When might negative values occur?

All fields of the 6 personal income tax report can be divided into 4 groups:

- calendar;

- quantitative;

- equity;

- sum.

Lines that require deadlines and dates (belonging to the calendar group) cannot contain negative values.

As for the quantitative group, only one line belongs to it - 060. It is necessary to indicate the income of individuals in it. Here, negative sums cannot arise either, even if all mathematical laws are taken into account.

6 personal income tax car rental

The category of fractional cells is intended for filling in tax rates. These lines reflect the part of the employee’s income that is transferred to the budget (13%, 30%, etc.). tax rates with a negative value also cannot exist, and therefore there is no point in looking for negative amounts in 6 personal income taxes.

It turns out that negative values can occur in rows that belong to the sum category.

Which cells can take negative values?

In order to understand which strings can accept negative amounts, let's look at the general category of numeric strings where it is necessary to indicate sum values:

- accrued and received income of employees (cells 020, 130, etc.);

- tax deductions (cell 030);

- calculated income tax (cell 040);

- withheld income tax (box 140);

- advance fixed payment (cell 050);

- income tax that the tax agent did not withhold (cell 080);

- income tax that was refunded by the tax agent.

If we analyze the above list, it becomes clear that negative values cannot accept a tax deduction and an advance fixed payment.

As a result, you should look for negative amounts in the report in cell 040, which indicates income tax calculations.

How to reflect personal income tax return in 6 personal income tax

No later than April 3, tax agents must submit to the tax authorities annual forms on the income of individuals - certificate 2-NDFL and calculation 6-NDFL. Vladislav Volkov, head of the personal income tax department of the Department of Taxation of Personal Income and Administration of Insurance Contributions of the Federal Tax Service of Russia, spoke about common questions and the most typical errors in the preparation of these reports BUKH.1S

.

New income and deduction codes

By order of the Federal Tax Service of Russia dated November 22, 2016 No. ММВ-7-11/ [email protected] new codes of income and deductions were approved. The changes came into force on December 26, 2016.

New codes for standard tax deductions have been introduced (126-149).

Changes have been made to income codes 1532, 1533, 1535 regarding income from transactions with derivative financial instruments

New income codes 1544-1549, 1551-1554 have been introduced regarding income received from transactions with securities and transactions with derivative financial instruments accounted for in an individual investment account. In this regard, existing deduction codes have also been clarified and new deduction codes have been introduced.

Information on form 2-NDFL must be submitted with new codes for 2021. However, if the codes in this certificate are presented without taking into account the latest changes, no penalties will follow.

New reward codes

Two new bonus codes have been introduced.

Code 2002. Amounts of bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, employment agreements (contracts) and (or) collective agreements (paid not at the expense of the organization’s profits, not at the expense of special-purpose funds or targeted revenues ).

Code 2003. Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted income.

The Ministry of Finance issued clarifications that the date of actual receipt of income from premiums is the date of direct payment of such income or transfer to the account of the taxpayer - an individual. In 2015, the Supreme Court of the Russian Federation issued a ruling dated April 16, 2015 No. GK15-2718, which stated that bonuses related directly to wages are paid in the same way as wages. And, therefore, the date of actual receipt of income from bonuses related to wages should be considered the last day of the month for which it was accrued. After this, there was no official clarification from the Ministry of Finance that its position was changing. However, earlier the Ministry of Finance itself indicated that if the determinations of the higher courts go against its position, then the position of the courts is accepted.

Changes in reporting under Federal Law No. 113-FZ dated May 2, 2015

The most important errors when filling out reports are related to the dates of actual receipt of income.

Below are dates for specific types of income.

| Type of income | Date of actual receipt of income |

| Salary | The last day of the month for which salaries are accrued. Let me remind you that only salary and now bonuses are taken into account. For other income, accounting is carried out on a date-to-date basis. |

| Final settlement with the dismissed employee | Employee's last working day. |

| Vacation and sick leave | The day when money was withdrawn from the cash register or transferred from the company account to the employee’s card. |

| Travel expenses that the employee did not confirm with documents | The last day of the month in which the advance report was approved. |

| Over-limit daily allowance | The last day of the month in which the advance report was approved. |

| Gifts in excess of 4,000 rubles, material assistance subject to personal income tax and other income not related to wages | The day when money was withdrawn from the cash register or transferred from the company account to the employee’s card. For income in kind - the day of transfer of goods and materials, payment for work or services per person. |

| Contractor's remuneration | The day when the money was issued from the cash register or transferred from the company account to the contractor’s card |

| Material benefits from loans | The last day of each month during the period for which the loan was issued. |

| Dividends | The day when money was withdrawn from the cash register or transferred from the company account to the card of a company participant (shareholder). |

Date of personal income tax withholding for material benefits

Previously in paragraph 2. Article 231 of the Tax Code of the Russian Federation stated that the tax agent withholds personal income tax until it is fully withheld, even from payments next year. Now this provision has lost force; after the tax agent reports the impossibility of withholding personal income tax, his obligation to withhold ceases.

Therefore, if before December 31, for example, there were no payments in cash for material benefits or income in kind, a 2-NDFL certificate with sign 2 is sent. But there is a nuance regarding the date of tax withholding associated with material benefits. For example, if an employee took out a loan to buy a home. He receives monthly income in the form of material benefits. According to today's legislation, if on December 31 the salary for December is not paid, then a tax arises on the benefit that cannot be withheld. But there is a way out. If the date of receipt of income from other cash payments falls on the last day of December, income tax can be withheld from this payment in the form of a material benefit. How have you always done it? According to the financial benefit, tax was withheld from this January salary for December. The same can be done today. The date of actual receipt of income from the December salary falls on the 31st, and no matter what was not paid, you can deduct from the same amount. This will probably be better than submitting certificates with feature 2 every year.

Deadline for transferring personal income tax for certain types of income

Many tax agents put in line 120 of the 6-NDFL reporting the date when the tax was actually transferred. It is not right. Of course, there is no need to wait until the last day of the month to make the transfer. If, for example, vacation or sick leave was paid on the 15th, withheld on the 15th and transferred on the 15th, this is not a violation. But in 6-NDFL, the deadline for transferring vacation pay tax must be set to the last date of the month. That is, line 100 is the 15th day, line 110 is the 15th day, line 120 is the last day.

For section 2, there is a certain formula for self-control - the amount of tax on line 140, reduced by 090, should fall into the budget between lines 110 and 120. That is, from the date of tax withholding to the date of tax remittance. If it “falls” ahead of schedule, it will not be counted. If a debt arises, the tax authority will make demands.

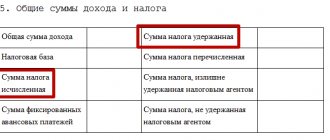

The ratio of sections 6-NDFL and 2-NDFL

Certain relationships of values between reporting documents will be controlled by tax authorities. In particular, section 1 of the 6-NDFL calculation must be equal to 2-NDFL (or section 2 of the income tax return). Section 2 6-NDFL must be equal to tax transfer + CRSB (actual transfer).

In this case, sections 1 and 2 do not correspond. The sum of 140 lines may not coincide with the sum of 070 lines; there is no such control ratio.

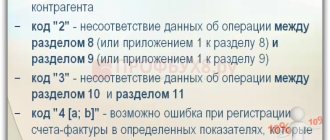

Interdocumentary control ratios

Line 020 6-NDFL at the corresponding rate (line 010) = Line “Total amount of income” at the corresponding rate of 2-NDFL certificates with prize 1, submitted for all taxpayers + Line 020 at the corresponding rate (line 010) of appendices No. 2 to the declaration on income tax, presented for all taxpayers.

Line 020 does not include amounts that are not subject to tax. For example, severance pay upon dismissal, if it does not exceed three times the salary. And if it exceeds, then only the amount of this excess enters 020. There is no separate code for this excess; in 2-NDFL you need to enter 4800.

Line 025 6-NDFL = Income in the form of dividends (income code 1010) of 2-NDFL certificates with sign 1, presented for all taxpayers + Income in the form of dividends (income code 1010) of appendices No. 2 to the DNP, presented for all taxpayers.

If line 025 is filled in, then this amount must be included in line 020.

Line 040 6-NDFL at the corresponding rate (line 010) = line “Tax amount calculated” at the corresponding rate of 2-NDFL certificates with attribute 1, submitted for all taxpayers + Line 030 at the corresponding rate (line 010) of Appendix No. 2 to the DNP, presented for all taxpayers.

There is a formula for controlling the amount of calculated tax, where the value of line 020 (the amount of accrued income) minus the amount of tax deductions (030), multiplied by the rate, is equal to 040. Sometimes tax authorities require compliance with this formula without reading about the discrepancies. It is not right. This formula may not converge, and this is stated in the control ratios. Because, firstly, in our country not all income is considered a cumulative total, and secondly, after all, 6-NDFL is a consolidated form for all taxpayers. And 040 should not be calculated by empty multiplication according to the formula, but precisely as the calculated tax for each taxpayer.

Line 080 6-NDFL = Line “Tax amount not withheld by the tax agent” of 2-NDFL certificates with attribute 1, submitted for all taxpayers + Line 034 of Appendix No. 2 to the DNP, submitted for all taxpayers

080 clearly includes only those amounts that the tax agent cannot withhold during the tax period. As for the rolling salary between reporting periods (for example, March-April), it does not need to be placed there. You can keep it in the next quarter.

Line 060 6-NDFL = Total number of 2-NDFL certificates with sign 1 and appendices No. 2 to the DNP, submitted for all taxpayers by this tax agent

It will not be the number of pieces of paper that will be added up, but the number of people – taxpayers. At the same time, I would like to remind you that income from securities is reflected precisely in the income tax return, Appendix 2. And there is no need to duplicate this data in 2-NDFL. As for dividends, they are indicated in Appendix No. 2 to the DNP only for securities. Dividends in LLCs from equity participation are reflected only in 2-NDFL.

Line 070 does not participate in inter-document control relationships. It will not fit in with either 2-NDFL or Appendix No. 2 to the DNP, because the very indication of the amounts in 070 and the amounts of withheld tax in 2-NDFL are different. In 2-personal income tax it goes for the period, in 6-personal income tax - in the period. Therefore, in line 070, the amount of tax withheld is entered only in the reporting period when it was directly withheld. If there were no payments (example with the transfer of salaries between quarters), then the amount is not entered in 070, because it was not withheld.

Form 2-NDFL: filling out

A common mistake is when tax agents do not wait for a notification from the Federal Tax Service confirming the right to reduce tax on fixed advance payments. If you have not received a notification, then the amount of fixed payments in 2-NDFL is not reflected in principle. Sometimes they are indicated in advance, knowing that a notification is about to arrive. And this is unreliable information.

The TIN in 2-NDFL may not be indicated if the tax agent does not have information about the taxpayer’s TIN.

How to indicate tax rates when recalculating Russian residence? In general, there should not be two sections - 30% and 13%. These two sections can occur if a non-resident is working - a highly qualified specialist, whose entire income is not taxed at 13% (clause 3 of Article 224 of the Tax Code - all kinds of gifts and material assistance will be taxed at 30%).

In 2-NDFL and 6-NDFL it is strictly forbidden to indicate negative values. Sometimes this is done during recalculation, when a person is recalled from vacation, or he brought sick leave. All reversals and all recalculations must be done in accounting registers. In 2-NDFL the final amount of income is indicated.

For what period in 2-NDFL and 6-NDFL should I indicate lost wages? For example, if salaries for November and December are paid in March and April. In 2-NDFL it is indicated for the period in which it was accrued. In 6-NDFL, under section 1, these amounts will go the same way as in 2-NDFL - according to accrual, and under section 2 - based on actual payment. With such filling, of course, one should expect a notification from the tax authority to provide explanations, because this is a clear violation of labor laws. We should not be afraid, but explain the situation to the tax authorities.

2-NDFL – provision of corrective and canceling information.

Canceling information with code 99 is presented only if the certificate should not have been submitted in principle, or it was submitted erroneously.

Nowadays, banks sometimes write off customer debts without having yet exhausted all options for debt collection. The written-off debt, accordingly, is designated as the borrower’s income and they rush to tax it. And then suddenly a miracle happens and the borrower repays the debt. Consequently, there is no income, it is canceled - sign 99.

If you made a mistake in the total values, you do not need to cancel the certificate. It should simply be submitted as a clarification. If you need to clarify your identification data, you can also submit a corrective certificate, but along with it you must submit a corresponding statement explaining what exactly is changing.

Overpayment of personal income tax can now be counted against arrears, including other taxes

In February, there was a positive shift for taxpayers associated with the return of overpaid personal income tax.

Previously, the Ministry of Finance took the position that overpayment of personal income tax is subject to refund only and cannot be counted against future payments. But in February, a letter was issued according to the tax authorities system - No. ГД-4-8/2085 dated 02/06/2017 about offsets of such amounts. Finally we got it.

True, automatic offset against future periods is not provided. The overpayment can be offset against the arrears - both personal income tax and other federal taxes. As well as vice versa, you can count the overpayment of other taxes against the arrears of personal income tax. The letter applies not only to future periods, but also to past periods.

The procedure is the same as for returns. It is necessary to submit extracts from tax registers, payment documents, and other documents confirming that this is an excess amount. An on-site inspection is not required here.

You can simplify the procedure a little for yourself. For example, if you pay vacation pay on the 15th, then the tax on it must be paid before the last date of the month. Write an application to offset the overpayment against this tax between the 15th and last day of the month. In this way we bypass clause 9 of Art. 226 of the Tax Code, due to which it is impossible to offset the overpayment automatically.

In what cases are negative values allowed?

Let's look at an example where negative amounts can occur.

In April of this year, Kovalchuk N. got a job as a janitor. She was entitled to a salary of 6 thousand rubles. Due to the fact that she was raising 3 children, she had the right to write an application for “children’s” deductions. As a result, for the first working month, income tax in the amount of 780 rubles was withheld from her salary. (6,000 x 13%).

The following month, the employee wrote an application for “children’s” deductions, so a recalculation was carried out. According to the recalculation, the personal income tax value will be -728 rubles. ((6,000 ×2 months – 5,800 ×2 months) ×13% –780 rub.).

In May, income tax was calculated as follows:

(6,000 x 3 months – 5,800 x 3 months) x 13% – 52 = 26 (rub.)

It is impossible to consider in detail all cases where negative values may occur. But one thing can be said: personal income tax report 6 should not contain values with a “-” sign.

Similar articles

- How the tax office checks 6-NDFL

- How to correctly fill out section 2 of section 6 of personal income tax

- 6 personal income taxes for the half-year on an accrual basis: sample

- Amount of calculated and withheld tax 6-NDFL

- 6 Personal income tax for separate divisions

Filling out form 6-NDFL. Practical advice - Accounting

20.05.2016

Reports must be submitted quarterly no later than the last day of the month following the reporting period (for 1 quarter, for six months, for 9 months), and for the year no later than April 1 of the following year (clause 2 of Article 230 of the Tax Code of the Russian Federation). If the deadline falls on a weekend, it is postponed to the next working day. In 2021, for the first quarter in form 6-NDFL it was necessary to report no later than May 4.

If no more than 24 people receive income from an organization or individual entrepreneur, then the calculation can be submitted on paper; for 25 or more people it is necessary to report in electronic form. The form contains a title page and 2 sections. When filling out, you must be guided by the approved Procedure for filling out form 6-NDFL, letter of the Federal Tax Service dated January 20, 2016.