Who will be affected by the new clarifications?

Letter No. SD-4-3/7484 of the Federal Tax Service of Russia dated April 19, 2021 is devoted not only to the preparation of a VAT return for scrap metal in 2018, but also applies to all VAT tax agents listed in paragraph 8 of Art. 161 of the Tax Code of the Russian Federation.

Let us remember that we are talking about those who deal with:

- with raw animal skins;

- scrap and waste of ferrous metal and non-ferrous metal, secondary aluminum and its alloys.

That is, this:

- sellers who pay VAT (except for those exempt from calculation and payment obligations);

- buyers who pay VAT and at the same time tax agents (except for those exempt from calculation and payment obligations);

- buyers who are VAT non-payers and at the same time tax agents (it does not matter whether they fulfill the payer’s obligations for calculating and paying VAT or other obligations).

In the said letter, tax officials clarified how each of these categories should correctly fill out a VAT return for the sale of scrap metal in 2021. Let us remind you that the form of this report was approved by order of the Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Also see “VAT return: due dates in 2021”.

Results

So, we found out that when selling scrap, the acquiring party must charge and pay VAT. But she will do this only if the scrap seller is a VAT payer and is not exempt from paying tax, for example, under Art. 145 of the Tax Code of the Russian Federation. There are also some features in the issuance of invoices for advance payments and for shipment by taxpayer sellers, which we also examined. In addition, we described how tax registers for VAT accounting are filled out by each party participating in a transaction for the sale of scrap.

If the scrap seller is exempt from VAT or applies a special tax regime, the buyer does not have the obligations of a tax agent. The main thing is to approach the preparation of the initial documents (contracts, invoices, acts, etc.) very carefully so that the controllers do not have any claims against either the selling or acquiring party.

Sources:

- Tax Code of the Russian Federation

- Federal Law of November 27, 2017 No. 335-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out for sellers who pay tax

This category does not reflect the sale of scrap metal in the 2018 VAT return in Section 3, since the tax base is not established.

But there are three exceptions:

- para. 7 paragraph 8 art. 161 of the Tax Code of the Russian Federation (inaccurate entry by the payer-seller in the “primary” of the phrase “Without VAT”);

- para. 8 clause 8 art. 161 of the Tax Code of the Russian Federation (loss of the right to exemption from the duties of the payer or to a special regime);

- sale of these goods to ordinary individuals without individual entrepreneur status.

At the same time, transactions with scrap metal must be reflected in the sales book, as well as Sections 1 and 9 of the VAT return. When issuing adjustment invoices - in Section 8.

Codes for types of VAT transactions when waiving the 0% rate

Codes of types of VAT transactions in case of refusal of the 0% rate, recommended by Letter of the Federal Tax Service of the Russian Federation dated January 16, 2018 N SD-4-3/ [email protected]

Applicable from 01/01/2018.

| Operations (clause 7 of article 164 of the Tax Code of the Russian Federation) | Operation type code | Comments |

| sale of raw materials exported under the customs export procedure, taxation of which is carried out at a rate of 18% | 37 | |

| sales of non-commodity goods exported under the customs export procedure, taxation of which is carried out at a rate of 18% | 38 | |

| sales of non-commodity goods exported under the customs export procedure, taxation of which is carried out at a rate of 10% | 39 | |

| implementation of works (services) provided for in paragraphs. 2.1 - 2.5, 2.7 and 2.8 clause 1 art. 164 of the Tax Code of the Russian Federation, in relation to raw materials (non-raw materials) goods exported under the customs export procedure, taxation of which is carried out at a rate of 18% | 40 |

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

How to fill out for buyers-payers-tax agents

Now about how to fill out a VAT return with scrap metal to tax agents as paying buyers. You'll have to try hard here.

The Federal Tax Service explains that the calculated tax and deductions for it (clauses 3, 5, 8, 12 and 13 of Article 171 of the Tax Code of the Russian Federation) must be shown in the corresponding lines of Sections 3, 8 and 9 of the declaration. And don't forget to fill out Section 1.

ATTENTION

Tax officials pay attention: if purchased scrap metal, etc., is involved in raw materials commodity-export operations, then VAT is deducted in accordance with clause 3 of Art. 172 of the Tax Code of the Russian Federation. Therefore, deductions for the sale of raw materials are indicated in Sections 4, 5, 6 of the VAT return, respectively.

How to fill out for non-paying tax agent buyers

In this case, the tax authorities propose to fill out a VAT return (scrap) in 2021 on the basis of temporary rules until appropriate amendments are made to the aforementioned order dated October 29, 2014 No. ММВ-7-3/558, which establishes the declaration form, format and rules for completing this report.

In Section 2, the sales of scrap metal should be reflected in the VAT return as follows:

- lines 010 to 030 – leave empty;

- on line 060, bring the final amount of tax to be transferred to the treasury in accordance with clause 4.1 of Art. 173 Tax Code of the Russian Federation;

- on line 070, indicate the new code 1011715 (it is used in the sale of raw animal skins/scrap and waste of ferrous metal and non-ferrous metal, second aluminum and its alloys).

As a result, this category includes in its declaration:

- title plate (in the column “At location (registration)” indicate code 231);

- Section 1 with dashes;

- Sections 2 and 9.

The Federal Tax Service also made an important clarification regarding the VAT declaration (sale of scrap metal) in 2021: invoices from sellers for advance payments, for which VAT is deducted by buyers, are shown as a negative number in Section 9.

As stated in the letter from the Federal Tax Service - “... until appropriate changes are made to the Control ratios of the VAT return indicators. From the 1st quarter of 2021, the procedure will change: entries on invoices reflected in Section 9, when transferring payment (partial payment) on account of future deliveries (+ based on clauses 5 and 13 of Article 171 of the Tax Code of the Russian Federation) are made in Section 8 for the correct application of deductions.

ADVICE

If you reflected the sale of scrap in your VAT return for the 1st quarter of 2021 without taking into account the clarifications of the Federal Tax Service of Russia discussed above, then we strongly advise you to submit an update for this period.

Please note that the procedure for applying VAT by tax agents under clause 8 of Art. 161 of the Tax Code of the Russian Federation is also set out in the letter of the Federal Tax Service dated January 16, 2021 No. SD-4-3/480.

Also see “VAT return for the 1st quarter of 2021: due date and filling out the form.”

How is the sale of scrap metal reflected in accounting?

Buyers of scrap metal make payments separately based on the results of each quarter in which they received such goods.

Reduce the tax accrued during the quarter by the amount of deductions and increase by the amount of restored VAT. The tax agent - the buyer must increase the VAT charge on the tax amounts that he recovered when:

- received goods for which he had previously paid an advance payment and accepted tax as a deduction (or upon return of the advance);

- took into account the decrease in the cost or quantity of goods (corrected the amount previously accepted for deduction).

Such rules are established by paragraph 4 of subparagraph 3 of paragraph 3 and paragraph 6 of subparagraph 4 of paragraph 3.

The buyer agent has the right to reduce the tax accrued at the end of the quarter for the following types of deductions. They are listed in paragraph 4.1.

- Accrued VAT. You can use it only if two conditions are met. Firstly, the agent must be a VAT payer. Secondly, the purchased scrap metal must be registered and intended for use in transactions subject to this tax. If both conditions are met, then the deduction can be applied in the quarter in which VAT was calculated. The Tax Code allows deduction of “calculated” and not paid amounts.

Agents who apply special regimes are not VAT payers. Therefore, they are not entitled to this deduction. As do buyers who use the tax exemption under .

Scrap metal exporters who apply a 0 percent rate have a special VAT claim for deduction. Scrap metal is a commodity commodity. Therefore, if you purchased it for sale for export, then you can apply the deduction no earlier than on the last day of the quarter in which the documents confirming the right to the zero rate were collected. This follows from point 3. Explanations - in .

When returning the goods to the seller or prepayment to the buyer. Agents - buyers have the right to such it if they are VAT payers (clause 5 of Article 171 of the Tax Code). Wherein:

- if the buyer returns the goods received, he takes for deduction the tax that he previously accrued instead of the seller when shipping this goods;

- if the seller returns the advance payment, then the buyer accepts for deduction the tax accrued earlier (on the day the seller receives the advance payment).

- From the advance payment transferred by the agent. When an advance form of payment is provided, VAT is calculated from the advance payment transferred to the seller and accepted for deduction (paragraph 2, clause 12, article 171 of the Tax Code). This right can be used by everyone: VAT payers, those who apply special regimes, and those who use the right to tax exemption.

With prepayment for the seller. Agents first charge value added tax on the advance payment, and then accept it as a deduction. The right to deduction arises at the moment when the seller has shipped the goods for which he previously received an advance payment (Clause 8 of Article 171 of the Tax Code).

When the cost or quantity of goods decreases. Agents - buyers have the right to it instead of sellers. First they charge value added tax on the shipment. Then, if the cost or quantity of goods has been reduced, the excess tax charged is taken as a deduction. This follows from paragraph 13 of Article 171 of the Tax Code.

- the amount of the prepayment received (for the advance);

- cost of goods shipped (for shipment).

There are no special rules for processing and registering invoices when selling scrap metal. Until amendments have been made to it, please refer to the appendices to it. There are also new transaction codes for recording invoices in the sales ledger, purchase ledger and invoice ledger.

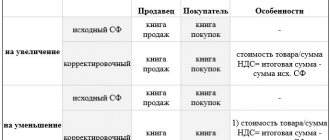

| The buyer is a tax agent, VAT payer | The buyer-agent applies a special regime or uses a VAT exemption | ||||

| The buyer made an advance payment | |||||

| Calculation from prepayment using the formula: VAT amount on advance | Advance amount | Advance amount | Rate 18% | Settlement rate (18/118) | |

Registers an invoice for prepayment in the sales book. Indicates the amount calculated by the formula. You do not create your own invoice for prepayment.

Acts as a buyer Accepts for deduction the tax calculated from the prepayment.Registers an invoice for prepayment from the seller with the calculated amount in the purchase book. He does not create his own invoice for the advance payment.

The seller shipped and the buyer purchased the goods The agent acts instead of the sellerAccrual from shipment according to the formula:

VAT amount on shipment

| Cost of shipped goods | Cost of shipped goods | Rate 18% | Settlement rate (18/118) |

Registers the shipment invoice in the sales ledger. Indicates the amount calculated by the formula. Does not create your own shipping invoice.

Accepts for deduction the tax calculated from the advance payment.

Registers an invoice for prepayment in the purchase book. Indicates the amount calculated by the formula. Doesn't create his own account.

Acts as a buyer Accepts for deduction the calculated amount of VAT on the shipment. Registers an invoice for it with the calculated amount in the purchase book. Has no right to deduction. Nothing is recorded in the purchase ledger. Restores the tax previously accepted for deduction from the advance payment. Registers an invoice for prepayment with the calculated amount in the sales book. He does not create his own account (subclause 3, clause 3, article 170 of the Tax Code).Record corrected and adjusting invoices in the books in the same manner. In situations where the buyer is not an agent, complete the paperwork in the general manner.

Sellers who pay VAT issue invoices for advance payments and shipments with the note “VAT is calculated by the tax agent.” The exception is the sale of scrap metal for export and to individuals. Agents - buyers do not prepare payment documents for prepayment and shipment of scrap metal themselves. This procedure follows from paragraph 8 of Article 161, paragraph 3.1 of Article 166 and paragraph 5 of Article 168 of the Tax Code.

The seller, a value added tax payer, registers invoices for prepayment and for shipment in his sales book. In column 2, indicate the transaction codes that are given in the attachment to the letter. For example, if you are registering a primary invoice for an advance payment, enter code 33 in column 2, and if for shipment, enter code 34. For transaction codes for other situations, see the table “Codes of types of VAT transactions.”

In column 14 (cost without tax) indicate:

In column 13b and column 17 (tax amount):

- make dashes if you are compiling a sales book on paper;

- indicate the number “0” if you maintain it electronically in the established format or upload information to section 9 of the declaration.

This order follows from the attachment to the letter.

When dealing with scrap metal, the seller, a VAT payer, fills out a purchase book if he registers an adjustment invoice to reduce the cost of shipments. In this case, indicate transaction type code 34 in column 2 of the book. In column 15, indicate the difference in cost. If you are compiling a purchase book on paper, put a dash in column 16 (amount of tax to be deducted).

The buyer - agent registers invoices for advance payment and for shipment in the sales book. Despite the fact that he acts both as a seller and as a buyer, all transactions for the calculation (recovery) of VAT are recorded in one book.

In column 2 of the sales book, indicate the transaction codes according to the appendix to the letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3/480. For example:

- 41, when you register an invoice for an advance payment in order to charge tax on it instead of the seller;

- 42, when you register an invoice for a shipment in order to charge tax on it instead of the seller;

- 43, when you register an invoice for an advance payment, so that after the goods have been shipped by the seller, you can restore the deduction from the advance payment as a buyer.

In column 14 (cost without tax) enter:

- the amount of the prepayment, if you register an invoice for it;

- cost of goods upon registration for shipment.

In column 17 of the sales book, the buyer indicates the amount from the advance payment or the amount from shipment, which was determined by the calculation method. This procedure follows from the attachment to the letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3/480.

Registers in the sales book an invoice for the advance received from the seller. Indicates the VAT amount calculated using the formula. He does not prepare his own invoice for the advance payment.

Accepts for deduction VAT calculated on the advance payment.Registers in the purchase book an invoice for an advance payment from the seller with the calculated amount of VAT. He does not prepare his own invoice for the advance payment. The seller shipped and the buyer purchased the goods. 3 The tax agent acts instead of the seller.

Calculate VAT on shipments using the formula:

| Cost of shipped goods | × | VAT rate (18%) | × | Settlement rate (18/118) |

Registers the shipment invoice received from the seller in the sales ledger. Indicates the VAT amount calculated using the formula. He does not prepare his own invoice for shipment.

The tax agent acts as a buyer4 Accepts for deduction the calculated amount of VAT on the shipment. Registers in the purchase book an invoice for shipment from the seller with the calculated amount of VAT.Restores VAT previously accepted for deduction from the advance payment. Registers in the sales book an invoice for an advance payment from the seller with the calculated amount of VAT. Does not have the right to deduct. Nothing is recorded in the purchase ledger.

Does not restore VAT accepted for deduction from the advance payment. Nothing is recorded in the sales book.

Record corrected and adjusting invoices in the books in the same manner.

Let us remind you that the form of this report was approved by order of the Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. Also see.

“This category does not reflect the sale of scrap metal in the VAT return in 2019 in Section 3, since the tax base is not established. But there are three exceptions:

- para. 8 clause 8 art. 161 of the Tax Code of the Russian Federation (loss of the right to exemption from the duties of the payer or to a special regime);

- para. 7 paragraph 8 art. 161 of the Tax Code of the Russian Federation (inaccurate entry by the payer-seller in the “primary” of the phrase “Without VAT”);

- sale of these goods to ordinary individuals without individual entrepreneur status.

At the same time, transactions with scrap metal must be reflected in the sales book, as well as Sections 1 and 9 of the VAT return. When issuing adjustment invoices - in Section 8. Now about how to fill out a VAT return with scrap metal to tax agents as paying buyers.

conclusions

The VAT return for the first quarter must be completed taking into account the new requirements of the Federal Tax Service. If you have already reported for VAT, it is safer to submit an “adjustment”.

Sellers are VAT payers

They do not determine the tax base, so in Section 3 the sale of scrap metal is not shown. As part of the declaration, they must submit the title page, section 1 and section 9.

Buyers – tax agents – VAT payers

The accrual of tax and the deductions due to it must be reflected in section 3. The title page, sections 1, 3, 8 and 9 are submitted as part of the declaration.

Buyers – tax agents – VAT evaders

Indicate the amount of tax payable to the budget on line 060 of section 2. The new transaction code on line 070 of section 2 is 1011715. The declaration includes the title page, section 1 with dashes, as well as sections 2 and 9. Invoices for advance payment, VAT for which buyers accept deductions, are reflected in section 9 with a minus.

Read also

27.12.2017