SZV-M what kind of report is this?

What kind of report is SZV-M?

In fact, this is a special reporting form with the personal data of all employees, which every business entity must send to the Pension Fund every month. After processing this document and comparing the data, the fund determines which of them is a pensioner. This information is necessary to take measures to stop pension indexation, which are determined by current legislation. At the same time, with its help they will determine that the pensioner quit his job and will again begin to index his payment.

The PF believes that if a citizen is in the report, then he is employed, and information about him is included in the report.

At the same time, after his dismissal, information about him disappears from the form. Thus, this makes it possible to automatically disable or enable indexing based on the received data. Attention: the SZV-M form is compiled not only according to the data of pensioners, but in general for all employees of the company.

After submitting the report, the business entity has the opportunity to determine the accuracy of their registration data and other information. This form is completed and sent to the fund after the end of each calendar month based on its results.

SZV-K: what is it and who is taking it in 2021 with an example of filling it out

Then it was also introduced to generalize information about work experience before 2002. Then human resources departments had to “raise” the work books of employees and inform the Pension Fund of Russia about the length of service of employees before 2002.

The compulsory pension insurance system introduced in 2002 provided for fundamentally new sources of financing pension payments - these are insurance premiums that are required to be paid by policyholders who use hired labor in their business activities or provide themselves with work. Since 2002, timely and complete payment of insurance premiums has made it possible for citizens to exercise their right to pension provision.

However, length of service before 2002 is also taken into account when assigning insurance pensions.

Who should submit the SZV-M form

The report must be submitted to the Pension Fund if in the previous month the business entity had valid labor agreements with employees. This rule also applies to persons with whom contracts for the provision of services have been concluded. Therefore, this form must be submitted to both organizations and entrepreneurs.

In the case where an individual entrepreneur carries out activities alone, without involving third parties, he should not submit a report. Also, he should not be registered with the Pension Fund and Social Insurance Fund as an employer.

An enterprise may have a situation in which it temporarily does not conduct any activities, and salaries to employees are not calculated or issued. This could be when opening or closing a business, or during a crisis.

In this situation, it is necessary to understand that if the company has at least one valid contract, even if wages are not currently being paid, the report must still be submitted. This also needs to be done if a single contract has been drawn up, and it is with the director of the company. If there is no activity or employees, the report is not submitted.

Important: previously there was a rule according to which the only founder, if he was also a director but did not enter into an employment contract with himself, did not have to submit a report. This has changed since March 2021 - the Pension Fund has changed its position and now requires it to be included in the form in any case.

The amendments also affected the submission of forms for founders who are not employees. If previously it was important to conclude an employment agreement with employees, then the latest amendments have also changed the situation.

As in the case of the sole owner, the report must include information on all other individual owners, regardless of whether there is a valid agreement with them or not.

Which employees should be shown in the report?

The report must indicate all those employees who worked in the organization or individual entrepreneur during the reporting month. It doesn’t matter what type of contract was concluded with them; it also makes no difference how long each employee worked or whether he received wages. If he was fired on one of the days of the reporting period, it is still necessary to include him in the report.

Thus, the general rule is this: the SZV-M report includes all individuals for whose payments the employer must accrue contributions to the Pension Fund. All of them must be included even if these contributions will not be accrued during the reporting period.

Where should reports be submitted?

Any business entity - both an individual entrepreneur and a company - must submit a completed report to the PF body that registered them as an employer. This means that companies ship at their location, and individual entrepreneurs ship at their place of registration.

If a company has representative offices or branches, they must submit this report regardless of the parent companies at their location. In this case, the report indicates the TIN of the parent organization, and the KPP - assigned to the branch during registration.

Submission methods

The completed report must be submitted to the authority in one of the following possible ways - on paper or in electronic format.

However, the business entity itself cannot choose a more convenient option for it - it depends on the number of employees:

- If a business entity has contracts with more than 25 employees, the report must be submitted only in electronic format. In this case, the file must be prepared in a special computer program or service and signed with an electronic signature. If a business entity sends a paper report, although according to the law it must be submitted only electronically, a fine will be issued.

- If up to 24 employees are registered, the report can be submitted on paper, or, if desired, in electronic format.

Penalty for failure to submit reports

The law establishes that the completed report must be sent to the regulatory authority within a strictly specified time frame. If it is violated, a fine will be imposed on the subject for late submission of the SZV-M.

Currently it is 500 rubles. for each employee who needed to be included in the report. Since the amount of the penalty is calculated based on the number of employees in the month for which the report was not sent, for large firms with large staff, it can be quite significant.

A similar amount of fine is determined for business entities that submitted a form with incomplete or incorrect information. The amount of punishment in this case will be determined based on the number of people for whom information was not submitted or distorted.

Attention! Another type of penalty is for those who file the report incorrectly. Thus, an entity with more than 25 people must report only electronically. If the form is provided on paper, a penalty of 1000 rubles will be imposed.

Deadline for submitting the SZV-M form in 2018-2019

The law strictly defines the deadline for submission of SZV-M - this must be done before the 15th day of the month that follows the reporting month.

The rule applies to this period - if the set day falls on a weekend or holiday, then it must be moved forward to the next working day.

The law does not establish a minimum dispatch day. In fact, it is possible to prepare and submit the required form even before the actual end of the current month.

Attention: it is necessary to take into account that in the remaining days no employment agreements should be drawn up with employees. Otherwise, the responsible person will have to prepare and submit corrective information. If you ignore this requirement, you will be fined for providing incomplete information.

In this regard, it is recommended to make the change after the actual end of the month, at least on the 1st day of the month.

The deadlines for sending the report in 2018-2019 fall on the following dates:

| Report period | Dispatch time |

| -for July 2021 | 15-08-2018 |

| -for August 2021 | 17-09-2018 |

| -for September 2021 | 15-10-2018 |

| -for October 2021 | 15-11-2018 |

| -for November 2021 | 17-12-2018 |

| -for December 2021 | 15-01-2019 |

| -for January 2021 | 15-02-2019 |

| -for February 2021 | 15-03-2019 |

| -for March 2021 | 15-04-2019 |

| -for April 2021 | 15-05-2019 |

| -for May 2021 | 17-06-2019 |

| -for June 2021 | 15-07-2019 |

| -for July 2021 | 15-08-2019 |

| -for August 2021 | 16-09-2019 |

| -for September 2021 | 15-10-2019 |

| -for October 2021 | 15-11-2019 |

| -for November 2021 | 16-12-2019 |

| -for December 2021 | 15-01-2020 |

Amendments to the Instructions on the procedure for maintaining personalized records

As for the first point of changes, now it is not enough for organizations to simply send and submit SZV-M to the fund. From October 1, it is also necessary to receive a notification from the Pension Fund about the acceptance of this report. This notification will represent a kind of receipt from the Pension Fund of Russia regarding receipt and acceptance of the report, but until the receipt is provided, the report is considered not accepted, and this entails penalties for failure to submit the SZV-M. Afterwards, the Pension Fund will send a data control protocol. As stipulated in the instructions, it is provided to the organization no later than the working day following the day the report is submitted. The policyholder must sign the protocol.

Another important change that policyholders need to take into account is the clarification of the conditions for exemption from fines for organizations when submitting a report. So, according to the previously existing procedure, the employer is exempt from the fine if updated information is submitted within five working days from the date when the fund body received a notification about the need to eliminate inaccuracies and discrepancies and if errors are detected and corrected by the employer before they are identified by the Pension Fund.

However, in practice, accountants were faced with the fact that when submitting the updated form SZV-M, which included employees who were not previously reflected in the original form of the report, they received a notification from the Pension Fund of the Russian Federation that a fine had been assessed. The fund's position was that expanding the list of employees does not correct an error in the information about the insured person. Such situations often led employers to challenge the fine in court, and quite often the court took the side of the insured.

Now amendments to the Instructions clarify and eliminate controversial provisions. It is now possible to avoid a fine if the following conditions are met:

- correctable errors must be made in relation to individuals included in the original SZV-M;

- errors must be detected and corrected independently or within 5 working days from the date of receipt of notification from the fund about their elimination.

Violation of these requirements entails a fine of 500 rubles.

for each insured person. The new edition of the Instruction on the procedure for maintaining personalized records dated December 21, 2016 No. 766n contains one more change. We are talking about the application of penalties if an error is identified and corrected by the organization itself. If the policyholder discovered and corrected an error before the Pension Fund learned about it, then there are no grounds for charging a fine (Part 3, Clause 39 of the Instructions). According to the order of the Ministry of Labor of the Russian Federation dated June 14, 2018 No. 385n, two conditions must be met in order to avoid sanctions:

- the organization itself discovered an error in the previously submitted information and corrected it before the Pension Fund learned about it;

- erroneous information was accepted by the Pension Fund.

Thus, the preparation and compilation of the SZV-M has not undergone significant changes. The Pension Fund of Russia, by order of June 14, 2021 No. 385, clarified a number of provisions of the instructions on maintaining personalized records in order to eliminate controversial and ambiguous provisions of the previously existing instructions.

Sample filling SZV-M

To compile this report, you can use accounting programs or special services. This will avoid errors when filling out.

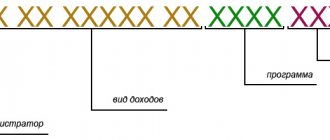

Section 1

This section contains information about the individual entrepreneur or organization who submits information to the Pension Fund. Here you need to write off the registration number in the Pension Fund, the full name or full name of the entrepreneur, the assigned TIN and KPP codes.

Section 2

This section contains the numbers of the month and year for which the report is sent. The month must have two digits, and the year must have four. Below is a hint on how to correctly enter these numbers.

Section 3

This section contains one column that defines the report attribute; here you need to write one of three values:

- ISHD - the form for this period is sent for the first time;

- Additional information - a form has already been submitted for this month, and it is necessary to correct the data or enter new ones. For example, using this code you can add an employee to a report who was not there before. If there is an addition to a previously submitted report, the new one must contain only previously unspecified data.

- OTMN - applies if the report has already been submitted previously, and it is necessary to remove any information from it. A report with this code should only include information that is removed.

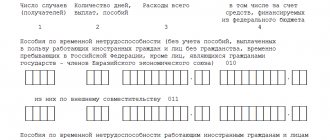

Section 4

This section is a table with four columns. The following data is recorded in it: serial number of the line, full name of the employee, SNILS and TIN codes.

The rules for designing the form allow you not to indicate the TIN code if it is not assigned to the employee. The SNILS code must be indicated in any case. There are no dashes in empty columns.

The table lists, line by line, all employees with whom there were valid employment agreements in a given month. This also applies to those hired in a given month, those fired, those on a business trip, vacation, absent due to illness, etc.

Also in the table you need to enter individuals with whom civil contracts were drawn up this month, but on the condition that deductions were made to funds for the remuneration paid.

The completed report must be signed by the head of the company or entrepreneur, after which a seal is placed on the form.

Attention: due to the fact that the form does not provide space for the signature of the responsible person and the indication of power of attorney data, only the manager can submit the form in person.

Should I submit zero reporting?

Those responsible for reporting often ask on the SZV-M form whether it is necessary to submit zero reporting or not.

The Pension Fund of the Russian Federation clearly determines that if a company exists, then information must be provided at least on its founders, if they are individuals, and directors.

Therefore, the possibility of sending a zero report is completely excluded.

It must be remembered that if there is no activity, but there are concluded employment contracts with employees, then in this case the report on the SZV-M form must still include information on these citizens.

Attention: Individual entrepreneurs do not submit a zero report for themselves. If he does not act as an insured under employment contracts and work contracts, then there is no need to submit reports in the SZV-M form.

How do you exchange documents with the Pension Fund now?

Now you need to send personalized reports to the Pension Fund of Russia using the following algorithm:

- The policyholder sends the SZV-M form to the Pension Fund;

- In response, the Pension Fund of Russia sends the policyholder a receipt for delivery of the statements.

- The Pension Fund of the Russian Federation sends a protocol for monitoring information to the policyholder (no later than the business day following the day the report is submitted).

- In response, the employer must send to the Pension Fund a receipt for delivery of the control protocol.

Obviously, all documents in this exchange must be signed with qualified electronic signatures of authorized persons (EDS). Please note that instead of one electronic document - the SZV-M form itself - now as many as 4 electronic documents take part in submitting reports.

FAQ

Do I need to provide a form upon dismissal?

According to legal requirements, if an employee leaves a business entity, he must be given a copy of the SZV-M forms along with a set of mandatory documents. Receiving this document in hand is confirmation that in a given month he has work experience and contributions to the funds were made.

To the question of SZV-M, when dismissing an employee, for what period should you answer - for all months of the current year during which the employment agreement was valid with him.

Since when the report is submitted to the Pension Fund, it contains data on all employees of the company, an extract must be made before handing it over. Only the resigning employee himself should be present. If a business entity provides complete reports, it will disclose the personal data of other employees, and this will be a violation of the law and will lead to penalties.

Important: the report must be issued in person in any case, even if the employee only worked for one day. To obtain confirmation of the issuance of forms, it is necessary to obtain a receipt from the employee indicating how many reports were handed over to him and for what period.

It is worth noting that the law has not yet established specific penalties for the failure to issue these documents. However, the employee can file a complaint about the non-issuance of documents to the labor inspectorate, prosecutor's office or court. Unfortunately, it is difficult to predict the actions of these authorities after receiving it.

Are reports submitted if the individual entrepreneur has no employees?

The law defines cases when individuals registered as entrepreneurs must send SZV-M reports to the Pension Fund. These include cases of hiring individual entrepreneurs’ personnel under employment and civil contracts.

If an entrepreneur carries out activities independently, without the involvement of hired employees, then he may not submit reports to the Pension Fund of the Russian Federation in the SZV-M form.

If an entrepreneur terminates concluded labor agreements with his employees, then his obligation to submit the SZV-M report to the Pension Fund of the Russian Federation disappears starting from the month following the month of termination of the contracts. In this case, it is advisable to send an explanatory letter to the inspector, which reflects the moment of termination of the employment relationship.

According to the law, an entrepreneur does not have to submit a report to himself in the SZV-M form.

Should I submit a report if the company is being liquidated?

When a decision is made to close an enterprise, the liquidation procedure begins. All this time, a certain number of employees can work in the organization. Therefore, when liquidating an organization, it must submit the SZV-M form until the last employee is fired. At the same time, compliance with established deadlines is also mandatory.

Next, you need to proceed from who is carrying out the liquidation - the liquidator or the liquidation commission. The founders of the company are given the right to attract civil contract specialists who will deal with this process.

According to the signed agreements, these persons will receive remuneration, for which the legislation establishes the obligation to charge contributions. Therefore, the liquidated organization must, until the last moment, right up to making an entry about the closure of the legal entity in the Unified State Register of Legal Entities, submit SZV-M forms to the liquidators.

Attention: if the liquidation is carried out by a liquidation commission, then information is provided to its chairman and each member.

There is an option when the owner of the company will take on the responsibilities of closing the company. If they do not accrue and pay remuneration to themselves for performing these functions, then they do not need to submit a report to the Pension Fund.

Should I rent it out to new organizations if there is no bank account and no director?

Representatives of the Pension Fund of Russia have repeatedly commented on the situation when a new business entity does not have a bank account and an employment contract has not been drawn up with the head of the company. Until March 2018, in this case, the submission of a SZV-M report was not required.

The exception was cases when the director had an employment contract. However, already in March 2021, companies whose director and sole founder are represented by one person, without employees, were required to send information to the Pension Fund.

Attention: amendments have now been made that information in the SZV-M form must be submitted even for founders who are not employees of the company.

Do I need to provide a form upon dismissal?

The law establishes that upon dismissal, an employee must receive a copy of the SZV-M report. It will confirm the fact of the employee’s work and the accrual of contributions to him, regardless of what contract was signed with him. The document must be issued in any case, even if the dismissed person worked for only one day.

Form SZV-M, when sent after a month, contains data on all employees of the company. Since they are personal data, when handing over the report to the person leaving, you need to make an extract, i.e. leave him alone. There are fines for the employer for disclosing personal data.

The certificate must be issued in person on the final day of work. It should be noted that there is no penalty for SZV-M for failure to issue it. According to the Civil Code, an employee can sue the company for compensation for moral damage because he did not receive the required documents. However, in practice no one does this.

Attention! Many people do not know for what period a SZV-M must be issued when an employee is dismissed. The number of certificates handed over must be equal to the number of months that the employee has worked.

After the documents are issued, the employee must provide written confirmation of their receipt.