Minimum wage and regional coefficient in 2021

Before the adoption of the new law, some injustice was seen in the calculation of benefits: when comparing the actual amount of average earnings with the minimum wage, the regional coefficient (RC) was not taken into account. Although, when accruing, the final benefit amount was adjusted by an increasing factor. As a result, employees whose earnings were higher than the minimum wage, but lower than the minimum wage taking into account the Republic of Kazakhstan, received a smaller amount than those who were immediately assigned benefits at the “minimum wage”.

As of June 19, 2020, this imbalance has been eliminated. When calculating benefits after this date, the employer immediately adds regional coefficients and allowances to the minimum wage.

Results

The regional coefficient when calculating sick leave is applied only in cases where the amount of temporary working capacity benefits is calculated based on the minimum wage. This is due to the fact that the corresponding coefficient is “automatically” taken into account in the average earnings, on the basis of which sick leave is calculated in the general case.

You can learn more about the application of the regional coefficient in various areas of labor relations in the articles:

- “What is the amount of the premium for shift work?”;

- “Allowances for work in special climatic conditions are not compensation and are subject to personal income tax”.

Sources:

- Decree of the Government of the Russian Federation of May 29, 1993 N 512

- Resolution of the State Labor Committee of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated August 17, 1971 No. 325/24

- Order of the Government of the Russian Federation dated January 29, 1992 No. 176-r

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of the minimum wage taking into account the regional coefficient

The new wording provides that the rules apply to persons whose work experience is less than six months, or who had no earnings in previous years, or to citizens with low average earnings. At the same time, the federal, not regional, minimum wage is used for calculation (in 2021 - 12,130 rubles).

Let us show with an example how to calculate sick leave according to the minimum wage with the regional coefficient in practice.

Example 1

Primus LLC operates in the Perm region. The regional coefficient in the city of operation is 1.15. In July 2021, a company employee brought sick leave. The start date of incapacity for work is 06/25/2020, the end date is 07/01/2020. The length of service of this employee on the day the illness began is 5 months (benefits for up to 5 years of experience are based on 60% of average earnings).

How the accounting department of Primus LLC calculates the benefit:

- The federal minimum wage is adjusted to the Republic of Kazakhstan, equal to 1.15:

12130 x 1.15 = 13949.50 rub.

- The daily allowance amount will be:

13949.50 x 24 months. / 730 x 60% = 275.17 rub.

- The benefit is calculated based on the number of days of illness:

275.17 x 7 days = 1926.19 rubles.

When issuing funds, the accounting department will withhold personal income tax of 13% (1926.19 x 13% = 250 rubles), so the employee will receive less: 1926.17 - 250 = 1676.17 rubles.

When calculating sick leave in 2021, you should keep in mind the following: Law No. 104-FZ dated 04/01/2020 stipulates that from April to December 2020, the amount of benefits calculated from average earnings (when recalculated for a full month) should not be lower the minimum wage, and in case of part-time employment, the amount of benefits from the minimum wage is determined in proportion to the time worked.

Example 2

Variant LLC operates in Murmansk. Regional coefficient – 1.8. In August, the employee was ill for 10 days, for which he presented a sick leave certificate issued by the medical institution. The employee's salary for 2021 is 248,000 rubles, for 2021 - 260,000 rubles, 3 years of experience.

How the Variant accounting department calculated the allowance:

- calculated the actual average daily earnings:

(248000 + 260000) / 730 = 695.89 rubles.

- adjusted it according to the length of service (for up to 5 years of experience, 60% of average earnings are paid):

695.89 x 60% = 417.53 rub.

- compared it with the maximum size:

417,53 < 2301,37;

- To compare with the minimum, the average of the minimum wages was calculated:

12130 x 1.8 / 31 (number of days in August) x 60% = 422.59 rubles;

because the actual amount turned out to be less (417.53<422.59), the payment was calculated according to the minimum wage;

- benefit amount for 10 days of illness:

422.59 x 10 days. = 4225.90 rub.

Since personal income tax is withheld from disability benefits (4225.90 x 13% = 549), the employee will receive 13% less:

4225.90 - 549 = 3676.90 rub.

Example

At Volna LLC, two employees are going on sick leave from 01/21/2020 to 01/30/2020. Everyone has more than 8 years of insurance experience, that is, they receive 100% sick pay. The region has a regional coefficient of 50%.

Workers differ only in the income they received in the two previous years (2018–2019):

- the income of the first employee is 291,113 rubles (less than 24 minimum wages);

- the income of the second employee is 291,121 rubles (more than 24 minimum wages).

Let's calculate the amount of payment for ten days of sick leave that each of them will receive.

Calculation according to the old rules

| First employee | Second worker | |

| We calculate the average daily earnings based on the employee’s income | 291,113 rubles / 730 days = 398.78 rubles | 291,121 rubles / 730 days = 398.80 rubles |

| We calculate the minimum amount of average daily earnings based on the minimum wage | 24 months × 12,130 rubles / 730 days = 398.79 rubles | |

| Compare the actual average earnings with the minimum | 398,78 < 398,79 Minimum earnings are higher | 398,80 > 398,79 Actual earnings are higher |

| Calculating the total benefit amount | 398.79 rubles × 10 days × 1.5 (RK) = 5,981.85 rubles | 398.80 rubles × 10 days = 3,988 rubles |

Result : Volna LLC has two employees with income for two years, which differs by only 8 rubles, and the same insurance length. In this case, the first employee with a lower income will be paid sick leave in an amount that is 1.5 times more than the amount paid to the second employee. If I were the second employee, I would like to go to the accountant and ask him not to take into account 8 rubles for the past two years.

The difference is due to the fact that according to the old FSS methodology, it was possible to apply the regional coefficient only in the case when the average earnings calculated from the minimum wage turned out to be higher than the actual one. That is, the benefit is calculated based on the minimum average daily earnings. If actual earnings exceeded the minimum, the regional coefficient was not applied. This methodological problem was in effect from January 1, 2011 to June 19, 2021 (before the Federal Law of June 8, 2020 No. 175-FZ came into force).

Calculation according to the new rules - from June 19, 2021

With the entry into force of the new rules, the regional coefficient will need to be applied at the stage of comparing the actual average daily earnings with the minimum, which will eliminate the problem.

Let's see what the calculation will look like in July 2021. July was taken deliberately, since there are 31 calendar days. To exclude the influence of Federal Law No. 104-FZ dated April 1, 2020 on the calculation results.

| First employee | Second worker | |

| We calculate the average daily earnings based on the employee’s income | 291,113 rubles / 730 days = 398.78 rubles | 291,121 rubles / 730 days = 398.80 rubles |

| We calculate the minimum amount of average daily earnings based on the minimum wage | 24 months × 12,130 rubles × 1.5 (RK) / 730 days = 598.19 rubles | |

| Compare the actual average earnings with the minimum | 398,78 < 598,19 Minimum earnings are higher | 398,80 < 598,19 Minimum earnings are higher |

| Calculating the total benefit amount | 598.19 rubles × 10 days = 5,981.90 rubles | 598.19 rubles × 10 days = 5,981.90 rubles |

Result : In this case, justice prevailed - both employees received the same amount of benefits. Note that Federal Law No. 104-FZ dated April 1, 2020 for sick leave in the period from April 1 to December 31, 2021 partially compensated for the problem that was caused by the rules of the Social Insurance Fund. But the issue was finally settled only by Federal Law No. 175-FZ dated 06/08/2020.

Fill out electronic sick notes quickly and without errors and create registers in Externa

Calculation for part-time work

If an employee works on a reduced schedule, on a part-time or part-time basis, average earnings are calculated in proportion to the time worked. Therefore, for the purposes of calculating payments, the minimum wage, taking into account the Republic of Kazakhstan, is also adjusted to the employment rate.

Law No. 175-FZ stipulates a special condition for monthly child care benefits: its size in any calculation cannot be lower than the minimum level specified in the law of May 19, 1995 No. 81-FZ for non-working persons - from 06/01/2020 this is 6752 rub.

When new rules apply

New calculation rules were approved by Federal Law No. 175-FZ dated 06/08/2020. These are valid for benefits that begin on or after June 19, 2020. The changes concern three types of benefits (Article 14 of the Federal Law of December 29, 2006 No. 255-FZ):

- for temporary disability;

- for pregnancy and childbirth;

- for child care up to 1.5 years.

In general, these payments are calculated based on the average salary for the previous two years, but there are two exceptions (clause 1.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ):

- There had been no official income for the previous two years.

- Average monthly earnings for the previous two years are below the minimum wage.

The new rule applies to all employees whose salary over the previous two years was more than 24 minimum wages, but less than 24 minimum wages, taking into account the regional coefficient.

Is the northern surcharge taken into account?

For workers in the Far North and equivalent areas, both regional coefficients and northern bonuses are used when calculating wages. But when calculating minimum wage benefits, both the regional and northern coefficients are not used simultaneously. The law states that the rule applies specifically to the regional coefficient. Therefore, when paying benefits at the “minimum wage”, only the Republic of Kazakhstan should be taken into account. Northern allowances are taken into account when calculating payments based on actual earnings as part of the amounts taken into account in the billing period for the previous 2 years.

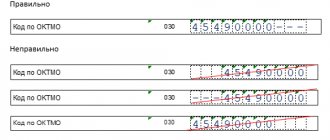

Sample sheet filling

Order of the Ministry of Health and Social Development of the Russian Federation No. 624-N dated June 29, 2011 regulates the procedure for making entries on sick leave.

The form of the certificate of incapacity for work itself is also approved at the legislative level.

Having carefully studied the form of the document, you can understand that there is no separate column for the regional coefficient. However, there are certain positions that can only be filled by the employer.

If the employee has not had any earnings for two years, then in the forms “average earnings for calculating benefits” and “average daily earnings” the amounts are written based on the minimum wage; the coefficient is not included here.

If the minimum wage = 9489, fill in these two fields:

- 227736 (minimum wage*24) – written in the “average earnings...” field;

- 311.97 (minimum wage*24/730) – to be filled in the “average daily earnings...” field

As the minimum wage increases, the values will be different. Sample of filling out sick leave from the minimum wage.

In the boxes: “amount of benefit at the expense of the employer”, “at the expense of the Social Insurance Fund” and “total accrued” the amount is entered taking into account the application of the regional coefficient.

Sample of filling out a certificate of incapacity for work with an increasing coefficient for the region:

About quarterly and annual bonuses

Quarterly bonuses are considered one of the forms of employee incentives. Typically payments are made every three months of work.

These types of compensation must be recorded in the following documents:

- Regulations on bonuses.

- Labor agreements.

- Regulatory acts related to the company.

This fixation leads to the fact that rewards become part of the overall system of remuneration for work. In such circumstances, coefficients are applied to any categories of employees.

“The thirteenth salary” is an incentive for subordinates, usually depending on the labor remuneration for the previous year, as well as the duration of cooperation with a specific employer.

The payments themselves may have several sources, including a labor fund, a material support fund, a social development fund, and so on. The organization has a Charter, which describes all the sources from which money comes. The effect of increasing rates coincides with normal situations. It is required if payment fixation is present.

What income does it not apply to?

The application of an increasing rate for the following payments is not relevant:

- Northern surcharge. This is a separate concept that differs from the regional supplement itself.

- Travel allowances. Except in cases where work is performed in areas with a difficult climate as a result of such a trip.

- One-time financial assistance. It is excluded from accounting if such assistance is of a one-time nature and is not stated in any official documents of the company.

- Irregular types of bonuses.

- Vacation pay. The calculation is already underway by district, if necessary.

Regional percentages

The Far North and territories equal to it suggest dividing bets into 4 groups. In each case the size is different. Groups 1 and 2 – 80%. They concern the Far North itself. Groups 3 and 4 – 50 and 30%, apply to regions with values equal to this territory.

Different regions have the following procedure for applying increasing rates:

- 100% applies to Antarctica, Chukotka Autonomous Okrug, Arctic Ocean, Koryak Autonomous Okrug.

- Group 2 or 80% is the city of Vorkuta, Yakutia, Khabarovsk Territory, Chukotka.

- Group 3 – 50%. The allowance is relevant for the Khanty-Mansiysk Autonomous Okrug, Arkhangelsk Region, and the Republic of Karelia.

- 30% or 4 group. Here we are talking about the Trans-Baikal Territory, the Komi Republic, Tyva, and the Republic of Buryatia.

Each region has certain areas where the applied coefficient differs from the standard rules stated above.

Who calculates the amount of benefits and pays the funds to the employee?

The benefits are paid either by the manager himself or by the Social Insurance Fund of the Russian Federation.

If the employer pays:

- The employer pays for three sick days. At the same time, he uses company funds.

- After four days of illness, sick leave is also paid by the manager, but in this case the Social Insurance Fund of the Russian Federation compensates for losses.

- If sick leave is issued due to injury, then the employer pays for the entire period of incapacity for work.

The benefit is paid by the Social Insurance Fund of the Russian Federation after four days of illness of the employee. The fund compensates for the employer's losses. After four days from the moment of illness and from the first day after the injury of the employee, the FSS of the Russian Federation pays benefits in the following cases:

- if at the time the employee went on sick leave the company dissolved and ceased to exist;

- if the employer does not have excess funds to pay benefits, that is, the funds for such expenses are simply not available in the company’s account;

- if the manager is unable to pay the required amount because the company is facing bankruptcy in the near future.

Remember that at the legislative level there are deadlines for when benefits with a regional coefficient for sick leave are received:

- The manager assigns benefits and pays them in one of two options. Option one – after ten days after the payment is assigned. Option two - on payday.

- The Social Insurance Fund of the Russian Federation pays benefits ten days after the request.

The minimum wage for calculating sick leave in 2021

Before calculating sick leave in 2021 from the minimum wage, you need to check whether such a calculation is needed. It is used in situations where the employee has only recently started working or if his earnings are below the established minimum wage.

How is sick leave calculated in 2021? The calculation of sick leave according to the minimum wage in 2021 is based on the minimum wage valid on the date of opening of the sick leave. Let's look at an example of calculating the accrual of sick leave in 2021 from the minimum wage.

Rules and procedure for calculating sick leave based on the minimum wage

It is worth noting that when determining the amount of the benefit, one must be guided by its maximum and, most importantly, minimum amount, which is established by law for each type of payment.

Even if the calculated amount turned out to be less than the minimum amount of the benefit, then, for example, the monthly child benefit in this case should be paid in its minimum amount. The line “Average earnings” includes all types of payments that were made in favor of the employee in the billing period, on the basis of an employment contract and provided that insurance premiums were calculated on these amounts. If during the billing period the employee had no income or it was so small that it turned out to be less than the minimum wage, then in this case 24 times the minimum wage, which was in effect at the time of incapacity (!), is taken. From January 1 in 2021 - this is 11,280 rubles. Thus, the line contains 24 * 11,280 = 270,720 rubles.

Calculation examples

Consider a position in the field with a current increase of 1.8. To establish the exact amount of compensation, the remuneration for labor is multiplied with an increasing number.

Example – salary 45 thousand rubles, increase – 1.8. 45000 multiplied by 1.8. We receive 81 thousand rubles. This is the final amount of monthly payments for a particular citizen.

A special situation is when they count from salary.

For example, the standard salary is 18 thousand rubles. But the employee uses a five-day work week and works 4 hours a day. Because of this, the payment is reduced to 9 thousand. 1.4 – size for commercial organizations tied to the area. We multiply 9000 by 40%. We receive an increase of 3,600 rubles.

How will sick leave be calculated from the minimum wage in 2021?

Vesna LLC paid driver Semenov a salary for 2017 of 298,500.00 rubles, for 2021 314,700.00 rubles. Semenov submitted a sick leave certificate to the accounting department (he was sick from 01/10/2021 to 01/18/2021), in which on 01/14/2021 there is a note about violation of the regime with code 24 - “late appearance for an appointment” (codes are given in the order Ministry of Health and Social Development dated June 29, 2011 No. 624n, transcripts can be found in our article). The reason for non-appearance is unexcused. The driver's experience as of January 10, 2021 is 15 years.

In some cases, in order to correctly calculate an employee’s sick leave, you need to know and apply the current minimum wage. We will help you figure out how to calculate sick leave from the minimum wage in 2021.

The legislative framework

The following legislative framework regulates the regional coefficient:

- “Labor Code of the Russian Federation”, Article No. 129 and Article No. 316;

- Federal Law No. 255 of December 29, 2006;

- Decree of the Government of the Russian Federation No. 512 of May 29, 1992;

- Order of the Government of the Russian Federation No. 176 of January 29, 1992.

You can also learn about the basic rules for paying the regional coefficient in the following video:

The regional coefficient is an excellent monetary compensation for citizens of the Russian Federation working in regions with a harsh climate and poor ecology. This coefficient is usually not calculated on sick leave, but there are exceptions to the rules that allow employees to receive involuntary unemployment benefits due to illness.

Help with a description of the allowances

Upon dismissal, a certificate describing the length of service must be issued. It concerns the experience gained in certain conditions. Then, when receiving the document, difficulties may arise, so it is better to take care of solving the problem in advance.

Typically such certificates contain the following information:

- Description of allowances.

- Salary amount.

- An exact description of the addressee for the allowance.

- Employer's name.

- Company details.

Other information is entered if necessary; no one has established a standard form for certificates.

A certificate of length of service is issued to military personnel when they retire. In the future, this is also taken into account when determining various compensations.

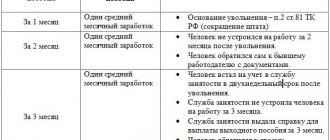

Who should calculate and pay sick leave benefits?

Payment of temporary disability benefits is carried out as follows:

| Payer | Terms of payment | A comment |

| Employer | First 3 days of illness | At my own expense |

| From the 4th day of illness | At your own expense, but with subsequent reimbursement of expenses from the Social Insurance Fund | |

| Work injury | At your own expense for all days of illness | |

| FSS | From the 4th day of illness | Reimburses expenses to the employer |

| From day 4 of illness and work injury (from day 1) |

|