Deadline

Rosprirodnadzor accepts calculations annually until April 15. For 2019, the calculation had to be submitted by April 15, 2021. The deadline for submitting calculations for 2021 is April 15, 2021.

The delivery location depends on the type of activity of the organization:

- Manufacturers submit calculations (like other forms of environmental collection) to the territorial RPN authority at their location.

- Importers submit calculations to the RPN Central Office (in Moscow).

- If an organization simultaneously produces and imports, it submits one report (indicating both the quantity of goods produced and the quantity of imported goods) to the Central Office of the RPN.

About payments for air pollution from cars

Section 2 of the reporting is completed by those organizations that have mobile sources of pollution. It doesn't matter whether they are owned or rented.

There are no separate emissions limits for vehicles. But there are technical standards for emissions of pollutants into the atmosphere.

When conducting a technical inspection, specialists check whether a particular vehicle meets the specified requirements.

It is prohibited to operate a vehicle if it emits more harmful substances than specified in current regulations. Or a ban is imposed until the violations are eliminated.

The mass of pollutant emissions does not determine the payment standards. The determining factor here is the type of fuel used and its type.

The standards must be multiplied by the amount of fuel that was actually consumed. Primary accounting documents will help to accurately calculate how much fuel was consumed in a particular case. In volumetric units, fuel is taken into account by those who maintain waybills.

But basic payment standards are set separately for a ton of fuel. Liters are converted to tons for those interested in accurate calculations. To do this, multiply the volume of the material by the density.

back to menu ↑

How to calculate the amount of environmental tax for 2021

To calculate the amount of environmental tax payable, perform the following calculation:

- Multiply the eco-fee rate by the weight of the product/packaging sold in the Russian Federation for domestic consumption (or by the number of units of the product, depending on the type of product).

- Multiply the resulting number by the recycling standard (in relative units).

To calculate the mass or quantity of goods and packaging, take them into account for the year preceding the reporting period. That is, in the report for 2021, the mass and quantity are taken according to 2021 data. Accordingly, the report for 2021 will require information from 2019.

If you carried out recycling, but did not comply with the standard in full, then calculate the difference between the standard and actual volume of recycling for the reporting year. It is this value that must be multiplied by the eco-fee rate.

About some features of the calculation

For each pollutant and waste, payment amounts are calculated separately. This also applies to each type of fuel on which mobile objects operate. When calculating the payment for environmental emissions, several factors must be taken into account:

- Additional coefficients 2 and 1.2.

- Ecological significance coefficient for the region.

Emissions also require the determination of several indicators at once:

- Coefficient for suspended solids.

- Additional coefficient 2.

- Ecological significance of the region.

Finally, when the waste fee is calculated, it is based on:

- Coefficient of the location of the facility where waste is disposed.

- Additional coefficient 2.

- Ecological significance.

An inflation factor can be added to all of the above schemes. It is established in the Federal budgets for the next calendar year.

back to menu ↑

Collection rates

All collection rates for groups of packaging and goods are given in Government Decree No. 284 dated 04/09/2016. For example, if an organization produces handmade carpets or floor coverings, it needs to find group 2 “Carpets and rugs”. The line opposite will reflect the rate of 16,304 rubles per ton. If a company imports barrels or plywood drums, it needs to go down to group 9 “Wooden containers” - here the rate will be 3066 rubles per ton. An importer or manufacturer of anti-corrosion or hydraulic oils should look into group 17 “Petroleum products” - the rate will be equal to 3,431 rubles per ton.

Regional reports

Before March 1 , 2021, it is necessary to submit a report to the regional cadastre of production and consumption waste of the Nizhny Novgorod region. Information is provided in the following waste sections:

- classification catalogue;

- register of waste disposal facilities;

- waste data bank;

- a database of technologies used in the field of waste management and disposal.

The procedure and forms for presenting information, including the submission of environmental reports in 2021, are determined by Decree of the Government of the Nizhny Novgorod Region dated July 25, 2008 No. 306.

An example of submitting reports and calculating the amount of environmental fees

Malachite and Lapis Lazuli LLC purchased 135 tons of cardboard boxes for packaging its products in 2021, and 158 tons in 2021. We will determine the packaging group that is indicated in the List. For cardboard boxes, this is group No. 51 “Packaging made of paper and non-corrugated cardboard”. In the declaration on the quantity of packaging released into circulation, we will indicate the number of boxes sold in 2021 - 158 tons. In the report on compliance with recycling standards, we use the volume of packaging sold for 2021 - 135 tons. For 2021, the recycling standard for group No. 51 is 15%, which means that it is necessary to dispose of:

135 × 0.15 = 20.25 tons.

If “Malachite and Lapis Lazuli” recycled boxes in the reporting year (2019) or in the year preceding the reporting year (2018), then this report includes information on the number of recycled boxes, and also indicates on the basis of which documents it was produced (contract , act, license).

Let's assume that in 2021 the enterprise recycled 8 tons out of 20.25 (20.25 -8 = 12.25), so it will need to contribute to the budget the amount for 12.25 tons:

12.25 tons × 2,378 rub. = 29,130.5 rub.

Fee standards

The payment standards in 2021 are established by Decree of the Government of the Russian Federation of September 13, 2016 N 913 “On payment rates for negative environmental impact and additional coefficients.” Previously, payment was regulated by 2 regulations:

- Decree of the Government of the Russian Federation dated June 12, 2003 No. 344,

- Decree of the Government of the Russian Federation dated July 1, 2005 No. 410.

These documents are no longer valid.

Decree of the Government of the Russian Federation dated September 13, 2016 N 913 approved new rates of payment for negative impact on the environment for 2016, 2021 and 2021. It also established that in relation to territories and objects under special protection in accordance with federal laws, payment rates for negative environmental impact are applied using an additional coefficient of 2.

To encourage legal entities and entrepreneurs to take measures to reduce the negative impact on the environment in order to calculate fees for the negative impact on the environment when disposing of waste, the following coefficients established by Federal Law dated January 10, 2002 N 7-FZ are applied to the rates of such fees:

- coefficient 0 when placing hazard class V waste from the mining industry by placing artificially created cavities in rocks during land and soil reclamation;

- coefficient 0.3 when placing production and consumption waste generated in one’s own production, within the established limits for their placement at waste disposal sites owned by a legal entity or individual entrepreneur by right of ownership or other legal basis and equipped in accordance with established requirements;

- coefficient 0.5 when placing waste of IV, V hazard classes, which was generated during the disposal of previously disposed waste from the processing and mining industries;

- coefficient 0.67 when placing waste of hazard class III, which was formed during the neutralization of waste of hazard class II;

- coefficient 0.49 when placing waste of hazard class IV, which was generated during the neutralization of waste of hazard class III;

- coefficient 0.33 when placing waste of hazard class IV, which was generated during the neutralization of waste of hazard class II.

When applying indexation coefficients to the standards of payment for negative environmental impact in previous years, one must be guided by the following:

- for payment standards established by Decree of the Government of the Russian Federation N 344 (as amended in 2003) for substances and groups of substances for which payment standards have not been changed by Decree of the Government of the Russian Federation N 410, use the 2003 coefficients;

- for payment standards for substances and groups of substances established by Decree of the Government of the Russian Federation N 410, use the 2005 coefficients.

How to fill out the calculation of the amount of environmental tax in Externa

The calculation includes:

- Title page

- Section 2.1. and Section 2.2

Fill out the title page of the report on the standards in the same way as the title page of the declaration. To fill out the title page:

- Indicate the type of activity of the organization. If the organization is an importer or a manufacturer and an importer at the same time, then the on-load tap-changer body will be filled in automatically.

If the organization is only a manufacturer, indicate the territorial office of the RPN where the report will be sent. Start typing the name or code of the organ and select it from the list that appears.

- Specify the reporting period.

- Fill in the remaining information about the organization and the performer who completed the report. Some of the data is automatically filled in from the details in Kontur.Externe. If there is an error in some data, correct it not on the title page, but in the details, so that in the future all forms are filled out with the correct data. To do this, in Extern, select the menu item “Details and settings” → “Payer details”.

Do offices need to pay for waste?

It may seem that the activities of offices have nothing to do with this, since their activities do not affect the environment. But that's not true.

Rosprirodnadzor expects payments to come from any organizations and enterprises. This also applies to those involved in the so-called office business.

After all, consumer waste is always generated, including waste incandescent or fluorescent lamps, garbage, cartridges from office equipment, and so on.

But we must take into account that the environmental fee must be paid by the person to whom the waste belongs. And here everything is again determined by how the agreement is concluded with the organization that removes the garbage.

If it is owned by an organization, it pays tax. If not, then those who carry out the export must pay.

back to menu ↑

Section 2.1. and section 2.2

The sections are filled out in the same way, only in section 2.1 the amount of the fee for goods is calculated, and in section 2.2 - for packaging. Below is a detailed description of how to fill out section 2.1:

- Click on the “+ Add Row” link.

- In column 3, select a product in the directory. To do this, start entering the code or name of the product in the search bar and select it from the drop-down list.

- In column 6, indicate the total weight of goods produced or imported during the calendar year preceding the reporting period, in kg (clause 6 of the Rules for collecting environmental fees).

- If waste disposal was carried out, in column 9 indicate how much waste from the use of goods was transferred for disposal. The remaining data (columns 7-8, 10-12) will be filled in automatically.

- Fill in the data for all products/packaging, adding new lines.

The total fee for the goods/packaging is automatically calculated in the summary line.

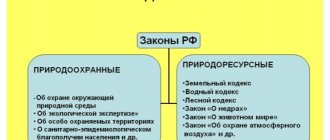

What taxes are environmental?

In connection with the use of certain natural objects, there is a need to pay a tax fee. Let's take a closer look at the situations in which this happens.

- Transport tax. In 2021, it must be paid if it is proven that the vehicle is harmful to the environment.

- Mineral extraction tax. For example, when extracting natural resources, including coal and oil, which are exhaustible.

- Water tax. In Russia it is paid for introducing an imbalance into the environment when using water resources.

- Fee for the exploitation of aquatic biological resources in Russia, objects of the animal world. This tax is paid if damage to nature is caused as a result of hunting or other types of catching animals.

- Land.

back to menu ↑