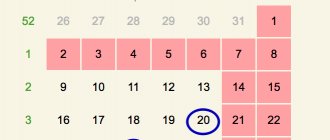

In 2015, the calculation of insurance contributions to the Pension Fund and the Compulsory Medical Insurance Fund (form RSV-1) must be submitted quarterly in paper form by the 15th day, and electronically by the 20th day of the second calendar month following the reporting period.

The last dates for submitting paper reports in 2015 are:

- May 15, 2015 for the 1st quarter of 2015;

- August 17, 2015 for the first half of 2015;

- November 16, 2015 for 9 months of 2915;

- February 15, 2021 - report for 2015;

And when submitting reports electronically:

- May 20, 2015 for the 1st quarter of 2015;

- August 20, 2015 for the first half of 2015;

- November 20, 2015 for 9 months of 2915;

- February 22, 2021 - report for 2015;

In what form should reports be submitted: paper or electronic?

In what form the report should be submitted depends on the number of individuals in whose favor the company made payments in the previous reporting (calculation) period.

Different approaches to determining the population limit

In the single form RSV-1, the Pension Fund of the Russian Federation reflects two types of information, so accountants have to use two federal laws:

- dated July 24, 2009 No. 212-FZ (hereinafter referred to as Law No. 212-FZ);

- dated 01.04.96 No. 27-FZ (hereinafter referred to as Law No. 27-FZ).

However, they specify differently the condition under which a company is required to submit reports electronically (Table 1 below).

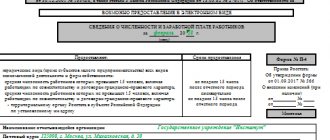

Table 1 Who is required to submit reports electronically

| Part 10 of Article 15 of Law No. 212-FZ | Paragraph 3 of Part 2 of Article 8 of Law No. 27-FZ |

| Companies with an average number of individuals in whose favor payments were made, more than 25 people for the previous billing * period | Companies with 25 or more (including those who entered into civil contracts for which insurance premiums were charged) for the previous reporting period** |

* The billing period is a calendar year (Part 1, Article 10 of Law No. 212-FZ).

** Reporting period - I quarter, half year, 9 months and calendar year (Part 2 of Article 10 of Law No. 212-FZ).

Safe solution

Due to the fact that companies submit a single reporting form to the Pension Fund, it is safer to follow the recommendations of Article 8 of Law No. 27-FZ.

Article 8 of Law No. 27-FZ states that in the number of employees, performers under civil contracts, for whose remuneration insurance premiums were calculated, must also be taken into account.

That is, if a company employed 25 people in 2014, it must submit a report electronically . Otherwise, she faces a fine of 200 rubles. (Part 2 of Article 46 of Law No. 212-FZ).

If the number of employees in 2014, including performers under civil contracts, is less than 25 people , the company can choose in what form to submit the report - paper or electronic.

Signature in the electronic report RSV-1 Pension Fund

The report must be signed by an authorized person with an enhanced qualified electronic signature. Authorities are verified by a unified identification and authentication system (clause 10, part 3, article 29 of Law No. 212-FZ).

What form should I use to submit a report to the Pension Fund for the first quarter of 2015?

The Pension Fund planned to update the PFR form RSV-1 by the beginning of the reporting campaign. The draft new form was published on the Pension Fund website. It takes into account changes in the legislation on insurance premiums since 2015.

The Pension Fund issued a press release on April 3, 2015. It says that the Pension Fund departments accept reports for the first quarter of 2015 using the forms and formats of 2014.

Thus, the report must be submitted according to the current PFR form RSV-1, approved by Resolution of the PFR Board dated January 16, 2014 No. 2p.

Settlement of overpayments on insurance premiums

Today, in accordance with paragraph 21 of Article 26 of Law No. 212-FZ, it is not allowed to offset overpaid insurance contributions to the budget of one state extra-budgetary fund against future payments of the payer of insurance premiums, repayment of arrears on insurance premiums, arrears of penalties and fines to the budget of another state extra-budgetary fund.

Since 2015, this paragraph has been changed - it now contains clear instructions on the procedure for offsetting overpayments on insurance premiums “within” one fund.