The recycling standard for environmental collection (2020) is the volume of waste that manufacturers and suppliers of certain categories of goods must dispose of and reuse.

The list of products subject to disposal, recycling standards, and the environmental fee rate in 2021 - all this is approved by the Government. Please note that new rates apply for 2018 fees. And in June 2021, responsibility for reporting on waste disposal and declarations on the quantity of goods released from the list of goods subject to disposal was tightened.

How to determine whether you need to pay an environmental fee and submit reports?

To answer this question, you need to look at the list of goods and packaging approved by Decree of the Government of the Russian Federation dated December 28, 2017 No. 2970-r. Depending on whether you are a manufacturer or importer of goods and packaging included in this list, there are three options available.

- If this list does not include goods or packaging that you produce or import, then you do not need to submit environmental tax reporting;

- If it contains goods that you produce or import, then you need to generate reports and calculate the amount of the environmental fee. At the same time, an environmental fee must be paid in the case when an organization or individual entrepreneur either does not dispose of goods at all, or disposes of them in a volume that does not correspond to the standard established for this type of goods for the reporting year. If the recycling standard is met in full, then it is enough to generate reports and confirm the disposal with documents, and the payment itself will be zero.

- If you are a manufacturer or importer of packaging from this list, consider the following nuances:

- The environmental fee for packaging goods is paid by producers of these goods only if they sell it to the end consumer. This is stated in the Rules for the collection of environmental fees (approved by Government Decree No. 1073 dated October 8, 2015, as amended on August 23, 2018; hereinafter referred to as the Rules for the collection of environmental fees). For example, a manufacturer of cardboard boxes supplied them to retail stores for sale to end consumers. In this case, the box manufacturer must pay the environmental fee for packaging. If the boxes were sold to a bakery for packaging cookies, then the bakery must pay an environmental fee for them, since it packs its goods in them;

- The environmental fee for reusable packaging is paid by its manufacturers. For example, a bakery packs cookies in cardboard boxes, which are then placed on pallets. In this case, the environmental fee for cardboard boxes is paid by the bakery, and for pallets - by the pallet manufacturer.

Fill out and submit all environmental fee reports online Submit an application

How to report

There are several ways to prepare and submit environmental collection reports:

• on paper.

It is allowed to report on paper if the organization does not have the technical ability to connect to the Internet. However, in this case it is still necessary to submit an electronic version of the report in xml format (for example, on a disk or flash drive);

• using free services of Rosprirodnadzor.

You can generate a report in the Natural Resources User Module or in the Natural Resources User’s Personal Account (under the account of a legal entity) and send it from the Natural Resources User’s Personal Account. Before sending, you must sign the report with a qualified electronic signature;

• through software solutions of the electronic document management operator.

Who pays the environmental tax when producing goods according to complex schemes, and who is exempt from paying it?

When determining who is responsible for paying the environmental fee, several special cases must be taken into account. These include tolling and off-take schemes.

The production of goods under the tolling scheme (or the production of goods from raw materials supplied by customers) is as follows. Company 1 places an order with company 2 for the production of goods from the raw materials of company 1. The produced goods belong to company 1 (customer) by right of ownership. She implements it and is responsible for paying the environmental fee.

For example, an organization orders T-shirts with its logo from a sewing workshop and provides fabric for this. The finished T-shirts belong to the organization, so it is the organization that pays the environmental fee.

The production of goods under the off-take scheme involves the sale of finished goods made to order. In this case, company 1 places an order with company 2 to produce goods. At the same time, company 2 uses its own raw materials. Company 2 (manufacturer) sells finished goods to company 1 (customer). The manufacturer is responsible for paying the environmental fee.

For example, an enterprise orders a sewing workshop to sew T-shirts with the company logo. Workshop materials are used to make them. The finished T-shirts are the property of the sewing workshop, and it is they who pay the environmental fee.

There are also certain groups of manufacturers and importers who are exempt from paying the environmental fee. These include:

- packaging manufacturers selling it to other manufacturers for packaging products (as in the example above, when a cardboard box manufacturer sells boxes to a bakery);

- manufacturers and importers of packaging, which is subsequently used for its own needs (for example, a factory buys boxes to transport screws in them from one workshop to another).

- manufacturers of goods that are not included in the list approved by Decree of the Government of the Russian Federation dated December 28, 2017 No. 2970-r (for example, manufacturers of food products);

- companies that independently recycle their goods and packaging for goods;

- exporters of goods and packaging.

Organizations and individual entrepreneurs that independently dispose of their goods and packaging in volumes not less than those provided for by the standards for the reporting year are exempt from paying the environmental fee. However, they must submit environmental reporting.

Also see “Environmental fee: who is the payer, how to calculate the amount payable, how and where to submit reporting on the fee.”

What kind of reporting is submitted for the environmental fee?

Environmental fee reporting consists of four forms:

- Declaration on the quantity of goods released into circulation on the territory of the Russian Federation, packaging of goods included in the list of goods, packaging of goods subject to disposal after they have lost their consumer properties, sold for domestic consumption on the territory of the Russian Federation (form approved by Decree of the Government of the Russian Federation dated December 24, 2015 No. 1417 as amended on July 25, 2018). Also see “Environmental fee: the declaration form for goods and packaging subject to recycling has been updated.”

- Reporting on compliance with waste disposal standards from the use of goods (form approved by Decree of the Government of the Russian Federation dated 12/08/15 No. 1342 as amended on 10/17/18). This report must contain information about the actual quantity of goods disposed of in the current year. It is also necessary to indicate on the basis of which documents the disposal was carried out (agreement, act, license). If the manufacturer or importer did not dispose of goods, then zero reporting should be submitted on compliance with recycling standards.

- Calculation of the amount of environmental fees (form approved by order of Rosprirodnadzor dated August 22, 2016 No. 488). The amount of environmental fees that must be contributed to the budget is calculated if the organization did not dispose of the product at all, or disposed of it in a smaller volume than established by the standard.

- Report on recycling facilities and waste collection sites from the use of goods (form approved by Decree of the Government of the Russian Federation dated December 30, 2015 No. 1520). This report is submitted only by those organizations that have the specified facilities. The report consists of two forms, which include data on waste collection locations and the availability of recycling facilities.

It is important to keep in mind that the first three types of “environmental” reporting must be prepared in exactly the above sequence. Let's explain with an example.

Let's say that in 2021 a publishing house published 100 tons of magazines, and in 2021 - 200 tons. The specified printed products were sold on the territory of the Russian Federation. To report on environmental fees for 2019, you need to complete the following steps.

First, you need to prepare a declaration on the number of goods released into circulation. It needs to indicate the number of magazines sold for 2021 - 100 tons.

Next, you need to generate reports on compliance with recycling standards. Please note: in this form you need to take into account the weight or quantity of goods sold not for the reporting year, but for the calendar year preceding the reporting period (clause 6 of the Rules for collecting environmental fees). For 2021, the recycling standard for publishing printed materials is 15%, which means that 15 tons of magazines need to be recycled. Accordingly, the publishing house must collect at least 15 tons of obsolete magazines and dispose of them.

Let's assume that not 15, but 10 tons of magazines were recycled. In this regard, in reporting on compliance with recycling standards, it should be noted that 10 tons of magazines were recycled, and indicate the documents on the basis of which the recycling was carried out.

At the next stage, it is necessary to calculate the amount of environmental fees in relation to non-recycled magazines, that is, in relation to 5 tons of magazines (15 tons - 10 tons).

When do I need to submit reports and pay the environmental fee? What happens if you miss deadlines?

A declaration on the quantity of goods (packaging) released into circulation and reporting on compliance with recycling standards must be submitted before April 1 of the year following the reporting year. That is, you need to submit a declaration and reporting for 2021 before April 1, 2020 inclusive.

The calculation of the amount of the environmental fee must be submitted by April 15 of the year following the reporting year. Payment must be made within the same period. That is, you must submit a calculation and pay the environmental fee for 2021 before April 15, 2021 inclusive.

If the payer of the environmental fee does not submit, or submits with a delay, reports on compliance with recycling standards or a declaration on the quantity of goods (packaging) released into circulation, he will face a sanction under Article 8.5.1 of the Code of Administrative Offenses of the Russian Federation:

- for officials - from 3 thousand to 6 thousand rubles;

- for individual entrepreneurs - from 50 thousand to 70 thousand rubles;

- for legal entities - from 70 thousand to 150 thousand rubles.

In the event that the specified reporting is not presented in full, or with inaccurate information, the fine will be:

- for individual entrepreneurs - twice the amount of collection for each group of goods (group of goods packaging), but not less than 100 thousand rubles;

- for legal entities - twice the amount of collection for each group of goods (group of packaging of goods), but not less than 250 thousand rubles.

If the tax is not paid or the payment is not made in full, Rosprirodnadzor will issue a demand for voluntary repayment of the debt. If, after 15 calendar days from the date of receipt of the demand, it is not fulfilled voluntarily, Rosprirodnadzor will be able to recover the amount of the fee in court (clause 25 of the Rules for collecting environmental fees). Also, for non-payment of environmental fees, Article 8.41.1 of the Code of Administrative Offenses of the Russian Federation establishes an administrative fine:

- for officials - from 5 thousand to 7 thousand rubles;

- for individual entrepreneurs - three times the amount of the unpaid fee for each group of goods (group of packaging of goods), but not less than 250 thousand rubles;

- for legal entities - three times the amount of the unpaid fee for each group of goods (group of goods packaging), but not less than 500 thousand rubles.

Procedure and deadline for payment of ES

The procedure for submitting reports depends on who the payer is:

- If you are a manufacturer of goods or packaging: transfers to the budget are sent to the account of the territorial body of Rosprirodnadzor at the place of state registration;

- If you are an importer of goods or packaging (or a manufacturer and importer): funds are transferred to the central office of Rosprirodnadzor in Moscow.

Codes, payment details, forms of payment orders are presented on the websites of the territorial bodies of Rosprirodnadzor and the central office of Rosprirodnadzor in the “Details” section.

Payment is made in the currency of the Russian Federation.

It is possible to submit reports in paper and electronic form in XML format (via the RPN receiving gateway or reporting system). If the reporting is submitted in paper form, the document is certified by a seal, the pages are stitched and numbered. An inventory must be attached to the document. A copy on digital media is included with the declaration. Documents are submitted in a single copy in person or by post with acknowledgment of receipt. The receipt mark is the date of acceptance of the document by the supervisory authority or the day of mailing.

Deadlines for submitting reports and paying environmental fees:

- Until April 1 of the year: declaration on the volume of goods released and a report on compliance with recycling standards;

- Until April 15 of the year: calculation of the fee amount and payment of the fee.

Note: the year of filing is considered to be the year following the reporting year. In other words, the declaration and reporting for 2021 must be submitted before April 1, 2021.

To which body of Rosprirodnadzor must environmental reporting be submitted?

The answer to this question depends on who is the payer of the environmental fee:

- manufacturers submit declarations and other forms of “environmental” reporting to the territorial RPN authority at their location;

- importers - to the central office of the RPN (Moscow);

- organizations and entrepreneurs who are both producers and importers - to the central office of the RPN (Moscow).

This procedure is established in paragraph 13 of the Declaration Regulations (approved by Decree of the Government of the Russian Federation dated December 24, 2015 No. 1417, valid as amended on July 25, 2018).

Please note: there are two ways to submit reports to the RPN.

First: buy an electronic signature certificate from one of the accredited certification centers, generate and sign reports, and then independently upload them to the receiving gateway of Rosprirodnadzor.

Second: connect to the reporting system, which can be used to fill out a report using all current parameters, check it and send it to the RPN website.

Submitting reports through the system has two huge advantages.

- You do not have to “knock” on the receiving gateway of the on-load tap-changer yourself. As the practice of submitting reports on the NVOS shows, the gateway can work with serious interruptions. Therefore, there is a high probability that you will have to spend more than one hour to successfully download reports. But when submitting through the system, you send the report once to the server of the electronic document management (EDF) operator, and then the robot itself uploads it to the RPN gateway.

- When submitted through the system, the EDF operator records the time of loading the report. And this gives you a document that confirms that you submitted the report at a certain time. This will be very useful if a dispute arises about the time of submission of the report. Judicial practice shows that if there is confirmation from the EDF operator, the courts usually make decisions in favor of the declarant.

Fill out and submit environmental reporting through an EDI operator Submit an application

How to fill out the calculation of the amount of environmental tax in Externa

The calculation includes:

- Title page

- Section 2.1. and Section 2.2

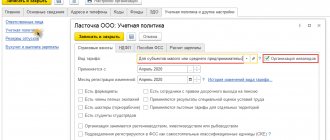

Fill out the title page of the report on the standards in the same way as the title page of the declaration. To fill out the title page:

- Indicate the type of activity of the organization. If the organization is an importer or a manufacturer and an importer at the same time, then the on-load tap-changer body will be filled in automatically.

If the organization is only a manufacturer, indicate the territorial office of the RPN where the report will be sent. Start typing the name or code of the organ and select it from the list that appears.

- Specify the reporting period.

- Fill in the remaining information about the organization and the performer who completed the report. Some of the data is automatically filled in from the details in Kontur.Externe. If there is an error in some data, correct it not on the title page, but in the details, so that in the future all forms are filled out with the correct data. To do this, in Extern, select the menu item “Details and settings” → “Payer details”.

What product and packaging reference books should be used when preparing reports?

When preparing “environmental” reporting, manufacturers must apply the All-Russian Classifier of Products by Type of Economic Activity OK 034-2014 (CPES 2008) (approved by order of Rosstandart dated January 31, 2014 No. 14-st, as amended on July 10, 2018). Importers must be guided by the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union (TN FEA).

If an organization is both a manufacturer and an importer of goods (packaging), then for manufactured goods it must use the OK 034-2014 directory, and for imported goods - the Commodity Nomenclature of Foreign Economic Activity.

What is meant by the term “recycling”?

The content of the concept of “waste disposal” is disclosed in Article 1 of the Federal Law of June 24, 1998 No. 89-FZ “On Production and Consumption Waste”. Waste recycling refers to the use of waste for the production of goods (products), performance of work, provision of services, including the reuse of waste. In particular, it is possible to reuse waste for its intended purpose (recycling), return it to the production cycle after appropriate preparation (regeneration), as well as extract useful components for their reuse (recovery).

It is important to understand that recycling is not equivalent to neutralization (heat treatment), since neutralization does not imply the return of waste to the production cycle.

Waste generated as a result of the activities of an organization or individual entrepreneur is transferred for neutralization. This waste is taken into account when drawing up a declaration of payment for negative environmental impact. If a manufacturer or importer, obligated to dispose of goods that have lost their consumer properties and turned into waste, transfers them for disposal, this will lead to double payment. First, he will pay for the services of the contractor under the waste disposal contract, and then he will have to pay an environmental fee.

What is the recycling standard?

The recycling standard is a percentage of the total quantity of goods and packaging put into circulation on the territory of the Russian Federation, expressed in units of mass of goods and packaging or units of goods (Clause 12 of Article 24.2 of the Law on Industrial Waste).

Recycling standards are established for each group of goods and packaging. To prepare reports on environmental fees for 2021, you should be guided by the standards approved by Decree of the Government of the Russian Federation dated December 28, 2017 No. 2971-r (as amended on June 16, 2018).

For example, the recycling rate for magazines (group No. 16 “Printed publishing products”) for 2021 is 15%. This means that if a publishing house published and sold 100 tons of magazines in the Russian Federation in 2021, then it must either dispose of 15 tons of magazines or pay an environmental fee for this amount of goods for 2021.

Note that if a manufacturer or importer exceeded the recycling standard in the previous calendar year, then the recycling standard for the current year can be reduced by the amount of excess of the standard for the previous year. This possibility is provided for in paragraph 13 of Article 24.2 of the Law on Industrial Waste.

How to comply with recycling standards?

The Industrial Waste Law provides for three ways to comply with recycling standards (clauses 4 - 6, Article 24.2 of this law):

- Dispose of goods and packaging yourself. In this case, the manufacturer or importer needs to organize collection points for disused goods and packaging, as well as build a recycling process. To do this, as a rule, it is necessary to allocate certain premises, purchase technological equipment and obtain a license for waste management activities (if we are talking about waste of I-IV hazard classes).

- Conclude an agreement with a specialized company. If waste of I-IV hazard classes is transferred for disposal, a specialized organization must have a license. A license is not required for recycling class V waste (cardboard, polyethylene, ferrous metal scrap, etc.). reporting on compliance with recycling standards must be accompanied by an agreement with a specialized company, a copy of its license (if necessary), and a recycling act.

- Join an association (union) of manufacturers/importers. It is important to take into account that if the association does not comply with recycling standards during the reporting year or does not comply with them in full, then the manufacturer or importer of goods will have to be responsible for compliance with the standards.

By the way!

Letter of Rosprirodnadzor dated January 26, 2017 No. AS-10-02-36/1417 “On sending information on the disposal of waste from the use of goods and packaging”: At the same time, it should be noted that in the conclusion between the manufacturer, importer of goods and the operator for handling municipal solid waste , regional operator or individual entrepreneur, legal entity engaged in the collection, transportation, processing, disposal of waste (except for municipal solid waste), contracts for the provision of waste disposal services, the parties independently, taking into account the requirements of environmental legislation, determine the terms of the form, subject and content of the agreement and after its conclusion undertake to fulfill the provisions provided for by the agreement in accordance with the Civil Code of the Russian Federation dated November 30, 1994 No. 51-FZ.

How to calculate the amount of environmental tax?

The formula for calculating the environmental fee is given in paragraph 6 of the Rules for collecting the environmental fee. In general, the amount of environmental collection is equal to the product’s weight (packaging) multiplied by the collection rate and the recycling standard established for the reporting year. In this case, it is necessary to take into account the mass of goods (packaging) sold for domestic consumption in the territory of the Russian Federation for the calendar year preceding the reporting period. Depending on the type of product, instead of its mass, the formula uses the number of units of the product.

If the payer of the environmental fee disposed of goods, but in a smaller volume than required by the standard, then to calculate the amount of the fee, you must first determine the difference between the established and actual value of the number of recycled goods for the reporting year. The resulting value must be multiplied by the fee rate (clause 8 of the Rules for collecting environmental fees).

Environmental fee rates are set annually. When preparing reports for 2021, you should be guided by the rates approved by Decree of the Government of the Russian Federation dated 04/09/16 No. 284 (as amended on 10/31/18).

Example

The publishing house published and sold 100 tons of magazines in the Russian Federation in 2018.

The magazine recycling rate for 2021 is 15%.

There was no magazine disposal in 2021 or 2021.

The environmental tax rate for 2021 for publishing printed products is RUB 2,378. per ton.

The amount of environmental tax for 2021 will be 35,670 rubles. (100 tons x 15% x RUB 2,378 per ton).

Automatically generate a payment invoice for payment of the environmental fee based on the data from the declaration and submit all collection reports Submit an application

Collection rates

All collection rates for groups of packaging and goods are given in Government Decree No. 284 dated 04/09/2016. For example, if an organization produces handmade carpets or floor coverings, it needs to find group 2 “Carpets and rugs”. The line opposite will reflect the rate of 16,304 rubles per ton. If a company imports barrels or plywood drums, it needs to go down to group 9 “Wooden containers” - here the rate will be 3066 rubles per ton. An importer or manufacturer of anti-corrosion or hydraulic oils should look into group 17 “Petroleum products” - the rate will be equal to 3,431 rubles per ton.

How to reduce the amount of environmental fees?

The environmental fee was established, first of all, in order to introduce responsibility for manufacturers and importers for the fate of goods (packaging) after their sale to consumers; prevent the storage of waste in landfills, into which goods are converted after they have lost their consumer properties, and also stimulate the recycling of waste.

In this regard, in order to reduce the amount of environmental fees, you can use the following methods:

- comply with recycling standards established for the reporting year;

- use packaging made from recycled materials. In this case, it is possible to apply a reduction factor to the recycling standard (Clause 14, Article 24.2 of the Law on Industrial Waste). However, this rule does not apply to goods made from recycled materials.

It is also necessary to remember that it is possible to fulfill the obligation to dispose of goods (packaging) throughout the entire territory of the Russian Federation, and not only in the subject of the Russian Federation where the manufacturer or importer is located (clause 8 of Article 24.2 of the Law on Industrial Waste).

From what moment is the obligation to dispose considered fulfilled?

The obligation of the manufacturer or importer to dispose of goods (packaging) is considered fulfilled:

- from the date of reporting on compliance with recycling standards (if the payer of the environmental fee has complied with the standards in full). Supporting documents must be attached to the reporting;

- from the date of payment of the environmental fee (if the payer of the environmental fee did not dispose of the goods or packaging, or disposed of them in a smaller volume than required by the standard). This is stated in paragraph 9 of Article 24.2 of the Law on Industrial Waste.

Deadlines for voluntary debt repayment

If the payer evades repayment of the fee or does not pay it in full, Rosprirodnadzor authorities send demands for repayment of the debt on a voluntary basis.

Payment must be made within 15 calendar days, otherwise supervisory authorities are forced to levy payment through the courts. In this case, the payer is charged not only with the amount of debt, but also with the legal costs of the departments.

Interesting: we remind you that before amendments were made to the rules for collecting environmental fees, the period for voluntary repayment was 30 calendar days.