How to draw up a power of attorney to submit reports to the tax office?

The tax office has not approved a unified form for the transfer of powers. This means that organizations and individual entrepreneurs have the right to issue a power of attorney in any form. The main thing is that the document indicates the date and place of preparation; information about whose interests the authorized person represents; information about himself and his rights, a list of transactions that are entrusted to him. You also need to specify the validity period of the power of attorney. If this is not done, it will be valid for one year from the date of preparation. The finished paper must be certified by the director of the organization or individual entrepreneur.

Form

There is no standardized form for trust documents. Accordingly, this document can be compiled in any style. However, it is necessary to take into account the requirements put forward by law:

- The document must be drawn up on paper. Moreover, it does not matter whether the data is entered by hand or on a computer. Both options are valid;

- The power of attorney must clearly state who assigns responsibilities to whom. You also need to list the powers vested in the representative. As a rule, the chief accountant needs a power of attorney to perform certain actions. They are the ones that should be spelled out in the document;

- The head of the organization must sign his autograph here. Without this important element, the document will be considered void;

- the power of attorney must have a certain validity period. To do this, the date of its registration must be indicated.

To issue such a power of attorney, many legal entities use their own letterhead, which is developed specifically for these purposes. Although this is not a requirement.

( Video : “Everything about drawing up a power of attorney”)

In what cases is it necessary to draw up a power of attorney?

It is not always possible to understand exactly when the chief accountant needs a trust document. After all, there are situations when contacting certain authorities is the direct responsibility of the employee. The most common situations where you cannot do without a trust document include:

- obtaining bank statements related to the current account, submitting and receiving various documents at the bank;

- submission of reports, declarations and other similar documents to the tax authorities;

- if the chief accountant needs to sign various documents on behalf of the director;

- contacting government authorities to change the company’s registration data;

- submitting documents to the Social Insurance Fund, pension fund, as well as receiving the results of verifications.

Can a representative revoke a power of attorney issued in his name?

According to the civil code, only the person who issued it can revoke a power of attorney. At the same time, your relationship with the client is based on a contractual basis. Accordingly, as soon as the contract terminates, you can require the client to revoke the power of attorney. In addition, you can inform the inspectorate that it is time to revoke the power of attorney, since you are no longer serving the client.

Send two letters: to the client and to the inspectorate. Tell the client that you have stopped working with him and require him to revoke the power of attorney. Inspections - that you no longer represent the client's interests. For the inspection, this will be sufficient grounds to revoke the power of attorney in the information resource.

What it is?

In accounting, a power of attorney is a document that is created on behalf of the principal in favor of another person and gives him the right to perform certain actions. Thus, a director or boss can write a power of attorney in the name of an accountant or another employee who cannot carry out certain operations without the participation of the former or without his knowledge and consent.

A power of attorney is a document of strict accountability when it comes to enterprises. The main goal pursued by the process of creating this paper is the transfer of powers.

Is it possible not to indicate the passport details of the representative in the power of attorney for the right to submit reports?

The inspector can only take passport data from a power of attorney or a message about representation. But he is obliged to enter data into the system only on the basis of a power of attorney. He can take them from the message about representation only of his own free will. So the only way to correctly document the data of an authorized person is to register them in a power of attorney.

There is no need to be afraid of compromising your passport data. The Inspectorate is the same operator for processing personal data as any other supervisory authority. The risk is, rather, that the power of attorney remains at the disposal of your client, whose interests you represent. If this is a concern, the contract should stipulate what responsibility the parties bear in the event of disclosure of personal data.

Report through Extern for your company or clients if you have an accounting firm. Convenient tables help keep all reports, payments and budget calculations under control. 3 months free.

Start using

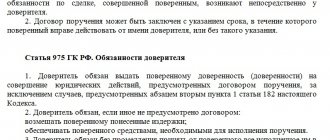

The legislative framework

In 2013, the form proposed for completion ceased to be mandatory for maintenance in all organizations without exception. However, it has not lost its practical significance. The presence of a log of registration of issued powers of attorney is often asked by regulatory organizations during inspections. This helps them make sure that they are doing a full-fledged job in the company.

The journal form is an appendix to Instruction of the USSR Ministry of Finance No. 17 of January 14, 1967. Then it was one of the stages of documenting the receipt of inventory items.

Also, the log of issued powers of attorney is very close to this document. It can also very well lay claim to the title of the most functional magazine in this area. It can be easily found in one of the appendices to the Instructions for the use and completion of forms, which were approved by Resolution of the State Statistics Committee No. 71a of October 30, 1997.

Now, with the advent of new legislation, the magazine has increased its functionality. Now each organization has the right to understand and improve the subtleties of its use independently.

The main thing is that this application is recorded in the accounting policy and an order from the manager is issued about this.

How to inform the tax office about a power of attorney?

The power of attorney must be provided on paper. Additionally, you can transfer it via the Internet in the form of a scan, signing it with the electronic signature of an authorized representative. But the scan only notifies inspectors that the original has been sent and needs to be found. The inspection has the right not to accept the scan until there is a power of attorney on paper.

If the paper power of attorney is lost, you can contact the tax office - directly to the inspector, if you have an established relationship with him, or with an official letter. And if you report through Kontur.Extern, you can contact us: we will help the inspection find a power of attorney and enter data on it.

What rights are given to an attorney?

At any enterprise, the chief accountant is responsible for many issues. Typically, a trust document is not simply issued. It is issued for some specific actions. They are the ones that should be specified in the power of attorney. As for specific rights, they are determined exclusively by the director of the company, who is the drafter of the document. One power of attorney can be issued not for one action, but for several at once. All powers vested in the representative must be spelled out in the document in as much detail as possible.

How to issue a power of attorney to submit reports to the tax office

The Civil Code clearly states that any employee of the organization can submit statistical, accounting and tax reports. However, they must have the appropriate power of attorney. The chief accountant is no exception. The manager must issue a trust document on him, on the basis of which the accounting employee will submit reports. However, there are exceptions to this rule. Some organizations, by their charter, give chief accountants certain powers, including the ability to submit reports. The chief accountant does not need a power of attorney to perform such actions. However, first the tax authority must provide information about this employee. Although you need to know, tax authorities have the right to refuse to accept such documents at their discretion. In other words, they simply prohibit the chief accountant from submitting reports without the appropriate power of attorney.

In addition to the chief accountant, another organization that is fully engaged in accounting can also submit reports to the tax office on behalf of the company. In this case, the power of attorney is issued to the head of this company. Usually this is a document with the right of subrogation. Thanks to this, the director of a company that does accounting entrusts some specialist to work with the tax authority.

How much time do I need to allow for sending a power of attorney to the inspectorate?

Tax officers are required to enter the data of the new power of attorney into the system within 3 business days. But technical or legal difficulties can never be ruled out. In order not to take risks, it is better to transfer the power of attorney at least 10 days before submitting the reports.

When a power of attorney is replaced by an old one, it must be transferred no later than 15 days before the expiration of the previous document. This will allow you to avoid blocking accounts if during the period “between powers of attorney” the Federal Tax Service sends a request to the client.

To make sure that the data on the power of attorney has been entered, we recommend that you make an ION request before submitting the reports. If you receive a receipt in response, everything is in order - you can report.

Components of a document

The journal is not a strictly reporting paper. Roughly speaking, it can be drawn up in a regular notebook. However, some design requirements must be met. In particular, the attached example of a form and sample journal contains the following fields to fill out:

- Number of the issued power of attorney. They are numbered in chronological order. You should focus on the dating. The earlier the power of attorney is signed and the sooner it comes into force, the closer to the beginning it should be located. It is advisable to adhere to this principle when filling out.

- Date of issue.

- Validity period of the issued paper. When the functionality of the power of attorney is exhausted, it will need to be revoked.

- To whom was it issued?

- Supplier name.

- Number and date of the contract or other types of agreements, transactions.

- Signature of the person who received the power of attorney.

- A note on the execution of instructions under a power of attorney. This line records the numbers, names and dates of documents that indicate the employee has performed an action (this is what the power of attorney intended).

In addition to the tabular part, the magazine must have a cover. On its front part the main data is indicated: the start and end dates of the journal, its full name. It also wouldn’t hurt to mention the details of the organization that runs it. Mention of all this data is a necessary minimum when preparing this kind of documentation.

To whom can a power of attorney be issued in form M-2?

Unlike powers of attorney, which are written in free form and which can be issued to any individual and even a third-party organization, a standard M-2 power of attorney can only be issued to employees of an enterprise who are on its staff.

Typically, the function of issuing a power of attorney falls on a specialist in the accounting department, who controls the financial part of the transaction, as well as the process of receiving and receiving inventory items, but it must also be endorsed by the director of the company.

What form of document is required and when?

There are two main forms for a power of attorney - one-time and special. The first is for those cases when the action on behalf of the principal is performed once or extremely rarely. If the chief accountant regularly submits reports under a power of attorney on an ongoing basis, then it is rational to issue a power of attorney in a special form.

Considering the fact that a power of attorney is a document of strict accountability, it is quite reasonable to assume that the law provides for some requirements and norms for its preparation and registration.

To begin with, we note that it can be drawn up both on behalf of an individual and on behalf of a legal entity. There are no mandatory forms or forms for this, but there is a list of mandatory details that must be present on paper.

A power of attorney that is filled out incorrectly or does not contain all the necessary data is considered invalid.

If such documents are issued frequently at an enterprise, then a special journal is created for their registration, which is kept by the secretary. There are also requirements for maintaining the journal - all its pages must be numbered and stamped, and also certified by the signatures of the head of the enterprise and the accountant.

It must indicate the following information about the power of attorney:

- Serial or registration number.

- Date of issue.

- Validity.

- Full name of the authorized person.

- Purpose and other data.

A power of attorney transfers powers to a specific citizen, who in turn cannot and does not have the right to entrust it and transfer powers to a third party. The document is issued in one copy; when exercising authority, only the original document must be presented.

Read about M2 forms here.

Form details

In large enterprises, a special form may be provided for issuing a power of attorney , developed according to the specifics of the enterprise’s activities. To register a new one, it will be enough to simply fill in the blank lines and sign with management. If nothing is written on a line, it is simply skipped, then you need to put a dash in it.

If a specific validity period is not specified, the default is assumed to be one calendar year.

A power of attorney is issued for a certain period, it can be either one day or a year, sometimes several years (maximum three years). In order to issue a power of attorney, you must enter all the necessary data, a list of which we will consider below:

- The name is POWER OF ATTORNEY and is indicated at the top of the form.

- Place of compilation (city).

- The full correct name of the enterprise within which the paper is being drawn up.

- Data of the person who acts on behalf of the enterprise and the basis for his authority.

- Organization details - OKPO code.

- Date of preparation.

- Validity.

- FOI of the trustee.

- The list of actions that a trustee can perform in accordance with this document must be spelled out as clearly and specifically as possible.

- Sample signature of the authorized representative.

- Signature of the manager and company stamp.

Having all the details will allow you to avoid negative consequences in the event of failure to perform or untimely execution of actions by an employee or authorized representative.

Why do you need a power of attorney in form M-2?

Typically, representatives of those companies in which the receipt of some goods or materials by proxy occur with high frequency and in large quantities resort to drawing up such a document.

However, a power of attorney is most often formed for a one-time acceptance of goods and for a strictly limited period.

The basis for drawing up a power of attorney is an agreement concluded between enterprises: on supply, purchase and sale, etc., as well as receipts, invoices, acts, invoices and other similar papers.

How to cancel a document

The principal has the right to revoke the powers given to him at any time, just as the representative has the right to refuse them at any time. The representative and other persons to represent whose interests the document was issued must be notified of the revocation. Additionally, the principal has the right to publish information about the cancellation in the official publication where bankruptcy data is posted. If the transaction is completed in notarial form, the notary enters information about its cancellation into the register of notarial actions (Article 189 of the Civil Code of the Russian Federation).

Notary visa

In the vast majority of cases, a power of attorney is not required to be certified by a notary. But in some cases this must be done:

- if a power of attorney is issued to complete a transaction that must be certified by a notary in accordance with the law (clause 2 of Article 185 of the Civil Code of the Russian Federation), for example, when purchasing real estate;

- when entrusting your powers to someone (clause 3 of Article 187 of the Civil Code of the Russian Federation);

- upon transfer of receipt of a work book;

- when a representative of an individual receives a certificate of assignment of a TIN;

- when exercising their powers by authorized representatives of a taxpayer - an individual.

In addition, the head of a specialized organization notarizes powers of attorney for signing client reports issued to his employees.

Clause 3 of Article 185 of the Civil Code of the Russian Federation lists cases when issued powers of attorney are equated to notarized ones. These include:

- powers of attorney of military personnel and other persons undergoing treatment in hospitals, sanatoriums and other military medical institutions, certified by the head of such an institution, his deputy for medical affairs, a senior or duty doctor;

- powers of attorney of military personnel, and at points of deployment of military units, formations, institutions and military educational institutions, where there are no notary offices and other bodies performing notarial acts, also powers of attorney of workers and employees, members of their families and family members of military personnel, certified by the commander (chief) this part, connection, institution or institution;

- powers of attorney of persons in places of deprivation of liberty, certified by the head of the corresponding place of deprivation of liberty;

- powers of attorney of adult capable citizens located in social protection institutions, certified by the administration of this institution or the head (his deputy) of the relevant social protection body.