Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

Certificate 2-NDFL tells about the employee’s sources of income, salary and taxes withheld. Each income source or tax deduction has its own code. These codes were approved by Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] At the end of 2021, the tax service changed the list of codes (Order dated October 24, 2017 No. ММВ-7-11/ [email protected] ). These codes are valid from January 1, 2021 to present. In the article we will tell you which codes to put in the 2-NDFL certificate for 2021 in 2021.

What do personal income tax codes mean?

The Tax Code obliges tax agents to keep records of income paid to individuals, not in any form, but using special codes.

Thus, paragraph 1 of Article 230 of the Tax Code of the Russian Federation states that each tax agent must compile tax accounting registers. They need to record income paid to individuals in accordance with the codes approved by the Federal Tax Service. The current codes are given in the Federal Tax Service order No. ММВ-7-11/ [email protected] (hereinafter referred to as order No. ММВ-7-11/ [email protected] ). They are used, including for filling out certificates in form 2-NDFL. This means that incorrectly assigning a digital code to income will result in an error in the 2-NDFL certificate. This, in turn, threatens the tax agent with a fine of 500 rubles. for each incorrectly completed income certificate (Article 126.1 of the Tax Code of the Russian Federation, clause 3 of the Federal Tax Service letter No. GD-4-11/14515 dated 08/09/16).

Fill out and submit 2-NDFL via the Internet with current codes

In addition, in many accounting programs, payment codes are tied to determining the date of actual receipt of income. And it is used when filling out line 100 of section 2 of the 6-NDFL calculation. Consequently, due to an error in income coding, the tax agent may incorrectly fill out the 6-NDFL calculation. For this violation, the fine is also 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation).

Finally, this same pay encoding is used in most accounting programs to calculate average earnings. Therefore, incorrect assignment of a code may cause incorrect calculations with employees for vacation pay, business trips, sick leave, etc. If the payment turns out to be underestimated, the organization may be fined in the amount of 30,000 to 50,000 rubles, an official - from 10,000 to 20,000 rubles, and an individual entrepreneur - from 1,000 to 5,000 rubles. (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If the employee is transferred more than is due, there may be problems with the payment of various benefits compensated from the budget.

IMPORTANT. Errors in the application of codes can lead to underestimation or overestimation of vacation pay, travel allowance, sick leave and other payments “tied” to average earnings. Therefore, it is better to calculate these payments in web services, where current codes are installed and entered into reporting automatically.

Calculate your salary, vacation pay and benefits for free in the web service

KBK salary in 2021

When transferring taxes and fees, it is very important to fill in the BCC in field 104 in the payment order.

KBK (budget classification code) is a special 20-digit code that characterizes a certain type of budget income or expense.

If you make a mistake in it, then when funds arrive in the Treasury account they will not be classified as the correct payment. As a result, the organization will have an arrears and will be charged penalties for late payments. Also, the tax authority can write off the resulting arrears by collection order.

For accrued remuneration to employees for the performance of labor duties, the employer charges and pays insurance premiums in accordance with Chapter 34 of the Tax Code of the Russian Federation:

- for social insurance;

- for compulsory pension insurance;

- for compulsory health insurance.

These payments are administered by the Federal Tax Service. Another contribution is paid to the Social Insurance Fund for insurance against accidents at work.

In addition, the employer withholds and transfers to the budget personal income tax on income paid to employees.

List of KBK for salary taxes in 2021

| Type of tax (contribution) | KBK |

| Personal income tax | 182 1 0100 110 |

| Insurance premiums: | |

| on OPS | 182 1 0210 160 |

| on compulsory medical insurance | 182 1 0213 160 |

| at VNiM | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Sample of filling out a payment order for the transfer of insurance premiums

Income code 4800 with decoding

Let's start with the most universal code - 4800 “Other income”. It corresponds to any income for which there is no more suitable code in Order No. ММВ-7-11/ [email protected] (letter of the Federal Tax Service dated 07/06/16 No. BS-4-11/12127). For example, this code indicates income in the form of a one-time additional payment for vacation (letter of the Federal Tax Service dated August 16, 2017 No. ZN-4-11 / [email protected] ).

In addition, code 4800 can be used, in particular, in relation to the following income: average earnings saved for the days of medical examination; payment for downtime caused by reasons beyond the control of the parties; compensation for the delay in issuing a work book to a dismissed employee; the average salary retained for donors on the days of blood donation and on the days of rest provided to them; the amount of forgiven debt on the advance report; excess daily allowance, etc.

This code is also used for settlements with individuals who are not employees of an organization or individual entrepreneur. For example, using this cipher it is necessary to reflect the amount of winnings that a buyer or client received when participating in a lottery that was not held for the purpose of advertising goods, works or services. Also, code 4800 is used when “requalifying” interim dividends if, at the end of the year, the amount of profit turned out to be lower than the calculated one.

Peculiarities of taxation of personal income tax on payments made abroad

If a specialist is sent to solve business problems abroad, he has a number of additional expenses that are not typical for domestic trips:

- for obtaining a visa;

- to purchase health insurance;

- consular fees;

- fee for the right to enter by car, etc.

Compensation for expenses associated with a trip abroad is exempt from taxation, provided that the expenses were actually incurred and documented. If the papers submitted to the employer are in a foreign language, they must be translated.

If checks confirming foreign expenses are denominated in foreign currency, the accountant converts them into rubles at the official exchange rate of the Central Bank of the Russian Federation, established on the last date of the month when management signed the specialist’s advance report.

Income code 2000 with decoding

The next most common code is 2000. According to Order No. ММВ-7-11 / [email protected] , this code corresponds to “remuneration received by the taxpayer for the performance of labor or other duties.”

Typically, the use of this code does not cause difficulties - everything that is reflected in the employer’s accounting as a salary accrued under an employment contract for the daily performance of job duties “passes” under code 2000. The same value is assigned to the average earnings saved for the period of a business trip, since it also is a salary (letter of the Ministry of Finance dated November 12, 2007 No. 03-04-06-01/383).

Automatically calculate the salary of a posted worker according to current rules Calculate for free

Income codes 2002 and 2003 with decoding

But bonuses for the purpose of coding income as wages are not recognized, although they are named in Article 129 of the Labor Code of the Russian Federation as part of remuneration. Moreover, bonuses are reflected in tax registers and in 2-NDFL certificates in three different codes.

The main code is 2002. It is used for awards that simultaneously satisfy three conditions:

- the payment is not made at the expense of profits, earmarked proceeds or special-purpose funds;

- the payment is provided for by law, labor or collective agreement;

- the basis for payment is certain production results or other similar indicators (i.e. indicators related to the employee’s performance of his or her job duties). This circumstance must be confirmed by an order for payment of the bonus.

Code 2003 reflects bonuses (regardless of the criteria for their assignment) and other remunerations (including additional payments for complexity, intensity, secrecy, etc., which are not bonuses), which are paid from special-purpose funds, targeted revenues or profits organizations.

For other bonuses, code 4800 must be used.

Also see: “Taxes on premiums: we calculate personal income tax and contributions, take them into account in expenses, and reflect them in reporting.”

Is employee travel taken into account?

Management must pay for travel if an employee is sent on a business trip. Travel tax is not provided if:

- round-trip tickets are purchased within the country;

- when carrying luggage;

- in case of payments for airport services or roads to it;

- commission fees are being paid.

To exempt yourself from personal income tax compensation, you must document your travel expenses by presenting them to the tax authority.

Income codes 2012 and 2013 with explanation

The 2012 code corresponds to the amount of vacation pay, that is, the average earnings retained by the employee during the vacation period. This code is used to make payments both for regular vacations and for additional ones, including educational ones.

Code 2012 can only be applied to vacation pay that is paid to existing employees. If the employer transfers compensation to the dismissed employee for unused vacation, this income must be assigned code 2013.

ATTENTION. The Labor Code allows for the provision of leave followed by dismissal (Part 2 of Article 127 of the Labor Code of the Russian Federation). In this case, the employee receives the final payment and work book before the vacation, and does not return to the previous employer after the vacation. However, from the point of view of labor legislation, the transferred amounts are vacation pay, and not compensation for unused vacation. Therefore, the code 2012 must be applied to such a payment.

Also see: “An employee is ill or recalled from vacation: what to do with personal income tax, contributions and reporting?”

Payslip: concept and requirements for its preparation

A payslip is a document that is drawn up by the employer to inform the worker about the accruals that are due to him. The obligation to draw up payment sheets follows from the provisions of Art. 136 of the Labor Code of the Russian Federation, according to which the employer is obliged to inform workers in writing on a monthly basis:

- information about the composition of salaries;

- information about other payments;

- information about withheld funds, in particular, tax deductions;

- information about the amount that will be paid to the employee for the pay period.

Important! The law does not contain mandatory requirements for the content of the payslip and the procedure for its execution. Each employer has the right to independently develop a form for this document and approve it by local act.

Based on the interpretation of the requirements of Art. 136 of the Labor Code of the Russian Federation, set out above, the following information must be reflected in the payslip:

- about funds accrued to the worker;

- about retained funds;

- about the amount to be paid.

Income code 2300 with decoding

Using code 2300 in personal income tax reporting, temporary disability benefits are indicated. This code must be assigned not only to the benefit that is paid in case of illness of the employee himself, but also to those amounts that are transferred in the case of caring for sick children or other family members.

REFERENCE. Formally, maternity benefits also fall under this code, since the basis for its accrual is sick leave. But since maternity benefits are not subject to personal income tax (clause 1 of article 217 of the Tax Code of the Russian Federation), this payment may not be recorded at all in the registers and certificate 2-NDFL (clause 1 of article 230 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated April 2, 2019 No. 03- 04-05/22860).

Create electronic registers and submit them to the Social Insurance Fund via the Internet

Changes in the obligations of employers under Law No. 12-FZ

Labor legislation imposes many different responsibilities on the employer.

One of them is timely payment of salaries. Find out from this article whether it is possible to pay salaries ahead of schedule and whether the employer will be punished for frequent salary payments.

The Law “On Amendments to the Federal Law “On Enforcement Proceedings”” dated February 21, 2019 No. 12-FZ supplemented this obligation: it ordered employers to indicate a special code for the type of income when issuing payment orders for the payment of wages and (or) other income. The introduced encoding will allow banks and bailiffs to distinguish income from which debts can be withheld.

This innovation came into effect on June 1, 2020 (Article 2 of Law No. 12-FZ).

Legislators obliged the Bank of Russia to develop codes and describe a system for reflecting them in salary slips (clause 5.1 of Article 70 of the Law “On Enforcement Proceedings” dated 02.10.2007 No. 229-FZ as amended by Law No. 12-FZ). Which is what he did, issuing instructions dated October 14, 2019 No. 5286-U.

Revenue codes 2762 and 2760 with decoding

Using code 2762 in tax registers and 2-NDFL certificates, you must indicate the entire amount of financial assistance issued to the employee at the birth of a child. Let us remind you that such financial assistance is not subject to personal income tax up to 50 thousand rubles. for each child, provided that the payment is transferred no later than one year after his birth (clause 8 of article 217 of the Tax Code of the Russian Federation).

When paying employees of other types of financial assistance, the code 2760 is used. In this case, the basis for the transfer of money does not matter. So, if the company decides to issue financial aid for vacation, then this amount must be separated from the main “vacation pay” and reflected with code 2760. This code must also be assigned to financial aid paid to former retired employees. Let us remind you that such income is not subject to personal income tax up to 4,000 rubles. per year (clause 28 of article 217 of the Tax Code of the Russian Federation).

How to fill out a payment form from June 1, 2021

The form of the payment order has not changed; the income code must be entered in field 20 “Payment purpose code”.

You can only put one code on a payment. Thus, it is impossible to transfer an employee’s salary and daily allowance in a total amount; for this, two payment orders with codes 1 and 2 are issued. Salary and vacation pay can be sent in one payment - they have a common code.

If writs of execution have been sent to the employee, and the employer withholds funds from the debtor’s income, then in text field 24 “Purpose of payment” you need to make the following entry:

//VZS// withheld amount in figures without spaces // .

Rubles are separated from kopecks by a dash sign “–”, and if the amount collected is in whole rubles, then “00” is indicated after the dash.

For example, alimony in the amount of 15 thousand rubles was withheld from the salary for July. In the “Purpose of payment” field, you need to make an entry like this:

//VZS//15000–00//. Salary for July 2020.

Sample of filling out a payment order

If there were no deductions under writs of execution, you do not need to write anything, just enter the income code in field 20.

In a salary project, when a register is created for payments to employees, the withheld amount is entered in each line with the full name of the debtors in the same format as for payments. Deductions are also indicated in the payment order for the total amount, but in this case field 20 “Name of pl.” do not fill out.

Forms of registers may differ from bank to bank. If you are in doubt about the correctness of filling out, contact your bank where the salary project is open for clarification.

Income code 2720 with explanation

Code 2720 is used in personal income tax reporting to include the cost of gifts for employees. In particular, it should be used for gifts for the New Year, birthday, etc.

ATTENTION. According to the rules of paragraph 28 of Article 217 of the Tax Code of the Russian Federation, gifts worth no more than 4,000 rubles are exempt from personal income tax. in a year. This income must be reflected in the tax registers, regardless of the amount of the gift. But in the 2-NDFL certificates the cost of gifts does not exceed 4,000 rubles. for a year, you don’t have to show it (letters from the Federal Tax Service dated 07/02/15 No. BS-4-11/ [email protected] and dated 01/19/17 No. BS-4-11/ [email protected] ).

Also see: “Tax accounting for gifts and bonuses, or what an accountant should do after February 23 and March 8.”

Results

From June 1, 2021, employers will need to indicate special codes for types of income in settlement documents for employee payments. With their help, banks will be able to distinguish between the amounts from which debts can be withheld in enforcement proceedings.

Sources:

- Federal Law of October 2, 2007 No. 229-FZ

- Directive of the Bank of Russia dated October 14, 2019 No. 5286-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Income codes 2400 and 1400 with decoding

To indicate rental income, you need to choose one of two codes (depending on the object that is transferred under the contract). Thus, income from the rental of any cars, as well as sea, river and aircraft, is reflected in personal income tax reporting using a special code 2400. It is necessary to show the fee for the rental of these types of transport, even if it is paid to the employee (including h. to the manager). The same code also covers income from other uses of vehicles. Therefore, it includes income from contracts for the provision of services for driving your own car, rental agreements with a crew, etc.

REFERENCE. Compensation for the use of a personal car, paid under an employment contract in the amount established by its parties, is not subject to personal income tax. There is no income code for this payment, and it does not need to be indicated in personal income tax reporting.

Also see: “How to more profitably register an employee’s use of his car (new edition).”

Draw up and print a vehicle rental agreement for free using a ready-made template

In addition, code 2400 applies to rental payments for fiber-optic and (or) wireless communication lines, and other means of communication, including computer networks.

Income from the rental of any other property (including real estate, including residential) must be reflected using code 1400. It does not matter who exactly receives this income from an organization or individual entrepreneur: a manager, an ordinary employee or an outsider.

If there is an error in the code or it is not specified

If you do not indicate the income code on the payment slip, there is a chance that the bank will not honor it. In this case, you risk being late on your salary. And for this there are various responsibilities. However, as the Central Bank explains, banks have no obligation to monitor the correctness of codes indicated by payers in payment orders, and payments without codes are subject to execution by the credit institution if the result of other acceptance procedures for execution is positive.

If you put code 1 instead of code 2 or 3, and the bank has a writ of execution for the employee, the bank will collect money that it cannot apply for. And this, at a minimum, is a claim against you from an employee. A trial is also possible.

The Central Bank of the Russian Federation spoke about how to correct the income type code.

The ConsultantPlus system has answers to questions about the application of the new rules. For example, you can find out what is the procedure for indicating the type of income code in a payment order when paying salaries or other income in this material. And if you don’t have access to the K+ system, get a trial demo access for free.

Revenue code 2001 with decoding

Code 2001 is used for remuneration paid to directors on the board of directors and other members of the organization's collegial governing body.

ATTENTION. The salary of an executive under code 2001 is not “posted”, even if the corresponding position is called “director”. However, if the manager is a member of the board of directors (board, other collegial body) and receives additional remuneration for this, then this amount must be separated from the salary and reflected for personal income tax purposes using code 2001.

Income code 2014 with explanation

The amounts of severance pay, as well as the average monthly earnings saved for the period of employment, are reflected in personal income tax reporting with the code 2014. This code applies only to that part of the payments that is subject to personal income tax (in total, it exceeds three times the average salary, and for “northerners” - sixfold). The income tax-free amount of severance pay and average earnings for the period of employment for personal income tax purposes is not fixed or coded.

Also see: “Payments when laying off an employee in 2019‑2020.”

Calculate a “complex” salary with coefficients and bonuses for a large number of employees Try for free

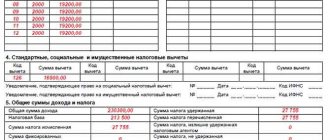

Samples

A sample certificate for employees, which contains the sick leave income code (“2300”), which is relevant today:

The same document, when submitted to the Federal Tax Service, looks different and is drawn up on two sheets. Typically, a report is submitted to the tax office based on the results of the past year. The document is generated automatically and sent electronically. A separate certificate is generated for each employee.