Ways to pay off fines for traffic violations

Before paying an administrative fine for non-compliance with traffic rules on highways, the driver must choose the best method for depositing funds. The traditional one is to visit the cash desk of any nearest bank with a receipt already filled out and pay off your debt in cash. The payment document can be received by mail if you live at the place of official registration, or you can print it yourself on the official website of the traffic police after information about the collection appears there.

For those who prefer to pay online, there is the opportunity to deposit money non-cash through Internet banking. For example, it is very convenient to pay fines through Sberbank Online. In addition, the function for paying off fines using a bank card is available at any self-service terminals and ATMs of Russian banks. The “State Services” portal and electronic wallets are also popular.

Payer status field 101 traffic police fines for legal entities

for managers and accounting employees of organizations and enterprises on filling out settlement documents for the transfer of insurance contributions to the Pension Fund of the Russian Federation and compulsory medical insurance funds. Payment orders for the transfer of insurance contributions to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds are issued by payers when transferring payments from their accounts, in accordance with the rules established by the Regulations of the Central Bank of the Russian Federation dated October 3, 2002 N 2-P “On non-cash payments in the Russian Federation”, as well as Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the Budget system of the Russian Federation.”

INFORMATION ABOUT ENTRY INTO FORCE FROM 03/28/2019.

How to find out the details of the payment recipient

Every driver is interested in how to find out the bank details for paying a fine for traffic violations committed. It does not matter whether he prefers to deposit the required amount in cash or uses a universal form for making online payments.

When using special services to automatically search and pay off debts on traffic fines, all required data is filled in automatically, and the payer only needs to indicate his information and the transfer amount.

It is very important to know what details to pay when paying off a fine for a traffic violation. The recipient of the payment in this case is not a specific division of the traffic police, but the regional Office of the Federal Treasury of the Russian Federation (UFK RF). It is this department that collects all payments to the state budget. For example, if the resolution was issued by one of the traffic police departments in the Ulyanovsk region, then the recipient of the fine will be the Federal Inspectorate for the same region.

Cities of federal significance have their own Federal Criminal Codes of the Russian Federation. For example, in Moscow and the Moscow region there are different divisions of this department. When filling out payment details, you should pay attention to this.

If you received a notice of a fine and a copy of the decision by registered mail, in the envelope you will find a completed receipt with all the necessary details. They can also be obtained through the official website of the traffic police. To do this, you need to select the region in which your violation was recorded and open the “State Traffic Inspectorate Units” section.

In the list of traffic police departments in your region, find the inspectorate whose employees issued a decision on an administrative offense in the form of a fine. Its name can be found in your copy of the protocol drawn up by the inspector. If you don’t have the document on hand, you should search for fines on the traffic police website by order number or driver’s license and vehicle registration number. As a result, you will find the exact name of the desired department department.

At the next stage, click the link “Consideration of cases of administrative offenses and collection of fines.”

On the monitor under the inspection address you will see the payment details of the Federal Criminal Code of the Russian Federation for your region or city.

Answers to accounting questions

Copyright: Lori's photo bank How to pay a fine to the tax office Payment of income tax IGK payment order form in a payment order Payment to bailiffs (sample) Violation of traffic rules committed on a company car, and recorded by a traffic police inspector or CCTV cameras, entails drawing up a protocol and imposition of a fine on the enterprise, which, according to the traffic police, owns the vehicle.

It is undeniable that a legal entity, i.e.

– an organization cannot drive a car that belongs to it. However, in case of recording a violation of an accident with a company car, traffic police inspectors, as a general rule, draw up a report specifically for the legal entity, regardless of who was driving it at the time of the offense. In such a situation, the actions of the inspectors are lawful, because they draw up a protocol based on the provisions of paragraph.

1 tbsp. 2.6.1 of the Code of Administrative Offenses of the Russian Federation, which establishes that in the event of an administrative offense in the field of traffic rules (including the use of official vehicles), the owner of the vehicle is held accountable. After drawing up a protocol on traffic violations, the owner, information about which is necessarily indicated in the document, must pay the fine imposed on him.

For legal entities, such payment is provided through a payment order for payment from the current account of the owner of the vehicle. Pay the fine imposed on the organization by a legal entity

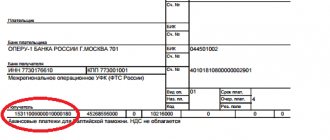

Structure of payment details of the Federal Criminal Code of the Russian Federation

The details of the recipient of payments for fines consist of several values, each of which carries important information. An error will lead to the payer’s money not reaching its intended destination.

Recipient

When filling out the receipt yourself, you must correctly indicate the name of the recipient of the funds. As mentioned above, it is the regional Department of the Federal Treasury of the Russian Federation. However, you do not need to write its name in full.

The name of the recipient should be indicated in an abbreviated form in the same form in which it appears in the details received on the official website of the traffic police.

For example, UFK for the Ulyanovsk region (Ministry of Internal Affairs of Russia for the Ulyanovsk region). It should be remembered that the name of the organization is not the purpose of payment to pay the fine.

Recipient's TIN

The receipt must indicate the recipient's TIN, which consists of 10 digits and is assigned by the tax authority at the place of registration of the legal entity. Each division of the Federal Tax Service has its own unique taxpayer identification number entered in the Unified Register of the Federal Tax Service of the Russian Federation.

checkpoint of the organization

If the TIN is assigned to both individuals and legal entities, then the KPP (reason code for registration) is only available to organizations and enterprises. It is assigned by the Federal Tax Service at the place of registration of the legal entity and consists of 9 digits. The checkpoint contains information about the region where the organization is located, the Federal Tax Service inspection that issued the code, the reason for registration and its serial number. This value in the details is used to record incoming payments. The average payer is only required to correctly indicate the checkpoint combination.

OKTMO value

OKTMO (All-Russian Classifier of Territories and Municipalities) can have up to 8 digits in its combination. It is intended to identify the location of the organization that is the recipient of the payment - in a certain region, city, district, rural settlement, etc.

Checking account

The recipient's current account opened in a particular bank is very important. This is where the funds transferred as payment of traffic police fines go. The current account consists of 20 digits, and all of them must be entered correctly by the payer. If you enter at least one digit incorrectly, the transaction will not go through and the debt will not be repaid.

Bank identification code

When making any payments, you must indicate your bank identification code (BIC). It is assigned by the Bank of Russia and no longer belongs to the UFC, but to a specific financial institution that is engaged in servicing the organization’s current account.

Budget classification code

It is necessary to add a budget classification code (BCC) to the payment details, which serves to identify the type of payment to the state budget - traffic police fines. You will find out which BCC to indicate right now. All fines for violations of the Traffic Rules, regardless of the region, have a single BCC value - 18811630020016000140.

Is it necessary to indicate the name of the traffic police inspection?

When filling out a receipt or a universal online form for paying fines for non-compliance with traffic rules, you do not need to indicate the full name of the State Traffic Inspectorate, since it is not the direct recipient of the payment. In addition to the details of the Federal Criminal Code in your region, you must indicate the number of the resolution on the administrative offense, your personal data, registration address and the name of the payment - “Fine for violating traffic rules”.

When paying fines by a legal entity, preparing a payment order

» News Sample payment order for payment of a traffic police fine in 2021 for an organization Attention Since the beginning of 2021, disputes related to filling out field 101 of payment orders when paying insurance premiums have not subsided.

We recommend reading: An employee sued the organization for non-payment of wages

In this field, we remind you that you need to indicate the status of the organization or individual entrepreneur that transfers funds to the budget. “Important Payer statuses” must be indicated by a two-digit code in accordance with Appendix 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Payment order 2021, new filling rules For customs payments, two new values will be added to detail “106”:

- “PD” - passenger customs declaration;

- “KV” is a receipt from the recipient of an international postal item.

Due to the new deadlines for personal income tax payment, you need to fill out not one personal income tax payment form, but several.

For example, on salary, vacation pay and sick leave.

- Payment of traffic police fine payment order individual sample

- Traffic police fines – LLC – Payment systems

- Receipt samples: Form PD-4 Sberbank (tax)

- Payment of traffic police fines from a legal entity, payment with VAT or not

- Payment of traffic police fine payment order individual sample

- Sample of filling out a payment order in 2021 Receipt samples: Form PD-4 Sberbank (tax)

- Which payer status should be entered in field 101 of the payment order?

- Making a payment for a fine

- Traffic police details for paying a fine - where and to whom to pay

- Payment of traffic police fines from a legal entity, payment with VAT or not

- Making a payment for a fine

- Traffic police fines – LLC – Payment systems

- Which payer status should be entered in field 101 of the payment order?

- Traffic police details for paying a fine - where and to whom to pay

- Payment of traffic police fines from a legal entity, payment with VAT or not

- Sample of filling out a payment order in 2021

- Receipt samples: Form PD-4 Sberbank (tax)

Registration of payment for a fine KBC for penalties are established for each type of tax and contribution.

What is hidden behind the abbreviation UIN?

When filling out a universal online payment form in your personal online banking account, you will definitely have a question about what a UIN is. The unique accrual identifier consists of 20 digits. When receiving a certain amount into its current account, the FCC must simultaneously receive information about the reason for which the money was transferred and on what basis. If the reason lies in the KBK (fine for violating traffic rules), then the basis is the UIN.

Since 2014, the traffic police has indicated a unique accrual identifier in the resolution in the form of a document number. Thus, the UFK determines according to the UIN which fine was paid off. If a driver has several outstanding fines at the same time, then the UIN will be for each of them.

Originator status in the payment: all possible values

What should I put in field 101 of the payment order “Drawer Status” in 2021? Practice shows that filling out this information in practice raises many questions.

In addition, changes have recently been made to the rules for filling out this code.

Our review contains all the current code values for the field with the originator status. The field with the originator status in the 2021 payment order is located in the upper right corner.

It is left empty only in one case - when payments occur between private individuals and are not related to the budget system. Based on the regulation of the Central Bank of Russia No. 383-P, the field in question, the status of the compiler in 2021, is filled out only if any sums of money are transferred to the budget (incl.

including extra-budgetary funds). That is, when paying taxes, fees, contributions, state duties, etc. Let us note that the affixing of the status of the preparer in the 2021 payments was influenced by amendments to the tax legislation, where most of the rules on insurance contributions to extra-budgetary funds were transferred from 01/01/2021.

This has led to the fact that since the end of April 2021, Appendix No. 5 to Order of the Ministry of Finance No. 107n, which regulates the filling out of field 101, has been in effect in a new edition. All statuses of the document preparer in the 2021 payment order Code Who is the payment preparer and in what situation 1 Legal entity: · tax payer ; · fees; · insurance premiums; · other payments supervised by tax authorities.2Tax agent3Russian Post (on behalf of an individual, with the exception of customs duties)4Tax5FSSP and its territorial bodies6Legal entity - participant in foreign trade activities (exception - recipient of international mail)7Customs8Payer: · organization; · merchant; · private notary; · advocate; · head of peasant farm.

Task: transferring money to the budget system. Exception: taxes, fees, insurance premiums and other payments supervised by tax authorities.9IP: · tax payer; · fees; · insurance premiums; · other payments supervised by tax authorities.10Private notary: · tax payer; · fees; · insurance premiums; · other payments supervised by tax authorities.11Lawyer (adv.

office): · tax payer; · fees; · insurance premiums; · other payments supervised by tax authorities.12Head of peasant farm: · tax payer; · fees; · insurance premiums; · other payments supervised by tax authorities.13 Ordinary individual: · tax payer; · fees for tax authorities performing legally significant actions; · insurance premiums; · other payments that are supervised by tax authorities.15 Credit institution (its branch) Paying agent Russian Post Task: drawing up a payment order for the total amount with a register for the transfer of money accepted by an individual. its branches Task: drawing up an order for the transfer of money withheld from the salary (income) of the debtor - an individual to pay off debts on payments to the budget system.

The basis is an executive document that came to the organization.20Credit institution (its branch)Paying agent Task: drawing up an order for the transfer of money for each payment of an individual21Responsible participant of the KGN22Participant of the KGN23FSS24Individual Task: · transfer of money to pay fees, insurance premiums supervised by the FSS; · other payments to the budget system (with the exception of fees for tax officers performing legally significant actions and other payments supervised by tax and customs authorities).25 Guarantor banks Task: drawing up an order for the transfer of money to the budget: · when returning VAT received in excess by the payer (offset him) in a declarative manner; · payment of excise taxes on the sale of excisable goods outside the Russian Federation and excise taxes on alcohol and/or excisable alcohol-containing products.26 Founders (participants) of the debtor Owners of the property of the debtor - a unitary enterprise Third parties Task: drawing up an order for the repayment of claims against the debtor for mandatory payments included in the register during bankruptcy27 Credit institutions (their branches) Task: drawing up an order for the transfer of money transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget. select a piece of text and press Ctrl+Enter.

We recommend reading: How to return money to a Sberbank card for a purchase in a store

Is it possible to pay without details?

To transfer funds to the recipient's account through a bank, payment details are always required, so they must be fully specified in the payment receipt. If you do not want to enter them yourself, choose a payment method through online banking, electronic wallets or other services that allow you to find unpaid fines based on your driver’s license and vehicle registration certificate. In this case, the necessary details will be automatically filled in based on the data received from the GIS GMP system, and you will only have to confirm the transaction.

Sample of filling out a payment order to the tax office in 2020–2021

Example

An on-site inspection was carried out at Zvezda LLC. Based on the audit report, a decision was made that the organization underpaid income tax. Based on the decision that has entered into force, the organization sent a demand No. 18-52/45678 dated 02/07/20XX for payment of arrears, penalties and a fine. UIN specified in the request: 12345678912345678912.

Let's consider how the payment order will be filled out in this case (if necessary, you will be able to submit a payment order to pay the fine in 2020-2021).

For details of filling out payment orders to pay a fine at the request of the tax inspectorate or according to a tax audit report, see ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Finding your unpaid fines

Every Russian driver has the opportunity via the Internet to search for traffic police fines that have not yet been paid. This allows you to timely find your new penalties for traffic violations and make payments without waiting for a registered letter from the State Traffic Inspectorate.

The function for searching for outstanding debt is available on the official website of the traffic police without registering an account and confirming your identity.

In addition to the web resource of the State Traffic Inspectorate, checking fines by UIN number, driver's license and car registration certificate number is available to users of the State Services portal, payment services Yandex.Money, QIWI, WebMoney, as well as some other specialized online services.

Purpose of payment administrative fine

carried out upon presentation of an identity document: passport of a citizen of the Russian Federation. If you are not a resident of the Russian Federation, then in addition to a foreign citizen’s passport you will also need a notification of registration at your place of residence. payments credited to the budget (personal income tax, simplified tax system, UTII, etc.) and extra-budgetary funds (pension, medical insurance, social insurance); payments for provided housing and communal services (housing and communal services, gas, electricity, water supply); payments for other paid services provided (Internet, TV, services, etc.); payments for goods (via an online store, a store by order); insurance payments (pension, medical insurance, social insurance); voluntary contributions (voluntary pension insurance, charity); payments in favor of individuals carrying out entrepreneurial activities without forming a legal entity (IP); payments for the purchase of real estate, contributions to housing, housing construction,

KBC for payment of monetary penalties (fines)

The most widespread type of fines. The accrued fine must be paid on time (within 2 months), otherwise there is a new offense, which in turn is also punishable by a fine and additional unpleasant measures against the defaulter.

A little more about paying fines and monetary penalties

- For violation of budget legislation at the federal level 1 1600 140. For arrears to the Pension Fund - 1 16 20010 06 0000 140.

- For failure to pay contributions to the Social Insurance Fund on time - 1 16 20020 07 0000 140.

- For non-payment of contributions to the FFOMS - 1 1600 140.

- The fine for violations of cash handling, cash transactions, and the use of special bank accounts identified by the inspection (if this was due to the requirements) is 1,1600,140.

- For violations related to the use of currency 1 16 05000 01 0000 140.

When issuing a payment order to transfer payments to the budget system of the Russian Federation, you must be guided by the Rules, approved. By Order of the Ministry of Finance of Russia dated November 12, 2021 No. 107n, as well as the Regulations, approved. Bank of Russia 06/19/2021 No. 383-P.

For committing a tax offense, an organization or individual may be subject to tax sanctions in the form of a monetary penalty - a fine. We will tell you how to issue a payment order for the payment of a fine (clauses 1.2 of Article 114 of the Tax Code of the Russian Federation) in our consultation and give an example of such a payment order.

How to submit a payment for a fine to the tax office

In order for the obligation to transfer the fine to be considered fulfilled, it is necessary to correctly indicate in the payment order the Federal Treasury account and the name of the recipient's bank (clause 4, clause 4, clause 8 of Article 45 of the Tax Code of the Russian Federation). But starting from 2021, the account of the Federal Treasury can be clarified (clause 7 of Article 45 of the Tax Code of the Russian Federation). This means that if you make a mistake on your bill, you will not have to return the money or pay a fine again. The problem can be resolved by clarifying the payment.

Using this online service, you can generate payments and receipts for the payment of any taxes under the simplified tax system, UTII and for employees, submit any reports via the Internet, etc. (from 150 rubles/month). 30 days free, with your first payment (using this link) three months free. 1. State duty for issuing a foreign passport (old).

state duty payer status 01 or 08 The development of the project is aimed at administering mandatory contributions for pension, medical and social insurance by the tax service, which involves entering code “01” instead of the previously indicated code “08”.

We recommend reading: Report on the Production Practice of an Accountant at an Enterprise 2021

Sample payment for traffic police fine

( Total payable: 1000 rubles). 2. State duty for issuing a foreign passport (new) containing an electronic storage medium. (Total payable: 2500 rubles). 3. State duty for obtaining a foreign passport for a child under 14 years of age. (

Did you submit your tax return on time? Or forgot to pay tax? Has the tax office sent a demand for payment of penalties and fines? We will help you draw up a payment order to pay penalties and fines to the tax office or extra-budgetary fund.

How to correctly fill out a payment form for a fine at the traffic police 2021

Currently, to pay the tax and the fine thereunder, the first 13 and from the 18th to the 20th digits of the BCC are identical and only filling out the 14–17 digits has its own peculiarities. These 4 characters are reserved for the correct designation of the subtype of income. The 14th character in code “3” indicates that a fine is being paid.

— Recipient’s TIN – 1654002946; — Recipient checkpoint – 165945001; — Recipient – UFK for the Republic of Tatarstan (State Traffic Safety Inspectorate of the Ministry of Internal Affairs for the Republic of Tatarstan); — Budget classification code 188 1 1600 140; - OKTMO - The code of the municipality is indicated at the place where the protocol was drawn up (for example, the city of Kazan-92701000); — UIN 188... (20 characters) is indicated in field No. 22 (please additionally indicate the UIN in the “Purpose of payment” field to identify the payment).