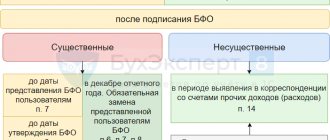

When the need for adjustment arises

There are quite a lot of situations in which it is necessary to adjust amounts after delivery in business practice. Here are some of them:

- Errors in shipping documents.

- Claims from the buyer about an inadequate range of goods, claims about the quality of the goods.

- Re-grading and, as a consequence, recalculation of the price and quantity of goods.

- Bonuses that reduce the price.

- Additional agreement concluded to an existing agreement, etc.

How to fill out an adjustment invoice when the cost of delivery is reduced ?

Situations in which an accountant has to adjust the implementation of a previous period can arise in any area of business, especially when it comes to large companies operating in several areas and types of activities; about large shipment volumes.

If changes occur within 5 days from the date of initial shipment, no special problems arise. For example, for tax accounting purposes, it is enough to issue a new invoice that takes into account the changes (Article 168 of the Tax Code of the Russian Federation, paragraph 3). However, this is not always the case. Let's consider situations of adjusting the implementation of the past period in one direction or another using examples.

How to take into account sales adjustments when prices change ?

How not to lose a deduction on an adjustment invoice for a reduction?

The CSF for reduction is a document on the basis of which a taxpayer can claim a VAT deduction. You can use the right to deduction only if the CSF does not contain significant errors.

For example, controllers may refuse a deduction if in the CSF:

- goods not specified in the PSF are listed;

- negative values are indicated (all numbers in the CSF must be positive, even when adjusting the cost of the product downward).

When errors in invoices cannot deprive a deduction, find out from the material “What errors in filling out an invoice are not critical for deducting VAT?”

K+ experts explained in detail how to correct errors in an adjustment invoice. You can find out the procedure by getting free trial access to the system.

Learn about other errors inherent in the CSF that can negatively affect the deduction in the next section.

Increase

Suppose that in the current period an error was identified in the mutual settlements of the previous period of Alpha LLC, after which Beta LLC transferred an additional amount to the company for the goods. The difference in sales volume was 12,000 rubles, including VAT. 12000 / 1.20 = 10000 rub. 12000 - 10000 = 2000 rub.

How is the VAT tax base adjusted when the sales price changes ?

Alfa LLC postings:

- Dt 62 Kt 90-1 12000 rub. — additional accrual of revenue (including VAT).

- Dt 51 Kt 62 12000 rub. — receipt of funds from Beta LLC.

- Dt 90-3 Kt 68 2000 rub. — the additional amount of VAT to the budget is reflected.

- Dt 68 Kt 51 2000 rub. — an additional amount of VAT is transferred to the budget.

On a note! According to the instructions for using the chart of accounts (pr. No. 94n dated October 31, 2000 of the Ministry of Finance) and depending on the features of the working chart of accounts approved by the accounting policy, accounts 91 (instead of 90-1), 76 (instead of 62) can be used in transactions, respectively , 60).

Relevance indicator 0/1

The declaration representative fills in the relevance indicator in the VAT declaration appendix in the case where the adjustment number on the title page does not reflect “0”.

It is filled out in an updated declaration to correct previously made errors when the tax authority has sent a corresponding request for its filing within 5 days. The taxpayer has the right to disagree with the requirement and provide an explanation within the established time limit.

If there is data for adjustment, sections 8 and 9 are filled in on lines 001 with one of two values:

- “0” - data was not previously indicated in this section, erroneous data was indicated, incomplete data was indicated.

- “1” – the information is current, reliable, and does not require correction.

The updated tax return is submitted to the tax office at its location , regardless of whether the previous reporting was submitted here or to another department.

Often a public easement is established without the consent of the owner of the land plot. Is it possible to privatize land if the house is owned, and how to do it correctly? Step-by-step instructions are here.

Is it possible to find out the owner of a land plot by cadastral number? A detailed answer to this question is in our article.

Decrease

Let us now assume that in March Beta LLC signed a certificate of completion of work with Pixel LLC in the amount of 24,000 rubles, including VAT, for installation and configuration of new software. In April, the installed software experienced malfunctions. The examination identified a fatal software defect. Pixel LLC fully agreed with the claim received from the counterparty and in February returned the money to Beta LLC. This transaction is reflected in the accounts of both companies. 24000 / 1.2 = 20000 rub. 24000-20000 = 4000 rub.

Pixel LLC (service provider)

March:

- Dt 62 Kt 90-1 24,000 rub. – revenue accrued (including VAT).

- Dt 90-3 Kt 68 4000 rub. – VAT has been charged.

- Dt 51 Kt 62 24,000 rub. – payment from Beta LLC according to the work completion certificate.

April (1st quarter data adjustment):

- Dt 91-2 Kt 62 20,000 rub. – loss, decrease in sales.

- Dt 68 Kt 62 4000 rub. – VAT reduction.

- Dt 62 Kt 51 24000 – return of previously transferred funds to Beta LLC.

In this case, it is also possible to post Dt 91-2 Kt 62 RUB 24,000. – the decrease is reflected together with VAT, Dt 68 Kt 91-1 4000 rub. – VAT is allocated on this amount, a tax deduction based on the adjustment invoice. However, the instructions for the chart of accounts do not indicate the connection of 91 accounts with VAT. At the same time, the accounting meaning of accounts 90 and 91 is certainly similar.

Beta LLC

March:

- Dt 20, 26 Kt 60 20,000 rub. – the cost of installing the software is included in the price.

- Dt 19 Kt 60 4000 rub.

- Dt 68 Kt 19 4000 rub. – VAT has been taken into account and accepted for deduction.

- Dt 60 Kt 51 RUB 24,000 – payment for the work of Pixel LLC.

April:

- Dt 76/2 (since there was a claim) Kt 91/1 20,000 rub. – other income is recorded.

- Dt 76/2 Kt 68 4000 rub. – VAT restoration for settlements with Pixel LLC.

- Dt 51 Kt 76/2 24,000 rub. – refund from Pixel LLC.

Consolidated adjustment invoice: can it be prepared when the cost of goods decreases?

The supplier may issue a single (consolidated) CSF if adjustments to the cost of goods are needed for several deliveries to one buyer.

This opportunity has been provided for the last 5 years thanks to clause 5.2 of Art. 169 of the Tax Code of the Russian Federation (after the entry into force of the law dated 04/05/2013 No. 39-FZ).

Registration of a consolidated CSF for reduction is possible if:

- the seller agreed with the buyer to reduce the cost of shipped goods;

- the decrease affects several (two or more) deliveries issued with separate primary invoices.

The unified CSF must contain information:

- about all serial numbers and dates of issued PSF;

- on the quantity of goods and their total cost (with and without VAT) for all invoices before and after adjustments;

- the difference between invoice values before and after changes are made.

In the consolidated CSF, errors are also possible that will not allow the taxpayer to claim a tax deduction. The main specific error of this document is the indication in it of data on several buyers (subclause 3, clause 5.2, article 169 of the Tax Code of the Russian Federation). It is also unacceptable in the consolidated CSF to collapse the totals if the cost of some goods decreases and others increases.

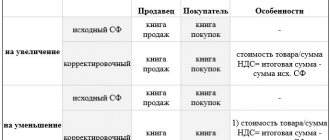

Nuances of tax accounting

An invoice from the seller to reduce the cost of shipment, VAT for deduction is registered in the purchase book. This can be done no earlier than the buyer’s consent to the reduction has been received, and no later than 3 years from the date of registration of the adjustment invoice (Articles 171-13, 172-10 of the Tax Code of the Russian Federation).

If sales increased, the adjustment document is entered into the sales book in the same quarter in which it was drawn up (Article 154-10 of the Tax Code of the Russian Federation).

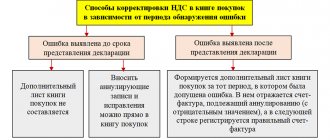

For income tax, when the sales volume changes, and therefore the tax base, an adjustment declaration is submitted. The information must be reflected in the period of initial recording of the business transaction. This is stated in a number of letters from the Ministry of Finance (for example, No. 03-03-06/1/44103 dated 12/07/17).

As implementation increases, this rule always works. If an adjustment has occurred downwards, it is possible to reflect this in the adjustment period, with one condition: in the period of initial shipment, income tax is calculated for payment. During the period of initial shipment there was a loss (or zero income) - which means an adjustment declaration is submitted (Article 54-1 of the Tax Code of the Russian Federation).

A single adjustment to the implementation of a retro discount in “1C: Accounting 8” (rev. 3.0)

Let's consider an example of a seller reflecting in "1C: Accounting 8" edition 3.0 sales adjustment transactions when providing a discount on previously shipped goods and claiming VAT for deduction.

Example

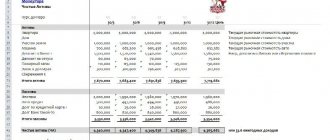

The organization TF-Mega LLC (seller) entered into an agreement for the supply of goods with Trading House LLC (buyer). Both organizations apply a common taxation system and are VAT payers. According to the terms of the agreement, the seller made the following shipments of goods to the buyer during 2021:

On July 20, 2018, in accordance with the terms of the contract, the seller provided the buyer with a discount on goods shipped for the entire year in the amount of 5% of the original cost, reduced the cost of sales and issued a single adjustment invoice in the amount of RUB 28,320.00. (including VAT 18% - RUB 4,320.00). The sequence of operations is given in the table. |

Implementation adjustments

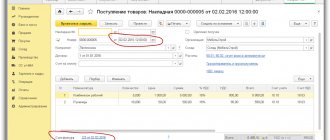

To reflect in the program an adjustment downward to the cost of all previously sold goods, you need to create a Sales Adjustment document with the operation type Adjustment as agreed upon by the parties for each sales operation.

You can create a document Adjustment of sales in relation to goods shipped in January 2021 (operations: 1.1 “Adjustment of revenue of goods sold on 01/25/2018”; 1.2 “Adjustment of VAT accrued on 01/25/2018”), based on the previously posted document Sales (act, invoice) .

In the new unposted document Adjustment of sales (Fig. 1) with the type of operation Adjustment by agreement of the parties on the Products tab in the Price column in the line after the change, you must indicate a new price for each product item taking into account the discount provided. The values of the remaining fields are automatically calculated for the changed product items:

- cost without VAT - in the Amount column;

- VAT amount - in the VAT column;

- cost including VAT - in the Total column.

Since the provision of a retrospective discount must be reflected both for the purposes of applying VAT, and for accounting (AC), and tax accounting (TA) for income tax, then in the document Adjustment of sales in the line Reflect adjustment should be set to In all sections of accounting.

After posting the document, reversal accounting entries will be generated:

Debit 62.01 Credit 90.01.1 - for the negative difference between the cost of goods including VAT before and after adjustment in the amount of RUB 10,620.00. (RUB 5,900.00 + RUB 4,720.00); Debit 90.03 Credit 19.09 - for the negative difference in the amount of VAT on the sales transaction before and after adjustment in the amount of RUB 1,620.00. (900.00 rub. + 720.00 rub.).

For the purposes of applying VAT, when posting a document, a credit entry is made in the VAT accumulation register presented. The VAT register data presented will be taken into account in the future when creating purchase ledger entries. An entry into this register is a potential entry in the purchase book, an expense is a VAT claim for deduction or a tax write-off on other grounds (for example, the tax amount can be included in the cost of goods, written off against the organization’s net profit, etc.).

In a similar way, documents are generated: Adjustment of sales with the type of operation Adjustment by agreement of the parties in relation to sales of goods carried out:

- 03/25/2018 — operations 1.3 “Adjustment of revenue from goods sold on 03/25/2018”; 1.2 “Adjustment of VAT accrued on March 25, 2018”;

- 05/25/2018 — operations 1.5 “Adjustment of revenue from goods sold on 05/25/2018”; 1.6 “Adjustment of VAT accrued on May 25, 2018.”

After completing the Sales Adjustment documents in relation to goods shipped on 03/25/2018 and 05/25/2018, entries are also made in the accounting register and the VAT accumulation register presented. A single adjustment invoice (operation 1.7 “Issuing a single adjustment invoice for shipments of goods”) for all adjustment operations is created by clicking the Write adjustment invoice button at the bottom of the document form Adjustment of sales with the type of operation Adjustment by agreement of the parties (see Fig. . 1).

Rice. 1. Implementation adjustments

You can create a single adjustment invoice from any Sales Adjustment document with the transaction type Adjustment by agreement of the parties. In this case, in the new adjustment invoice, the basis document will be indicated by the adjustment document through the field of which the adjustment invoice was created.

In the created and posted document Adjustment Invoice Issued, which can be accessed via a hyperlink, all fields will be filled in automatically.

In addition, the adjustment invoice will be automatically assigned a serial number in accordance with the general chronology and marked with:

- transaction type code 18, which corresponds to the value “Drafting or receiving an adjustment invoice due to a decrease in the cost of shipped goods...” (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] );

- switch to the On paper position, the flag in the Issued field (transferred to the counterparty) and the issue date (same as the date of preparation of the adjustment invoice), if there is no valid agreement on electronic exchange.

To create a single adjustment invoice for several adjustment operations, i.e., for several previously issued invoices, you need to click on the Change hyperlink in the line Documents-bases of the document Adjustment invoice issued, open the form for the list of documents-bases and Click the Add button to enter information about all adjustment documents taken into account for the formation of a single adjustment invoice (Fig. 2).

Rice. 2. Formation of a single adjustment invoice

As a result, the generated document Adjustment invoice issued will represent a single adjustment invoice drawn up for all invoices issued upon shipment of goods:

- invoice No. 30 dated January 25, 2018;

- invoice No. 31 dated March 25, 2018;

- invoice No. 32 dated May 25, 2018.

Please note that in the single adjustment invoice the transaction type code will be automatically replaced from the value 18 to the value 01, since it is the code “01” that should be used when drawing up or receiving a single adjustment invoice (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ). When posting the Adjustment Invoice document issued to the Invoice Journal register, entries are entered to store the necessary information about the issued single adjustment invoice.

By clicking the Print document Adjustment invoice issued button, you can view the compiled single adjustment invoice and print it on paper (Fig. 3).

Rice. 3. Printed form of a single adjustment invoice

In the printed form of a single adjustment invoice, you should pay attention to the fact that the indicators of commodity items that have the same name and the same price are summed up.

And product items with different names and/or different prices are displayed in separate lines (see letter of the Ministry of Finance of Russia dated September 8, 2014 No. 03-07-15/44970, communicated by letter of the Federal Tax Service of Russia dated September 17, 2014 No. GD-4-3/ [ email protected] ).