What is a collection order?

A collection order is a document that is provided directly to the debtor’s bank if there is an undisputed basis for collecting funds. Collection can be issued as a counterparty

in accordance with the clauses of the agreement, and by

the tax authorities

according to the law.

A mandatory condition is to notify the counterparty - the debtor - of the existence of an overdue debt before issuing collection. Such notice must specify the time limit for fulfilling the obligation to pay the amount without compulsion. If the debtor does not make payment independently within the specified time, then a collection order may be issued to his bank with the obligatory indication of a clause of the agreement or an article of a certain law

.

supporting documents from him

indisputable recovery (agreement or annex to it).

Tax authorities issue a collection order based on certain articles of the Tax Code, depending on what tax or fee has not been paid. In addition, the collection order issues the unpaid amount of fines and penalties.

Banks, in accordance with paragraph 1 of Article 60 of the Tax Code of Russia, are obliged to fulfill these instructions in the first place

. Also, the procedure for executing collection orders is prescribed in the Regulations of the Central Bank dated 07/06/2017 No. 595-P “On the payment system of the Bank of Russia”. That is, a block is placed on the amount indicated in the collection. If there are not enough funds on the current account to write off, the account is blocked until the bank is able to write off this amount in full.

Tax authorities have the right to demand additional clarification from the bank:

- about the write-off amount;

- why the collection order was not written off;

- balance of funds in the current account of the taxpayer-debtor and others.

Before issuing collection to the bank, tax authorities are required to notify the taxpayer of the obligation

on payment of tax. To do this, through electronic communication channels (if available) or through Russian Post, the Federal Tax Service sends a request for tax payment. It looks something like this:

Only after the formation of such a requirement and after the period specified in it has passed, the tax authority has the right to issue a collection to the bank and a decision to suspend transactions on the accounts

.

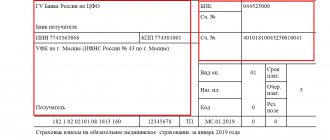

Payment document form

The collection order, form 0401071, is approved in Appendix 4 to Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds.” The structure of a payment collection document is similar to a payment order form.

The key difference between collection orders and payment requests is that a payment order is an order from the payer to write off money from his account in favor of the recipient. During collection, the payer's money is withdrawn by order of the recipient.

Collection on an additional account: what can be done and how to avoid a repeat situation

So, the Federal Tax Service issued a demand for tax payment, but the organization did not pay it on time. Next, the tax authorities review information on open accounts

legal entity or individual entrepreneur in all banks in Russia.

Information on opening and closing current accounts is provided to the Federal Tax Service

and is updated in a timely manner by financial institutions without the participation of the client himself.

If a company has only one account, there are no problems. The tax authorities send a decision to suspend transactions on the current account to the taxpayer-debtor, and a collection order to the bank. The solution looks like this:

The collection order is not sent to the legal entity (debtor) itself either by the Tax Service or by the bank

. That is, the taxpayer will not be notified about which account the money will be written off from.

The presence or absence of blocking on the account can be checked

on the website of the Federal Tax Service of Russia at this link. To check, you need to select the “Request for current decisions on suspension” type from the list provided, indicate the TIN of the legal entity and the BIC of the bank (any bank in which the company’s account is opened). The form looks like this:

A controversial situation arises if an enterprise or individual entrepreneur has several open current accounts. In this case, decisions to suspend operations

according to the current account are issued to all accounts, and collection - only to one bank.

And if the collection order was generated for an additional account in which there is no money or there is not enough money for payment on demand, then a controversial situation arises: what to do in this case?

It is worth noting that collection cannot be withdrawn by the tax authorities

, if payment has not been made.

There are only 3 possible solutions:

- contacting the Federal Tax Service to generate a new collection order;

- replenishment of an additional current account for the collection amount;

- payment of the amount of the enterprise's debt by the business owner or other legal entity.

In the future, to avoid such situations, it is better for the company to write an official letter in free form

, in which to indicate which current account of the legal entity is the main one and to which all possible collection orders must be issued. This document can be issued on the official letterhead of the enterprise, if available. The letter must be registered both with the company and with the tax authority, so it is issued in 2 options (one option remains with the Federal Tax Service, the second with a mark of acceptance - with the legal entity). The document is signed by the manager or an authorized person and stamped (if any).

Sequence and procedure for issuing tax orders

There are provisions regulating the procedure for collecting debts for arrears and taxes.

For arrears in relation to each type of tax, a separate requirement is raised, since each type of tax has its own BCC, and if an overpayment occurs (for example, an overpayment for personal income tax), then it can be refunded.

How to correctly draw up an application for a refund of excess tax - read this article.

Writing off a collection order

The collection order is written off if all the necessary papers are available, confirming the indisputability of such a decision and the fact of independent non-payment of debts or the use of acceptance, while the provision on responsibility for the safety of the client’s account balances remains in force, and if the bank made the write-off without checking the thoroughness of the authority collector, he is responsible for unlawful actions in relation to the client’s accounts.

Contacting the Federal Tax Service to generate a new collection order

As previously stated, the company will not know to which account the collection order was issued

until he notices that the account is blocked and funds (if any) are not debited.

If such a situation arises in practice, then the responsible person needs to call the local Federal Tax Service inspectorate (the telephone number is indicated in the decision to suspend account transactions or in the request for tax payment). Using the TIN of the legal entity, a tax specialist will announce to which bank the collection was sent

.

The tax authority may refuse to reissue a collection order, since tax legislation does not require it to do so.

Sometimes (in isolated cases)

) The Federal Tax Service agrees to issue a second collection to another bank or draw up a letter redirecting a previously issued order from one bank to another. For example:

- provided that this situation occurred for the first time;

- the tax authority has a letter containing the details of the main current account;

- the amount of the collection order is large and others.

It is worth noting that tax officials are “reluctant” to reissue instructions. Most often, they ask to pay the claim in person or to top up the current account to which the collection was issued. But still practice shows that this is possible

.

In 2021, it will be easier for inspectors to collect debts

From June 1, 2021, if inspectors did not have time to issue a collection, the entire procedure from going to court to collecting the debt will take two months. This applies to debts whose amount does not exceed 100,000 rubles. (Part 3 of Article 229.2 of the Arbitration Procedure Code of the Russian Federation).

Having received an application from the inspectorate, the judge issues a court order within 10 working days. There is no need for any proceedings to summon both parties. Only a single decision of the court (Part 4 of Article 229.5 of the Arbitration Procedure Code of the Russian Federation). Next, five working days are allotted to send the order to the debtor. And the debtor is given 10 working days to file his objections. After another 10 working days, the court order comes into force. Based on it, bailiffs will collect debts on their own.

Replenishment of an additional current account for the collection amount

If the tax authority refuses to meet the debtor halfway (and formally the Federal Tax Service has the rights

!), then there is nothing left to do but replenish an additional current account. It can be done:

- by depositing cash into the account;

- by means of non-cash transfer from the main account (if available);

- issuing invoices to counterparties with other details.

But each of the above methods has its disadvantages. Deposit cash

only possible if they actually exist. If the company is in a difficult financial situation, then it is also necessary to find or collect this amount. To do this, proceeds can be withdrawn from the company’s cash desk (if any), or a loan or loan can be issued from the business owner or manager. If the amount of unpaid taxes is large, then it may take a long time to collect the amount to pay the tax. Applying for a loan to a legal entity is a long process. In addition, the company must have large turnover in the account for the previous year.

The second option is to transfer money from the main account

. Most often, if a company failed to pay a tax or fee on time, it means that it does not currently have this amount. Otherwise the tax would have been paid.

It is worth noting that when a decision is made to suspend operations on an account, the collection amount is blocked on all of the company’s accounts and debited from only one. That is, the organization has the right to manage money the amount of which exceeds the blocking.

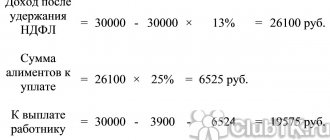

Example: The Federal Tax Service has blocked transactions on current accounts. The collection amount is 50 thousand rubles. One of the company’s accounts contains 65 thousand rubles. What amount is the LLC entitled to use?

The enterprise has the right to dispose of only 15 thousand rubles, since 50 thousand will be blocked until the collection amount is debited from the current account to which the collection order was issued.

The last option is issuing invoices to counterparties with other details

for payment. The main disadvantages here are time and additional documents. The organization needs to notify the buyer that their details for payment for goods, works or services have changed in a separate letter, which is sent either immediately when the details are changed, or together with a posted invoice for payment.

If in the future the company wants to issue invoices to counterparties using the old details, then you will have to draw up a repeat letter

.

Is it possible to revoke a bailiff's order if the principal amount has been paid?

Hello. The supplier filed a lawsuit demanding repayment of the debt, payment of penalties and reimbursement of state fees. We paid off the debt, reimbursed the state duty, but do not agree to pay penalties. We filed a request to the appeal court to reduce or cancel the amount of the penalty. The Court of Appeal did not support us. We would like to submit it to the cassation office. The bailiffs have already issued a collection order to our account for the entire amount (debt, penalties, state duty), although we paid the debt and state duty to the supplier. Can we revoke the bailiffs' collection order for the entire amount, given that we do not agree with the amount of the penalty and will appeal in cassation?

Lawyers' answers (2)

The bailiffs need to take documents about the amounts that you have already paid, they will revoke their arrest order for this amount.

As for the fines, the bailiffs have no reason to revoke the arrest for the amount of the fines, since the court decision has entered into legal force and is subject to mandatory execution. Try to use the court to prohibit the debiting of funds from your account until the cassation appeal is considered on the merits.

- 10.0 rating

- 5023 reviews

You have the right to challenge the decision of the bailiffs regarding the principal amount of the debt in the order of subordination and in court after providing the bailiffs with evidence of payment of the debt.

Federal Law of October 2, 2007 N 229-FZ (as amended on December 28, 2016) “On Enforcement Proceedings”

Article 123. Filing a complaint in the order of subordination 1. A complaint against a decision of a bailiff or a deputy senior bailiff, with the exception of a resolution approved by a senior bailiff, against their actions (inaction) is submitted to the senior bailiff, under whose subordination the bailiff is located. executor or deputy senior bailiff.

Article 124. Form and content of a complaint filed in the order of subordination 1. A complaint against a decision of an official of the bailiff service, his actions (inaction) is submitted in writing. The said complaint must be signed by the person who filed it or his representative. The complaint signed by the representative must be accompanied by a power of attorney or other document certifying the authority of the representative. 2. The complaint must indicate: 1) the position, surname, initials of the official of the bailiff service, the resolution, actions (inaction), the refusal to perform whose actions are being appealed; 2) last name, first name, patronymic of the citizen or name of the organization that filed the complaint, place of residence or place of stay of the citizen or location of the organization; 3) the grounds on which the decision of the official of the bailiff service is appealed, his actions (inaction), refusal to take actions; 4) the requirements of the person filing the complaint. 3. The person who filed the complaint may not submit documents that confirm the circumstances specified in the complaint. If the presentation of such documents is important for the consideration of the complaint, then the official of the bailiff service considering the said complaint has the right to request them. In this case, the period for consideration of the complaint is suspended until the requested documents are submitted, but for no more than ten days.

Article 126. Time limit for consideration of a complaint filed in the order of subordination 1. A complaint filed in the order of subordination must be considered by an official of the bailiff service authorized to consider the said complaint within ten days from the date of its receipt. 2. The court’s acceptance for consideration of an application to challenge a decision, actions (inaction) of an official of the bailiff service suspends consideration of the complaint filed in the order of subordination.

Article 128. The procedure for challenging decisions of officials of the bailiff service, their actions (inaction) 1. Resolutions of an official of the bailiff service, his actions (inaction) on the execution of a writ of execution may be challenged in an arbitration court or a court of general jurisdiction in the manner established by the procedural legislation of the Russian Federation, taking into account the specifics established by this Federal Law.

Payment of the company's debt by third parties

There is another possible course of action - payment of tax by another person. Moreover, it does not matter from whom the payment comes (from an individual or a legal entity). The main thing is that the purpose of the payment must indicate: “payment of tax... for (period) for Romashka LLC TIN/KPP...”.

Despite the fact that the payer will be another person, the Federal Tax Service will determine the payment based on the information specified in the “Purpose of payment” field.

If the taxpayer-debtor decides to take this option, then immediately after the payment has been made, contact the tax service and notify that the payment of the tax or fee was made by another person (name of the enterprise or last name, first name and patronymic, who made the payment, TIN and checkpoint if available). You can also send a payment order to the Federal Tax Service to confirm payment.

Russian legislation has made it possible to pay taxes and fees for third parties from the end of 2021

, when Part 1 of Article 45 of the Tax Code of Russia was changed. Payment can be made through the special service “Payment of taxes for third parties” on the Federal Tax Service website.

If the tax payment was made by third parties, you should pay attention to documentary evidence of this transaction. If this is gratuitous assistance from the owner, then an appropriate agreement must be drawn up. If the parent organization or an interdependent person paid, then the payment of tax must be reflected in the reporting in accordance with the rules of PBU. Otherwise, a number of questions may arise

from the Federal Tax Service specialists.

Topic: How to revoke a tax collection

Quick link Documentation and reporting Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General accounting

- Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Software for accounting and tax accounting

- Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange

- Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums

- Interview

- Simple as a moo

- Author's forum Goblin_Gaga

- An accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences

- Internet conferences

- Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive

- FAQ (Frequently Asked Questions)

- FAQ: Frequently asked questions about accounting and taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

What to do if there are errors in the payment?

As mentioned earlier, a payment order for debiting and transferring funds is most often issued by the owner of a bank account either to repay current obligations to the budget or to make any payments in favor of counterparties.

Of course, the payment document executed by the servicing bank must be drawn up correctly and contain all the necessary details. How to fill out a payment order correctly?

If there are any inaccuracies in the payment order, the transferred funds may not reach the intended recipient.

Typical errors often made when processing payment orders include: overpayments, which imply the possibility of a partial refund of the funds paid, and underpayments, in which it is practiced to either deposit additional amounts or offset a previously made overpayment.

If the requested payment has not yet been executed and is being processed by the bank, the payer has the right to prepare a clarifying document and send it to the operational department of the servicing financial institution.

As practice shows, the following mistakes are most often made by the drafters of payment orders:

- The TIN code is indicated incorrectly. If the remaining information is true, the payment order will be executed; you will not need to specify the details.

- An incorrect basis for making a payment is indicated. This error is not significant. The money will still arrive to the recipient. It is recommended to establish contact with the recipient of the funds - his response is supplemented by clarifying the basis for the payment.

- For the recipient of the money who is under a special tax regime (for example, the simplified tax system), the VAT amount is allocated in the payment order. If the counterparty does not pay VAT, this error must be corrected by sending a clarifying letter to the bank servicing the payer. The payer's bank sends a corresponding notification to the recipient's bank.

- Incorrect indication of the purpose of the payment being made. The servicing bank should be notified of this inaccuracy.

- Indication of incorrect information about the counterparty - the recipient of the money. For example, the addressee’s details have already changed, and the payment order contains outdated information. In this case, the transferred funds are retained by the servicing bank until the data is properly clarified. The first option to solve the problem is to send a clarifying letter to the bank. The second option is to wait for the refund of the paid funds (on the sixth day) and issue a new payment document with the correct data.

How to recall an erroneous document from the bank?

Clients of financial institutions who make non-cash payments are often interested in the possibility of revoking a payment order that has already been submitted to the servicing bank for execution.

The official regulatory act - the Regulations on non-cash payments in the Russian Federation - clearly provides for this option.

A payment document revoked by a bank client is necessarily returned to the sender of the money - the owner of the bank account.

A clear regulated period has been established during which a client of a financial institution is allowed to cancel a payment transaction and return the corresponding order.

Thus, withdrawal of a payment order is allowed within 10 (ten) days, counted from the date of transmission of this document to the servicing bank.

The payer – the owner of the bank account – can complete this procedure in one of two available ways:

- Through the appropriate online banking option.

- Using the special functionality of the Client-Bank system.

Cancellation via the Client-Bank system

Many bank account holders use the Client-Bank system to make non-cash transfers. This tool allows you to manage your bank account remotely.

The user of this system has the ability to remotely (via the Internet) generate, execute and revoke payment orders.

Canceling a payment order using Client-Bank is performed as follows:

- Open a complete list of payment documents issued by the account owner recently. In this case, you must indicate the appropriate category - payment order.

- In the list of selected documents, you need to find and select exactly the payment that should be cancelled. Using the system functionality, for this order you need to activate the cancellation (revocation) option.

- When the option to cancel a payment document is selected, the user will need to compose a cover letter. This procedure is mandatory. She plays an important role in solving the task.

In what cases can you cancel - reasons

The cover letter generated when canceling a payment order should indicate the reason for the requested revocation. As a rule, in these cases a standard list of possible grounds is used.

This may be an incorrect transaction amount, an error in the purpose of the payment transaction, or other probable reasons. It should be noted that for the servicing bank the real reason for canceling the payment is not significant.

It is important that the client must indicate the motivation for withdrawing the order in the cover letter.

Final steps

Once the cover letter with the reason for cancellation is completed, it should be properly stored in the Client-Bank system.

If this is not done, the bank manager will not receive a comment explaining the reason.

This means that the request to revoke the payment will not be executed.

Having correctly completed the application and cover letter, the user goes to the prepared requests tab and sends the required request for consideration to the servicing financial institution.

An application to cancel a client payment is immediately sent to bank employees. Its consideration may take some time. The applicant must periodically check the status of the submitted request.