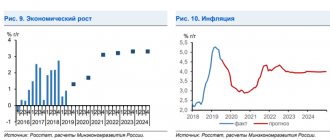

Deflator coefficients are used when calculating UTII, patent, property tax for individuals, personal income tax, and trade fees. The Ministry of Economic Development of the Russian Federation has already planned coefficient values for 2019.

Every year, the Ministry of Economic Development sets the size of deflator coefficients for the next year. The coefficient takes into account changes in consumer prices for goods and services in the previous year. The coefficients are calculated by multiplying the deflator coefficient of the previous year by the coefficient taking into account changes in consumer prices of the previous year. For the coming year 2021, the Ministry of Economic Development published a draft order establishing the size of deflator coefficients. The values of the coefficients indicated in the table are planned. 1.

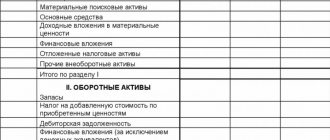

Table 1

| Tax/fee | 2018 | 2019 |

| Personal income tax | 1,686 | 1,729 |

| simplified tax system | 1,481 | 1,518 |

| UTII | 1,868 | 1,915 |

| Patent | 1,481 | 1,518 |

| Property tax for individuals | 1,481 | 1,518 |

| Trade fee | 1,285 | 1,317 |

Please note: indexation of income limits for the simplified tax system by the deflator coefficient is frozen until 2021. Therefore, the deflator coefficient for the simplified tax system in 2019 is not used to determine the income limit.

If we compare the value of the current year and future values of the coefficients, they increased by 2.5-2.6%.