Who is required to provide the Certificate When to submit the Certificate For whom the Certificate must be provided Reporting period and date of submission of information Certificate for husband/wife If it is not possible to provide the Certificate Regulatory framework

Civil servants have their own list of privileges and responsibilities. One of the responsibilities is the annual provision of a Certificate of income, expenses, property and property-related obligations . This is a special form in which summary information about all movements of funds in accounts is entered.

This certificate is often called a declaration for civil servants. This name is essentially incorrect, so we recommend using the legal wording.

The certificate of income and expenses is carefully checked, and if errors or inconsistencies are found, an internal audit is assigned.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

Who must file a declaration

The following must declare their income, expenses, property and property liabilities:

- civil servants of the highest category of positions;

- heads (their deputies) of territorial bodies of the federal executive power;

- civil servants appointed by the Government of the Russian Federation;

- civil servants involved in the provision of public services, licensing, quotas, etc.;

- civil servants associated with the organization of public procurement, distribution of budget funds, management of state property;

- applicants for the above positions (submit a certificate for the first time along with documents for admission to the position).

A complete list of positions, holding (replacing) which a civil servant is required to declare income and expenses, is given in Decree of the President of the Russian Federation dated May 18, 2009 No. 557 “On approval of the list of civil service positions for which civil servants are required to provide information on income.”

A civil servant must also declare information about income, expenses, property and property obligations of his spouse and his minor children (Part 7, Article 20 of the Law on the State Civil Service).

Who is required to provide the Certificate?

Civil service employees whose powers involve providing such information:

- Persons holding a government position in the Russian Federation, a subject of the Russian Federation, or a municipal position on a permanent basis.

- State and municipal employees in positions included in the lists of regulatory legal acts of the Russian Federation.

- Employees of state corporations, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, as well as organizations created by the Russian Federation on the basis of federal laws. Appointment to these positions and dismissal from them are made by the President of the Russian Federation or the Government of the Russian Federation. In addition, these are positions included in the lists established by regulations of funds and local regulations of organizations.

- Employees of organizations created to perform tasks assigned to federal government bodies, filling individual positions on the basis of an employment contract in these organizations, included in the lists established by federal government bodies.

Place your order and we will fill out the 3-NDFL declaration for you!

Order a declaration

Citizens applying for replacement:

- Government position of the Russian Federation, subject of the Russian Federation, municipal position.

- Any civil service position.

- Municipal service positions included in the lists established by regulatory legal acts of the Russian Federation.

- Positions in state corporations, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, as well as organizations created by the Russian Federation on the basis of federal laws. Appointment to these positions and dismissal from them are made by the President of the Russian Federation or the Government of the Russian Federation. In addition, these are positions included in the lists established by regulations of funds and local regulations of organizations.

- A separate position on the basis of an employment contract in organizations created to perform tasks assigned to federal government bodies, included in the lists established by federal government bodies.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Civil servant declaration form for 2019

Information about income, expenses, property and property-related obligations of civil servants must be included in the certificate in the approved form (this is what is popularly called a declaration). It contains information for the reporting period - from January 1 to December 31 of the reporting year.

If there is no information for declaration, then the certificate must indicate “no”.

Each sheet of the certificate must be signed by the civil servant himself (the applicant for the position). For family members, the certificate is filled out and signed by the civil servant himself (applicant for the position).

The document that approved the form of the declaration of income of a civil servant is Decree of the President of the Russian Federation dated June 23, 2014 No. 460 “On approval of the form of a certificate of income, expenses, property and property-related obligations and amendments to certain acts of the President of the Russian Federation.”

Further, from our website, via a direct link, you can submit a civil servant’s declaration for 2021 for free:

And here is a form for a certificate of income and property of a civil servant in excel format:

IMPORTANT!

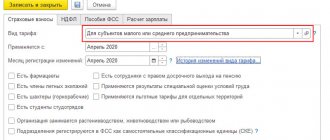

From 07/01/2020, Decree of the President of the Russian Federation dated 01/15/2020 No. 13 will come into force, amending the income certificate of civil servants. New information will appear in it (for example, SNILS). The declaration procedure will also change. For example, you will only need to generate a certificate using the special “BC Help” software.

What to do if the BC help does not open

Such problems arise solely as a result of the PC software not meeting the stated requirements or the absence of additional files required for the application to work. In particular:

- The user does not have administrator rights.

- You do not have permission to make changes to the program's source files.

- NetFramework version 3.5 is not installed on the computer - it can be downloaded from the Microsoft website here https://www.microsoft.com/ru-ru/Download/confirmation.aspx?id=22 [file size 3 MB].

To correct the inconsistencies, you can try running the application on another computer or update your system and drivers.

A slightly different situation is when the BC program starts correctly, but incomprehensible hieroglyphs are printed in the fields intended for filling. This error is specific to the applicant information section. The problem lies in the BDE Administrator that is installed on the computer.

To correct the error, you need to run the specified file as an administrator and go to the configuration section. Here the subcategories Drivers-Native-DBase-LangDriver are selected sequentially. In the column of the last section, a change is made to the dBase RUS cp866 format.

Due in 2021

The civil servant must submit information to the personnel service by April 30 of the year following the reporting year. That is, information for 2019 must be submitted by April 30, 2021. Exceptions are employees of the Administration of the President of the Russian Federation, their term is until April 1.

IMPORTANT!

The current procedure for filing a declaration of income and property of a civil servant does not provide for reasons why it may not be submitted or submitted at the wrong time. Neither vacation (including parental leave), nor a business trip, nor sick leave cancels the official’s obligation to report on time.

If a government employee cannot submit the certificate in person on time, he is recommended to send it by mail. Certificates are considered submitted on time if they were submitted to the postal service organization before 24 hours of the last day of the established deadline.

IMPORTANT!

The official’s lack of information to fill out the certificate is also not a reason not to submit anything. If it is impossible to fill out a certificate (for example, for an absent family member), the government employee is required to draw up and submit a corresponding application. This must be done within the same time frame and according to the same rules that apply to regular certificates.

Filling rules

There are a number of mandatory requirements when filling out the document:

- Fill out yourself or on the computer.

- You cannot use a pencil.

- No corrections are permitted.

- If the form is provided in printed form, then only on A4 paper.

- Damaged declarations for civil servants will not be accepted for consideration.

- It is unacceptable to use correction fluid or cover up mistakes with it.

Filling out and sample declaration of a civil servant for 2021

The most convenient way is to fill out a certificate (declaration of a civil servant) on a computer. There is a special program - “BK Certificates”, posted on the official websites of the President of the Russian Federation and GIS in the field of civil service.

From 07/01/2020, it will be possible to fill out income certificates for civil servants only in this software. But for 2021, you can still choose the option of forming it in Excel or manually on paper.

The completed certificate must be certified with a personal signature.

The title page is the usual stuff, nothing unusual here.

Section “Income Information”

When completing this section, please include all income from January 1 to December 31, 2021. These, in particular, do not include loans and credits, as well as payments for reimbursement of expenses.

In the section you need to indicate:

- in the column “Income from the main place of work” - earnings at the place of service;

- in the column “Income from teaching and scientific activities” - income received, for example, for the publication of scientific articles;

- in the column “Income from other creative activities” - income from various creative activities;

- in the column “Income from deposits in banks and other credit institutions” - the amount of interest you received on deposits;

- in the column “Income from securities and participation interests in commercial organizations” - the amount of income from transactions with securities and dividends;

- in the “Other income” column – all income that is not reflected in the previous lines.

After filling out all the lines in the section, summarize all income and indicate the total amount.

Section “Information about expenses”

This section must be completed if a civil servant, spouse or minor children in 2021 bought (acquired as a result of an exchange) real estate, land, transport, securities or shares (including participation in construction).

A nuance: this section is not filled out by those who are just entering the civil service and submitting a certificate along with a package of documents for applying for a position.

Section “Information about property”

In this section, you need to provide information about real estate and vehicles that you owned as of December 31, 2021.

Section “Information on securities”

In this section you need to provide information about available securities, shares in the authorized capital of commercial organizations and funds.

Section “Information on property obligations”

In this section you need to indicate the real estate that is provided to you for temporary use, as well as the basis for use (lease agreement, actual provision, etc.)

Section “Information on real estate, vehicles and securities alienated during the reporting period as a result of a gratuitous transaction”

This section must be completed if you donated real estate, transport, or securities during 2021.

The procedure for filling out each section is discussed in detail in the Methodological Recommendations on the provision of information on income, expenses, property and property-related liabilities and filling out the appropriate certificate form in 2021 (for the reporting year 2021). They were approved by letter of the Ministry of Labor of Russia dated December 27, 2019 No. 18-2/10/B-11200.

Here is a sample of filling out a declaration of income and expenses of a civil servant for 2021 (can be downloaded from the link below and viewed in full):

EXAMPLE OF COMPLETING A CERTIFICATES OF INCOME FOR A CIVIL EMPLOYEE 2020

And this is an example of filling out a declaration of income and expenses of a family member of a civil servant for 2021 (can be downloaded from the link below and viewed in full):

EXAMPLE OF COMPLETING AN INCOME CERTIFICATE FOR A FAMILY MEMBER OF A CIVIL EMPLOYEE 2020

How to print a BC certificate

To do this, you need to select an icon stylized as a printer image, and the document will be sent to the print queue. If the user has missed required fields, the BC program displays a corresponding warning and offers to display a list of unfilled sections. After corrections are made, the document is sent for printing again.

An important point you need to know when printing documents is checking the specified addresses. The application checks the relevance of the specified information with the data in the directories.

If the BC program does not find the required addresses, a context window appears on the screen informing about detected inaccuracies and offering to display incorrect information. By selecting “Yes” in this window, the user is given the opportunity to make corrections. In most cases, it is necessary to correct the street name or remove abbreviations that are unreadable for the program.

In addition, the application displays a one-time message that prompts the user to check that the printer is connected correctly. This is not an error, but rather a formal reminder that the action is only possible on laser printers configured for A4 single-sided printing.

When printing documents through Bookmaker Help, you need to remember the following features:

- Handwritten notes are not allowed on barcodes: page numbering, signatures, etc.

- Printed sheets are signed in the lower right corner, with the exception of the last one: here a corresponding column is provided for this.

- Pages of certificates prepared for different reporting periods are not interchangeable even if the information contained in them is identical (for example, pages for 2021 and 2021 cannot be changed).

In addition, the absence of a check mark in the information confirmation item leads to the blocking of the print queue.

To print a BC certificate from a flash drive on another computer (this may be needed if you don’t have a printer), you need to save it in .pdf format and write it to a flash drive. To do this, you need to install the PDF-Reader program or its equivalent. After this, at the stage of selecting a printer, the print to PDF option will appear. After this, insert the flash card into a computer with a connected printer, open the PDF file and select “Print”. You can also print one page in the BC help from a flash drive.

If the option above does not work, use these instructions for saving PDF in pictures:

Step 1

Step 2

Step 3

Step 4

Methods for submitting a 3-NDFL certificate

You can submit your tax return in paper or electronic form.

At the tax office

Declarations in paper form are submitted to the tax authority at the place of registration. If there is none, at the place of residence. Addresses of inspections can be found on the Federal Tax Service website. When submitting documents, the inspector will check their correctness and tell you whether corrections are needed. You can submit a declaration in person or through a representative, who can be any person. To submit documents, the representative must have a notarized power of attorney. To save time and avoid long waits for an appointment, you can make an appointment in advance for a specific time through the State Services portal.

By post

You can send the completed 3-NDFL declaration and supporting documents by mail in a certified letter with a mandatory list of attachments. This is a good option for those who do not live at the registration address and cannot submit documents in person. In addition to saving time, this method has another advantage. If for some reason the documents are not accepted, the response letter will indicate the reasons for the refusal.

Through the State Services portal

The tax return can be submitted electronically through the State Services website. To do this, you must have a verified account and an enhanced qualified electronic signature (ECES). The declaration is filled out online and sent to the tax authority. If you do not have an electronic signature, you can apply to obtain one from one of the accredited certification centers. Their addresses are listed on the website.

On the Federal Tax Service website

You can submit a declaration electronically in the taxpayer’s personal account on the website of the Federal Tax Service of Russia. To do this you need:

- Fill out the declaration form.

- Export the finished document to xml format.

- Sign the UKEP.

- Send the completed declaration and scanned copies of accompanying documents to the tax authority.

The tax return will be submitted to the tax authority at the place of registration of the payer.

In what cases is a declaration submitted?

Every citizen of the Russian Federation who has received income must fill out a declaration and send it to the tax authority in a timely manner. Let us consider several examples of making a profit.

when it is necessary to draw up a document.

Examples:

- sale of property, both residential and non-residential;

- receiving income from shares or other securities;

- winning the lottery;

- receiving a present or other income as a gift;

- receiving income from renting out a house, room, plot or garage.

The document must also be prepared if you are interested in a 13% refund if the payment was made for goods or services from a special category.

These include:

- acquisition of property;

- obtaining higher education;

- treatment;

- execution of a voluntary pension insurance agreement;

- charity.

It must be taken into account that when selling an apartment, within the framework of the law, each buyer has the right to return 13% of the value of the property. However, an additional maximum limit is set, which is 260,000 rubles, within which the payment will be made.

It turns out, a certificate in form 3-NDFL

is compiled only in two cases: when you need to pay tax on the profit received or return the funds back in the amount of 13%.