The chief accountant is one of the key positions in almost all organizations; when concluding an employment contract, it is advisable to think through all the important points relating to this position.

The Labor Code of the Russian Federation (LC RF) establishes special rules that regulate the legal status of persons holding the position of chief accountant at an enterprise.

The hiring of an employee to the position of chief accountant is formalized by concluding an agreement for a certain period by agreement of the parties, which cannot exceed five years. The main condition is a voluntary decision, without pressure from the employer. Additional conditions for concluding such an agreement are not required; the fact of acceptance of the agreement specified in Part 2 of Art. 59 of the Labor Code of the Russian Federation position.

As you know, the probationary period for all employees is limited to three months. But for the chief accountant this period can be set longer, up to six months , this allows for clause 5 of Art. 70 Labor Code of the Russian Federation. The validity period of the employment contract and the probationary period are required to be indicated in the employment contract.

For the chief accountant, the following must be indicated in the employment contract form:

- contract expiration date;

- reasons for concluding a fixed-term contract with reference to the rule of law.

At times, employers are cunning and, in order to avoid difficulties during the dismissal of a chief accountant who has not completed the probationary period, they enter into a fixed-term employment contract with the employee for a period of three to six months. After which they can renew these contracts more than once, thereby depriving the employee of the guarantees provided to him by law.

If the matter comes to the courts, decisions in most cases are made in favor of the employees, and contracts with them are reissued to be concluded for an indefinite period. But the employer has the right to play it safe and designate a probationary period when hiring. Let me remind you that the trial period cannot exceed 6 months. It follows from this that if a fixed-term employment contract with a validity period of six months is concluded, the probationary period in this case should not exceed 14 days , in accordance with Part 6 of Art. 70 Labor Code of the Russian Federation.

The chief accountant reports directly to the head of the organization. Cash settlement documents, financial and credit obligations without the signature of the chief accountant are considered invalid and are not accepted for execution . In general, the responsibilities of the chief accountant are enshrined in the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

The requirements of the chief accountant for processing business transactions and submitting the necessary documents and information to the accounting department are mandatory for all employees of the enterprise. This requirement is prescribed in the relevant local regulations of the company.

Write down all the general conditions and information in the employment contract with the chief accountant. Taking into account the specifics of the organization and the category of the employee’s position, indicate a list of job responsibilities and additional terms of the contract.

Together with the head of the organization, the position of chief accountant is one of the main ones, therefore, when hiring, it is necessary to take into account all the nuances regulated by the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, hereinafter referred to as Law No. 129-FZ. If the employment contract does not take into account the specifics of such an employee’s work, the company will be fined 50 thousand rubles.

The specifics of formalizing labor relations with the chief accountant are important not only for the parties signing the employment contract, but in some cases also relate to the company’s relationships with third parties. Before concluding an employment contract with the chief accountant, it is a good idea to make sure that he is not disqualified as an official at his previous place of work . The check can be carried out on the official website of the Federal Tax Service using the “Search for information in the register of disqualified persons” service. The same request can be officially submitted to the territorial bodies of the Federal Tax Service, the response time limit is no more than five working days.

The position of the only accountant included in the staff can be called both “accountant” and “chief accountant” - this will not cause complaints from regulatory authorities. But in the case when it is called “Accountant” according to the professional standard, it will be implied that the functions of the chief accountant were assumed by the head of the company.

II. Functions

The chief accountant is assigned the following functions:

2.1. Management of accounting and reporting at the enterprise.

2.2. Formation of accounting policies with the development of measures for its implementation.

2.3. Providing methodological assistance to employees of enterprise departments on accounting, control and reporting issues.

2.4. Ensuring the preparation of salary calculations, accruals and transfers of taxes and fees to budgets of various levels, payments to banking institutions.

2.5. Identification of on-farm reserves, implementation of measures to eliminate losses and unproductive costs.

2.6. Introduction of modern technical means and information technologies.

2.7. Monitoring the timely and correct execution of accounting documentation.

2.8. Ensuring healthy and safe working conditions for subordinate performers, monitoring their compliance with the requirements of legislative and regulatory legal acts on labor protection.

Regulatory framework, or Where to find out what the chief accountant should do

Most subconsciously understand what responsibilities the chief accountant of any organization has.

But when it comes to paperwork, many employers don't know where to start. And we need to start with the Unified Qualification Directory of Positions of Managers, Specialists and Other Employees, approved. Resolution of the Ministry of Labor of the Russian Federation dated August 21, 1998 No. 37, which details the responsibilities of the chief accountant at the enterprise. Another good source of information when drawing up a job description for such an employee is Order of the Ministry of Labor of Russia dated February 21, 2019 No. 103n, which approved the professional standard. This standard can be used as a basis for creating a personal identification document for an employee. For example, when a company was created, the responsibilities of the chief accountant were assumed by the manager. Subsequently, a primary employee was hired. After some time, the manager transferred his accounting functions to this employee, but formally he remained the chief accountant. The result was an accountant with the responsibilities of a chief accountant, but with the same job description. Now, in order to add the necessary rights and responsibilities to the employee’s LNA, the director does not need to invent wording; it will be enough to look at the standard. It can also be used when selecting candidates, since the standard lists both the requirements for candidates (work experience, level of education) and labor functions for different positions.

III. Job responsibilities

To perform the functions assigned to him, the chief accountant of the enterprise is obliged to:

3.1. Organize accounting of economic and financial activities and control over the economical use of material, labor and financial resources, and the safety of the enterprise’s property.

3.2. Formulate an accounting policy in accordance with accounting legislation, based on the structure and characteristics of the enterprise’s activities, the need to ensure its financial stability.

3.3. Organize accounting of property, liabilities and business transactions, incoming fixed assets, inventory and cash, execution of cost estimates, performance of work (services), results of financial and economic activities of the enterprise, as well as financial, settlement and credit transactions, timely reflection on accounting accounts of transactions related to their movement.

3.4. Monitor compliance with the procedure for preparing primary and accounting documents, settlements and payment obligations, spending the wage fund, conducting inventories of fixed assets, inventory and cash, checking the organization of accounting and reporting, as well as documentary audits in the divisions of the enterprise (branches ).

3.5. Take measures to prevent shortages, illegal spending of funds and inventory, violations of financial and economic legislation.

3.6. Ensure the legality, timeliness and correctness of the execution of documents, work (services) performed, payroll calculations, correct calculation and transfer of taxes and fees to the federal, regional and local budgets, insurance contributions to state extra-budgetary social funds, payments to banking institutions, funds for financing capital investments, repaying bank loan debts on time, as well as deductions for material incentives for enterprise employees.

3.7. Participate in the preparation of materials on shortages and thefts of funds and inventory items, control the transfer, if necessary, of these materials to investigative and judicial authorities.

3.8. Lead the work on the preparation and adoption of a working chart of accounts, forms of primary accounting documents used for registration of business transactions for which standard forms are not provided, development of forms of internal accounting documents, as well as ensuring the procedure for conducting inventories, monitoring the conduct of business transactions, compliance with technology processing of accounting information and document flow procedures.

3.9. Participate in conducting an economic analysis of the economic and financial activities of an enterprise based on accounting and reporting data in order to identify on-farm reserves, eliminate losses and unproductive costs.

3.10. Work to ensure strict compliance with staffing, financial and cash discipline, estimates of administrative, economic and other expenses, the legality of writing off shortages, accounts receivable and other losses from accounting accounts, the safety of accounting documents, their execution and delivery in the prescribed manner to the archive.

3.11. Take measures to accumulate financial resources to ensure the sustainability of the enterprise.

3.12. Ensure the rational organization of accounting and reporting at the enterprise on the basis of maximum centralization of accounting and computing work and the use of modern technical means and information technologies, progressive forms and methods of accounting and control, the formation and timely submission of complete and reliable accounting information about the activities of the enterprise, its property status , income and expenses, as well as the development and implementation of measures aimed at strengthening financial discipline.

3.13. Interact with banks on the placement of available funds on bank deposits (certificates) and the acquisition of highly liquid government securities, control over accounting transactions with deposit and loan agreements, securities.

3.14. Participate in the development and implementation of rational planning and accounting documentation, progressive forms and methods of accounting based on the use of modern computer technology.

3.15. Ensure the preparation of balance sheets and operational summary reports on income and expenses of funds, the use of the budget, other accounting and statistical reporting, and their submission in the prescribed manner to the relevant authorities.

3.16. Provide methodological assistance to employees of enterprise departments on accounting, control, and reporting issues.

3.17. Manage employees of the company's accounting department.

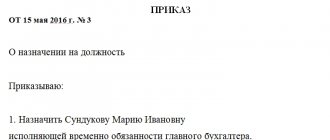

Temporary reassignment of the chief accountant

You can appoint yourself as chief accountant either on a permanent or short-term basis. The second option is relevant in these cases:

- The specialist went on long vacation/sick leave.

- The employee was fired, and a new specialist has not yet been found.

- Other employees cannot replace an absent employee.

To temporarily appoint yourself as chief accountant, you also need to draw up an order. It must contain these provisions:

- The period during which the chief accountant assumes the functions of the chief accountant.

- The reason for the absence of the main specialist.

The rest of the order is drawn up in a standard form.

IV. Rights

The chief accountant has the right:

4.1. Represent the interests of the enterprise in relations with other structural divisions of the enterprise and other organizations on financial, economic and other issues.

4.2. Establish job responsibilities for employees subordinate to him, so that each employee knows the range of his duties and is responsible for their implementation. Employees of other departments involved in accounting report to the chief accountant on all issues of organization and maintenance of accounting and reporting.

4.3. Submit proposals for improving economic and financial activities for consideration by the management of the enterprise.

4.4. Sign and endorse documents within your competence.

4.5. Receive in a timely manner from the heads of the enterprise departments (specialists) information and documents (orders, instructions, contracts, estimates, reports, standards, etc.) necessary to perform their job duties. (For untimely, poor-quality execution and preparation of these documents, delay in transferring them for reflection in accounting and reporting, for the unreliability of the data contained in the documents, as well as for the preparation of documents reflecting illegal transactions, the officials who compiled and signed these documents are responsible ).

4.6. Submit for consideration by the director of the enterprise proposals on the appointment, relocation, dismissal of accounting employees, proposals for their encouragement or the imposition of penalties on them.

4.7. Involve specialists from departments of the enterprise in solving the tasks assigned to it (if this is provided for by the regulations on departments, if not, with the permission of the manager).

4.8. Require the director of the enterprise to provide assistance in the performance of his official duties and rights.

Termination of an employment contract with the chief accountant

In the “Change and termination of the employment contract” section, indicate the procedure for changing the contract and its termination. The chief accountant may be dismissed for additional reasons:

- when the owner of the enterprise changes (Article 81 of the Labor Code of the Russian Federation);

- for an unreasonable decision, due to which the company’s property was not preserved, was used for other purposes, or when damage was caused to the employer (Clause 9, Part 1, Article 81 of the Labor Code of the Russian Federation).

We will pay special attention to the termination of employment relations when the owner of the organization changes. This is an additional basis for termination established by clause 4 of Art. 81 of the Labor Code of the Russian Federation, is regulated in detail by other norms of the Labor Code of the Russian Federation. The new owner has three months if he wants to fire the chief accountant (Part 1 of Article 75 of the Labor Code of the Russian Federation). In this case, no evidence of dishonesty or insufficient qualifications of the chief accountant is required; the only necessary condition is a change of owner.

If the new owner signed an additional agreement with the chief accountant. agreement to the employment contract (changes in wages, duties, other conditions), then after this it is impossible to formalize dismissal, since this is unlawful, even within a three-month period.

The signing of the agreement is documentary confirmation that the new owner has decided to work with the chief accountant on new terms. After all, the legislation gives the new employer the right to choose - to continue working with the chief accountant or to fire him. If a decision is made to part with an employee, compensation must be paid, and the law defines a minimum amount - no less than three times the average monthly salary (Article 181 of the Labor Code of the Russian Federation).

In the “Final Provisions” section, describe the procedure for resolving possible disputes and disagreements between the employer and employee.

V. Responsibility

The chief accountant is responsible for:

5.1. For failure to perform (improper performance) of one’s job duties as provided for in this job description, within the limits determined by the labor legislation of the Russian Federation.

5.2. For offenses committed in the course of carrying out their activities - within the limits determined by the administrative, criminal and civil legislation of the Russian Federation.

5.3. For causing material damage - within the limits determined by labor, criminal and civil legislation of the Russian Federation.

Filling out the nature of the job

In small enterprises, chief accountants are often forced to travel to the bank, tax office, Pension Fund, Social Insurance Fund and other government agencies. In this case, the question arises: how to organize a trip of this type?

There is no clear answer to this question. Therefore, if the chief accountant will have to frequently travel to other organizations, it is recommended that he be assigned a traveling nature of work with compensation for the corresponding expenses, and the employee’s job description can indicate how often and where he will travel.

Results

As we can see, the list of functions of the chief accountant is quite wide, and it is a mistake to believe that all of his work involves drawing up a balance sheet. A modern chief accountant can analyze the financial condition of the company, clearly knows labor legislation and the rights of his employees, and can advise the director on methods of saving and tax optimization.

Sources:

Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.