Sometimes, after purchasing or selling a product, it is necessary to adjust the written “primary” document. The initiative can come from the supplier or the buyer if one of them, when preparing the initial delivery documents, saw an error. In other cases, the organization itself, during acceptance, identifies some problems and inaccuracies taking into account the quantity - in this case, adjustments are also required.

But it is not always possible to correct created and posted documents - in some cases it will not be possible to do this at all, in others the corrections will not be correct. Thus, corrections cannot be made to documents during the closed period. The fact is that if an adjustment is made to the receipts for previous years, then in 1C 8.3 it can lead to the re-posting of a large number of dependent documents. As a result, a lot of data will be distorted, revenue amounts, taxes, etc. will change. Such consequences, of course, are undesirable, so the operation must be reflected using separate documents, without affecting others - fortunately, this is provided for in the 1C system.

Rules

A dictionary will help you find out how to spell the word “adjustment”.

Correction is on the list of terms and scientific vocabulary of Latin origin. In Latin the word form is written “correctio”, with two “rr”. In Russian it is also written “pp”. According to the norms that are accepted in the Russian language, borrowed expressions belong to the dictionary and their spelling just needs to be remembered. There are no rules for dictionary words; they are apart from spelling norms.

Examples of using the word in sentences

We advise you to look at several examples where this word is used:

- The president's speech before a speech can be adjusted many times.

- The magazine material needs correction.

- It is necessary to adjust your life attitudes in order to find your path.

How wrong

Omitting one “r” is not the only mistake. You can see “correction” and “correction” as often as “correction”. Remember, this lexeme is written with “pp”, “o” and “e”.

What is the correct adjustment or adjustment?

Contents [Show]

correction - correction, straightening, editing, correction; redirection, adjustment, adjustment, adaptation, correction, regulation, amendment Dictionary of Russian synonyms. correction noun • correction • rectification • editing • introduction... ... Dictionary of synonyms

CORRECTION - adjustment (from Latin correctio amendment) partial change, correction, amendment made to forecasts, plans, projects, programs, calculations. Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.. Modern economic dictionary. 2nd ed., rev. M... Economic Dictionary

correction - noun, number of synonyms: 9 • correction (35) • correction (8) • correction (16) ... Synonym dictionary

Correction - cf. 1. process of action according to ch. adjust 2. The result of such an action; correction 2.. Explanatory dictionary by Efremova. T. F. Efremova. 2000 ... Modern explanatory dictionary of the Russian language by Efremova

Adjustment - g. 1. process of action according to ch. adjust 2. The result of such an action; correction 2.. Explanatory dictionary by Efremova. T. F. Efremova. 2000 ... Modern explanatory dictionary of the Russian language by Efremova

Correction (adjustment) - introduction of amendments in direction, range and height to the settings of sighting devices (protractor, level and sight), remote fuse or fire control devices to align the average trajectory of projectiles (mines) with the target... ... Brief dictionary of operational-tactical and general military terms

CORRECTION, ADJUSTMENT - (from Latin correctio amendment) partial change, correction, amendment made to forecasts, plans, projects, programs, calculations... Vocational education. Dictionary

correction, correction - (from Latin correctio amendment) partial change, correction, amendment made to forecasts, plans, projects, programs, calculations ... Dictionary of economic terms

correction - Correction, repair, processing, finishing, repair, reform, transformation, improvement; adjustment Prot. restoration... Dictionary of Russian synonyms and similar expressions. under. ed. N. Abramova, M.: Russian dictionaries, 1999. correction of correction ... Dictionary of synonyms

CORRECT - CORRECT, ruesh, ruesh; anna; imperfect., that. 1. Make adjustments to something, correct it. K. shooting. 2. Read the proof of what n. | Sovereign correct, ruyu, ruesh; anna, adjust, ruyu, ruesh; anna (to 1 value) and... ... Ozhegov's Explanatory Dictionary

In your case, ADJUSTMENT.

Correction. G. 1. process of action according to Ch. adjust 2. The result of such an action; adjustment. dic.academic.ru › Explanatory Dictionary by Efremova

CORRECTION , etc. no, w. . special.Correction.K. vision (correction of visual impairments with glasses). Yandex.Dictionaries › Explanatory dictionary of foreign words. — 2004

CORRECTION , corrections, women. (lat. correctio) (book). 1. Correction (special). Vision correction (correction of visual impairments using glasses; medical). 2. Same as vision correction (med.). dic.academic.ru › Ushakov’s Explanatory Dictionary

Correction . G. Correction, amendment. dic.academic.ru › Explanatory Dictionary by Efremova

The meaning of the word "adjustment"

CORRECTION, -i, g. Military Making adjustments to the aiming of guns based on the results of observations from observation points, airplanes, balloons, etc. Information about the work of Boris Ignatievich in the field of organizing artillery fire and especially adjustments helped him a lot in his work. L. Sobolev, First listener.

All meanings of the word "adjustment"

Sentences containing "adjustment":

- He will have only a few seconds from the moment the target is detected until the torpedo is released and there is too little opportunity for even a slight adjustments

course.

- In the morning, weather permitting, the crews carried out a mandatory mission, usually reconnaissance, aerial photography or adjustment

artillery fire.

- Summer and especially autumn roach fishing requires significant adjustments

these parameters are decreasing.

(all offers)

| adjustment | adjustments |

| adjustments | adjustments |

| adjustment | adjustments |

| adjustment | adjustments |

| adjustment adjustment | adjustments |

| adjustment | adjustments |

Making the Word Map better together

Hello! My name is Lampobot, I am a computer program that helps you make Word Maps. I can count perfectly, but I still don’t understand very well how your world works. Help me figure it out!

Thank you!

I began to understand the world of emotions a little better.

Question: strain

- is it something positive, negative or neutral?

Sentences containing "adjustment":

- He would have only a few seconds from the moment he detected the target until the torpedo was released and too little opportunity for even a minor correction

. - In the morning, weather permitting, the crews carried out a mandatory task, usually reconnaissance, aerial photography or adjustment

. - Summer and especially autumn roach fishing requires a significant

downward adjustment - (all offers)

leave a comment

What is the difference between the words "correction", "adjustment" and "proofreading"?

- The tryphoneme KOR - KAR in Russian means a strong, stable foundation that protects someone or something. Let's check this: SHIP, with SHELL, FRAME, ROOT, CORPUS, CORSET, CORSAGE, CARTUS, CORdon, CORAN, BASKET, CORRIDOR, CORIPHEAUS, CORM, , BOX, CORA, CORONA, COROsta, CORPORATION, CORRECTOR, CORRELATION, CORTEGE, CORRATION and etc. Therefore, the words “correction”, “adjustment” and “proofreading” will mean the actions of preserving the main idea, for example, the idea of the integrity of the text or the idea of correct aiming in adjusting fire. In other words, if a factor appears that distorts the main idea, then in this case words with the triphoneme KOR are used to correct them.

- Correct - make corrections or amendments to something.

TEXT CORRECTION correction in the original proofs and proofs of errors and inaccuracies made by the performers when typing and reproducing the originals or not noticed by the author and publishing workers when preparing the originals, as well as updating materials that were out of date during typing, and corrections in the typesetting itself.The words CORRECTION and ADJUSTMENT are paronyms, that is, they are very similar, but the area of use is somewhat different. CORRECTION of the oval face, figure, weight of a person... CORRECTION of text, program...

To understand the difference between these words, you should consult a dictionary. Correction and correction are nouns based on the verb to correct (to make adjustments, changes to something, to correct someone’s actions // Change activities, the direction of creativity, etc. in accordance with the situation. Correct errors in the typesetting print). These words are synonyms and may differ in compatibility according to tradition.

The word correction has the following meanings. 1. Special Correction (Vision correction). 2.Techn. Making amendments to the operation of measuring instruments, regulators, etc., depending on their operating conditions.

- Correction and correction are almost synonymous. Proofreading is a copy of a typed fragment of text, in which the proofreader must find and mark errors that need to be corrected.

- the first is closest to the original in Latin. The artillerymen fired and made adjustments; the correction turned out to be correct.

Meaning

Derived from the verb “correct,” which means to make changes. Comes from the Latin correctio, which means amendment, correction. In Latin, the verb corrigere is also used - to correct. The expression “correct” has an analogue “correctus”, that is, corrected. Initially, the word was used in the field of typographical typesetting, later it spread to other fields, including the military (fire adjustment).

Synonyms

There is a synonymous series that will help not only avoid mistakes, but also enrich speech:

- correction;

- editorial;

- make edits/amendments.

Features of accounting in one period and in different ones

If the cost of shipped products (services, property rights) increases in the current period (adjustment period):

- in the current period, the seller includes the resulting difference in the tax base, regardless of the period in which the products (services, property rights) were shipped (clause 10 of Article 154 of the Tax Code of the Russian Federation);

- the buyer makes a tax deduction for the difference between the VAT calculated before and after the adjustment (clause 13 of Article 171 of the Tax Code of the Russian Federation).

Kontur.VAT+ takes into account adjustments and corrections and verifies the results with counterparties for all quarters.

Find out more

If the cost of shipped products (services, property rights) decreases in the current period (adjustment period):

- the seller makes a tax deduction for the difference between the VAT calculated before and after the adjustment (clause 13 of Article 171 of the Tax Code of the Russian Federation). At the same time, the tax base, which was determined at the time of shipment of products (services, property rights), is not adjusted;

- the buyer recovers VAT for the amount of the difference between the VAT calculated before and after the adjustment (clause 4, clause 3, article 170 of the Tax Code of the Russian Federation);

- adjustments for reduction are carried out with KVO 18.

The seller and buyer reflect these transactions in their purchase and sales books as follows:

To correctly record adjustments in the books of purchases and sales in different reporting periods, use the following cheat sheet:

Example 1

According to the lease agreement between Sokol (lessor) and Lastochka (tenant), the rent amount is 106,000 rubles.

per month (including VAT). According to the additional agreement concluded in February 2021, the rental payment increased to RUB 112,600. per month (including VAT). According to the additional agreement, this change is effective from October 1, 2021. For the 4th quarter of 2021, rent amounted to RUB 318,000. (including VAT - 48,508 rubles). After concluding an additional agreement in February 2021, rent for the 4th quarter of 2021 increased to RUB 337,800. (including VAT - RUB 51,529).

In February 2021, after signing the additional agreement, Sokol issues an adjustment invoice to Lastochka and indicates:

- the previous amount of lease payment for the 4th quarter of 2021 (RUB 318,000, including VAT - RUB 48,508);

- new rental payment amount for the 4th quarter of 2021 (RUB 337,800, including VAT - RUB 51,529);

- difference (increase) (RUB 19,800, including VAT - RUB 3,020).

In this situation, Sokol increases the tax base for the 1st quarter of 2019 by registering an adjustment invoice in the sales book for this period by 16,780 rubles. (without VAT).

Lastochka has the right to deduct VAT in the amount of RUB 3,020 in the 1st quarter of 2021. according to the adjustment invoice received from Sokol, registering this invoice in the purchase book of the 1st quarter of 2021.

Example 2

In September 2021, Sokol shipped products worth RUB 96,000 to Lastochka.

(including VAT - RUB 14,644). In February 2021, the parties agreed to reduce the cost of shipped products. The cost after reduction was 82,400 rubles. (including VAT - 12,569 rubles).

In February 2021, Sokol issues an adjustment invoice to Lastochka, indicating:

- the previous cost (96,000 rubles, including VAT - 14,644 rubles);

- new cost (RUB 82,400, including VAT - RUB 12,569);

- difference (decrease) (RUB 13,600, including VAT - RUB 2,075).

In this situation, in February 2021, Sokol has the right to claim VAT in the amount of 2,075 rubles. according to the adjustment invoice issued to Lastochka. To do this, Sokol registers the adjustment invoice issued to Lastochka in its purchase book for the 1st quarter of 2021.

Lastochka in February 2021 must restore VAT in the amount of 2,075 rubles indicated in the adjustment invoice received from Sokol. In this regard, in February 2021, Lastochka must make a restoration entry in its sales book for the 1st quarter of 2019.

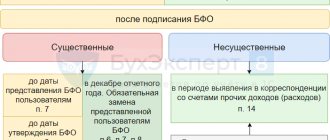

Registration of corrections depending on the period occurs according to the scheme presented below.

The practice of drawing up adjustment invoices has shown that adjustments to the cost of goods, services or property rights can be carried out repeatedly.

Please note: When a re-adjustment occurs, the seller will issue an adjustment invoice. It records the data from the previous adjustment invoice. This is how the next adjustment invoice includes the difference between the new data and the data from the previous adjustment.

In this case, the new adjustment invoice includes the date and number of the previous one. It is registered by the parties in the books of sales and purchases in the generally established manner for the amount of the difference indicated in it. In this case, the records of the previous adjustment invoice are not canceled (they remain in the form in which they were reflected when it was issued).

Significance of errors

Note that all situations discussed above relate only to significant errors. If the accountant finds a minor blemish or inaccuracy, then, regardless of the period of discovery, corrective entries are made for the current period. That is, the previous reporting period is not affected, and new corrective financial reports are not compiled.

Therefore, is it possible to submit an adjustment to the annual financial statements if there is a minor blot? No you can not. Corrections are made only for significant errors.

An error is considered significant if, individually or in combination with other accounting indicators, it can lead to a distortion of the general understanding of the financial and economic position of the enterprise and to the adoption of incorrect management decisions by users of financial statements.

How is the significance of errors determined? The company establishes the procedure for determining materiality independently. This decision must be fixed in the accounting policy. For example, write: “an error is considered significant if its value distorts the indicator of any line of the report by more than 10%.”

How to fix it? To correct significant inaccuracies in accounting, a retrospective recalculation method is used. In other words, all financial statements indicators are subject to recalculation under the condition that the identified error would never have been committed. Note that entities maintaining simplified accounting have the right not to use the retrospective method of recalculation.

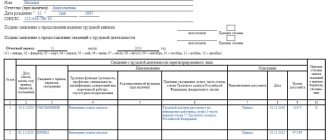

How data on SZV-TD is adjusted and canceled

In some situations, the employer needs to adjust the work data initially sent to the Pension Fund. To do this, the SZV-TD contains a line with previously transmitted information with the attribute o, and the second line indicates the correct information about the event.

If the transmitted information needs to be canceled, then only one line is indicated in the SZV-TD with this data and the attribute o.

When it is necessary to correct the date of an application for choosing a work book format, the SZV-TD indicates the new date of this application in a specific line. When canceling information, you need to put the previously indicated date and the o sign in the line.

Adjustment after the report date

The procedure for making changes to an already submitted annual financial report is regulated at the legislative level, in principle, as are the rules for preparing accounting reports.

Thus, Order of the Ministry of Finance dated June 28, 2010 No. 63n, or PBU 22/2010, establishes the key rules for adjusting financial statements after the reporting date prepared by an economic entity. The action algorithm depends on the date the error was discovered, on the degree of its materiality, significance, and on whether the financial statements were approved by the owners of the company or not. Note that the adjustment of simplified financial statements is carried out by analogy.

Thus, for one situation adjustment is impossible, but for another it is mandatory. Let's figure out what actions an accountant should take in each case.

Algorithm for correcting VAT errors

Let's look at the algorithm for correcting VAT errors in 1C 8.3 in customer accounting.

A total error was detected in the purchase ledger in the current period.

According to the 1C algorithm, corrections are made in the current Purchase Book :

- register a Corrective Invoice (CIF);

- automatically in the Purchase Book of the current period: the primary (defective) SF is cancelled;

- a correctional SF is registered.

- Section 8;

A total error was detected in the purchase ledger in the next period.

According to the 1C algorithm, corrections are made using the Additional sheet of the purchase book :

- register a Corrective Invoice (CIF);

- automatically in the Additional sheet of the purchase book of the previous period: the primary invoice is cancelled;

- a correctional SF is registered.

- Section 8 in the Previously submitted information Current switch ;

Read more Workshop on correcting VAT amount errors detected in the next period in the purchase book

How information is generated in SZV-TD

SZV-TD is regulated by Resolution of the Pension Fund of December 25, 2019 No. 730p. The document is filled out for all individuals with whom an employment relationship has been established. This list also includes part-time workers or remote workers.

Information in SZV-TD is entered on the basis of orders or instructions from the manager, as well as other documents on personnel records. Reporting is completed separately for each person if at least one of the personnel events occurred during the reporting period - acceptance or termination of a contract, transfer, submission of an application for a version of the work book (on paper or electronically).

In addition, the SZV-TD records other situations, for example:

- change of employer name;

- assignment of a specialty, qualification category, second profession;

- deprivation of an employee of the right to occupy specific positions or carry out certain activities by court decision.

Attention! When submitting information for the first time for a person, you must additionally record the last personnel event held at this employer before 01/01/2020.

When creating a SZV-TD, all lines are filled out in accordance with clauses 2.5.1-2.5.8 of the Procedure for filling out the report (Resolution No. 730p).

If there were no personnel changes for the employee in 2021, and an application to choose a work book format was not received from him, the information is as of 2021. sent no later than February 15, 2021. In addition, in this situation, there is no need to submit SZV-TD with zero values.

If a person is hired or dismissed between April 9 and December 31, 2020, the SZV-TD is transferred to the Pension Fund no later than the working day following the day of the date of the manager’s order.