Account type: Active.

Account type:

- Accounting by department

- Tax

Analytics on account “23”:

| Subconto | RPM only | Total accounting | Accounting in currency |

| Nomenclature groups | No | Yes | Yes |

| Expenditures | Yes | Yes | Yes |

General characteristics of 23 accounts

According to the Chart of Accounts for financial and economic activities and the Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), the 23rd accounting account is “Auxiliary production”.

This cost account 23 is intended to summarize information about the costs of production that are auxiliary (auxiliary) in relation to the main production of the organization.

In particular, account number 23 is used to account for production costs that provide:

- supply of different types of energy resources - electricity, steam, gas, air, etc.;

- transport services;

- OS repair;

- production of tools, dies, spare parts;

- production of building parts, structures or enrichment of building materials (more relevant for the construction industry);

- construction of temporary structures;

- extraction of stone, gravel, sand and other non-metallic materials;

- logging, sawing;

- salting, drying and canning of agricultural products, etc.

In addition, account 23 is active.

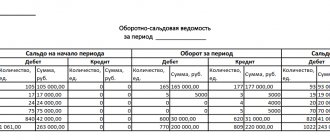

Note that the balance of account 23 at the end of the month shows the value of work in progress.

Analytical accounting for account 23 is carried out by type of production.

This page is an appendix to the Chart of Accounts for accounting of financial and economic activities of organizations.

Account 23 “Auxiliary production” is intended to summarize information about the costs of production that are auxiliary (auxiliary) for the main production of the organization. In particular, this account is used to account for production costs that provide:

- service with various types of energy (electricity, steam, gas, air, etc.);

- transport services;

- repair of fixed assets;

- production of tools, dies, spare parts; building parts, structures or enrichment of building materials (mainly in construction organizations); construction of (temporary) non-title structures;

- extraction of stone, gravel, sand and other non-metallic materials;

- logging, sawmilling;

- salting, drying and canning of agricultural products, etc.

The debit of account 23 “Auxiliary production” reflects direct costs associated directly with the production of products, performance of work and provision of services, as well as indirect costs associated with the management and maintenance of auxiliary production, and losses from defects. Direct costs associated directly with the production of products, performance of work and provision of services are written off to account 23 “Auxiliary production” from the credit of inventory accounts, settlements with employees for wages, etc. Indirect costs associated with the management and maintenance of auxiliary production, are written off to account 23 “Auxiliary production” from accounts 25 “General production expenses” and 26 “General business expenses”. If appropriate, production maintenance costs can be taken into account directly on account 23 “Auxiliary production” (without prior accumulation on account 25 “General production expenses”). Losses from defects are written off to account 23 “Auxiliary production” from the credit of account 28 “Defects in production”.

The credit of account 23 “Auxiliary production” reflects the amounts of the actual cost of products completed by production, work performed and services rendered. These amounts are written off from account 23 “Auxiliary production” to the debit of the accounts:

- 20 “Main production” - when releasing products (works, services) to the main production;

- 29 “Service industries and farms” - when releasing products (works, services) to service industries or farms;

- 90 “Sales” - when performing work and services for third parties;

- 40 “Output of products (works, services)” - when using this account to account for production costs, etc.

The balance of account 23 “Auxiliary production” at the end of the month shows the cost of work in progress.

Analytical accounting for account 23 “Auxiliary production” is carried out by type of production.

Account 23 “Auxiliary production” corresponds with the accounts:

| by debit | on loan |

| 02 Depreciation of fixed assets 04 Intangible assets 05 Depreciation of intangible assets 07 Equipment for installation 10 Materials 11 Animals for growing and fattening 16 Deviation in the cost of material assets 19 Value added tax on acquired assets 21 Semi-finished products of own production 23 Auxiliary production 25 General production expenses 26 General business expenses 28 Defects in production 40 Release of products (works, services) 43 Finished products 60 Settlements with suppliers and contractors 68 Settlements for taxes and fees 69 Settlements for social insurance and security 70 Settlements with personnel for wages 71 Settlements with accountable persons 76 Settlements with various debtors and creditors 79 On-farm settlements 80 Authorized capital 91 Other income and expenses 94 Shortages and losses from damage to valuables 96 Reserves for future expenses 97 Deferred expenses | 07 Equipment for installation 08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 15 Procurement and acquisition of material assets 20 Main production 21 Semi-finished products of own production 23 Auxiliary production 25 General production expenses 26 General business expenses 28 Defects in production 29 Service production and farms 40 Output products (works, services) 43 Finished products 44 Selling expenses 45 Shipped goods 73 Settlements with personnel for other operations 76 Settlements with various debtors and creditors 79 On-farm settlements 80 Authorized capital 90 Sales 91 Other income and expenses 94 Shortages and losses from damage to valuables 96 Reserves for future expenses 97 Deferred expenses 99 Profits and losses |

{access public}

How to close account 23

When it is necessary to close account 23, direct expenses directly related to the production of products/performance of work/provision of services are written off to account 23 from the credit of inventory accounts, settlements with employees for wages, etc.

Also see “Accounting for inventories”.

Indirect costs associated with the management and maintenance of auxiliary production are written off in account 23 from the accounts:

- 25 “General production expenses”;

- 26 “General business expenses”.

KEEP IN MIND

If appropriate, production maintenance costs can be taken into account directly on account 23 without prior accumulation on account 25 “General production expenses”.

Losses from defects are written off to account 23 from the credit of account 28 “Defects in production”.

Cases from practice

In order to have a clearer idea of how accounting is maintained for auxiliary departments, let's look at one of the practical cases.

Let's imagine that there is a certain enterprise that produces bakery products. On the balance sheet of this enterprise there is a workshop engaged in the maintenance of production equipment. During the reporting period, employees of the designated workshop carried out maintenance work on the equipment of another bakery. In accordance with the terms of the signed agreement, the cost of technical work is 157,300 rubles, the amount of VAT is 28,314 rubles.

The total costs incurred by the workshop in executing this order amounted to 76,050 rubles, including:

- wages of employees - 58,900 rubles;

- insurance premiums for accrued wages - 13,438 rubles;

- accrued depreciation on repair equipment - 3,712 rubles.

As a result, the accounting records for completed business transactions look like this:

1) Dt 23

Kt 10, 70 and 69 – 76,050 rubles, workshop costs incurred as part of the order;

2) Dt 62

Kt 90.1 – 157,300 rubles, revenue received for services rendered;

3) Dt 90.2

Kt 23 - 76,050 rubles, workshop costs when fulfilling the order;

4) Dt 90.3

Kt 68 – 28,314 rubles, accrued tax amount;

5) Dt 90.9

Kt 99 – 52,936 rubles, accounting for profit received.

What about the loan 23 accounts

Here, in transactions on account 23, the amounts of the actual cost of completed products, work performed and services provided are reflected. They are written off from account 23 to the debit of the accounts:

- 20 “Main production” - when releasing products (works, services) to the main production;

- 29 “Service industries and farms” - when releasing products (works, services) to service industries or farms;

- 90 “Sales” – when performing work and services for third parties;

- 40 “Output of products (works, services)” - when using this account to account for production costs, etc.

Basic postings

In practice, the following standard accounting entries are used to reflect the costs of auxiliary divisions of the enterprise:

1) Dt 23

Kt 02.01, 05 – accrual of depreciation of fixed assets and intangible assets used in the main workshops;

2) Dt 23

Kt 10.01 and 43 – release from warehouses of materials and finished products to utility shops;

3) Dt 23

Kt 97.21 – write-off of part of deferred costs for the reporting period;

4) Dt 23

Kt 60.01 and 76.05 – involvement of third parties to carry out work required by auxiliary workshops;

5) Dt 23

Kt 70 and 69 – payroll for employees of non-core departments;

6) Dt 10.01

Kt 23 - accounting for materials manufactured in auxiliary workshops or returned by them;

7) Dt 90.02

Kt 23 – write-off of the cost of goods in subsidiary workshops that were sold to third parties;

Dt 40

Kt 23 – actual cost of finished products of auxiliary departments.

Features of using 23 accounts

Typically, an enterprise distributes the costs of auxiliary production between types of products, as well as its other divisions (for example, service farms) in proportion to the selected base.

Also see “What an accountant needs to know about service industries and farms.”

The choice of cost distribution base 23 accounts depends on:

- technological specifics of a particular organization;

- its cost structure;

- other factors.

EXAMPLE

Auxiliary costs can be distributed proportionally between types of main production:

- salaries of key production workers;

- the cost of materials released into production;

- the size of production workshops;

- number of personnel, etc.

Read also

19.07.2019

simplified tax system

If an organization pays a single tax on income, the expenses of auxiliary production do not reduce the tax base. Such organizations do not take into account any expenses (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). Moreover, if the organization’s auxiliary production facilities provide services (perform work) to other organizations and citizens, only income from their sales will be taken into account when calculating the single tax (Clause 1 of Article 346.15, Article 249 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, take into account the costs of auxiliary production in the manner prescribed in Article 346.17 of the Tax Code of the Russian Federation. In this case, expenses must be included in the list of expenses that can be taken into account when calculating the single tax (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). For example, if an auxiliary division of an organization repairs a fixed asset, then include the cost of spare parts in the tax base as they are replaced and paid to the supplier (subclause 3, clause 1, article 346.16, clause 2, article 346.17, clause 2, article 346.16, p. 1 Article 252 of the Tax Code of the Russian Federation), and employees’ salaries - as employees are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). Apply this procedure if auxiliary productions provide services (perform work) to other organizations and citizens (Article 346.17 of the Tax Code of the Russian Federation).

Apply a special procedure for accounting for costs when calculating the single tax if auxiliary production facilities carry out repairs, reconstruction, modernization, completion (additional equipment) and liquidation of fixed assets.

If in the municipality in which the organization is registered, some types of services are transferred to the payment of UTII, determine whether the sale of services provided by auxiliary production to other organizations and citizens falls under this special tax regime (subclauses 6 and 7 of clause 2 of article 346.26 Tax Code of the Russian Federation).

If the provision of services by auxiliary production to other organizations and citizens falls under UTII, do not tax income from such activities with a single tax under simplification (clause 4 of Article 346.12 of the Tax Code of the Russian Federation). When calculating UTII, take into account imputed income as an object of taxation (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). In addition, organize separate accounting of property, liabilities and business transactions in relation to the activities of an organization subject to UTII and the activities of an organization subject to a simplified tax regime (clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

Situation: is it possible for an organization to use simplified UTII when providing services by auxiliary production to other organizations and citizens?

UTII can be paid when services are provided by auxiliary production to other organizations and citizens, depending on the type of these services. Thus, the activities of repair, maintenance and washing of vehicles fall under UTII. This is stated in paragraph 9 of Article 346.27 of the Tax Code of the Russian Federation.

In addition, it matters whether the provision of services by auxiliary production to other organizations and citizens constitutes a business activity. As is known, entrepreneurial activity is an independent activity aimed at systematically generating profit, which the organization engages in at its own risk (Clause 1, Article 2 of the Civil Code of the Russian Federation). This means that if an organization systematically receives income from auxiliary production services provided to other organizations and citizens, then it is engaged in entrepreneurial activity. If the organization received a one-time income from this operation, then it has nothing to do with entrepreneurial activity. This means that you don’t need to pay UTII on it.

These conclusions are confirmed by letters of the Ministry of Finance of Russia dated May 10, 2007 No. 03-11-04/3/153, dated March 15, 2006 No. 03-11-04/3/135, dated February 15, 2005 No. 03-06 -05-04/31 and dated March 11, 2005 No. 03-06-05-04/55.

Purpose of auxiliary production

If we consider a more detailed description of this process, we can note a clear relationship between the main and auxiliary processes. Through the auxiliary process, the operation of the main or servicing production is traditionally ensured by introducing into it the necessary set of tools, energy, services and work.

There is also the possibility of selling products and services of auxiliary activities externally. All auxiliary production within the framework of accounting is displayed on account 23. This includes a set of the following areas:

- energy management;

- instrumental activity;

- repair work;

- technical control.

As for the core activity process, traditionally it includes the following areas:

- raw material procurement department;

- blacksmith shops;

- mechanical workshops;

- assembly departments.

That is, it turns out that through one event another process of activity is supported.

OSNO and UTII

If an organization applies a general taxation system and pays UTII for the costs of auxiliary production, services (work) of which were used in activities on UTII and activities on the general taxation system, it is necessary to organize separate accounting for income tax and VAT (clause 9 of Article 274, clause 7 of article 346.26 and clauses 4, 4.1 of article 170 of the Tax Code of the Russian Federation).

The costs of auxiliary production, which relate to activities on the general taxation system, will increase income tax expenses. Do not take into account the costs of auxiliary production spent in activities on UTII when taxing (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

The procedure for accounting for input VAT on the costs of auxiliary production also depends on the activity in which the services (work) of such production are consumed. If services (work) are used in activities on the general taxation system, VAT can be deducted subject to the general conditions established by Article 171 of the Tax Code of the Russian Federation. If they were used in activities on UTII, then VAT must be taken into account in their cost (clause 4, 4.1 of Article 170 of the Tax Code of the Russian Federation).

On the application of VAT deduction on auxiliary production costs, the purposes of which are initially unknown, see How to deduct input VAT when separately accounting for taxable and non-taxable transactions.

As a rule, it is always possible to determine what type of activity the services (work) of auxiliary productions belong to. However, situations are possible when services (work) relate simultaneously to two types of activities. In this case, distribute the costs of auxiliary production in proportion to income (clause 9 of Article 274 of the Tax Code of the Russian Federation).