The use of imputation, which is very convenient for small stores, will very soon be prohibited. It was good because the amount of tax depended not on income, but on the area of the hall. There are practically no tax systems that are similar in terms of profitability. Nevertheless, now is the time to decide what to do next. In this article we will look at what modes you can switch to after the abolition of UTII for retail trade.

Create a UTII declaration

Read about how to fill out the UTII declaration for the 4th quarter of 2021 here.

Taxation of an auto parts store

Activities in the retail trade of auto parts are subject to special taxation regimes:

- Simplified taxation system (revenue limit 60 million rubles per year)

- A single tax on imputed income

Comparison of the types of taxes paid by an entrepreneur on UTII and on the simplified tax system.

When switching to preferential tax regimes (USNO, UTII), the entrepreneur is exempt from paying other taxes.

Similar materials that may interest you:

Professional income tax

In 2021, a new regime suitable for entrepreneurs appeared - NAP. It is based on the payment of tax on professional income. However, serious restrictions have been introduced for it, of which the following are most relevant for retail stores:

- You can only sell goods made by yourself (resale is prohibited);

- You cannot hire employees under employment contracts;

- IP income from the beginning of the year should not exceed 2.4 million rubles.

If at least one of these requirements is not met, the individual entrepreneur is transferred to the main system. Nevertheless, for small stores in which the entrepreneur personally offers for sale goods of his own making, this regime may be suitable. Among its advantages, we note that an entrepreneur should not:

- submit reports;

- buy online cash register - receipts are generated through a mobile application;

- pay insurance premiums (however, you will not have to count on a pension during the period of application of the NAP).

Methodology for calculating taxes for an auto parts dealer

Let's look at the procedure for calculating taxes: USTV and simplified tax system

How is UTII calculated for an auto parts store?

The calculation of the tax amount for UTII is calculated using the following formula:

Physical indicator * Basic profitability * K1 coefficient * K2 coefficient * Tax rate

- A physical indicator in the retail trade of auto parts is the area of the sales floor in square meters.

- Basic income is 1,800 rubles per month (set by the government).

- K1 is a deflator coefficient, established by the Ministry of Economic Development of the Russian Federation for the calendar year.

- K2 is an adjustment coefficient of basic profitability that takes into account the totality of the features of doing business. Established by municipal authorities at the location of the business.

- UTII tax rate: 15%

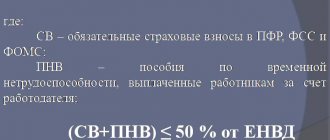

An entrepreneur, when calculating the amount of tax on UTII, has the right to reduce the amount of calculated tax by the amount of social contributions made from the wage fund of employees, but not more than 50% of the calculated amount of UTII tax.

Calculation of the simplified tax system for a car parts store

The calculation of the amount of income tax under the simplified tax system is calculated using the following formula:

Revenue * Expenses * Tax rate

- Revenue - Revenue from spare parts trading activities

- Expenses - Expenses associated with the activities of trading spare parts. You can familiarize yourself with the procedure for determining expenses in the Tax Code of the Russian Federation. Article 346.16

- Tax rate: 15%

Advertising and marketing activities

- Advertising in the media, development of a business card website for our store;

- Advertising on billboards, distributing flyers and business cards;

- Discount for regular customers, promotions (free oil change);

The success of almost any business greatly depends on the right advertising campaign. Therefore, it will be very useful for you to read the article about opening your own advertising agency.

The level of trade markup on goods will average 40-50%. The sales season is in spring and autumn.

The planned sales volume in monetary terms (revenue) is as follows: The monthly dynamics of revenue is presented in the form of a graph: To achieve the break-even point of sales, it is necessary to sell goods worth 315,000 rubles per month.

An example of choosing a taxation system for a car shop

Next, using a specific example, we will analyze what taxation system

- Type of activity: Retail sale of spare parts

- Location: Lipetsk

- Store area: 740 sq.m. incl. sales area 440 sq.m.

- Revenue: 4.8 million rubles.

- Expenses 4.2 million rubles. (payroll deductions 130 thousand rubles)

- Profit: 0.6 million rubles.

- Basic income: 1,800 rubles

- K1 coefficient for 2012: 1.4942

- K2 coefficient for 2012: 0.8 (i.e. 1.8)

1. Calculation of the tax base: 440 sq.m. * 1,800 rub. * 1.4942 * 1.8 = 2.13 million rubles.

2. The estimated tax amount is 2.13 million rubles. * 15% = 319 thousand rubles.

3. We reduce the amount of tax by the amount of social contributions: 319 tr. – 130 tr.

3. Amount of tax to be paid: 189 thousand rubles.

1. Calculation of the taxable base: 4.8 million rubles. – 4.2 million = 0.6 million rubles.

2. Calculation of tax payable: 600 thousand rubles. * 15% = 90 thousand rubles.

As can be seen from the example, with such calculated indicators, it is more profitable for an entrepreneur to be on the simplified tax system , income minus expenses, saving 99 thousand rubles per month.

- Type of activity: Retail sale of spare parts

- Location: Lipetsk

- Store area: 140 sq.m. incl. sales floor area 65 sq.m.

- Revenue: 800 thousand rubles.

- Expenses 700 thousand rubles. (payroll deductions 30 thousand rubles)

- Profit: 100 thousand rubles.

- Basic income: 1,800 rubles

- K1 coefficient for 2012: 1.4942

- K2 coefficient for 2012: 0.8 (i.e. 1.8)

1. Calculation of the tax base: 65 sq.m. * 1,800 rub. * 1.4942 *1.8= 315 thousand rubles.

2. Estimated tax amount

315 thousand rubles. * 15% = 47 thousand rubles.

3. We reduce the amount of tax by the amount of social contributions: 47 tr. – 23.5 tr.

4. Amount of tax to be paid: 23.5 thousand rubles.

1. Calculation of the taxable base: 800 thousand rubles. – 650 thousand rubles. = 150 thousand rubles.

2. Calculation of tax payable:

150 thousand rubles. * 15% = 22.5 thousand rubles.

Under such introductory conditions, an entrepreneur can be either on UTII or on the simplified , since the amounts of taxes payable are comparable, but taking into account the fact that tax accounting with UTII is much simpler, it is optimal to choose the tax system: UTII.

Using the knowledge gained, you can independently select the optimal taxation system for your own spare parts store .

Deadlines for filing tax returns:

Organizations no later than March 31 of the year following the expired tax period.

Main system

On OSNO, organizations pay income tax (20% rate) on their income, while entrepreneurs pay personal income tax (13% rate). In addition, you must pay 20% VAT, although for a number of goods the rate is lower - 10%. At the same time, it allows for the deduction of input VAT, so the main system is suitable for those who work with legal entities and individual entrepreneurs.

In addition, with an income of up to 2 million rubles over the last 3 months (this is approximately 21 thousand rubles per day), you can receive an exemption from VAT under Article 145 of the Tax Code of the Russian Federation. For individual entrepreneurs, this may be a suitable solution - the tax will be even less than with the simplified tax system of 15%, which will be discussed below.

The advantage of OSNO for stores is that there are practically no restrictions on the product range. Whereas on other systems, in particular when purchasing a patent, there are many of them. The only thing that needs to be taken into account is that an individual entrepreneur, in principle, cannot sell strong alcohol. This is prohibited by law 171-FZ of November 22, 1995. But you can sell beer and other similar drinks.

mrMashine 03 Jul 2021

Good afternoon. There is an online store and a physical one. There is a sale of oil (an excisable product, but I read that only producers are taxed)

The implementation will accordingly be via the Internet and in the real world, and from stock and to order.

I work alone. area 14 sq.m. Rent for an individual.

Which taxation system should you choose? I opened an individual entrepreneur a week ago and there is still time to apply for the transition to the simplified tax system or UTII

Do I need a cash register? Or can you use sales receipts with an individual entrepreneur stamp or something like that?

All questions for now

IrinaB 04 Jul 2021

Which taxation system should you choose? I opened an individual entrepreneur a week ago and there is still time to apply for the transition to the simplified tax system or UTII

As you probably know, retail trade can be transferred to UTII. An online store and the sale of excisable goods for the purposes of applying UTII do not apply to retail trade.

“ retail trade is a business activity related to the trade of goods (including in cash, as well as using payment cards) on the basis of retail purchase and sale contracts. This type of business activity does not include the sale of excisable goods specified in subparagraphs 6 - 10 of paragraph 1 of Article 181 of this Code , food and beverages, including alcohol, both in the manufacturer’s packaging and packaging, and without such packaging and packaging, in bars, restaurants, cafes and other catering facilities, unclaimed items in pawnshops, gas, trucks and special vehicles, trailers, semi-trailers, trailers, buses of any type, goods according to samples and catalogs outside the stationary distribution network (including in the form of postal items (parcel trade), as well as through teleshopping, telephone communications and computer networks ), transfer of medicines on preferential (free) prescriptions, as well as products of own production (manufacturing). Sales of goods and (or) public catering products manufactured in these vending machines through vending machines are classified as retail trade for the purposes of this chapter.”

UTII: car repair

From January 1, 2013, the transition to paying a single tax on imputed income is carried out voluntarily. At the same time, as before, “imputation” can be applied to the provision of services for repair, maintenance and washing of vehicles (Article 346.26 of the Tax Code of the Russian Federation). It is necessary to switch to paying UTII if local authorities have introduced the UTII system for this type of activity in the prescribed manner.

Article 346.27 of the Tax Code of the Russian Federation defines that services for repair, maintenance and washing of vehicles include paid services provided by individuals to organizations according to the list of services provided by the All-Russian Classifier of Services to the Population OK 002-93, approved by Resolution of the State Standard of Russia dated June 28, 1993 N 163 , in the service subgroup 017000.

Please note that these services do not include refueling services for vehicles, warranty repair and maintenance services, as well as services for storing vehicles in paid parking lots and impound parking lots.

However, in practice, car repairs are accompanied by the replacement of spare parts. In this regard, taxpayers often have a question about what is the procedure for calculating UTII in this case.

Let us recall that this issue is controversial, since these services can be considered as two types of activities - vehicle repair and retail trade in spare parts.

A car service must pay UTII for two types of activities

The Russian Ministry of Finance previously believed that if the supply of used spare parts and consumables for the repair of vehicles is carried out with a trade markup and is allocated in work orders as a separate line, the cost of spare parts and materials is not included in the cost of the repair service. Consequently, in this situation, the sale of materials is recognized as retail trade, in respect of which UTII must be paid.

IrinaB 04 Jul 2021

Thanks for the answer

I suspected that according to the correct system, there are 2 people who are familiar with spare parts stores - they both have UIDS, so it turns out that they can be grabbed at any moment?

If UTII is used for excisable goods, then yes, until the first inspection. If they keep separate records (sale of auto parts on UTII, and sale of oils on the simplified tax system), then they do everything correctly.

You can allocate the sale of auto parts in a “physical” store to UTII. But is it worth it? In any case, you have an online store and sale of oils on the simplified tax system (you can’t get away from cash register machines). You will have to keep separate records. If you plan to do your accounting yourself, this is an extra headache for you.

If you stay at 6%, then you need a cash register. Do you need an ecl as a receipt printer? Will anyone do?

I applied for 6%. basically

Are you sure that 6% is more profitable? If all the documents from the supplier are available for the goods (invoices, acts, c/f, etc.), then it is worth calculating the simplified tax system “Income-Expenses”. In many regions the rate has been reduced. Check your local simplified tax law.

KKM is required with EKLZ. Be sure to enter into an agreement with the central service center and register the cash register with the tax office.

no one will track how much I actually punched in the cash register, only through the account.

How can this not be tracked? When checking the cash register, everything will be tracked.

IrinaB 05 Jul 2021

The fact of the matter is that documents from suppliers are invoices and that’s it. or can they be taken into account?

Invoice + c/f (if VAT is highlighted in the invoice) + document confirming payment for the goods (payment order, cash receipt). If these documents are available, then you are taking into account the expense.

after all, KKM is an extra. investments now and every month, as far as I understand, you need to pay for the service + cashier’s books, etc. - waste of time. I work alone and to be honest, it’s not enough.

I wrote to you how it should be according to the law, but to comply with it or not is up to everyone to decide for themselves

Description of products and services

The assortment of the outlet will include spare and consumable parts for cars of both foreign and domestic production. In addition to the goods presented on the display cases and shelves, the store will also work on orders from the catalogue. In general, the supply department will work according to the principle: the most popular items should always be in stock. These products include:

- Engine oil;

- Wheel disks;

- Tires;

- Filters (oil, air, fuel);

- Light bulbs;

- Candles;

- Wipers;

- Oil seals;

- Hardware, washers, screws, caps;

- Clamps, pipes;

- Alternator and timing belts;

- Tools;

- BB wires;

- Auto chemical goods;

- Gaskets;

- Grenades;

- Steering tips;

- Silencers;

- Bearings;

- First aid kits and pumps;

- and so on.

In this case, the customer will be offered spare parts from different manufacturers at distinctive prices, for example, “original” or “non-original” spare parts.

The price level will be slightly below the average price level for spare parts in retail outlets in our city. And thanks to a well-thought-out logistics system, orders will be delivered in the shortest possible time.

Serg787 28 Aug 2021

Plus 6% is that you don’t have to report on the primary documents (AS I KNOW, SOMEONE MAY CORRECT IT EXACTLY) so whether you punched the receipt or didn’t punch it when selling motor oil (and in this case, cash register equipment is required), they can only grab you by the hand when verification or if they slip a secret buyer to the TAX OFFICERS).

As an option, make yourself a workplace, say 2-4 square meters. m. designate it in the lease agreement as Area under UTII and do the RFP to order or from a warehouse in another room, and pay UTII for these meters, and put racks with oils on the simplified tax system of 6% and do not bother with documents (invoices, etc.. ) in this situation, you are freed from unnecessary accounting, but not breaking checks when selling oils is naturally a violation of the law, but this is at your own peril and risk, they can only take you by the hand. Some uninformed individual entrepreneurs have been engaged in HRA for years and do not know that motor oils need to be sold with KKM. It depends where they check.

Post edited by Serg787: 28 August 2021 — 18:06

Marketing plan

First, let's determine the market capacity. According to statistics, in Russia there are about 270 cars per 1000 residents, that is, every fifth person has their own car. Our city is home to 120 thousand residents, respectively, they account for about 20 thousand cars.

The most popular car brands include: Lada, Chevrolet and KIA.

Of the total volume of the auto parts market, 52% of sales come from domestic cars and 48% from foreign cars.

The ratio of purchased components for domestic cars and foreign cars:

On average, each car owner spends about 15 thousand rubles on maintaining his car (without gasoline and insurance). These are mainly costs for engine oil, tires, filters, and spare parts.

It follows that the capacity of the auto parts market in our city is: 20 thousand (cars) * 15 thousand rubles (car expenses) = 300 million rubles per year.

It should be noted that the demand for spare parts will only grow in the near future, as the number of car owners and, accordingly, the number of cars increases. According to statistics, the growth rate of this market is about 20% per year.

Competitors. According to the research, there are about 30 retail outlets in the city that sell a similar group of goods, 10 of which are large service stations that have their own retail departments (We recommend reading: “Service Station Business Plan.”

In close proximity to our outlet there are:

- Service station with its own sales department. They mainly sell on pre-orders;

- Motor oil center. The main range is oils, filters and other consumables;

- Retail outlet of 5m2 in a small shopping center. They sell only by catalog with delivery within a week.

Let's conduct a comparative analysis of the strengths and weaknesses of our competitors:

| Competitors | Characteristic | conclusions | |

| Strengths | Weaknesses | ||

| ONE HUNDRED | Car owners who use the services of a service station order spare parts from their store | Low range of spare parts and consumables from the warehouse, mostly all goods are made to order. Delivery of the order takes more than a week. Relatively high prices | You can compete with lower prices, a wider range and faster delivery of spare parts |

| Motor Oil Center | Large range of motor oils at low prices | Due to the specific specialization in motor oil, there are no other types of consumables and spare parts | You can compete through a wider range and faster delivery of spare parts |

| Retail outlet in a shopping center | Low prices, fast order delivery | There is almost no product in stock; they sell only by catalog | You can compete due to a wider range of goods in stock |

Sale of motor oils and spare parts: a combination of two taxation systems

Article 493 of the Civil Code of the Russian Federation establishes that, unless otherwise provided by law or contract, a retail purchase and sale agreement is considered concluded from the moment the seller issues a cash receipt or sales receipt or other document confirming payment for the goods to the buyer.

Accordingly, for the purposes of applying Chapter 26.3 of the Code, retail trade includes business activities related to the trade of goods, both for cash and non-cash payments, carried out under retail purchase and sale agreements, regardless of what category of buyers (individuals or legal entities ) these goods are sold.

A similar conclusion is contained in the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 157.

Thus, entrepreneurial activity for the sale of auto parts for trucks, carried out under retail sales contracts, through a store with a sales floor area of less than 80 square meters, regardless of which category of buyers (individuals or legal entities) these auto parts are sold, subject to provisions of Chapter 26.3 of the Code and the above provisions of the Civil Code of the Russian Federation, can be recognized as retail trade and transferred to UTII.

Deputy Director of the Department

A detailed analysis of the question of which taxation system to choose for a business in the retail trade of auto parts. The material provides specific examples and calculations on the basis of which a decision is made on choosing UTII or simplified taxation system.

Activities in the retail trade of auto parts are subject to special taxation regimes:

- Simplified taxation system (revenue limit of 60 million).

- A single tax on imputed income

- A physical indicator in the retail trade of auto parts is the area of the sales floor in square meters.

- Basic income is 1,800 rubles per month (set by the government).

- K1 is a deflator coefficient, established by the Ministry of Economic Development of the Russian Federation for the calendar year.

- K2 is an adjustment coefficient for basic profitability that takes into account the totality of the features of doing business. Established by municipal authorities at the location of the business.

- UTII tax rate: 15%

Comparison of the types of taxes paid by an entrepreneur on UTII and on the simplified tax system.

When switching to preferential tax regimes (USNO, UTII), the entrepreneur is exempt from paying other taxes.

Let's look at the procedure for calculating taxes: USTV and simplified tax system

Physical indicator * Basic profitability * K1 coefficient * K2 coefficient * Tax rate

An entrepreneur, when calculating the amount of tax on UTII, has the right to reduce the amount of calculated tax by the amount of social contributions made from the wage fund of employees, but not more than 50% of the calculated amount of UTII tax.

Revenue * Expenses * Tax rate

- Revenue - Revenue from spare parts trading activities

- Expenses - Expenses associated with the activities of trading spare parts. You can familiarize yourself with the procedure for determining expenses in the Tax Code of the Russian Federation. Article 346.16

- Tax rate: 15%

Next, using a specific example, we will analyze what taxation system

- Type of activity: Retail sale of spare parts

- Location: Lipetsk

- Store area: 740 sq.m. incl. sales area 440 sq.m.

- Revenue: 4.8 million rubles.

- Expenses 4.2 million rubles. (payroll deductions 130 thousand rubles)

- Profit: 0.6 million rubles.

- Basic income: 1,800 rubles

- K1 coefficient for 2012: 1.4942

- K2 coefficient for 2012: 0.8 (i.e. 1.8)

1. Calculation of the tax base: 440 sq.m. * 1,800 rub. * 1.4942 * 1.8 = 2.13 million rubles.

2. The estimated tax amount is 2.13 million rubles. * 15% = 319 thousand rubles.

3. We reduce the amount of tax by the amount of social contributions: 319 tr. – 130 tr.

3. Amount of tax to be paid: 189 thousand rubles.

1. Calculation of the taxable base: 4.8 million rubles. – 4.2 million = 0.6 million rubles.

2. Calculation of tax payable: 600 thousand rubles. * 15% = 90 thousand rubles.

As can be seen from the example, with such calculated indicators, it is more profitable for an entrepreneur to be on the simplified tax system, income minus expenses, saving 99 thousand rubles per month.

- Type of activity: Retail sale of spare parts

- Location: Lipetsk

- Store area: 140 sq.m. incl. sales floor area 65 sq.m.

- Revenue: 800 thousand rubles.

- Expenses 700 thousand rubles. (payroll deductions 30 thousand rubles)

- Profit: 100 thousand rubles.

- Basic income: 1,800 rubles

- K1 coefficient for 2012: 1.4942

- K2 coefficient for 2012: 0.8 (i.e. 1.8)

1. Calculation of the tax base: 65 sq.m. * 1,800 rub. * 1.4942 *1.8= 315 thousand rubles.

2. Estimated tax amount

315 thousand rubles. * 15% = 47 thousand rubles.

3. We reduce the amount of tax by the amount of social contributions: 47 tr.

According to Autostat, the number of cars in the Russian Federation last year exceeded 50 million units, over 80% of which were individual passenger vehicles. Having made a simple calculation and received a figure of about one car for three people, we can confidently say that in the Russian Federation almost every family has its own car. Moreover, according to statistics from the same Autostat, despite the emerging trends towards rejuvenation of the Russian car fleet, the average age of a car is significantly higher than the average European one: for foreign cars - 9 years, for domestic cars - 14 years.

These figures clearly reveal two facts: firstly, there are a lot of cars in Russia, and secondly, among them there are many cars at an age when repairs become a regular expense item for the owner. Therefore, a business selling auto parts in Russia is a profitable enterprise. An additional advantage is the ability to open quickly enough and start making a profit. Of course, creating a large store will require time for decoration, preparation of premises and investment of about 1.5-2 million rubles. But now a large store is rarely chosen as a form of auto parts business.

Another option has become very popular, for which a small room of 7-10 m2 is enough. In such a store, only the most popular goods that do not take up much space are available: motor oils and car chemicals, light bulbs, filters, auto electronics, spark plugs, etc. And auto parts, the main source of income, are brought to order from suppliers’ warehouses. This organization is especially convenient for selling spare parts for foreign cars. The cost of opening such a store is up to 10 times less than a large one: 200-300 thousand rubles.

Creating an online store of auto parts will cost a certain amount: to create a website at the first stage, an amount of about 200 thousand rubles is enough, but you can simply rent an online store as a ready-made solution, for example, on the Zaptrade system engine, which for most entrepreneurs is incomparably more profitable than developing your own . You can work on a rental engine for years, covering the rent from the income received from trading.

Registration of business activities

Like any other entrepreneurial activity related to sales, a spare parts business requires official registration, regardless of whether you have a “physical” office or sales are conducted virtually, only via the Internet. The Internet is difficult to control, so some entrepreneurs prefer to first open and run a business, and only then use the first (often “second”) earned money to register it. But in this case, problems may arise with the tax service and you may receive a fine for illegal business. For a car shop as a form of small business, the most suitable forms of entrepreneurship are individual entrepreneurs and LLCs.

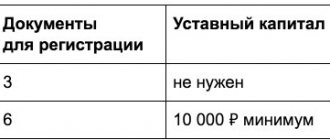

Choosing a form of ownership for an auto parts and auto chemical goods store

The main advantage of an individual entrepreneur is fairly quick registration. To start your business, you need to get a TIN from the tax service: if you don’t have one, registration usually takes about five days. Then you need to decide on the choice of taxation system and OKVED codes. We will return to these points in more detail below.

The package of documents for registering an individual entrepreneur is small: a passport and photocopies of all its pages, a receipt for payment of the state duty (800 rubles), a copy of the TIN certificate, an application for registration of an individual entrepreneur and the application of the simplified taxation system (STS). After registration, you need to open a bank account and you can actually start working.

The advantage of an individual entrepreneur is the ability to maintain simplified accounting, which even the owner himself can handle. It is enough to create a book of business transactions, in which the income and expenses of the entrepreneur should be entered point by point, and submit it to the tax office once a quarter to calculate tax payments.

The IP form has many disadvantages:

— personal liability of the entrepreneur for the company’s debts,

— difficulties in working with legal entities due to the fact that individual entrepreneurs do not pay VAT, accordingly, it is 18% more profitable for a legal entity to cooperate with another legal entity,

- impossibility of subsequent sale of the business,

— impossibility of attracting co-founders.

However, you need to figure out how significant these shortcomings are for a business related to the sale of auto parts and auto chemicals. Firstly, if you intend to open a business using credit funds, if it develops negatively, you can easily get into serious debt. This is especially true if you have a physical office, for which, among other things, you need to pay rent, pay utility bills, Internet, etc.

Secondly, difficulties may arise when working with some large suppliers who are legal entities, but the problem is solved by the fact that among the suppliers there are many who also work as individual entrepreneurs. The situation with buyers is even simpler: they are more interested in prices, product quality and delivery speed than in the form of business. On the contrary, in a company with an individual entrepreneur form, where the owner and manager are often the same person, it can be easier to return a part that is of poor quality or unsuitable for one reason or another than in a large store with its extensive bureaucracy.

Thirdly, the form of individual entrepreneur becomes “close” when the store reaches a high level and begins to generate solid income. In other words, when the business itself becomes capital. The development of IP is quite limited and can only rely on the entrepreneur’s own resources. A simple example: the owner of a nearby auto repair shop suggests that you combine assets and invest money in new areas of your store so that you have tires in stock that he can offer to his customers at a discount. If you have an individual entrepreneur, this cannot be done. Individual entrepreneur is good for small businesses with small income. As business grows, the form of entrepreneurial activity will also have to change.

Registering an LLC is more complicated, requires a thicker package of documents and will take more time, but its advantage is that to open a business you can combine the assets of several founders, each of whom will own property in certain shares. This is convenient, for example, when you have ideas and a desire to develop a business, but do not have the necessary start-up capital. When registering an IP, you can only count on a loan. By forming an LLC, you can try to interest an investor with your proposal (for example, the same owner of a developing car service center), who is ready to invest in your project. Moreover, in the event of a negative course of events, the investor will suffer more than you yourself.

If you work as an LLC, you will have to report to the Tax Service, the Pension Fund and the Social Insurance Fund. In addition, legal entities are much more likely to experience unexpected inspections from various authorities. Accounting for an LLC is also difficult, and even a small enterprise cannot do without spending on accounting services when preparing reports. There is also a difference in fines for non-compliance with legal requirements, delays, violations, etc.: an individual entrepreneur can be punished in an amount of up to 5 thousand rubles without a court decision, and up to 50 thousand rubles - by decision. LLC - up to 50 thousand rubles without a decision and up to 1 million rubles with a decision.

The form of entrepreneurship can be any, and much depends on the conditions of the entrepreneur and his intentions. But the vast majority of creators of spare parts stores at the first stage prefer to choose the form of IP. The cost of opening a small business, especially if it is an online store, does not require significant investments: you can simply save them, participate in the state support program for small businesses, borrow from friends or , as a last resort, take out a small loan. At first, it’s easy for an entrepreneur to combine a young online store with a part-time job, and in a “physical” store, it’s easy to work independently as a manager, without spending money on maintaining a hired employee.

Choosing a tax form and OKVED codes for an auto parts and auto chemical goods store

When choosing a simplified tax system, the significant advantage of which is the individual entrepreneur form, the mandatory payments are as follows:

- annual insurance premium, the amount of which is set in each tax period: in 2015 it is 22,261.38 rubles. for enterprises with an annual income of less than 300 thousand rubles. plus an additional 1% of income over 300 thousand rubles;

- taxes on wages of employees (if any) to the trade union, pension fund, for health and social insurance;

— payments according to the chosen taxation system.

The last point requires clarification. Today in the Russian Federation there are two taxation options, the choice of which depends on the type of activity and income of the enterprise: 1) 6% of total income, 2) 15% of the difference between income and expenses. According to general logic, if current costs are minimal, it is more profitable to choose the first option. If they are significant, the second option is more suitable.

It is the second option that is usually more applicable for an auto parts store, since payments to suppliers are a very significant expense item. The calculation is as follows: suppose that during the quarter you sold spare parts for 250 thousand rubles, of which 120 thousand were paid to suppliers, and 50 thousand for renting premises and an insurance premium. In the first case, you will pay 250,000 x 0.06 = 15,000 rubles. In the second case - (250'000-120'000-50'000)x0.15=10'500 rub. In any case, at the end of the tax period (year), you have the right to change the form of tax payments if the chosen one turns out to be unprofitable.

Determining the OKVED code is also an important procedure, and it is worth familiarizing yourself with it before starting a business. For a car shop, under the first number, you should select OKVED code 50.30 “Trade of automobile parts, assemblies and accessories.” In this case, you need to take into account that the absence, for example, of OKVED code 52.61.2 “Retail trade carried out through teleshopping and computer networks” will make sales on the Internet illegal and threaten you with an unexpected fine during inspection.

The conditions of modern legislation make it possible for almost any beginning entrepreneur to create a store selling auto parts. Great competition in this market is a problem only for the “sofa” entrepreneur. In any large city, you just need to get into a car and spend a couple of days driving around to find a place where there are quite a lot of houses and cars, and there is not a single auto store nearby - this particular place can become a market for your enterprise.

But when entering this market, among other things, it is important to have at least a basic understanding of the structure of a car and learn how to use catalogs for selecting auto parts if your choice is spare parts for foreign cars. Otherwise, returns of incorrect parts will irrevocably damage your reputation and clutter up your store's usable space with items you'll probably never sell.

Sale of motor oils and spare parts: a combination of two taxation systems

4. Amount of tax to be paid: 23.5 thousand rubles.

1. Calculation of the taxable base: 800 thousand rubles. – 650 thousand rubles. = 150 thousand rubles.

2. Calculation of tax payable:

150 thousand rubles. * 15% = 22.5 thousand rubles.

Under such introductory conditions, an entrepreneur can be on both UTII and the simplified tax system, since the amounts of taxes payable are comparable, but taking into account the fact that tax accounting with UTII is much simpler, it is optimal to choose the tax system: UTII.

Using the knowledge gained, you can independently select the optimal taxation system for your own spare parts store.

Organizations no later than March 31 of the year following the expired tax period.

Victor Stepanov, 2012-08-15

4. Amount of tax to be paid: 23.5 thousand rubles.

Based on Article 492 of the Civil Code of the Russian Federation, under a retail purchase and sale agreement, a seller engaged in business activities of selling goods at retail undertakes to transfer to the buyer goods intended for personal, family, home or other use not related to business activities.

An example of calculating UTII in retail outlets with an area of up to 5 m2

IP Artemenko A.R. has 10 retail outlets each selling accessories for cell phones in different shopping centers in the city of Krasnodar (K2 = 1) with an area of less than 5 m2 each. In the 4th quarter of 2021, he transferred 8 thousand rubles. insurance premiums for yourself and 60 thousand rubles. for hired personnel.

Let's consider the procedure for calculating imputed tax:

NB = 504,360 (9,000 × 1.868 × 1 × (10 + 10 + 10));

UTII = 75,654 rubles. (504,360 × 15%).

UTII payable for the 3rd quarter will be 37,827 rubles. (75,654 - 37,827 (1/2 of the tax amount, since the amount of insurance premiums paid exceeds 50% of the tax)).

Which taxation system should I choose for an auto parts store?

We are opening an auto parts store, rural area. The area of the sales area is 18*4 meters. It is also planned to sell motor oils. Retail. Which taxation system will be the correct UTII or simplified tax system? Do I need to set up an online cash register for UTII? After all, this system does not imply the introduction of a cash register system?

I'm really looking forward to clarification. Thank you very much. Elena.

Good afternoon What approximately are your expected income and expenses for the month? I think that UTII will not suit you, since with an area of 72 sq. m. (18*4) tax per quarter will be 105 thousand rubles.

Hello, Natalia. Thank you for the answer. Now I called my accountant. I didn’t indicate the footage exactly, just by eye. In fact, the area is about 70 square meters. meters. And the tax they calculate is approximately 12,000 per quarter. But when it comes to oils, it seems that we need to simplify things. Now I’m still worried about whether I need to buy an online cash register. Or will a receipt printer be enough? And what about the tax system? Where is right? )

Yes, the tax amount will be quite high with UTII.

But for oils, it seems, you need a simplified version Elena

Oils are excisable goods, so UTII cannot be used when selling them. The only question is which simplified tax system should you use: 6% or 15%.

Do I need to buy an online cash register? Or will a receipt printer be enough? And what about the tax system? Elena

The use of online cash registers depends on the taxation system. With UTII, cash registers may not be used until July 1, 2018. With the simplified tax system or OSNO, cash registers are mandatory.