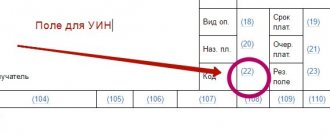

When and how the “Code” field is filled in

The code field in the 2019-2020 payment order is filled out differently, depending on whether the payer independently transfers funds to the budget or fulfills the request of the fiscal authority.

Check whether you are filling out payments for insurance premiums correctly with the help of explanations from ConsultantPlus. Get free trial access and see how to fill out the order line by line.

If the payer acts independently, sending an order for a transfer, then 0 is entered in the “Code” field. When a request to make payments to the budget comes from the fiscal authority, then in the payment order in this field the code must correspond to the UIN. This rule directly follows from clause 1.21.1 of Bank of Russia Regulation No. 383-P dated June 19, 2012, which states that the UIN must be included in the payment when it is assigned by the recipient of the funds.

However, the latest clarifications of the Federal Tax Service of the Russian Federation (letter dated March 13, 2017 No. ZN-4-1 / [email protected] ) indicate that filling out the UIN number does not add anything to the information about the payer if the latter’s TIN is given in the payment document. And the TIN for a payment order is a required requisite. That is, it is also permissible to indicate 0 in the UIN field when paying on demand.

Read more about this position of the Federal Tax Service in the material “Do I need a UIN in the payment for a fine?” .

IMPORTANT! In payment orders in 2019-2020, field codes intended for entering UIN cannot be left blank. If you do not have information about the UIN or there are reasons not to indicate it, you just need to enter 0. By leaving field 22 empty, you risk receiving a refusal to make a payment from the banking institution.

In what case is the UIN filled out when paying tax for a third party, see here .

Error 0400400013, due to which RSV may not be accepted

Some users who have a preferential rate for SMEs and have exceeded the maximum base for contributions began to complain that the tax office is sending them a negative report on the DAM with the following error description: Error

0400400013; The amount of accrued CBs (cumulatively from the beginning of the billing period) for the insured person exceeds the maximum allowable 284240 Error 0400400013; SNILS x-x-x x line 170 / tariff * 22% = 284240.01

Indeed, in certain cases, calculation using the formula given in the description of the error can lead to a result on contributions up to the excess, a penny more than it should be:

- 172,995.84 (amount of employee contributions at the basic rate) / 22% (basic rate) * 22% + 50,565.53 (amount of employee contributions at the reduced rate) / 10% (preferential rate) * 22% = 284,240.006 rub.

And taking into account rounding, contributions will be in the amount of 284,240.01 rubles.

In order to quickly solve the problem and still pass the DAM , you can transfer the penny that arises to contributions in excess of the maximum base.

To do this, you should find in which of the months of the second or third quarter at a preferential rate the amount of contributions from a base not exceeding the maximum value is rounded up when using the check using the formula described above and leads to the appearance of an extra penny. Next, create a document Recalculation of insurance premiums ( Taxes and contributions – Recalculation of insurance premiums ) and fill it out. A penny from the base before it is exceeded should automatically be transferred to the base above the limit.

Let's consider the situation using the example of filling out a report for the first half of 2021.

According to the basic tariff for the six months, the employee’s contributions are calculated in the amount of RUB 172,995.84.

At a reduced rate - 50,565.53 rubles.

At the same time, the following contributions were calculated at a reduced rate for the last three months:

For April and May, 14,287 rubles each. (from base to RUB 142,870)

For June – 21,991.53 rubles. (from the base to exceeding RUB 219,915.27).

If you calculate the amounts for the second quarter using the formula given in the error description, you will get:

- 172,995.84 (Amount of contributions per employee at the basic rate) / 22% (basic rate) * 22% + 50,565.53 (Amount of contributions per employee at the reduced rate) / 10% (preferential rate) * 22% = 284,240.006 rub.

Taking into account rounding = RUB 284,240.01.

If you check for the last three months at a reduced rate, it turns out that for June the amount of contributions according to the formula should be rounded up by 1 kopeck:

- 21,991.53 (contributions for June at a reduced rate) / 10% (preferential rate) * 22% = 48,381.366 rubles. or 48,381.37 rubles.

Therefore, we will make adjustments per penny in June for June. To do this, enter the document Recalculation of insurance premiums and fill it out. A penny in contributions from the base up to the limit will be transferred to contributions above the limit

After this, automatically in Section 3 at a reduced rate for June, the amount of contributions from a base not exceeding the limit ( line 170 ) will decrease by 1 kopeck

Corresponding changes will occur in Subsection 1.1 at a preferential tariff (tariff code 20 ), where contributions for June from the base before the excess will decrease by 1 kopeck ( line 061 ), and from the base above the limit will increase by the same kopeck ( line 062 )

The described changes in the DAM using the example of the first half of the year can be made manually, without using the document Recalculation of insurance premiums , however, in the next quarter in the Calculation of salaries and contributions on the Contributions , the program automatically entered a line with the transfer of kopecks.

See also:

- Errors when filling out the Calculation of insurance premiums and 4-FSS for the 1st half of 2021

- Adjustment of the DAM when an employee has an employment contract and a GPC agreement at a preferential rate for SMEs

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- An error in the calculation of contributions that occurs during recalculations when the maximum value of the base for calculating insurance premiums has been reached...

- “Error” in 1C programs when calculating insurance premiums at a preferential rate for small and medium-sized businesses We receive requests from our subscribers regarding incorrect calculations...

- Attention! Rules for the recalculation of contributions after updating to ZUP 3.1.10.491/3.1.14.97 with a preferential SME tariff in case of exceeding the maximum value of the contribution base For organizations that have established a preferential SME tariff since April 2021,...

- Errors in RSV, 4-FSS and average earnings, corrected in ZUP 3.1.14.129 On July 27, 2020, the next release of ZUP 3.1.14.129 was released, in which…

Where to get UIN

The source of information on the UIN is the requirements for payment of taxes and penalties. Therefore, if you are not listed as a debtor for payments to the budget, then you will not have a UIN - as a detail for inclusion in the payment order, it will simply not be generated by the payee due to the absence of such a document as a demand from the fiscal authority.

Example

Lira LLC did not pay the property tax on time, and therefore the fiscal authority sent a demand to this debtor, in which he indicated the UIN. When fulfilling the request and generating the payment, the accountant of Lira LLC transferred the UIN from the document sent by the fiscal authority to field 22.

Can a bank require a UIN?

Sometimes banking institutions simply oblige payers to fill in field 22 UIN when sending orders for payment to the budget. How legitimate is this demand?

It all depends on the basis of your payment. If you make a tax payment based on an independent calculation, then you simply have nowhere to get the value of the unique identifier, because no reference book for this detail exists and cannot exist, since the key word here is “unique”, i.e. unrepeatable. In this case, 0 is entered in field 22. But if the tax is paid at the request of the fiscal authority in which the UIN is indicated, then field 22 must be filled in, but the figure entered in it can correspond to either the UIN number or the value 0.

To avoid inaccuracies when paying taxes, we recommend that you read the material “Errors in payment orders for taxes .

What codes must be indicated in salary slips from June 1, 2021, ConsultantPlus experts told.

Get trial access to the system and study the explanations for free.

Payment order. Step-by-step filling instructions

A payment order is a document with which the owner of a current account instructs the bank to transfer funds to another specified account. In this way, you can pay for goods or services, pay an advance, repay a loan, make government payments and contributions, that is, in fact, ensure any movement of finances permitted by law.

Payment orders must be drawn up in accordance with the procedure established by the Ministry of Finance, since they are processed automatically. It does not matter whether the payment is submitted to the bank in paper form or sent via the Internet.

A complex form developed by the Central Bank of the Russian Federation and approved by federal legislation must be filled out correctly, since the cost of an error may be too high, especially if it is an order for tax payments.

To avoid problems associated with incorrectly filling out the fields of a payment order, we will understand the features of each cell.

Results

In payment orders, the codes of field 22, intended for entering the UIN (if the payment to the budget is made on demand), are filled in either with data taken about this indicator from the payment recipient’s request, or with the number 0. In other cases, this field is set to 0.

For more information about filling out field 22, see the article “Filling out field 22 in a payment order (nuances).”

Read about filling out other fields in a payment order in the following materials:

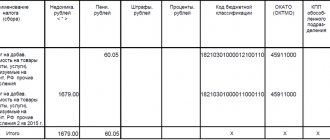

- “OKTMO in a payment order (nuances)”;

- “We indicate the tax period in the payment order - 2019-2020”;

- “We fill out field 108 in the payment order in 2019-2020”;

- “Fill in field 104 in the payment order (nuances).”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Where in the document

Let us say right away that the popularity of payment orders does not eliminate all questions regarding filling out lines and individual details in this form. In addition, every few years, new changes occur in this area that affect the rules for filling out any details. Thus, one of the fields of the payment slip that was often affected by new requirements is line 110.

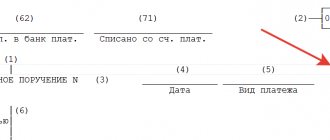

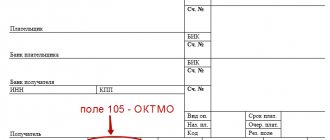

The figure below shows the legally approved form of payment. The payment type is allocated to the bottom right corner. This is field 110.