Cash transactions are the process of receiving, issuing and storing cash. All legal entities and individual entrepreneurs in the course of their business activities are faced with the need to make payments in cash. At the same time, violation of the rules for conducting cash transactions may entail the imposition of penalties and unscheduled inspections by regulatory authorities. The PPT.ru material will help you figure out exactly how to organize the procedure for conducting cash transactions in 2021 in accordance with the legislation of the Russian Federation.

The rules for conducting cash transactions in 2021 (CR) are regulated by the Directives of the Bank of Russia. For their violation of Part 1 of Art. 15.1 of the Code of Administrative Offenses provides for fines imposed on both legal entities and individual entrepreneurs and their employees. In this article, we examined the main provisions of the Directives of the Central Bank of the Russian Federation regarding the rules for conducting cash transactions in 2020, compliance with which will allow you to avoid administrative liability and penalties.

Introductory information

The regulatory legal act that regulates cash management is Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses.” This document was amended by Directive of the Central Bank of Russia dated June 19, 2017 No. 4416-U. The changes will take effect 10 days after publication (the document was published on August 8). Consequently, the procedure for conducting cash transactions changes from August 19, 2021.

Why were the changes needed?

But why was it necessary to adjust the regulations on the procedure for conducting cash transactions? We can find the main answer in the explanatory note to the draft amendments being commented on:

What follows from the explanatory note

The development of the project is due to the introduction of online cash register equipment (online cash registers) from July 1, 2021, which ensures the storage of fiscal data in fiscal drives. See “Online ticket offices from July 1, 2021.”

The draft amendments clarify the procedure for issuing incoming cash order 0310001, and also provide for issuing outgoing cash order 0310002 for the total amount of accepted and issued cash when legal entities and individual entrepreneurs use cash register equipment.

Thus, the receipt and expenditure of funds will be verified with the data transmitted to the Federal Tax Service online.

The procedure for registering cash documents in electronic form is also being clarified and certain provisions of Directive No. 3210-U are being updated. We will tell you in more detail about the most significant adjustments to cash discipline from August 19, 2021.

The procedure for organizing and conducting cash transactions

In order for an institution to avoid problems with regulatory authorities, it is necessary to comply with several key requirements for recording cash flow. Let's consider the key conditions for organizing an online cash register in 2021.

Observe the following procedure for conducting cash transactions:

- Assign a cashier. Enter a new staff position “accountant-cashier” or assign the responsibilities for conducting cash payments to another specialist. Please note that only a full-time employee of the institution is appointed as a cashier. Such responsibilities cannot be assigned to a freelancer or contract worker. Familiarize the cashier with the current procedure for maintaining a cash register against signature.

- Approve your cash limit. The cash balance limit is the maximum amount of cash that can be stored in a specialized room every day, that is, in the cash register. The exception is days of payment of salaries, benefits and scholarships. On other days, the amount of money exceeding the limit for cash transactions must be deposited into a current account.

- Record every cash transaction. Any movement of money, receipt or expense at the cash desk must be reflected in the appropriate document. And not only primary, but also registered in the accounting journal.

- Reflect transactions in accounting. For each cash transaction at the cash desk, an appropriate accounting entry must be made. Reflect the movement of money in the appropriate accounts in accordance with the instructions for maintaining accounting records.

- Ensure total control of operations. Organize systematic checks. Only professional control and verification of how the cash register rules are observed will allow you to avoid fines for violation of cash discipline.

Money can be issued on account without an application

Accountable persons are employees to whom an organization or individual entrepreneur gives money to carry out official assignments and who are required to submit a report on their use.

To receive cash on account, the employee must write an application in any form, in which he must record the required amount and indicate for what purpose it will be spent. This follows from paragraph 6.3 of the Bank of Russia Instructions from the Bank of Russia dated March 11. 2014 No. 3210-U. A familiar application for the withdrawal of money from a cash register may look, for example, like this:

Thanks to the commented changes, from August 19, 2021, 2017, organizations or individual entrepreneurs will have the right to issue money on account based on an internal administrative document. The Central Bank did not provide for its name or form. Therefore, an organization or individual entrepreneur will be able to issue an order, instruction or any other administrative document on the issuance of funds. The form of the administrative document is arbitrary. However, it must contain records of the amount of cash and the period for which cash is issued, the signature of the manager and the date. This is required by clause 6.3 of the Bank of Russia Instructions from the Bank of Russia dated March 11. 2014 No. 3210-U (new edition).

Let's give a possible example of an organization's order to issue money against a report, which the director (or other authorized person) can issue in July 2021.

Please note that after August 19, 2021, it will be possible to work as before and issue reports based on employee applications. The Central Bank leaves this option acceptable. Previously, as we have already said, the statement was mandatory and the only possible option.

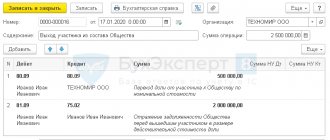

From August 19, 2021, upon receiving an application from an employee or an administrative document (for example, an order) to issue money for reporting, the accountant will be required to generate an expense cash order (0310002). An expenditure cash order is issued every time money is issued from the cash register. Draw it up according to form No. KO-2 in one copy (clause 4.1 of Bank of Russia Instructions No. 3210-U dated March 11, 2014). Here is an example of an expenditure and cash order drawn up in July 2017, where the order issued by the director, and not a statement, is recorded as the basis for the issuance of funds.

You can use this sample cash receipt order KO-2 as an example. Based on the generated cash register, the cashier is obliged to issue funds to the employee.

What to do if the cash register malfunctions

Many users of online cash registers encountered a massive outage on December 20, 2017. As a result of uncertainty about how to work in such a situation and fear of penalties, many retail outlets throughout the country were forced to close. As a result, the Federal Tax Service urgently issued a clarification in which it explained the procedure for action in the event of a massive technical failure in the operation of the cash register (letter dated December 20, 2017 No. ED-4-20/25867). It concluded that institutions can continue to operate in this case without the use of cash registers; in this case, there will be no penalties. After the system is restored to working order, the user is required to generate a correction cash receipt, which must reflect the total amount of revenue unaccounted for by cash register.

How not to violate cash discipline if the only cash register that the company uses in its activities breaks down? If the CCP breaks down, the organization has the right to conduct business without using it. In this case, the buyer is given a paper document confirming the fact of payment (for example, a sales receipt). Immediately after eliminating the breakdown, in order to avoid a fine, it is necessary (clause 14.5 of the Code of Administrative Offenses of the Russian Federation):

- generate a correction check for each operation;

- report the situation in writing, indicating information about each correction check created.

It is very important to follow the procedure before the Federal Tax Service finds out about a breakdown as a result of an inspection. Only in this case penalties will not be applied. In order not to find yourself in a situation where it is impossible to work if the cash register is broken, the tax authorities suggest purchasing a spare cash register (letter No. ED-4-20/24899).

You can issue money on account if you have a debt

Many people know that it is impossible to give accountable amounts from the cash register to an employee who has not yet accounted for the money previously received. Violation of this restriction may result in a fine of up to 50,000 rubles (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Let us remind you that this rule does not apply to cases where money is transferred to a card.

However, as of August 19, 2021, the situation changes. From this date, organizations and individual entrepreneurs will be able to issue an employee a new amount for reporting at any time. Even if the previously issued amount was not returned on time. This amendment was included in clause 6.3 of the Bank of Russia Instructions from the Bank of Russia dated 11.03. 2014 No. 3210-U.

Nobody canceled the return period

The period for which cash can be issued on account is not limited by law. If the deadline for the return of accountable amounts is set by the manager, then no later than three working days after its end, the employee must report for the money received (clause 6.3 of the Bank of Russia Directive No. 3210-U dated March 11, 2014). This deadline has not been canceled. However, now, even if the employee has not returned the accountable amounts within the prescribed period, he has the right to receive a new accountable amount of money.

Let us remind you that if an employee does not return the amount of the unspent advance on time, the money can be withheld from the salary. For these purposes, a collection order is issued - no later than one month from the day the period established for the report expires. However, it is possible to recover amounts from an employee if he does not dispute the basis and amount of deductions. Therefore, it is required to obtain the employee’s written consent to deductions. Otherwise, it will be possible to collect the debt only through the court (Articles 137, 248 of the Labor Code of the Russian Federation).

The receipt for the PKO can be sent by email

A cash receipt order is filled out when money is received at the cash desk. It is drawn up in one copy according to form No. KO-1 (clause 4.1 of Bank of Russia Instructions No. 3210-U dated March 11, 2014). The cash receipt order form consists of two parts:

- the cash receipt order itself;

- the tear-off part is a receipt (issued to the person who deposited the money).

If the amount of money indicated in the receipt coincides with the amount deposited, the cashier signs the order. Then he puts a seal or stamp on the receipt for the order (if the organization has a seal) and issues a receipt to the depositor.

As for the changes, the receipt for the electronic cash receipt order from August 19, 2021 can be sent to the depositor’s email. No need to print. Just hand out the receipt from the paper PKO, as before. First, we note that it was required to issue “paper” receipts, even if the RKO was generated in electronic format.

Federal Tax Service checks

If earlier, before the change in the procedure for cash transactions in 2012, control over cash transactions was assigned to banks, now its implementation is entrusted to the Federal Tax Service. When conducting an on-site tax audit, the commission will check compliance with cash discipline in general: not only the fact of the availability of primary cash documents and the procedure for accounting for funds in the cash register, but also:

- whether cash payments were made in excess of the established limit;

- how cash revenue is accounted for (including checking the fiscal memory of cash register systems);

- Is the procedure for storing available cash in the cash register followed?

- does the amount of cash balance correspond to the established cash limit;

- whether the requirements for issuing cash register checks (or BSO) at the buyer’s request, established by the current version of Federal Law No. 54-FZ dated May 22, 2003, are met.

Not only the cashier has the right to maintain a cash book

Record information about cash flows in the cash book using Form No. KO-4. All organizations should do this. Only individual entrepreneurs who keep records of income and expenses or physical indicators in accordance with the Tax Code of the Russian Federation have the right not to create a cash book (clause 1, 4.6 of Directive No. 3210-U).

The cash book is kept by the cashier (clause 4, clause 4.6, clause 4 of Directive N 3210-U). However, from August 19, 2021, the Central Bank allows any employee, not just the cashier, to fill out the cash book. When the amendments come into force, the director will be able to fill out the book, for example (clause 4 of Directive No. 3210-U).

If, from August 19, 2021, the cash book will be maintained not by the cashier, but by another employee, then the corresponding responsibilities should be in his job description.

The cash book can be kept on paper or in electronic form (clause 4.7 of Instructions No. 3210-U).

Read also

29.09.2016

Cash balance limit

Limit (balance) is the maximum amount of cash that can remain in the cash register at the end of the working day. The amount by which the limit is exceeded is handed over to the bank. This rule must be strictly observed by all organizations that are not small businesses.

However, as with all rules, there is an exception here too. The limit can be exceeded on days when salaries and other payments to employees are paid, as well as on holidays and weekends when the organization is working.

Company managers should take into account the following: if they do not set a limit by issuing an appropriate order, the limit will be considered equal to zero. This means that any cash in the cash register will be an excess of the balance, which may entail administrative liability.

Read more about the cash balance limit in the article.