, accounting, management) take part.

The expectant mother is obliged:

- at the beginning of pregnancy, register with a gynecologist;

- upon arrival of 30 (28 or 27) weeks, obtain sick leave and certificates from your doctor;

- obtain a certificate from the bank about the current account number for transferring benefits;

- make copies of your passport;

- submit to the personnel, accounting department or secretary the collected documents in the original and a copy of the passport;

- write an application for leave indicating its start and duration;

- indicate in the application your desire to receive maternity benefits;

- list the attached documents;

- read the text of the order for granting leave;

- Do not go to work from the specified date.

Employees of the enterprise responsible for processing maternity leave are obliged to:

- receive documents and a statement from an employee going on maternity leave;

- draw up and sign a vacation order;

- familiarize the applicant with it;

- calculate benefits;

- draw up a calculation note in form T-60, on the basis of which special payments are made;

- transfer it to the card or bank account specified in the application from the company’s funds;

- draw up documents in the prescribed form to reduce transfers to the social insurance fund by the amount of funds paid;

- prepare a report on the expenditure of the allocated amount in a timely manner.

NOTE:

After giving birth, the woman in labor submits to the company a copy of the baby’s birth certificate. If circumstances arise to extend the leave, for example, complicated childbirth, then an additional sick leave sheet is submitted and the entire procedure with writing an application, calculating and paying benefits is repeated for additional days.

After the expiration of the leave period, mommy has the right:

- write an application for leave to care for a newborn child;

- give up vacation and go to work, and all documents for vacation and benefits will be completed by another family member, for example, the child’s father or grandmother.

IMPORTANT

It is not allowed to interrupt vacation at the initiative of the employer and call a pregnant or postpartum employee to work for production reasons.

Payment

Who pays?

Vacation for all these days, including weekends and holidays, is paid at the expense of the Social Insurance Fund. Moreover, it does not matter what taxation regime the company is in. Payments are made by the employer, and then the FSS (social insurance) reimburses him.

In those regions where the Social Insurance Fund pilot project operates (there are now more than 20), benefits will be reimbursed directly to employees from the Social Insurance Fund. In this case, the employer helps the employee collect all documents.

When I get?

Maternity benefits must be calculated and accrued no later than 10 calendar days from the moment the employee applied for it. The basis is the original sick leave certificate. The benefit is paid on the next day when the company pays wages, and in full. That is, there is no need to “split” it by month.

Necessary documents for maternity leave in 2018

The list of documents that must be presented at the enterprise in order to obtain the right to maternity leave is limited by law.

In fact, this list only includes sick leave. To make it easier to receive benefits, an employee can provide information about an open account or card. If the applicant is sure that the account number and other mandatory bank details are correctly indicated in the application, then she is not required to document this information.

In addition, in the Russian Federation there is a system of rewarding women who register with gynecology in a timely manner, before 12 weeks. Therefore, along with a sick leave certificate, a pregnant woman can receive from the hospital and present to the enterprise a certificate stating that she was registered at up to 12 weeks of pregnancy. Providing such a certificate in 2021 entitles you to receive a one-time payment in the amount of 613 rubles 14 kopecks. This amount, like other benefits, is indexed annually in parallel with the growth of inflation.

ADDITIONAL INFORMATION

Another mandatory document must be submitted to those employees who, over the previous two years, have worked fully or partially at another company. This document is a certificate of income. If several jobs have changed within two years, then it is in the applicant’s interests to provide certificates from all employers.

Basis for calculating maternity benefits

To receive maternity benefits, the following documents are required (clause 5, article 13 of Federal Law No. 255 of December 29, 2006):

- information about the insured person. They can be requested upon employment or during the period of employment. Employees are required to provide information in a form approved by the Social Insurance Fund in the form of a paper or electronic document;

- a paper “maternity” sick leave or an electronic sick leave number, which contains the corresponding disability code;

- a certificate of income received in the pay period from another employer;

- application for changing years in the billing period (if necessary).

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

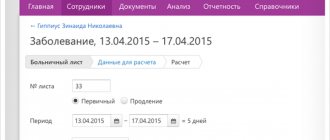

Sick leave

The main document ensuring the right to maternity leave is a maternity sick leave, which is issued at the antenatal clinic at the place of registration. The sick leave form was approved in 2011 (MSZR order No. 624n) and is valid to this day.

All columns on the sick leave sheet are filled out by the staff of the antenatal clinic. A woman receiving a document in her hands has the right to check the correctness of its completion, in particular such positions as:

- FULL NAME,

- date of issue,

- date of birth,

- name of place of work,

- dates of sick leave (start and end),

- presence of a mark on early registration,

- presence of a doctor's signature and seal.

Despite the fact that the medical institution is responsible for the correctness and completeness of filling out, it is in the interests of the maternity leaver that all data on the sick leave sheet is immediately indicated correctly.

FOR YOUR INFORMATION

In 2021, the practice is to switch to electronic sick leave certificates, which health authorities will independently send to employers without handing them over to patients.

The nuances of drawing up an application for maternity leave

An application for maternity leave has a standard form and consists of the same details and components as any application.

The woman making the application must indicate the following information:

- addressee (employer, indicating the position and full name of the manager);

- your data, including full name and position or place of residence for non-workers;

- state the reasons for the application (going on leave, paying maternity benefits and incentives for early registration);

- indicate the account for transferring accrued amounts;

- list the attached documents (sick leave, certificates from consultation and from previous places of work, and so on);

- Don't forget about the signature and date.

An application for maternity leave and other documents can be submitted not only in person, but also via regular mail or email.

From what sources is the benefit financed?

One should not assume that benefits are some kind of state grace. This benefit is financed from the Social Insurance Fund, which is replenished from the funds of working Russians. A fairly significant amount is withheld from the income of each working resident of the country, which is sent to this fund. The system is built in such a way that we don’t notice it and don’t think much about it, but without such contributions our income would be significantly higher.

Thus, the woman earned herself enough for this leave, which is why the formula for calculating benefits is based on how actively payments were made to the fund in the last two years.

Payment for maternity leave in 2021

In 2021, all women who have a place of work or study have the right to receive maternity leave, regardless of other circumstances, such as:

- work experience in one or different organizations;

- place of work or service;

- presence of Russian citizenship;

- age;

- Family status.

This right is enshrined in Articles 255 and 256 of the Labor Code of the Russian Federation. Persons officially registered as unemployed are also entitled to receive benefits.

The timing of vacation and its duration are the same for everyone, with some exceptions.

The grounds for calculating maternity leave payments differ for different groups of women, depending on their place of work, as follows:

- those working under an employment contract (permanent or temporary) receive maternity benefits based on the total amount of earnings for the two previous years;

- military personnel - in the amount of monetary allowance;

- students - in the amount of the scholarship.

In case of insufficient work experience (up to six months), amounts are paid based on minimum wage rates.

Simultaneous payments are not allowed:

- social insurance funds for sick leave and wages;

- two types of social benefits, for example, child care and maternity benefits.

On the other hand, if a woman works in several places at the same time, then she is provided with vacation and vacation pay is paid by all employers, regardless of their number.

Rights

Annual vacation due!

According to Art. 260 TK. “Before or immediately after maternity leave, or at the end of parental leave, a woman, at her request, is granted annual paid leave (28 days), regardless of her length of service with a given employer.” You can calculate your vacation here.

Moreover, if a woman has less than 28 days of vacation time, vacation pay is given to her in advance. These vacation pay are either included in the vacation period or returned upon dismissal.

See also: Sample application for adding another leave to maternity leave.

Where to go if maternity benefits were accrued incorrectly?

First try to resolve this issue with an accountant. If it doesn’t work out, then contact the labor inspectorate or the Social Insurance Fund. Recalculation can be requested within 3 years.

Absenteeism and dismissal

It is impossible to dismiss a pregnant woman from an existing organization (and individual entrepreneur) (Article 261 of the Labor Code of the Russian Federation) at the initiative of the employer. Also, it is impossible for such a woman to be given absenteeism, because Pregnancy is always a valid reason for not showing up for work.

If a maternity leaver was fired during the liquidation of the organization

You need to take certificates and go to the social security authorities (RUSZN) - they will continue to pay benefits in full, as before dismissal.

Employees of organizations in which bankruptcy proceedings have begun can apply directly to the Social Insurance Fund to receive sick leave or maternity benefits (Federal Law of March 9, 2016 No. 55-FZ).

Is it possible to go back to work early?

An employee has the right to go to work before the end of maternity leave. However, you cannot receive benefits and wages at the same time (there may be claims from the Social Insurance Fund). Therefore, you can only leave unofficially.

Fixed-term employment agreement (contract)

If the employee finds herself in a situation and a fixed-term employment contract was concluded with her, then its validity is extended until the employee returns from sick leave for pregnancy and childbirth (maternity leave). They cannot fire such an employee earlier.

If a student is on maternity leave

Women studying full-time in educational institutions of primary vocational, secondary vocational and higher vocational education (HEIs), and in institutions of postgraduate vocational education have the right to maternity benefits. This benefit is paid to student mothers in the amount of the scholarship established by the educational institution (Resolution of the Government of the Russian Federation No. 865 of December 30, 2006).

How to calculate maternity leave pay in 2021?

To calculate the amount to be paid when applying for maternity leave in 2021, it is necessary to make rather complex calculations.

Before you begin calculations, you need to have the following information:

- the amount of the vacation worker’s salary for the previous two years (2016 and 2017);

- the number of days in these two years (365+365=730);

- the presence and number of days that must be subtracted from the total (sick days, leave without pay, pregnancy);

- the amount of the minimum wage (minimum wage);

- maximum social benefit rates;

- total work experience.

To calculate the amount, first calculate the average daily earnings, i.e. the total amount of income is divided by the number of days (for a total of 2 years minus those excluded).

The next step is to multiply the average daily amount by the number of vacation days indicated on the sick leave.

When calculating, there are the following nuances, which take into account not wages, but other initial data.

- If the amount received for the month is less than the minimum wage established as of the current date, then vacation pay increases to this indicator (7800 at the end of 2021).

- if the work experience is insignificant, calculations are not made, but the minimum wage rates are taken immediately;

- with high salaries, they must be checked against the maximum indicators of social payments (in 2021 - 755,000 rubles per year) and vacation pay must be accrued within the specified limits.

You can do the calculation yourself using an automatic calculator. It is enough to enter the total amount of salary for 2 years and count the number of days to get the exact amount to be paid.

The FSS portal contains a calculator with which you can independently calculate the amount of the certificate of incapacity for work for pregnancy and childbirth, as well as the amount of child care benefits. To do this you need to know:

- period of validity of sick leave;

- wages for the previous 2 years (2015 and 2016);

- number of excluded days for each year;

- number of children, including those born earlier (for care allowance).

The FSS calculator takes into account other regional features, including regional coefficients

After entering the required data, an automatic calculation is made, which can be viewed on the screen or printed.

What are maternity benefits?

Maternity pay is a one-time benefit for pregnancy and childbirth (at least 58,878 rubles in 2021). Maternity leave is issued by the Social Insurance Fund on sick leave for a period of 140 to 194 days. For the calculation, take the average earnings for two calendar years. Only the mother can receive maternity payments. Such sick leave is given immediately (and paid in one amount) for the entire period and is not divided into parts. Minimum (according to the minimum wage) - 58,878.25 (from January 1, 2021); RUB 55,830.6 (from January 1, 2021); Maximum - 340,795 (in 2021); 322,191.80 (in 2021).

Duration

- 140 days (70 days before the expected date of birth and 70 days after) for uncomplicated pregnancy;

- 156 days (70+86), if the birth was complicated or the baby was born;

- 156 days (0+156) premature birth (between 22 and 30 obstetric weeks).

- 194 days (70+124), if several children are expected to be born;

- 194 days (84 days before the birth of the child and 110 after), if several children unexpectedly appeared;

- 160 or 176 days of maternity leave in the Chernobyl zone or in another contamination zone;

Mothers entitled to maternity benefits during the period after childbirth have the right, from the day of birth of the child, to receive either a maternity benefit or a monthly child care benefit (255-FZ Article 11.1).

Deadline for maternity leave

Mothers most often go on sick leave for pregnancy and childbirth at 30 weeks. They leave at 28 weeks if the birth of several children is predicted.

Benefits are calculated based on the date of maternity leave. It is especially important if sick leave opens at the end of December or beginning of January. The exact date of maternity leave is determined solely by the doctor on the sick leave. No amount of statements can correct this date.

Calculation of maternity benefits

To calculate maternity leave, we need to calculate three numbers:

- Minimum

- Calculation of average earnings for 2 years (according to calculations)

- Maximum

Minimum > By salary > Maximum

Maternity benefits will be paid to you according to your average earnings, but not less than the minimum and not more than the maximum.

Minimum calculation

The minimum amount of maternity leave is calculated very simply. Here is an example of the minimum for standard conditions in 2021:

Minimum wage on the day of opening of sick leave (12,792) × 24 (months) ÷ 730 (calendar days for 2 years) × 140 (duration of maternity leave) × 1 (rate at work) × 0% (regional coefficient) = 58,878.25 ₽

The regional coefficient can be viewed here (all regions). To calculate the minimum, always take 730 days

| Minimum maternity leave (duration 140 days) | ||

| Sick leave opening date | Minimum maternity leave * | |

| Full rate | Part-time | |

| From 07/01/2017 to 12/31/2017 | 35901,37 ₽ | 17 950,68 ₽ |

| From 01.01.2018 to 31.04.2018 | 43675,40 ₽ | 21 837,70 ₽ |

| From 05/01/2018 to 12/31/2018 | 51380,38 ₽ | 25 690,19 ₽ |

| From 2021 | 51918,90 ₽ | 25 959,45 ₽ |

| From 2021 | 55 830,6 ₽ | 27 915,3 ₽ |

| From 2021 | 58 878,25 ₽ | 29 439,13 ₽ |

| Unemployed | 2861,32 ₽ | |

*They cannot pay less than the minimum amount. If the experience is less than 6 months, then only the minimum amount will be paid.

Calculation of average earnings

Let's give an example of calculating average earnings Uncomplicated singleton pregnancy (140 days) | Income for 2 years 480,000 rubles | 6 days of illness (725 days):

480,000 (salary for 2 years) ÷ 725 (calendar days) = 662.07 ₽ (average daily earnings) 662.07 (average daily earnings) × 140 (duration of sick leave) = 92689.8 ₽

Experience does not affect the calculation. There is only one rule - the experience must be more than 6 months, otherwise the minimum.

Salary and income

The salary is taken in full (including personal income tax). Income also includes: vacation pay, official bonuses, business trips (minus sick leave).

Amounts of sick leave, maternity and child benefits are never included in maternity calculations.

There are maximum income limits for each year. Income cannot be higher than this amount (you will not be able to enter), because... he does not pay contributions to the Social Insurance Fund. For example, for 2021, such income cannot exceed 912,000 rubles.

Years to calculate

They take the two years preceding the year of maternity leave (in 2018, this is from January 1, 2021 to December 31, 2021). At the same time, for choosing years, the start date of sick leave is important, but when of birth is not important. You can only take a full year from January 1 to December 31. You cannot choose two identical years. It is impossible to take into account the year of maternity leave.

For example, if a woman goes on maternity leave in 2021, then she will not be able to take 2021 into account under any circumstances.

If you were on maternity leave in the reference year(s)

for a child or on maternity leave (at least one day), then, if desired, you can replace the year (one year) with the previous year (year) (see statement below) You cannot replace years for other reasons (for example, if you did not work). In this case, you can only replace it with the previous year. You cannot take any years for replacement.

For example, a woman goes on maternity leave in 2021. Before that, she was on maternity leave for 3 years, 2015-2018. Then you can take any 3 years from 2013 to 2021. For example: 2014 and 2016.

What if you're on vacation all year?

If a woman has been on maternity leave all year, then you can safely take this year, because... it does not affect the calculation (all its days are excluded). But you can’t take two such years. One must include salary and income. Otherwise - minimum.

Is it possible to take only one year?

In the case described just above, one year is actually taken, because Maternity days are excluded completely. But the calculation always takes two years.

Days for calculation

The fewer days the better. But you can’t take zero. If there are no days, the calculation is “minimum.”

Take 730 or 731 (the number of calendar days in two years). But there are exceptions...

When calculating maternity and child benefits, the number of days 731 can be reduced. When calculating, it is necessary to exclude: 1) periods of temporary incapacity for work (regular sick leave), maternity leave (maternity leave), and parental leave; 2) the period of release of the employee from work with full or partial retention of wages in accordance with the law, if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages for this period (downtime due to the fault of the employer, etc.).

No other cases can reduce the number of days. And if, for example, a woman worked for only a year out of two calculation years (a month, a year and a half - it doesn’t matter), and the rest of the time she was simply unemployed, then they still divide by 730. And this reduces the calculation.

Maximum

The amount of the maximum depends solely on the selected two years and the duration of maternity leave. Example of calculating the maximum for the selected years 2021 + 2021. Duration 140 days:

865,000 (maximum amount for Social Insurance Fund in 2019) + 912,000 (maximum amount for Social Insurance Fund in 2020) = 1,777,000 (maximum earnings for 2 years) 1,777,000 (maximum earnings for 2 years) ÷ 730 (calendar days for two years ) = 2,434.25 ₽ (average daily earnings) 2,434.25 (average daily earnings) × 140 (duration of maternity leave) = 340,328.80 ₽

This maximum can only be applied by those who go on maternity leave in 2021, because 2019+2020 can only be chosen in 2021.

| Maximum maternity leave (duration 140 days) | |

| Selected years | Maximum |

| 2021+2020 (from 2022) | RUB 360,164 |

| 2020+2019 (from 2021) | RUB 340,328.80 |

| 2019+2018 | 322 191,80 ₽ |

| 2018+2017 | 301 095,20 ₽ |

| 2017+2016 | 282 493,40 ₽ |

| 2016+2015 | 266 191,80 ₽ |

| 2015+2014 | 248 164,00 ₽ |

| 2014+2013 | 228 603,20 ₽ |

| 2013+2012 | 207 123,00 ₽ |

| 2012+2011 | 186 986,80 ₽ |

| 2011+2010 | 167 808,20 ₽ |

| 2010+2009 and earlier | 159 178,60 ₽ |

Maternity leave in 2021 for 2 and 3 children

The rules for calculating payments when going on maternity leave are the same, regardless of how many children there are in the family, i.e.

- sick leave is paid based on the salary for the previous two years;

- one-time benefit for early registration.

NOTE:

After a mother takes leave to care for a child up to 3 years old, she is paid a one-time allowance in connection with the birth of a child, and then until the date when the child turns 1.5 years old, a monthly allowance is calculated in the amount of 40% of the average amount. wages.

The difference in the accrued amounts arises if her salary is less than the officially approved minimum wage. In this case, the benefit is calculated in a fixed amount and is in 2021 (after July 1, 2017):

- for the first child – 3120 rubles;

- for each subsequent baby – 6131.37 rubles.

If a mother has older children and is on leave to care for both children, then the benefit amounts are added up.

ADDITIONAL INFORMATION

A similar situation arises when twins are born, i.e. for the first child, 40% of the salary is accrued, for two - 80%, for triplets and more children - no more than 100% of the accrued salary for the 2 full years preceding maternity leave.

How is it paid if the woman is an individual entrepreneur?

BL benefits are paid to those persons who made contributions to the Social Insurance Fund: through the employer or independently. According to Article 4.5 of Law No. 255-FZ, certain categories of women can enter into voluntary relationships under compulsory social insurance in case of temporary disability associated with motherhood and childhood. These include:

- lawyers;

- individual entrepreneurs;

- members of peasant farms;

- those engaged in private practice (notaries, cadastral engineers, etc.);

- members of tribal communities of indigenous peoples of the North.

For example, if a woman with an individual entrepreneur knows that she will go on maternity leave by the end of 2020, then in 2021 she submits an application to the Social Insurance Fund and pays insurance contributions to the budget of the territorial Social Insurance Fund by December 31 of the current year, starting from the year the application was submitted. — 2021. At the time of the BIR leave, the individual entrepreneur must have paid insurance premiums for 2 years.

The contribution amount is calculated as follows:

Contribution = (minimum wage × Insurance premium rate) × 12,

Where

| The minimum wage in 2021 is 12,130 rubles. |

insurance premium tariff according to clause 2, clause 2, art. 425 of the Tax Code of the Russian Federation - 2.9%.

Contribution 2021 = (11,280 × 2.9%) ×12 = 3925 rubles.

Contribution 2021 = (11163 × 2.9%) × 12 = 3884.72 rubles.

If the individual entrepreneur fulfills the conditions for the voluntary transfer of contributions, then the maternity benefit will be calculated from the minimum wage approved for the year the insured event occurred. After May 1, 2021, the benefit is calculated as follows:

11280 × 24 / 730 × 140 = 51,919 rubles,

where 11280 is the minimum wage,

24 - number of months in 2 years,

730 - fixed number of calendar days per billing period,

140 is the number of vacation days during a normal pregnancy.

The ratio of funds spent on mandatory contributions for 2021 and 2017 to the amount of maternity payments ranges from 12.6 to 12.8%, no more than 13% for 2 years.

The law prohibits making retroactive contributions to the Social Insurance Fund. This means that if a woman individual entrepreneur became pregnant in the current year and during the same period entered into a voluntary relationship with the Social Insurance Fund, then she cannot pay contributions for the previous period. This means that the main condition for calculating benefits from the extra-budgetary fund is not met.

Is maternity leave included in the length of service for calculating a pension?

There are special rules for calculating the length of service required when calculating pension payments.

There are also certain restrictions regarding maternity leave.

- Thus, the period of maternity leave is fully included in the length of service.

- The periods during which the woman was on children's leave for up to one and a half years are taken into account. But there is a time limit according to which the total amount of time spent on vacation cannot be more than 6 years, i.e. only to care for 4 children.

- Periods of children's leave for a period of 1.5 to 3 years are excluded from social service when calculating pensions.

In 2021, a draft law on full payment and the inclusion of three years of vacation in the work experience was submitted for consideration, but no decisions have been made in this area to date.

Maternity leave in 2021 for father

The definition of maternity leave usually refers to two different types of leave - maternity leave and child care leave.

There are certain differences between the rules for granting these leaves. The main one is the circle of people who are granted vacation days.

Only a mother who has independently given birth or adopted a child under 3 months can receive sick leave for pregnancy and childbirth.

At the same time, a wider range of people are entitled to care leave. This could be a father, grandmother or other relative. The family independently determines the person who will care for the baby.

ADDITIONAL INFORMATION

Traditionally, these functions are assigned to the mother, but there are often cases when a woman receives the largest salary, or has significant prospects in a career, scientific or creative activity. In this case, a more economically advantageous option is chosen, and the father, or less often the grandmother, goes on vacation.

To apply for such leave, it is necessary to provide a certificate from the mother’s place of work stating that she did not take advantage of her right to leave.

There are options when, at the birth of twins, parental leave for each child is taken out separately by the father and mother.

Maternity leave for men if the wife does not work

In cases where a woman does not work, the father can receive part of the benefits due in connection with the birth of a child.

First of all, this concerns a one-time payment. If the mother does not have a place of work, the father must collect a package of documents confirming the birth of the child and the mother’s lack of income, including:

- birth certificate;

- wife's work record;

- a certificate from the employment fund confirming that she is not registered;

- a certificate from the Social Insurance Fund confirming that the mother has not applied for benefits;

- a certificate confirming that the father lives in the same place as the child.

All of the above documents are attached to the application for benefits, which is submitted at the father’s place of work. Application deadlines are limited, i.e. it must be submitted before six months have passed since the birth of the child.

Also, the father can similarly take out parental leave in his name or take advantage of other benefits due to the mother of a small child (for example, working part-time).

ATTENTION

Maternity leave is not issued to fathers who are military personnel, except for those who have entered into a contract. A military father can receive leave in the event that the mother has died, abandoned the child, or for other reasons the father is raising the child on his own. However, this leave is provided only for 3 months.

Situations

What if you have two jobs?

I. 1 employer for more than two years and 2 employers for more than two years. If an employee worked in several places at the time the maternity leave was issued, and in the previous two years she worked all the time in the same place, then maternity payments are made for all places of work. Monthly maternity benefit is paid only to one place of work of the employee’s choice and is calculated from the employee’s average earnings.

II. 1 employer for less than two years and 2 employers for less than two years. If an employee at the time of issuance of maternity leave worked for several insurers, and in the previous two worked for other insurers, then all payments are assigned to her by the employer at one of the last places of work of the maternity leaver’s choice.

III. 1 employer for more than two years, and 2 employers for less than two years If the employee at the time of issuing maternity leave worked for several insurers (employers), and in the two previous years she worked for both those and other insurers, then maternity payments can be made both for one place of work, from the average earnings for all employers, and for all current employers, from the average earnings at the current place.

Although, according to the judges of the Moscow District, the resolution of May 11, 2021 No. F05-5284/2016 states that a maternity leaver should in any case receive two benefits (clause 2 of Article 13 of the Federal Law of December 29, 2006 No. 255-FZ ).

If your lifetime experience is less than six months

If your total insurance period is less than 6 months, then you will receive maternity leave - 1 minimum wage rubles per month. Also, if during the calculations the amount turned out to be less than the calculation according to the minimum wage, then the calculation according to the minimum wage is taken (see above in the table).

The minimum wage in all regions is the federal one. No surcharges. The minimum wage from January 1, 2021 is 12,792 rubles.

What if I work part time?

If an employee works part-time, the minimum wage for minimum maternity leave must be recalculated. Let's say, for a part-time employee, the minimum wage will be 6,396 rubles. (RUB 12,792: 2).

If a maternity leaver is unemployed?

Unemployed women should contact the local branch of RUSZN (district department of social protection of the population, also known as RUSZN, also known as Paradise SOBES). The payment is made by the territorial body of the Social Insurance Fund that assigned the benefit. You can also register with the employment center and receive unemployment benefits.

If twins were unexpectedly born or adopted

If a maternity leave was initially issued with sick leave for 140 days, but she unexpectedly gave birth to twins, the sick leave (maternity leave time) should be extended by 54 days. Not only pregnant women can count on maternity benefits. This right is also given to women who decide to adopt a baby under three months of age. They are paid benefits for the period from the date of adoption until the expiration of 70 days from the date of birth of the child. If a family takes two or more children, then the following period is paid: from adoption to 110 days from the date of birth of the children.

If I go on vacation before my maternity leave, will this affect my maternity benefits?

It will have an effect, but only slightly - vacation pay is included in the calculation, but usually they are almost equal to the salary.

If the maternity leaver had no income during the billing period

The calculation includes all payments for all places of work for the last two calendar years for which contributions to the Social Insurance Fund of the Russian Federation were accrued. But in practice, it is quite possible that the employee had no income during the estimated two years. In this case, the benefit must be calculated based on the minimum wage.

If the employee was on maternity or child leave during the two years included in the calculation

If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones (255-FZ Article 14). Of course, if it’s more profitable for the employee. To do this, she must write a special application. But keep in mind: real payments are taken into account and are not indexed in any way.

If you recently got a job and had no earnings in the previous two years, you cannot replace the years on this basis alone.

In this case, you can only replace it with the previous year. You cannot take any years for replacement.

Law on payments to the unemployed

Payment for maternity leave for pregnancy and childbirth is made on the basis of sick leave and is provided so that the woman does not have to work in the last months before giving birth. Since unemployed women do not need such leave, they are deprived of social benefits issued in lieu of wages.

IMPORTANT

An exception is provided for women who have lost their jobs as a result of bankruptcy of an enterprise or job cuts. If this dismissal occurred no earlier than a year before the due date for maternity leave, then the unemployed receive sick leave benefits.

In 2021, the amounts of such benefits are:

- for those dismissed due to bankruptcy - the same as for those employed, i.e. 40% of average monthly earnings for the previous 2 years;

- for those dismissed due to the liquidation of the enterprise, the monthly payment amount for 140 days will be 613.14 rubles per month;

- students are entitled to a stipend payment.

Unemployed women are entitled to all other payments, except maternity leave, if they are registered with the employment fund.

In this case, the following is paid:

- allowance for early registration 613.14 rubles;

- a one-time payment - 16,350.33 rubles, which can be received by a working father or, in his absence, a non-working mother who applies to the social insurance fund;

- monthly allowance until the child turns 1.5 years old.

If an unemployed woman is not registered with the unemployment fund and does not apply for benefits within the established time frame, then she will lose it.

Deadlines

Application deadlines

Maternity benefits are assigned if the application for it is made no later than six months from the date of the end of maternity leave (255-FZ Article 12, paragraph 2).

Recalculation for increase

If you have new documents or decide to calculate in a different way (replace years, reduce calculation days, provide certificates), you have the right to apply for recalculation of benefits within three years in order to increase the amount of maternity benefits.

The application is written in free form.

| STATEMENT I ask you to recalculate my maternity benefits in accordance with clause 2.1. Article 15 of the Federal Law of the Russian Federation No. 255-FZ dated December 29, 2006. I am attaching the following documents: …. Date Signature. |

Can I choose a date or reschedule?

The issuance of certificates of incapacity for work during pregnancy and childbirth is carried out at 30 weeks of pregnancy (clause 46 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

If a woman, when contacting a medical organization within the prescribed period, refuses to receive a certificate of incapacity for work under the BiR for the period of maternity leave, her refusal is recorded in the medical documentation. When a woman before childbirth repeatedly applies for a certificate of incapacity for work for maternity leave, the certificate of incapacity for work is issued for all 140 (156 or 194) calendar days from the date of the initial application for the specified document, but not earlier than the period established by the first paragraphs or the second of this paragraph.

Those. theoretically, the deadline can be postponed to a later date (for example, to January, so that the current year is included in the calculation). It is not possible to go to an earlier date.

Nuances of applying for maternity leave in 2021.

Summing up the discussion of legislation in the field of providing leave in connection with pregnancy, childbirth and the birth of a child, it should be noted that there have been no fundamental changes in the rules and amounts of payments.

In 2021, the practice of gradually increasing benefits, taking into account inflation trends, continued. Also, the minimum amount of maternity benefits is growing at a given pace, which in 2021 should be equal to the subsistence level.

Source

Maternity pay during childbirth

Also, the mother or father of the child (but only one of them) at the birth of the child is entitled to a lump sum payment, which can be used to purchase the most necessary things for the baby at first.

The amount of such payment from February 1, 2021 is 16.759 rubles 9 kopecks

.

As in all other cases, this value is what is established for the entire country. If in the region where you live there are local coefficients and premiums for harsh climate (“Ural”, “northern”, etc. additives), the payment will be correspondingly higher. Moreover, the authorities of individual regions are not prohibited from setting their own payments. For example, in Moscow, parents will receive an additional one-time payment from the capital’s mayor’s office.