Home / Salary disputes / Procedure for compensation for delayed wages (postings)

Almost every enterprise has experienced delays in wages at least once. However, every employer must understand that such a problem is urgent and must be resolved as soon as possible. Otherwise, you will have to pay each employee monetary compensation for the delay.

Documenting

The amount of compensation for delayed wages is established in the collective or employment agreement.

For example, you can indicate that compensation is 0.06 percent of the amount owed for each day of delay in salary. If the amount of compensation is not established by an employment or collective agreement, then it is calculated based on 1/300 of the refinancing rate for each day of delay. Such rules are established in Article 236 of the Labor Code of the Russian Federation. Attention: the amount of compensation established by the organization for delayed salaries cannot be less than 1/300 of the refinancing rate. Otherwise, this condition of the collective (labor) agreement will be invalid (Article 8 of the Labor Code of the Russian Federation).

Pay compensation for the delay along with repayment of arrears of wages.

Situation: is it necessary to pay compensation for delayed wages in an increased amount (exceeding 1/300 of the refinancing rate), if such a condition is established by a regional agreement?

Yes, it is necessary if the organization has joined the regional agreement.

An increased amount of compensation for delayed wages may be established by regional agreement. Such agreements are concluded by regional executive authorities in agreement with trade unions and employers.

All organizations in the region can join the regional agreement, even if they did not participate in its conclusion. A proposal to join a regional agreement is officially published along with the text of the agreement. If within 30 calendar days the organization does not send a written reasoned refusal, it is considered that it agrees with the regional agreement. Consequently, the organization will be obliged, from the moment of official publication of the regional agreement, to establish compensation for delayed wages in an amount not lower than the regional one. If the organization decides not to join the agreement, it sends a written refusal to the executive body of the constituent entity of the Russian Federation.

This procedure is provided for in Article 48 of the Labor Code of the Russian Federation.

KVR and KOSGU in 2021 for budgetary institutions

Note that if the period of time during which the wages were delayed included weekends (holidays), then they are taken into account along with working days. Labor relations Wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, employment contract (Part.

Compensation for delayed wages in 2021 posting

In accordance with the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 1, 2021 N 65n, expenses for payment of compensation for late payment of wages are reflected in Article 290 “Other expenses” of KOSGU.

Payments are made twice a month. Advance payments and direct salaries are issued to employees within the period established by the collective or labor agreement. In the event of a delay in the payment of wages, regardless of the reasons for such a delay, the employer accrues compensation for the delay in wages, the entries for recording which will be presented later in the article.

Deadline for salary delay

The organization must set a specific date for payment of salaries. It is impossible to establish a period during which wages should be paid, rather than a specific day of payment. When determining the set payment date, keep in mind that if the payment day coincides with a non-working day, the salary must be paid the day before.

Such conclusions follow from Article 136 of the Labor Code of the Russian Federation and are confirmed by paragraph 3 of the letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242.

Accordingly, define the period of salary delay as the number of days by which the payment is overdue. The first day of delay is the day following the due date for payment of wages. The last day of delay is the date of actual payment of wages. This procedure is established in Article 236 of the Labor Code of the Russian Federation.

Situation: how to determine the duration of the salary delay - in calendar or working days?

When calculating compensation, determine the duration of the delay in payment of wages in calendar days. Article 236 of the Labor Code of the Russian Federation states that compensation must be calculated for each day of delay. There is no reason to exclude weekends and holidays from this period.

Compensation calculation

Calculate compensation for delayed wages using the formula:

| Compensation for delayed wages | = | Salary arrears | × | 1/300 of the refinancing rate (or a greater percentage established by the organization) | × | Number of days of delay |

An example of calculating compensation for delayed wages. The amount of compensation is established in the collective agreement

The collective agreement adopted by the organization establishes the following terms for payment of wages:

- On the 20th – an advance of 40 percent of the salary;

- 5th – final payment.

According to the collective agreement, compensation for delayed wages is 0.06 percent for each day of delay.

The organization paid the final payment for December 2015, as well as the entire salary amount for January 2021, on February 16, 2016.

The amounts owed and the delay period were:

- 300,000 rub. (final payment for December 2015) – 47 days (from January 1 to February 16, 2021 (January 1–8, 2021 are holidays, so salaries for December must be paid on December 31, 2015));

- 250,000 rub. (advance payment for January 2021) – 27 days (from January 21 to February 16, 2021);

- 300,000 rub. (final calculation for January 2021) – 11 days (from February 6 to February 16, 2021).

Along with the arrears of wages, the organization paid compensation for the delay. The amount of compensation was: 300,000 rubles. × 47 days × 0.06% + 250,000 rub. × 27 days × 0.06% + 300,000 rub. × 11 days × 0.06% = 14,490 rub.

Situation: how to calculate the amount of debt owed to an employee, with which compensation must be paid for delayed payment of wages - taking into account personal income tax or without taking into account?

Determine the amount of wage arrears from which compensation is calculated without taking into account personal income tax.

When paying wages, the organization is obliged to withhold personal income tax from it, which means it should not pay it to the employee (clause 4 of article 226 of the Tax Code of the Russian Federation). Personal income tax is not part of unpaid wages. And compensation for the delay must be calculated based on the actual amount of the debt (Article 236 of the Labor Code of the Russian Federation).

Situation: how to calculate compensation for delayed wages if the refinancing rate changed several times during the period of delay? According to the collective (labor) agreement, compensation is calculated based on the refinancing rate.

Calculate the amount of compensation, taking into account all changes in the refinancing rate. Divide the period of late payment of wages into periods in which different refinancing rates were in effect and calculate compensation for each of these periods. This conclusion follows from the literal interpretation of Article 236 of the Labor Code of the Russian Federation. It says that the amount of compensation for delayed wages is not less than one three hundredth of the refinancing rate in force at that time (i.e., during the period of delay).

An example of calculating compensation for delayed wages. The amount of compensation is not established by the collective (employment) agreement

The collective agreement adopted by the organization establishes the following terms for payment of wages:

- On the 20th – an advance of 40 percent of the salary;

- 5th – final payment.

The organization paid the final payment for December 2015, as well as the entire salary amount for January 2021, on February 26, 2016.

The amounts owed and the delay period were:

- 300,000 rub. (final payment for December 2015) – 57 days (from January 1 to February 26, 2021 (January 1–8, 2021 are holidays, so salaries for December must be paid on December 31, 2015));

- 250,000 rub. (advance payment for January 2021) – 37 days – from January 21 to February 26, 2021;

- 300,000 rub. (final calculation for January 2021) – 21 days – from February 6 to February 26, 2021.

Along with the arrears of wages, the organization paid compensation for the delay. Its size is not established in the collective agreement, so the calculation is made based on 1/300 of the refinancing rate, which is 11 percent.

Therefore, the amount of compensation was:

– for late wages for December 2015: 6270 rubles. (RUB 300,000 × 57 days × 1/300 × 11%);

– for late advance payment for January 2021: RUB 3,391.67. (RUB 250,000 × 37 days × 1/300 × 11%);

– for late wages for January 2021: 2310 rubles. (RUB 300,000 × 21 days × 1/300 × 11%).

The total amount of compensation was 11,971.67 rubles. (6270 rubles + 3391.67 rubles + 2310 rubles).

Personnel accounting and payroll calculation in 1C 8

Previously ( before the release of 1C ZUP 3.1.4.120 ), to implement the calculation of contributions from compensation, it was necessary to create a separate type of accrual, which is subject to contributions, and accrue compensation for this type of calculation using the One-time accrual , and not the Compensation for delayed salary . This was quite inconvenient, since the ability to automatically calculate compensation and automatically fill out the document was lost.

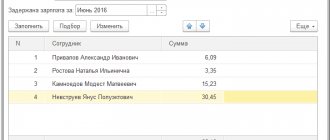

Payment of wages for January will be made with a delay of 5 days, i.e. not on the 5th, but on the 10th of February. Therefore, before registering the document Statement... it is necessary to calculate the compensation using the document Compensation for delayed wages . It is worth considering that in 1C ZUP 3 the document can be filled out automatically. It will be filled in by all employees who, as of the date the document is entered, have unpaid salaries for January and will calculate compensation from the date of the planned payment (02/05/2021 in this case) to the date specified in the document (02/10/2021).

Accounting

Payment of compensation for delayed wages is not related to expenses for ordinary activities. Compensation is a sanction for violation of the terms of an employment (collective) agreement.

In accounting, take this payment into account in other expenses (clause 11 of PBU 10/99). The accrual of compensation is not related to calculations of wages, so reflect it on account 73 “Settlements with personnel for other operations” (Instructions for the chart of accounts).

In accounting, reflect the accrual of compensation by posting:

Debit 91-2 Credit 73

– compensation for delayed wages has been accrued.

Compensation is calculated on the day the salary is paid. Only at this moment can the amount of expenditure be accurately determined, and, accordingly, the requirements of paragraph 16 of PBU 10/99 will be met.

Posting compensation for late payment of wages budget accounting

Personal income tax accrued: Dt 0 30211 830 “Reduction of payables for wages” Kt 0 30301 730 “Increase in payables for personal income tax” 3. The accrual according to the writ of execution is reflected: Dt 0 30211 830 Kt 0 304 03 730 “Increase in accounts payable for settlements of deductions from payments for wages" 4. Salaries were paid from the cash register: Dt 0 30211 830 Kt 0 20214 610 "Cash funds from the cash desk of a budgetary institution" 5. Salaries were transferred to bank cards: Dt 0 302 11 830 Kt 0 20211 610 "Cash outflow institutions from personal accounts with the treasury body" 6. Unpaid amounts deposited: Dt 0 30211 830 Kt 0 30402 730 "Increase in accounts payable to depositors" 7. Contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund have been accrued. Every month, each organization pays insurance contributions to the Pension Fund, mandatory social contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

Reflection of payment of compensation for delayed wages

KOSGU, read here. Postings for wages in a budgetary institution Based on the above regulatory documents, we will draw up the main entries for wages in the accounting of a budgetary organization. 1. Salary, vacation pay, bonus have been accrued. In this case, wage costs can be attributed to several different accounting accounts:

Compensation has been accrued for delayed salaries of employees. If these expenses form the cost of finished products, works, services that the institution sells for a fee, write them off to ( ). This procedure is established by paragraphs, Instruction No. 162n.

Personal income tax and insurance premiums

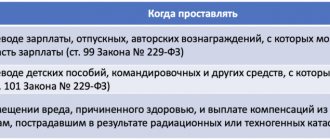

The amount of compensation cannot be less than 1/300 of the refinancing rate in force during the period of delay of the amounts not paid on time for each day of delay (Article 236 of the Labor Code of the Russian Federation). That is, the organization has the right to pay compensation in a larger amount. The procedure for taxation of personal income tax will depend on the registration of such compensation. The table will help you figure this out.

| Compensation amount | Provided for by the collective (labor) agreement | Obligation to withhold and remit personal income tax |

| 1/300 refinancing rate | doesn't matter | No |

| more than 1/300 of the refinancing rate | Yes | No |

| more than 1/300 of the refinancing rate | No | yes, from the amount exceeding the minimum amount of compensation |

This follows from the provisions of paragraph 3 of Article 217 of the Tax Code of the Russian Federation, Article 236 of the Labor Code. The correctness of this approach is confirmed by letters of the Ministry of Finance of Russia dated April 18, 2012 No. 03-04-05/9-526, dated November 28, 2008 No. 03-04-05-01/450, dated August 6, 2007 No. 03- 04-05-01/261 and the Federal Tax Service of Russia dated June 4, 2013 No. ED-4-3/10209 (the document is posted on the official website of the tax service in the section “Explanations mandatory for use by tax authorities”).

Situation: is it necessary to charge insurance premiums for compensation for delayed payment of wages?

Yes need.

This is due to the fact that such compensation is not named in the closed lists of payments not subject to insurance premiums, namely:

– in Article 9 of the Law of July 24, 2009 No. 212-FZ – in relation to contributions to compulsory pension (social, medical) insurance;

– in Article 20.2 of the Law of July 24, 1998 No. 125-FZ – in relation to contributions for insurance against industrial accidents and occupational diseases.

This means that it must be regarded as a payment made to employees within the framework of labor relations, and subject to insurance premiums in the general manner (Part 1, Article 7 of the Law of July 24, 2009 No. 212-FZ, Part 1 of Article 20.1 of the Law dated July 24, 1998 No. 125-FZ).

A similar conclusion was made in letters from the Ministry of Labor of Russia dated August 6, 2014 No. 17-4/B-369, and the Ministry of Health and Social Development of Russia dated March 15, 2011 No. 784-19.

Advice: there are arguments for not charging insurance premiums for compensation. They are as follows.

Compensation for delayed payment of wages cannot be regarded as an employee's remuneration, but is considered the financial responsibility of the employer. It is an independent type of legally established compensation payments related to the performance of a person’s labor duties. Consequently, compensation for delayed payment of wages is not subject to insurance premiums on the basis of:

- paragraph “i” of Part 2 of Article 9 of the Law of July 24, 2009 No. 212-FZ - in relation to contributions to compulsory pension (social, medical) insurance;

- subclause 2 of part 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ - in relation to contributions for insurance against industrial accidents and occupational diseases.

This approach is confirmed by arbitration practice (see, for example, the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 No. 11031/13, the ruling of the Supreme Court of the Russian Federation dated December 18, 2014 No. 307-KG14-5726, the decisions of the Arbitration Court of the North-Western District dated October 2, 2014 No. A56-3173/2014, FAS Volga District dated July 21, 2014 No. A06-6685/2013, Far Eastern District dated May 15, 2013 No. F03-1527/2013, Moscow District dated March 27, 2013 No. A41-28843/12, Volga-Vyatka District dated October 25, 2012 No. A31-11529/2011).

The procedure for calculating other taxes depends on what taxation system the organization uses.

Tax accounting.

Personal income tax

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation exempts from personal income tax all types of compensation payments established by the current legislation of the Russian Federation (within the limits of the norms provided for by the legislation of the Russian Federation), including compensation related to the performance of work duties by the taxpayer (paragraph 11). And since compensation for delayed payment of wages is a measure of the employer’s financial responsibility, this payment is not subject to personal income tax. The official bodies also agree with this approach (see letters of the Ministry of Finance of Russia dated 02/28/2017 No. 03-04-05/11096, dated 01/23/2013 No. 03-04-05/4-54, Federal Tax Service of Russia dated 06/04/2013 No. ED- 4-3/10209).

Indeed, with such qualification of the indicated compensation, it can hardly be recognized as income of the taxpayer in the sense of Art. 41 of the Tax Code of the Russian Federation, although the payment of compensation itself is carried out within the framework of labor relations.

If this payment is considered as an element of remuneration (the possibility of such qualification of this payment was mentioned earlier), then take advantage of the exemption provided for in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, it’s unlikely to work.

And further. Use the exemption provided for in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, for the sake of tax optimization it is dangerous. An illustrative example in this case is the Resolution of the Federal Antimonopoly Service of Ukraine dated November 30, 2012 No. F09-11655/12 in case No. A60-7589/2012. In this case, the arbitrators concluded that, under the guise of compensation for the delay in the payment of wages, wages were paid to individual employees. As a result, the court found it lawful to withhold personal income tax from the entire amount of compensation. This conclusion was made based on the following circumstances:

– compensation payments were of a regular, systematic nature, and their amount significantly exceeded the amount of wages accrued to individual employees; – analysis of cash flows for each month indicated that the company has the ability to pay wages on time; – the amount of money sent by the company monthly to pay wages was, as a rule, lower than the amount of compensation paid in the same month.

Insurance premiums

As for the accrual of insurance premiums on compensation amounts for violation of the established deadline for the payment of earnings, here officials of the Ministry of Finance are adamant. They believe that such payments should be subject to insurance premiums in accordance with the general procedure. To substantiate this position, financiers cite the following arguments (see letters dated September 24, 2018 No. 03-15-05/68049, dated March 21, 2017 No. 03-15-06/16239).

The object of taxation with insurance contributions is payments and other remuneration in favor of individuals subject to compulsory social insurance, in particular, within the framework of labor relations (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation).

The base for calculating insurance premiums is determined at the end of each calendar month as the amount of payments and other remunerations provided for in paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, accrued separately in relation to each individual from the beginning of the billing period on an accrual basis, with the exception of the amounts specified in Art. 422 of the Tax Code of the Russian Federation (clause 1 of Article 421 of the Tax Code of the Russian Federation).

All types of compensation payments established by the legislation of the Russian Federation (within the limits established by the legislation of the Russian Federation) related to the performance of labor duties by an individual are exempt from insurance premiums (clause 2, clause 1, article 422 of the Tax Code of the Russian Federation).

Compensation in accordance with Art. 164 of the Labor Code of the Russian Federation are monetary payments established for the purpose of reimbursing employees for costs associated with the performance of their labor or other duties provided for by the Labor Code of the Russian Federation and other federal laws.

But! Payments related to the delay in the payment of wages, in Art. 422 of the Tax Code of the Russian Federation are not mentioned and do not constitute compensation for the employee’s expenses associated with the performance of his labor duties. Therefore, the monetary compensation paid to an employee when the employer violates the established deadline for the payment (transfer) of wages, in the opinion of the Ministry of Finance, is subject to insurance contributions in the general manner (that is, as a payment within the framework of labor relations).

For your information:

special rule on including in the list of amounts of monetary compensation to an employee not subject to insurance contributions for violation by the employer of the established deadline for payment of earnings in

Art.

422 of the Tax Code of the Russian Federation no.

Meanwhile, in Resolution No. 11031/13 dated December 10, 2013, the Presidium of the Supreme Arbitration Court indicated that compensation for late payment of earnings should be classified as compensation payments related to the performance by an individual of his labor duties. The mere fact of the existence of an employment relationship between an employer and an employee is not a basis for the conclusion that all payments in favor of the latter constitute payment for his labor (see also the Ruling of the Supreme Court of the Russian Federation dated December 28, 2016 No. 310-KG16-17515 in case No. A64-7720/2015). And if we remember that the above-mentioned norms of Ch. 34 of the Tax Code of the Russian Federation are not too different from the provisions of Federal Law No. 212-FZ of July 24, 2009, on the basis of which the Presidium of the Supreme Arbitration Court made this conclusion, we believe that there is a high probability that the courts will continue to be guided by this position when considering disputes.

We emphasize: recognition of the analyzed payment as an element of remuneration (as mentioned earlier) will not allow challenging the additional accrual of insurance premiums, since in this case the legal position of the senior arbitrators cannot be used as an argument.

Income tax

Payment of compensation for delayed wages is provided for by labor legislation. It is a sanction for violating the terms of an employment (collective) agreement. This follows from Article 236 of the Labor Code of the Russian Federation. Despite this, the Russian Ministry of Finance prohibits taking such payments into account as expenses.

Situation: is it possible to take into account the amount of compensation for delayed wages as part of non-operating expenses or labor costs? The organization applies a general taxation system.

No you can not.

Expenses for payment of compensation for delayed wages are not considered non-operating expenses in the form of sanctions for violation of contractual obligations (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation). The obligation to pay compensation for delayed wages is provided for by labor legislation, and subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation applies to civil law relations.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38.

Labor costs taken into account when calculating income tax include compensation charges related to work hours or working conditions provided for by Russian legislation and labor (collective) agreements (Article 255 of the Tax Code of the Russian Federation). Compensation for delayed wages is not related to the working hours and working conditions (Article 236 of the Labor Code of the Russian Federation). Therefore, these payments do not reduce taxable profit as labor costs.

Such clarifications are given in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38, as well as in the resolution of the Federal Antimonopoly Service of the Central District dated February 21, 2008 No. A09-7868/05-15.

Advice: there are arguments that allow you to take into account the amount of compensation for delayed wages as part of expenses (non-operating or labor costs). They are as follows.

The basis for including compensation for delayed wages in non-operating expenses is that subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation does not directly indicate in case of violation of which contractual obligations - civil or labor - it is applied. Therefore, this subclause can also be applied to compensation for delayed wages. In addition, such compensation is not named in Article 270 of the Tax Code of the Russian Federation as expenses not taken into account when taxing profits. Therefore, it can be taken into account as part of non-operating expenses. This position is confirmed by judicial practice (see, for example, decisions of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 11, 2008 No. A29-5775/2007, Ural District dated April 14, 2008 No. F09-2239/08-S3, Volga District dated June 8, 2007 No. A49-6366/2006).

Compensation for delayed wages can also be taken into account as part of labor costs. It is explained this way. Taxable profit is reduced by any payments to employees in cash and (or) in kind, including compensation accruals provided for by labor and (or) collective agreements (paragraph 1, paragraph 3 of Article 255 of the Tax Code of the Russian Federation). The exception is the payments listed in Article 270 of the Tax Code of the Russian Federation. When calculating the tax base for income tax, they cannot be taken into account under any circumstances. In addition, the list of labor costs that are taken into account when taxing profits is open (clause 25 of Article 255 of the Tax Code of the Russian Federation). Therefore, compensation for delayed wages can also be taken into account as part of labor costs. This conclusion is confirmed by the Federal Antimonopoly Service of the Moscow District in its resolution dated March 11, 2009 No. KA-A40/1267-09.

Under such circumstances, the organization can independently decide which group of expenses to include the costs associated with the payment of compensation for delayed wages (clause 4 of Article 252 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. General organization

In August, Alpha LLC delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases.

The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

In tax accounting, the amount of compensation for delayed wages is not taken into account. Alfa does not withhold personal income tax from the compensation amount.

Answer

But the provisions of paragraphs. 13 clause 1 art. These payments also do not accrue insurance contributions for compulsory social insurance against accidents at work and occupational diseases (clause 2, clause 1, article 20.2 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases").

Compensation does not need to be taxed even if, under the terms of the employment contract, it exceeds the minimum established by law (letter of the Ministry of Finance of Russia dated November 28, 2008 No.

Salaries must be paid twice (every two weeks) per month. The employer needs to transfer or issue money to employees on the specified day. If this does not happen, he will have to pay compensation on demand. Moreover, if the debt is not repaid within 15 days following the payment date, employees have the right not to fulfill their work duties. In this situation, it does not matter for what reason the salary is delayed. If the institution decides to calculate insurance premiums from the amount of monetary compensation in order to avoid disputes with regulatory authorities. How to reflect compensation for delayed wages in accounting?

The employer bears administrative (fines on the organization and management) and criminal liability for non-payment of wages to employees.

Expenses of a municipal government institution for the payment of compensation for delayed wages should be reflected according to expense type 853 “Payment of other payments”, linked for budget accounting purposes with Article 290 “Other expenses” of KOSGU.

The Ministry of Finance confirms the possibility of establishing the amount of monetary compensation paid by the employer to the employee in accordance with the provisions of Art.

The amount of monetary compensation paid to an employee may be increased by a collective agreement, local regulation or employment contract. The obligation to pay the specified monetary compensation arises regardless of the employer’s fault.

simplified tax system

If an organization applies a simplification with the object of taxation being income, do not take into account compensation for delayed wages when calculating the single tax (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account the amount of compensation for delayed payment of wages as part of labor costs? The organization applies a simplification; it pays a single tax on the difference between income and expenses.

No you can not.

An organization can reduce the income received by paying for labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). Labor costs include, among other things, compensation accruals related to the work schedule or working conditions provided for by the norms of Russian legislation and labor (collective) agreements (Article 255, paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation).

Compensation for delayed payment of wages is not related to the working hours and working conditions (Article 236 of the Labor Code of the Russian Federation). Therefore, it is impossible to take into account compensation for delayed payment of wages as part of labor costs. A similar conclusion is contained in the letter of the Federal Tax Service for Moscow dated August 6, 2007 No. 28-11/074572.

The same explanations are given in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38. Despite the fact that the explanations of the specialists of the financial department are addressed to income tax payers, simplified organizations can also be guided by them (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Advice: there are arguments that allow you to take into account the amount of compensation for delayed wages as part of labor costs. They are as follows.

Labor costs include any accruals to employees in cash and (or) in kind, including compensation accruals provided for by labor and (or) collective agreements (paragraph 1, paragraph 3 of Article 255, paragraph 2 of Article 346.16 Tax Code of the Russian Federation). In addition, the list of labor costs that are taken into account when taxing profits is open (clause 25, article 255, clause 2, article 346.16 of the Tax Code of the Russian Federation). Therefore, compensation for delayed wages can be taken into account as part of labor costs when calculating the single tax under simplification.

This conclusion is confirmed by the Federal Antimonopoly Service of the Moscow District in its resolution dated March 11, 2009 No. KA-A40/1267-09. This resolution is dedicated to organizations on the general taxation system. However, simplified organizations can also be guided by the conclusions drawn in it (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. The organization applies a simplification (“income minus expenses”)

Alpha LLC applies a simplified tax system and pays a single tax on the difference between income and expenses. In August, Alpha delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases. The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

When calculating the single tax, compensation for delayed wages is not taken into account in expenses. Alfa does not withhold personal income tax from the compensation amount.

UTII

If an organization pays UTII, the amount of compensation for delayed salaries will not affect the tax calculation in any way. UTII is calculated based on imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. The organization pays UTII

Alpha LLC is a UTII payer. In August, Alpha delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases. The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

Alfa does not withhold personal income tax from the compensation amount.

Responsibility for delayed wages

Administrative liability is provided for late wages:

- for an organization – a fine in the amount of 30,000 to 50,000 rubles;

- for officials (for example, a manager) - a warning or a fine from 1000 to 5000 rubles;

- for entrepreneurs – a fine of 1,000 to 5,000 rubles.

Repeated violation entails:

- for an organization – a fine from 50,000 to 70,000 rubles;

- for officials (for example, a manager) – a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to three years;

- for entrepreneurs – a fine from 10,000 to 20,000 rubles.

These are the requirements of parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

In addition, criminal liability is provided for officials (Article 145.1 of the Criminal Code of the Russian Federation) and disciplinary liability (Article 192 of the Labor Code of the Russian Federation).

KOSGU: payments to employees from 2020

- Subarticle 266 of KOSGU Social payments in cash - compensation in money in exchange for free purchase of medicines; child benefit in the amount of 50 rubles. up to 3 years of age.

- Subarticle 267 of KOSGU Social payments in kind - monetary compensation for sanatorium and resort treatment; children's voucher to a health camp; medical services.

We recommend reading: How to check a receipt for payment of state duty

Starting in 2021, a new procedure for applying KOSGU will be introduced. The most significant changes affect wages, social and non-social benefits, income in kind and cash. From this article you will learn how the classification of KOSGU codes has changed: wages, social benefits, benefits for public sector employees.

Criminal liability of the manager

The head of an organization may be held criminally liable provided that he was directly or indirectly interested in the delay in wages. It does not matter how many employees’ payments were delayed (one is enough). The deadlines for delaying wages, in case of violation of which the manager may be brought to criminal liability, are as follows:

- complete non-payment – over two months;

- payment of wages in an amount below the minimum wage (minimum wage) - more than two months;

- partial non-payment – over three months.

For a manager who has allowed partial non-payment of wages for more than three months, the following types of criminal liability are provided:

- a fine of up to 120,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to one year);

- deprivation of the right to hold certain positions or engage in certain activities for a period of up to one year;

- forced labor for up to two years;

- imprisonment for up to one year.

The head of an organization in which wages were not paid in full for two months or were paid in an amount below the minimum wage is subject to more stringent criminal liability measures. Namely:

- a fine in the amount of 100,000 to 500,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to three years);

- forced labor for a period of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years;

- imprisonment for a term of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years.

These types of liability are listed in parts 1 and 2 of Article 145.1 of the Criminal Code of the Russian Federation.

If the delay in wages entailed serious consequences, then the punishment will be even more severe (Part 3 of Article 145.1 of the Criminal Code of the Russian Federation).

Criminal liability can be avoided if the cause of the delay did not depend on the will of the manager.

Key points

To reflect the amounts of accrued remuneration for the work of employees of public sector institutions, separate accounting instructions should be applied. In other words, the general Chart of Accounts (Order No. 94n) cannot be applied in this case.

Accounting for public sector employees

- Code “1” or 0 302 11 000 - is intended to reflect operations for directly calculating wages. For example, on this accounting account reflect the accrued salary, incentives, and compensation payments. If a territorial (district) coefficient is applied to earnings, then reflect these amounts with code “1”. Also include in the group the amounts of accrued vacation pay and sick leave benefits at the expense of the employer.

- Code “2” or 0 302 12 000 - information on other payments in favor of employees is accumulated. For example, this group includes accruals in favor of women receiving benefits for children under three years of age. Currently, the amount of such payment is 50 rubles. If there is a regional coefficient in your region, then include it in the group with code “2”.

- Code “3” or 0 302 13 000 - this group includes all calculations for calculating benefits for illness, pregnancy and childbirth, one-time payments from the Social Insurance Fund. That is, code “3” is intended to reflect charges for wage payments.

At the same time, compensation for late payment of wages is not directly named in any of the subarticles of the KOSGU detailing Article 290 “Other expenses” of the KOSGU. According to Directive No. 65n, penalties for late payment of taxes, fees, insurance premiums, expenses for paying penalties for violation of the terms of contracts (agreements) for the supply of goods, performance of work, provision of services, as well as the costs of paying penalties, fines for late repayment of debt obligations for the purpose of applying sub-articles of KOSGU are considered as economic sanctions.

Financial responsibility of the organization

The financial liability of the organization in the form of payment of compensation for delayed wages is established by Article 236 of the Labor Code of the Russian Federation. The organization is obliged to pay the specified compensation to employees even if the delay in wages occurred due to reasons beyond its control. The amount of compensation for delayed payment of wages must be reflected in pay slips (Article 136 of the Labor Code of the Russian Federation).

If an organization does not pay compensation voluntarily, then the court can force it (clause 55 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

Compensation for delayed wages 2021 budget accounting postings

This procedure follows from the Procedure for the application of KBK No. 132n, paragraphs, the Procedure for the application of KOSGU No. 209n, . In accounting, reflect compensation for late payment as follows. In the accounting of government institutions: When calculating compensation, make the following entry: No. Contents of transaction Account debit Account credit 1.

How to reflect compensation for delayed wages in accounting and taxation

If the employer violates the established deadline for paying wages, the employer is obliged to pay it with interest (monetary compensation) in the amount of not less than one three hundredth of the Bank of Russia refinancing rate in force at that time. The amount of insurance contributions is less than 50 kopecks.

We recommend reading: How to calculate night hours for a watchman

If the organization applies PBU 8/2021 “Estimated liabilities, contingent liabilities and contingent assets”, then as employees receive the right to annual paid leave, an estimated liability is recognized in the amount of vacation pay and insurance contributions due to employees. In this case, instead of account 70 (69 for insurance premiums), account 96 “Reserves for future expenses” is used. And when granting vacation (accruing vacation pay), the following entry is made: Debit 96 Credit 70 (69)

If the organization applies PBU 8/2021 “Estimated liabilities, contingent liabilities and contingent assets”, then as employees receive the right to annual paid leave, an estimated liability is recognized in the amount of vacation pay and insurance contributions due to employees. In this case, instead of account 70 (69 for insurance premiums), account 96 “Reserves for future expenses” is used. And when granting vacation (accruing vacation pay), the following entry is made: Debit 96 Credit 70 (69)

Accounting entries for payroll

If the organization applies PBU 8/2021 “Estimated liabilities, contingent liabilities and contingent assets”, then as employees receive the right to annual paid leave, an estimated liability is recognized in the amount of vacation pay and insurance contributions due to employees. In this case, instead of account 70 (69 for insurance premiums), account 96 “Reserves for future expenses” is used. And when granting vacation (accruing vacation pay), the following entry is made: Debit 96 Credit 70 (69)

Even in the case when an employee provides a written statement in which he refuses double payment, this does not relieve the employer of the obligation to pay exactly in the order established in the Labor Code of our state. Otherwise, the employer will be held responsible for his illegal actions.

Bankruptcy

Let’s say that due to insufficient funds, the employer has an outstanding debt for payments due to employees (wages, severance pay, etc.) for more than three months. In this case, the head of the debtor organization or the individual entrepreneur himself must apply to the arbitration court with an application for bankruptcy. This is provided for in paragraph 1 of Article 9 of the Law of October 26, 2002 No. 127-FZ.

In addition, employees (including former employees) can apply to the arbitration court to declare the employer bankrupt for debts on wages and other payments. This is stated in paragraph 1 of Article 7 of the Law of October 26, 2002 No. 127-FZ.

Employees have the right to hold a meeting. Deadline – no later than five working days before the date of the meeting of creditors. The organization and holding of the meeting of employees is entrusted to the arbitration manager. At the meeting, employees elect their representative who will protect their interests in the bankruptcy process of the employer. The procedure for holding a meeting is described in detail in Article 12.1 of the Law of October 26, 2002 No. 127-FZ.

Claims for payment of arrears of wages and other remuneration to employees (including former employees) are included in the register of creditors' claims by the insolvency administrator or the registrar upon the proposal of the insolvency administrator. If such claims are disputed, they are included in the register on the basis of a judicial act establishing the composition and amount of these claims (clause 6 of Article 16 of the Law of October 26, 2002 No. 127-FZ).

Payroll postings

An enterprise (organization), in the event of a shortage of funds, can partially pay employees in kind, but such payments should not exceed 20% of the accrued amount of wages. When paying for labor with products of own production, it is taken into account at market prices in accordance with Art. 40 Tax Code of the Russian Federation. Personal income tax and unified social tax on payments to employees in kind are paid on a general basis based on the market value of products or other material assets issued to employees.

- on wages, including basic and additional wages, as well as incentive and compensation payments;

- on the calculation and payment of material assistance, benefits and compensation;

- for payment of vacation pay and compensation for unused vacation;

- on deductions from wages to compensate for losses from marriage, shortages, theft, damage to material assets, etc.;

- on payment by employees of trade union dues, utilities and other services;

- on deductions from wages based on writs of execution based on a court decision, etc.

Employee rights

An employee has the right to stop working if the salary is delayed for more than 15 days. In this case, the amount of debt and the guilt of the organization (lack of guilt) in the delay do not matter (clause 57 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). The maximum period of termination of work is until the debt is fully repaid. Before stopping work, employees are required to notify their supervisor in writing of their actions. After this, they have the right not to come to work at all (Part 3 of Article 142 of the Labor Code of the Russian Federation, Clause 57 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). In this case, employees are required to return to work only the next day after receiving written notification from the organization of their readiness to repay their arrears. At the same time, the organization must pay the delayed salary on the day they return to work.

Such conditions are provided for in Article 142 of the Labor Code of the Russian Federation. There is also a list of cases when stopping work due to delayed wages is prohibited.

During the period of suspension of work due to delays in salary, the employee is paid in the amount of average earnings. They also pay compensation for late payment.

These are the requirements of Part 4 of Article 142 and Article 236 of the Labor Code of the Russian Federation.

Question

Salaries were issued to the accountable person distributing wages from the cash register: Dt 0 20811 560 “Settlements with accountable persons for wages” Kt 0 20134 610 “Cash in the institution’s cash desk.” 9. The employee received a salary from the distributing party: Dt 0 30211 830 “Reducing payables for wages” Kt 0 20811 660 “Settlements with accountable persons for wages.” For information on transactions used to reflect payroll transactions in commercial organizations, read the article “Payroll transactions and accounting.” An example of how payroll is reflected in the accounting of a budget organization. Let's look at the entries for payroll in the accounting of an enterprise using a specific example. Example: The salary of a hospital employee is 24,000 rubles.

If the employer violates the established deadline for payment of wages and other payments due to the employee, the employer, on the basis of Article 236 of the Labor Code, is obliged to pay them with interest. In accordance with Article 255 of the Tax Code of the Russian Federation, labor costs include any accruals to employees, incl.

Workers have the right to receive wages for their work at least twice a month. From the 15th day of the month until its end, the employee must receive an advance payment, and from the 1st to the 15th day of the month - the final payment. Such time frames are enshrined in the Labor Code. Receipt from an employee of compensation for the costs of the institution transferring compensation for delayed salaries to employees is reflected in account 0.205.31.000 as compensation for the institution's costs with the following entries: Debit 2.205.31.560 Credit 2.401.10.130 - the employee's debt for reimbursement of compensation transferred by the institution for delayed salaries to employees has been accrued; Debit 2.201.34.510 (2.201.11.510) Credit 2.205.31.660 - the amount of compensation was deposited into the cash register (received into the personal account).