The essence and purpose of income tax

Income tax is the main type of direct taxes. It is calculated as a percentage of the total income of citizens and organizations minus documented expenses. Income tax goes to the country's budget for the needs of the population.

Thus, personal income tax can be used for the following purposes:

- maintenance and improvement of public spaces;

- cultural events;

- education;

- Housing and communal services.

Personal income tax is one of the types of taxes that citizens are required to pay on their income

In terms of budget revenues, the tax ranks third after taxes on value added and corporate profits.

Results

The deadline for transferring personal income tax from salary depends on the date of actual receipt of income. Since 2021, this deadline has become the same for all forms of salary payment: no later than the day following the day of its actual issuance, taking into account the possibility of postponement due to weekends. An exception is established for sick leave and vacation pay, the deadline for paying tax on which corresponds to the last day of the month of their payment.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Objects of personal income tax taxation

According to the Tax Code, the following types of income are subject to personal income tax taxation:

- remuneration for work;

- dividends on shares;

- income from the transfer of property for rent;

- income from the sale of property, sale of securities and other assets;

- insurance payments upon the occurrence of an insured event;

- income received from the use of copyright or related rights in the Russian Federation;

- pensions, benefits, scholarships and other similar payments;

- income received from the use of any vehicles, including sea, river, aircraft and automobile vehicles, in connection with transportation to the Russian Federation and (or) from the Russian Federation or within its borders;

- income received from the use of pipelines, power lines (power lines), fiber-optic and (or) wireless communication lines, and other means of communication, including computer networks, on the territory of the Russian Federation;

- payments to the legal successors of deceased insured persons in cases provided for by the legislation of the Russian Federation on compulsory pension insurance.

Tax legislation establishes the types of income of citizens on which income tax is levied.

However, not all income is taxable.

This means, for example, the following:

- financial assistance that the organization pays to an employee after the birth of a child (its amount should not exceed 50 thousand rubles);

- maternity benefits for employees on maternity leave;

- compensation for damage caused to employee health;

- reimbursement of employee expenses for paying interest on loans and credits received for the purchase or construction of housing;

- gifts, the cost of which does not exceed 4 thousand rubles. per year received by individuals from organizations and individual entrepreneurs.

Full list in Art. 217 Tax Code of the Russian Federation.

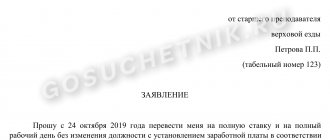

Frequency of payments

According to the Labor Code (Article 136), the employer must clearly define the timing of payment of wages. This information is displayed in:

- employment agreement;

- collective agreement;

- internal regulations.

At the same time, it is indicated exactly on which days the accounting department will pay the money. An important point is frequency. It is advisable that the enterprise issue both an advance and the salary itself, and the gap between them should not exceed 15 days.

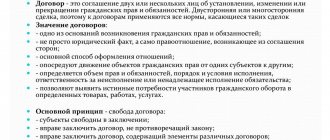

Regulatory basis for calculating personal income tax

The system for calculating and paying personal income tax is regulated by the Tax Code of the Russian Federation.

Articles of the code related to the calculation of income tax:

- 210 — sets the algorithm for calculating the tax base;

- 217 - defines a list of payments in favor of citizens who are not subject to personal income tax;

- 218–220 - establishes the amount of tax deductions;

- 224 - introduces personal income tax rates for specific groups of workers;

- 225, 226 — regulates the calculation algorithm.

In addition, the following documents are used when calculating income tax:

- Order of the Ministry of Taxes and Duties No. BG-3–04/583 dated October 31, 2003;

- Order of the Federal Tax Service No. SAE-3–04/706 dated October 13, 2006, approving the form of information on citizens’ incomes;

- Order of the Ministry of Finance of the Russian Federation No. 145n dated December 29, 2009, which introduces the tax reporting form.

The procedure for calculating and withholding income tax from wages

Personal income tax is necessarily calculated from the remuneration for the work done by the employed person. Organizations or individual entrepreneurs that have employees are tax agents for them.

The functionality of a tax agent includes the following actions:

- tax calculation and withholding;

- sending the withdrawn amount to the budget;

- submission of a personal income tax report.

Accounting must calculate the tax in full:

- as from the earnings of employed people carrying out work within the framework of an employment contract;

- and from cash accruals under GPC agreements.

Deduction is made in any of two cases:

- when earnings are given in money;

- when income is presented in kind (issued by products).

If an employee receives little income and has difficulty making ends meet, he will still not be exempt from personal income tax. It is understood that the tax will be calculated in the general manner. The tax base must be calculated by the accounting department on a monthly basis.

The following is taken into account:

- general algorithm for calculating personal income tax on remuneration for work;

- personal income tax rate depending on who the taxpayer is;

- various types of deductions.

General procedure for calculating income tax on earnings

Personal income tax is calculated only from those amounts of money (or products) of an employed person, the source of which is the employer.

In addition to remuneration for labor, the following income is subject to personal income tax:

- bonus amounts;

- disability benefits;

- vacation pay, etc.

Income tax is calculated at the end of each month on an accrual basis from the beginning of the tax period. This action is carried out no later than the day following the day the earnings are issued. The tax period is a standard year.

Income tax is calculated as follows:

- the tax base is determined from the beginning of the year to the current month;

- the amount of tax benefits due to an individual is calculated from the amount received;

- deductions are made at the tax rate approved for this category of employees;

- the tax amount is rounded to full rubles, i.e. the amount is less than 50 kopecks. is not taken into account, but equal to or more than 50 kopecks. rounded up to the nearest whole ruble.

Calculating personal income tax is not complicated, but it requires careful attention from the accountant

Taxation changes are expected in 2021.

Thus, the list of income exempt from personal income tax has been adjusted:

- compensation for unused additional days of rest for contract military personnel will need to be subject to personal income tax;

- payment of the cost of travel to the place of vacation and back for “northerner” employees is not subject to personal income tax;

- Non-personal income tax payments include income in cash and in kind related to the birth of a child and paid in accordance with the law.

Personal income tax rate and features of taxation of residents and non-residents of the Russian Federation

The income tax rate varies depending on the categories of taxpayers:

- for residents - 13% (those who continuously stay in the Russian Federation for 183 or more days a year);

- for non-residents - 30% (the most common rate).

The rule does not affect the following persons:

- those performing military service;

- those in public service and on business trips abroad.

These persons act as tax residents, even if they work abroad for most of the year.

Other personal income tax rates are also provided:

- 9% - this is how income from interest on mortgage bonds and certificates issued before 01/01/2007 is taxed;

- 15% - applies to the income of non-resident individuals (payments are received in the form of dividends from Russian organizations).

- 35% - tax on the amount of prize money and winnings over 4 thousand rubles.

Recently, amendments to the Tax Code of the Russian Federation have been in effect:

- the personal income tax rate for foreigners who work on the basis of a patent for an individual entrepreneur or for those engaged in private practice is 13%;

- a rate of 13% is also provided for EAEU citizens who work in Russia (i.e. citizens of Belarus, Kyrgyzstan, Kazakhstan, Armenia).

Personal income tax rates differ for different categories of employees

Last year, there was a lot of talk at the top about increasing the personal income tax rate to 15% with the introduction of a non-taxable minimum, but no final decision was made on the issue. Despite the lack of consensus, officials mostly agreed that an increase in the amount of tax could initiate the emergence of new “gray” schemes and an increase in “shadow” turnover in the future. Therefore, for now, those employed in our country do not have to worry about an increase in the tax burden.

Deductions and their accounting when calculating personal income tax

The tax base indicator can be reduced through a special deduction. A deduction is an amount that reduces the amount of income on which personal income tax is charged. In some cases, a deduction refers to the return of part of previously paid income tax for an individual. Only those workers whose tax rate is 13% have the right to count on such a relief.

Table: type of tax deductions

| Name | Characteristic |

| Standard | Provided to the following categories of citizens:

The amount of relief does not exceed 1 thousand 400 rubles. per month for each first and second child. If there are three or more children in a family, then the deduction increases to 3 thousand rubles. for the third and subsequent children. Features of the deduction:

If a citizen is a disabled minor or a disabled person of groups 1–2, enrolled full-time in an educational institution under the age of 24, the amount of relief will be:

|

| Social | Provided to citizens if there are costs for:

Social deduction for charity reimburses expenses for charitable events. At the same time, the amount of relief is not higher than 25% of the individual’s earnings. The amount of social deduction for education depends on:

Social deductions for treatment can be applied for both yourself and your children until they reach adulthood. |

| Property | Issued in the following situations:

|

| Professional | The following may apply for them:

|

Examples of calculating personal income tax from remuneration for labor

Petrova E.V.’s monthly earnings are 36 thousand rubles. She has a twelve-year-old son, and therefore an employed woman is allowed to take advantage of a child deduction in the amount of 1 thousand 400 rubles. per month. Also in April, the employee was awarded a bonus in the amount of 12 thousand rubles.

The amount of personal income tax collected from a worker’s income for April:

- The tax base for personal income tax for January-April will be: 36 thousand rubles. x 4 months + 12 thousand rubles – (1 thousand 400 rubles x 4 months) = 150 thousand 400 rubles.

- Amount of income tax for January-April: 150 thousand rubles. 400 rub. x 13% = 19 thousand 552 rub.

- Personal income tax withheld from the employee’s income for January-March: (36 thousand rubles x 3 months - (1 thousand 400 rubles x 3 months)) x 13% = 13 thousand 494 rubles.

- Personal income tax withheld from income for April: 19 thousand 552 rubles. – 13 thousand 494 rub. = 6 thousand

An employee of the consulting agency Krivko A.S. has three minor children. She worked all January without sick leave. Her salary is 50 thousand rubles. In the same month, the employer gave her financial assistance of 5 thousand rubles. Thus, Krivko A.S.’s income for the month amounted to 55 thousand rubles.

To calculate personal income tax, the agency’s accounting department will deduct from the monthly income the amount of deductions for children and a discount on financial assistance, but only within the limit of 4 thousand rubles:

- 55 thousand rubles – (1 thousand 400 rubles + 1 thousand 400 rubles + 3 thousand rubles + 4 thousand rubles) = 45 thousand 200 rubles;

- 45 thousand 200 rub. x 13% = 5 thousand 876 rub.

The accounting department will deduct this amount from the employee’s salary as personal income tax and send it to the budget. Smirnova N. Yu., who is raising a minor child on her own, is entitled to a double deduction of tax benefits. With earnings of 10 thousand rubles. it has a deduction of 2 thousand 800 rubles.

The income tax calculation will look like this:

- 10 thousand rubles – (1 thousand 400 rubles x 2) = 7 thousand 200 rubles;

- 7 thousand 200 rub. x 13% = 936 rub.

Payroll accounting

Insurance premiums are included in the cost of production, i.e. pass through the debit of accounts 20 (26,29,...) or 44 in correspondence with account 69 “Calculations for social insurance and security”. 69 accounts usually have subaccounts for each contribution. Wiring:

We recommend reading: Ttp sudebniepristavi ru tekst kak uznat zadolzhennost u sudebnyh pristavov html

No later than the day following the day of salary payment, the organization is obliged to pay personal income tax. Insurance premiums, including insurance premiums, are paid by the 15th of the following month. Payment is made from the current account (account 51), the debt to the Federal Tax Service and funds is closed (accounts 68 and 69). Postings:

Tax reporting of organizations and individual entrepreneurs for personal income tax

Employers are required to keep records of each employee to whom they have paid income. Tax agents must also report to the Federal Tax Service on personal income tax calculated and withheld from employed persons.

There are two types of reports:

- 6-NDFL (generalized data is entered on all employees who received income from the employer);

- 2-NDFL (information is provided for each person employed separately).

Each type of reporting has its own deadlines for submission.

Form 6-NDFL consists of the following sheets:

- title page;

- section 1;

- section 2.

Declaration 6-NDFL contains general data for all persons who received income from the employer

The declaration must be sent to the tax office no later than the last day of the month following the reporting quarter. This form has not been adjusted in 2021, but a number of changes were made last year.

These are changes like this:

- on the title page of form 6-NDFL, the barcode “15201027” was changed to “15202024”;

- The successor organization submits calculations to the Federal Tax Service at its location for the last submission period and updated calculations for the reorganized structure (in the form of accession/merger/division/transformation) indicating on the title page in the line “at the location (accounting) (code)” numbers "215";

- in this case, at the top of the title you need to provide the TIN and KPP of the assignee;

- in the line “tax agent” indicate the name of the reorganized organization or its separate structure.

Table: deadlines for filing 6-NDFL

| Billing period | Deadlines for filing a declaration |

| For the first quarter of 2019 | Until April 30 |

| For the second quarter of 2019 | Until July 31 |

| For the third quarter of 2019 | Until October 31 |

| For the fourth quarter of 2019 | Until April 1, 2020 |

The innovations also affected the 2-NDFL report.

The document can be prepared in two versions:

- the first option has a machine-oriented form and is intended for tax agents;

- the second version of the form is issued by tax agents to individuals upon their applications for presentation at the place of request.

The 2-NDFL declaration records information for each employee separately.

Since 2021, new codes have been introduced into the 2-NDFL certificate:

- 2013 - compensation for unused vacation;

- 2014 - severance pay/average monthly earnings for the period of employment/compensation to the manager, his deputies and the chief accountant in excess of three times the average monthly salary;

- 2301 - fines and penalties to the consumer from the organization based on a court decision;

- 2611 — bad debt written off from the balance sheet;

- 3021 - interest (coupon) on circulating ruble bonds of domestic companies.

Table: deadlines for submitting 2-NDFL

| Situations | Submission deadlines |

| 2-NDFL declarations are sent to the tax office for those employees for whom the employer paid wages in the reporting year, but personal income tax was not levied on this income. | No later than March 1 of the year following the reporting year. |

| Reports are submitted to the tax office regarding absolutely all employees to whom the employer paid wages in the reporting year. | No later than April 1 of the year following the reporting year. |

If the declaration is not submitted on time, the tax agent will face penalties:

- in the amount of 200 rubles. for each overdue 2-personal income tax;

- in the amount of 1 thousand rubles. for failure to submit 6-personal income tax on time.

What else is indicated in the employment contract?

In accordance with Article 57 of the Labor Code, the employment agreement should also indicate that funds will be guaranteed to be transferred to the Social Insurance Fund for the employee. No specific details are required - it is enough to refer to the Labor Code and other federal laws.

If there is additional insurance at the enterprise, it is reported with an indication of the attributes of local regulations governing the procedure for its provision.

Another important point is that in some regions with difficult climatic conditions, there are so-called regional coefficients. You should be aware that these amounts are not included in the salary body and are indicated separately.