Professional standards are increasingly used in the field of labor relations. Increasing the efficiency of accounting is largely possible thanks to new approaches to the issue of job responsibilities and qualifications.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

An accountant is always one of the key positions in any organization, so the professional standard for this specialty was one of the first approved and is in great demand today.

Who is obliged to comply with the accounting standard, what requirements are described in it, how they are applied in practice, whether non-compliance can be dangerous, it will be interesting to find out for current and future accountants, as well as their employers.

Target

In accordance with the text of the standard, the main goal of persons who are engaged in accounting is to generate documented and systematized information about accounting objects, to draw up accounting (financial) statements on its basis, disclosing information about the financial position of an economic entity as of the reporting date, the financial result its activities and cash flows for the reporting period, necessary for users of these statements to make economic decisions.

Design rules

The document is drawn up on a letterhead with the logo of the organization. Its form is not strictly regulated by law, but is developed in accordance with GOST 7.0.97-2016 and Professional Standards. Before the preamble “I approve,” the details of the organization and the director are listed, and the date is also indicated. The DI contains at least 4 sections, is presented to the employee for review and is approved by order of the director.

General provisions

General conditions of labor interaction with a deputy accountant:

- employee category (manager);

- to whom does he report (chief accountant);

- procedure for appointment to a position (order);

- qualification requirements (education, length of service, work experience);

- the procedure for replacing another official during a period of temporary absence;

- knowledge that the deputy must have (list in a bulleted list).

The deputy chief accountant must know the basics of civil law, financial and tax legislation, the rules for conducting monetary inventory, the procedure and form of settlements, the rules for maintaining accounting documents, etc.

Responsibilities

The section contains a detailed list of labor actions that the manager undertakes to perform:

- organization of accounting work, formation of accounting policies;

- management of work on the preparation of a working chart of accounts, internal reporting forms, etc.;

- information support for internal and external users, guidance over the formation of an information system;

- organization of work on maintaining an accounting register, execution of estimates and property accounting;

- ensuring that accounting documents reflect information on the movement of assets, business transactions, income and expenses;

- compliance with the procedure for compiling and submitting primary documentation;

- calculation of product costs, provision of management accounting and production costs;

- control over the timely payment of taxes and insurance premiums, payments for other means of financing;

- participation in economic analysis, elimination of losses and non-production costs;

- control over compliance with cash and financial discipline, legality of write-offs and movement of funds;

- documentation of shortages, illegal financial activities and loss of material assets;

- archiving accounting documents, monitoring their safety and timely redirection to the archive;

- information and methodological support on accounting issues, management of accounting personnel;

- assigning personnel to advanced training courses, carrying out other assignments of the chief accountant.

The given list of job responsibilities can be expanded depending on the accounting workload and goals of the organization.

Rights

Legal guarantees of the deputy chief accountant in accordance with the policy of the organization and the legislation of the Russian Federation:

- social guarantees provided for by the labor legislation of the Russian Federation;

- obtaining documents necessary to perform official duties;

- making proposals to improve the conditions of labor interaction, modernize financial activities;

- professional development, educational courses;

The deputy chief accountant has the right to familiarize himself with draft decisions of management directly related to his activities.

When developing legal guarantees, one must be guided by the norms of labor legislation (Article 21 of the Labor Code of the Russian Federation) and not allow the rights and legitimate interests of the manager to be infringed.

Labor functions

Despite the designated categories of specialists, the professional standard initially approved by the Government of the Russian Federation contained only two groups of labor functions:

- group A. Accounting (skill level 5);

- group B. Preparation and presentation of financial statements of an economic entity (skill level 6).

From April 6, the following will be added to the accountant’s professional standard 2021:

- group C. Preparation and presentation of financial statements of an economic entity that has separate divisions (skill level 7);

- group D. Preparation and provision of consolidated reporting (skill level 8);

- group E. Providing accounting services to economic entities, including preparation of financial statements (skill level 8).

For more information about descriptions of qualification levels, see Order of the Ministry of Labor of Russia dated April 12, 2013 No. 148n.

The descriptive part of possible job titles includes:

- accountant;

- accountant category I;

- accountant II category;

- Chief Accountant;

- head (manager, director) of the accounting department (management, service, department);

- head (manager, director) of the department (service, department) of consolidated financial statements;

- Director of Operations Management;

- Director of Accounting Outsourcing;

- Commercial Director;

- Director of Business Development.

The variety of names of professions in the accounting and financial sector proposed in the new standard fully reflects reality. And if the organization has introduced other job titles, they may remain unchanged.

Key document

For a payroll accountant, a job description is perhaps his main document after the employment contract. The manager must approve it by his order.

The presence of such instructions means that the payroll accountant understands his area. And in case of problems with salary payments and (or) income tax, insurance contributions, a link to a specific sample job description for a salary accountant will make it possible to put such a specialist in his place. In case of a stalemate, say goodbye to him. This approach is also applicable to the job description of a payroll accountant of a budgetary institution.

It should be noted that the job description of a payroll accountant stands somewhat apart from similar instructions of immediate superiors - the chief accountant and his deputy. The reason is simple: the payroll accountant's responsibilities are narrower. Also see “Job Description for the Chief Accountant” and “Job Description for the Deputy Chief Accountant”.

It is noteworthy that domestic legislation does not directly impose special requirements on the job description of a salary (personnel) accountant of the 20178 model. True, when approving the text of this document, it is easier not to exercise freedom of creativity, but to focus on the appropriate professional standard. More about him.

Group A, or accountants with categories

In the Order of the Ministry of Labor dated December 22, 2014 No. 1061n, in contrast to the EKS, which distinguished three categories of accountants (first, second categories and the accountant directly), the requirements for the level of education are minimized: it is enough for employees to have a secondary vocational education. The provisions for practical work experience remained the same - at least three years.

But the new professional standard has changed the requirements for practical work experience and education. From 04/06/2019, accounting can be entrusted to persons who have a diploma of secondary vocational education or additional vocational education in special programs for non-core secondary education. To occupy the position of an accountant with the category, you will need at least 1 year of experience in a lower position.

As for functional responsibilities, they remained unchanged.

What is the professional standard for a chief accountant?

In search queries you can often find, especially recently, the phrase “professional standard chief accountant”.

For ignorant users, this set of words may cause confusion, but everything is explained quite simply. For quite a long time, the Labor Code of the Russian Federation has had Article 195.1, which defines the qualifications of an employee and explains what a professional standard is. According to this norm, the qualifications of an employee are recognized as the level of knowledge, skills and professional skills of the worker, and the professional standard is a characteristic of the complex of these characteristics necessary for the employee to carry out his work activity. Thus, the professional standard of a chief accountant is a list of professional qualities of an employee required to work in the position of chief accountant. In 2015, Article 195.1 was slightly amended, and new norms appeared - Articles 195.2 and 195.3, which introduced mandatory professional standards for a number of positions and professions from July 1, 2016. In addition, the innovations establish recommendations for the application of professional standards in relation to types of work activities for which their use is not mandatory.

Group B, or chief accountants, heads of accounting departments

In the professional standard in force until 04/06/2019, it was stated that the chief accountant is not required to have a higher education, a secondary vocational education is sufficient. Higher education, of course, is welcome, but the requirements are revised to the mandatory completion of an appropriate advanced training program or professional retraining (specifics are not specified). Work experience requirements:

- in the absence of higher education - at least five of the last seven calendar years must be related to accounting, preparation of accounting (financial) statements or auditing activities;

- if you have a higher education - at least three of the last five calendar years.

Also, the professional standard for the chief accountant, approved by the Government of the Russian Federation in 2014, contained a provision under which in certain economic entities additional requirements may be established for the chief accountant or other official responsible for accounting (for example, in Chelyabinsk).

Other provisions are specified in Order of the Ministry of Labor dated February 21, 2019 No. 103n. The new professional standard for chief accountant 2021 requires that a person applying for the position of chief accountant or head of the accounting department have a diploma in one of the following levels of education:

- higher profile - bachelor's degree;

- higher non-core - bachelor's degree and additional professional education under the professional retraining program;

- secondary vocational - training programs for mid-level specialists;

- secondary vocational non-core - training programs for mid-level specialists and additional professional education - professional retraining programs.

To obtain a position, you will need at least five years of experience if you have a higher education, and if you have a secondary education, at least 7 years. Additionally, special requirements are introduced for persons who want to work in JSCs, the Central Bank of the Russian Federation, extra-budgetary funds, insurance organizations, investment and non-state pension funds.

The job responsibilities of chief accountants and heads of accounting departments have increased not only quantitatively, but also qualitatively, but also the wording of the requirements has become succinct and specific.

Rights of a payroll accountant

As you can see, the accountant has a lot of responsibilities: he needs to accrue, withhold, and pay. Don’t forget to check everything and reflect it in your accounting. Do employees have any rights? Of course have.

Rights of the accountant of the settlement desk:

- Receive clarification on work issues from senior management.

- Make independent decisions, but only within the limits of your authority.

- Study projects and management orders related to the work of an accountant.

- Require responsible persons to adhere to the document flow schedule.

- Notify management about violations of the document flow schedule.

- Make suggestions to improve the quality and speed of the work process.

- Demand decent working conditions from the employer.

- Receive the necessary information and information from the structural divisions and employees of the company.

It is important for an accountant not to forget about his rights and demand their implementation from higher authorities or the management of the company. Otherwise, there can be no question of quality work.

Group C, or chief accountants working in companies with branches

To prepare and provide financial statements of an economic entity that has separate divisions, specialists will need one of the following education:

- higher - master's degree or specialty;

- higher non-core - master's degree (specialty) and additional professional education - professional retraining programs.

To work as a chief accountant in a company with branches, you must have at least 5 years of experience in management positions. What the responsibilities of such an employee are is described in detail in the professional standard in several labor functions.

Rules for reading the instructions

The employer is obliged to familiarize the newcomer with the job description. Moreover, this must be done in a special order. Firstly, familiarization with the work regulations must be carried out before the actual signing of the employment contract. Moreover, the employer has the right to approve his own procedure for conducting the introductory procedure. This can be the employee’s handwritten signature in the following forms of documents:

- In the job description itself. For example, in a special field provided by the document structure.

- In a special familiarization magazine, the form of which was developed in the organization.

- In the list of documents that a newcomer should be familiar with when applying for employment in the company. The list is drawn up as an annex to the employment contract.

- In the employment contract itself, if its structure and content provide for this condition. For example, after the “Signatures of the parties” block, the employee makes a handwritten note: “I have read the job description before signing the employment contract.”

Group D, or employees submitting consolidated statements

The educational requirements for such employees are similar. But to compile and provide consolidated reporting, the chief accountant will need work experience:

- at least five of the last 7 calendar years of work in management positions related to the preparation of accounting or auditing activities;

- at least three years out of the last 5 with a higher specialized education.

The skills, abilities and knowledge that will be needed to perform the work are described in section 3.4 of the professional standard. To maintain a professional level, specialists are recommended to annually take advanced training courses lasting at least 20 hours.

Employee liability provisions

The instructions, like the employment contract, must disclose provisions on the employee’s responsibility for the performance of his duties. Therefore, include in the document not only the rights and functional responsibilities of the payroll accountant, but also the following responsibilities:

- for failure to fulfill duties;

- for causing material harm to the employer;

- for offenses committed in the performance of official duties, provided for by the Code of Administrative Offenses of the Russian Federation, the Civil Code of the Russian Federation and the Criminal Code of the Russian Federation;

- for violation of internal labor regulations and safety requirements;

- for failure to comply with the rules for working with personal data;

- for disclosure of confidential information;

- other.

Liability standards cannot be invented by the employer. The provisions and standards of labor laws must be observed. Otherwise, it will infringe on workers' rights.

Group E, or accounting consultants

As in the case of groups C and D, the level of education of persons who provide accounting services should be the highest. The length of service requirements are similar to those stated for chief accountants preparing and submitting consolidated statements. But at the same time, they are required to undergo full-fledged advanced training programs at least once every three years.

As for the responsibilities, consultants, company executives and commercial directors have many of them, and they are very diverse - from organizing and managing the main business processes of an enterprise to participating in advertising campaigns and studying judicial practice in the field of taxation.

Who is obliged to implement the new professional standard “Accountant” 2021

Employers are required to implement a new professional standard when the requirements for an accountant are established by law. For example, open joint-stock companies, banks, insurance companies, etc. (clause 4 of article 7 of the Federal Law of December 6, 2011 No. 402-FZ). Other companies may apply the standard if they wish. For example, when developing job descriptions or employee certification programs. The employer does not have the right to simply fire an employee who does not meet the requirements of the new professional standard “Accountant”.

Who should develop DI?

The job descriptions of the accountant are developed by the chief accountant or his deputy for his subordinates and are agreed upon with the legal department. The document is approved by the head of the organization.

The law does not require the compulsory preparation of an DI , however, the presence of this document provides some advantages for the employer:

- the opportunity to specify the requirements for the position;

- define the authority and set clear tasks for the specialist;

- indicate the extent of liability in the event that an employee commits a serious violation;

- prevent possible disputes.

What is he responsible for?

The responsibilities of a payroll accountant should not extend beyond this job function. Let's name the main ones:

- calculate wages;

- monitor the state of the wage fund;

- all issues of income tax on payments that an organization makes in favor of individuals;/li>

- all income tax issues on payments made by the organization in favor of individuals;

- calculation and payment of insurance premiums;

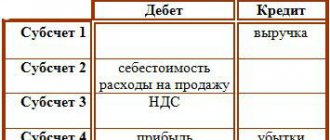

- reflection in accounting of transactions with salaries and other payments to personnel, as well as taxes and contributions from them;

- reflection of relevant payments in tax accounting, preparation of tax reporting (mainly for personal income tax);

- processing time sheets;

- analysis of the correctness of registration of temporary disability certificates and other documents on the right to be absent from the workplace;

- control of payments to employees according to statements;

- preparation of materials for inspections by the Federal Tax Service, etc.

Below you can find a sample 2021 job description for a salary accountant in the form of its main structural elements. It is as close as possible to the professional standard of this profession. (file structure)