Salary

Current as of July 1, 2017

Many personnel workers already know that from July 1, 2021, the federal minimum wage has been increased from 7,500 to 7,800 rubles. See “Minimum wage from July 1, 2021 in Russia.” Employers are not entitled to pay their employees less than the current minimum wage. However, we note that the minimum wage cannot be less than the federal one. Knowing this, some regions set the “local” minimum wage higher than the federal one. What minimum wage should be used in calculations from July 1? Is it possible to abandon the regional “minimum wage” minimum wage? Do salaries need to be increased? In this article you will find answers to questions, and you can also familiarize yourself with the minimum wage table from July 1, 2021 by region of Russia.

Minimum wage from July 1, 2021

From July 1, 2021, the minimum wage in Russia has increased and its amount is 7,800 rubles. This is provided for by Federal Law No. 460-FZ of December 19, 2016 “On Amendments to Article 1 of the Federal Law “On the Minimum Wage.”

Note that the last time the minimum wage was increased from July 1, 2021 to 7,500 rubles (Federal Law, Article 1 of Federal Law dated June 2, 2016 No. 164-FZ). Here is a table showing the increase in the minimum wage in recent years:

| Minimum wage in Russia: dimensions | ||

| Promotion date | Minimum wage size | Normative act |

| from July 1, 2021 | RUB 7,800 | Art. 1 of the Federal Law of December 19, 2016 No. 460-FZ |

| from July 1, 2021 | RUB 7,500 | Art. 1 of Federal Law dated June 2, 2016 No. 164-FZ |

| from January 1, 2021 | RUB 6,204 | Art. 1 of the Federal Law of December 14, 2015 No. 376-FZ |

| from January 1, 2015 | 5965 rub. | Art. 1 of Federal Law dated December 1, 2014 No. 408-FZ |

Also see “Minimum wage from January 1, 2021.”

Minimum wage from July 1, 2021 and wages

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation). However, keep in mind that an employee may receive less than the minimum wage in person - minus personal income tax and other deductions, for example, alimony. Accordingly, from July 1, 2017, it is impossible to pay less than 7,800 rubles.

It is worth noting that the salary of employees from July 1, 2021 may be less than 7,800 rubles. After all, the total salary, which includes (Article 129 of the Labor Code of the Russian Federation) cannot be less than the minimum wage:

- remuneration for work;

- compensation payments, including additional payments and allowances;

- incentive payments (bonuses).

The total amount of all such payments from July 1, 2021 must be at least 7,800 rubles.

What taxes are withheld if the salary is equal to the minimum wage?

Some employers set the employee's salary strictly in accordance with the minimum wage (no more and no less). However, if an employee’s salary is equal to the minimum wage, personal income tax and insurance premiums, including “for injuries,” should still be withheld from it. This is confirmed by legal norms:

- Personal income tax – articles 210 and 217 of the Tax Code of the Russian Federation;

- insurance contributions for compulsory pension (social, medical) insurance - Articles 420 and 422 of the Tax Code of the Russian Federation;

- insurance premiums for insurance against industrial accidents and occupational diseases (“injuries”) - Articles 20.1 and 20.2 of the Law of July 24, 1998 No. 125-FZ.

Minimum wage in the regions from July 1, 2017

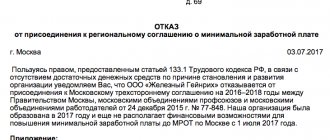

It is worth recalling that from July 1, 2021, regional authorities can establish in a special agreement their own minimum wage, which exceeds the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation). However, the regional minimum wage can be abandoned. For these purposes, you will need to issue a reasoned refusal and send it to the local branch of the Committee on Labor and Employment.

In accordance with Part 1 of Art. 133.1 of the Labor Code of the Russian Federation in a constituent entity of the Russian Federation, a regional agreement may establish a different minimum wage. It should not be lower than the minimum wage approved by federal law (Part 4 of Article 133.1 of the Labor Code of the Russian Federation).

Employers are considered to have acceded to the regional agreement on the minimum wage if, within 30 calendar days from the date of its publication, they have not sent a written reasoned refusal to join it to the Ministry of Labor of Russia. In this case, the organization is obliged to comply with all provisions of the regional agreement (Part 8 of Article 133.1 of the Labor Code of the Russian Federation). This means that the minimum wage established by the regional agreement is mandatory for the employer.

How are things going in the regions?

7500 rub. This is the minimum wage at the federal level. However, depending on the region, the minimum wage may vary.

But, what is very important, this size cannot be lower than the minimum set by the state.

In the Labor Code this is regulated by Article 133.1 part 1.

The minimum wage in the regions depends on many factors . Such as distance from the center, difficulty of delivering goods, climatic conditions. For example, in Moscow and the Moscow region the minimum wage is significantly higher than in the country as a whole.

Below we present the minimum wage value as of January 1, 2021 (from July 1, 2017) in different regions of Russia:

- Sverdlovsk region 8,154 rub. for employees of organizations in the non-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 8,154 rubles. for employees of organizations in the public sector, mechanical engineering, chemical, light industry and agriculture, 7,500 rubles. for organizations financed from the federal budget, 8,862 rubles. for employees of organizations in the non-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 8,862 rubles. for employees of organizations in the public sector, mechanical engineering, chemical, light industry and agriculture (8,480 rubles for employees of organizations in the non-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 8,480 rubles for employees of organizations in the public sector , mechanical engineering, chemical, light industry and agriculture, 7,800 rubles for organizations financed from the federal budget, 9,216 rubles for employees of organizations in the extra-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 9,216 rubles for employees of organizations in the public sector, mechanical engineering, chemical, light industry and agriculture);

- Republic of Adygea 7,500 rub. (RUB 7,800);

- Altai Territory 8,116 rub., 7,500 rub. for employees of organizations financed from the federal, regional, and local budgets (8,441 rubles, 7,800 rubles for employees of organizations financed from the federal, regional, and local budgets);

- Astrakhan region 7,500 rub. (RUB 7,800);

- Belgorod region 7,500 rub. (7,800 rubles, 8,368 rubles for employees of enterprises financed from the regional and local budget);

- Bryansk region 7,500 rub. (RUB 7,800);

- Vladimir region 8,500 rub., 7,500 rub. for employees of organizations financed by regional and municipal budgets (RUB 8,840, 7,800 for employees of organizations financed by regional and municipal budgets);

- Volgograd region 11,031 rub. 7,500 rub. for organizations financed from the federal budget (11,031 rubles, 7,800 rubles for organizations financed from the federal budget);

- Vologda region 7,500 rub. (RUB 7,800);

- Voronezh region 7,500 rub. (RUB 7,800);

- Ivanovo region 9,694 rubles;

- Trans-Baikal Territory from RUB 8,059. up to 10,429 rub., 7,500 rub. for employees of the public sector of the economy, 7,500 rubles. for employees of agricultural organizations (from 8,381 rubles to 10,429 rubles, 7,800 rubles for employees of the public sector of the economy, 7,800 rubles for employees of agricultural organizations);

- Irkutsk region 7,500 rub. (RUB 7,800);

- Republic of Kalmykia 7,500 rub. (RUB 7,800);

- Kaluga region 9,314 rubles;

- Kamchatka region from 16,910 rub. up to 19,510 rub. (from RUB 17,586 to RUB 19,510);

- Kirov region 7,500 rub. (RUB 7,800);

- Komi Republic 7,500 rub. (RUB 7,800);

- Kostroma region 9,357 rubles;

- Republic of Crimea 7,500 rub. (RUB 7,800);

- Krasnodar region 10,086 rub., 7,500 rub. for organizations financed from the federal budget (10,086 rubles, 7,800 rubles for organizations financed from the federal budget);

- Krasnoyarsk region from 9,926 rub. up to 24,026 rub., 7,500 rub. for organizations financed from the federal budget (from 10,323 rubles to 24,987 rubles, 7,800 rubles for organizations financed from the federal budget);

- Kurgan region 7,620 rub., 7,500 rub. for public sector employees (RUB 7,925, RUB 7,800 for public sector employees);

- Kursk region 8,326 rubles, 7,500 rubles. for public sector organizations (9,665 rubles, 7,800 rubles for public sector organizations);

- Lipetsk region 10,263 rubles;

- Moscow 17,300 rub. (RUB 17,992);

- Magadan region 16,134 rub.

- Republic of Mari El 9,251 rub., 7,500 rub. for employees of organizations financed from the federal, regional, and local budgets (9,621 rubles, 7,800 rubles for employees of organizations financed from the federal, regional, and local budgets);

- Republic of Mordovia 7,500 rub. (RUB 7,800);

- Murmansk region 13,650 rub. (RUB 14,196);

- Nenets Autonomous Okrug 12,420 rub., 7,500 rub. for organizations financed from the federal budget (12,917 rubles, 7,800 rubles for organizations financed from the federal budget);

- Nizhny Novgorod region 7,500 rub. (RUB 7,800);

- Novgorod region 8,801 rub., 7,500 rub. (for organizations financed from the regional and local budget);

- Novosibirsk region 9,390 rub., 9,030 rub. for organizations financed from the federal budget (9,766 rubles, 9,391 rubles for organizations financed from the federal budget);

- Oryol region 8,938 rubles;

- Orenburg region 7,500 rub. (RUB 7,800);

- Penza region 7,500 rub. (RUB 7,800);

- Perm region 9,730 rub., 7,500 rub. for organizations financed from the federal budget (9,730 rubles, 7,800 rubles for organizations financed from the federal budget);

- Primorsky Krai 7,500 rub. (RUB 7,800);

- Pskov region 7,500 rub. (RUB 7,800);

- Rostov region 7,500 rub. (RUB 7,800);

- Ryazan region 7,500 rub. (RUB 7,800);

- Samara region 7,500 rub. (RUB 7,800);

- St. Petersburg 11,700 rub. excluding compensation and incentive payments, 7,500 rubles. for organizations financed from the federal budget (16,000 rubles, 7,800 rubles for organizations financed from the federal budget);

- Sakhalin region from 15,000 rub. up to 20,000 rub., 7,500 rub. for organizations financed from the federal budget (from 15,600 rubles to 20,800 rubles, 7,800 rubles for organizations financed from the federal budget);

- Sverdlovsk region 8,154 rub. for employees of organizations in the non-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 8,154 rubles. for employees of organizations in the public sector, mechanical engineering, chemical, light industry and agriculture, 7,500 rubles. for organizations financed from the federal budget, 8,862 rubles. for employees of organizations in the non-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 8,862 rubles. for employees of organizations in the public sector, mechanical engineering, chemical, light industry and agriculture (8,480 rubles for employees of organizations in the non-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 8,480 rubles for employees of organizations in the public sector , mechanical engineering, chemical, light industry and agriculture, 7,800 rubles for organizations financed from the federal budget, 9,216 rubles for employees of organizations in the extra-budgetary sector of the economy (except for organizations in mechanical engineering, chemical, light industry and agriculture), 9,216 rubles for employees of organizations in the public sector, mechanical engineering, chemical, light industry and agriculture);

- Smolensk region 7,500 rub. (RUB 7,800);

- Stavropol Territory 7,954 rub.

- Tambov region 7,500 rub. (RUB 7,800);

- Republic of Tatarstan 7,500 rub. (RUB 7,800);

- Tver region 7,500 rub. (RUB 7,800);

- Tomsk region from 7,500 rub. up to 8,925 rub. (from RUB 7,800 to RUB 9,282);

- Republic of Tyva 7,500 rub. (RUB 7,800);

- Tula region 13,000 rub., 11,000 rub. for employees of state and municipal institutions (RUB 13,520, RUB 11,440 for employees of state and municipal institutions);

- Tyumen region 9,300 rub., 7,700 rub. for employees of budgetary, government, autonomous institutions and autonomous non-profit organizations established by a subject or municipal entity, 7,500 rubles. for organizations financed from the federal budget (9,627 rubles, 8,008 rubles for employees of budgetary, state, autonomous institutions and autonomous non-profit organizations established by a constituent entity or municipal entities, 7,800 rubles for organizations financed from the federal budget);

- Republic of Udmurtia 7,500 rubles, taking into account the regional coefficient (7,800 rubles, taking into account the regional coefficient);

- Khabarovsk Territory: In the regions of the Far North: in the Okhotsk region - 15,510 rubles, in the Ayano-Maisky region - 14,269 rubles, 12,408 rubles. in areas equated to the regions of the Far North (districts: Amursky, Vaninsky, Verkhnebureinsky, Komsomolsky, Nikolaevsky, named after Polina Osipenko, Sovetsko-Gavansky, Solnechny, Tuguro-Chumikansky, Ulchsky, the city of Komsomolsk-on-Amur), 11,414 rubles. in the southern regions of the Far East (districts: Bikinsky, Vyazemsky, named after Lazo, Nanaisky, Khabarovsky, Khabarovsk city) (In the regions of the Far North: in the Okhotsk region - 16,130 rubles, in the Ayano-Maisky district - 14,840 rubles, 12,904 rubles in areas equated to the regions of the Far North (districts: Amursky, Vaninsky, Verkhnebureinsky, Komsomolsky, Nikolaevsky, named after Polina Osipenko, Sovetsko-Gavansky, Solnechny, Tuguro-Chumikansky, Ulchsky, the city of Komsomolsk-on-Amur), 11,871 rubles . in the southern regions of the Far East (districts: Bikinsky, Vyazemsky, named after Lazo, Nanaisky, Khabarovsky, Khabarovsk city))

- Yamalo-Nenets Autonomous Okrug 12,431 rub., 7,500 rub. for employees of organizations financed from the federal budget (12,928 rubles, 7,800 rubles for employees of organizations financed from the federal budget);

- Yaroslavl region 9,640 rub., 8,021 rub. for employees of small and medium-sized enterprises, 7,500 rubles. for public sector organizations (10,026 rubles, 8,342 rubles for employees of small and medium-sized enterprises, 7,800 rubles for public sector organizations).

All wage transactions must be recorded in a special journal or entered into a computer database. An employer can reduce wages without the employee’s consent only in very limited cases, which you can read about here.

The maximum amount of deductions from wages is 70%. In what cases this happens, read our article.

If the salary is below the minimum wage: consequences

If, from July 1, 2021, the employee’s salary is less than the minimum wage (7,800 rubles), then the employer may be held accountable in the form of fines. The fine for an organization can range from 30,000 to 50,000 rubles, and if detected again - from 50,000 to 70,000 rubles. For a director or chief accountant, the liability may be as follows: for a primary violation, they may issue a warning or a fine of 1,000 to 5,000 rubles, for a repeated violation, a fine of 10,000 to 20,000 rubles. Moreover, they can be disqualified for a period of one to three years (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Read also

14.09.2016

Benefits

From July 1, 2021, to calculate some benefits, you need to take into account the federal minimum wage - 7,800 rubles. This minimum wage affects the amount of benefits in two cases:

- The employee's length of service is less than six months;

- The employee's salary is below the minimum wage.

Also, the size of the minimum wage affects the amount of minimum benefits for child care up to 1.5 years and maternity benefits. If you want to find out the new benefit amounts after increasing the minimum wage, we recommend that you read our articles:

- “Benefits from July 1: new increased amounts”;

- "Children's benefits from July 1, 2021: new sizes."