Home > About the Center > Publications

Svetlysheva Olga Yurievna , teacher of the Center in the direction of Personnel Management and Personnel Management

From this article you will learn:

- What requirements must be observed when drawing up a job description for a deputy chief accountant?

- What are the qualification requirements for a deputy chief accountant?

- What are the job responsibilities of a deputy chief accountant?

- How to competently make changes to the job description of a deputy. chief accountant?

Drawing up a job description for a deputy chief accountant is not a mandatory procedure for the employer. Article 57 of the Labor Code of the Russian Federation provides for the requirement to include the employee’s labor function as one of the mandatory conditions of the employment contract.

Each employer determines independently whether it is necessary to draw up job descriptions. It should be remembered that a job description helps to more effectively manage personnel.

Main reminder: rapprochement

Let us say right away that domestic legislation does not separately regulate the issue of the scope and composition of powers, the necessary qualities of a deputy chief accountant. The sample job description for this specialist can be virtually anything. However, this person replaces the third person in the company - the chief accountant. Especially during periods of absence of the latter from the workplace. Therefore, in practice, the job description of the deputy chief accountant is as close as possible to a similar document of the chief accountant.

Also see “Job description for the chief accountant”.

Both of these documents should correlate well with each other, so when making adjustments to one, do not forget about the instructions of the second specialist.

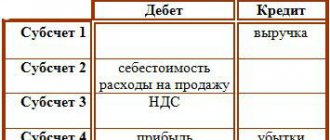

Of course, the deputy chief accountant, as in fact the fourth person in the company after the manager and his deputy (deputies), is also responsible for all accounting issues. Among them:

- development of accounting policies;

- accounting;

- preparation of complete financial statements on time;

- tax accounting and reporting issues;

- prompt assistance to the chief accountant.

Thus, the requirements that the law and management place on the chief accountant should be reflected in the sample job description for the deputy chief accountant.

This is also an internal document that the general director must approve by order. Its presence will not only allow the deputy chief accountant to understand the range of his duties and responsibilities, but may also become a key reason for terminating the contract with this specialist. This procedure is the same, both in relation to the job description of the deputy chief accountant of any LLC, and for the instructions of the deputy in a budgetary institution.

Next, you can see the job description of the deputy chief accountant in the form of its main structural elements. It is as close as possible to the professional standard of this profession.

Basic requirements for a deputy chief accountant

The main requirements for candidates for the position of deputy chief accountant relate to the applicant’s professional skills and existing education. Typically, deputies are subject to the same requirements as the main specialist managers. So, according to Art. 7 of Law No. 402-FZ “On Accounting” dated December 6, 2011, the chief accountant must have a higher economic education and at least 5 years of work experience related to accounting. In relation to a deputy, the requirements may be reduced at the discretion of the employer, but their mitigation, as a rule, concerns only length of service.

Also among the requirements it is usually mentioned that an applicant for the position of deputy chief accountant must know:

- accounting legislation;

- basics of civil, financial and tax legislation;

- methodological, regulatory documents and instructions on the organization of accounting and reporting;

- rules for conducting inventory, inspections and documentary audits;

- procedure for processing accounting transactions;

- internal documents of the organization;

- basics of labor legislation.

In addition to the above, employers' requirements for candidates for the position of deputy chief accountant may include additional knowledge and skills of the applicant. For example, the work of a modern accountant is impossible without the use of a computer, so experience with a specific accounting program may be added to the list of requirements. Some organizations also state in their requirements knowledge of a foreign language (usually English).

Job responsibilities of Deputy Chief Accountant

The “Job Responsibilities” section indicates the employee’s responsibilities based on the tasks and functions of the structural unit (accounting), and sets out in detail the main areas of activity of the deputy. chief accountant.

This section may also list the employee’s responsibilities that are assigned to him in accordance with the practice of distributing other responsibilities adopted in the structural unit (accounting) and performed based on the decision of the head of the organization.

The “Job Responsibilities” section is developed taking into account section 3.2. Professional standard for an accountant “Generalized labor function”.

For example:

The “Rights” section lists the rights of the deputy chief accountant established by law and local acts of the organization in relation to management, subordinates, other structural units of the organization and third-party institutions on issues related to the competence of the deputy. chief accountant. In this section, you can record the employee’s right to training, development, career growth, participation in professional associations and other public organizations permitted by Russian legislation.

For example:

Sometimes there is a separate “Relationships” section, for example:

To perform his functions and exercise the rights provided for in these instructions, the Deputy Chief Accountant interacts in his work with:

- With the chief accountant on issues: ...

- With heads of structural divisions on issues: ...

- With accounting employees regarding: ...

- With commercial banks on issues: ...

- With audit firms regarding: ...

The “Responsibility” section indicates the level of responsibility of the deputy chief accountant for failure to fulfill or improper fulfillment of official duties and requirements of Russian legislation. In this section of the job description, it is recommended to clarify in what cases (failure to perform or improper performance of job duties specified in the instructions; violation of the legislation of the Russian Federation and the norms and requirements established in the PVTR and other local regulations) a disciplinary sanction may be applied to the deputy chief accountant (remark, reprimand, dismissal for appropriate reasons).

For example:

Guide to professional standards

By default, the organization itself decides what to demand from a person in the position of deputy chief accountant. At the same time, she starts from her own:

- areas of activity;

- scale (for example, small business, “special regime”, medium-sized LLC);

- internal device;

- staffing levels;

- control mechanism, etc.

Keep in mind: today it is no longer enough to simply download the job description of a deputy chief accountant. But we have solved this problem for you. Now, when filling out the job description of a deputy chief accountant of the 2021 sample with responsibilities and other things, the company must periodically correlate this with the professional standard “Accountant”. It was approved at the end of 2014 by order of the Ministry of Labor No. 1061n. But when exactly? And when the qualification requirements for the labor function of the chief accountant (we are talking only about it!) are presented by:

- Labor Code of the Russian Federation;

- other federal laws;

- other regulatory documents of the Russian Federation.

Only in this case should you keep this professional standard in mind. Then a job description for a deputy chief accountant with qualification requirements from the professional standard will be the right decision. Also see “Professional standard for an accountant: how and why to apply it.”

Let us remind you that this professional standard only mentions the position of chief accountant. But basically we are talking about an accountant in a general sense. In addition, the Accounting Law equates to chief accountants persons who are also entrusted with accounting. This means that when the law talks about the chief accountant, it also means his deputy. Here is an illustrative example from this law:

The Accounting Law says nothing about the skills and knowledge of the deputy chief accountant. Consequently, what is written about this in the professional standard does not have to be included in the sample job description of the deputy chief accountant .

Keep in mind: absolutely any organization can take the professional standard “Accountant” as a guideline when developing its requirements for a deputy chief accountant in terms of experience, skills, abilities, etc. There are no restrictions in the legislation on this matter.

It should be noted that the practical application of the new professional standard has already begun to raise many questions. The main thing is when you can and when you need to use it. The Ministry of Labor periodically tries to resolve controversial issues.

ADVICE Pay attention to the Qualification Directory of Employee Positions, approved by Resolution of the Ministry of Labor dated August 21, 1998 No. 37. It will tell you how to competently select and exploit labor resources. This document is also universal and recommended for everyone - from private business to the public sector. For example, when drawing up a job description for the deputy chief accountant of a school.

The following is a specific job description for the deputy chief accountant based on the professional standard. job description.

Read also

09.12.2017

Qualification requirements for a deputy chief accountant

The “Qualification Requirements” section is being developed taking into account the Professional Accountant Standard; it includes the requirements of the 6th qualification level:

- Education and training: higher or secondary vocational, as well as additional vocational education (programs for advanced training and/or professional retraining);

- Practical work experience: at least 5 years out of the last 7 calendar years of work related to accounting, preparation of accounting (financial) statements or auditing activities (if you have a higher education, then at least 3 years out of the last 5 calendar years);

- List of what the deputy The chief accountant must know and be able to;

- The deputy chief accountant may be subject to special conditions for access to work.

For example:

Comments on the post

The above qualification characteristics of the position “Chief Accountant” are intended to resolve issues related to the regulation of labor relations and ensuring an effective personnel management system in various organizations. Based on these characteristics, a job description for the chief accountant is developed, containing the rights and responsibilities of the employee, as well as a specific list of his job responsibilities, taking into account the peculiarities of the organization and management of the activities of the enterprise (institution).

When drawing up job descriptions for managers and specialists, it is necessary to take into account the general provisions for this issue of the directory and the introduction with general provisions for the first release of the directory of positions.

We draw your attention to the fact that the same and similar job titles may appear in different editions of the CEN. You can find similar titles through the job directory (alphabetically).

From this article you will learn:

Drawing up a job description for a deputy chief accountant is not a mandatory procedure for the employer. Article 57 of the Labor Code of the Russian Federation provides for the requirement to include the employee’s labor function as one of the mandatory conditions of the employment contract.

Each employer determines independently whether it is necessary to draw up job descriptions. It should be remembered that a job description helps to more effectively manage personnel.

What is the job of a deputy chief accountant?

We can say that the deputy chief accountant is a second-level manager. His functions do not include solving problems of managing the organization or even one of its structures, but nevertheless there is a small division under his subordination. Managing the financial flows of an enterprise and making management decisions is the responsibility of the chief accountant. He is also responsible for the activities of the accounting department to management. And the deputy carries out routine operations - ensures the implementation of assigned tasks, monitors reporting deadlines, prepares the necessary documents, etc.

In large companies, a separate deputy chief accountant may work in each area.

The deputy chief accountant manages several ordinary accountants, entrusting them with solving current tasks and monitoring their implementation. In addition, he can take on the responsibilities of the chief accountant if he is temporarily absent from the workplace.

To make it more clear how the functions of the chief accountant and his deputy differ, you need to study their job descriptions - it clearly states what each of them should do and what rights they have. It is worth noting that the range of job responsibilities depends not only on the position held, but also on the specifics of the enterprise.

Job descriptions are internal documents, and therefore companies develop them independently. However, it is recommended to adhere to the structure that is accepted in personnel records management. The employer is allowed to include in the job description any information that he considers necessary. But if the head of the company follows the recommended structure, then all the nuances will be taken into account and not a single important point will be missed. Typically, a job description consists of 3-4 sections:

- General provisions . They specify the requirements for applicants (level of education, work experience, etc.), the procedure for employment, dismissal and replacement of an employee. Also, general provisions determine the place of the position of deputy chief accountant in the structure of the organization and assign to him a direct supervisor - the chief accountant.

- Job rights and responsibilities (this part of the instructions can be divided into two more) . This is a key section; it contains a description of all the responsibilities and rights of the employee. Special attention must be paid to the development of this section, because employees must perform only those functions that are established for them by the job description, and have the right to refuse any assignments that go beyond the requirements set out in this document.

- Employee responsibility . This section describes the violations for which the employee must be held accountable and the sanctions applied in a given situation. At the same time, the severity of punishment for disciplinary violations cannot be higher than that provided for by labor and civil legislation. This also applies to financial responsibility. And administrative and criminal offenses should not be punished more harshly than required by the Code of the Russian Federation on Administrative Offenses and the Criminal Code of the Russian Federation, respectively.

The job description must also indicate when it was approved and by whom. As a rule, this information is placed at the beginning of the document (in the upper right corner) and a line is left next to it for the signature of the manager who approved this instruction.

What is the purpose of the job description?

When hiring a new employee or transferring an employee of an enterprise to a new position, he must be familiarized with the responsibilities that he will have to perform in his new position. This is necessary, first of all, in order to establish one of the main subjects for which an employment contract is concluded - the labor function of the employee.

A document called a job description serves this purpose. In terms of content, it turns out to be broader than a simple list of responsibilities, since it usually also includes determining the employee’s place in the hierarchy of the relevant department, listing the requirements for his level of qualifications, and also defines the rights associated with the performance of official functions and responsibilities.

The obligation to draw up a job description is not established by law, but in reality this document is needed for both the employer and the employee. It allows the employer to:

- clearly describe the responsibilities associated with a specific position;

- remove the problem of drawing up individual requirements when searching for a suitable candidate for a position;

- facilitate the process of introducing a new employee (or employees) to his job functions.

- control how well a particular person copes with the job;

- hold him accountable for failure to fulfill his official duties.

At the same time, the employer is interested in the fullest possible reflection in the instructions of the real functions performed by the employee, since the latter has the right to refuse to perform additional work and the right to demand additional payment for work that is not part of his duties.

All this, while not formally mandatory, makes the job description a very important and necessary document, the drafting of which should be approached with special care.

Deputy function options

Depending on the characteristics of the structure of the organization whose employee is the deputy chief accountant, the following options for his functions are possible:

- The organization is part of a holding, and all chief accountants of the companies that form this holding report to the chief accountant and are called his deputies. At the same time, the deputy chief accountant of the holding essentially remains the chief accountant of his organization and performs all his functions in full.

- The deputy chief accountant is an employee of the large accounting department of a large enterprise. In this case, as already described above, he will, while performing part of the accounting work himself, monitor that the accounting department conducts its work in accordance with the requirements of the accounting policy established in the organization, sign part of the current primary documents and periodically replace the chief accountant during his absence. The duty of substitution for such a situation is usually included in the job functions of the deputy.

- In a small organization with a small accounting department, an employee can be appointed deputy chief accountant who performs his functions almost equally with the chief accountant in terms of approvals, signatures, and reporting. At the same time, organizational issues, methodology and accounting policies remain the prerogative of the chief accountant, and accounting work is divided evenly among everyone, including the chief accountant.

Thus, the scope of responsibilities of the deputy chief accountant in different organizations may vary significantly. Therefore, they must be clearly stated in the job description.

How to correctly make changes to the job description of a deputy chief accountant?

Any change to the job description of the deputy chief accountant is made by order of the head of the organization. All changes made are agreed upon with the chief accountant and other interested parties.

In case of changes to the terms of the employment contract determined by the parties, an agreement with the employee should be drawn up in writing (Article 72 of the Labor Code of the Russian Federation).

Changes are communicated to the deputy chief accountant against signature.

30.11.2017

When a deputy chief accountant is required to replace higher management

The deputy chief accountant has a great responsibility. Any deputy chief accountant, especially if there are no other deputies in the company, must, if necessary, take on the functions of his manager. This responsibility must be specified in the job description and other regulations that define the functionality of the deputy chief accountant. The transfer of the duties and powers of the chief accountant to his deputy is possible in the following cases:

- Vacation of the head of the accounting department . The exercise of the right to rest should be available to every employee, regardless of what position he occupies and what level of his responsibility.

- The head of the accounting department is on a business trip . Since the chief accountant bears great responsibility, he may be sent on various business trips to deliver the necessary papers, participate in negotiations or court hearings.

- Absence of the chief accountant from the workplace due to illness . While the chief accountant is on sick leave, his responsibilities are transferred to the deputy, so as not to delay the resolution of important issues.

If vacations and business trips are planned in advance, and the deputy has the opportunity to prepare to perform the functions of the chief accountant, then, as a rule, people go on sick leave unexpectedly, so quite high demands are placed on applicants for the position of deputy chief accountant.