The Russian budget functions, like in many other countries, using a special codified system, which includes various revenue items within the budget: duties, fines, social contributions and many others. In our country, this code system is called budget classification codes (BCC). These codes are used by entrepreneurs and other entities to make payments in the Russian fiscal system. This system contains many different codes, of which in this material we will give a decoding of KBK 1821 02 02103 08 1013 160 ( intended for paying premiums for health insurance ).

When was the BCC for insurance premiums last updated?

Since 2021, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities.

As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs. The presence of a situation where, after 2021, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2021, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2021 and for periods after January 2021. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

Read more about KBK in this material.

From April 23, 2018, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

We talked about the details here.

From January 2021, BCC values were determined in accordance with Order of the Ministry of Finance dated June 8, 2018 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2021 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2021 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

We talked about the nuances in the material “From 2021 - changes in the KBK.”

However, from April 14, 2019, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2021 BCC.

In 2021, the list of BCCs is determined by a new order of the Ministry of Finance dated November 29, 2019 No. 207n, but it has not changed the BCC for contributions. Find out which BCCs have changed here.

Thus, the last update of the BCC on insurance premiums took place on April 14, 2019. Nothing else has changed yet, and these same BCCs will be in effect in 2021 (Order of the Ministry of Finance dated 06/08/2020 No. 99n).

All current BCCs for insurance premiums, including those changed as of April 14, 2019, can be seen in the table by downloading it in the last section of this article.

Structure of the KBK

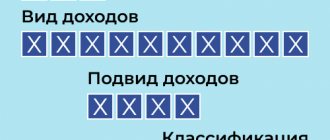

This code consists of 20 characters - numbers, separated by hyphens into groups, it has the following form XX - X XX XX XXX XX - XXXX - XXX.

Each group of characters corresponds to an encrypted meaning determined by the Ministry of Finance. Let's consider the structure of the profitable BCC, since they are the ones that entrepreneurs mainly have to use (expense codes can be found mainly when returning funds under any government program).

- "Administrator" . The first three signs show who will receive the funds and is responsible for replenishing this or that part of the budget with them, and manages the received money. The most common codes for businessmen begin with 182 - tax authority, 392 - Pension Fund, 393 - Social Insurance Fund and others.

- "Type of income" includes signs from 4 to 13. This group of signs helps to fairly accurately identify receipts based on the following indicators:

- group – 4th character (that is, the first in this paragraph);

- subgroup – 5th and 6th characters; a two-digit code indicates a specific tax, duty, contribution, fine, etc.;

- article – category 7 and 8 (the value of the purpose of the received income is encoded in the settlement documents for the budget of the Russian Federation);

- subarticle – 9, 10 and 11 characters (specifies the item of income);

- element - 12 and 13 digits, characterizes the budget level - from federal 01, municipal 05 to specific budgets of the Pension Fund - 06, Social Insurance Fund - 07, etc. Code 10 indicates the settlement budget.

- “Program” - positions from 14 to 17. These numbers are designed to differentiate taxes (their code is 1000) from penalties, interest (2000), penalties (3000) and other payments (4000).

- “Economic classification” – last three digits. They identify revenues in terms of their economic type. For example, 110 speaks of tax revenues, 130 - from the provision of services, 140 - funds forcibly seized, etc.

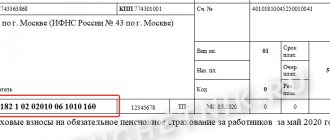

IMPORTANT INFORMATION! The 20-digit code must be entered correctly and without errors in the “Purpose of payment” field (field No. 104) of the payment order. In fact, it duplicates the information indicated in the “Base of payment” field, as well as partially in the “Recipient” and “Recipient’s current account” fields.

BCC for insurance premiums in 2020–2021 for the Pension Fund of Russia

Payment of insurance premiums to the Pension Fund is carried out by:

- Individual entrepreneurs working without hired employees (for themselves);

- Individual entrepreneurs and legal entities hiring workers (from the income of these workers).

At the same time, payment of a contribution by an individual entrepreneur for himself does not exempt him from transferring the established amount of payments to the Pension Fund for employees and vice versa.

Individual entrepreneurs who do not have staff pay 2 types of contributions to the Pension Fund:

- In a fixed amount - if the individual entrepreneur earns no more than 300,000 rubles. in year. For such payment obligations in 2020-2021, KBK 18210202140061110160 (if the period is paid from 2017) and KBK 18210202140061100160 (if the period until 2017 is paid) are established.

IMPORTANT! The income of an individual entrepreneur on UTII for the purpose of calculating fixed insurance premiums is imputed income, not revenue (letter of the Ministry of Finance of the Russian Federation dated July 18, 2014 No. 03-11-11/35499).

- In the amount of 1% of revenue that exceeds RUB 300,000. in year. For the corresponding payment obligations accrued before 2021, KBK 18210202140061200160 has been established. But contributions accrued in 2017–2021 should be transferred to KBK 18210202140061110160. That is, the code is the same as for the fixed part (letter from the Ministry of Finance of Russia dated 04/07/201 7 No. 02-05-10/21007).

Find out about the current fixed payment amount for individual entrepreneurs by following the link.

Individual entrepreneurs and legal entities that hire employees pay pension contributions for them, accrued from their salaries (and other labor payments), according to KBK 18210202010061010160 (if accruals relate to the period from 2017) and KBK 18210202010061000160 (if accruals are made for the period before 2021) .

You will find a sample payment order for contributions to compulsory pension insurance for employees in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

What are the consequences of an error in the KBK?

If the payment purpose code is specified incorrectly, the payment will be transferred to the budget, but it will not be distributed correctly there, which means that the state will not actually receive it. The result may be the same as if the money had not been transferred at all: the tax office will count the arrears under a certain item. At the same time, if the BCC is simply mixed up, there may be an overpayment under another item.

As a result, the tax office will issue a demand for payment of arrears, a fine for late payment of tax or a fee and penalties for late payment. This situation is extremely unpleasant for a conscientious entrepreneur who paid the tax on time, whose entire fault lies in confusion with numerous CBCs.

The usual procedure for an entrepreneur when an error is detected in the KBK

- The most important thing is to make sure that the error did not lead to non-receipt of income to the budget, otherwise it will be considered that the funds were not paid, with the payer being fully responsible for this.

- Submit to your tax accounting office a statement about the detected error and a request to clarify the basis, type and affiliation of the transfer of funds, if necessary, the tax period or tax payer status.

- The application must be accompanied by payment orders for which the tax was paid and received by the budget.

- If necessary, a reconciliation of paid taxes is carried out jointly with the inspector (a report is drawn up about it).

- After a few days (the period is not defined by law), a decision is made to clarify this payment and is handed over to the applicant.

IMPORTANT! When a payment is clarified, it is considered completed on the day the payment order is submitted with an incorrect BCC, and not on the day the decision on clarification and offset is received. Thus, the delay in mandatory payment, which provides for penalties, does not actually occur.

Let's look at various cases that occur due to errors in the CBC and analyze what an entrepreneur should do.

- The inspectorate assessed penalties for non-payment of taxes . If there was a beneficial request from the payer to offset the amount paid, then you should additionally ask the tax office to recalculate the accrued penalties. If the tax office refuses to do this, going to court will most likely allow for a recalculation (there is a rich case law with similar precedents).

- The BCC does not correspond to the payment specified in the assignment . If the error is “within one tax”, for example, the KBK is indicated on the USN-6, and the payment basis is indicated on the USN-15, then the tax office usually easily makes a re-offset. If the KBK does not completely correspond to the basis of the payment, for example, a businessman was going to pay personal income tax, but indicated the KBK belonging to the VAT, the tax office often refuses to clarify, but the court is almost always on the side of the taxpayer.

- Due to an error in the KBK, insurance premiums were unpaid . If the funds do not reach the required treasury account, this is almost inevitably fraught with fines and penalties. The entrepreneur should repeat the payment as quickly as possible with the correct details in order to reduce the amount of possible penalties. Then the money paid by mistake must be returned (you can also count it against future payments). To do this, an application is sent to the authority to whose account the money was transferred erroneously. Failure to comply with a request for a refund or re-credit is a reason to go to court.

- The funds entered the planned fund, but under the wrong heading . For example, the payment slip indicated the KBK for the funded portion of the pension, but they intended to pay for the insurance portion. In such cases, contributions are still considered to have been made on time, and you must proceed in the same way as under the usual procedure. The court can help with any problems with a fund that refuses to make a recalculation, and an illegal demand for payment of arrears and the accrual of penalties.

REMEMBER! According to the law, an error in the KBK is not a reason for which the payment will not be considered transferred. The payment order contains additional information indicating the purpose of the payment and its recipient, therefore, if it is indicated correctly, there is and cannot be a reason for penalties against the entrepreneur; other decisions can be challenged in court.

What BCCs for FFOMS contributions are established in 2020–2021

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using BCC 18210202103081013160 (if related to the period from 2021) and BCC 18210202103081011160 (if related to the period until 2021).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2021) and KBK 18210202101081011160 (for accruals made before 2021).

You will find a sample payment order for compulsory medical insurance contributions for employees in ConsultantPlus. You can get a trial full access to K+ for free.

How does KBK stand for?

KBK - budget classification codes

The organizations' BCCs, which are necessary for the payment to go where it was intended, change almost every year. And the responsibility for their correct indication lies with the payer!

Let's try to figure out what these mysterious codes are, why they are needed, how they are formed and why they change regularly. We will also tell you what to do if you find an error in the specified code, and what you risk in this case, and most importantly, how to prevent this risk and not end up with accrued fines and penalties for paying taxes and fees on time.

What BCCs for insurance premiums are established for the Social Insurance Fund in 2020–2021

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

A sample payment order for contributions to OSS from VNiM for employees can be found in ConsultantPlus. You can get a trial full access to K+ for free.

Read more about the specifics of calculating insurance premiums when signing civil contracts in the article “Contract and insurance premiums: nuances of taxation .

Results

Insurance premiums intended for extra-budgetary funds are required to be paid by both individual entrepreneurs and legal entities. BCC for insurance premiums for 2020–2021 when making payments, you should use only current ones - this is an important factor in the timely recording of payment by its recipient.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

- Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.