Benefits and compensation

Marina Melnikova

Financial expert

Current as of December 25, 2020

From January 1, 2021, the Social Insurance Fund will pay social benefits directly to individuals in all regions of the Russian Federation. On its website, Social Insurance presented the document flow procedure. The new role of the employer is to collect applications, documents and transfer them to the Social Insurance Fund. If the established deadlines are violated, the employee may lose government benefits. We will tell you what you need to tell an employee to avoid trouble in our article.

Why does the FSS pay benefits directly?

From the beginning of 2021, employers will not reduce insurance premiums by the amount of employee benefits paid. Federal Law No. 243-FZ dated July 3, 2016 terminates the “offset mechanism” for sick pay expenses in accordance with clause 2 of Art. 431 Tax Code of the Russian Federation.

The procedure for working within the framework of direct payments for the period 2012-2020. approved by Government Decree No. 294 dated April 21, 2011. It has already proven its effectiveness in most regions of the country. The draft law for 2021 is under consideration (ID 01/05/09-19/00094739).

Social Insurance will provide 2 types of payments:

- for temporary disability (including work-related injuries) from the 4th day of disability;

- maternity benefits: maternity benefits, payments at the birth of a child and leave for up to 1.5 years.

Organizations will continue to pay as usual:

- the first 3 days of sick leave at your own expense;

- 4 additional days of leave to care for a disabled child;

- funeral benefit;

- temporary disability benefits through interbudgetary transfers.

Direct payments allow the Social Insurance Fund to maintain personalized records and track the entire cycle of social payments (from sick leave to current account). Social Insurance has the opportunity to control the ratio of insurance premiums and expenses of legal entities in order to carry out checks in case of imbalance.

Benefits for organizations from implementing a direct payment process:

- there is no need to divert funds from circulation to pay benefits and wait for reimbursement from Social Insurance. Payment for maternity leave is an additional burden on the company’s balance of payments;

- there will be no penalties for incorrect or unlawful accrual of benefits;

- reducing cases of fraud - payments based on fake sick leave certificates.

How to apply the regional coefficient to benefits

In addition, you will need to submit an updated form if the policyholder’s accident insurance premium rate changes from the new year, but he will receive a notification about this from the Social Insurance Fund after he reports for the first quarter. Considering the deadlines established for this, such a situation is also possible (clauses 4, 5, 11 of the Procedure for confirming the main type of economic activity of the insured..., approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 N 55). In what form should the updated 4-FSS be submitted? The updated 4-FSS must be submitted in the same form in which the calculation with incorrect information was originally submitted (clause 1.5 of Article 24 of the Law of July 24, 1998 N 125-FZ). By the way, from reporting for 9 months of 2021, policyholders must use the updated Form 4-FSS, since changes were made to it in June 2021 (Order of the Federal Insurance Fund of the Russian Federation dated 06/07/2017 N 275).

What to tell employees about direct payments: sample documents, payment rules

We present step-by-step instructions for direct payments, which it is highly advisable for staff to familiarize themselves with:

Deadline

You can apply for benefits no later than 6 months from the end of the insured event (recovery, disability, birth of a child, etc.).

Package of documents

The employee must collect supporting documents and write a statement in the form corresponding to the insured event. Application forms are given in Appendix No. 1 to Order No. 578 of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

When choosing a payment method in the application, you need to take into account that sick leave for Chernobyl victims and maternity benefits will be transferred only to the MIR card (RF Government Decree No. 419 of 04/11/2019).

Sample application for payment of sick leave

An authorized employee of the company accepts documents. To avoid any disagreements, it is better to hand them over against signature and record the date.

Payment terms

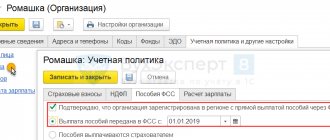

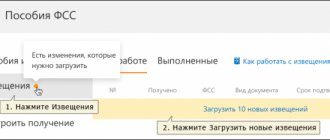

Within 5 days, the employer sends documents to Social Security. You can do this:

- in paper form with an inventory, if the staff does not exceed 25 people;

- in electronic form, if the staff is more than 25 people.

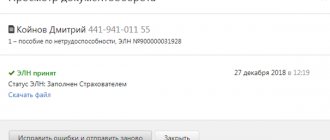

The FSS has 10 days to check and pay. The employer will be notified of errors or missing documents in writing.

An application for monthly child care benefits must be submitted once. Leave will be paid monthly until the 15th.

Control of accruals

Employees will be able to check Social Insurance calculations and receive a 2-NDFL certificate on the Social Insurance Fund website or at a fund branch (in person or by submitting an application by mail).

Purpose of the statement

The purpose of forming a request is to agree on a reconciliation act for mutual settlements between the parties.

For reconciliation acts between counterparties, decryption is requested:

- In order to confirm business transactions, any of the interacting parties can request to sign a reconciliation report.

Since the ability to make transactions without meeting with the counterparty, to send payments without visiting the bank, forms a significant volume of documents received by mail or courier. When preparing accounting and tax reporting, the document allows the accountant to be sure that all documents are reflected in the accounting. - In order to comply with the accounting rules (PBU), adopted by Order No. 34 of the Ministry of Finance of the Russian Federation on July 29, 1998 (as amended on March 26, 2007 No. 26n), which oblige organizations to clarify the volume of property and liabilities before submitting annual reports.

Calculations are classified as mandatory for inventory. - To confirm the fact of the counterparty's debt.

Every creditor wants to be sure that the debtor remembers the debt and is ready to pay. According to the judges, the reconciliation act is not unambiguous evidence of the existence of a debt, but it can become an additional resource in a dispute with the debtor. In addition, the act extends the limitation period - if it exists, the limitation period begins to be calculated not from the date of the transaction, but from the date of signing the act (Resolution of the Presidium of the Supreme Arbitration Court, No. 13096/12 of 02/12/2013).

A request for the current status of settlements with the Federal Tax Service and extra-budgetary funds is made in order to:

- Return of excess funds transferred and stored in the accounts of the inspection or fund of the organization.

- Identification of arrears in taxes and contributions in order to pay off the debt and eliminate the possibility of accrual of fines and penalties.

- Identifying discrepancies in the accounting data of the organization and the fund or inspection in order to identify and correct errors of one of the parties.

Why can the FSS refuse to pay?

Within 5 days from the date of receipt of the documents, the FSS may send a notification to the employer that the data has not been verified. The organization has 5 working days to make corrections.

Reasons for refusal:

- Errors when filling out documents.

The employee indicated incorrect details of the recipient's account, the full name does not match the passport, the SNILS number in the application does not match the number on the card, etc.

- Incomplete set of documents.

There are no certificates or copies of documents confirming the right to payment.

- Incorrect salary or length of service information.

The income amounts on the certificate of incapacity for work do not match the information in the primary documents.

- Deadlines were violated.

More than 6 months have passed since the relevant event - the employee’s recovery, the birth of a child, etc.

Useful information from ConsultantPlus

See the ready-made solution What an employer needs to do - a participant in the pilot project of the Federal Social Insurance Fund of the Russian Federation.

Employer's liability

For untimely provision of information, distortion or concealment of data, legal entities are liable under Part 4 of Art. 15.33 of the Code of Administrative Offenses of the Russian Federation - an administrative fine for officials from 300 to 500 rubles.

Within 3 days, the organization must inform Social Security that the employee has lost the right to child care benefits for children up to 1.5 years old due to:

- full-time work;

- dismissal;

- the beginning of maternity leave.

If violations are detected, the employer must reimburse the Social Insurance Fund for unnecessary expenses incurred (clause 16 of Government Resolution No. 294 of April 21, 2011).

Let's sum it up

- From 01/01/2021, employers throughout the Russian Federation will no longer accept sick leave and maternity benefits for reimbursement: Social Insurance will transfer them directly to employees’ accounts.

- Employees must collect a package of documents and fill out an application for each insurance event.

- Employers are responsible for ensuring that documents are received by the Social Insurance Fund on time. Officials of organizations bear administrative responsibility for distortion or concealment of data.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to write a cover letter for documents

There is no single unified form of writing. Requirements for the preparation of organizational and administrative documentation are described in GOST R 6.30-2003. The requirements of this standard are recommended.

How to write a cover letter for documents? Let's start with the basic rules:

- on company letterhead;

- indicating the date and registration number.

Let's take a closer look at a sample cover letter about sending documents, what main sections the text can be divided into and what information should be reflected in them.

About sending a response to a claim

Theme that defines its purpose

Covering letter of submitted documents

A specific appeal to the manager, preferably addressed, indicating the name and patronymic

Dear Ivan Ivanovich!

In response to your claim, I am enclosing confirmation that the stated requirements were met within the time limits specified in the Supply Agreement.

Statement of the essence with summing up and expression of hope, gratitude, etc.

According to the information received from you, there were facts of violation of clauses 2.3 and 3.6 of the Agreement. In turn, I inform you that the components were transferred on time, which is confirmed by the Invoice, and the work was completed on time, which is confirmed by the date of acceptance of the work on the Work Order. I consider the requirements set forth in claim No. 2, sent to us on July 14, 2017, to have been fulfilled in full. I ask you to consider and send information about your decision to us within the period established by law. I express my gratitude to you for using the services of our company, and I hope for further cooperation.

List of applications. Polite signature

- Supply contract, number of sheets.

- Consignment note, number of sheets.

- Work order, number of sheets.

- Photo of the installed banner, number of sheets.

Head, Sidorova Maria Ivanovna.

Full name and contact details of the performer.

Example of a cover letter for documents

Enterprise employees not only have to send such requests to counterparties, but also receive them from them. It makes sense for business clerks to develop a form for an incoming cover letter for documents. It will be required if the counterparty provides the package without explanation. This often happens when collaborating with individuals, but for legal entities this case is no exception. To optimize document flow, the counterparty will be able to fill out the proposed form, which will indicate all the necessary information.

Sample cover letter for transfer of documents. Form designed to be filled out by the counterparty: