How non-profit organizations account for fixed assets

The conditions under which non-profit organizations accept fixed assets for accounting differ from the rules for commercial structures. Here are the criteria for a fixed asset for non-profit organizations:

- period of use of the object – more than 12 months;

- the organization does not plan to sell the property;

- the object is intended for the statutory, entrepreneurial activities of the organization or for its management needs.

Such conditions are written in paragraph 4 of PBU 6/01.

If an NPO has acquired or received free of charge (as a gift) an object that is intended for transfer to third parties, it is not included as a fixed asset. These assets are taken into account as part of materials.

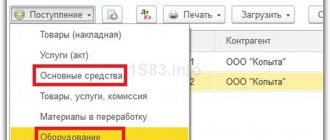

Accounting entries for the receipt of fixed assets will vary depending on how they were received: for a fee or free of charge.

Accounting for intangible assets

Intangible assets (IMA) are accounted for in non-profit organizations on the basis of PBU 14/2007. When accepting them for accounting, the period of planned use for solving the statutory tasks of the organization is established. This period is subject to annual review and clarification. If there are adjustments, they are reflected in accounting and reporting forms at the beginning of the year as changes in estimates.

Depreciation on intangible assets is not accrued in non-commercial organizations, even when they are used in commercial activities (clause 24 of PBU 14/2007). If intangible assets are acquired using business income, then depreciation is allowed.

Dt 08.5 KT 10, 70, 69 - the costs of creating the product are taken into account;

Dt 04 Kt 08.5 - the program is registered as an intangible asset;

Dt 86 Kt 83 - target amounts were used to create intangible assets.

What postings should be used to reflect fixed assets for a fee?

Purchased fixed assets are reflected in the accounting of non-profit organizations depending on the funds with which they were acquired and for what activity. There can be two sources: income from business activities or targeted income. Postings for each individual case are in the tables below.

Fixed assets came from income from business activities subject to VAT

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for a computer | 60 | 51 | 48 380 | payment order, bank statement |

| Received a computer | 08 | 60 | 41 000 | invoice |

| The amount of VAT paid to the supplier is reflected | 19-1 | 60 | 7380 | invoice |

| Accepted for VAT crediting on activities subject to VAT | 68 | 19-1 | 7380 | invoice, bank statement |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 000 | act of acceptance and transfer of fixed assets |

Fixed assets came from income from business activities, which are not subject to VAT

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for a computer | 60 | 51 | 48 380 | payment order, bank statement |

| Received a computer | 08 | 60 | 41 000 | invoice |

| The amount of VAT paid to the supplier is reflected | 19-1 | 60 | 7380 | invoice |

| VAT is included in the price of the property, which will be used in income-generating activities exempt from VAT | 68 | 19-1 | 7380 | invoice, bank statement |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 000 | act of acceptance and transfer of fixed assets |

Fixed assets purchased using targeted proceeds*

| Contents of operation | Debit | Credit | Sum | Primary document |

| Paid for fixed asset | 60-2 | 51 | 41 300 | payment order, bank statement |

| Computers received | 08 | 60-1 | 41 300 | waybill, invoice |

| Advance paid to supplier credited | 60-1 | 60-2 | 41 300 | check |

| The computer is accepted for accounting as an object of fixed assets | 01 | 08 | 41 300 | act of acceptance and transfer of fixed assets |

| The source of financing for the purchased OS is reflected | 86-1, etc. | 83-1 | 41 300 | accounting certificate, estimate of income and expenses |

* A peculiarity of accounting for fixed assets that were received through targeted financing is that it is necessary to use account 83. The Russian Ministry of Finance recommends that the balances on it be reflected in the balance sheet in the line “Real estate and especially valuable movable property fund.”

Such recommendations are given by the Ministry of Finance of Russia in paragraph 15 of information PZ-1/2015, in letters dated February 19, 2004 No. 16-00-14/40, dated February 4, 2005 No. 03-06-01-04/83.

OS receipts

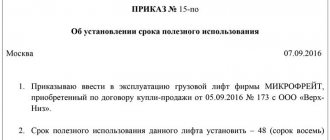

According to the rules of the legislation of the Russian Federation, the assessment and accounting of fixed assets of non-profit structures is regulated by Order of the Ministry of Finance No. 26n. To achieve its goals, an NPO can conduct business, acquire and sell securities, and own property in the form of structures, equipment, and land. These resources are the main funds of NPOs.

Assets are accepted for accounting as fixed assets for non-profit organizations if they are intended:

- For long-term use (over a year).

- Objects are used for management purposes, in business activities and bring economic benefits to the organization.

- The funds are used as a fee for temporary possession (use).

- The objects will not be resold in the future.

If property received by an NPO as targeted income is used by the association for non-commercial purposes, it is not subject to depreciation. Fixed assets acquired at the expense of profits received as a result of business activities are depreciated in tax accounting (Law No. 117-FZ, clause 2 of Article 256 of the Tax Code of the Russian Federation).

https://www.youtube.com/watch?v=ytcreatorsru

If property received by an NPO as targeted income is used by the association for non-commercial purposes, it is not subject to depreciation.

Fixed assets of non-profit organizations are recorded in accounting at their original cost, the amount of which is determined depending on the source:

- OS contributed to the authorized capital - the cost is established by agreement of the founders of the NPO.

- OS as donations, gratuitous contributions, targeted financing - the value is determined by the market price based on the date of acceptance into accounting.

- Assets received as a result of entrepreneurial activity - the amount spent by the association on the construction (purchase, manufacture) of products without VAT is taken into account.

The actual costs of non-profit organizations for transporting objects, repairs, and arrangement are also included in the initial cost of the fixed assets. The preliminary accumulation of costs included in the cost of the object is entered into account 08 “Investments in non-current assets” without taking into account the sources of fixed income. Accounting for funds is carried out according to the certificate of acceptance and transfer of fixed assets (standard form No. OS-1).

What postings are made when receiving fixed assets free of charge?

Fixed assets that come to non-profit organizations free of charge are taken into account at their current market value. The postings to capitalize such a fixed asset are in the table below.

| Contents of operation | Debit | Credit | Sum | Primary document |

| The obligation under the donation agreement, payment of the membership fee, etc. is reflected. | 76 | 86 | 45 000 | donation agreement, etc. |

| The market value of the object is reflected | 08 | 76 | 45 000 | Act |

| Costs for delivery, assembly, installation are reflected | 08 | 76 | 1500 | contracts, acts, accounts, etc. |

| Included in fixed assets | 01 | 08 | 46 500 | act of acceptance and transfer of fixed assets |

| The source of financing for the purchased OS is reflected | 86-1, etc. | 83-1 | 46 500 | accounting certificate, estimate of income and expenses |

Postings and decoding of operations

Account 86 is used in the following main business transactions.

| Debit | Credit | Explanation of the operation |

| 86 | 20, 26 | Target amounts spent |

| 83 | Amounts spent are included in additional capital | |

| 98 | Target amounts added to future expenses | |

| 07 | 86 | Equipment for statutory events taken into account |

| 08 | Contribution to non-current assets reflected | |

| 10, 11 | Materials (animals) were capitalized as a target receipt | |

| 15 | Inventory taken into account for events according to the Charter | |

| 20 | The main production facility was received | |

| 41 | Goods transferred for targeted programs are taken into account | |

| 76 | Financing accrued |

Where in the balance sheet and its explanations do non-profit organizations reflect fixed assets?

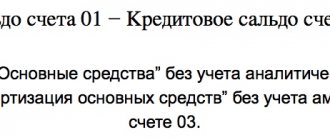

In the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in section 1 in the line “Fixed Assets”. This must be done at the full original cost. Do not reduce it by the amount of wear.

In the explanations to the Balance Sheet, the value of fixed assets of non-profit organizations is reflected in Section 2 “Fixed Assets”, Table 2.1 “Availability and Movement of Fixed Assets”. However, in this NPO table, the columns “Accumulated depreciation” and “Accrued depreciation” are renamed “Accumulated depreciation” and “Accrued depreciation”, respectively. That is, unlike the balance sheet, the table shows both the full original cost and accrued depreciation.

This is stated in Note 6 to Appendix 3 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Accounting statements of non-profit organizations

Every year, based on the results of their activities, NPOs, like ordinary commercial organizations, must record the accounting results of their operations in their financial statements.

All non-profit organizations, without exception, must submit 2 forms (clause 2 of Article 14 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- balance sheet;

- report on the intended use of funds.

Non-profit organizations engaged in entrepreneurship additionally generate a report on financial results.

Non-profit organizations submit cash flow and capital flow reports only if there are requirements in industry-specific laws.

You can find more detailed explanations on the composition of the financial statements of non-profit organizations in our separate article “Accounting statements of non-profit organizations”.

How to write off fixed assets

The Russian Ministry of Finance recommends writing off fixed assets that can no longer be used in the accounting of non-profit organizations as follows. Reduce the indicators for the groups of articles “Fixed assets” and “Fund of real estate and especially valuable movable property”. At the same time, reduce the amount of wear and tear.

| Contents of operation | Debit | Credit | Sum | Primary document |

| Fixed assets purchased using targeted proceeds or received free of charge have been written off | 83 | 01 | 45 000 | Accounting information |

| Depreciation written off | – | 010 | 45 000 | Accounting information |

This procedure is prescribed in paragraph 6 of the information of the Ministry of Finance of Russia PZ-1/2015.

JUSTIFICATION

This issue was discussed in the professional community and, in particular, at meetings of the industry committee on non-profit organizations of the BMC. Preservation of the NOCDI Fund allows non-profit organizations to generate more informative reporting on the use of targeted funds. Taking into account the specific reporting requirements of non-commercial organizations, as well as the significantly different (compared to commercial organizations) audience of reporting users, it seems advisable to largely preserve the procedure for accounting for fixed assets in non-commercial organizations, which was formed as part of the application of PBU 6/01 (2001 - 2021) in terms of , which does not contradict the FSBU OS.

We suggest you read: Go on maternity leave from maternity leave

The current regulatory and legal acts in the field of accounting, in particular, Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n, letters of the Ministry of Finance of Russia (including summarizing the practice of applying legislation - “PZ”) regarding the formation and write-off of the NOCDI Fund are not contradict the FSBU OS and are applicable taking into account the above recommendations.

EXAMPLES

Example 1. As of 01/01/2018 (date of commencement of application of the Federal Accounting Standards of Ukraine), the non-profit organization has a fixed asset on its balance sheet with an initial cost of 100,000 rubles. Expected period of OS use: 4 years. The depreciation accumulated behind the balance sheet is RUB 25,000. The NOCD fund is accounted for in account 83.

Balance sheet indicators of non-commercial organizations as of December 31, 2017 (before the application of the Federal Budgetary Accounting Standards)

| |

| Fixed assets | 100,000 rub. |

| III. Special-purpose financing | |

| Fund of real estate and especially valuable movable property | 100,000 rub. |

Dt 010 Depreciation (behind balance sheet) 25,000 rub.

| Dt. 83 Kt 02 | 25,000 rub. | recognition of accumulated depreciation as depreciation to reduce the NOCDI Fund |

| Dt 010 | — 25,000 rub. | Reversal (write-off) of previously accrued depreciation taken into account on the balance sheet |

| |

| Fixed assets | 75,000 rub. |

| III. Special-purpose financing | |

| Fund of real estate and especially valuable movable property | 75,000 rub. |

010 Depreciation (behind balance) 0 rub.

Example 2 (continuation of example 1). During 2021, a new fixed asset was recognized with a cost of 50,000 rubles. Expected period of use is 5 years.

| Dt 01 Kt 08 | 50,000 rub. | OS recognition |

| Dt. 26[2] Kt 83 | 50,000 rub. | Formation of the NOCDI Fund |

| Dt 86.1 Kt 262 | 50,000 rub. | Accounting record of the closing of the month with the expense of the entire cost of the fixed asset included in the expenses of the period |

Example 3 (continuation of examples 1-2). For 2021, annual depreciation was accrued at a time for a fixed asset recognized (put into operation) before the start of application of the Federal Budgetary Accounting Standards (FSBU OS) (see also example 1). The amount of depreciation for this fixed asset for 2021 is 25,000 rubles. In addition, for fixed assets recognized (acquired) in 2018, one-time annual depreciation in the amount of 10,000 rubles was accrued (see also example 2).

| Dt 262 Kt 02 | RUB 35,000 | Accrual of depreciation on two fixed assets with its attribution to period expenses |

| Dt. 83 Kt 86.VR[3] | 25,000 rub. | Reduction of the NOCDI Fund for an OS object recognized (put into operation) before the start of application of the Federal Budgetary Accounting Standards for OS |

| Dt 86.VR Kt 262 | 25,000 rub. | Accounting record for closing the month: attributing to expenses of target financing depreciation accrued on fixed assets recognized before the start of application of the Federal Accounting Standards for Financial Accounting |

| Dt 86.1 Kt 83 | (10,000) rub | Partial reversal of the formation of the NOCDI Fund for OS recognized (put into operation) in the current reporting period |

| Dt 86.1 Kt 262 | 10,000 rub. | Accounting entry for closing the month: attributing to expenses of target financing depreciation accrued on fixed assets recognized in the current reporting period |

| |

| Fixed assets | RUB 90,000[4] |

| III. Special-purpose financing | |

| Fund of real estate and especially valuable movable property | 90,000 rub. |

Example 4. A fixed asset with a cost of RUB 100,000 is written off, accumulated depreciation is RUB 50,000

| Dt. 02 Kt 01 | 50,000 rub. | Write-off of depreciation |

| Dt 83 Kt 01 | 50,000 rub. | Write-off of the book value of fixed assets with simultaneous write-off of the residual value of the NOCDI Fund |

| In accordance with the explanations of the Ministry of Finance, the following version of accounting entries can also be used when writing off fixed assets | ||

| Dt 91.2 Kt 01 | 50,000 rub. | Write-off of the book value of fixed assets |

| Dt 83 Kt 91.1 | 50,000 rub. | Write-off of the residual value of the NOCDI Fund |

[1] The term “Fund of Real Estate and Particularly Valuable Movable Property” was introduced into circulation by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n “On Forms of Accounting Reports of Organizations.” Previously, other names were used to refer to this fund in reporting.

[2] In accordance with the explanations of the Ministry of Finance and established practice, accounts 20, 86 can be used in this debit accounting entry.

[3] Special subaccount of account 86, credit turnovers on which will not be taken into account when generating the Report on the Targeted Use of Funds, Sheet 7 of the Income Tax Declaration, etc., since credit turnovers on this subaccount do not reflect the receipt of targeted funds and /or restoration of targeted funding.

https://www.youtube.com/watch?v=channelUCbFnqL3oz0gIC8V90D8PIyg

[4] 90,000 rubles (book value of fixed assets) = 100,000 rubles (cost of fixed assets) - 25,000 rubles x 2 (depreciation accumulated over 2 years) 50,000 rubles (initial cost of fixed assets) - 10,000 rubles (depreciation accumulated over year).

What entries are made when selling fixed assets?

The accounting records for the sale of a fixed asset depend on the NPO taxation system. A set of wiring for the general and simplified system is in the tables below.

Postings when selling fixed assets to non-profit organizations under the general taxation regime

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The amount of VAT payable to the budget has been accrued [(64 900 – 60 000) × 18/118] | 91-3 | 68 | 748 | invoice, calculation |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) [64 900 – 748] | 91-9 | 99 | 64 152 | accounting certificate-calculation |

Postings for the sale of fixed assets to non-profit organizations in a simplified manner

| Contents of operation | Debit | Credit | Sum | Primary document |

| Listed per OS object | 60 | 51 | 60 000 | payment order, bank statement |

| Supplier's invoice accepted | 08 | 60 | 50 847,46 | invoice |

| The amount of VAT on the acquired fixed asset is reflected | 19 | 60 | 9152,54 | invoice |

| The amount of VAT is included in the price of the object | 08 | 19 | 9152,54 | accounting information |

| The object is included in fixed assets | 01 | 08 | 60 000 | act of acceptance and transfer of fixed assets |

| The source of financing for the acquired fixed asset is reflected | 86-2 | 83 | 60 000 | accounting certificate, estimate of income and expenses |

| Accrued depreciation during the operation of the OS object | 010 | 21 000 | accounting certificate-calculation | |

| The buyer's debt for the asset being sold is reflected | 76 | 91-1 | 64 900 | contract, invoice |

| The original cost of a retiring fixed asset has been written off | 83 | 01 | 60 000 | act of acceptance and transfer of fixed assets |

| The amount of depreciation accrued during the operation of the asset has been written off | 010 | 21 000 | accounting certificate-calculation | |

| Received funds from the OS buyer | 51 | 76 | 64 900 | bank statement |

| The financial result from the sale of an asset has been identified (without taking into account other operations) | 91-9 | 99 | 64 900 | accounting certificate-calculation |

| Single tax charged for simplification (64 900 × 6%) | 99 | 68 | 3894 | accounting certificate-calculation |

Moral or physical wear and tear

When writing off an item of fixed assets (FPE) acquired using targeted funding or received by an NPO as targeted revenue due to moral or physical wear and tear, its initial cost (depreciation on such fixed assets is not charged) is written off from additional capital, that is at the expense of those funds that served as a source of financing for its acquisition.

The chart of accounts for accounting of financial and economic activities of organizations and the Instructions for its application (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) for accounting for the disposal of fixed assets to account 01 “Fixed assets”, it is recommended to open a sub-account “Retirement of fixed assets”. The cost of the disposed object is transferred to the debit of this subaccount, and the amount of accumulated depreciation is transferred to the credit.

According to the author, when writing off objects for which depreciation was not accrued, there is no need to use an intermediate entry using the subaccount “Retirement of fixed assets”, therefore the initial cost of such fixed assets is written off from the credit of account 01 directly to the debit of account 83 “Additional capital” .

In addition, upon disposal of a fixed asset, a non-profit organization must also write off the amount of depreciation accrued during the operation of this property in off-balance sheet account 010 “Depreciation of fixed assets.”

Example 1. An asset with an initial cost of 15,000 rubles, received by a non-profit organization as targeted income, is written off due to obsolescence. The amount of depreciation accrued on the date of write-off of the object is 5,000 rubles.

Reflection of transactions in accounting:

Dt sch. 83 Set count. 01 - 15,000 rub. — the initial cost of the fixed asset is written off;

K-t sch. 010 - 5000 rub. - the amount of depreciation is written off.

Write-off of the cost of an asset acquired from profits from business activities and used for its implementation (depreciation is charged for such assets), due to moral or physical wear and tear, is reflected in accounting in the subaccount “Retirement of fixed assets” opened to account 01.

In this case, the original (replacement) cost of the fixed asset object is written off to the debit of the specified subaccount in correspondence with the corresponding subaccount of the fixed assets accounting account, and to the credit of the specified subaccount - the amount of accrued depreciation for the useful life of the organization of this object in correspondence with the debit of the depreciation accounting account.

Upon completion of the disposal procedure, the residual value of the fixed assets item is written off from the credit of the subaccount for accounting for the disposal of fixed assets to the debit of the profit and loss account as operating expenses.

Example 2. An item of fixed assets with an initial cost of 15,000 rubles, acquired from profits from business activities and used for its implementation, is written off due to obsolescence due to the ineffectiveness of its modernization. The amount of depreciation accrued during its operation is 5,000 rubles.

Non-profit organizations have opened the following accounting sub-accounts for account 01 “Fixed Assets”:

- 01-1 “Fixed assets in operation”;

- 01-2 “Disposal of fixed assets.”

Reflection of transactions in accounting:

Dt sch. 01-2 Set count. 01-1 — 15,000 rub. — the initial cost of the disposed fixed asset is written off;

Dt sch. 02 Set count. 01-2 — 5000 rub. — the amount of depreciation accrued during the operation of the asset is written off;

Dt sch. 91-2 Set of accounts. 01-2 — 10,000 rub. — the residual value of the disposed fixed asset is written off.

Based on the executed act for write-off of fixed assets, transferred to the accounting service of the organization, a note is made on the inventory card about the disposal of the fixed assets item. The corresponding entries on the disposal of an object are also made in a document opened at its location.

Inventory cards for retired fixed assets are stored for a period established by the head of the organization in accordance with the rules for organizing state archival affairs, but not less than five years.

If, upon disposal of fixed assets, the organization receives income in the form of material assets (parts, components and assemblies of the disposed object, suitable for repairing other fixed assets, as well as other materials obtained as a result of dismantling (disassembling) the object), then these material assets are credited to the accounting accounts property at the current market value on the date of write-off of the fixed asset in correspondence with account 91 “Other income and expenses”, subaccount 91-1 “Other income”, as operating income.

It should be borne in mind that income in the form of the cost of received materials or other property (according to paragraph 13 of Article 250 of the Tax Code of the Russian Federation) during dismantling or disassembly in the event of liquidation of fixed assets taken out of service for the purpose of calculating income tax is recognized as non-operating income of the taxpayer, and expenses for their liquidation, including the amount of depreciation not accrued in accordance with the established useful life - non-operating expenses (clause 8, clause 1, article 265 of the Tax Code of the Russian Federation).

Moreover, the specified norms of Chapter 25 of the Tax Code of the Russian Federation apply to liquidated fixed assets, both acquired at the expense of targeted financing or received as targeted revenues (with the exception of amounts of underaccrued depreciation, since such objects are not depreciated), and acquired at the expense of profits from business activities NPO.

BASIC

Is it possible to calculate depreciation in tax accounting?

Non-profit organizations that received fixed assets free of charge or purchased them using earmarked funds and use them in their statutory activities do not accrue depreciation on them. This is directly stated in subparagraph 2 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation.

How to determine sales proceeds

When calculating income tax, determine the proceeds from the sale of a fixed asset of an NPO as its full sales price excluding VAT. It cannot be reduced for the cost of purchasing the property. Since targeted funds are not taken into account in income, then costs at their expense are not taken into account either. In addition, the organization had no intention of using such property for the purpose of generating income. And generating income is one of the conditions to write off as expenses for the acquisition of an object.

This conclusion follows from paragraph 1 of Article 252, paragraph 2 of Article 251, Article 250 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated February 5, 2010 No. 03-03-06/4/9.

How to calculate VAT on the sale of fixed assets

For non-commercial organizations, there are two options for calculating VAT on the sale of fixed assets.

First option : VAT must be charged on the full sales price (clause 1 of Article 154 of the Tax Code of the Russian Federation). Do this if VAT was not paid upon receipt of the fixed asset. For example, they received it for free or purchased it from an organization on a simplified basis.

Second option : charge VAT on the difference between the sale and residual value of the property. That is, according to the rules of paragraph 3 of Article 154 of the Tax Code of the Russian Federation. Using these rules, determine the tax base when the fixed asset was purchased with VAT, but the tax was not deducted. For example, the object was used for statutory activities or in business activities exempt from VAT. For full details on how to do this and examples, see How to calculate VAT on the sale of property accounted for with input VAT.

Scheme of work of non-profit organizations

To understand the accounting procedures for non-profit organizations, you first need to understand the essence of their work. According to Art. 2 of the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ, NPOs are formed to carry out activities in public spheres:

- social;

- charitable;

- cultural and educational;

- scientific;

- sports;

- spiritual (immaterial);

- to provide legal and legal assistance to the population and organizations;

- resolution of controversial and conflict situations, etc.

Non-profit organizations can additionally engage in entrepreneurial activities, but do not have the right to distribute the profit received from it among their participants (Clause 1, Article 2 of Law 7-FZ). This means that all profits should be directed to targeted payments or organizational expenses of the NPO.

Taking into account the above, the activities of NPOs can be presented in the form of a generalized diagram:

Accounting for an NPO largely depends on whether it is engaged in entrepreneurial activities or not. Below we will look at each of the options.

You can find out which non-profit organizations can use simplified accounting methods and what these methods are in ConsultantPlus. Trial full access to the system can be obtained for free.

simplified tax system

Acquisition costs

Expenses for the acquisition of fixed assets received free of charge or at the expense of earmarked funds for statutory activities cannot be recognized as expenses under the simplified procedure. This conclusion follows from paragraph 4 of Article 346.16, paragraph 1 and subparagraph 2 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation.

Income and expenses upon sale

When calculating the single tax, an NPO includes in its income the full sales value of the fixed asset. And even if you use a simplification with the “income minus expenses” object, do not take into account the initial cost of the fixed asset in expenses. Since targeted funds are not taken into account in income, then costs at their expense are not taken into account either. In addition, the organization had no intention of using such property for the purpose of generating income. And generating income is one of the conditions to write off as expenses for the acquisition of an object.

This conclusion follows from paragraphs 1 and 4 of Article 346.16, subparagraph 1 of paragraph 1.1 of Article 346.15, paragraph 1 of Article 252, Article 250, paragraph 2 of Article 251 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated February 5, 2010 No. 03-03-06/ 4/9.

Accounting for charitable organizations

Charitable organizations carry out their activities in accordance with Federal Law No. 135-FZ of August 11, 1995 “On Charitable Activities and Charitable Organizations” (hereinafter referred to as Law No. 135-FZ).

The sources of formation of the property of a charitable organization may be:

- founding and membership fees;

- charitable donations, grants provided by citizens and legal entities in cash or in kind;

- income from non-operating operations;

- income from activities to attract philanthropists and volunteers (organization of entertainment, cultural, sports and other public events);

- conducting campaigns to collect charitable donations;

- income from legally permitted business activities;

- income from the activities of business entities established by a charitable organization;

- volunteer labor;

- other sources not prohibited by law.

The expenses of the charitable organization are carried out according to the estimate, which is an integral part of the charitable program. The charity program establishes the stages and timing of the implementation of the estimated revenues and planned expenses (expenses for logistical, organizational and other support, for remuneration of persons participating in the implementation of charitable programs, other expenses associated with the implementation of charitable programs).

The charity program is approved by the highest governing body of the charitable organization.

When implementing long-term charitable programs, the funds received are used within the time limits established by the program.

A charitable organization has the right to use no more than 20 percent of the financial resources spent during the financial year to pay administrative and managerial personnel. The restriction does not apply to the remuneration of persons participating in the implementation of charitable programs.

At least 80 percent of charitable cash donations are used for charitable purposes within a year of receiving the donation.

Charitable donations in kind are sent to charitable purposes within one year from the date of their receipt.

The benefactor or charitable program may set other deadlines.

The property of a charitable organization cannot be transferred to the founders (members) of this organization on terms more favorable than for other persons.

A charitable organization has the right to carry out business activities only to achieve its statutory goals.

Funds received by a charitable organization from carrying out other business activities are collected into the local budget and must be used for charitable purposes.

Features of NPO accounting, expert recommendations in 2021

Now I will tell you in more detail about the features of accounting in non-profit organizations. How does it differ from accounting in an LLC and especially an individual entrepreneur? Features related to reporting, accounting for non-commercial income, how to reflect commercial income and much more.

I’ll break all the differences into groups, in case you’re interested in a specific question:

Let's start in order.

Start of registration of a new NPO

NPOs have no authorized capital and no owners (beneficiaries). Yes, after creating an NPO, the founders contribute a minimum of 10,000 rubles to the balance sheet of the non-profit organization, but this is not the authorized capital.

Having created an NPO, the founders are required to contribute “primary property”, this is a regular contribution, in nature it is similar to the entrance fee.

Its accounting is kept on account 86 and if it is deposited in money, then the posting will be as follows:

D51-K86 – initial replenishment of NPO property by the founder

This is exactly the basis that should be in banking documents. As a last resort, just a “founder’s contribution.”

Features of NPO reporting

This topic is extensive, I will describe the main features and start with the most important mistake.

- Even a zero non-profit organization on the simplified tax system without income, salaries and a current account submits about 40 reports a year. The non-profit organization provides reports to the Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, Rosstat, and the Ministry of Justice. “Nulevka” submits MONTHLY SZV-M reports to the Pension Fund of Russia, quarterly and annual. Failure to submit reports entails fines of 500-2000 rubles. for each report per organization + 300 rubles per manager personally. Fines do not relieve you from the obligation to submit all these reports! We constantly restore NPOs whose leaders for some reason decided that they could submit one report at the end of the year.

- NPOs have their own form of accounting and financial reporting, Form No. 1 (Balance Sheet), which is distinguished by the “Capital” section.

- When submitting accounting and financial statements to the Federal Tax Service (Balance), the NPO must fill out the “Report on the intended use of funds” section. Commercial organizations usually do not rent it out.

- In the Declaration of Profit or Declaration of the simplified tax system, additional sheets of “target financing” are filled out. That is, even if the NPO had no revenue, the declaration will not be zero.

- Non-profit organizations submit reports to the Ministry of Justice. It consists of at least three documents: confirmation of continuation of activities, composition of management bodies, absence of foreign funding. If you do not submit these reports, the Ministry of Justice will liquidate you!

- Rosstat has a sample, and commercial organizations are rarely included in it. NPOs are almost always required to provide additional reports, according to this sample! You can check it on the statistics website using the TIN of your non-profit organization.

- The NPO submits the SZV-M form to the Pension Fund on a monthly basis. It cannot be zero; the minimum is indicated by the manager. But at the end of the year we must remember to pass the SZV-STAZH, with the status of this “NEOPL” leader. Decoding that he did not receive a salary.

Features of registration of non-commercial receipts

Receipts from voluntary contributions and donations are not subject to taxes. They are determined by the basis of payment and acts are not provided for them.

Read more in the article “Non-profit income to NPOs”.

All these proceeds are targeted financing and go to account 86 “Targeted financing” for example:

D51-K86 voluntary contribution to the statutory purposes of the NPO (in money)

D10-K86 donation of materials for the statutory purposes of NPOs (materials)

D08-K86 gratuitous transfer of fixed assets or intangible assets for the development of the statutory goals of an NPO

It is important that if the basis for the payment does not indicate that the transfer of assets is made for the statutory purposes of the NPO, the tax office will by default consider the receipt as revenue. An exception is such a form of NPO as a FUND; it is intended for collecting and distributing donations. Only in the fund all receipts are recognized as a donation by default.

Separate accounting in a non-profit organization

Non-profit organizations are required to maintain separate accounting records in two main areas.

- Non-commercial activities. Which keeps records of voluntary contributions and donations, as well as the intended use of these funds. Main account 86 “target financing”

- Income-generating activity. Which keeps records of taxable revenues and receipts, with the formation of their cost and accounting for accounts 90 “Sales” and 91 “Other income and expenses”

It often happens that a non-profit organization is engaged in only one of these areas. For example, foundations mainly conduct only non-commercial activities, and educational autonomous non-profit organizations conduct only income-generating activities. Then the accounting task becomes much easier. But most actively operating NPOs actively maintain records in both directions.

The difficulty lies in allocating expenses. On accounts 20 and 26, subaccounts are created for each of their directions, for example:

20-1 and 26-1 – non-commercial activities, which are then closed to account 86

20-2 and 26-2 – income-generating activities, which are then closed to account 90

The costs may be the same; the attribution of costs depends on which direction they were used. There may be expenses that were used in both directions in parts. For example, we bought paper, part of it was used in a non-profit event, and part of it went to the sales department.

Or employees who are involved in two directions with one salary. Try to avoid such splits! There is only one supporting document (a deed or a delivery note), and it will differ from the write-off amount; the tax office does not like this. This makes accounting opaque and questionable.

Try to initially allocate requests for expenses and make them into separate items; I will give an example of such measures :

- Order office supplies on two different accounts

- Concluding different rental agreements depending on the use of space

- Introduction of separate rates for employees as internal part-time workers

It is not necessary to completely get rid of such operations, but I advise you to reduce them to a minimum.

Important! An accountant cannot determine from documents and payments alone which area to assign expenses to. It is important to build financial accounting.

The manager, at the level of orders and approval of invoices for payment, determines in which direction the expenses will be allocated. This document flow must be recorded with visas, be transparent and understandable.

Financial accounting provides transparency and clarity in the allocation of expenses.

I will give examples of the order of main transactions:

D26-2 -K60 - attribution of costs for purchases of services and goods

D90 -K26-2 - write-off of costs

D62-K90 - revenue reflection

D90 -K99 - closing the month (writing off profit on account 90)

D99-K86 – assignment of net profit to the development of statutory activities

D51 – K86 receipt of voluntary contributions and donations to the account

D26-1 -K60 - attribution of costs for purchases of services and goods

D86 -K26-1 - write-off of costs as the intended use of funds

Provided the main entries for understanding the construction of separate accounting.

Features of accounting for target financing

In a non-profit organization, proceeds may go towards general statutory purposes. But besides this, there may be targeted revenues within the framework of statutory activities. Donations that people pay for a specific cause or event.

For example, for the treatment of a specific child or for holding a specified sporting event. Such allocated activities have their own budget, and proceeds for them can be spent strictly according to the budget. This requirement has an accounting consequence.

The target event is allocated to separate subaccounts, for example, in Regular 1C Enterprise 8.3:

- 86-2-1 “Help Vanya”

- 20-1-1 “Help Vanya”

- 26-1-1 “Help Vanya”

Or a sub-account “Help Vanya” is created on these accounts if there are a lot of events and 1C VDGB is used for non-profit organizations.

It turns out that costs are distributed not only between commercial and non-commercial activities. There is an allocation of expenses and distribution within non-profit activities for individual events.

Expenses for a separate event form an actual cost estimate for the allocated area, on the basis of which an “Act on the intended use of funds received” is formed.

It, in turn, can be published on the website or provided to the sponsor, confirming the targeted and successful use of the funds provided.

It was separately stated that all receipts of FUNDS are recognized as donations by default. But in addition to a unique right, there is also a duty. Funds are required to undergo an annual audit. And if the funds are used in a non-transparent, questionable or unreliable manner, the fund will not pass the audit. The audit company will not give a positive opinion, risking its license! More details on the NPO Audit page.

Features of accounting during the liquidation of non-profit organizations

Let me briefly talk about preparing NPOs for liquidation. Before liquidation, companies usually wind down by selling assets and distributing money to pay off debt and profit to the founders. But NPOs have another way.

Non-profit organizations can pay off debts and transfer the remaining property to another non-profit organization with which its statutory goals coincide. This transaction is not subject to tax! The transfer occurs as a contribution for statutory purposes from one NPO to another.

The property of the NPO is not transferred to the founders and other persons and is not distributed between them! The only exception is the “Private Institution”, but it has a different way of forming this property.

This allows you to reset the remaining balance lines to zero. The more empty the liquidation balance sheet of an NPO, the easier it is to liquidate. Non-profit organizations are liquidated in about 6 months, foundations only through the courts in about 12 months.

All this time, it is necessary to regularly submit all zero reports to the Federal Tax Service, Pension Fund, Social Insurance Fund, Rosstat, and the Ministry of Justice.

Don’t forget that if you decide to abandon the NPO so that the Ministry of Justice can liquidate it, it will do so, but! It will also disqualify the head and founders of the NPO for 3 years and blacklist them. It will prohibit them from creating organizations for 3 years, and they will be prohibited from leaving the existing one or they will also be liquidated within 6 months. I think it’s clear that you can’t do that!

I hope my material was useful to you.

If clarity does not appear, just come to us for accounting support. We will definitely do everything perfectly. We support more than 1000 successful NPOs and will create conditions for the successful development of yours!

Still have questions? Call! We will be happy to answer. 8-800-100-42-36 (5 chief accountants on line)

Or write comments or chat, we will also answer.

Source: https://reg-nko.ru/sub/Osobennosti_buhucheta_NKO