The leasing agreement provides for the conditions for the transfer of property for use or temporary possession to the lessee, with or without the transfer of ownership rights. It also defines the main aspects of the transaction - the possibility of purchasing the object into the ownership of the recipient company upon completion of the contract or before its expiration, the redemption price of the asset, etc.

In practice, there are 2 methods of purchasing leased property:

- Upon expiration of the contract, a lump sum payment of the agreed redemption value (there is also the possibility of early payment of the redemption value of the asset);

- By making periodic advances as part of leasing payments.

The accounting support of transactions in the lessee's accounting depends on whose balance sheet the leased object is accounted for - the lessor or the recipient of the property, as well as how the redemption value is indicated in the agreement. Let's figure out how to reflect the repurchase of leased property in accounting.

Reasons for early repurchase of the leased asset

In relation to loan agreements, early repayment is a fairly common occurrence. In this case, the bank must recalculate, but in the case of leasing the situation will be somewhat different. The possibility of early repayment of leased property exists and there may be completely different reasons for this, for example:

- The company has available funds and wants to reduce overpayments. It should be remembered that without additional approvals, it is not always possible to recalculate interest under a leasing agreement.

- The leased property must be urgently transferred to the ownership of the organization. Such a need may arise, for example, in the event of a sale of a company or when concluding transactions related to a company takeover or merger.

- The conditions for using the property have changed. As a rule, the leasing agreement specifies clear conditions for limiting the use of the leased property. For example, when transferring such property to a third party, it will be necessary to obtain approval from the lessor or to purchase the property.

Important! The lessor can also act as the initiator of the early repurchase of the leased asset. For example, this is possible if there is a significant deterioration in the financial situation of the lessee.

Calculation of leasing payments

The leasing payment will be calculated every month. To do this, we will create a document “Receipts (acts, invoices) with the type of operation “Leasing services”.

In the document:

- We indicate the date and organization.

- We choose a lessor and a contract.

- In the “Settlements” section, we will set the account for settlements with the counterparty 76.07.2 “Debt on leasing payments”. We leave the advances accounting account at 60.02.

- In the tabular section, select the item and indicate its cost. In the example, the leasing payment is 50,000 rubles.

Posting a document.

Payments in subsequent months are calculated in the same way.

Early repurchase of the leased asset at the initiative of the lessee

In most cases, it is the lessee who initiates the early repurchase. But at the same time, it should be remembered that the minimum period for leasing is 12 months and if less time has passed from the moment of concluding the contract to the full redemption, then this moment must be taken into account when calculating taxes.

The main part of the concluded leasing agreements stipulates that in the event of early redemption of the property, the lessee is obliged to pay all the interest that was initially provided for in the agreement. In other words, in this case there will be no savings from early redemption. The only solution in this case may be to carefully study the terms of the contract and agree on its individual terms with the lessor.

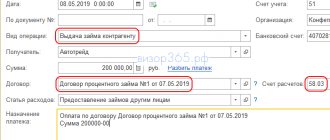

Payment of leasing payment

To pay the lessor, we will create a document “Write-off from current account” with the transaction type “Payment to supplier”.

Under the terms of the agreement, we pay the lease payment amount of 50,000 rubles, as well as part of the redemption price of 5,555.55 rubles. (RUB 200,000 / 36 months).

Let's look at the document postings.

- According to Dt 76.07.2, leasing debt will be gradually repaid.

- According to Dt 60.02, an advance on the redemption value of the property is reflected.

Payments are made in the same way in subsequent months.

Termination of a leasing agreement at the initiative of the lessor

The main thing that is worth noting is that it is not at all profitable for the leasing company to terminate the leasing agreement early. Her goal when purchasing the property was to transfer it to a specific person, and it will be difficult to find and transfer the property to another lessee. Selling such equipment or real estate will take a lot of time and will not generate income.

However, in some cases, the lessor is still forced to terminate the contract with the lessee on his own initiative unilaterally.

Such a decision can be made if the lessee has delayed payment for a period exceeding 2 months. In addition, the client is also late in payment or insurance payments.

Typically, a leasing company offers its client to repay the debt early by purchasing the property at its residual value. If the client refuses to do this, then the lessor has the right to simply seize the property.

Important! In order for the lessor to have the right to terminate the leasing agreement early, he must have sufficient grounds for this. Desire alone will not be enough.

What is a lease early repayment letter?

A letter of early repayment is a document notifying the lessor of the desire of the other party to terminate the relationship early. It can be sent:

- on a personal visit;

- by registered mail;

- by email with digital signature.

Rules for writing a letter:

- For an individual, it is permissible to use a blank sheet of paper, for legal entities - only a company letterhead.

- In the upper right corner the addressee's details are indicated: position, name of organization, full name of the head, legal address.

- The title of the document “Appeal” is written below.

- The main text begins with the wording “Dear...”. After which the main idea about the desire for early repayment is stated.

- Mandatory items that should be indicated: number of the leasing agreement, information about the property leased, reason for early repayment.

- At the end, the date of drawing up the document and the signature of the lessee are indicated.

Valid reasons that can be indicated in a letter:

- the emergence of free funds;

- changing the rules for using property;

- urgent need to transfer the vehicle into the ownership of a legal entity;

- other economic reasons.

Procedure for early redemption of property

The procedure for early purchase of property is quite common and leasing companies have developed a certain mechanism for it. It is represented by several stages of redemption:

- The client sends a request to calculate the amount for early repayment. He also notifies the company that he plans to redeem the property ahead of schedule and names the expected date. A request is made in writing, the form of which can be requested from the manager of the leasing company.

- Having received the request, the leasing company’s employees make calculations and prepare an additional agreement to the leasing agreement. At the same time, the agreement provides for all the necessary conditions for further avoidance of disputes between the parties.

- The lessee pays the total amount to the lessor's account. This should be done before the date that was agreed upon.

- The last stage is the registration of the transfer of the leased asset to the recipient. The conditions and terms for the transfer of rights to property are also stipulated in the additional agreement. Sometimes they may be provided for in the main leasing agreement.

Depreciation calculation

Every month, at the end of the month, depreciation on the leased property is automatically calculated.

In postings, depreciation is taken into account on account 02.03.

Also, at the close of the month, leasing payments are recognized in tax accounting.

Features of early redemption of the leased asset

All leasing companies are aimed at obtaining benefits from the conclusion of each transaction. Therefore, when drawing up a leasing agreement, they include conditions that make it difficult for clients to buy out the leased asset early . You may encounter problems when the contract:

- A moratorium on early repayment has been established. It is usually set for 12 months from the date of conclusion of the contract. This allows you to make a profit, as well as eliminate the situation when the transaction is recognized by the tax authority as imaginary and tax is charged.

- Additional costs for early redemption. The leasing company does not want to give up its profits, so it tries to stipulate in the contract a commission that includes the company’s expenses.

- Increased purchase price. Under such conditions, any deviations from the contract lead to the redemption price increasing.

Accounting for the leased asset on the lessee's balance sheet in 1C: Enterprise Accounting 8

Published November 28, 2015 10:07 pm Author: Administrator Leasing always presents certain difficulties for an accountant. Especially many questions arise when accounting for the leased asset on the lessee’s balance sheet. In this article we will try to figure out how to work with the new features of the 1C: Enterprise Accounting 8 program in this situation. Currently, the program automates such operations as the receipt of property under lease, its acceptance for accounting, the calculation of depreciation on it, the reflection of current leasing payments, including the write-off of VAT on these payments, as well as the repurchase of property received under lease.

The first operation is reflected in the document “Receipt of leasing”. To go to the document, select the “OS and intangible assets” section.

In the selected document you will need to indicate the amount of all payments under the leasing agreement, that is, the full cost together with the redemption amount.

You will also need to note the accounts for accounting for rental obligations and accounting for VAT on rental obligations. After all, if you pay attention to the chart of accounts, you will notice that it has been replenished with sub-accounts for accounting for transactions with leased property, including transactions in foreign currency and in conventional units.

When posting the receipt document, entries will be generated to the debit of the non-current assets account and deferred VAT will be generated. It is important to note that ownership of leased property does not transfer. No invoice will be issued for this transaction.

To put an object of fixed assets into operation, we refer to the document “Acceptance for accounting of fixed assets”, which is located in the same section “Fixed assets and intangible assets”.

How does this acceptance differ from ordinary acceptance for accounting? Firstly, the method of receipt is “Under a leasing agreement.” That is, on the “Non-current asset” tab, you need to select the value “Under a leasing agreement” in the “Method of receipt” field. Based on this action, the details “Counterparty” and “Agreement” will appear, which also need to be filled out - this is the second difference in the document. “Counterparty” in this case is the lessor, and “Agreement” is the leasing agreement.

Thirdly, accounting accounts. On the “Accounting” tab, the accounting account (01.03) is indicated, as well as accrual parameters and the depreciation account (02.03).

Fourthly, the tax accounting amount is the amount of the lessor's expenses. Therefore, on the “Tax Accounting” tab, we indicate the initial cost for tax accounting purposes. This cost is the amount of the lessor's expenses for the acquisition of the leased asset. It is also necessary to fill out the method for reflecting expenses for leasing payments and do not forget about the parameters for calculating depreciation. Based on the fact that the property is listed on the lessee’s balance sheet, then in the “Procedure for including cost in expenses” field, “Accrual of depreciation” is indicated, and the “Accrue depreciation” flag is set.

When this document is posted, we receive a reflection of the initial cost of the property that was leased in the debit of account 01.03. According to accounting, the cost will be excluding VAT, and according to tax accounting, it will be the amount of the lessor’s costs. On the debit of account 01.K we will see the difference between the initial cost of the leased asset in accounting and accounting records, and account 08.04 will be closed.

As for subaccount 01.K “Adjustment of the value of leased property”, it takes into account the part of the cost of the organization’s fixed assets that are leased that is not depreciated in the NU.

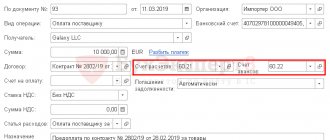

Based on the agreement, it is necessary to carry out monthly accrual of leasing payments, which occurs using the document “Receipt (act, invoice)” with the transaction type “Purchases”.

In the calculations, it is required to enter an account for accounting for debt on lease payments, depending on the specific situation: 76.07.2, 76.27.2 or 76.37.2. The tabular section indicates the account for accounting for rental obligations; we also select, if necessary: 76.07.1, 76.27.1 or 76.37.1.

Below the tabular part we can enter and register an invoice, then VAT will be deducted.

After completing the document, we see a reflection of the accrual of the next lease payment, the write-off of part of the lease obligations, the write-off of the amount of “deferred” VAT and the reflection of “input” VAT on the amount of the accrued lease payment. Since we are considering property that is on the balance sheet of the lessee, its value is repaid through depreciation charges. To calculate the amount of depreciation for a month for both accounting and tax accounting, you need to perform month closing.

When we turn to the “Closing of the month” processing, we see the regulatory operations that are relevant for our situation: “Depreciation and depreciation of fixed assets” and “Recognition of leasing payments in the NU”. When performing the first of these operations, the amounts accrued on account 02.03 are written off as expenses. When implementing the following regulatory operation, the difference between the lease payments that were made through receipt documents and the accrued depreciation in tax accounting is calculated. When we work with the closure of the month, we can use the help-calculation “Recognition of expenses for fixed assets received under lease.”

The selected report illustrates the amounts of lease payments in the accounting and tax accounting of the lessee.

If suddenly, after accepting the leased property for accounting, it was necessary to change the method of reflecting expenses on lease payments, then in this case the document “Changing the reflection on lease payments” is provided, located in the section “Fixed assets and intangible assets”.

When creating, select the position of the same name.

In the “Method” field, indicate the new required method.

In the future, to correctly carry out the transfer of ownership, you should refer to the document “Repurchase of leased items”, through the section “Fixed assets and intangible assets”.

The document in question has been implemented specifically for the lessee to transfer data from subaccounts for leased property to subaccounts of its own fixed assets; pay off the remaining lease obligations, reflect the VAT claimed; pay off the remaining VAT on rental obligations.

As soon as we select the required organization and indicate the required counterparty and agreement, the remaining information is filled in automatically. Table data can be adjusted if necessary.

On the “Accounting” tab, we check the accounts in which our own fixed assets will now be accounted for.

Filling out the “Tax Accounting” tab is based on the chosen order of including the redemption value in expenses. When calculating depreciation, we determine the remaining useful life; when selecting “Inclusion in expenses upon acceptance for accounting,” the method of reflecting expenses.

The document also contains the “Depreciation bonus” tab, so if the inclusion order is selected “Depreciation calculation”, then the organization can, if necessary, use the right to apply a depreciation bonus.

As a result, all mutual settlements regarding the leased asset are closed. After the transfer of ownership, the value of the now own fixed asset is written off as expenses through depreciation.

If you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Author of the article: Kristina Savvina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #30 Irina 01/19/2021 21:04 The only normal article on leasing. But this is 8.3 - it is relatively automated there now. But in 8.2, think as you want.

Quote

+1 #29 aigul1509 12/28/2017 22:40 Good afternoon! Could you please tell me if there is an article on early redemption of the leased asset?

Quote

0 #28 Olesya T 05.26.2017 17:28 Good afternoon! Please explain, what is the difference between the procedure for accounting for leasing on the balance sheet of the lessee for a small enterprise that does not apply PBU 18/02? Thank you very much in advance for your answer!

Quote

+10 #27 Elena Zimenkova 04/18/2017 22:07 Good afternoon! Help me to understand! The balance on account 01.k after closing the month and recognizing expenses on leasing payments became negative. Initially, according to DT account 01K (the difference between the cost in accounting and accounting records) was 92,000, monthly depreciation was 44,209, leasing services were monthly in the amount of 139,140.29, respectively, according to CT 01K, the amount of 94,931.29 was reflected monthly. Accordingly, the balance on the account. 01K became negative. What's wrong and where is the error?

Quote

0 #26 Tatyana 03.26.2017 13:31 I quote Natalya Ukhova:

I quote Tatyana: Hello, Olga! Please help me deal with the early redemption of leased property. No one gives an answer to such a difficult topic. I make a document “Repurchase of the leased asset”, it turns out to be some kind of nonsense. According to CT account 02 Depreciation of leased property in NU, the amount with a minus remained hanging. On account 02, depreciation of fixed assets according to NU is the same amount with a plus. Why was depreciation according to NU not written off? Maybe this document is not suitable for early redemption?

Hello!

Does closing the month not adjust the amounts in accounts 01 and 02? Also, tell me, do you keep records according to PBU 18/02? Natalya, we do not comply with PBU 18/02. When closing the month, transactions are not adjusted. In the document “Repurchase of the leased asset” itself, the entries are as follows: according to NU Dt 20.01 Kt 02.03 with a plus, and then reversal. But then I don’t understand what the program is doing. The accumulated depreciation during leasing for us is 500 thousand according to the accounting book, 264 thousand according to the NU. The document makes the following entries: Dt 02.03 Kt 02.01 500 thousand according to the BU AND NU. I don’t understand why the amount is NU?? The following posting is only according to NU: Dt 02.03 Kt 01.01 275 thousand (we have accumulated depreciation 264 thousand) Result: in the Turnover according to Dt 01.01. (NU) the amount is 11 thousand less than the redemption amount, and Kt 02.01 (NU) 500 thousand (it shouldn’t be there at all), Kt 02.03 500 thousand with a minus. Why such wiring? Thanks in advance for your answer! Quote 0 #25 Ukhova Natalya 03.25.2017 22:26 I quote Tatyana:

Hello, Olga! Please help me figure out the early redemption of leased property. No one gives an answer to such a difficult topic. I make a document “Repurchase of the leased asset”, it turns out to be some kind of nonsense. According to CT account 02 Depreciation of leased property in NU, the amount with a minus remained hanging. On account 02, depreciation of fixed assets according to NU is the same amount with a plus. Why was depreciation according to NU not written off? Maybe this document is not suitable for early redemption?

Hello!

Does closing the month not adjust the amounts in accounts 01 and 02? Also, tell me, do you keep records according to PBU 18/02? Quote 0 #24 Ukhova Natalya 03.25.2017 22:22 Quoting Irina VV:

Hello, please tell me how in the program 1C:Enterprise 8.3 (8.3.9.1850) Enterprise Accounting (basic), edition 2.0 to reflect the transfer of ownership of the operating system after the end of the leasing agreement, if depreciation is not completely written off according to the accounting book and the operating system is purchased at the redemption price by a separate purchase agreement sales.

Good afternoon

There is an article on your question on ITS: its.1c.ru/…/…, if you do not have a subscription, you can sign up for a free demo version for 7 days. Quote +1 #23 Tatyana 03/24/2017 23:21 Hello, Olga! Please help me deal with the early redemption of leased property. No one gives an answer to such a difficult topic. I make a document “Repurchase of the leased asset”, it turns out to be some kind of nonsense. According to CT account 02 Depreciation of leased property in NU, the amount with a minus remained hanging. On account 02, depreciation of fixed assets according to NU is the same amount with a plus. Why was depreciation according to NU not written off? Maybe this document is not suitable for early redemption?

Quote

0 #22 Irina VV 03.23.2017 18:00 Hello, please tell me how in the program 1C: Enterprise 8.3 (8.3.9.1850) Enterprise Accounting (basic), edition 2.0 to reflect the transfer of ownership of the operating system after the end of the leasing agreement, if according to the accounting book it is not completely written off depreciation and fixed assets are purchased at the redemption price through a separate purchase and sale agreement.

Quote

0 #21 TatyanaAn 01/31/2017 15:40 Hello. My 1K account for differences in NU leasing became negative after a few months, this is not correct. The fact is that leasing payments are not uniform throughout the term, at first they are very large, but by the end of the leasing agreement they decrease, but depreciation remains the same. But 1K can’t be negative, can it?

Quote

0 #20 Ukhova Natalya 01/21/2017 18:01 I quote Lyudmila V:

HELLO! I have an LLC on the simplified tax system, dr. Please tell me about the postings in 1s accounting 8.3 basic. Under the leasing agreement, the total amount, including VAT, is 855 thousand. Incl. 1. leasing payments 840 thousand; 2. leasing payments due after transfer of 449 thousand; 3. Commission for processing a leasing transaction is 15 thousand. According to the right of redemption, the cost is 1 thousand rubles. The commission for the transfer of ownership upon redemption is 10 thousand rubles, it will not be charged if there are no delays in payments - there is none. The fee for making changes to the contract is 3 thousand rubles - there are no changes. Leasing term 12 months. Accounting with the lessee. We were given a discount on payment of an advance payment of 78 thousand. The total amount of the leasing agreement, taking into account the discount, became 777 thousand. Advance payment including discount 312 thousand. The difference between the amount of the advance and the amount of the advance payment will be reimbursed by receiving a subsidy from the budget. We will also reimburse the costs of comprehensive insurance of 29 thousand and 9 compulsory motor insurance to the lessor. Regression graph. Monthly invoices arrive - what is provided for temporary possession of the leased item - what to do with them? Another invoice has arrived - a subsidy to compensate for the lessor's losses upon presentation of a discount on the tax payment of 78 thousand? We initially paid 1.advance payment 312 thousand; 2. commission for registration of the contract is 15 thousand; 3. Compensation for comprehensive insurance 29 thousand 4. compensation for compulsory motor insurance 9 thousand. HONESTLY I'M SHOCKED how to plant everything - I'm a newbie. THANK YOU

Good afternoon, it is very difficult to answer such broad questions, we usually consider them in a personal consultation =) To reflect leasing transactions on the lessee’s balance sheet, you can use our article presented above, or the article on the ITS resource: its.1c.ru/…/ … If you don’t have a subscription, you can get free demo access for 7 days.

Quote 0 #19 Lyudmila V 01/17/2017 14:30 HELLO! I have an LLC on the simplified tax system, dr. Please tell me about the postings in 1s accounting 8.3 basic. Under the leasing agreement, the total amount, including VAT, is 855 thousand. Incl. 1. leasing payments 840 thousand; 2. leasing payments due after transfer of 449 thousand; 3. Commission for processing a leasing transaction is 15 thousand. According to the right of redemption, the cost is 1 thousand rubles. The commission for the transfer of ownership upon redemption is 10 thousand rubles, it will not be charged if there are no delays in payments - there is none. The fee for making changes to the contract is 3 thousand rubles - there are no changes. Leasing term 12 months. Accounting with the lessee. We were given a discount on payment of an advance payment of 78 thousand. The total amount of the leasing agreement, taking into account the discount, became 777 thousand. Advance payment including discount 312 thousand. The difference between the amount of the advance and the amount of the advance payment will be reimbursed by receiving a subsidy from the budget. We will also reimburse the costs of comprehensive insurance of 29 thousand and 9 compulsory motor insurance to the lessor. Regression graph. Monthly invoices arrive - what is provided for temporary possession of the leased item - what to do with them? Another invoice has arrived - a subsidy for compensation of the lessor's losses upon presentation of a discount on the tax payment of 78 thousand? We initially paid 1.advance payment 312 thousand; 2. commission for registration of the contract 15 thousand; 3. Compensation for comprehensive insurance 29 thousand 4. compensation for compulsory motor insurance 9 thousand. HONESTLY I'M SHOCKED how to plant everything - I'm a newbie. THANK YOU

Quote

-1 #18 Ukhova Natalya 01/10/2017 17:45 I quote Natalya R:

Good evening, sorry, I asked the question incorrectly again, I wrote it in tabular form, it was drawn in by a line. The leasing payments have not ended. Non-depreciable difference on leased property is 468,830.47. Lease payments are not over yet. After the next payment, the balance on DT in NU became “-“, and the balance on DT in BP “+”, before the last payment it was the other way around. Maybe it was not the shock absorber that closed. difference. But what will happen to 01K now? Please help me figure it out!

Also, could you tell me that in the accounting policy settings there is a checkbox “PBU 18 is applied”?

Account 01.K reflects the part of the cost of fixed assets leased that is not depreciable in NU. In theory, you need to check whether the document “Admission: Acceptance of leasing payments at NU” is entered correctly? Quote +1 #17 Natalya R 01/09/2017 22:00 Good evening, sorry, I asked the question incorrectly again, I wrote it in tabular form, it got sucked in as a line. The leasing payments have not ended. Non-amortisable difference on leased property is 468,830.47. Lease payments are not over yet. After the next payment, the balance on DT in NU became “-“, and the balance on DT in BP “+”, before the last payment it was the other way around. Maybe it was not the shock absorber that closed. difference. But what will happen to 01K now? Please help me figure it out!

Quote

+1 #16 Natalya R 01/09/2017 18:42 Good afternoon, here is the data on account 01K NU Dt468 830.47 Kt486 351.23 -17 520.76 VR DT-468 830.47 KT-486 351.23 17 520, 76 Leasing payments have not yet ended, until December NU was “+” BP “-“, but in December it was the other way around, according to math. Everything is clear to the calculations, but it is not clear what should happen to 01K. Please help me figure it out.

Quote

0 #15 Ukhova Natalya 01/09/2017 09:38 I quote Natalya R:

Hello, please tell me if it is possible for account 01.K, “Adjustment of the value of leased property” to have a negative balance on DT. Thank you

Good morning!

Tell me, at what point in accounting does a negative balance arise and according to what type of accounting (accounting, accounting)? Quote +3 #14 Natalya R 01/06/2017 11:23 pm Hello, please tell me whether it is possible to have a negative balance under account 01.K, “Adjustment of the value of leased property”. Thank you

Quote

0 #13 Ukhova Natalya 12/15/2016 11:11 I quote Evgeniy:

I quote Natalya Ukhova: I quote Evgeniy: Good afternoon! Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Good afternoon

Those. did the amount in the account increase on 01.03? Has the amount of the lessor's expenses for purchasing the leased asset changed? Yes, that’s exactly it. It turns out that the amount of fixed assets in leasing changes only according to accounting? Then you can proceed as follows: 1) Tab of fixed assets and intangible assets - Parameters of depreciation of fixed assets - Change parameters of depreciation of fixed assets. In the document, leave the “Reflect in accounting” checkbox, fill out the tabular section by selecting the desired OS, then the Fill button for the list of OS, then change the Cost column to calculate depreciation. (BU), where to put the current balance for 01.03 + the amount for additional. agreement. This document will make movements in the depreciation registers and from the next month, at the end of the month, depreciation will be accrued from the new amount. 2) enter the document receipt of goods and services (amount according to additional agreement) to the account 08.04. 3) enter the document “Operation entered manually”, where to make the posting 01.03 - 08.04 for the required operating system in the lease. Quote 0 #12 Evgeniya I 12/13/2016 12:26 Quoting Ukhova Natalya:

I quote Evgeniy: Good afternoon! Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Good afternoon

Those. did the amount in the account increase on 01.03? Has the amount of the lessor's expenses for purchasing the leased asset changed? Yes, exactly like that Quote 0 #11 Ukhova Natalya 12/13/2016 09:06 I quote Evgeniy:

Good afternoon Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Good afternoon

Those. did the amount in the account increase on 01.03? Has the amount of the lessor's expenses for purchasing the leased asset changed? Quote 0 #10 Evgeniya I 12/09/2016 17:24 Good afternoon! Tell me the procedure in 1C 8.3, if during the validity of the leasing agreement the total amount of the agreement was increased by an additional agreement (due to an increase in interest)? Thank you in advance!

Quote

+2 Vera Kondruseva 08/29/2016 21:52 Good afternoon! If I understand correctly, then the amount of all lease payments + the redemption price of the car goes to account 01.03. What about the cost of the car indicated in the acceptance certificate and the contract? There is a completely different amount, i.e. the net value of the car without the “interest” of the leasing company. Shouldn’t depreciation be calculated on this “net” cost? Thank you very much in advance!

Quote

0 Olga Shulova 08/04/2016 08:59 I quote Ivan Tarasov:

But when selecting a leasing agreement, we do not display either the counterparty or the agreement, although the release is quite new.

Hello!

Can you tell me the exact release number? Are these fields completely absent or is there no way to select something in them? Quote 0 Tarasov Ivan 08/03/2016 13:43 But when choosing a leasing agreement, we do not display either the counterparty or the agreement, although the release is quite new.

Quote

+1 Natalya Latysheva 05/31/2016 14:27 Hello! Leasing selection services are accounted for in cost accounts (25, 26, 44, 91.02) depending on the purpose of the leased property: production, administrative purposes, etc.

Quote

0 TAMARA777 05/27/2016 21:02 Good afternoon! info service for searching and selecting leasing according to contract. leasing (invoice from the lessor) on which account should it be recorded? thank you very much in advance

Quote

0 Ukhova Natalya 05/18/2016 19:55 I quote Olga1011:

Good afternoon Tell me please. and in what account should the advance payment under the leasing agreement be recorded?

Good afternoon

The document “Receipt (act/invoice)” (type of transaction: leasing services) makes CT the balance on account 76.07.2, if the agreement is in rubles. Payment and prepayment for these services are shown on DT invoice 76.07.2. For payments in foreign currency we use account 76.27.2 Quote 0 Olga1011 05/17/2016 18:35 Good afternoon! Tell me please. and in what account should the advance payment under the leasing agreement be recorded?

Quote

0 Olga Shulova 02/19/2016 22:03 I quote ???:

Good afternoon, Olga, I have recently discovered the enormous benefits of your lessons, I have a question specifically about leasing: using your example of accepting fixed assets for accounting on the NU tab, where does the amount of the initial cost (750,000) come from? If the receipt is 1,500,000? Thank you in advance for your response

Hello!

Thank you for your nice words. In this case, the amount in NU is some abstract value that is different from the amount in BU. As a rule, when purchasing fixed assets on lease, the amounts for accounting and tax accounting are always different, and for tax purposes they are smaller, because in NU, the cost of fixed assets takes into account the amount of expenses of the lessor (and NOT the lessee) for the acquisition of the leased asset Quote +1 ??? 02/17/2016 14:33 Good afternoon, Olga, I have recently discovered the great benefits of your lessons, I have a question specifically about leasing: using your example of accepting fixed assets for accounting on the NU tab, where does the amount of the initial cost (750,000) come from? If the receipt is 1,500,000? Thank you in advance for your response

Quote

Update list of comments

JComments

Accounting for early repurchase of the leased asset

The procedure for recording the redemption of property in accounting will depend on who has it on their balance sheet. If on the lessor’s balance sheet, the entries will be as follows:

| Business transaction | D | TO |

| Property written off balance sheet | 001 | |

| The property is recognized by the OS | 08 | 60 |

| The asset is classified as inventory | 10 | 60 |

| VAT reflected | 19 | 60 |

In case of early repurchase of the leased asset, the postings will be as follows:

| Business transaction | D | TO |

| Property at its original cost is included in the property | 01 “Leased fixed assets” | |

| The amount of accrued depreciation is transferred to the depreciation account accrued on assets | 02 “Depreciation on own fixed assets” | |

| VAT is included in other expenses | 91.2 | 19 |

| Unpaid amounts under the leasing agreement are written off as other expenses | 76 | 91.1 |

Arrival of a minibus for leasing

Let's go to the menu “Fixed assets and intangible assets - Receipt of fixed assets - Receipt of leasing” and create a new document.

We indicate the lessor and the contract, the vehicle and the cost. Set the settlement account to 76.07.1 “Rental obligations”. Item accounting account - 08.04.1.

Document postings:

Existing nuances

Difficulties that the client may encounter:

| Did not find an answer to your question? Call a lawyer! Moscow: +7 (499) 110-89-42 St. Petersburg: +7 (812) 385-56-34 Russia: +7 (499) 755-96-84 |

- a complete ban on repayment within a certain period. The exact period is always specified in the contract; as a rule, it is at least 6 months from the date of signing the main agreement;

- overpayments associated with mandatory commissions. These funds will be used to pay for the work of employees and the need to prepare additional documents;

- increase in vehicle cost. You should refuse to sign an agreement on such terms, since it is obviously unprofitable for the lessee. For example, not only earlier repayment, but also the absence of contacts to the insurance company (due to the fact that the insured event did not occur) can lead to an increase in cost.

It is possible to repay the lease early and buy the property in full. There is no point in counting on the economic benefits of such an operation. The lessor is interested in making a profit, therefore, the lessee will have to pay the entire cost of the leased property in any case.

The essence of leasing

A leasing agreement is concluded between two interested parties. The subject of the contract is buildings, equipment, cars and other types of property. The lessee can become the legal owner of the leased property by purchasing it.

For the subject of leasing, you need to draw up a transfer and acceptance certificate. Depreciation is calculated by the party whose property is recorded on its balance sheet.

Fill out and send reports to the Federal Tax Service on time and without errors with Kontur.Extern. 3 months of service are free for you!

Try it

From what period can you fearlessly buy out the leased asset?

The risks posed by early termination of a leasing agreement were summarized by Kirill Zimarev, head of leasing practice at Stare Legal:

— Civil legal risks. The lessee, by purchasing the property ahead of schedule, becomes the owner of the leased asset in the same way as in the case of purchasing the leased asset at the end of the lease agreement. However, if the lessor used the leased asset as collateral, then the lessee needs to ensure that the collateral record is cleared by the lessor.

Tax risks. Tax risks lie in the possibility of the tax authority recharacterizing a leasing agreement into an installment purchase agreement. In this case, the application of leasing tax benefits will be considered unjustified, namely: instead of paying VAT on leasing payments throughout the entire term of the leasing agreement, the lessor will be charged VAT on the entire cost of the property from the date of sale (there are such cases, for example, the Resolution of the Arbitration Court of the Western-Russian Federation). Siberian District dated 03/02/2018 N F04-6306/2017 in case N A81-3829/2017). In theory, having recognized the use of accelerated depreciation as unlawful, the tax authority can recalculate and additionally charge property taxes, but we did not find such cases.