Most Russians believe that a certificate of incapacity for work (sick leave) is issued only for periods of illness or maternity leave. But that's not true. Article 59 of the Federal Law of November 21, 2011 No. 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation” states that citizens will receive such a document in the following situations:

- in case of illness;

- when diagnosing an injury;

- in case of poisoning;

- during follow-up treatment in sanatorium-resort organizations;

- when caring for a sick family member;

- due to quarantine;

- for the duration of prosthetics in stationary conditions;

- during pregnancy and childbirth;

- when adopting a child;

- for other conditions associated with temporary disability.

What are the rules for accruing sick leave - 2020-2021

The calculation and accrual of temporary disability benefits in 2020-2021 are carried out according to the following algorithm:

Stage 1. The accountant calculates the average daily wage for the sick employee - for this he determines the billing period and the employee’s total earnings for the billing period.

The calculation period for sick leave is 2 calendar years preceding the year of the employee’s illness.

Example 1

Accountant Ignatieva came to work at Stigma LLC in April 2005. This is her first job. Ignatieva was on sick leave from 07/01/2020 to 07/10/2020, then the billing period was 2018–2019. (but if Ignatieva was on maternity leave in 2021 or 2021 or was caring for a baby and had no income, then for the billing period, upon application from the employee, the accountant can take the years preceding the billing period, that is, 2016–2017, but not earlier) .

No matter how many days there are in the years of the billing period, its duration is always 730 days. Excluded from this period are days of illness, pregnancy and childbirth, child care, as well as periods when a person did not work, but his earnings were retained, provided that contributions to the Social Insurance Fund were not accrued from this earnings.

Read more about excluded periods here.

Earnings for the billing period are wages, bonuses and other payments from the employer, for which social security contributions were calculated. State benefits and compensation from the employer are not included in this amount.

The accountant will find the average daily earnings (ADE) by dividing earnings for the billing period by 730 days.

Example 1 (continued)

Ignatieva earned 683,455 rubles in 2021, and 657,320 rubles in 2018.

SDZ Ignatieva: (657,320 + 683,455) / 730 = 1,836.68 rubles.

Stage 2. The accountant must compare the received SDZ amount with the maximum and minimum amounts. The maximum size of SDZ is calculated in accordance with the amounts of contribution limits to the Social Insurance Fund in the previous (calculated) 2 years; in 2021 it is equal to 2301.37 rubles. ((865,000 + 815,000) / 730 days). In 2021 - 2,434.25 rubles. ((912,000 rub. + 865,000 rub.) / 730 days)

The minimum SDZ is equal to:

Minimum wage on the date of opening of sick leave × 24 months / 730 days.

In 2021, the minimum wage is 12,130 rubles, therefore, the minimum SDZ is 398.79 rubles. In 2021, the minimum wage, according to the current law “on the minimum wage,” is equal to the subsistence minimum, approved. for the 2nd quarter of 2021. The cost of living is 12,392 rubles.

But the government proposed calculating the minimum wage for 2021 in a new way. According to the project, it will increase to 12,792 rubles. Read more about the planned innovations in the Review from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Thus, the employer cannot take an SDZ amount of more than 2,301.37 rubles to calculate sick leave. and less than 398.79 rubles.

Important! If for days of incapacity for work falling on the period from April 1 to December 31, 2021 (inclusive), the amount of the benefit determined according to Law No. 255-FZ, calculated for a full calendar month, is less than the minimum wage, the benefit is calculated based on the minimum wage (Art. 1 of Law No. 104-FZ). How to calculate sick leave from April 1, read here.

If the employee’s earnings are above the maximum, then the benefit is paid based on the maximum SDZ.

Example 1 (continued)

Since Ignatieva’s SDZ is equal to 1,836.68 rubles. and this is less than the maximum SDZ for 2021 (2,301.37 rubles), then sick leave should be calculated based on the SDZ in the amount of 1,836.68 rubles, calculated based on Ignatieva’s actual income.

If the SDZ calculated by the accountant is less than the minimum, then the accountant takes the daily earnings in the amount of 398.79 rubles to calculate the benefit. - for a full-time worker.

NOTE! If the sick person works part-time, and his SDZ is less than or equal to the minimum, then the minimum SDZ is subject to reduction in proportion to the duration of working hours. That is, for an employee at 0.5 times the wage rate with average daily earnings less than 398.79 rubles. you will have to compare your actual earnings for the day with earnings calculated based on the amount of 398.79 / 2 = 199.40 rubles. This rule does not apply to employees whose SDZ is higher than the minimum: even if an employee works at a quarter rate, then his average daily earnings do not need to be divided by 4 (clause 16 of the Government of the Russian Federation of June 15, 2007 No. 375). Find out more about sick pay for part-time workers in this article.

Stage 3. The accountant must determine the total length of service of the employee for his entire career, since only an employee who has worked for more than 8 years has the right to receive 100% of the average daily wage. If the employee’s work experience is from 5 to 8 years, then they will pay him 80% of the average daily earnings, if less than 5 years (but more than six months) - 60%. For an employee with less than 6 months of work experience, sick leave is calculated based on the minimum wage (Article 7 of Law No. 255-FZ).

Read more about calculating length of service for calculating sick leave here.

From October 6, 2021, new rules for calculating sick leave are in effect. See here for details.

Example 1 (continued)

Since Ignatieva’s total work experience is 15 years 2 months (from April 2005 to June 2021 inclusive), she will receive 100% of the average daily earnings.

NOTE! For those who have received an injury or occupational disease at work, the earnings must be taken in full for calculation and a benefit paid in 100%, regardless of length of service (Article 9 of the Law “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ).

Stage 4. The accountant multiplies the resulting SDZ amount by the number of sick days. The sick employee's certificate of incapacity for work is paid for by the Social Insurance Fund, but only from the fourth day of illness. The first 3 days must be paid by the employer.

But if a relative is sick and an employee is caring for him, then the rules for paying for such sick leave are different. Read about them in the material “Paying sick leave to care for a sick relative .

In what cases is the benefit paid?

Article 5 of Law 255-FZ lists insured events, upon the occurrence of which the employee is paid sick leave . Here they are:

- diseases and injuries;

- the need to care for a sick family member;

- quarantine for an employee, his child under 7 years of age or another incapacitated family member;

- prosthetics for medical reasons in a specialized hospital;

- follow-up treatment in sanatoriums after hospitalization.

Sick leave is required if the above cases occurred during work under an employment contract, as well as within 30 calendar days after its end.

Where to get a certificate for accrual of sick leave

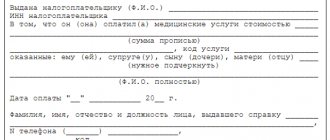

If an employee worked for you for several years before illness, then information about how much he earned is available in the accounting department. If the employee has worked for you for less than two years, you will take the earnings for calculating sick leave from a certificate of the amount of wages in the form of Order of the Ministry of Labor dated April 30, 2013 No. 182n, issued to the employee at the previous place of work. Every employer must issue such a document when dismissing an employee. The certificate contains information about the person himself, his earnings for the last two calendar years and the number of days of incapacity for work. A part-time worker may also request such a document from you in order to receive temporary disability benefits at their main place of work.

A sample certificate of earnings for accrual of sick leave can be viewed at the link .

Reviews

Irina, Moscow

“As an employer, I can say that calculating payments using the Accounting Outline scheme is very convenient. I can accurately calculate all the necessary amounts under any conditions for providing sick leave. There have never been any mistakes before.”

Karina, Perm

“I independently calculated the amount of sick leave I was entitled to, and in the end I received exactly as much as I expected. I didn’t think about calculating sick leave on my own.”

How to make entries for accrual of sick leave

The accountant will reflect the accrual of sick leave in accounting as follows:

Dt 20 (and other cost accounting accounts - depending on how the patient works in which department) Kt 70 - sick leave accrued for the first 3 days of the employee’s illness;

Dt 69 (according to the subaccount of settlements with social insurance) Kt 70 - sick leave accrued at the expense of the Social Insurance Fund.

On the payment day, the accountant will make the following entries:

Dt 70 Kt 68 (subaccounts for income tax calculations) - income tax is withheld from sick leave;

Dt 70 Kt 50 (if from the cash register) or 51 (from the current account) - benefits were paid to the employee.

NOTE! For firms in the regions participating in the FSS pilot project, personal income tax must be withheld only from benefits for the first 3 days of incapacity for work (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Example 1 (continued)

The amount of Ignatieva’s benefit for 10 days of illness: 1,836.68 × 10 = 18,366.80 rubles. Minus personal income tax, Ignatieva will receive 15,978.80 rubles.

The accountant will make the following entries:

Dt 20 Kt 70 in the amount of RUB 5,510.04. — sick leave accrued at the expense of the employer;

Dt 69 Kt 70 in the amount of RUB 12,856.76. — sick leave was accrued at the expense of the Social Insurance Fund;

On the day of payment of wages to employees:

Dt 70 Kt 68 in the amount of RUB 2,388.00. — personal income tax is withheld from benefit amounts;

Dt 70 Kt 50 in the amount of RUB 15,978.80. — Ignatieva’s temporary disability benefit was issued under RKO.

NOTE! In accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, income tax on temporary disability benefits in 2021 - 2021 must be transferred to the budget no later than the last day of the month in which the benefit was paid.

Minimum term

Legislative acts do not establish a minimum number of days of sick leave. The period of incapacity for work is determined only by the attending physician, based on the characteristics of the disease and the current condition of the patient. The exact number of days directly depends on the patient’s well-being and the period of necessary rehabilitation. The following rehabilitation conditions are distinguished:

- outpatient;

- day hospital;

- hospital

Often the minimum rehabilitation period, determined by the attending physician, is 3 days. If the patient is provided with outpatient treatment, then a certificate of temporary incapacity for work is issued for 15 days. If necessary and with the consent of the medical advisory commission, it is extended.

Accrual of sick leave in 2021 - 2021: calculation examples

We will show you in more detail how to correctly calculate and accrue sick leave in 2021 - 2021.

Example 2

From 07/01/2020 to 07/05/2020, the cleaning lady Govorunova was on sick leave. She brought a certificate of incapacity for work to Barter LLC on July 6, 2020 - the accountant has 10 calendar days to accrue benefits.

Read about the timing of benefits payment in this article.

Govorunova works at 0.5 rate; she also worked for the previous 2 years and was not on maternity leave. Govorunova’s work experience is 12 years. Estimated period: 2018–2019.

Govorunova got a job at Barter LLC in January 2021; before that, she worked for individual entrepreneur I. F. Kuznetsov. Her earnings for 2021 are 68,505 rubles. The accountant will take the salary for 2021 from the certificate of salary amount given to Govorunova by IP Kuznetsov upon dismissal - 65,732 rubles. At the moment, Govorunova works only at Barter LLC. Average daily earnings of Govorunova:

(68,505 + 65,732) / 730 = 183.89 rubles.

This is less than the minimum SDZ size in 2021 (RUB 398.79). But, since Govorunova works part-time, her average daily earnings should be compared with 0.5 minimum wage = 199.40 rubles. Since the employee’s actual SDZ is greater than the minimum, we take the actual earnings to calculate:

199.40 × 5 days of illness = 997.00 rubles, of which the employer will pay 598.20 rubles. (for the first 3 days of illness), and 398.80 rubles. - social insurance.

EXAMPLE of calculating sick leave for caring for a sick family member from ConsultantPlus: Ivanova M.I. from July 2 to July 10, 2020 (9 calendar days) she was unable to work due to caring for her sick mother. Before this case of incapacity for work, Ivanov M.I. I took sick leave to care for my sick mother for 8 calendar days... Read the continuation of the example after receiving a trial demo access to the K+ system. It's free.

Example 3 (calculation of sickness benefit when changing years)

Engineer Mayseenko fell ill on July 1, 2020, and her sick leave was closed on July 10, 2020. Mayseenko’s work experience is 3 years and 7 months. She works part-time in 2 organizations: at Sopromat LLC she has been working at 0.5 rate since 2015, and she got a job with IP Stolyarov A.P. in December 2021, also at 0.5 rate.

Mayseenko decided to receive benefits from Sopromat LLC. Since in 2018–2019. She was first on maternity leave, and then cared for the child, then she wrote a statement asking her to change the years for the calculation. In this case, the calculation period is 2016–2017. At Sopromat LLC in 2021, Mayseenko earned 246,350 rubles, in 2021 - 275,034 rubles.

From IP Stolyarov A.P. Mayseenko will take a certificate stating that temporary disability benefits were not accrued or paid to her. SDZ Mayseenko's accountant will take only one place of work - Sopromat LLC, since the individual entrepreneur Stolyarov A.P. Mayseenko in 2016–2017. did not work:

(246,350 + 275,034) / 730 = 714.22 rub.

This amount fits within the boundaries between the upper (2301.37 rubles) and lower (398.79 × 0.5 = 199.10 rubles) size of the SDZ. Since Mayseenko’s experience is less than 5 years, she is entitled to only 60% of the SDZ:

714.22 × 60% = 428.53 rub.

Mayseenko's sick leave amount: 428.53 rubles. × 10 days of illness = 4285.35 rubles. For the first 3 days, expenses will be borne by the policyholder - 1,285.59 rubles, social insurance will pay 2,999.76 rubles. Minus income tax, Mayseenko will receive 3,728.35 rubles.

NOTE! If you are replacing an employee's years for calculating benefits, then there are mandatory conditions. First, the employee must write an application for a replacement. And second, the sick leave calculated with the replacement of years must be greater than that calculated in the usual manner, otherwise the employer pays benefits based on the standard calculation period.

Maximum duration

The maximum duration should not exceed 15 days for outpatient treatment, that is, for recovery at home, taking into account periodic follow-up visits to the attending physician. This period can be extended only on the basis of a decision of the medical advisory commission (MCC). Special periods are provided for paramedics and dentists; for them, the maximum number of days on sick leave is 10 days.

If treatment is carried out in a hospital setting, then everything depends on the patient’s condition, diagnosis and the presence of complications in the patient. The maximum duration in inpatient conditions is not defined by law. A certificate of incapacity for work is issued for the entire duration of the employee's stay in the hospital. Extended after discharge - for the period of patient recovery. Typically, the period of such a document does not exceed 10 days. If the patient is recovering from surgery, then the certificate is issued for a maximum period during which procedures that are mandatory in the postoperative period are carried out.

Similar requirements are provided for when treating an employee in a day hospital. The duration is determined directly by the attending physician, depending on the patient’s condition and the type of disease.

Results

The accrual of sick leave in 2021 has not undergone significant changes: the accountant needs, as before, to know the employee’s SDZ, length of service, and number of sick days. However, there are nuances in paying sick leave to an employee who was injured at work or to a woman who was recently on maternity leave.

For information on calculating sick leave after maternity leave, read the article “How to calculate sick leave after maternity leave?”

Find out how to pay sick leave for a domestic injury here. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When benefits are not paid

When illness or injury occurs, benefits are not always paid . There are 2 cases when payment is not due:

- if the employee’s injury or illness was a consequence of a crime he committed;

- if the court has determined that he caused the damage to himself intentionally (including a suicide attempt).

There are also grounds for reducing the amount of sick leave benefits (Article 8 of Law 255-FZ):

- if the employee violates the regimen prescribed by the doctor;

- if he does not appear for inspection or examination;

- if the illness or injury was the result of intoxication (alcohol, drugs, toxic).

There is a period for payment of sick leave benefits - no more than 6 months from the date of restoration of working capacity.

Do I need to notify the employer?

Labor legislation does not stipulate the obligation of workers to warn management about illness. No such norm is specified in 255-FZ of December 29, 2006 on temporary disability. The employer does not have the right to force employees to provide mandatory notification of their absences from work due to illness. Such a rule cannot be prescribed in regulatory and local acts and management orders. Reporting illness is exclusively the employee’s right, but in no case is it an obligation.

The employee conveys a warning about temporary disability both orally (directly to the manager or through colleagues) and in writing, by drawing up a notice addressed to the manager. The application is drawn up in free form, indicating the diagnosis and estimated duration of the illness.